Lewis Wickes Hine Workers in Maryland packing company 1909

“We need to fundamentally renegotiate American trade agreements so that our largest export doesn’t become decent-paying American jobs,” said Sanders.”

• Obama’s Plans For TPP, TTIP Trade Deals In Tatters After Senate Vote (Guardian)

Barack Obama’s ambitions to pass sweeping new free trade agreements with Asia and Europe fell at the first hurdle on Tuesday as Senate Democrats put concerns about US manufacturing jobs ahead of arguments that the deals would boost global economic growth. A vote to push through the bill failed as 45 senators voted against it, to 52 in favor. Obama needed 60 out of the 100 votes for it to pass. Failure to secure so-called “fast track” negotiating authority from Congress leaves the president’s top legislative priority in tatters. It may also prove the high-water mark in decades of steady trade liberalisation that has fuelled globalisation but is blamed for exacerbating economic inequality within many developed economies with the outsourcing of manufacturing jobs.

Internet activists had said the deal would curb freedom of speech, while other critics charged it would enshrine currency manipulation. Drama over the landmark trade negotiations has been escalating for weeks, propelling Obama into a public feud with Democrats – going so far as to accuse opposing members within his party of lying about the fast-track bill. The vote marked a rare moment in which Republicans lined up to support the president’s agenda, even as GOP leadership pointed to Obama’s failure to rally his own party in favor of the legislation.

“Really it’s a question of does the president of the United States have enough clout with members of his own political party to produce enough votes to get this bill debated and ultimately passed,” Texas senator John Cornyn, the No 2 Republican in the Senate, told reporters on Capitol Hill. White House officials dismissed the Senate vote against fast tracking as a “procedural snafu” but without this crucial agreement from lawmakers to give the administration negotiating freedom, it is seen as highly unlikely that international diplomats can complete either of the two giant trade deals currently in negotiation: the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (TTIP).

Major defeat. The increased weight of Elizabeth Warren and Bernie Sanders has a lot to do with this.

• US Senate Votes Against Fast-Tracking TPP (RT)

Lawmakers in the United States Senate have thrown a wrench in a plan that would have given President Barack Obama “fast track” authority to advance a 12-nation trade deal between the US and Pacific Ring partners. In a 52-45 vote on Tuesday afternoon, the Senate opposed moving forward for now on the Trans-Pacific Partnership. A procedural vote required at least 60 “ayes” in order to let the Senate host discussions on whether or not to give the president so-called “fast track” authority on the matter. Failure to reach that threshold puts the future of the trade agreement in jeopardy. Had the vote gone the other way, lawmakers would have hosted a debate to decide whether to give President Obama the power to approve the potential deal on his own, before asking Congress to either ratify or reject any agreement.

Ahead of Tuesday’s vote, Senator Orrin Hatch (R-Utah), the chairman of the Senate Finance Committee, told Reuters the possibility of expediting the process as the White House had requested “may be dead” due to lack of support soon after the procedural vote failed. “In the future, if we see a sharp decline in US agriculture and manufacturing,” Hatch said after the votes were counted, “…people may very well look back at today’ events and wonder why we couldn’t get our act together.” “I’m already thinking that: why couldn’t we get our act together?” he asked. “I have no doubt some will come to regret what went on here today, one way or another.”

Sen. John Cornyn (R-Texas), the majority whip of the chamber, added on the Senate floor that he was disappointed that Democratic lawmakers refrained from voting for the fast-track authorization, but said he was willing to “work with anybody, including the pres of the United States, to try to get our economy growing again.” President Obama has been touting the TPP as a catalyst for the domestic jobs market and an enabler of workers’ rights abroad, and last week he pitched the deal at the main office of footwear giant Nike. “If I didn’t think that this was the right thing to do for working families then I wouldn’t be fighting for it,” Obama told the crowd at Friday’s event. [..] TPP partners currently include the United States, Japan, Mexico, Canada, Australia, Malaysia, Chile, Singapore, Peru, Vietnam, New Zealand and Brunei.

‘Wait a minute. I’m going to take notes and then you’re going to take my notes away from me and then you’re going to have them in a file, and you can read my notes? Not on your life.’”

• Top Democratic Senator Blasts Obama’s TPP Secrecy (Intercept)

Sen. Barbara Boxer, D-Calif., today blasted the secrecy shrouding the ongoing Trans-Pacific Partnership negotiations. “They said, well, it’s very transparent. Go down and look at it,” said Boxer on the floor of the Senate. “Let me tell you what you have to do to read this agreement. Follow this: you can only take a few of your staffers who happen to have a security clearance — because, God knows why, this is secure, this is classified. It has nothing to do with defense. It has nothing to do with going after ISIS.” Boxer, who has served in the House and Senate for 33 years, then described the restrictions under which members of Congress can look at the current TPP text.

