Henry Matisse Bouquet of flowers for July 14 Oct 7 1919

Coordinated efforts to crash the conomy. Ignore the recovery narrative.

• Japan and Europe Start the Central Bank Reset (BBG)

This is going to be an exciting year for monetary policy. In fact, it already is, thanks to Europe and Japan. Investors were taken aback last week when the Bank of Japan bought fewer bonds and the ECB revealed – shock, horror – its language would have to evolve with the euro region’s economy. Both developments, and the reaction, were welcome. They say a lot about the strength of global growth and how it still surprises many people. First to Japan: Investors were wrong to interpret the reduced purchases as a sign that a policy shift is imminent. They were, however, right about the long-term direction of policy. It isn’t going to get looser. Will it remain accommodative as far as the eye can see? Yes.

With Japan’s economic sunny patch extending and inflation headed in the right direction – if still way too low – it’s not a stretch to see Governor Haruhiko Kuroda or his successor ease up a little on the stimulus. Just not right now. That was Jan. 9. Two days later, the fever struck in Europe. The proximate cause was the release of minutes from the ECB’s December meeting and the implication contained therein that communications would have to reflect a stronger growth terrain and improving, albeit still low, inflation. The euro jumped and German bond yields climbed. It feels like we just got through a big change from the ECB: the taper of bond purchases to 30 billion euros a month until September. (Remember when officials hated the word “taper”?) Now, here were policymakers flagging further revisions.

What’s the thread linking these two happenings? Despite all the data and pronouncements about a robust global economy and a synchronized upswing, people are still taken aback by signs that (a) it’s a reality and (b) policy is bound to react. I’m not saying policy is going to change overnight. But if you start with a global framework – we are in a global marketplace, are we not? – key to that framework really ought to be the direction of policy. Ask yourself: Are monetary chieftains going to make policy more easy or less easy, assuming the upswing in growth is sustainable? The answer has to be “less.”

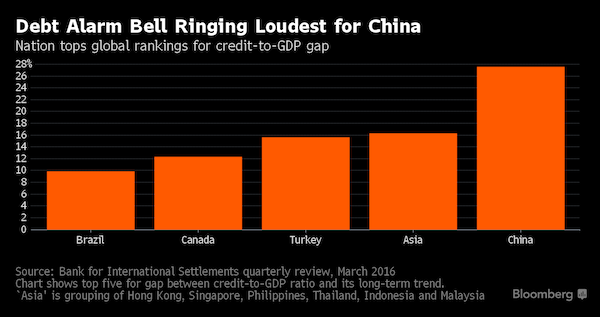

Because it’s by far the biggest, and it’s a debt bubble, not a gossip one.

• The Bubble That Could Break the World (Rickards)

