G.G. Bain Auto polo, somewhere in New York 1912

Either Draghi gets to fly the chopper, or the EU falls to bits. Wait, it’ll do that anyway. So why give him the keys?

• Will Merkel Hand Over The Keys To The Helicopter? (Napier)

Now only one question matters for global investors – Wo ist der Hubschrauber? (Where is the helicopter?). The decline of European commercial bank share-prices before Brexit made it clear that a monetary reflation of Europe was failing. The collapse in these same share-prices post-Brexit means that even the politicians now realise that the ECB acting alone cannot stabilize the European economy. Indeed, given the evident political strains in the European Union, saving the economy from recession is now key to saving the European political union project itself. So, will Mrs Merkel abolish fiscal austerity across Europe and permit each of the states of the European political union expand their debt mountains at the same time that the ECB is buying that debt?

Are the keys to der Hubschrauber to be handed over? To save the European political union Germany must now confront its greatest fear and enfranchise the political union’s central bank to conduct outright monetary financing of all its constituent governments. Investors need to remain very cautious indeed as it is in no way clear that Mrs Merkel will hand over the keys to der Hubschruaber. Should she do so, however, major changes in investment allocation are necessary as helicopter money will be raining from the skies in Japan, the Eurozone, the UK and even in the USA if President Clinton also wins the House and the Senate.

This form of reflation will likely work and in due course work too much. Few things are binary in investment, but this huge decision to be taken in Berlin is the biggest binary event for investors this analyst has yet come across. The repercussions will reverberate throughout this century. This analyst would like to present you with a firm forecast as to the possibility of ‘helicopter money’ coming to the European political union. However, it is too close to call. Even if that assertion is correct, this is truly dire news for financial markets.

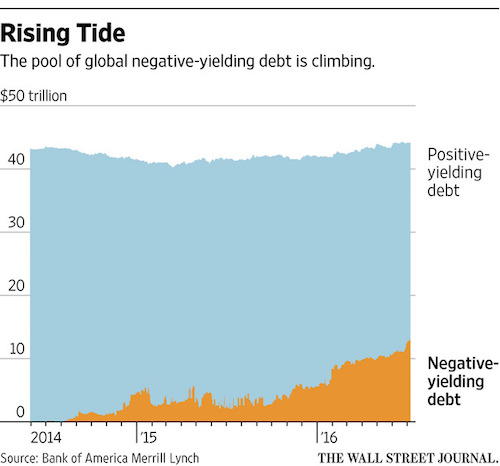

What? “..the global yield grab is raising questions about whether rates can prove reliable economic indicators.” That’s an actual question?

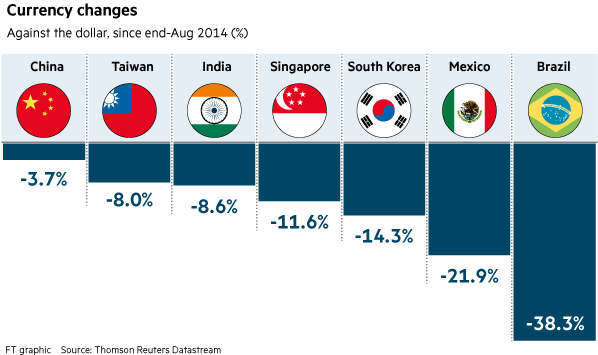

• Black Hole of Negative Rates Is Dragging Down Yields Everywhere (WSJ)

The free fall in yields on developed-world government debt is dragging down rates on global bonds broadly, from sovereign debt in Taiwan and Lithuania to corporate bonds in the U.S., as investors fan out further in search of income. The ever-widening rush for yield could create problems if interest rates snap back, which would cause losses on investors’ low-yielding portfolios, or if credit quality falls. And the global yield grab is raising questions about whether rates can prove reliable economic indicators. Yields in the U.S., Europe and Japan have been plummeting as investors pile into government debt in the face of tepid growth, low inflation and high uncertainty, and as central banks cut rates into negative territory in many countries.