“The guard says, ‘you can’t take notes.’ I said, ‘I can’t take notes?’” Boxer recalled. “‘Well, you can take notes, but have to give them back to me, and I’ll put them in a file.’ So I said: ‘Wait a minute. I’m going to take notes and then you’re going to take my notes away from me and then you’re going to have them in a file, and you can read my notes? Not on your life.’” Boxer noted at the start of her speech that she hoped opponents of the trade promotion authority bill — the so-called fast-track legislation required to advance the TPP — would be able to block the bill via a filibuster. Senate Majority Leader Mitch McConnell, R-Ky., is expected to file a motion to invoke cloture on the measure later this afternoon.

“Instead of standing in a corner, trying to figure out a way to bring a trade bill to the floor that doesn’t do anything for the middle class — that is held so secretively that you need to go down there and hand over your electronics and give up your right to take notes and bring them back to your office — they ought to come over here and figure out how to help the middle class,” Boxer said.

We must see jail time now.

• US Set to Rip Up UBS Libor Accord, Seek Conviction (Bloomberg)

The U.S. Justice Department is set to rip up its agreement not to prosecute UBS Group AG for rigging benchmark interest rates, according to a person familiar with the matter, taking a new step to hold banks accountable for repeat offenses. The move by the U.S. would be a first for the industry, making good on a March threat by a senior Justice Department official to revoke such agreements and putting banks on notice that these accords can be unwound if misconduct continues. UBS is among the five banks that are poised to reach settlements with U.S. regulators over allegations that they manipulated currency markets, people familiar with the situation have said.

Four of them – Citigroup, JPMorgan, Barclays and Royal Bank of Scotland – will likely enter pleas related to antitrust violations, people familiar with the talks have said. “This is basically a trade off,” said Andreas Venditti at Vontobel in Zurich. “They get leniency on foreign exchange and a lower fine and instead the Justice Department comes back with Libor.” UBS’s cooperation in the currency probe may help shield it from antitrust charges in that matter. However, the bank is still exposed to fraud charges in that case, and any admission of wrongdoing could also put it in violation of an earlier deal the Zurich-based bank struck with the Justice Department.

In a December 2012 non-prosecution agreement with the U.S. to resolve a worldwide investigation into the manipulation of the London interbank offered rate, or Libor, UBS promised not to commit crimes for two years. That agreement, which was set to expire last year, was extended through December as the Justice Department investigated currency rigging. As part of the currency settlements, which are set to be announced in coming days, UBS is expected to plead guilty to a charge stemming from the Libor agreement.

QE becomes the snake that eats its tail.

• No Respite In Selloff Of Low-Risk Bonds (Reuters)

Low-risk bonds sold off again on Tuesday driving down stocks and helping push the euro higher against the dollar. Ten-year U.S. Treasury yields, the benchmark for global borrowing costs, hit their highest since early December, while German 10-year yields added 8 basis points to 0.67%. Volatility in the bond markets weighed on stocks, adding to existing investor anxiety over the perilous state of Greece’s finances. Shares in Europe and followed Wall Street lower. “It’s a matter of concern for the market. When any particular asset class goes through periods of extreme volatility in a short space of time, people feel the pressure to take their risk exposure lower,” Ian Richards, global head of equities strategy at Exane BNP Paribas, said.

Less than a month ago German 10-year yields hit a record low of 0.05%, driven down by a €1 trillion ECB bond-purchase scheme intended to kick-start inflation. Traders, who struggle to fully explain the recent yield surge, blame it on a rise in inflation expectations, higher oil prices, and restricted liquidity, caused by ECB purchases, as investors sought to exit a crowded trade. “It’s clear that the market hasn’t stabilized. Before the sell-off started the common perception was one of low volatility. Now investors are more cautious, asking for a premium for the volatility we’ve seen recently,” said Jan von Gerich, chief fixed income analyst at Nordea.

“For years, companies have been choosing [to outsourec labor], which reduces the requirement for capital in the West, thereby reducing the price of that capital.”

