Lucien Hervé The Accuser, Delhi, India 1955

Tomorrow we have the State of the Union. Donald Trump will be gloating from ear to ear, but he’ll be subdued – by his standards. Expect perhaps $1 or even $1.5 trillion in infrastructure spending to be announced, plus an immigration plan that gives Democrats much of what they want in exchange for some of the things Trump wants, as well as more on trade surpluses and deficits. The Democrats will attempt to turn it into a circus of sorts by bringing guests, and they will fail.

What America needs right now is dialogue, but it’s only moving further away from it. Anything that’s wrong with anything or anyone gets blamed on Trump. By half the population. That’s nice and easy and convenient, but it doesn’t lead anywhere.

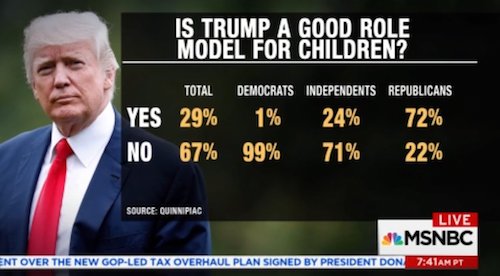

This pic, even though it features a very dumb question, says a lot about where the country stands, and it’s not standing pretty. Everybody’s just busy confirming their own opinions 24/7, egged on by networks, newspapers and social media. It’s like Moses split the nation.

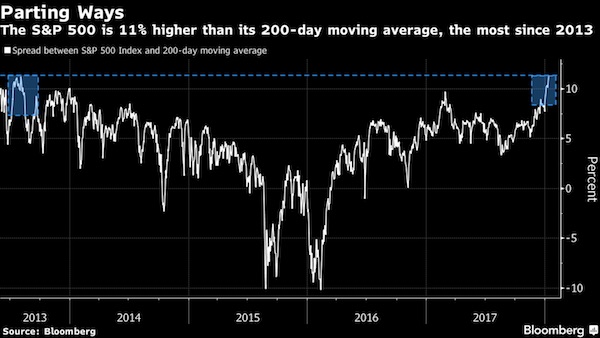

Watched the Trump speech in Davos last week. He made all the points you would expect him to. No scandals, nothing anyone could blame him for. In fact, it’s true that the US economy is doing well, in Trump terms. They’re not my terms, because they laud stock markets that quit being actual markets the moment the Fed and it global brethren killed off price discovery. But in Trump terms a record S&P 500 is all you need to know, alongside low unemployment numbers, even if the latter have everything to do with underpaid shit jobs robbed of all benefits American workers once fought so hard for.

In Trump’s view, that’s a good thing. In mine, it’s a recipe for mayhem. I was watching CNN in the build-up to the speech, and Trump’s denial of the NYT report that he had intended to fire Special Counsel Robert Mueller was completely ignored. Like he never said it. At CNN, anonymous sources have -way- more credibility than the president. That’s a bit of a problem.

After the speech, all sorts of people were interviewed, and Joe Stiglitz of Nobel Memorial fame was one of them. He couldn’t muster anything better than that Trump is a bigot, a misogynist and a racist. That’s a terribly poor reaction to a speech like the one we saw and heard -which included not one word that would make any sane person think of these ‘topics’-, certainly from an economist.

The 1-year-old Donald Trump presidency has brought us a lot of new things, but none more significant than that Trump has been under investigation since day 1 (and even before that). This sets a dangerous precedent that will resound through US politics for a very long time to come, not least of all because today, one year into the presidency, none of the investigations has resulted in anything tangible, while they continue without a finish line in sight.

The problem with that is that if you can do it with one president, someone will do it with the next one and the next one after that as well. Which does great damage not to Trump, but to the entire US political system, and the Office of the President of the United States in particular. If the office cannot command sufficient respect on Capitol Hill to limit any such investigation to an absolute minimum, in deference to what it represents, why would anyone else, domestically or abroad, show such respect?

Obviously, some people may claim that the situation is unique, simply because it concerns Trump, but that argument doesn’t fly very far, because he was elected president, the culmination of a process that, given the powers endowed upon the office, should be close to sacred in the country. And if the very people (s)he must most closely work with, in the Senate and the House, are willing to subject a newly elected president to endless investigations without producing any results for a whole year, where and what are the limits?

It is at present of course all based on opaque accusations of the Trump campaign working with Russian intelligence to swing America’s election process in favor of the president. But to date, four different committees on Capitol Hill, plus Special Counsel Robert Mueller, have made nothing public that proves any such ‘collusion’. And Mueller’s investigation is not only unlimited in time, it’s also unlimited, in practical terms, in scope: whatever is deemed even possibly, perhaps, linked to collusion with Russia, goes.