Even Friday, despite a strong U.S. jobs report that helped send the S&P 500 to nearly a record, yields on the 10-year Treasury note ultimately declined to a record close of 1.366% as investors took advantage of a brief rise in yields on the report’s headlines to buy more bonds. Yields move in the opposite direction of price. As yields keep falling in these haven markets, investors are looking for income elsewhere, creating a black hole that is sucking down rates in ever longer maturities, emerging markets and riskier corporate debt. “What we are seeing is a mechanical yield grab taking place in global bonds,” said Jack Kelly at Standard Life Investments. “The pace of that yield grab accelerates as more bond markets move into negative yields and investors search for a smaller pool of substitutes.”

Self-fulfilling perversity.

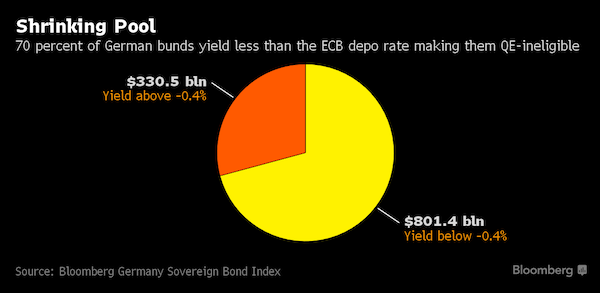

• 70% Of German Bonds Are No Longer Eligible For ECB Purchases (ZH)

Back in April of 2015, we warned that the biggest risk facing the ECB is running out of eligible securities which the central bank can monetize. Draghi’s recent launch of the CSPP, in which the ECB has been buying not only investment grade but also junk bonds, is an indirect confirmation of that. A direct one comes courtesy of a Bloomberg calculation according to which following a seventh straight week of gains in German bunds, the yields on securities of all maturities has plunged to unprecedented lows, which has left about $801 billion of debt out of the statutory reach of the ECB. As noted earlier, there is now $13 trillion of global negative-yielding debt. That compares with $11 trillion before the Brexit vote.

The surge in sovereign debt since Britain’s vote to exit the European Union last month has pushed yields on about 70% of the securities in the $1.1-trillion Bloomberg Germany Sovereign Bond Index below the ECB’s -0.4% deposit rate, making them ineligible for the institution’s quantitative-easing program. For the euro area as a whole, the total rises to almost $2 trillion. As Bloomberg adds, following a rush for safety and a scramble for capital appreciation ahead of more ECB debt purchases, the yield on German 10-year bunds to a record-low, and those on securities due in up to 15 years below zero, even though – paradoxically – the rush to buy these bonds has made them no longer eligible for direct ECB purchases as they now have a yield lower than the ECB’s deposit rate threshold.

Or rather, they are ineligible for the time being. As a result, the rally has boosted the same concerns we warned about for the first time in the summer of 2014, namely that the ECB’s Public Sector Purchase Programme could run into scarcity problems well before its completion date of March 2017, prompting speculation policy makers may tweak their plan.

“..the economic gods created market-based price discovery for a reason. It was to insure that in the great arena of financial market supply and demand, the forces of fear and greed would contend on a level playing field..”

• Wall Street Monkeyshines – Look Ma, No Hands! (David Stockman)

The boys and girls on Wall Street are now riding their bikes with no hands and eyes wide shut. That’s the only way to explain Friday’s lunatic buying spree in response to another jobs report that proves exactly nothing about an allegedly resurgent economy. When the S&P 500 first hit 2130 back in May 2015, reported LTM earnings were $99.25 per share, and that was already down 6.4% from the cyclical high of $106 per share in September 2014. Thus, stocks were being valued at a nosebleed 21.5X in the face of falling earnings. During the four quarters since then, reported LTM earnings have slumped by a further 12.3% to $87 per share. So that brings the “cap rate” to 24.5X earnings that have shrunk by 18% over the last six quarters. Wee!

You have to use the parenthetical because the casino is not capitalizing anything rational. It’s just drifting higher in daredevil fashion until something big and nasty stops it. That something would be global deflation and US recession. Both are racing down the pike at accelerating speed. Needless to say, when these lethal economic forces finally hit home, the puppy pile-up on Wall Street is going to be one bloody mess. But that’s the price you pay when you have destroyed honest price discovery entirely, and have transformed the money and capital markets into robo-machine driven venues of rank speculation. Janet Yellen and the other 100 clowns who run the world’s central banks, of course, have no clue as to the financial doomsday machine they have enabled. Indeed, they apparently think efficient pricing and allocation of capital doesn’t matter.

