Harris&Ewing The Post Office building in Washington DC 1911

Picture of failure.

• US Recession Jitters Stoke Fears of Impotent Fed and Fiscal Paralysis (AEP)

An ominous paper by the US Federal Reserve has become the hottest document in high finance. It was intended to reassure us that the world’s hegemonic central bank still has ample firepower to overcome the next downturn. But the author was too honest. He has instead set off an agitated debate, and rattled a lot of nerves. David Reifschneider’s analysis – ‘Gauging the Ability of the FOMC to Respond to Future Recessions’ – more or less concedes that the Fed has run out of heavy ammunition. The Federal Open Market Committee had to cut interest rates by an average of 550 basis points over the last nine recessions in order to break the fall and stabilize the economy. It could not possibly do so right now, or next year, or the year after.

QE in its current form cannot compensate, and nor can forward guidance. They are largely exhausted in any case. “One cannot rule out the possibility that there could be circumstances in the future in which the ability of the FOMC to provide the desired degree of accommodation using these tools would be strained,” he wrote. This admission is painfully topical as a plethora of data suggest that the US economy may have hit a brick wall in August. The ISM gauge of manufacturing plunged below the boom-bust line to 49.4, and the services index dropped to a six-year low, with new orders crashing nine points. My own tentative view is that these ISM readings are rogue surveys. The Atlanta Fed’s ‘GDPNow’ tracker points to robust US growth of 3.6pc in the third quarter. The New York Fed version is coming in at 2.8pc.

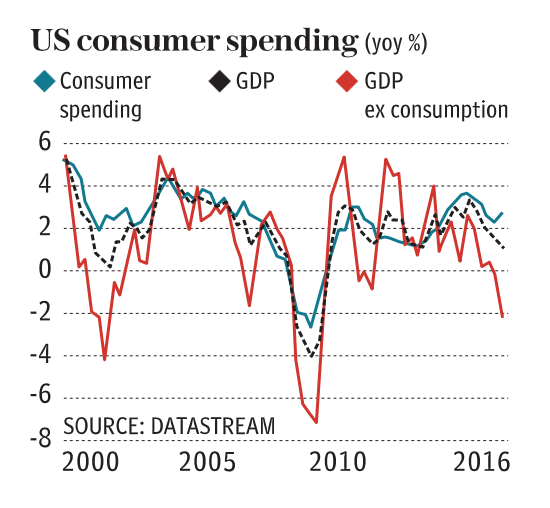

Yet the US expansion is already long in the tooth after 87 months, and late-cycle chemistry is notoriously unpredictable. Warning signs certainly abound. Corporate profits have been slipping for six quarters, the typical precursor to an abrupt slump in business spending. “The only thing keeping the US out of recession is the US consumer. If consumption stalls then we really are in trouble,” says Albert Edwards from Societe Generale. I am willing to bet against him for now. The M1 money supply – often a good leading indicator – has picked up after a weak patch earlier this year and is now surging at a rate of 10.1pc. This pace would normally signal burst of torrid growth a few months later. It is in stark contrast to the monetary contraction before the Lehman crisis.

My presumption is that the day of reckoning has been pushed well into 2017, but in the dead of the night I have a horrible sweaty feeling that Mr Edwards may be right. It is not a time to be chasing stock markets already at vertiginous levels. The Reifschneider paper argues that the Fed can probably muddle through, so long as it succeeds in pushing interest rates back up to 3pc or so before the next recession hits. Even then it might have to launch a further $4 trillion of QE and stretch its balance sheet to a once unthinkable $8.5 trillion.

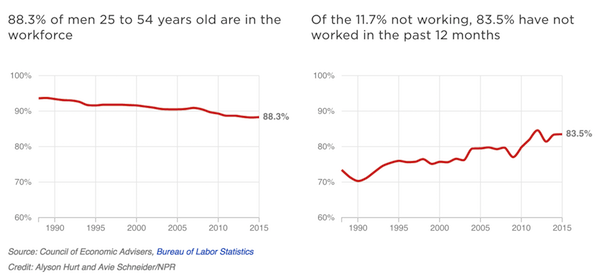

” In the 1960s, nearly 100% of men between the ages of 25 and 54 worked..”