• Everyone Looks in the Wrong Place for the Answer to Low Real Rates (Bloomberg)

Ben Bernanke and Larry Summers recently had a public discussion on global interest rates, which currently are exceptionally low, and whether or not secular stagnation—the idea that slow growth in the developed economies may be here to stay—is the culprit. They proved unable to agree on either the cause of, or a solution to, current low real rates. Bernanke, the former central banker, sees the problem as a global savings glut and the solution in monetary policy and structural reforms. Larry Summers, the former U.S. Treasury Secretary, suggests that if secular stagnation is the problem, the solution lies in expansionary fiscal policies. What if they’re both wrong?

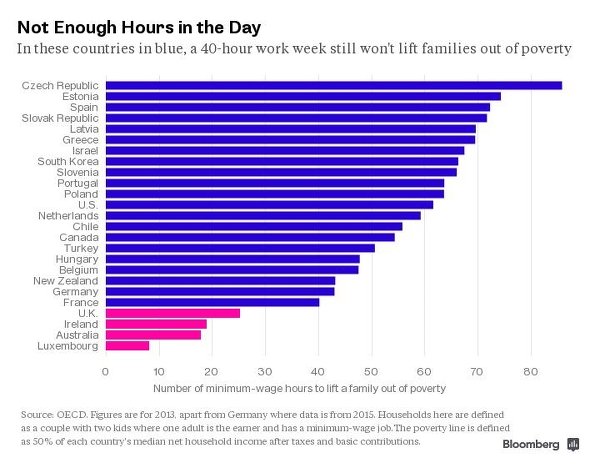

In a column published in voxeu.org over the weekend, Toby Nangle, head of multi-asset allocation at Columbia Threadneedle Investments, suggests that current low real rates have little to do with central banks or fiscal policy. The problem is a much larger and longer trend than either Bernanke or Summers suggest and is due, according to Nangle, to the effects of globalization and the collapse of labor power in the West. At its simplest, Nangle’s thesis is that the supply of cheap, skilled labor from East Asia and former communist countries over the past few decades has meant that global labor costs have remained lower than they otherwise would have been. Globalization has meant that industry has had access to this alternative source of labor, which has massively reduced labor power to negotiate higher wages in the West.

[..] a large selection of people who are well-off in global terms—the Western working class—have not benefited at all from the past three decades of global growth. Access to a new reserve army of cheap global labor through globalization has encouraged companies to invest in this workforce rather than in capital at home. A garment company, for example, could chose to build a highly automated, capital-intensive factory in the U.S. or build a low-tech, high-labor factory in the Far East. For years, companies have been choosing the latter option, which reduces the requirement for capital in the West, thereby reducing the price of that capital. For labor-market pricing power to remain weak, the supply of excess labor has to remain strong. Labor market globalization is largely a China story, and there are signs that supply is now drying up.

“Whenever a country increases its debt to GDP sharply over five years, in the next five years there’s a 70% chance of a financial crisis and 100% chance of a major economic slowdown..”

• China Outlook Even Worse Than Imagined: Analyst (CNBC)

The worst of the Chinese economic slowdown is likely still ahead because of the nation’s debt, according to a senior Morgan Stanley investment strategist. “China, to try and sustain its growth rate in the post-financial-crisis era, has engaged in the largest credit binge of any emerging market in history,” said Ruchir Sharma, head of emerging markets and global macro at Morgan Stanley Investment Management, Sharma, speaking Tuesday at the Global Private Equity Conference in Washington, D.C., predicted that the credit boom would cause problems. Whenever a country increases its debt to GDP sharply over five years, in the next five years there’s a 70% chance of a financial crisis and 100% chance of a major economic slowdown, according to Morgan Stanley research.

The Chinese government this week cut interest rates for the third time in six months because of projected 7% GDP growth this year, the lowest level in more than two decades. Sharma said the slow growth he forecast would be around 4% or 5% over the next five years, about half the rate of what it used to be. “If China follows this template, it really is payback time,” he said. Another speaker at the conference, former U.S. Gen. Wesley Clark, took a less grim view. “I’m not as worried about the buildup of debt in China as other countries,” the founder of Wesley Clark & Associates said. He cited two reasons. The renminbi is not fully convertible to other currencies, and the Chinese economy still has elements of central control.

“Every year people at these business conferences say the demise of the Chinese economy is coming very rapidly,” Clark added. “But it hasn’t happened. And President Xi is not going to let it happen if he can avoid it.” Another China bull, Robert Petty, managing partner and co-founder of Clearwater Capital Partners, said China can forestall its debt problems. “We believe the balance sheet of China absolutely has the capacity to do two things: term it out and kick the can down the road,” Petty said.

“Within the EU there are a lot of financial funds which will continue to be available for Greece..”