After all, their entire modus operandi is to peg the price of money, bonds and the yield curve sharply below market-clearing levels – so that households and business will borrow and spend more than otherwise. Likewise, they aim to goose stock prices to ever higher levels. That’s so the top 10% and the top 1%, who own the preponderant share of equities, will feel the wealth(effects) and then spend-up and invest-up a storm. But the economic gods created market-based price discovery for a reason. It was to insure that in the great arena of financial market supply and demand, the forces of fear and greed would contend on a level playing field. Short-sellers and contrarians heading south were to intercept the lemmings of greed heading north before they reached the edge of the cliff. Now there is nothing but cliff.

The idea is that simply because pensions buy stocks, these will go up in ‘value’. Yeah, that should work.. For a week.

• China Pension Readies $300 Billion Warchest for Stock Market (BBG)

China’s pension funds are about to become stock investors. The country’s local retirement savings managers, which have about 2 trillion yuan ($300 billion) for investment, are handing over some of their cash to the National Council for Social Security Fund, which will oversee their investments in securities including equities. The organization will start deploying the cash in the second half, according to China International Capital and CIMB Securities. Chinese policy makers announced the change last year in a bid to boost yields for a pension system that has long suffered low returns by limiting its investments to deposits and government bonds.

For the nation’s equity markets – which are dominated by retail investors and among the world’s worst performers this year – the state fund’s presence is even more valuable than its cash, said Hao Hong, chief China strategist at Bocom International Holdings. The NCSSF has “such a good reputation in being a value investor that if they take the lead, the signaling effect is actually quite strong,” said Hong, who had predicted the start and peak of China’s equity boom last year. “It’s almost like Warren Buffett saying he is buying a stock.” The NCSSF, which oversees 1.5 trillion yuan in reserves for China’s social security system, has returned an average 8.8% a year since 2000, the Securities Daily reported earlier this year, citing official data. The larger pension system, on the other hand, has been locally managed and made just 2.3% annually through 2014, the newspaper said.

Is someone overestimating demand perhaps?

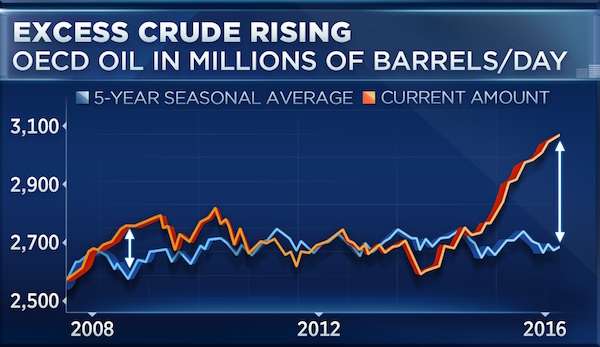

• Massive Stockpile Means Oil Rebound Is Over: Barclays (CNBC)

A massive global stockpile of oil could mean trouble ahead for the global crude market, according to Barclays. Crude oil prices dropped to a two month low on Thursday, after the Energy Information Administration reported a smaller-than-expected decrease in oil stockpiles. That may be a canary in the coalmine, a top energy market watcher explained. “For the last 6 quarters there’s been this discrepancy between global supply and global demand,” Michael Cohen, head of energy commodities research at Barclays, said last week on CNBC’s “Futures Now.” Cohen said Barclays is bearish on oil for the next six to eight months, because the current stockpile could increase in an economic downturn, likely to drive prices lower.

In the summer months, increased travel often increases the demand for gasoline, and drags up crude oil by default. Yet once that season ends, inventory levels may continue to rise. Looking at a chart of the expected crude oil supply compared with the current amount, Cohen said the disconnect is staggering. The chart accounts for oil supply from the 38 countries in the Organization for Economic Cooperation and Development (OECD), which includes the U.S., U.K., France, Germany and Canada, among others. During the recent financial crisis, crude production overhang was 138 million barrels. Now, the overhang is twice that, at 383 million barrels among the OECD, Cohen said.

