Vincent van Gogh Field with Irises near Arles 1888

How’s that for a headline?

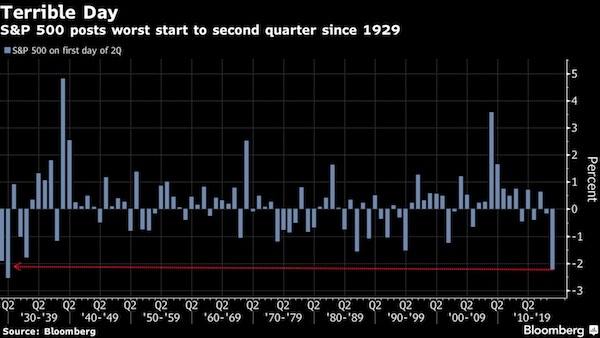

• Stocks’ Second-Quarter Start Is the Worst Since the Great Depression (BBG)

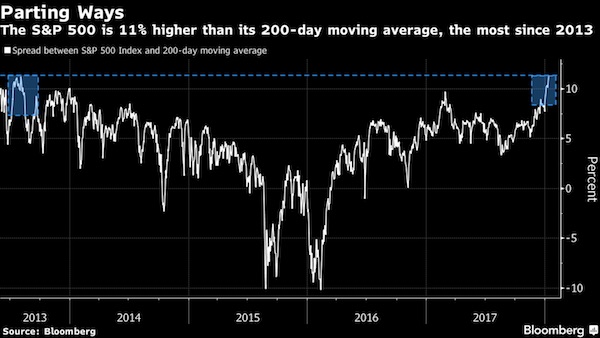

If you feel like the second quarter began badly, you’d be right. U.S. stocks had their worst April start since 1929, according to data compiled by Bloomberg. The S&P 500 index slumped 2.2%, a rout exceeded only by its 2.5% decline 89 years ago, a prelude to the devastating crash later that year that brought on the Great Depression. (Back then, the index only comprised 90 stocks.) China’s retaliatory trade tariffs combined with President Donald Trump’s criticism of Amazon.com Inc. to send equities into a tailspin Monday.

Shares in the online retailer tumbled, encouraging a sell-off in consumer discretionary and technology stocks. The S&P 500 closed below its 200-day moving average – a key technical support – and volatility climbed. The stock slide also looked pretty bad when compared to the beginning of other quarters. Equities lost more than on any other quarterly first day since October 2011, when stocks plummeted 2.8%, Bloomberg data show.

Is there a buyback blackout? Or, better question: should stocks depend on buybacks to such an extent?

• Stocks Lose Critical Buyer at Worst Time (BBG)

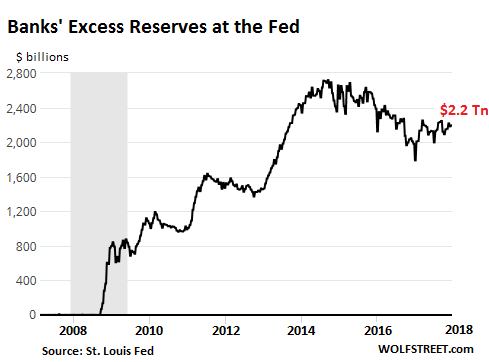

The stock market’s missing a key participant as the second quarter kicks off with a rout. Corporate America is stuck on the sidelines as the S&P 500 Index plunges to its lowest level since early February. That’s to comply with regulations under which companies refrain from discretionary stock buybacks for about five weeks before reporting earnings through the 48 hours that follow. So, with first-quarter reporting season kicking into high gear in two weeks, companies must sit on their hands while the market fizzles. The timing of discretionary buybacks has gained traction in recent years with corporate appetite dwarfing all other investors as the biggest source of demand for U.S. stocks. Strategists such as Goldman Sachs’s David Kostin have pointed out that it’s no coincidence the late-January selloff occurred during a blackout period.

S&P 500 firms have bought back almost $4 trillion of their own shares since the bull market began nine years ago, data compiled by S&P Dow Jones Indices show. That demand helped mitigate damage in early February when stocks tumbled into the first correction in two years. Goldman Sachs’ buyback desk had its busiest week ever during the rout and companies were called “basically the only buyers.” Volume in S&P 500 stocks was about 7% above the 30-day average Monday. Not everyone agrees that the buyback blackout is partly to blame for Monday’s selloff. According to Marko Kolanovic, JPMorgan’s global head of quantitative and derivative strategy, the majority of buybacks are usually done through preset programs that are not subject to blackout.