• One In Six Prime-Age American Men Has No Job (NPR)

At 4.9%, the nation’s unemployment rate is half of what it was at the height of the Great Recession. But that number hides a big problem: Millions of men in their prime working years have dropped out of the workforce — meaning they aren’t working or even looking for a job. It’s a trend that’s held true for decades and has economists puzzled. In the 1960s, nearly 100% of men between the ages of 25 and 54 worked. That’s fallen over the decades. In a recent report, President Obama’s Council of Economic Advisers said 83% of men in the prime working ages of 25-54 who were not in the labor force had not worked in the previous year. So, essentially, 10 million men are missing from the workforce.

“One in six prime-age guys has no job; it’s kind of worse than it was in the depression in 1940,” says Nicholas Eberstadt, an economic and demographic researcher at American Enterprise Institute who wrote the book Men Without Work: America’s Invisible Crisis. He says these men aren’t even counted among the jobless, because they aren’t seeking work. Eberstadt says little is known about the missing men. But there are factors that make men less likely to be in the labor force — a lack of college degree, being single, or being black. So, why are men leaving? And what are they doing instead?

“GDP as most commonly used can be a flawed measurement if one tries to infer that the size or growth of economic activity is well correlated to the prosperity of its people..”

• GDP – Even Less Than Meets The Eye (720 Global)

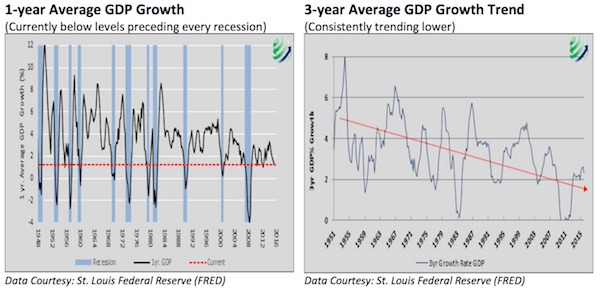

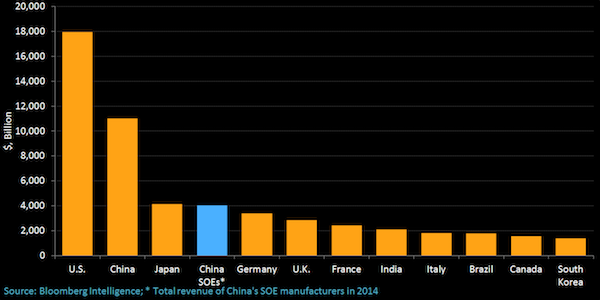

The most common statistic used to measure the size and growth rate of a nation’s economy is Gross Domestic Product (GDP). However, GDP as most commonly used can be a flawed measurement if one tries to infer that the size or growth of economic activity is well correlated to the prosperity of its people. Consider China and the United States for example. The U.S. has a GDP of approximately $16.5 trillion and a population of roughly 325 million while China has a GDP of nearly $11 trillion and a population of approximately 1.4 billion.

One could say that China’s economy is about two-thirds the size of the U.S. economy, however when one considers how that activity is spread amongst the citizens, China’s economy is only one-seventh that of the U.S. Accordingly, Chinese citizens are clearly less productive and prosperous than U.S. citizens GDP per capita (per citizen), as demonstrated above, is a valid way to measure the efficiency of one nation’s economic output versus another and is also an important statistic to gauge the productivity and prosperity trends in one country. We have frequently shown the declining trend in secular GDP growth in charts like those shown below.

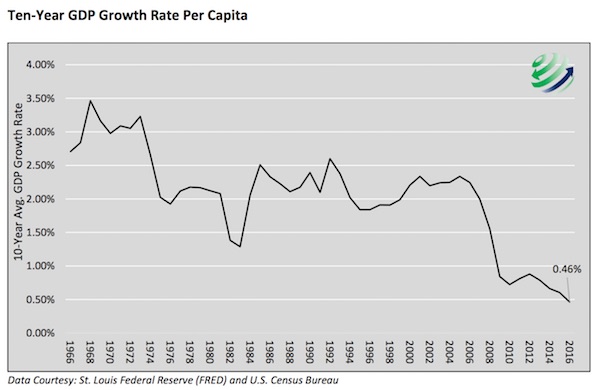

Above, GDP is plotted on an absolute basis and does not take into account the amount of economic activity or economic growth per person. Below, we show the ten-year growth rate of GDP per capita.