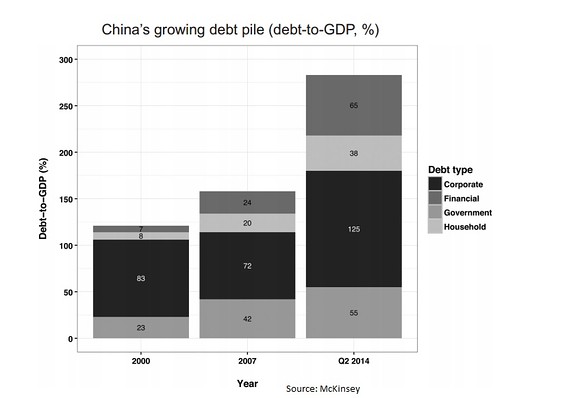

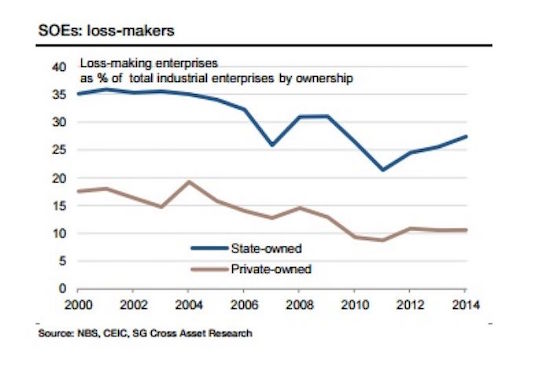

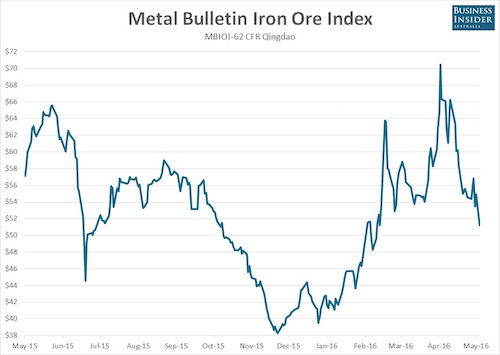

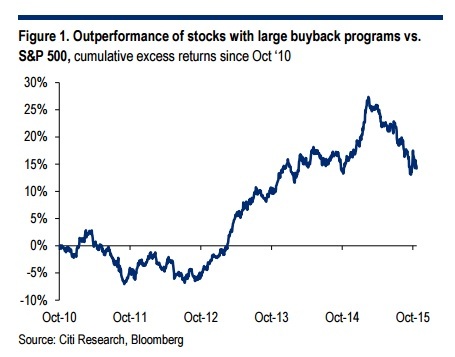

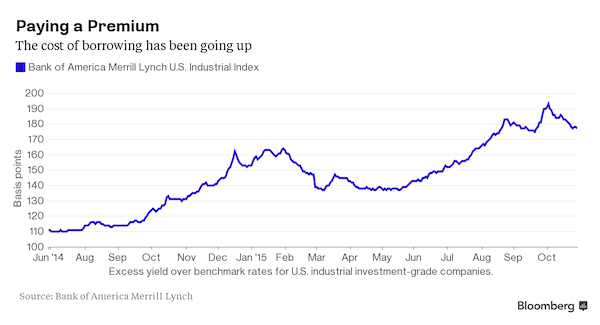

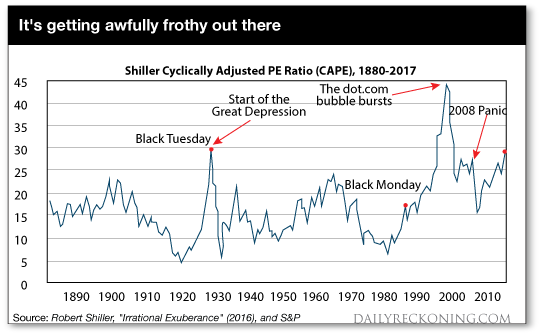

The credit-driven bubble has a different dynamic than a narrative-bubble. If professional investors and brokers can borrow money at 3%, invest in stocks earning 5%, and leverage 3-to-1, they can earn 6% returns on equity plus healthy capital gains that can boost the total return to 10% or higher. Even greater returns are possible using off-balance sheet derivatives. Credit bubbles don’t need a narrative or a good story. They just need easy money. A narrative bubble bursts when the story changes. It’s exactly like The Emperor’s New Clothes where loyal subjects go along with the pretense that the emperor is finely dressed until a little boy shouts out that the emperor is actually naked. Psychology and behavior change in an instant.

When investors realized in 2000 that Pets.com was not the next Amazon but just a sock-puppet mascot with negative cash flow, the stock crashed 98% in 9 months from IPO to bankruptcy. The sock-puppet had no clothes. A credit bubble bursts when the credit dries up. The Fed won’t raise interest rates just to pop a bubble — they would rather clean up the mess afterwards that try to guess when a bubble exists in the first place. But the Fed will raise rates for other reasons, including the illusory Phillips Curve that assumes a tradeoff between low unemployment and high inflation, currency wars, inflation or to move away from the zero bound before the next recession. It doesn’t matter. Higher rates are a case of “taking away the punch bowl” and can cause a credit bubble to burst.

The other leading cause of bursting credit bubbles is rising credit losses. Higher credit losses can emerge in junk bonds (1989), emerging markets (1998), or commercial real estate (2008). Credit crack-ups in one sector lead to tightening credit conditions in all sectors and lead in turn to recessions and stock market corrections. What type of bubble are we in now? What signs should investors look for to gauge when this bubble will burst? My starting hypothesis is that we are in a credit bubble, not a narrative bubble. There is no dominant story similar to the Nifty Fifty or dot.com days. Investors do look at traditional valuation metrics rather than invented substitutes contained in corporate press releases and Wall Street research. But even traditional valuation metrics can turn on a dime when the credit spigot is turned off.

BTC recovered somewhat overnight.

• South Korea Considers Shutting Down Domestic Cryptocurrency Exchanges (R.)

