Unknown General Patrick’s headquarters, City Point, Virginia 1865

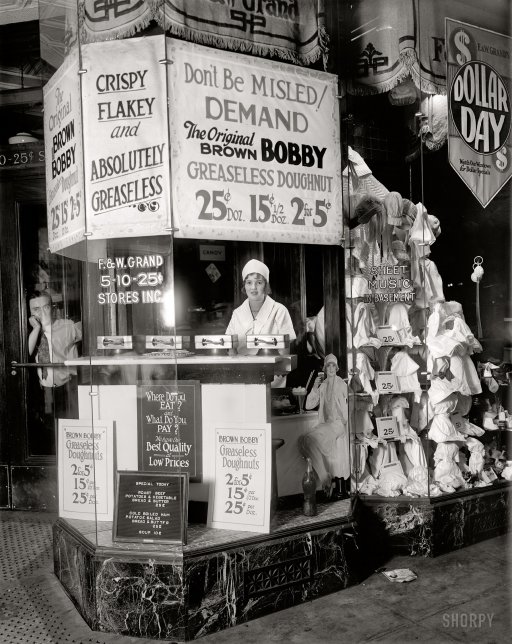

Progress 21st century style.

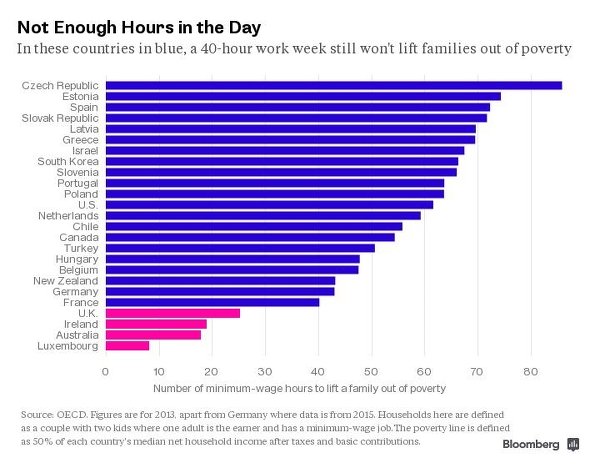

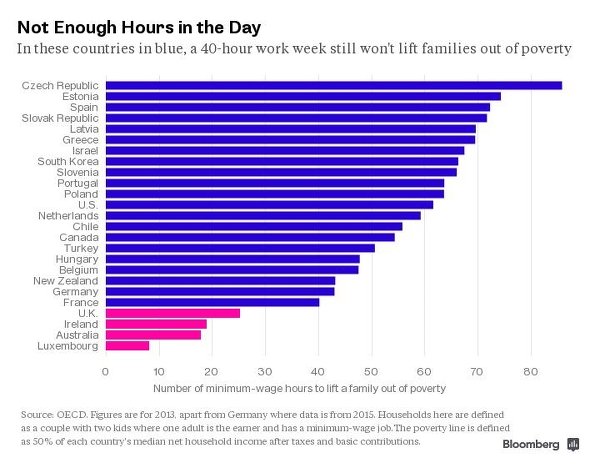

• 21 Countries Where a 40-Hour Work Week Still Keeps Families Poor (Bloomberg)

How often have you felt that no matter how hard and long you work you just couldn’t make ends meet? Turns out life is just that hard for minimum-wage workers pretty much across the globe. A global ranking out Wednesday by the Paris-based Organization for Economic Cooperation and Development painted a grim picture of the situation in member countries straddling continents. The 34-member organization found that a legal minimum wage existed in 26 countries and crunched the numbers to see how they compared. Forget taking a siesta in Spain. There, you’d have to work more than 72 hours a week to escape the trappings of poverty. Turns out that is the norm, not the exception. In the 21 countries highlighted with blue bars in the chart below, a full 40-hour work week still won’t lift families out of relative poverty.

This list includes France, home to the 35-hour work week, which almost met the threshold. Minimum wage workers there who are supporting a spouse and two children need to work 40.2 hours to get their families out of poverty. (The poverty line is defined as 50% of the median wage in any nation.) To gauge the generosity of each country’s floor on hourly pay, you can also look at another measure: The minimum wage as a percentage of the local median wage. Those ratios vary widely across the world. In the U.S., the minimum wage was less than 40% of the median wage in 2013, which meant the country had one of the lowest percentages among the economies the OECD examined. Those ratios are much higher across the Atlantic, but Europe’s sovereign debt crisis has taken its toll. In Ireland, Greece and Spain – three of the hardest-hit countries in the euro area – minimum wage levels as a ratio to the median wage were higher in 2007 than in 2013.

Read more …

That’s what I said.

• Central Bank Driven ‘Markets’ Have Nothing To Do With Economics (Stockman)

The German bund yield is soaring like a rocket today. After touching on the truly lunatic rate of 5 bps only a few weeks back, it has just crossed the 60 bps marker. Needless to say, when a blue chip 10-year bond widely held on @95% repo leverage moves that far that fast – there is some heavy duty furniture breakage happening in fast money land. But don’t cry for the bond market gamblers. They already made a killing front-running the ECB. During the 16 months between January 2014 and the April peak, speculators in German 10-year bunds would have made a 350% profit using essentially zero cost repo funding. So in the last few days they have given a tad of that back while making a bee line for the exit.