• EU Said to Consider Plan for Greece in Event of Euro Exit (Bloomberg)

Euro-area governments are considering putting together an aid package for Greece to cushion the country’s economy if it was forced out of the euro, according to two people familiar with the discussions. The Greek government doesn’t expect to need that help. Prime Minister Alexis Tsipras says he’s not considering leaving the currency bloc and is focused on getting the aid he needs to avoid a default. Even so, European officials are considering mechanisms to ring fence Greece both politically and economically in the event of a euro breakup, in order to shield the rest of the currency bloc from the fallout, one of the people said. “There is always a plan B,” Filippo Taddei, an economic adviser to Italian Prime Minister Matteo Renzi, said in an interview in Rome on Tuesday, without referring to the aid package specifically.

“But you have to ask yourself who has the ability to step in, in that event. And I think if you start making up a list you realize very quickly that that list is very short.” While euro-area finance ministers welcomed the progress Greece has made toward qualifying for more financial aid at a meeting in Brussels on Monday, policy makers are still concerned Tsipras may not be prepared to swallow the concessions necessary for a disbursement. Before any payment will be made, Greece has to submit a comprehensive program of economic reforms, win approval from its creditor institutions, secure the endorsement of euro-region finance ministers and then get past parliaments in Berlin and elsewhere. Greek Finance Minister Yanis Varoufakis said on Monday his country will run out of cash within a couple of weeks unless it gets help.

“Trying to pretend that economies as different as Germany and Greece can survive effectively under the same monetary umbrella has already been proven wrong and this is just going to be a long, long painful death for the Greek economy,” Richard Jeffrey at Cazenove Capital, said Monday. With Ukraine to the north of Greece ravaged by Russian-backed separatists and Libya to the south collapsing as rival militias fight for control, the German government has made it clear that leaving the euro wouldn’t jeopardize Greece’s place in the European Union. “Within the EU there are a lot of financial funds which will continue to be available for Greece,” Thomas Steffen, Germany’s chief negotiator with Greece within the euro area, said at an event in Berlin last week. “There is no reason to even contemplate that Greece would leave the European Union.”

Squeeze your grandma!

• Greece’s Creditors Said to Seek €3 Billion in Budget Cuts (Bloomberg)

Greece’s anti-austerity government needs to raise at least €3 billion through additional fiscal measures by the end of this year to meet the minimum budget targets acceptable by creditors, an official with knowledge of the discussions said. The reductions would bring the primary budget surplus in 2015 to just over 1% of gross domestic product, a target Greek Interior Minister Nikos Voutsis said today is acceptable. Without any change in fiscal policy, Greece would end 2015 with a budget deficit of about 0.5% of GDP, the official said. The so-called primary budget balance doesn’t include interest payments Greece, whose debt-to-GDP ratio is the highest in Europe, is locked in talks with euro region governments and the INF over the terms attached to its €240 billion bailout.

Uncertainty over whether it will do enough to receive more money has triggered a liquidity squeeze, prompting the European Commission to revise down deficit and debt forecasts last week. The commission now predicts the country’s debt will be 174% of GDP next year, 15 percentage points above the level projected in February. And that assumes Prime Minister Alexis Tsipras reaches a deal to get previously agreed aid flowing by June. The commission predicts that as defined in the bailout program there will be almost no surplus. Budget cuts aren’t the only thorny issue in the negotiations over the disbursement of the next emergency loans tranche for the cash-strapped economy.

Disagreements remain over the retirement age, pension cuts, privatizations and the government’s intention to reinstate collective bargaining restrictions in the labor market, the official said. As negotiations drag on, euro-area governments are considering putting together an aid package for Greece to cushion the economy in the event that it is forced out of the common currency, two people familiar with the discussions said yesterday. While the Greek government expects to remain in the euro, some officials are considering mechanisms to ring-fence Greece both politically and economically in the event of a breakup, one of the people said.

“The Greek side has so far fully met everything the Feb. 20 Eurogroup decision foresaw. It has taken as many steps as possible towards the European partners’ side,” the official quoted Tsipras as telling his cabinet.

• Greece Wants Action From Lenders (Reuters)

Greek Prime Minister Alexis Tsipras on Tuesday called on lenders to break an impasse in cash-for-reform talks after Athens had to resort to a temporary expedient to make a crucial payment to the IMF. Greek officials told Reuters they had emptied an IMF holding account to repay €750 million to the global lender on Monday, avoiding default but underscoring the dire state of the country’s finances. At his second cabinet meeting in three days, Tsipras told ministers Athens was sticking to its “red lines” and that it was time to see lenders meet Greece halfway, according to a government official. The official said Greece is still expecting a deal by the end of the month.