Given what a disaster Abenomics is, one wonders: how inept can Japan’s opposition be? Abe wins a two-thirds majority?! Can also change the constitution so Japan can go back to war.

• Japan PM Abe To ‘Accelerate Abenomics’ After Huge Election Win (BBG)

Japanese Prime Minister Shinzo Abe’s conservative coalition scored a convincing upper house election win, putting it on course for a two-thirds majority that would allow Abe to press ahead with plans to revise the country’s pacifist constitution. The Liberal Democratic Party secured 56 of the 121 seats in contention, public broadcaster NHK said, while junior coalition partner Komeito had 14. Alongside others who support Abe’s view on constitutional revision, plus uncontested seats, the prime minister is set for a super majority, it said. The results raise questions over whether Abe will switch his focus to altering the postwar U.S.-imposed constitution, a potentially time-consuming process that could expend his political capital and distract the government from its economic program.

Abe vowed during the campaign to focus on policies aimed at expanding the size of the economy to 600 trillion yen ($6 trillion) from 500 trillion yen. “If Prime Minister Abe’s coalition scores a hot, two-thirds majority on Sunday, it might be tempted to pass constitutional changes, draining political capital away from urgently needed economic reforms,” Frederic Neumann at HSBC in Hong Kong, wrote in an e-mailed note before the election. Tokyo shares headed for their biggest gain in almost three months after the upper house election result and as jobs data eased concerns over the U.S. economy. The Topix index added 2.8% to 1,243.93 at 9:43 a.m. in Tokyo.

“Abe said he’ll continue to put together his economic policy package, so that optimism is going to continue to support Japanese shares,” said Shoji Hirakawa, chief global strategist at Tokai Tokyo Research Center. Abe’s coalition, which previously held 136 of the 242 seats in the chamber, fended off a challenge from opposition parties that had sought to unify the anti-government vote by avoiding running candidates against one another in many districts. “I think this means I am being told to accelerate Abenomics, so I want to respond to the expectations of the people,” Abe told TBS television after early results were announced.

But EU demands bail-ins these days?

• Deutsche Bank Chief Economist Calls For €150 Billion Bailout Of EU Banks (ZH)

The cards have been tipped, and it appears Italy’s Prime Minister may have been right. In the aftermath of Brexit, much of the investing public’s attention has turned to Italian banks which are in desperate need of a bailout as a result of €360 billion in bad loans growing worse by the day (and not a bail-in, as European regulations mandate, as that would lead to an immediate bank run) to avoid a freeze and/or collapse of Italy’s banking sector. This has pushed stock prices – and default risk – on Italian banks to record levels. So far Italy’s bailout requests have mostly fallen on deaf ears, as Germany’s political leaders have resisted Renzi’s recurring pleas for a taxpayer funded rescue.

However, as we have alleged, and as the Italian Prime Minister admitted last week, the core risk for Europe is not just the Italian banking sector but the biggest bank of all in Europe: Deutsche Bank. Recall last Thursday, when Matteo Renzi said other European banks had much bigger problems than their Italian counterparts. “If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred,” Renzi said. He was, of course, referring to the tens of trillions of derivatives on Deutsche Bank’s books. Today, we got the most definitive confirmation yet that the noose is tightening not only around Italy, but Germany itself [..], when none other than David Folkerts-Landau, the chief economist of Deutsche Bank, has called for a multi-billion dollar bailout for European banks.

Speaking to Germany’s Welt am Sonntag, the economist said European institutions should get fresh capital for a recapitalization following a similar bailout in the US. What he didn’t say is that the US bailout took place nearly a decade ago, in the meantime Europe’s financial sector was supposed to be fixed courtesy of “prudent” fiscal and monetary policy. It wasn’t. As Landau says the US helped its banks with $475 billion dollars, and such a program is now needed in Europe, especially for Italian banks. In other words, just because the US did it, now it’s Europe’s turn to ask for more of the same.

“In Europe, the bailout does not need to be so large. A €150 billion program should be enough to help European banks recapitalize,” said David Folkerts-Landau. He adds that the decline in bank stocks is only the symptom of a much larger problem, namely a fatal combination of low growth, high debt and a “dangerous” deflation. “Europe is seriously ill and needs to address very quickly the existing problems, or face an accident,” said the chief economist.