As one easily notices GDP on a per capita basis is more worrisome than when viewed on a total basis as in the first two graphs. The economic growth rate per person is currently below one half of one%. More concerning, it is below levels seen during the great financial crisis in 2008 and it is still trending lower. This graph confirms our macroeconomic concerns and helps explain, in part, why so many U.S. citizens feel like they are being left behind. Factor in that many of the economic spoils are not evenly distributed, as assumed in this analysis, but are largely accruing to the wealthy, and the problem only worsens. As such, the growing social anxiety and trend towards populism, be it conservative or liberal leaning, will not likely dissipate if the aforementioned economic trends continue.

Centralization as a whole is going the way of the dodo.

• It Won’t Be Long Now – The End Game Of Central Banking Is Nigh (Stockman)

As Contra Corner readers recognize the only consistent way forward for America at this late stage of the game is a return to free markets, fiscal rectitude, sound money, constitutional liberty, non-intervention abroad, minimalist government at home and decentralized political rule. Unfortunately, that is not about to happen any time soon—–even if by some miracle Donald Trump is elected President. But what the book does claim is that the tide is turning against the failed Wall Street/Washington bipartisan consensus. I call this insurrection the “revolt of the rubes” in Flyover America. This uprising against the rule of the financial and political elites has counterparts abroad among those who voted for Brexit in the UK, against Merkel in the recent German elections in her home state, and among the growing tide of anti-Brussels sentiment reflected in polls throughout the EC.

Needless to say, the political upheaval now underway is largely an inchoate reaction to the policy failures and arrogant pretensions of the establishment rulers. Like Donald Trump himself, it does not reflect a coherent programmatic alternative. But my contention is that liberation from our current ruinous policy regime has to start somewhere—and that’s why the Trump candidacy is so important. He represents a raw insurgency of attack, derision, impertinence and repudiation. If that leads to throwing out the beltway careerists, pettifoggers, hypocrites, ideologues, racketeers, power seekers and snobs who have brought about the current ruin then at least the decks will be cleared.

So doing, the Trump candidacy—win or lose—is paving the way for an honest debate about the Fed’s war on savers and wage earners, the phony Bubble Finance prosperity it has bestowed on the bicoastal elites and Imperial Washington’s delusionary addiction to debt, war and special interest racketeering. In addition to the political revolt of the rubes, the establishment regime is now imperiled by another existential threat. To wit, the world’s central bankers have finally painted themselves into the mother of all corners. Literally, they dare not stop their printing presses because the front-runners and robo-traders have taken them hostage. Recent developments at all three major central banks, in fact, provide powerful evidence that the end of the current Bubble Finance regime is near.

Beijing control trumps efficiency, and that’s not going to change.

• China’s $1 Trillion Makeover Of Bloated SOEs Attracts Skeptics (BBG)

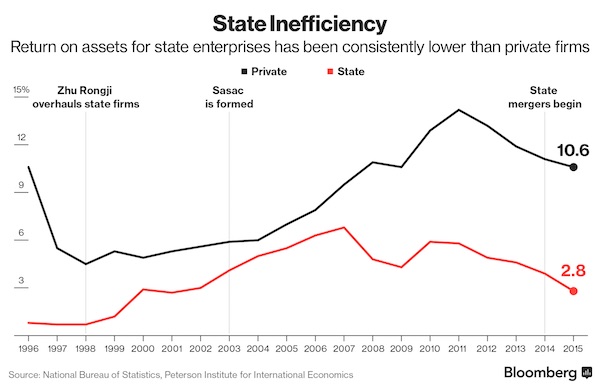

To grasp the scale of the challenges facing Chinese leaders in revamping their sprawling and inefficient state-owned enterprises, consider this: The combined revenue of 100-plus government-owned firms, spanning from train makers to banks and power companies, rivals Japan’s entire $4.1 trillion economy. China’s SOE sector, traditionally a source of political patronage and economic power for the Communist Party, accounts for about 40% of China’s industrial assets and 18% of total employment, according to Bloomberg Intelligence economists Fielding Chen and Tom Orlik. These government creations are also dragging down growth, with their return on assets in 2015 estimated to be at 2.8%, versus 10.6% for private sector-firms.