Yet during the uninterrupted march of the bund into the monetary Valhalla depicted above, how many times did you hear that the market was merely “pricing in” a flight to quality among investors and the dreaded specter of “deflation”. That is, what amounted to sheer lunacy – valuing any 10-year government bond at a deeply negative after-tax and after-inflation yield – was attributed to rational economic factors. No it wasn’t. The manic drive to 5 bps was pure speculative caprice, triggered by the ECB’s public pledge to corner the market in German government debt. What gambler in his right mind would not buy hand-over-fist any attempt to corner the market by a central bank with a printing press – especially one managed by a dim bulb apparatchik like Mario Draghi!

Never has an agency of a state anywhere on the planet pleasured speculators with such stupendous windfalls. Yet any day now we will hear from the talking heads on CNBC that, no, massive bond buying by central banks does not repress or distort interest rates because once Europe’s QE started, rates actually backed up. And, furthermore, this is entirely logical because QE will enable the economy to escape its deflationary trap, meaning that investors are discounting an imminent resurgence of growth!

Read more …

The spin narrative. “Yellen said that she thought risks to financial stability “are moderated, not elevated, at this point.”

• Yellen Says Stock Valuations Are ‘Quite High’ (MarketWatch)

Federal Reserve Chairwoman Janet Yellen on Wednesday used her bully pulpit to warn of the risks from “quite high” stock prices. “I would highlight that equity market valuations at this point generally are quite high,” Yellen said in a conversation with Christine Lagarde, the managing director of the International Monetary Fund, sponsored by the Institute for New Economic Thinking. “They are not so high when you compare the returns on equities to the returns on safe assets like bonds, which are also very low, but there are potential dangers there,” Yellen said. The S&P 500 is up about 12% over the last year and has more than tripled from its March 2009 low. The Fed has kept interest rates near zero since the end of 2008.

The price to earnings ratio of S&P 500 stocks was 20.40 for April, according to data from Haver Analytics, which is near five-year highs. Yellen said her comments were part of the Fed’s new remit in the wake of the Great Recession to monitor and speak publicly about potential risks to financial stability. Yellen noted that long-term bond yields were low due to low term premiums, which can move rapidly. “We saw this in the case of the taper tantrum in 2013,” Yellen said. “We need to be attentive and are to the possibility that when the Fed decides it is time to begin raising rates, these term premiums could move up and we could see a sharp jump in long-term rates,” Yellen said. As a result, the Fed was working overtime not to take markets by surprise, she said.

Yellen also repeated a long-standing concern with the leveraged loan market, saying there was a deterioration in underwriting standards. She also noted that the compression in spreads on high yield debt which looks like “reach-for-yield type of behavior.” Despite these concerns, Yellen said that she thought over risks to financial stability “are moderated, not elevated, at this point.” “We’re not seeing any broad based pickup in leverage, we’re not seeing rapid credit growth, we’re not seeing an increase in maturity transformation,” which are the hallmarks of bubbles, she said.

Read more …

More QE!

• El-Erian Warns Of Trouble As Bond Liquidity Dries Up (MarketWatch)

The leap in German bund yields over the last two weeks is another sign that liquidity issues could eventually present serious problems for financial markets, former Pimco Chief Executive Mohamed El-Erian on Wednesday warned at the annual SALT investment conference in Las Vegas. “There isn’t the countercyclical risk-taking we need,” said El-Erian, chief economic adviser at Pimco parent Allianz. That could spell trouble when there is a big shift market positioning, he warned at SALT, a gathering of around 1,800 hedge-fund and investment-industry professionals. That is because investors may not be able to reposition at a low cost. Bond liquidity is a “delusion, not an illusion,” he noted.

El-Erian’s remarks came during SALT’s opening panel, which included Peter Schiff, CEO of Euro Pacific Capital, and Gene Sperling, a former economic adviser to President Barack Obama and the Clinton White House. Sperling argued that a lackluster U.S. economic recovery is the aftermath of a financial crisis, which typically gives way to less robust recoveries as banks, businesses and consumers focus on eliminating debt. Meanwhile, the Federal Reserve was left to do much of the heavy lifting as the federal government’s stimulus efforts were offset by fiscal contraction at the state and local level.

Schiff, a persistent Fed critic, charged that the U.S. economy is witnessing a bubble rather than a recovery and that the Fed was crowding out small businesses who would otherwise be creating jobs. Fed Chairwoman may not entirely disagree with Schiff’s bubble assessment, On Wednesday, Yellen referred to stock valuations as “quite high,” and hinted that bond values may be even higher during a conversation with International Monetary Fund head Christine Lagarde sponsored by the Institute for New Economic Thinking.

Read more …

And how many times have I said this?: “..the developed economies have been zombified..”

• There Will Be No 25-Year Depression (Bill Bonner)

Today, we have bad news and good news. The good news is that there will be no 25-year recession. Nor will there be a depression that will last the rest of our lifetimes. The bad news: It will be much worse than that. On Monday, the Dow rose another 43 points. Gold seems to be working its way back to the $1,200 level, where it feels most comfortable. “A long depression” has been much discussed in the financial press. Several economists are predicting many years of sluggish or negative growth. It is the obvious consequence of several overlapping trends and existing conditions. First, people are getting older. Especially in Europe and Japan, but also in China, Russia and the US. As we’ve described many times, as people get older, they change. They stop producing and begin consuming.