Good read. “It’s the inevitable consequence of medieval governance falling prey to the fangs of Wall Street..”

• Bank Born Out of Black Death Struggles to Survive (BBG)

Siena, the medieval city renowned for its Palio horse races, is home to the world’s oldest bank. Within its aging walls lies a distinctly 21st-century tale of devastation wrought by local politicians and global financiers. Banca Monte dei Paschi di Siena, Italy’s third-largest lender, is struggling to survive as it seeks to repay a second bailout or face nationalization. Its downfall proved a boon to global investment banks. They offered merger and investment advice to executives beholden to politicians that helped wipe out 93 percent of Monte Paschi’s value. Then they sold it complex derivatives that hid, even worsened the losses. Efforts to rescue the 541-year-old lender have cost Italian taxpayers €4.1 billion.

The investment banks, including Merrill Lynch, JPMorgan and Deutsche Bank, earned more than $200 million in fees from 2008 through 2011, filings and deal memos show. “These international banks come to exploit, and Italy is vulnerable,” said former Senator Elio Lannutti, who heads Adusbef, a consumer group for Italian bank customers. “On one side, there’s the local incompetence, and on the other side the bad faith of the international investment banks.” Franco Debenedetti, a former CEO of Olivetti, was even blunter. “It’s the inevitable consequence of medieval governance falling prey to the fangs of Wall Street,” said Debenedetti, now chairman of Italy’s Bruno Leoni Institute, a pro-free-market research group in Turin.

[..] ..the heritage of a bank with 2,300 branches and 28,500 employees that traces its origins to combating excessive loan rates. Siena officials founded Monte Paschi in 1472, after the Black Death wiped out more than half the city’s population. They modeled it on the pawnshops Franciscan monks had set up to counter usury. As it grew, the lender helped fuel the Renaissance in Tuscany that pulled Europe from the Middle Ages.

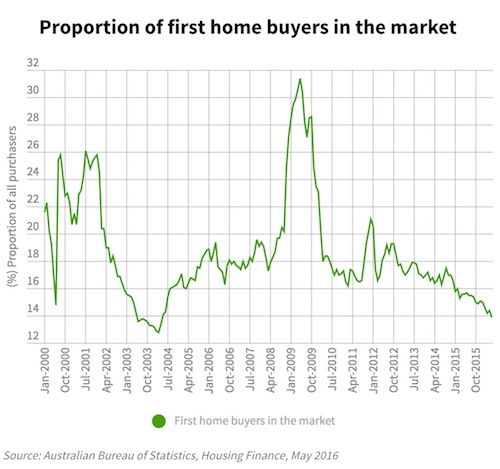

Well, they did it. Congrats! Young people can’t afford to live in their own communities any more. Is there a govenment responsibility here somewhere?

• Australia First-Home Buyers Hit Lowest Level In A Decade (Domain)

First-home buyers are now at their lowest levels in more than a decade, data released on Monday shows. As a proportion of all home buyers, first-home buyers dropped to 13.9% in May, according to housing finance data released by the Australian Bureau of Statistics. Down from 14.4% in April, this latest result is the lowest since 2004. At that time, the proportion fell to a record low 12.8% as grants for first-home buyers came to an end. For first-home buyers to make a significant return prices would have to fall, BIS Shrapnel senior manager of residential Angie Zigomanis said. “A drop in prices of some sort is needed, but we’ll also need a reduction in expectations in terms of what [first-home buyers] are looking for,” Mr Zigomanis said.

“At some point they have to come back, in theory … but for now the market is tough.” And a slowdown might be on the cards. While month-to-month figures can be volatile, overall lending figures are slowing from the frenzied levels of 2015, HSBC chief economist Paul Bloxham said. “We’re seeing a pullback in [housing finance] that has been going on since late last year, which is consistent with the idea that the housing market is set to cool,” he said. “[It’s a result of] tighter prudential settings and is also a sign that the exuberance has come out of the market … there was concern that strong activity from investors was overheating the market.”

Same in Kiwiland: “The leader of the Government is more worried about the short-term fates of leveraged-up speculators and developers than the long-term fate of Generation Rent.”