“The Greek side has so far fully met everything the Feb. 20 Eurogroup decision foresaw. It has taken as many steps as possible towards the European partners’ side,” the official quoted Tsipras as telling his cabinet. “It’s now our partners’ turn to make the necessary steps in order for them to prove in practice their respect towards the democratic popular mandate.” Earlier, Germany’s hardline finance minister Wolfgang Schaeuble said the negotiations’ tone had improved but not their substance, warning again that time was running out for Greece. “On the issues, progress in the talks is not comparable to the improvement in the atmosphere,” Schaeuble told reporters after a EU finance ministers’ meeting in Brussels.

Euro zone partners issued a lukewarm statement on Monday welcoming incremental progress in the talks but noting that more work was needed to narrow remaining gaps. Sources say these are mainly over pension and labor reforms and budget targets. The creditors are insisting Greece must adopt and begin implementing a full reform program before they will start releasing the last €7.2 billion from a bailout program that expires at the end of June.

Interesting move.

• Greece Tapped Reserves At IMF To Make Debt Repayment (Reuters)

Greece tapped emergency reserves in its holding account at the IMF to make a crucial €750 million debt payment to the Fund on Monday, two government officials said on Tuesday. With Athens close to running out of cash and a deal with its international creditors still elusive, there had been doubts whether the leftist-led government would pay the IMF or opt to save cash to pay salaries and pensions later this month. Member countries of the IMF have two accounts at the fund – one where their annual quotas are deposited and a holding account which may be used for emergencies. One official told Reuters that Athens used about €650 million from the holding account to make the payment.

“We made use of money in our holding account in the fund,” the official said, declining to be named. “The government also used about €100 million of its cash reserves.” Made a day early, the payment calmed immediate fears of a Greek default, but Finance Minister Yanis Varoufakis said on Monday the liquidity situation was “terribly urgent” and a deal to release further funds was needed in the next couple of weeks. A second Greek official said on Tuesday that the reserves the government tapped must be replenished in the IMF account in “several weeks.” Following legislative changes, Greece has meanwhile gathered €600 million of local government and other public entity money to help it deal with the cash crunch, the government’s spokesman said on Tuesday.

It’s not as if Athens isn’t trying.

• This Is How Greece Kept Its Budget On Track In Q1 (Macropolis)

Recent Greek budget data showed the huge revenue gap of €968 million recorded in January narrowed to €389 million by the end of the first quarter (Q1) of 2015. At the same time, primary expenditure, which was just €53 million better than target in January, displayed a strong outperformance of €1.18 billion by the end of March. The underlying primary balance (excluding the impact of Public Investment Budget), which is defined as revenues (before tax refunds) minus primary expenditure, showed the shortfall of 915 million euros recorded in January gradually reversed to an outperformance of €791 million by the end of March.

Another important point to take away is that revenues exceeded primary expenditure in all three months of Q1, with the underlying monthly primary surplus ranging between €240 and €845 million. This means that the collected revenues in each month are more than adequate for the payment of primary expenses (salaries, pensions, grants to social security sector and a large part of non-payroll costs). A closer look at the evolution of the key budget items reveals some instructive findings for the underlying trends that were recorded within Q1.

On the revenue front, the target for January was exceptionally high as it was initially due to include VAT revenues and the fifth installment of the single property tax (ENFIA). However, the negative impact from the pre-election period as well the postponement of the VAT payment by one month had a marked impact on the revenue underperformance of that month. VAT payments in February did not result to any significant revenue collection, with VAT revenues coming in 30% lower than those collected in January. However, February closed with a modest revenue outperformance of €91 million, mainly boosted by higher income tax month on month.

German luxury car sales. Oh irony.

• The Real Sign That Greece’s Financial Turmoil Is Getting Worse (Telegraph)

Here is a slightly surprising sign that Greece is in the classic throes of a bank run: car sales jumped by 47pc in April. It was the 20th consecutive month that car registrations of new and used vehicles has risen. People living in a country gripped by financial turmoil often worry about the security of their money. If it’s in a bank, it can be caught up in capital controls or lost through insolvency. Better, then, to spend it. And the purchase of choice is often a car. This makes motor vehicle sales a decent proxy for financial turmoil (under some circumstances). Ordinary Greeks, many of whom are not wealthy enough to hold bank accounts outside of the country, are taking their money of the financial system and spending it on “hard” assets.