Moreover, stocks typically go up more when repurchases are announced than when the transactions actually occur. “The whole story about blackout is misconception,” Kolanovic wrote in an email. So, what could be behind the selloff? Kolanovic’s team last week attributed the recent downturn to an “irrational response” to global trade tensions. The S&P 500 is trading at below-average valuations even as earnings growth is picking up, a sign that any weakness would be worth buying, the strategists wrote in a March 27 note.

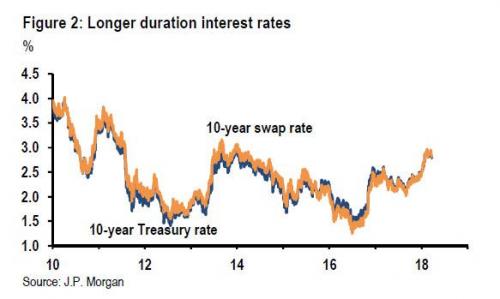

“..an estimated $350 trillion of contracts are based on Libor..”

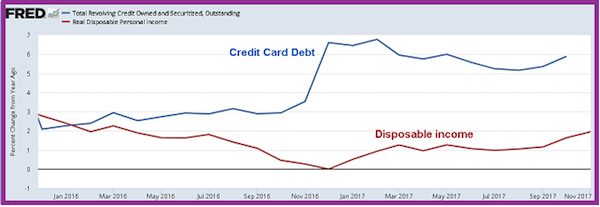

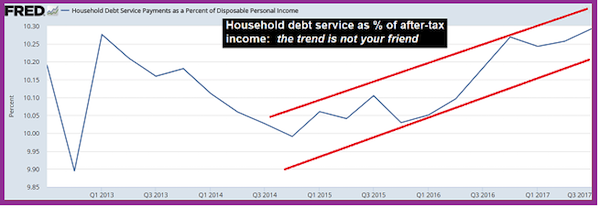

• Rising Rates Sounding Alarm Bells for Debt-Laden US Consumers (BBG)

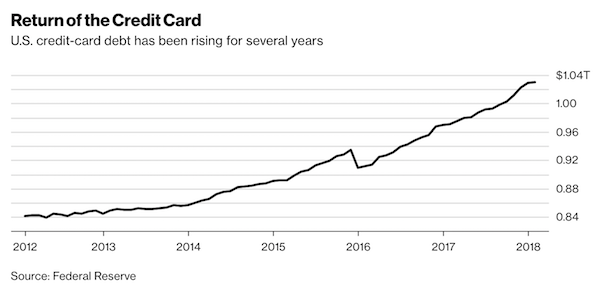

A healthy economy can be a dangerous thing. Americans have a history of loading up on debt in good times, then paying dearly when the bills come due. Adding to the pain: A booming economy is often accompanied by rising interest rates, which make mortgages, credit cards and other debt much more expensive. As the U.S. Federal Reserve raises rates, there are signs that consumers could be putting themselves in peril. “When consumers are confident, or over-confident, is when they get into credit-card trouble,” said Todd Christensen at Debt Reduction Services in Boise, Idaho. The nonprofit credit counseling service has seen a noticeable uptick in people looking for help with their debt, he said.

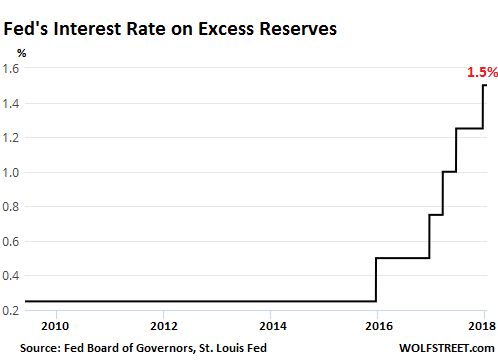

Spending on U.S. general purpose credit cards surged 9.4% last year, to $3.5 trillion, according to industry newsletter Nilson Report. Card delinquencies are also rising. U.S. household debt climbed in the fourth quarter at the fastest pace since 2007, according to the Federal Reserve. “There are warning signs out there,” said Kevin Morrison, senior analyst at the Aite Group. Especially concerning is a surge in student and auto loans over the past decade, he said. Meanwhile, the Federal Reserve is steadily hiking rates, most recently on March 21 when the federal funds rate rose a quarter point to a target range of 1.5% to 1.75%.