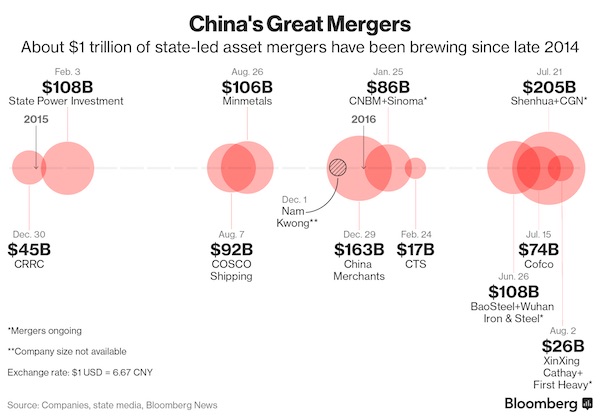

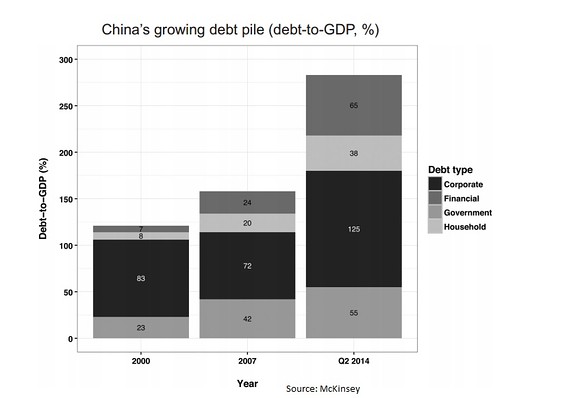

Cutting SOEs down to size and improving their profitability is critical to President Xi Jinping and Premier Li Keqiang’s signature economic policy of rebalancing the $10 trillion economy away from an over-reliance on debt-fueled infrastructure investment and exports to one powered more by services and consumer spending. One strategy has been to embrace mergers – about $1 trillion of asset combinations have been announced since late 2014. The broad government sector overhaul adds up to a major triage effort, keeping healthy or strategic state firms like banks, energy and telecoms under tight control while orchestrating supersized consolidation among ailing giants in shipping, cement and metals to improve efficiency and slash over-capacity. Without a major overhaul, China’s low labor productivity growth – now less than a tenth of European, Japanese and U.S. levels – isn’t likely to improve.

[..] Despite the pressure to turn around, there are about 50 or so “too-big-to-fail” state enterprises in energy, technology and defense that are deemed to be so strategic that they will continue to receive generous government support, according to Lin Boqiang, director of Xiamen University’s energy economics research center. For the rest, Xi’s SOE makeover will be a gradual process with progress coming in fits and starts. Combing two inefficient firms doesn’t necessarily create a healthy one without some forceful leadership to eliminate overlap and excess capacity, as could be the case in the steel industry. “When you combine BaoSteel and Wuhan Steel, two companies thousands of kilometers apart, I’m not sure what they could do together that they couldn’t do separately,” according to Lardy.

Too much wasted.

• China’s Massive Infrastructure Investment Is A Model To Avoid (MW)

Some leading U.S. politicians and economists including President Obama have admired China’s massive investment in new transportation projects and wished America could do the same. Yet a new research paper suggests China’s approach is “a model to avoid” and one that could trigger a global crisis unless dramatically altered. In a paper, four professors at Oxford University assert that a majority of large Chinese investment projects over the past three decades have underestimated costs, failed to deliver the promised benefits and played a smaller role than conventional wisdom suggests in making the country more prosperous.