South Korean policymakers joined the global chorus of virtual-coin critics on Thursday, saying Seoul is considering shutting down domestic virtual currency exchanges as the new breed of market exposes users to speculative frenzy and crime. The country’s tough stance comes as policymakers from the United States to Germany struggle to come up with stricter regulation against money laundering and other crimes. Responding to questions in parliament, South Korea’s chief of the Financial Services Commission said: “(The government) is considering both shutting down all local virtual currency exchanges or just the ones who have been violating the law.” Separately, Bank of Korea Governor Lee Ju-yeol told a news conference that “cryptocurrency is not a legal currency and is not being used as such as of now.”

Regulators around the world are still debating how to address risks posed by cryptocurrencies, as bitcoin, the world’s most popular virtual currency, soared more than 1,700% last year. Prices have plummeted since South Korea announced last week it may ban domestic cryptocurrency exchanges. On Wednesday, bitcoin slid 18%. According to Bithumb, South Korea’s second-largest virtual currency exchange, the nation’s bitcoin trading price stood at 15,697,000 won ($14,690.69) as of 0314 GMT on Thursday. On the Luxembourg-based Bitstamp exchange, bitcoin was traded at $11,750. [..] On Thursday, the BOK governor said the central bank had begun looking into the market’s impact on the economy. “We have started looking at virtual currency from a long-term standpoint, as central banks could start issuing digital currencies in the future. This sort of research has begun at the Bank of International Settlements and we are part of that research.”

“Studies have shown that over 90% of the media’s coverage of President Trump is negative…”

• Trump Reveals Winners Of Controversial ‘Fake News Awards’ (AFP)

Donald Trump unveiled the winners of his much-touted “Fake News Awards” late Wednesday, escalating his already persistent attacks on a number of major US media outlets. The awards dropped hours after a senator from Trump’s own Republican party hurled a stinging rebuke at the president, accusing the US leader of undermining the free press with Stalinist language. The brash Republican president announced the ten “honorees” using his preferred medium of Twitter, linking to a list published on the Republican Party’s website that crashed minutes after his big reveal. The “winners” of the spoof awards included top networks and newspapers CNN, The New York Times and The Washington Post, all of which have been regular targets of Trump’s ire.

Nobel-prize winning economist Paul Krugman, who writes a regular opinion column for The New York Times, nabbed the number one spot. The administration said he merited the award for writing “on the day of President Trump’s historic, landslide victory that the economy would never recover.” Following the former reality star’s stunning rise to power, Krugman had written that Trump’s inexperience on economic policy and unpredictability risked further damaging the weak global economy. The list also pointed to a reporting error from ABC’s veteran reporter Brian Ross, who was suspended for four weeks without pay after he was forced to correct a bombshell report on ex-Trump aide Michael Flynn.

[..] 11. And last, but not least: “RUSSIA COLLUSION!” Russian collusion is perhaps the greatest hoax perpetrated on the American people. THERE IS NO COLLUSION!

“We’re talking about big damages. We’re talking about numbers that you haven’t even thought about,” Trump said.”

• Trump Considers Big ‘Fine’ Over China Intellectual Property Theft (R.)

President Donald Trump said on Wednesday the United States was considering a big “fine” as part of a probe into China’s alleged theft of intellectual property, the clearest indication yet that his administration will take retaliatory trade action against China. In an interview with Reuters, Trump and his economic adviser Gary Cohn said China had forced U.S. companies to transfer their intellectual property to China as a cost of doing business there. The United States has started a trade investigation into the issue, and Cohn said the United States Trade Representative would be making recommendations about it soon. “We have a very big intellectual property potential fine going, which is going to come out soon,” Trump said in the interview.

While Trump did not specify what he meant by a “fine” against China, the 1974 trade law that authorized an investigation into China’s alleged theft of U.S. intellectual property allows him to impose retaliatory tariffs on Chinese goods or other trade sanctions until China changes its policies. Trump said the damages could be high, without elaborating on how the numbers were reached or how the costs would be imposed. “We’re talking about big damages. We’re talking about numbers that you haven’t even thought about,” Trump said.

U.S. businesses say they lose hundreds of billions of dollars in technology and millions of jobs to Chinese firms which have stolen ideas and software or forced them to turn over intellectual property as part of the price of doing business in China. The president said he wanted the United States to have a good relationship with China, but Beijing needed to treat the United States fairly. Trump said he would be announcing some kind of action against China over trade and said he would discuss the issue during his State of the Union address to the U.S. Congress on Jan. 30. Asked about the potential for a trade war depending on U.S. action over steel, aluminum and solar panels, Trump said he hoped a trade war would not ensue. “I don’t think so, I hope not. But if there is, there is,” he said.