• The Great New Zealand Housing Down-Trou (Hickey)

Former Reserve Bank Chairman Arthur Grimes essentially undressed our politicians in front of us this week when he challenged them to embrace a 40% fall in Auckland house prices. He exposed them as emperors without clothes. “What I do is whenever I find a politician who says they want affordable housing, I ask them a very simple question: ‘How much do you want house prices to fall by overall?’ “And not one of them has been able to answer that very simple question,” Grimes said this week. He was talking about the extraordinary response to his suggestion 150,000 houses be built in six years to push Auckland prices down. Prime Minister John Key’s response was immediate – and betrayed where he stands on the issue of using a supply shock to make housing affordable.

It was “crazy”, would leave people in the market with huge losses and put pressure on developers. So there we have it. The leader of the Government is more worried about the short-term fates of leveraged-up speculators and developers than the long-term fate of Generation Rent. Despite years of saying the only way to improve housing affordability is to increase supply, his position is any increase in supply that hurts the investors who have bought in the past couple of years is out of the question. The Prime Minister who boasts his Government is aspirational had this to say about going for a really big response to the challenge: “Where you’d get 150,000 homes from overnight, I don’t know.”

Key said he hoped house-price inflation could be slowed by the Government’s measures, with the implication affordability would somehow creep up on everyone with wage increases. The Treasury forecasts wages will rise by an average of 2.2% over the next six years. It also forecasts house prices will rise by an average of 5.7% over the same period. The Government’s own forecasts show this magical affordability catch-up is not going to happen – and is expected to get much worse. Auckland houses cost nearly 10 times household income. That’s double what it was in the early 2000s and almost double the rest of the country. The accepted model for affordability around the world is closer to three times income.

British media are anti-journalism.

• The Media Against Jeremy Corbyn (Jacobin)

The British media has never had much time for Jeremy Corbyn. Within a week of his election as Labour Party leader in September, it was engaging in a campaign the Media Reform Coalition characterized as an attempt to “systematically undermine” his position. In an avalanche of negative coverage 60% of all articles which appeared in the mainstream press about Corbyn were negative with only 13% positive. The newsroom, ostensibly the objective arm of the media, had an even worse record: 62% negative with only 9% positive. This sustained attack had itself followed a month of wildly misleading headlines about Corbyn and his policies in these same outlets. Concerns about sexual assaults on public transport were construed as campaigning for women-only trains.

Advocacy for Keynesian fiscal and monetary policies was presented as a plan to “turn Britain into Zimbabwe.” An appeal to reconsider the foreign policy approach of the last decade was presented as an association with Putin’s Russia. In the months which followed the attacks continued. Particularly egregious examples, such as the criticism of Corbyn for refusing to “bow deeply enough” while paying his respects on Remembrance Day, stick in the memory. But it is the insidious rather than the ridiculous which best characterizes the British media’s approach to Corbyn. One example of this occurred in January when it was revealed that the BBC’s political editor Laura Kuenssberg had coordinated the resignation of a member of Corbyn’s shadow cabinet so that it would occur live on television. Planned for minutes before Corbyn was due to engage in Prime Minister’s Questions, it was a transparent attempt to inflict the maximum damage possible to his leadership.

“..political bribes aren’t free speech and corporations aren’t persons.”

• How the Corporate Food Industry Destroys Democracy (Hartmann)

On July 1, Vermont implemented a law requiring disclosure labels on all food products that contain genetically engineered ingredients, also known as genetically modified organisms or GMOs. Wenonah Hauter, executive director of Food and Water Watch, hailed the law as “the first law enacted in the US that would provide clear labels identifying food made with genetically engineered ingredients. Indeed, stores across the country are already stocking food with clear on-package labels thanks to the Vermont law, because it’s much easier for a company to provide GMO labels on all of the products in its supply chain than just the ones going to one state.”

What that means is that the Vermont labeling law is changing the landscape of our grocery stores, and making it easier than ever to know which products contain GMOs. And less than a week later after that law went into effect, it is under attack. Monsanto and its bought-and-paid-for toadies in Congress are pushing legislation to override Vermont’s law. Democrats who oppose this effort call the Stabenow/Roberts legislation the “Deny Americans the Right to Know” Act, or DARK Act. This isn’t the first time that a DARK Act has been brought forward in the Senate, and one version of the bill was already shot down earlier this year. The most recent version of the bill was brought forward by Michigan Democratic Sen. Debbie Stabenow and Kansas Republican Sen. Pat Roberts, both recipients of substantial contributions from Big Agriculture.