“China is not a model to follow for other economies – emerging or developed – as regards infrastructure investing, but a model to avoid,” wrote professors Atif Ansar, Bent Flyvbjerg, Alexander Budzier and Daniel Lunn. Many Western lawmakers and economists have long praised China’s investment in new roads, rail, bridges and airports as means to improve the nation’s growth and reduce unemployment. Some have also suggested authoritarian governments are better able than democracies to get projects off the ground. “How do we sit back and watch China and Europe build the best bridges and high-speed railroads and gleaming new airports, and we’re doing nothing?” Obama complained in a speech several years ago urging Congress to spend more on infrastructure.

Jim Millstein, a former Treasury Department official from 2009-2011, makes a similar argument Wednesday, in a Washington Post column. “A well-designed program of new infrastructure spending can be just the catalyst the U.S. economy needs to get out of its rut,” he argued. Yet the Chinese approach is much costlier and less beneficial than it appears, the researchers contend. In many cases projects are subject to special-interest manipulation, poorly designed or shoddily implemented to meet political edicts. Quality, safety and environmental issues are not uncommon and the Chinese government is heavy-handed when obtaining land, even displacing masses of citizens from seized homes and property.

The power of shadow banks.

• P2P Lenders Push Chinese Students To Borrow At Exorbitant Rates (BBG)

Across college campuses in China, a small army of marketers is recruiting students to borrow money at interest rates many times that charged by the nation’s banks. Those without a credit history or parental approval can borrow money to buy a smartphone, pay for holidays, or get the latest sneakers through a raft of apps such as Fenqile. The market leader, whose name literally means Happy Installment Payments, has 50,000 part-time marketers across more than 3,000 universities and proudly touts the slogan “Wait no more; love what I love.” Welcome to the regulatory gray area where peer-to-peer lending meets e-commerce in China.

In the last three years, tens of millions of students have taken out micro-loans with the tap of a button to buy things. Once just the realm of startups, the sector has attracted heavy hitters in China’s online industry, including Alibaba’s finance affiliate and JD.com, which are pouring hundreds of millions of dollars into the lending model. In a nation with 37 million college students, the market is expected to reach $15 billion, according to the Beijing-based market research firm Analysys. While traditional banks, the biggest of which are state-owned, have long been regulated, such peer-to-peer lenders have not, though Fenqile at least says it welcomes more oversight.

Sounds like a huge global overcapacity. Which of course is in line with shrinking global trade.

• Collapse Of Hanjin Leaves $14 Billion Worth Of Goods Adrift (BBG)

Suppliers to companies such as Nike Inc. and Hugo Boss AG are scrambling to ensure their T-shirts and sneakers reach buyers in time for the year-end holiday season after the collapse of Hanjin Shipping Co. left an estimated $14 billion worth of goods adrift. Esquel Group, a Hong Kong-based manufacturer for fashion brands including Nike, Hugo Boss and Ralph Lauren, is hiring truckers to move four stranded containers of raw materials to its factories near Ho Chi Minh City as soon as they can be retrieved from ports in China. Liaoning Shidai Wanheng, a Chinese fabrics importer and a supplier to Marks & Spencer, has made alternative arrangements for shipments that were scheduled with Hanjin.

“Our production lines are waiting,” said Kent Teh, who runs Esquel’s Vietnam business. “We potentially have to take airfreight to deliver the garment items to clients in the U.S. and U.K.” Apparel, handbags, televisions and microwave ovens are among goods stranded at sea after Korea’s largest shipping company filed for bankruptcy protection last week, setting off a series of events that roiled the global supply chain. A U.S. Court on Tuesday provided a temporary reprieve, which may help vessels call on ports such as Los Angeles without the fear of getting impounded. Any major bottlenecks ahead of Thanksgiving and Christmas could put a dent in the two-month shopping season, which netted some $626 billion of sales last year in the U.S.

“The ratio varies widely, from close to 50% in Cyprus to around 1% in Sweden.” Italy is the big fish here.