Libor, a benchmark rate the world’s biggest banks charge each other, is also on the rise. The 3-month Libor reached 2.3% last week, the highest since November 2008. That could be a problem for companies, especially those with lower credit ratings, looking to refinance debt. Overall, an estimated $350 trillion of contracts are based on Libor, according to its administrator, ICE.

So the shadow banks can take over?

• China’s State-Owned Banks Told To Stop Local Government Loans (SCMP)

The central Chinese government has sent a blunt message intended to dissolve the marriage between banks and local governments, the nexus in China’s debt-fuelled growth model. In a directive full of “must nots”and “shalls” posted on its website last week, China’s Ministry of Finance, under the newly appointed minister Liu Kun, told state-owned financial institutions not to provide any funding to local governments, with the exception of buying government bonds. At the first meeting of the Central Economic and Financial Commission, the supreme economic decision making body headed by Xi Jinping on Monday, the Chinese president said local governments and state-owned enterprises must cut debt further.

China’s state-owned banks were told to check the registered capital of projects sponsored by local authorities, to appraise borrowers’ real repayment capabilities and not to accept local government’s guarantees for repayment or return, according to the ministry’s directive. Banks “must not provide any form of funding directly to local governmental departments or directly via local state-owned enterprises and institutions” and “must not increase new loans to local government financing vehicles irregularly”, according to the notice. It added that banks must not lend any money to local governments to be used as capital in projects, government investment funds or public-private partnership projects, it added.

Yin Zhongqing, deputy director of the financial and economic affairs committee at the National People’s Congress, told the South China Morning Post last month that at least 20 trillion yuan of “hidden debt” had been accumulated in the past three years. The national institution of finance and development under the Chinese Academy of Social Sciences last week estimated the total liabilities of local government financing vehicles was 30 trillion yuan, while another 10 trillion yuan of debt could be buried in public-private partnerships.

“A man with a 50,000 yuan debt is responsible; 200,000 yuan of debt is financially savvy; 1 million yuan of debt is a homeowner; 10 million yuan of debt is classy; and a 1 billion yuan debt is chairman of a listed company … if you don’t have any debt, you must be a total loser.”

• Chinese Families Are Racking Up Debt On An Unprecedented Scale (SCMP)

Chinese families with their long tradition of saving money are now accumulating debt at a rate never been seen before, according to data compiled by a state-backed think tank in Beijing. But the National Institution for Finance and Development also said mounting debt was not a concern because Chinese households still had far more savings than debts. The country’s household leverage ratio – or the ratio between debt incurred by families and GDP – surged to 49% at the end of last year from 17.9% at the end of 2008, going up about 3.5 percentage points annually, the think tank said in a report released on Thursday.

So in the period from 1993, when the data became available, to 2008, the household debt ratio went from 8.3% to 17.9%, with an annual rise of 0.65 percentage points. But in 2016 and 2017, that annual increase accelerated to about 4.9 percentage points, the think tank said. The rapid accumulation of household debt was the biggest factor behind the rise in China’s overall leverage last year, as the corporate sector’s debt ratio fell and local government borrowing was reined in, at least on the surface, it said.

Liu Lei, a researcher with the think tank, said at a briefing on Thursday that real household debt could be “8 percentage points” higher if special housing funds, peer-to-peer lending programmes and private micro loans were factored in. In August, Shanghai-based brokerage Haitong Securities said in a report that while China’s actual household debt ratio was not high compared to many developed countries such as the US and UK, its rate of increase was dangerous. “It took 40 years for the household debt ratio in the US to rise from a level of 20% to about 50%, but it took only less than 10 years in China,” according to the Haitong economists led by Jiang Chao.

[..] China’s excessive money printing in the last decade and skyrocketing property prices have benefited those who maximised their leverage to buy real estate, while the country’s savers bore the brunt of monetary easing, leading to a dramatic shift in attitude on saving versus borrowing. That change in attitude can be seen in a popular saying widely circulated on Chinese social media in recent years: “A man with a 50,000 yuan debt is responsible; 200,000 yuan of debt is financially savvy; 1 million yuan of debt is a homeowner; 10 million yuan of debt is classy; and a 1 billion yuan debt is chairman of a listed company … if you don’t have any debt, you must be a total loser.”

There’s so much wrong here, where to begin? Get out while you can.