They are no longer the dynamic innovators and eager early adopters of their youth; they become the old dogs who won’t learn new tricks. Nor are they the green and growing timber of a healthy economy; instead, they become dead wood. There’s nothing wrong with growing old. There’s nothing wrong with dying either, at least from a philosophical point of view. But it’s not going to increase auto sales or boost incomes – except for the undertakers. Second, most large economies are deeply in debt. The increase in debt levels began after World War II and sped up after the money system changed in 1968-71. By 2007, US consumers reached what was probably “peak debt.” That is, they couldn’t continue to borrow and spend as they had for the previous half a century. Most of their debt was mortgage debt, and the price of housing was falling.

The feds reacted, as they always do… inappropriately. They tried to cure a debt problem with more debt. But consumers were both unwilling and unable to borrow. Their incomes and their collateral were going down. This left corporations and government to aim only for their own toes. Central banks created more money and credit – trillions of dollars of it. But since the household sector wasn’t borrowing, the money went into financial assets and zombie government spending. Neither provided any significant support for wages or output. So, the real economy went soft, even as the cost of credit fell to its lowest levels in history. Third, the developed economies have been zombified. The US, for example, is way down at No. 46 on the World Bank’s list of places where it is easiest to start a new business. And only one G8 country – Canada – even makes the top 10.

Read more …

And for China’s steel suppliers.

• More Pain Ahead For China Steel (CNBC)

Sluggish demand at home is driving up the chronic supply surplus at China’s steel mills to critical levels and is set to drive down global prices, analysts warn. “Chinese authorities will be slow to react to the over-capacity,” E&Y’s Michael Elliott told CNBC. In the meantime, “steel prices will remain low for the next five years, until the global industry consolidation starts to take place,” he said. For a decade, China’s mostly state-owned steelmakers have been supplying the country’s building boom with more steel than it needed, while steel prices nearly halved during the same period. Now, with the economy growing at the slowest pace in six years and demand shrinking at home, the excess capacity is hitting critical levels, although China’s steel mills have shown few signs of slowing down production.

The level of excess capacity may be as high as 30% according to E&Y, and little relief is in sight on the domestic front: demand for steel in China contracted for the first time in a decade in 2014, falling by 3.3% on-year, and is set to drop by 0.5% on-year in both 2015 and 2016, according to World Steel Association forecasts. “The need for consolidation has been recognized for some time and the government has set targets for capacity closure in the past,” Capital Economics’ Caroline Bain said in a report on Tuesday. “However, production (and losses and debts) just kept on rising,” she said.

Beijing’s record on keeping to its reduction targets is not entirely stellar, in part because the state-owned steelmakers are major local employers. The government has just recently pushed back its target date for restructuring and consolidating the steel industry by ten years to 2025, according to E&Y’s Elliot. The solution, at least for the Chinese steel mills, has been to ramp up exports. In 2014, Chinese steel exports soared by 50% on-year and continued to grow by 40% on-year in the first-quarter of 2015, according to Capital Economics.

Read more …

Ambrose is all Tory. He may not be a happy man come nightfall.

• Brexit Threat Looms Over Britain’s Election And Europe’s Fate (AEP)

The subject of Europe has barely crept into the current campaign, which is odd given that UKIP’s primary demand – and its original raison d’etre – is the restoration of British self-government and the end of split parliamentary sovereignty between Westminister and Strasbourg. Yet the inescapable controversy of Britain’s dispensation with Europe looms over everything as we vote.

Whoever is elected will almost certainly have to deal a perpetual running sore in the eurozone. It is clear by now that monetary union is fundamentally deformed and will never be stable until there is a fiscal union and an EMU-wide government to back it up, but there is no democratic support for such a Utopian leap forward in any country. It is sheer fantasy following the Front National’s victory in the European elections in France. The ECB’s Mario Draghi has averted a deflationary collapse – in the nick of time – but the gap in competitiveness between the North and South is wider than ever. The EU Fiscal Compact will force the weakest debtor states to pursue contractionary policies for two decades to come asymmetrically, starving the south of investment and further entrenching the divide.[..]

A recent study by Stephen Jen, at SLJ Macro Partners, found that EMU states have reacted in radically different ways to globalisation and the rise of China. They are now further apart than they were in 1982. Worse yet, the perverse effects of euro itself has set off a self-reinforcing vicious circle. “The combination of a common monetary policy, fixed exchange rates and limited scope for member countries to conduct their own fiscal policies may have led to weak economies weakening further and strong economies strengthening further. We find these results rather alarming,” he said.

The implication is that EMU will lurch from crisis to crisis until the victims of this cruel dynamic rebel through the ballot box, as the Greeks are already doing. Cheap oil, a weak euro and a blast of QE have together lifted the region off the reefs for now, but the deformed structure will be exposed again when the world economy spins into another downturn. The European elites may imagine that a defeat for David Cameron can extinguish the Brexit threat. In reality it is has become a permanent fixture of the British landscape. They over-reached and brought it on themselves.

Read more …

There are 1000 reasons support should erode.