The American empire was built, once it had acquired enough geopolitical, financial and military power, on invading countries and turning them into shithouses. It wasn’t and original idea, America wasn’t the first country to do it, but it’s certainly been no. 1 in applying the ‘tactic’ over the past 100 years and change. Which makes it curious that when its own elected president calls some countries shithouses, that is treated like the worst thing anybody could have said anytime in history. And racist too, allegedly.

The entire country was built on racism, and it’s still to his day almost exclusively run by white males. Much of the racism may be hidden by now, but it’s still very much there. Go look at Baltimore, Chicago, Milwaukee, and the long list of black kids killed by white cops. It’s not much use trying to claim that America is over its past. But Trump is singled out as a racist, though it’s unclear what would make him worse than others.

And on Martin Luther King Day, all Democrats and many Republicans fell over each other once again claiming they knew exactly what Dr. King stood for in his days, and what he would have said if he were alive today (the same they thermselves say). They don’t have a clue. The only way to honor MLK is to assume he would have been lightyears ahead of you. To assume he would have condemned all US foreign as well as domestic policy, and the likes of Bill Clinton, both George Bushes, Trump, and even Obama, wouldn’t even have had a remote chance of becoming president.

Allegedly Trump never said “shithole countries”, but instead talked about “shithouse countries”. Which would explain why he could say he never used the language he was quoted as having used (“Why are we having all these people from shithole countries come here?”) That a private conversation with lawmakers held in the Oval Office was leaked again within no time will not only frustrate Trump to no end, it also paints a dangerous picture of the future of US politics.

What used to be the exclusive domain of police officers and TV series, the catchy line “anything you say can and will be used against you”, no longer applies only to suspected criminals, from here on in it should be read to American presidents too. Trump and his successors will no longer be able to discuss policy in the White House, they must assume everything they say will be in the press within hours if not minutes. That is dangerous.

But let’s dig some more. And ask ourselves what is worse, let alone more racist: turning nations into shithouses or calling them that after the fact. Half the planet was encouraged to speak out in indignation at the use of the term, but where were all those Americans when the bombs and drones were unleashed upon Syria, Libya, Iraq? Where were the media?

Trump singled out Haiti and El Salvador. Two completely different ‘cases’. But also too complete basket cases (another word for shithouse) , compared to their potential. Haiti was the first slave colony to liberate itself, under black rule. That was in 1804, and if you know what Americans’ view of slaves and black people in general was back then, you can imagine how the former no. 1 global sugar producer was treated. By France, the country that had ruled it, but also by America. And you want to claim Haiti is not a shithouse country today? Go to Port-au-Prince and ask people living in the poor part of town how they feel about that.

As for African countries, the Congo is always a good example. The richest nation on the planet when it comes to natural resources, and one of the poorest when it comes to living standards. Long governed by a regime under Belgium’s King Leopold, matched in cruelty only perhaps by Germany in WWII, the Congo is still maintained as a hellhole to this day. So American and European conglomerates can dig up the metals and minerals almost for free. Not a shithole, a hellhole.

No, Trump is not going to solve that, but he didn’t make it what it is either. Generations of Americans did that. Yeah, we understand why they don’t want it named the way Trump has.

Perhaps the best illustration of how convoluted the entire issue quickly became after Trump said shithouse, which then became shithole, is this LA Times article, which starts out with the headline that Americans with African roots ‘should’ all be insulted, but then rapidly devolves into something else altogether, that insults them a lot more: the history of American involvement in their countries. Slavery, occupation, warfare, plunder.

For Black Americans, Trump’s ‘Shithole’ Comment Was An Insult To Their Histories

Kimberly Atkins, the Washington bureau chief of the Boston Herald, recently did a DNA test “that pretty much confirmed my heritage is 100% the result of the slave trade,” she wrote in a private message on Twitter. “Eighty-seven percent from western coastal African countries and 13% European, all migrated by way of the American South.”

She traced part of her heritage to an ancestor who fought in the Union during the Civil War to guarantee his freedom and the abolition of the U.S. slave trade. “My ancestors did not come from shithole countries,” she tweeted. “They were neither tired nor poor. They were forcibly brought here to live in a shithole created for them.”

Trump’s singling out of Haiti was particularly frustrating for descendants from the Caribbean nation, coming as the nation mourned the eighth anniversary of an earthquake that killed hundreds of thousands of residents.

“Haiti is not unacquainted with racists or white supremacists. We defeated our share of them in 1804 when we became the world’s first black republic,” Haitian American author Edwidge Danticat wrote in a post on Facebook, expressing her frustration that Haitians’ mourning was being diverted by an insult from Trump.