• Young Lose Out In Britain’s Housing Wealth Boom (Times)

Three quarters of housing wealth in Britain is held by the over-50s, according to research revealing the generational divide in the property market. Such homeowners hold £2.8 trillion of equity. The over-65s own 43 per cent of housing wealth, £1.6 trillion, the study by the estate agent Savills found. Lawrence Bowles, a research analyst at the company, said: “The extent to which wealth is concentrated in older hands is something we have not seen in a long time.” Owners have piled up equity by living longer, paying off their mortgages and watching as prices grew steadily in the final decades of the last century. “It is looking likely that we will see more people downsizing in order to free up that equity,” Mr Bowles said.

At the other end of the spectrum, homeowners under 35 hold just £221 billion of equity but owe £223 billion in mortgage debt. This age group holds £6 of equity in every £100 compared with £75 held by their parents. First-time buyers face prices that are 5.2 times higher than average incomes, while in London prices are about 14 times higher than average earnings. In most regions, it takes about eight years for the typical first-time buyer to save a deposit. This rises to nine years in the southeast and to nearly ten in London, where the average 20 per cent deposit is now above £80,000.

“If Putin invades…”

• Swedes Turn Against Cashlessness (G.)

It is hard to argue that you cannot trust the government when the government isn’t really all that bad. This is the problem facing the small but growing number of Swedes anxious about their country’s rush to embrace a cash-free society. Most consumers already say they manage without cash altogether, while shops and cafes increasingly refuse to accept notes and coins because of the costs and risk involved. Until recently, however, it has been hard for critics to find a hearing. “The Swedish government is a rather nice one, we have been lucky enough to have mostly nice ones for the past 100 years,” says Christian Engström, a former MEP for the Pirate Party and an early opponent of the cashless economy.

“In other countries there is much more awareness that you cannot trust the government all the time. In Sweden it is hard to get people mobilised.” There are signs this might be changing. In February, the head of Sweden’s central bank warned that Sweden could soon face a situation where all payments were controlled by private sector banks. The Riksbank governor, Stefan Ingves, called for new legislation to secure public control over the payments system, arguing that being able to make and receive payments is a “collective good” like defence, the courts, or public statistics. “Most citizens would feel uncomfortable to surrender these social functions to private companies,” he said. “It should be obvious that Sweden’s preparedness would be weakened if, in a serious crisis or war, we had not decided in advance how households and companies would pay for fuel, supplies and other necessities.”

The central bank governor’s remarks are helping to bring other concerns about a cash-free society into the mainstream, says Björn Eriksson, 72, a former national police commissioner and the leader of a group called the Cash Rebellion, or Kontantupproret. Until now, Kontantupproret has been dismissed as the voice of the elderly and the technologically backward, Eriksson says. “When you have a fully digital system you have no weapon to defend yourself if someone turns it off,” he says. “If Putin invades Gotland [Sweden’s largest island] it will be enough for him to turn off the payments system. No other country would even think about taking these sorts of risks, they would demand some sort of analogue system.”

In this sense, Sweden is far from its famous concept of lagom – “just the right amount” – but instead is “100% extreme”, Eriksson says, by investing so much faith in the banks. “This is a political question. We are leaving these decisions to four major banks who form a monopoly in Sweden.”

A few days ago Elizabeth Warren agreed with Trump on China, now Sanders agrees about Amazon. What’s happening to the world?

• Bernie Sanders Agrees With Trump: Amazon Has Too Much Power (NW)

Independent Vermont senator and 2016 presidential hopeful Bernie Sanders echoed President Donald Trump in expressing concern about retail giant Amazon. Sanders said that he felt Amazon had gotten too big on CNN’s “State of the Union” Sunday, and added that Amazon’s place in society should be examined. “And I think this is, look, this is an issue that has got to be looked at. What we are seeing all over this country is the decline in retail. We’re seeing this incredibly large company getting involved in almost every area of commerce. And I think it is important to take a look at the power and influence that Amazon has,” said Sanders. The senator’s comments came on the heels of a number of tweets from Trump, who has long criticized the online retailer.

WIll Europe start chasing elected politicians?

• German Prosecutors Ask Court To Extradite Carles Puigdemont To Spain (G.)

German prosecutors have asked a court to permit the extradition of former Catalan separatist leader Carles Puigdemont to Spain. Prosecutors in the northern town of Schleswig said on Tuesday they have submitted a request to the regional court following “intensive examination” of the European arrest warrant issued by Spain. Puigdemont has been detained in Germany since 25 March. Spain accuses the 55-year-old of rebellion in organising an unauthorised referendum. The Schleswig court is likely to take several days to decide whether to extradite Puigdemont. His lawyers have urged the German government to intervene in the case, citing the “political dimension.”