• Extreme Secrecy Eroding Support For Obama’s TPP Trade Pact (Politico)

If you want to hear the details of the Trans-Pacific Partnership trade deal the Obama administration is hoping to pass, you’ve got to be a member of Congress, and you’ve got to go to classified briefings and leave your staff and cellphone at the door. If you’re a member who wants to read the text, you’ve got to go to a room in the basement of the Capitol Visitor Center and be handed it one section at a time, watched over as you read, and forced to hand over any notes you make before leaving. And no matter what, you can’t discuss the details of what you’ve read. “It’s like being in kindergarten,” said Rep. Rosa DeLauro (D-Conn.), who’s become the leader of the opposition to President Barack Obama’s trade agenda. “You give back the toys at the end.”

For those out to sink Obama’s free trade push, highlighting the lack of public information is becoming central to their opposition strategy: The White House isn’t even telling Congress what it’s asking for, they say, or what it’s already promised foreign governments. The White House has been coordinating an administration-wide lobbying effort that’s included phone calls and briefings from Secretary of State John Kerry, Labor Secretary Tom Perez, Treasury Secretary Jack Lew, Agriculture Secretary Tom Vilsack, Commerce Secretary Penny Pritzker and others. Energy Secretary Ernest Moniz has been working members of the House Energy and Commerce Committee. Housing and Urban Development Secretary Julián Castro has been talking to members of his home state Texas delegation.

Officials from the White House and the United States trade representative’s office say they’ve gone farther than ever before to provide Congress the information it needs and that the transparency complaints are just the latest excuse for people who were never going to vote for a new trade deal anyway. “We’ve worked closely with congressional leaders on both sides of the aisle to balance unprecedented access to classified documents with the appropriate level of discretion that’s needed to ensure Americans get the best deal possible in an ongoing, high-stakes international negotiation,” said USTR spokesman Matt McAlvanah. Obama’s seeking a renewal of fast-track authority, which would empower him to negotiate trade deals that then go to Congress for up-or-down votes but not amendments.

Read more …

“We don’t want a dystopian future in which corporations and not democratically elected governments call the shots.”

• UN Calls For Suspension Of TTIP Talks Over Human Rights Abuses (Guardian)

A senior UN official has called for controversial trade talks between the European Union and the US to be suspended over fears that a mooted system of secret courts used by major corporations would undermine human rights. Alfred de Zayas, a UN human rights campaigner, said there should be a moratorium on negotiations over the Transatlantic Trade and Investment Partnership (TTIP), which are on course to turn the EU and US blocs into the largest free-trade area in the world. Speaking to the Guardian, the Cuban-born US lawyer warned that the lesson from other trade agreements around the world was that major corporations had succeeded in blocking government policies with the support of secret arbitration tribunals that operated outside the jurisdiction of domestic courts.

He said he would becompiling a report on the tactics used by multinationals to illustrate the flaws in current plans for the TTIP. De Zayas said: “We don’t want a dystopian future in which corporations and not democratically elected governments call the shots. We don’t want an international order akin to post-democracy or post-law.” The intervention by de Zayas comes amid intense scrutiny in the US, Europe and Japan of groundbreaking trade deals promoted by Barack Obama. The European commission, which supports the talks, believes an agreement that would lower tariffs and establish basic health and safety standards would boost trade and add billions of euros to the EU’s income. UK ministers estimate Britain could benefit from a rise in GDP of between £4bn and £10bn a year.

Under the proposed agreement, companies will be allowed to appeal against regulations or legislation that depress profits, resulting in fears that multinationals could stop governments reversing privatisations of parts of the health service, for instance. The investor state dispute settlement (ISDS) scheme that includes the secret tribunals is already a cornerstone of a trade deal between the EU and Canada and is scheduled to be included in the TTIP deal, as well as a trans-pacific deal being negotiated between the US and Japan. EU officials said the ISDS would be part of the package when it is put to a vote in the EU parliament later this year. Cecilia Malmström, the European trade commissioner, has sought to dampen criticism by publishing discussion documents submitted to the TTIP talks.

Following growing calls from environmental groups, unions and MEPs for the deal to be scrapped, she has put forward a series of suggestions to “safeguard the rights of governments to regulate” and protect public service provision from demands for competition. More than 97% of respondents to an official EU survey voted against the deal. However De Zayas, the UN’s special rapporteur on promotion of a democratic and equitable international order, said that while these were helpful initiatives, the adoption of a separate legal system for the benefit of multinational corporations was a threat to basic human rights. “The bottom line is that these agreements must be revised, modified or terminated,” he said. “Most worrisome are the ISDS arbitrations, which constitute an attempt to escape the jurisdiction of national courts and bypass the obligation of all states to ensure that all legal cases are tried before independent tribunals that are public, transparent, accountable and appealable.

Read more …

Kudos.

• Defiant Greece Overturns Civil Service Cuts Agreed In Previous Bailouts (FT)

Even as the Greek government scrambled to reach an agreement on new economic reforms with its creditors in Brussels, it began reversing similar measures agreed during previous bailout negotiations in a parliamentary session in Athens. A new law proposed by the leftwing Syriza-led government and passed Tuesday night opens the way to rehire thousands of workers cut loose from the country’s inefficient public sector in a reform enacted by the previous government. The move came on the same day the new government announced changes to a finance ministry system of electronic procurements and public payments that was supposed to improve transparency and had been blessed by international lenders.