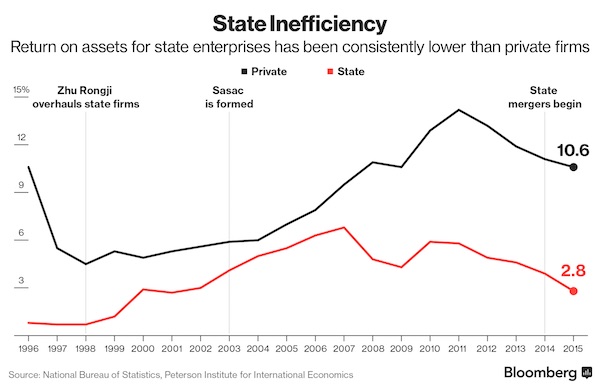

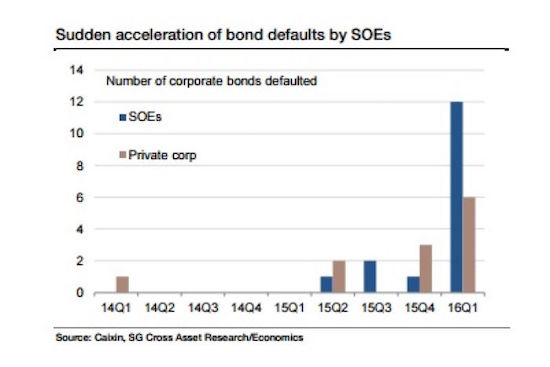

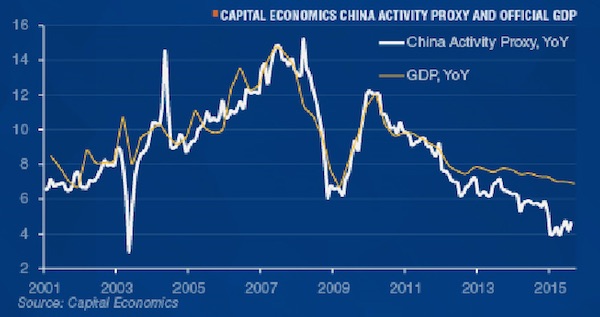

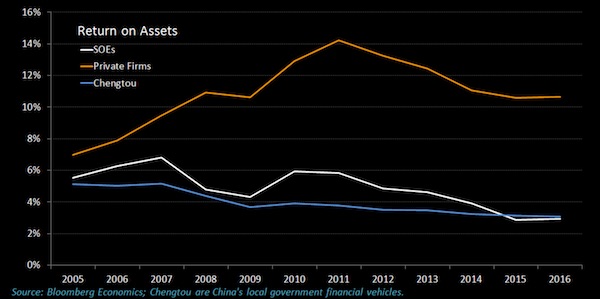

This is not going to work. It’s a one way ticket back to Mao.

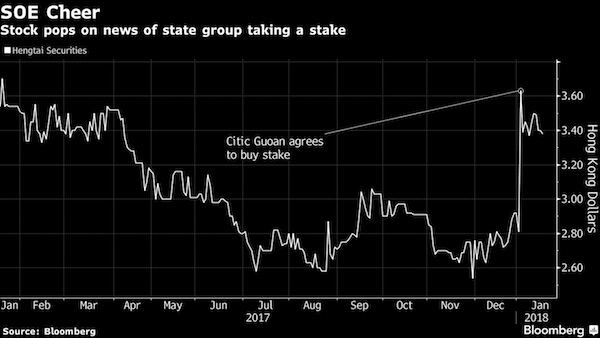

• China’s Communists Take More Stakes In Private Companies (BBG)