Just stop collecting the data. Problem solved.

• The Peril of Psychographics (New Yorker)

In September, 2016, Alexander Nix, the C.E.O. of Cambridge Analytica, the data and messaging company that was working at the time with Donald Trump’s supposedly flagging Presidential campaign, explained his firm’s work like this: “If you know the personality of the people you’re targeting, you can nuance your messaging to resonate more effectively with those key audience groups.” The fancy term for this is psychographic targeting. A few weeks later, Trump won the Presidency, against all odds and predictions, sending political operatives and journalists scrambling for explanations. “There was a huge demand internally for people to see how we did it,” Brittany Kaiser, Cambridge Analytica’s former business-development director, told the Guardian last Friday. “Everyone wanted to know: past clients, future clients.”

Whether Cambridge Analytica’s targeting work actually swayed the outcome of the election has been a subject of debate since then—because the firm’s record is spotty, psychographic targeting in political campaigns is a relatively new concept, and it has not yet been definitely shown that C.A. successfully used these methods on behalf of Trump’s campaign. Christopher Wylie, the former C.A. employee who recently came forward to detail how the company improperly acquired personal data from fifty million Facebook users, has said that the company used that data to create a “psychological warfare mindfuck tool.”

But Aleksandr Kogan, the Cambridge University researcher who provided the company with the Facebook data, has described it as “not that accurate at the individual level.” Kogan’s conclusion tracks with research that has been done by the U.K.-based Online Privacy Foundation, whose research director, Chris Sumner, recently told me that psychographics are much more accurate for groups rather than individual people.

The US and France are turning their backs on Turkey. Feel emboldened by that?

• Erdogan ‘Has Gone Completely Crazy’ – Greek Defense Minister (K.)

Raising the incendiary rhetoric another notch, Defense Minister Panos Kammenos lashed out against Recep Tayyip Erdogan Monday, saying that the Turkish president “has gone completely crazy.” Speaking to journalists outside the Parliament in Athens about the fate of the two Greek soldiers held in Turkey and Ankara’s provocations in the Aegean, Kammenos said there are no lines of communication with Erdogan. “We’re talking about Erdogan, who goes out and publicly insults the US and [Israeli Prime Minister Benjamin] Netanyahu,” he said, adding that “Turkey has no courts while its justice system works under the orders of the sultan [Erdogan].”

The two soldiers, he said, could, under these circumstances, be held there for 15 years. “You cannot answer to a madman,” he said, referring to the Turkish leader. The two soldiers have been held for a month in Turkey without any charges being brought against them yet. Kammenos, who is also the leader of the right-wing junior coalition partner, Independent Greeks (ANEL), said Turkish authorities have so far found nothing to prosecute the two soldiers but warned of a worst-case scenario reminiscent of the film “Midnight Express,” based on the travails of an American who served time in a Turkish prison in the 1970s.

“If you watch ‘Midnight Express,’ you will see that they kept on making up charges against him,” he said, adding that “nothing works democratically there [Turkey].” He also expressed concern that an incident could occur in the Aegean. “They may want to provoke this but you must know that the Turkish military is in a dire state at this moment,” he said, adding that, for its part, Greece “is ready.” He clarified that Greece will not take the bait but noted that if Turkey violates Greek national sovereignty, then “we will respond as we should.”

On the poorest in Greece: “..the state conducted 1.72 million confiscations of salaries, pensions and rent payments last year..”

See, the poor owe €1.2 billion. 40,000 rich individuals and companies owe €90 billion.

• Greek Confiscations Target State Debtors With Small Arrears (K.)

Over 3.3 million taxpayers owe the tax authorities amounts of less than 3,000 euros each. According to figures published by the Independent Authority for Public Revenue, the state conducted 1.72 million confiscations of salaries, pensions and rent payments last year, mostly concerning small debtors. Debtors owing up to 3,000 euros account for 80.5% of all debtors, and they owe 1.2 billion euros. These debts were run up in recent years and mainly stem from failure to pay income tax and the Single Property Tax (ENFIA), whereas bigger debts to the tax authorities concern 40,000 individuals and companies and add up to 90 billion euros, originating from fines and activated guarantees. It is quite impressive that the number of state debtors has increased by some 3 million in the years of the financial crisis, climbing from 1 million in 2010 to 4.1 million today.