And it followed legislation passed last week to reopen the state broadcaster, ERT, which was shut down by the previous government as a cost-cutting measure. The moves highlighted the conflicting impulses of Greece’s new left-wing government and creditors bent on securing economic reforms in exchange for their support. They could further complicate already-fraught negotiations aimed at closing the country’s current €172bn bailout and giving Athens access to €7.2bn in desperately needed cash; in February, the new government agreed any economic legislation would be introduced only after consultations with creditors.

Opposition lawmakers accused Syriza of violating that agreement with the new laws, which could expand the government payroll by as many as 15,000 employees. But government ministers remained defiant. “We aren’t going to consult [bailout monitors], we don’t have to, we’re a sovereign state,” Nikos Voutsis, the powerful interior minister, told parliament.

Read more …

He keeps on making a lot of sense. But that’s not the picture painted in the media.

• A Blueprint for Greece’s Recovery (Yanis Varoufakis)

Imagine a development bank levering up collateral that comprises post-privatization equity retained by the state and other assets (for example, real estate) that could easily be made more valuable (and collateralized) by reforming their property rights. Imagine that it links the European Investment Bank and the European Commission President Jean-Claude Juncker’s €315 billion investment plan with Greece’s private sector. Instead of being viewed as a fire sale to fill fiscal holes, privatization would be part of a grand public-private partnership for development. Imagine further that the “bad bank” helps the financial sector, which was recapitalized generously by strained Greek taxpayers in the midst of the crisis, to shed their legacy of non-performing loans and unclog their financial plumbing.

In concert with the development bank’s virtuous impact, credit and investment flows would flood the Greek economy’s hitherto arid realms, eventually helping the bad bank turn a profit and become “good.” Finally, imagine the effect of all of this on Greece’s financial, fiscal, and social-security ecosystem: With bank shares skyrocketing, our state’s losses from their recapitalization would be extinguished as its equity in them appreciates. Meanwhile, the development bank’s dividends would be channeled into the long-suffering pension funds, which were abruptly de-capitalized in 2012 (owing to the “haircut” on their holdings of Greek government bonds).

In this scenario, the task of bolstering social security would be completed with the unification of pension funds; the surge of contributions following the pickup in employment; and the return to formal employment of workers banished into informality by the brutal deregulation of the labor market during the dark years of the recent past. One can easily imagine Greece recovering strongly as a result of this strategy. In a world of ultra-low returns, Greece would be seen as a splendid opportunity, sustaining a steady stream of inward foreign direct investment. But why would this be different from the pre-2008 capital inflows that fueled debt-financed growth? Could another macroeconomic Ponzi scheme really be avoided?

During the era of Ponzi-style growth, capital flows were channeled by commercial banks into a frenzy of consumption and by the state into an orgy of suspect procurement and outright profligacy. To ensure that this time is different, Greece will need to reform its social economy and political system. Creating new bubbles is not our government’s idea of development. This time, by contrast, the new development bank would take the lead in channeling scarce homegrown resources into selected productive investment. These include startups, IT companies that use local talent, organic-agro small and medium-size enterprises, export-oriented pharmaceutical companies, efforts to attract the international film industry to Greek locations, and educational programs that take advantage of Greek intellectual output and unrivaled historic sites.

Read more …

Greece must leave the euro or it will never be it own master.

• European Lenders Dash Greek Hopes For Quick Aid Deal (Reuters)

European lenders on Wednesday dashed Greece’s hopes for a quick cash-for-reforms deal in the coming days, leaving Athens in an increasingly desperate financial position ahead of a major debt payment next week. Talks between the two sides have dragged on for months without a breakthrough and EU officials say Greece’s leftist government has failed to produce enough concessions for a deal at next Monday’s meeting of euro zone finance ministers. “Since the last Eurogroup quite a bit of progress has been made,” Eurogroup chief Jeroen Dijsselbloem said. “Still, lots of issues have to be solved, have to be deepened more, with more details, so there will be no agreements on Monday. We have to be realistic.”

Prime Minister Alexis Tsipras’s government remains hopeful the Eurogroup meeting will acknowledge progress in the talks, possibly enabling the ECB to let Greek banks buy more short-term government debt to ease a cash crunch. But there was no sign in Brussels or Frankfurt that any such easing of the squeeze is likely soon without concrete evidence of progress on reforms.The ECB’s governing council extended emergency liquidity assistance to Greek banks by €2 billion at its weekly review on Wednesday, the biggest increase in recent weeks. The governors also debated tightening collateral conditions but were expected to hold off for another week.

Athens managed to scrape together funds to make a €200 million interest payment to the IMF on Wednesday, but faces a more daunting €750 million repayment on May 12. With some municipalities, regional and public entities resisting an order to turn over cash reserves to the central bank, sources close to the government have expressed doubt about whether Athens can make both the IMF payment and pay wages and pensions later this month. A government source said the money raised so far by the decree has fallen short of a target of €2.5 billion and that Athens is expected to continue resorting to other one-off measures such as holding off some payments to suppliers. Monday’s Eurogroup meeting could serve as a “platform” for an eventual accord with lenders, Greek Finance Minister Yanis Varoufakis said after talks with his Italian counterpart.