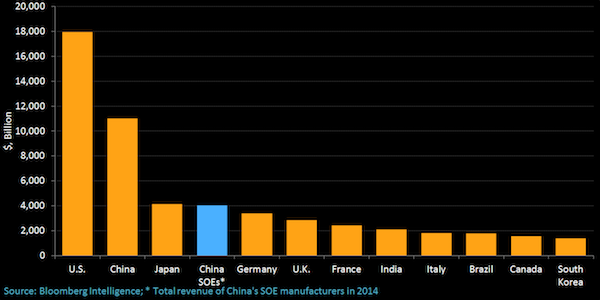

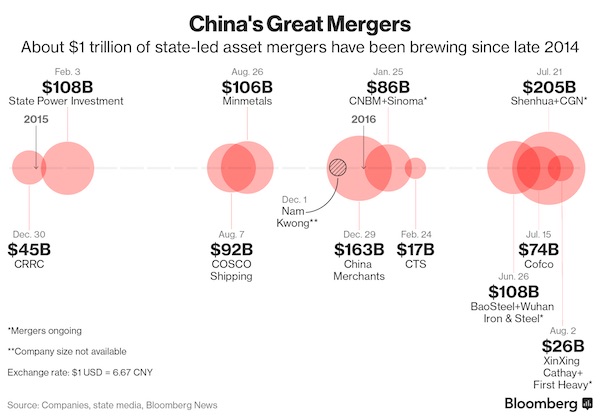

After tightening the Communist Party’s grip on state-owned enterprises, President Xi Jinping’s administration is signaling an increasing presence in private companies. Xi has called state enterprises the “backbone” of China’s socialist economy. But most of the giants were founded before the boom in technology-driven industries over the past two decades. That’s created a large swathe of the economy that’s largely private – think tech and consumer champions like Alibaba, Tencent and Baidu, along with innovators in sectors from finance to automation. Now, SOEs are on track to take stakes in private companies. “China wants to maintain state control over every aspect of the national economy, and it needs to keep up with the changes in the economic structure,” said Chen Li at Credit Suisse.

“How can it overlook the most important industries to the future economy?” Much of the overhaul of state-owned enterprises under Xi has focused on a consolidation in the hundreds of sprawling units across the country, such as those that have reshaped the shipping and train-making industries. But a lesser-noticed part of the broad “mixed ownership” initiative features SOEs being encouraged to take stakes in private companies. This part of the initiative has yet to gather pace, though equity strategists anticipate moves to come. They would showcase how China continues to develop its own path toward developed-nation status – not entirely state dominated, but with more control by political authorities than in countries like France that have nurtured state champions.

The head of the Beijing agency that oversees China’s SOEs, Xiao Yaqing, reiterated the push in a People’s Daily article on state enterprise reforms Dec. 13. The private stakes will be acquired through various means, he and other top officials have said. The mechanism has already been applied in the case of the state’s crackdown on financier Xiao Jianhua’s Tomorrow Holding empire. The government ordered the holding company to divest from many of its financial assets, people with knowledge of the matter said this month. State-owned Citic Guoan Group Co. bought a $1.4 billion stake in Hengtou Securities – known as Hengtai on the mainland – with a large part of the purchase coming from Tomorrow Group. Investors applauded the move, in a sign of what could happen when the state invests elsewhere. Hengtou has jumped more than 20% this year after announcing the stake sale.

More Trump success.

• Apple Expects to Pay $38 Billion Tax on Repatriated Cash (BBG)

Apple said it will bring hundreds of billions of overseas dollars back to the U.S., pay about $38 billion in taxes on the money and invest tens of billions on domestic jobs, manufacturing and data centers in the coming years. The iPhone maker plans capital expenditures of $30 billion in the U.S. over five years and will create 20,000 new jobs at existing sites and a new campus it intends to open, the Cupertino, California-based company said Wednesday in a statement. “We are focusing our investments in areas where we can have a direct impact on job creation and job preparedness,” Chief Executive Officer Tim Cook said in the statement, which alluded to unspecified plans by the company to accelerate education programs.

In its December approval of the most extensive tax-code revisions since 1986, Congress scrapped the previous international tax system for corporations — an unusual arrangement that allowed companies to defer U.S. income taxes on foreign earnings until they returned the income to the U.S. That “deferral” provision led companies to stockpile an estimated $3.1 trillion offshore. By switching to a new system that’s designed to focus on domestic economic activity, congressional tax writers also imposed a two-tiered levy on that accumulated foreign income: Cash will be taxed at 15.5%, less liquid assets at 8%. Companies can pay over eight years. Apple has the largest offshore cash reserves of any U.S. company, with about $252 billion in at the end of September, the most recently reported fiscal quarter.

The company, which opened a new headquarters in Cupertino last year, said it also plans to open another site in the U.S. focused initially on employees who provide technical support to Apple product users. Apple said it will announce the location of the new campus at a later date. The company already has a sprawling campus in Austin, Texas, for supply chain and technical support employees.

Or maybe not.