In December, when snap elections were called in Greece, monthly car registrations soared by nearly 70pc. Since then, bank desposits have shrunk by nearly 15pc of their total value. Another €7bn left the country in April alone. A similar phenomenon was observed during Russia’s financial meltdown late last year. The rouble’s crash resulted in many Russians scrambling to make “high-ticket” purchases, including four wheels. During Cyprus’s banking crisis in 2013, car registrations increased by nearly a third in 10 months. Many Cypriots rightly feared their unsecured deposits would be at risk from the “bail-ins” of the country’s biggest banks.

Cypriot consumers also chose to make their purchases in cash, rather than be tied to financing or hire-purchase deals. Despite depreciating in value quite quickly, cars are still a handy asset to own because they can be put to productive use – especially if the alternative is just stashing your money under a matress. In a strange irony of Greece’s woes, German industry is perversely one of the main beneficiaries of the country’s banking collapse. Greek consumers, like many of their fellow Europeans, buy German cars more than any other brand.

Dmitry stays sharp.

• America’s Achilles’ Heel (Dmitry Orlov)

Instead of collapsing quietly, the US has decided to pick a fight with Russia. It appears to have already lost the fight, but a question remains: How many more countries will the US manage to destroy before the reality of its inevitable defeat and disintegration finally catches up with it? As Putin said last summer when speaking at the Seliger youth forum, “I get the feeling that no matter what the Americans touch, they end up with Libya or Iraq.” Indeed, the Americans have been on a tear, destroying one country after another. Iraq has been dismembered, Libya is a no-go zone, Syria is a humanitarian disaster, Egypt is a military dictatorship executing a program of mass imprisonment.

The latest fiasco is Yemen, where the pro-American government was recently overthrown, and the American nationals who found themselves trapped there had to wait for the Russians and the Chinese to extract them and send them home. But it was the previous American foreign policy fiasco, in the Ukraine, which prompted the Russians, along with the Chinese, to signal that the US has taken a step too far, and that all further steps will result in automatic escalation. The Russian plan, along with China, India, and much of the rest of the world, is to prepare for war with the US, but to do everything possible to avoid it. Time is on their side, because with each passing day they become stronger while America grows weaker.

But while this process runs its course, America might “touch” a few more countries, turning them into a Libya or an Iraq. Is Greece next on the list? What about throwing under the bus the Baltic states (Estonia, Latvia, Lithuania), which are now NATO members (i.e., sacrificial lambs)? Estonia is a short drive from Russia’s second-largest city, St. Petersburg, it has a large Russian population, it has a majority-Russian capital city, and it has a rabidly anti-Russian government. Of those four facts, just one is incongruous. Is it being set up to self-destruct? Some Central Asian republics, in Russia’s ticklish underbelly, might be ripe for being “touched” too.

There is no question that the Americans will continue to try to create mischief around the world, “touching” vulnerable, exploitable countries, for as long as they can. But there is another question that deserves to be asked: Do the Americans “touch” themselves? Because if they do, then the next candidate for extreme makeover into a bombed-out wasteland might be the United States itself.

But all they have left is words.

• Central Banks Need To Talk A Lot Less And Act A Lot More (Satyajit Das)

Research confirms the increase in the length and complexity of the US Federal Reserve’s statements, parallelling the rise in the size of its balance sheet. Facing intractable problems and difficult choices, politicians have abnegated economic leadership to central bankers. With limited policy options available, central bankers have resorted to “forward guidance”: a tautology, as any guidance must be about future events. They now communicate commitments on future interest rates, liquidity provision or quantitative easing (QE) and currency values over a medium to long-term horizon. Forward guidance suffers from a number of weaknesses. Focus on any single or narrow set of indicators, such as unemployment or inflation, is not meaningful.

Forward guidance relies on the accuracy of central bank forecasts. Guidance is highly conditional. Central bankers have no “skin in the game” – their tenure or remuneration is not linked to outcomes. An unanticipated trigger event can lead to a sudden response or policy change. In January 2015, the Swiss National Bank’s decision to abandon its currency peg highlights the problem. It created volatility and uncertainty, precisely the opposite of the policy intention. Forward guidance increasingly confirms John Maynard Keynes’s fear that “confusion of thought and feeling leads to confusion of speech”. The Fed committed to keeping rates low until the unemployment rate fell below 6%. In early 2014, the Fed changed the unemployment target to a non-binding indicator.