“Nostalgia aside..” Nostalgia? What? Nostalgic for life? When everything’s dead, we go and be nostalgic?

• ‘Sentinel’ Dolphins Die in Brazil Bay. Some Worry a Way of Life Has, Too (NYT)

Something ominous was happening in the turquoise waters of Sepetiba Bay, a booming port outside Rio de Janeiro. Beginning late last year, fishermen were coming across the scarred and emaciated carcasses of dolphins, sometimes five a day, bobbing up to the surface. Since then, scientists there have discovered more than 200 dead Guiana dolphins, or Sotalia guianensis, a quarter of what was the world’s largest concentration of the species. The deaths, caused by respiratory and nervous system failures linked to a virus, have subsided, but scientists are working to unravel the mystery behind them. How, they ask, did a virus that might ordinarily have claimed a handful of dolphins end up killing scores of them?

And does part of the answer, scientists and local residents ask, lie in the bay itself, at once a testament to Brazil’s economic power and a portent of environmental risk. The dolphins are “sentinels,” said Mariana Alonso, a biologist at the Biophysics Institute at the Federal University of Rio de Janeiro, one of a number groups working to understand the epidemic. “When something is wrong with them, that indicates the whole ecosystem is fractured.” [..] Sepetiba Bay, 40 miles west of downtown Rio, became one of the principal gateways for Brazilian exports over the past generation. In 2017, 39 million tons of iron ore and other commodities shipped from there.

The wooden fishing boats that crisscross the bay now weave around massive merchant ships loaded with iron and steel. Though people still swim in its waters, four ports and a constellation of chemical, steel and manufacturing plants have risen on its shores. One of world’s most prominent iron ore producers, Vale, occupies a new terminal in an old fishing spot on nearby Guaiba Island. “When I was a child, buffalo roamed the farms around my village, and we had apples and coconuts,” said Cleyton Ferreira Figueiredo, 28, a convenience store cashier who, nostalgia aside, also sees advantages in the development. “Now everything is more urban, with schools and facilities. There are more jobs, and it takes me 15 minutes to get home when I finish.”

A little scary.

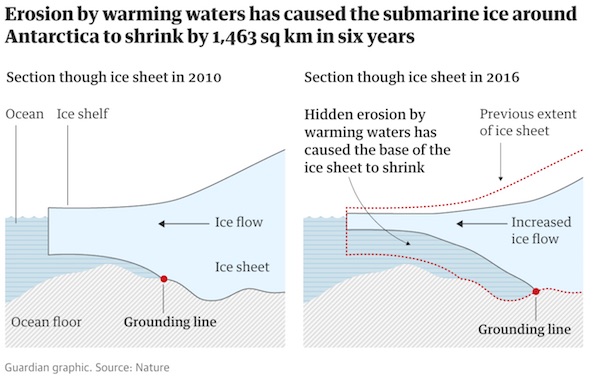

• Underwater Melting Of Antarctic Ice Far Greater Than Thought (G.)

Hidden underwater melt-off in the Antarctic is doubling every 20 years and could soon overtake Greenland to become the biggest source of sea-level rise, according to the first complete underwater map of the world’s largest body of ice. Warming waters have caused the base of ice near the ocean floor around the south pole to shrink by 1,463 square kilometres – an area the size of Greater London – between 2010 and 2016, according to . The research by the at the University of Leeds suggests climate change is affecting the Antarctic more than previously believed and is likely to prompt global projections of sea-level rise to be revised upward.

Until recently, the Antarctic was seen as relatively stable. Viewed from above, the extent of land and sea ice in the far south has not changed as dramatically as in the far north. But the new study found even a small increase in temperature has been enough to cause a loss of five metres every year from the bottom edge of the ice sheet, some of which is more than 2km underwater. “What’s happening is that Antarctica is being melted away at its base. We can’t see it, because it’s happening below the sea surface,” said Professor Andrew Shepherd, one of the authors of the paper. “The changes mean that very soon the sea-level contribution from Antarctica could outstrip that from Greenland.”

The study measures the Antarctic’s “grounding line” – the bottommost edge of the ice sheet across 16,000km of coastline. This is done by using elevation data from the European Space Agency’s CryoSat-2 and applying Archimedes’s principle of buoyancy, which relates the thickness of floating ice to the height of its surface.