Tsipras’ government has sought to shift blame onto the euro zone and IMF for a lack of agreement in the three-month-old negotiations, charging that each was setting different “red lines” on multiple issues from pension and labour reforms to the primary budget surplus, making a deal impossible. The three institutions issued a rare joint statement rejecting that accusation and insisting they share the same objective of helping Greece achieve financial stability and growth. German Finance Minister Wolfgang Schaeuble, one of Greece’s harshest critics among euro zone policymakers, also dismissed the accusation and said help for Greece had to “make sense”. “Neither the troika, nor Europe, nor Germany can be blamed for Greece’s problems,” Schaeuble said, referring to the trio of European Commission, ECB and IMF informally dubbed the troika. “Greece lived beyond its means for many years.”

Read more …

Let them walk cross the border.

• At Greek Port, ‘Migrants’ Dream And Despair In Abandoned Factories (Reuters)

Rapper Mahdi Babika Mohamed’s journey to a better life in Europe started in his native Sudan and passed through Libya and Turkey before abruptly ending in a squalid abandoned factory at Greece’s western port of Patra. There, the 37-year-old is one of hundreds of migrants making desperate attempts to board ferries to Italy by hanging on to the underside of cargo trucks – usually unsuccesfully. “We come from a country in war to another war here in Patra,” said Mohamed. “Every day I try to get on the ferry and it’s dangerous hiding under the trucks, I could die any minute.” Patra is no longer on the frontline of Greece’s migrant crisis as it was six years ago when authorities shut down a makeshift camp in the port where hundreds of migrants had lived in squalid conditions.

Focus has since shifted to the thousands of Syrian and other migrants now breaking through Greece’s eastern sea border, but the refugee problem in Patra is far from over. Today, about 100 Afghan, Iranian and Sudanese migrants live in two deserted textile and wood factories opposite the main ferry terminal, living off food scraps and without electricity. Some arrived recently, others have lived there for as long as two years. Each day, some try to jump over a high fence into the terminal in the hope of sneaking onto a ferry set for Italy, where they dream of a better life than in crisis-hit Greece, where jobs are scarce and sympathy even harder to find.

Others hide by the roadside, dashing to scramble underneath trucks waiting at traffic lights before entering the ferry terminal. One of those is Azam, a 26-year-old from South Sudan who says he boarded a small fishing boat in Egypt with 175 other immigrants earlier this year. He says he paid around $3,000 to go to Italy but the boat took them to Crete instead. Despite several attempts, he has yet to make it on to a ferry to Italy. But he refuses to abandon his dream. “I want to go to northern Europe and find a decent job and live a good life I will try until I make it,” Azam said. “I’ll never give up.”

Read more …

“The market has increasingly become aggressive in preparing for a Greek default and in protecting itself from the potential financial impact.”

• Greek Banks Are Having Trouble Trading Foreign Currencies (Bloomberg)

Greek banks are increasingly being hampered from trading currencies, one of most liquid markets, as international dealers cut back credit lines and costs soar, according to people with knowledge of the trades. International securities firms are curtailing trading with Greece’s major lenders that may expose them to the risk of a default by the nation and the possible use of capital controls to stem outflows from banks, the people said, asking not to be named because they are not authorized to speak publicly.

Those threats are adding to concern that the euro would decline in the event of a default or a Greek exit from the currency region, leaving counterparties exposed to multiple risks, said the people.

A months-long impasse on Greece’s bailout talks with creditors has prompted depositors to withdraw funds from the nation’s lenders, leaving banks no choice but to rely on emergency funds for liquidity. The ECB on Wednesday raised the limit on Emergency Liquidity Assistance, people familiar with the matter said, a sign the financial system remains under strain. “The latest sign the market is attempting to fortify itself against a Greek default is playing out in the FX market,” said Mark Williams, a former bank examiner for a Federal Reserve bank and now a lecturer at Boston University’s Questrom School of Business. “The market has increasingly become aggressive in preparing for a Greek default and in protecting itself from the potential financial impact.”

Read more …

ECB and politics should never appear in the same sentence.

• ECB Decision on Greek Haircuts Said to Depend on Political Talks (Bloomberg)

The ECB will decide after next week’s meeting of euro region finance ministers whether to tighten Greek access to emergency liquidity, two people familiar with the matter said. The ECB is prepared to raise the discount demanded on Greek collateral to a level last seen in 2014 unless the country’s government shows a willingness to compromise in bailout talks, said one of the officials, who spoke on condition of anonymity. An ECB spokesman declined to comment. The Governing Council’s stance adds pressure on Prime Minister Alexis Tsipras to make progress with creditors at Monday’s meeting of finance ministers in Brussels, or risk watching his country’s banks being pushed deeper into crisis.

Such is the rate of deposit withdrawals that ECB officials meeting Wednesday in Frankfurt raised their cap on Emergency Liquidity Assistance by €2 billion to €78.9 billion, the people said. The ECB also wants to ensure Greece makes a €767 million payment to the International Monetary Fund due on May 12, one of the officials said. The central bank decided in October to reduce the risk premium charged on Greek securities, citing “overall improved market conditions” for the assets at the time. Since then, the government has changed and the incoming administration has stalled on the reforms needed to access its bailout funds. Early this year, the ECB suspended a waiver on collateral requirements for Greek debt, forcing banks to rely more on ELA from their own central bank.