In May 2014, the full-employment goal was changed to cover the “disadvantaged”, including long-term unemployed and workers forced to work part-time. The Bank of Japan and European Central Bank targeted 2% inflation, despite the fact that actual inflation was near zero and proving unresponsive to traditional policies. In March 2014, at her first press conference, the new chair, Janet Yellen, stated that the Fed would not increase interest rates for a “considerable time”. In December 2014, the Fed announced it would be “patient”. Now the word patient has been jettisoned, although Ms Yellen has warned that not being patient is not the same as being impatient.

European central bankers lead the world in policy linguistics. Mario Draghi’s July 2012 statement that the ECB would “do whatever it takes” is credited with stabilising money markets and reducing borrowing costs of eurozone countries without requiring any actual intervention. In October 2013 he was ready to consider all available instruments, a message repeated in November and again in December. In January 2014 he stated that he would take further decisive action if required. In February and March, despite the lack of actual initiatives, he again vowed to take further decisive action if required. In April and May, the ECB undertook to act swiftly if required. Forced finally to announce new measures in June 2014, Mr Draghi finished with a rhetorical flourish: “Are we finished? The answer is no.” By November, he was recycling 2012: “We must do what we must”.

Beppe Grillo’s M5S has been targeting the EXPO madness for a long time.

• What Does Milan Gain By Hosting Bloated Expo 2015 Extravaganza? (Guardian)

A four-storey high rug of twinkling LEDs proclaims the glories of Turkmenistan’s textile traditions above a rain-soaked scene, casting a pinkish glow across the golden arches of the neighbouring McDonald’s. Across the way, a half-finished Nepalese pagoda towers over a faceted glass dome of Belgian produce, while Russia thrusts a gargantuan mirrored canopy into the air, aggressively cocked like a missile next to Estonia’s wooden shed. A bugle call is the signal for a Korean marching band to strike up, trumpeting the arrival of the country’s futuristic white space-blob, just as an Argentinian drumming troop thunders into action next door.

Sprawling across 110 hectares on the outskirts of Milan, this crazed collage of undulating tents, tilting green walls and parametrically-contorted lumps can mean only one thing: Expo 2015, latest in a long and controversial tradition of “world’s fairs”, has landed. “We’ve tried to build a stage where all the actors can make their voices heard,” says its design director Matteo Gatto, fresh from touring the Italian prime minister and the pope (who has his own, relatively restrained, pavilion) around the frenzied fairground. And Gatto appears to have achieved his aim: the 140 participating countries and brand sponsors are screaming their presence at full volume.

In the centre of Milan, however, others have been making their voices heard in a different way. As the fair opened on May Day, thousands took to the streets to protest, while violent splinter groups smashed shopfronts and torched cars. “The Expo is a machine for burning public money,” said one protester, carrying a “No Expo” banner. “It promised to bring jobs and boost the economy, but it’s being run by voluntary labour and has wasted billions on pointless infrastructure.” “It claims to be a celebration of slow food, local agriculture and healthy eating,” added another activist, carrying an anti-globalisation placard. “Its official motto is Feeding the Planet, Energy for Life, but it is sponsored by corporate giants like Coca-Cola and McDonald’s. The whole thing is beyond a joke.”

One more area in which the EU is entirely clueless. Expect total disaster.

• Europe Prepares Plan To Fight Human-Traffickers (Spiegel)

EU leaders convened in Brussels in late April for an emergency summit on the refugee crisis, which came to a head over the course of a few weeks that saw thousands of migrants drown trying to cross the Mediterranean. Negligence on the part of EU member state governments was partly to blame for the tragedy, with the Italian coast guard left alone to cope with the problem. The various leaders assembled in Brussels were eager to take decisive action – and to identify an enemy. “We agreed that we need to tackle the traffickers’ pernicious business model at its roots,” said German Chancellor Angela Merkel. Military action could not be ruled out, including the destruction of boats used by smugglers. Federica Mogherini, the EU’s high representative for foreign affairs and security policy, was tasked with drawing up a proposal for an EU-led military operation.

Two weeks later, Mogherini briefed the UN Security Council on plans for a resolution authorizing the use of force. They amount to a declaration of war on human-trafficking, as evidenced by the fact that the draft paper was classified as top secret by the European External Action Service, the EU’s diplomatic service. It outlines full-scale military action in the Mediterranean and North Africa. The EU is clearly pinning its hopes on deterrence. Rather than considering accepting a greater number of asylum-seekers, aiming for their more even distribution throughout the bloc or drawing up a new refugee policy worthy of the name, the powers-that-be in Brussels are focusing on efforts to keep migrants away from EU shores. Yet there is no precedent for such an uncertain mission in the history of the EU’s Common Security and Defense Policy.