Danticat’s father came to Brooklyn, N.Y., to drive a taxicab “sometimes sixteen hours a day, so that my three brothers (two teachers and an IT specialist) and I could have a better life,” Danticat wrote.

Danticat added: “We are also the country that the United States has invaded several times, preventing us from consistently ruling ourselves. If we are a poor country, then our poverty comes in part from pillage and plunder.”

Clint Smith, a writer and PhD candidate at Harvard University specializing in sociology and education, said that he hoped that at least the president’s remarks would prompt a fuller conversation about past U.S. and European involvement with the countries Trump mentioned — countries still troubled by the legacy of colonial rule and military interventions.

“You can’t understand the economic conditions in which Haiti exists now without understanding the centuries and centuries of direct imperialism and violence and economic exploitation that the country experienced after the Haitian revolution of 1804,” Smith said. “We can’t have a real conversation about what is happening, why Salvadorans are coming here, without discussing how the U.S. contributed to the civil unrest in that country.”

The larger conversation, Smith said, “is not often enough taking into account the way that U.S. policy directly contributed to the condition in which so many of these so-called shitholes are currently existing.”

The woman who says “My ancestors did not come from shithole countries” says it best. Before the slave traders came to ship their ancestors to Brazil and later America, their countries were not shithouses. But they did become just that after, and many if not most still are now.

From a less echo chamber-confined point of view, this little thingy is priceless:

That points to an aspect of all this that we can not ignore: the media. There has a been a profound shirt in that field, and it happened fast, it turned on a dime. The first signs were already there before the Trump presidency, but it’s all been going going gone out of the park since. Media organizations (for lack of a better term) like the New York Times, the Washington Post, MSNBC and CNN were anti-Trump from the get-go, but it was when they found out their attitude was commercially very interesting that they really went for it.

And in a way, that made sense; they all had big problems trying to adapt their business models to the internet age. Then they found that publishing one after another anti-Trump piece brought them tons of new subscribers and advertisement revenue. Also for their internet presence. One stone, two birds.

The problem is that all that revenue and readership comes from one half of America, and excludes the other half. You know beforehand that anything these firms publish about Trump will be biased, and not a little bit. Much of it is based on anonymous sources, not exactly a sign of solid journalism. But it sells. And they have a business to run. We get it.

For those outside of the echo chamber, however, they have become largely unreadable and unwatchable. It’s obvious by now that someone like me, who asks a few questions and doesn’t feel comfortable in an echo chamber, will almost of necessity be ‘accused’ of being a Trump supporter. Absolute nonsense, but that’s echo chambers for you. They’re deafening and they lead to brain damage in case of long term occupancy.

Perhaps even worse are social media, where untold numbers of people revel in the notion that many others think like them, and let that carry them away to ‘heights’ they would never have thought possible. In the case of Trump, many allow themselves to call him names -in writing- they never would have dared use before, but they see echoed back to them on Twitter and Facebook et al.

That their often insults of Trump in effect show their disrespect for America’s political system would never occur to them. It’s an us against them battle, and they feel greatly emboldened by the 24/7 presence of those that are like-minded. It’s entirely unclear where this is going in the future, but it should be obvious it won’t be anywhere pretty.

Neither Bob Mueller nor those 4 committees on Capitol Hill have presented anything of substance as of now, but it’s crystal clear that Donald Trump is not being considered innocent until proven guilty. Which not only goes straight against, and into the heart of, American values and principles of justice, it also doesn’t even begin to address the real problem.

The real problem, and it’s not new at all, is that both US political parties might as well be run by Tony Soprano. The presence inside party leadership of people like Steve Wynn is ridiculous, but so is that of John Podesta. That is undoubtedly blindingly obvious for a vast majority of Americans, but it’s not what they focus on. They focus on Trump instead, on the still contagious obsession with impeaching him, even though many understand that wouldn’t solve any of the underlying issues.

And then Trump gets to present great economic numbers tomorrow. The numbers are mostly fake, but they’re the same ones that the echo chamber media also use, so they’ll have to tackle him somewhere else. They’ll come up with something, don’t worry. Their audience will just wait to be fed the usual pre-chewed bite-size fare anyway.

America needs a dialogue. But all it has left is loud, echoing, deafening, monologues. And plenty shithouse counties and cities and neighborhoods within its own borders as well. For which, too, it’s useless to blame Trump. He’s just the logical conclusion of years of blindness, ignorance, greed, stupidity and neglect. All of which, as long as everyone focuses on him, are guaranteed to continue.

Trump is not what’s wrong with America. Rather, what is wrong with America is what has given it Trump. Someone asked God for a sign and He said: here you are.

Little shithouses for you and me