Increasing the haircuts now would force lenders to post higher collateral in exchange for funding. Even so, more draconian ideas have been floated. An internal ECB proposal circulated in April contained an option that would see haircuts raised to as high as 90%, a level consistent with Greece being in default. Euro-area central bankers are concerned about Greece’s solvency as debt repayments loom, though they remain reluctant to act before politicians have had a chance to salvage the bailout program. Most Governing Council members, led by President Mario Draghi, argued that it would be unfair to restrict access to liquidity before the outcome of Monday’s meeting is clear, one of the people said.

Read more …

Morals have nothing to do with it.

• Bernanke Inc.: The Lucrative Life of a Former Fed Chairman (Bloomberg)

Between Boyz II Men at The Mirage and Celine Dion at Caesars Palace, a hot new act is playing Vegas: Ben Bernanke. One day only, live from Sin City – the economist formerly known as chairman of the Federal Reserve. Fifteen months after leaving the Fed and its trappings of mystery and power, Bernanke, 61, is settling into the peripatetic and highly lucrative life of a Washington former. Beyond the dancing fountains of the Bellagio, in the gilded splendor of the Grand Ballroom, Bernanke will play to a full house at the SkyBridge Alternatives Conference on Wednesday: 1,800 hedge fund types who used to hang on his every word. Bernanke is, in a sense, one of them now – a well-paid investment consultant who can fete clients, open doors and add a gloss of Fed luster to conferences and meetings.

Call it Bernanke Inc., a post-Fed one-man-show that’s worth millions annually on the open market. While the former chairman hasn’t disclosed his fees and compensation – nor, as a private citizen, is he required to – he is almost certainly pulling down many times what he did while in government. First there are speaking fees, which bring in at least $200,000 per engagement, according to a person who hired Bernanke. Then there are new advisory roles at Pimco, the big bond house; and Citadel, one of the world’s largest hedge funds. Executive recruiters say each is probably worth more than $1 million a year. Finally, there’s a book deal, details of which haven’t been made public. Bernanke’s predecessor, Alan Greenspan, reportedly landed an $8.5 million contract for his memoir in 2006.

Bernanke – who has a day job as a distinguished fellow in residence at the Brookings Institution – used the same Washington lawyer, Robert Barnett, to negotiate his deal. Policy makers like Bernanke are often criticized for going to work for the financial industry, but they are following a well-worn path. Robert Rubin, Lawrence Summers, Timothy Geithner: countless economic policy makers, in the U.S. and elsewhere, have spun through the revolving door, sometimes more than once. Summers –who picked up work at the hedge fund D.E. Shaw – is scheduled to address the SALT conference this week as well. So are former Secretary of State Condoleezza Rice and former Defense Secretary Chuck Hagel. What does someone like Bernanke bring to a Pimco or a Citadel? Both say investment insight and some face time with clients. Many in the industry, however, tend to view such appointments as little more than high-paid marketing jobs.

Read more …

“The perception from the market based on their comments is they’re extremely dangerous.”

• Canada’s Political Landscape In Seismic Shift On Alberta Election (Guardian)

Canada’s rockbound political landscape has undergone a seismic shift with the election of a leftwing government in oil-rich Alberta, the country’s wealthiest and – until now – most conservative province. The once-marginal New Democratic Party swept to victory in the western province on Tuesday night, humiliating the Progressive Conservative party that has ruled the province since the first term of US president Richard Nixon. “We made a little bit of history tonight,” the province’s New Democrat leader, Rachel Notley, told supporters. The result marks the latest and most surprising setback to prime minister Stephen Harper’s signature diplomatic effort to transport bitumen from Alberta’s tar sands to world markets through the controversial Keystone XL pipeline.

During the campaign, Notley promised to withdraw provincial support for the project, raise corporate taxes and also potentially to raise royalties on a regional oil industry already reeling from the collapse in world prices. Notley led her party from a four-seat toehold in the provincial legislature to a commanding majority of 54 with a buoyant campaign that contrasted sharply with the flatfooted effort of the Progressive Conservatives under leader Jim Prentice, a former Harper cabinet member often touted as a future Conservative prime minister. Despite being one of a handful of PC candidates returned to office, Prentice resigned both his new seat and his leadership after the rout.

Canadian oil stocks slid slightly in response to the NDP win, with tar-sands giant Suncor Energy Inc losing 4.3% of its value in the first few hours of trading in Toronto before recovering half the loss by noon. The election of the NDP is “completely devastating”, declared financier Rafi Tahmazian of Canoe Financial in Calgary, Canada’s oil capital. “The perception from the market based on their comments is they’re extremely dangerous.” [..] .. ordinary Canadians were reeling from the sheer magnitude of the shift in Alberta, which has placed the country’s most notoriously conservative province, taken for granted as an impregnable redneck kingdom, in the hands of its most progressive regional government. To explain the phenomenon, Toronto-based writer Doug Saunders asked his American Twitter followers to imagine socialist presidential candidate Bernie Saunders “becoming Texas governor by a big majority”.

Read more …

Do you really want war with Russia?

• The Choice Before Europe (Paul Craig Roberts)

Washington continues to drive Europe toward one or the other of the two most likely outcomes of the orchestrated conflict with Russia. Either Europe or some European Union member government will break from Washington over the issue of Russian sanctions, thereby forcing the EU off of the path of conflict with Russia, or Europe will be pushed into military conflict with Russia. In June the Russian sanctions expire unless each member government of the EU votes to continue the sanctions. Several governments have spoken against a continuation. For example, the governments of the Czech Republic and Greece have expressed dissatisfaction with the sanctions. US Secretary of State John Kerry acknowledged growing opposition to the sanctions among some European governments.