Stabenow has received more than $600,000 in campaign contributions since 2011 from the Crop Production and Basic Processing Industry, and Pat Roberts has received more than $600,000 from the Agricultural Services and Products industry. When Senator Stabenow unveiled the industry-friendly legislation, she boasted that, “For the first time ever, consumers will have a national, mandatory label for food products that contain genetically modified ingredients.” Which sounds great, and it would be great, if it were true. But the fact is, the DARK Act would set up a system of voluntary labeling that would overturn Vermont’s labeling law and replace it with a law that’s riddled with so many loopholes and exemptions that it would only apply to very few products, and there’s no enforcement mechanism and no penalties or consequences of any kind for defying the bill.

[..] If our democracy actually worked, this bill never would have seen the light of day, because people overwhelmingly want to know what’s in their food and support GMO labeling. But our democracy doesn’t work, because our lawmakers are bought and paid for by special interests like Monsanto. If we want our lawmakers to pass popular laws that actually work, we need to get money out of politics, we need to overturn Citizens United and we need to amend the Constitution to make it clear that political bribes aren’t free speech and corporations aren’t persons.

” It’s not the independence of Britain from Europe, but the independence of Europe from the USA.”

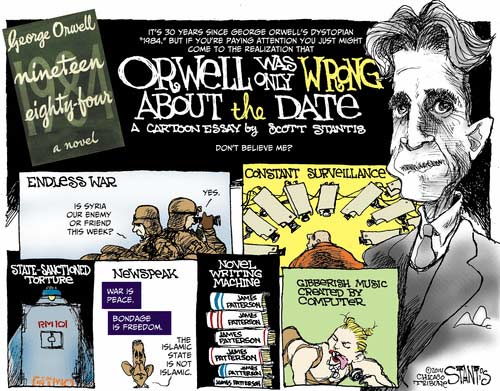

• 10 Years (Or Less): Orwell’s Vision Coming True (SHTF)

In the wake of all of the Brexit vote, a chilling blurb made headlines and it went largely unnoticed and uncommented upon. The line was couched within comments made by Boris Titov, an economic policy maker for Russia’s Kremlin. Actually all of the following merits attention, but one line stands out. The source for this excerpt is a Facebook post by Titov. Here it is: “…it seems it has happened — UK out!!! In my opinion, the most important long-term consequence of all this is that the exit will take Europe away from the anglo-saxons, meaning from the USA. It’s not the independence of Britain from Europe, but the independence of Europe from the USA. And it’s not long until a united Eurasia — about 10 years.”

This is a very revealing post to show how unfavorably the past 50 years of post-World War II American imperialism has been viewed. The tipping point, as mentioned in a previous article was the outright 180º that George H.W. Bush pulled on Mikhail Gorbachev: the promise of NATO membership upon reunification of the two Germany’s and the dissolution of the Soviet Union, and then not fulfilling that promise.

The American corporate interests inserted themselves, as the communist government shattered, leaving in its wake oligarchs, the Russian mafia, and a “Wild West” environment within Russia proper and the ex-SSR’s, the former Soviet satellite nations. A tremendous amount of chaos occurred for a decade that was both enabled and further fostered by the United States. The perception in Russia even before the Soviet Union came into being was that Russians were in an economic war with Great Britain, and the United States was looked upon as an “extension” of Britain: a country with language, law, and cultural parallels,especially in terms of expansion.

As of the past several years, the United States has been encroaching upon Russian territory and economic interests. That encroachment has intensified into a U.S.-created “Cold War Resurrection” stance with the bolstering of NATO forces in the Baltic states. The U.S. is virtually thumbing its nose at Russia with the distribution of the “anti-ballistic missile systems” emplaced in places such as Moldova. As Putin pointed out, it takes not even a sneeze and a couple of hours to convert those platforms into use for Tomahawks with nuclear capability. The Russians did not exercise “en passant” with such an opener, and are placing missiles of their own to face the U.S. assets.