The 30-page “Crisis Management Concept” outlines how the EU should respond in the future. In order “to disrupt the business model of the smugglers,” “systematic efforts” are need “to identify, seize and destroy vessels and assets before they are used by smugglers.” The plan calls for EU soldiers to destroy smugglers’ boats before they can be used. It states that keeping these operations safe from armed militias through “robust force protection” will also be required, as will “special forces units,” satellite surveillance, landing craft and “boarding teams.” A map shows the ambitious scale of the planned area of operations. It suggests that the EU campaign will be focused on Libya’s territorial waters as well as parts of Egypt’s and Tunisia’s ports and dockyards in coastal areas. It also foresees task forces deployed inside Libya in a bid to smash trafficking networks.

A March article, but still very relevant. This is how you kill a city.

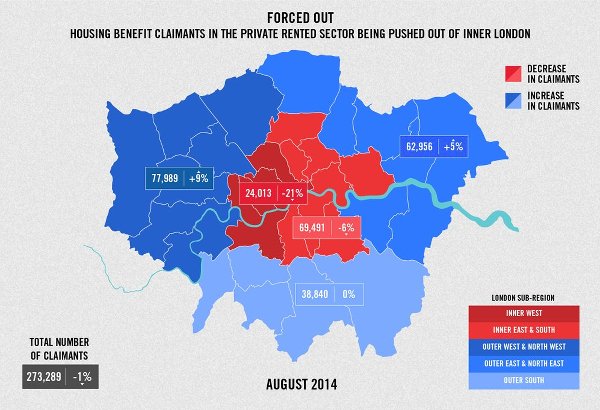

• How Struggling Families Are Being Forced Out of London (Vice)

When the housing benefit cap was announced in 2010, Boris Johnson said he would “not accept any kind of Kosovo-style social cleansing of London”, adding, “The last thing we want to have in our city is a situation such as Paris where the less well-off are pushed out to the suburbs.” Fast forward five years and everyone to the left of Boris has at some point bemoaned the ongoing social cleansing of the city. But who is actually being purged from London, and how do they feel about it? Sadly, the most under-reported aspect of the rapidly changing capital is the fate of the people who are being forced to leave it.

There was a flurry of headlines in 2012 and 2013 about London councils finding speculative locations for their homeless tenants in places like Stoke, Hastings, Birmingham and beyond. But it was always speculative: no-one has actually demonstrated how many people are being pushed out – until now. For the first time, VICE can confirm with hard facts what had always been the possibility of an exodus of London’s poor. It’s not an easy trend to measure, or give flesh to – quite simply, there is no London-wide monitoring system. But a data set gleaned from a series of FOI requests submitted by the Green Party over the last five years, seen exclusively by VICE, fleshes out some details on one of the most significant issues to be debated in the forthcoming election. [..]

In this substantial sample – which includes inner boroughs such as Camden, Lambeth and Kensington & Chelsea, as well as outer boroughs like Bromley and Merton – the number of families with children forced out of London rose from ten in the municipal year 2010/11, to 307 in 2013/14, and already stands at 364 for the current year, with several months’ worth of data still to come in. While the sample is incomplete, the pattern is clear: according to our data, over 35 times more families are having to move out of London this year compared to five years ago.

“.. it’s possible that they will become more receptive to facts once they are in an environment without food, water, or oxygen..”

• Earth Endangered by New Strain of Fact-Resistant Humans (Borowitz)

Scientists have discovered a powerful new strain of fact-resistant humans who are threatening the ability of Earth to sustain life, a sobering new study reports. The research, conducted by the University of Minnesota, identifies a virulent strain of humans who are virtually immune to any form of verifiable knowledge, leaving scientists at a loss as to how to combat them. “These humans appear to have all the faculties necessary to receive and process information,” Davis Logsdon, one of the scientists who contributed to the study, said. “And yet, somehow, they have developed defenses that, for all intents and purposes, have rendered those faculties totally inactive.” More worryingly, Logsdon said, “As facts have multiplied, their defenses against those facts have only grown more powerful.”

While scientists have no clear understanding of the mechanisms that prevent the fact-resistant humans from absorbing data, they theorize that the strain may have developed the ability to intercept and discard information en route from the auditory nerve to the brain. “The normal functions of human consciousness have been completely nullified,” Logsdon said. While reaffirming the gloomy assessments of the study, Logsdon held out hope that the threat of fact-resistant humans could be mitigated in the future. “Our research is very preliminary, but it’s possible that they will become more receptive to facts once they are in an environment without food, water, or oxygen,” he said.