• Apple May Not Hire 20,000 New Workers, or Bring Back Its Overseas Cash (MW)

Apple announced a series of plans Wednesday that were celebrated as promises to hire thousands of workers and bring home billions of dollars in cash. Well, not necessarily. Apple said in its release that the company planned to “create over 20,000 new jobs through hiring at existing campuses and opening a new one.” The key word there is “create,” which Apple really likes to use when discussing jobs: The company even has a portion of its website dedicated to “job creation” that claims it is “responsible for 2 million jobs” in the United States, most of which are jobs “attributable to the App Store ecosystem.” Apple currently employs 84,000 people in the U.S., it said Wednesday, while an October filing with the Securities and Exchange Commission said that it has a total of 132,000 full-time employees worldwide, suggesting that about a third of its employees work abroad.

A quarter of the 2 million jobs Apple claims responsibility for are positions through Apple’s U.S.-based suppliers. “From the people who manufacture components for our products to the people who distribute and deliver them, Apple directly or indirectly supports hundreds of thousands of U.S. jobs,” Apple says on the page. [..] Many also took Apple’s promise to pay $38 billion in repatriation taxes as a promise that Apple would bring home more than a quarter-trillion dollars it currently has overseas. However, Apple does not have to bring home that money, and much of it is tied up in long-term investments that would make it unlikely. The company has to pay taxes on overseas earnings whether it brings the money back to the United States or not, so paying the tax does not mean the money is coming home.

What I wrote about last week: “digital super states” like Facebook and Google have been working to “re-establish discourse control”.

• Assange Keeps Warning Of AI Censorship (CJ)

In a statement that was recently read during the “Organising Resistance to Internet Censorship” webinar, sponsored by the World Socialist Web Site, Assange warned of how “digital super states” like Facebook and Google have been working to “re-establish discourse control”, giving authority over how ideas and information are shared back to those in power. Assange went on to say that the manipulative attempts of world power structures to regain control of discourse in the information age has been “operating at a scale, speed, and increasingly at a subtlety, that appears likely to eclipse human counter-measures.”

What this means is that using increasingly more advanced forms of artificial intelligence, power structures are becoming more and more capable of controlling the ideas and information that people are able to access and share with one another, hide information which goes against the interests of those power structures and elevate narratives which support those interests, all of course while maintaining the illusion of freedom and lively debate. In an appearance via video link at musician and activist M.I.A.’s Meltdown Festival last June, the WikiLeaks editor-in-chief expounded in far more detail about his thoughts on the potential for artificial intelligence to be used for controlling online information and discourse in a way human intelligence can’t hope to keep up with.

Pointing out how AI can already outmaneuver even the greatest chess players in the world, he describes how programs which can operate with exponentially more tactical intelligence than the human intellect can manipulate the field of available information so effectively and subtly that people won’t even know they are being manipulated. People will be living in a world that they think they understand and know about, but they’ll unknowingly be viewing only establishment-approved information. “When you have AI programs harvesting all the search queries and YouTube videos someone uploads it starts to lay out perceptual influence campaigns, twenty to thirty moves ahead,” Assange said. “This starts to become totally beneath the level of human perception.”

Sell sell sell.

• Australia’s Household Debt-to-Income Ratio Reaches 200% (AFR)

The closely tracked Australian household debt-to-income ratio has now reached the 200% level, and analysts at UBS are concerned about rising pressures among borrowers. The increase was because of the Australian Bureau of Statistics revision to include self-managed superannuation debt. That resulted in a 3% rise in household debt from “extremely elevated levels”, and pushed the ratio to income to 199.7%, “one of the highest in the world,” according to UBS. “With subdued growth in household income expected to continue, this implies household leverage is likely to rise further in the near term,” it said. “As a result we expect total household debt to disposable income to peak around 205% before the slow deleveraging process begins.”

High household debt levels will constrain further borrowing and weigh on prospects for earnings growth at the big banks, analysts Jonathan Mott and Rachel Bentvelzen said as they downgraded their forecasts for housing credit growth. House prices, which have begun to decline in Sydney, are expected to slide further as a result of tighter lending standards, the retreat of foreign buyers, lending limits imposed by regulators and concerns about proposed changes to negative gearing and capital gains tax that have been tabled by the Opposition. “Sentiment for investment into the housing market is waning, with the ‘fear of missing out’ euphoria fading quickly, especially in Sydney,” the analysts said in a note to clients.

The insanity of today.

• Mario Draghi Told To Drop Membership Of Secretive Bankers’ Club (G.)

The president of the European Central Bank has been told by the EU’s watchdog he should drop his membership of a secretive club of corporate bankers, after claims the group had been given an inside seat from which it could influence key policies. Following a year-long investigation, Mario Draghi was informed on Wednesday by the European ombudsman, Emily O’Reilly, that his close relationship with the Washington-based G30 group threatened the reputation of the bank, despite his assurances to the contrary. Members of the exclusive club, of which only two of the current 33 are women, are chosen by an anonymous board of trustees, it emerged during the ombudsman’s investigation. Only the identity of the chair of the trustees, Jacob A Frenkel, the chairman of JPMorgan Chase, has been made public.