• EU Regulators: Bad Loans Are Systemic Challenge for European Banks (BBG)

European regulators are sounding the alarm about the persistence of bad loans weighing on the balance sheets of banks in the region. In a report Wednesday on financial risks, the European Union agencies that set rules and technical standards for banks, insurers and markets called for a joint effort to tackle non-performing loans. “Insufficiently addressed asset quality concerns and persistent high level of NPLs are a significant driver of uncertainty in the EU banking sector,” they said. “Given the widespread, and thus systemic, nature of the significant challenges related to NPL, European supervisors, regulators and legislators should consider pursuing a coordinated, articulated and more decisive approach to this matter.”

Supervisors such as the European Central Bank need to raise pressure on banks to account for and reduce NPLs “in a more proactive and bold fashion,” the report says. Banks should adopt “a conservative provisioning policy, a prudent valuation of loans and collateral” and commit “to a NPL resolution plan with time-bound targets.” [..] European banks have the highest ratio of bad loans among developed countries, and progress to lower the share has been slow. According to the report, 5.7% of all loans were overdue on average in the first quarter, more than three times the ratio in the U.S. or Japan. The ratio varies widely, from close to 50% in Cyprus to around 1% in Sweden. High NPL levels are a capital constraint, hurt profits and limit new lending, according to the agencies.

In line with Nicole’s article series we’re currently running.

• America’s Quiet War on Cash (TAM)

Government campaigns of intimidation – like the wars on drugs, terror, and poverty – have been used to extort the public for decades. Despite the previous failures of institutional “wars,” a new war on cash is being waged that threatens freedom in a more subversive way than ever before. Banks and governments around the world are cracking down on the use of paper money, and in turn, eliminating any anonymity left in the current system. Through strict rules on cash transactions and civil asset forfeiture laws, for example, the system has already instituted penalties for using cash. But as payments evolve into a purely digital network, the consequences of this new paradigm are being brought into the spotlight.

The ability to track, record, and mediate transactions of all individuals is a power dictators throughout history could have only dreamed of. Those who value privacy are turning to alternatives like cash, cryptocurrencies, and precious metals, but these directly threaten central bank dominance. This ongoing tug-of-war in financial innovation will determine whether we enter an age of individual empowerment or centralized enslavement. As mundane as it may seem, the main reason for this push to go cashless is directly tied to what world central banks are doing to prop up their economies. The manipulation of interests rates to zero or even negative has left central banks no ammunition to fight off the next recession. Without the ability to cut interest rates even further, stimulating economic growth is nearly impossible.

The decisions made in response to the 2008 crisis have led to a perverted environment in which customers could be charged just for holding money in their accounts. As long as individuals have the ability to move their funds into paper currency and escape the losses, banks are still limited to how far they can push the envelope. Regardless, the federal government continues to pressure banks into issuing “Suspicious Activity Reports” for withdrawals of even as little as $5,000. That amount will undoubtedly decrease if and when more people resort to stuffing cash under their mattresses.

Perhaps a little late?

• FBI Records on Financial Crisis Requested by U.S. Lawmaker (BBG)

FBI files on the firms that contributed to the 2008 financial crisis should be released to help the public understand why no senior executives were charged, a U.S. congressman from New Jersey said. Democrat Bill Pascrell asked FBI Director James Comey for witness interview transcripts, notes, reports and memos from the agency’s probes into the crisis, according to a letter dated Tuesday. Pascrell said the FBI initiated criminal inquiries into at least 14 companies as part of its investigation into the origins of the crisis, which was ignited when prices of subprime-mortgage bonds plummeted after home-loan defaults soared. “Here we are eight years later – do you think the public knows how this happened? Do you think the public knows all of the recommendations made to the Justice Department?” Pascrell said Wednesday in an interview.

“Why are Hillary Clinton’s e-mails any more important?” The FBI earlier this month released a summary investigation and interview with Clinton to provide context on its recommendation that the Justice Department not prosecute Clinton or her aides for using a private e-mail system. The Democratic presidential nominee was interviewed by FBI agents and federal prosecutors for 3 1/2 hours on July 2 in Washington. Pascrell, who sits on both the budget and ways and means committees, said in many cases it would be too late to bring legal actions. Releasing the information would increase transparency and provide a public service, he said.