Employing the three tools of US foreign policy–threats, bribery, and coercion, he warned Europe to renew the sanctions or there would be retribution. We will see in June if Washington’s threat has quelled the rebellion. Europe has to consider the strength of Washington’s threat of retribution against the cost of a continuing and worsening conflict with Russia. This conflict is not in Europe’s economic or political interest, and the conflict has the risk of breaking out into war that would destroy Europe. Since the end of World War II Europeans have been accustomed to following Washington’s lead. For awhile France went her own way, and there were some political parties in Germany and Italy that considered Washington to be as much of a threat to European independence as the Soviet Union.

Over time, using money and false flag operations, such as Operation Gladio, Washington marginalized politicians and political parties that did not follow Washington’s lead. The specter of a military conflict with Russia that Washington is creating could erode Washington’s hold over Europe. By hyping a “Russian threat,” Washington is hoping to keep Europe under Washington’s protective wing. However, the “threat” is being over-hyped to the point that some Europeans have understood that Europe is being driven down a path toward war.

Read more …

Problems that cannot be solved.

• California Regulators Approve Unprecedented Water Cutbacks (AP)

California water regulators adopted sweeping, unprecedented restrictions Tuesday on how people, governments and businesses can use water amid the state’s ongoing drought, hoping to push reluctant residents to deeper conservation. The State Water Resources Control Board approved rules that force cities to limit watering on public property, encourage homeowners to let their lawns die and impose mandatory water-savings targets for the hundreds of local agencies and cities that supply water to California customers. Gov. Jerry Brown sought the more stringent regulations, arguing that voluntary conservation efforts have so far not yielded the water savings needed amid a four-year drought. He ordered water agencies to cut urban water use by 25% from levels in 2013, the year before he declared a drought emergency.

“It is better to prepare now than face much more painful cuts should it not rain in the fall,” board Chairwoman Felicia Marcus said Tuesday as the panel voted 5-0 to approve the new rules. Although the rules are called mandatory, it’s still unclear what punishment the state water board and local agencies will impose for those that don’t meet the targets. Board officials said they expect dramatic water savings as soon as June and are willing to add restrictions and penalties for agencies that lag. But the board lacks staff to oversee each of the hundreds of water agencies, which range dramatically in size and scope. Some local agencies that are tasked with achieving savings do not have the resources to issue tickets to those who waste water, and many others have chosen not to do so.

Despite the dire warnings, it’s also still not clear that Californians have grasped the seriousness of the drought or the need for conservation. Data released by the board Tuesday showed that Californians conserved little water in March, and local officials were not aggressive in cracking down on waste. A survey of local water departments showed water use fell less than 4% in March compared with the same month in 2013. Overall savings have been only about 9% since last summer. Under the new rules, each city is ordered to cut water use by as much as 36% compared with 2013. Some local water departments have called the proposal unrealistic and unfair, arguing that achieving steep cuts could cause higher water bills and declining property values, and dissuade projects to develop drought-proof water technology such as desalination and sewage recycling.

Read more …

“..[beekeepers and bee-product manufacturers] generate a turnover of somewhere between €57 and €62 million per year. The value of the pollination services provided to the agricultural sector is estimated to run to €2.6 billion.”

• Save The Bees To Save The Planet (Giorgio Torrazza)

In 2004, local production of acacia, chestnut, citrus and meadow flower honey in Italy fell by half and the reason for this is very simple: the bees are dying. According to estimates released by the beekeepers associations, every year some 175-thousand tons of chemical substances are sprayed onto the fields, substances that pollute and compromise the ecosystem in which the bees live and reproduce. Here in Italy there are some 40-thousand beekeepers and 12-thousand bee-product manufacturers, and if you include all the associated secondary enterprises, together they generate a turnover of somewhere between €57 and €62 million per year. The value of the pollination services provided to the agricultural sector is estimated to run to €2.6 billion.

What is of inestimable value to mankind instead is that according to the FAO data, bees are responsible for pollinating 71 of the top 100 crops that constitute around 90% of all the foodstuff products worldwide. The multinationals encourage the indiscriminate use of insecticides and weed killers, many of which are currently banned in the European Union, but if the TTIP were to be approved, according to a study conducted by the Center for International and Environmental Law, no less than 82 pesticides currently banned in Europe but approved for use in the USA would flood onto the market, further aggravating an already dire situation. This is total folly. We interviewed a beekeeper by the name of Giorgio Torrazza who loves bees and explains in his own simple way precisely who is causing the problem and how to resolve it. #SavetheBees to save the planet!

The bee emergency is linked to parasites that come in from outside the country. There is the Varroa parasitic mite, which has been around for more than 30 years, then there is also the Asian predatory wasp and now there is also another parasite from Africa, the (Aethina tumida), which has already arrived in Calabria and will undoubtedly get here too. The parasite emergency is causing problems but it is still manageable at this stage. However, one of the things that is very difficult to manage at the moment are the chemical poisons that are being spread about like rose water on all the crops. If you spray a weed-killer, even if it is not classified as a pesticide, do you know what happens?

Read more …