O’Reilly noted the group’s secrecy and lack of transparency over the content of its meetings. She additionally called for a ban on all future presidents of the ECB taking up membership of the club, previously named the Consultative Group on International Economic and Monetary Affairs. The ruling followed a complaint by the Corporate Europe Observatory (CEO), a Brussels-based NGO, which claimed Draghi’s close relationship to G30 was in contravention of the ECB’s ethical code. During his presidency of the ECB, Draghi, an Italian economist who previously worked at Goldman Sachs, has attended four G30 meetings, in 2012, 2013 and twice in 2015.

O’Reilly said there was a danger that the bank’s independence could be perceived to have been compromised by Draghi’s involvement with the group, whose members include a number of central bank governors, private sector bankers and academics. The governor of the Bank of England, Mark Carney, is a member. But O’Reilly said there was no evidence of sensitive information being shared. The ombudsman said: “The ECB takes decisions that directly affect the lives of millions of citizens. In the aftermath of the financial crisis, and in consideration of the additional powers given to the ECB in recent years to supervise member state banks in the public interest, it is important to demonstrate to that public that there is a clear separation between the ECB as supervisor and the finance industry which is affected by its decisions.”

Not one word about emissions. Not one. Oh wait, “continuous improvements to its safety, security, efficiency and environmental footprint “. Pants on fire.

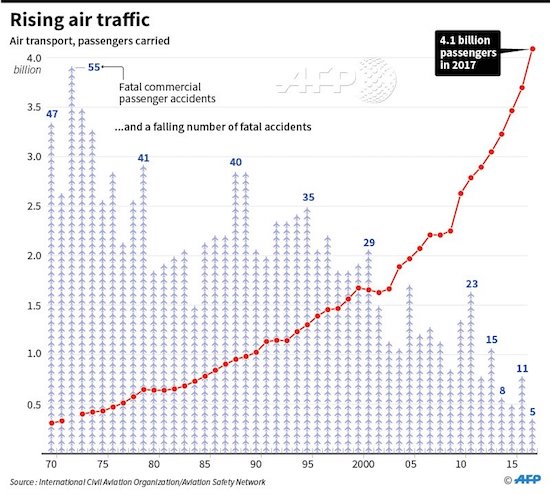

• Global Air Traffic At New Record (AFP)

Budget carriers continued to push global air traffic to new record levels last year, the International Civil Aviation Organization (ICAO) said on Wednesday. Scheduled air services carried “a new record” of 4.1 billion passengers in 2017, an increase of 7.1% over the previous year, ICAO said, citing preliminary data. The figure compares with 6% growth in 2016. “The sustainability of the tremendous growth in international civil air traffic is demonstrated by the continuous improvements to its safety, security, efficiency and environmental footprint,” ICAO Council president Olumuyiwa Benard Aliu said in a statement from the Montreal-based agency.

Early this month, two industry studies showed that last year was the safest for civil aviation since plane crash statistics were first compiled in 1946. A total of 10 crashes of civil passenger and cargo planes claimed 44 lives, said the Aviation Safety Network. A separate report from the To70 agency said no major airline crashed a plane in 2017. ICAO, a United Nations agency, said Wednesday that low-cost carriers flew an estimated 1.2 billion passengers or about 30% of the global total last year. The budget airline sector “consistently grew at a faster pace compared to the world average growth, and its market share continued to increase, specifically in emerging economies,” ICAO said.

Missed opportunity: including the emissions of electric cars.

• Europe’s Microwave Ovens Emit Nearly As Much CO2 As 7 Million Cars (G.)

Popping frozen peas into the microwave for a couple of minutes may seem utterly harmless, but Europe’s stock of these quick-cook ovens emit as much carbon as nearly 7m cars, a new study has found. And the problem is growing: with costs falling and kitchen appliances becoming “status” items, owners are throwing away microwaves after an average of eight years, pushing rising sales. A study by the University of Manchester worked out the emissions of carbon dioxide – the main greenhouse gas responsible for climate change – at every stage of microwaves, from manufacture to waste disposal. “It is electricity consumption by microwaves that has the biggest impact on the environment,” say the authors.