“..it is a case study in international charity fraud, of mammoth proportions…”

• Clinton Foundation: False Philanthropy (Ortel)

To informed analysts, the Clinton Foundation appears to be a rogue charity that has neither been organized nor operated lawfully from inception in October 1997 to date–as you will grow to realize, it is a case study in international charity fraud, of mammoth proportions. In particular, the Clinton Foundation has never been validly authorized to pursue tax-exempt purposes other than as a presidential archive and research facility based in Little Rock, Arkansas. Moreover, its operations have never been controlled by independent trustees and its financial results have never been properly audited by independent accountants.

In contrast to this stark reality, Bill Clinton recently continued a long pattern of dissembling, likening himself to Robin Hood and dismissing critics of his “philanthropic” post-presidency, despite mounting concerns over perceived conflicts of interest and irregularities. Normally, evaluating the efficacy of a charity objectively is performed looking closely into hard facts only -specifically, determining whether monies spent upon “program service expenditures” actually have furthered the limited, authorized “tax-exempt purposes” of entities such as the Bill, Hillary, and Chelsea Clinton Foundation, its subsidiaries, its joint ventures, and its affiliates (together, the “Clinton Charity Network”).

But, popular former presidents of the United States retain “bully pulpits” from which they certainly can spin sweet-sounding themes to a general audience and media that is not sufficiently acquainted with the strict laws and regulations that do, in fact , tether trustees of a tax-exempt organization to following only a mission that has been validly pre-approved by the Internal Revenue Service, on the basis of a complete and truthful application. This Executive Summary carries forward a process of demonstrating that the Clinton Foundation illegally veered from its IRS-authorized mission within days of Bill Clinton’s departure from the White House in January 2001, using publicly available information which, in certain cases, has been purposefully omitted or obscured in disclosures offered through the Clinton Foundation website, its principal public portal.

Fukushima is too big to be papered over. But that’s all that happens.

• Former Japan PM Accuses Abe Of Lying Over Fukushima (G.)

Japan’s former prime minister Junichiro Koizumi has labelled the country’s current leader, Shinzo Abe, a “liar” for telling the international community that the situation at the wrecked Fukushima Daiichi nuclear power plant is under control. Koizumi, who became one of Japan’s most popular postwar leaders during his 2001-06 premiership, has used his retirement from frontline politics to become a leading campaigner against nuclear restarts in Japan in defiance of Abe, a fellow conservative Liberal Democratic party (LDP) politician who was once regarded as his natural successor. Abe told members of the International Olympic Committee (IOC) in Buenos Aires in September 2013 that the situation at Fukushima Daiichi nuclear power plant was “under control”, shortly before Tokyo was awarded the 2020 Games.

IOC officials were concerned by reports about the huge build-up of contaminated water at the Fukushima site, more than two years after the disaster forced the evacuation of tens of thousands of residents. “When [Abe] said the situation was under control, he was lying,” Koizumi told reporters in Tokyo. “It is not under control,” he added, noting the problems the plant’s operator, Tokyo Electric Power (Tepco), has experienced with a costly subterranean ice wall that is supposed to prevent groundwater from flowing into the basements of the damaged reactors, where it becomes highly contaminated. “They keep saying they can do it, but they can’t,” Koizumi said. He went on to claim that Abe had been fooled by industry experts who claim that nuclear is the safest, cleanest and cheapest form of energy for resource-poor Japan.

“He believes what he’s being told by nuclear experts,” Koizumi said. “I believed them, too, when I was prime minister. I think Abe understands the arguments on both sides of the debate, but he has chosen to believe the pro-nuclear lobby.” After the Fukushima crisis, Koizumi said he had “studied the process, reality and history of the introduction of nuclear power, and became ashamed of myself for believing such lies”. [..] Koizumi, 74, has also thrown his support behind hundreds of US sailors and marines who claim they developed leukaemia and other serious health problems after being exposed to Fukushima radiation plumes while helping with relief operations

Home › Forums › Debt Rattle September 8 2016