“Efforts to reduce consumption should focus on improving consumer awareness and behaviour to use appliances more efficiently. For example, electricity consumption by microwaves can be reduced by adjusting the time of cooking to the type of food.” Each year more microwaves are sold than any other type of oven in the EU: annual sales are expected to reach 135m by the end of the decade. David Reay, professor of carbon management at the University of Edinburgh, pointed out that the damage done by microwaves is still a fraction of that done by cars. “Yes, there are a lot of microwaves in the EU, and yes they use electricity,” he said.

“But their emissions are dwarfed by those from cars – there are around 30m cars in the UK alone and these emit way more than all the emissions from microwaves in the EU. Latest data show that passenger cars in the UK emitted 69m tonnes of CO2 equivalent in 2015. This is ten times the amount this new microwave oven study estimates for annual emissions for all the microwave ovens in the whole of the EU.” The energy used by microwaves is lower than any other form of cooking. uSwitch, the price comparison website, lists microwaves as the most energy efficient, followed by a hob and finally an oven, advising readers to buy a microwave if they don’t have one. However, they urge owners to switch them off at the wall after use, to avoid powering the clock.

The Guardian can try to chest thump as much as it wants, but it too got triggered for real only through David Attenborough’s Blue Planet II, just like Theresa may et al.

• 1 Million Tonnes A Year: UK Supermarkets Shamed For Plastic Packaging (G.)

Britain’s leading supermarkets create more than 800,000 tonnes of plastic packaging waste every year, according to an investigation by the Guardian which reveals how top chains keep details of their plastic footprint secret. As concern over the scale of unnecessary plastic waste grows, the Guardian asked Britain’s eight leading supermarkets to explain how much plastic packaging they sell to consumers and whether they would commit to a plastic-free aisle in their stores. The chains have to declare the amount of plastic they put on the market annually under an EU directive. But the information is kept secret, and Tesco, Sainsbury’s, Morrisons, Waitrose, Asda and Lidl all refused the Guardian’s request, with most saying the information was “commercially sensitive”. None committed to setting up plastic-free aisles – something the prime minister called for last week.

Only two supermarkets, Aldi and the Co-op, were open about the amount of plastic packaging they put on to the market. Using their data, and other publicly available market share information, environmental consultants Eunomia estimated that the top supermarkets are creating a plastic waste problem of more than 800,000 tonnes each year – well over half of all annual UK household plastic waste of 1.5m tonnes. The 800,000 tonnes of waste from food and beverage products would fill enough large 10-yard skips to extend from London to Sydney, or cover the whole of Greater London to a depth of 2.5cm. The revelations will add to mounting public concern about the damage that plastic does to the natural world. The Guardian has already revealed the vertiginous growth in plastic production, and the heavy environmental toll it exacts.

Dominic Hogg, chairman of Eunomia, said the figures could be higher. “The data reported for plastic packaging put on the market as a whole is an underestimate in our view,” said Hogg. Supermarkets in the UK keep their plastic footprint secret with a confidentiality agreement signed with the agencies involved in the British recycling compliance scheme. It means the amount of plastic packaging created by each supermarket and the money they pay towards its recycling is kept out of the public domain. One leading supermarket manager is calling for the whole system to be made more transparent and targeted to make the irresponsible producers pay more. Iain Ferguson, head of sustainability at the Co-op, said Britain should adopt the French system of “bonus-malus”, where supermarkets are taxed more for using material which is not easily recyclable and less for sustainable and recyclable packaging.

And it really is this simple.

• The Plastic-Free Stores Showing The Big Brands How To Do It (G.)

In the past few weeks Richard Eckersley has noticed a change in the type of people who come into his shop. The former Manchester United footballer, who turned his back on the game to set up the the UK’s first “zero waste” store on Totnes high street in Devon, says it is no longer only committed environmentalists who pop in, looking for a cleaner way to shop. “We thought January might be a bit quieter but it has been crazy,” says Eckersley, who set up the Earth.Food.Love shop with his wife Nicola in March. “A lot of new people are coming in – people who have not necessarily been involved in green issues before … it really feels like this [concern about plastic waste] is starting to break out of the environmental bubble.”

Last week Theresa May put cutting plastic pollution at the heart of the government’s 25-year environmental plan, and although critics said it was short on detail she did call for supermarkets to introduce plastic-free aisles to offer customers more choice. But Eckersley says many consumers are already way ahead of politicians. He and his wife have helped people who are planning to set up similar stores in Wales, Birmingham and Bristol. “We are getting calls every week from around the country from people wanting to set up something similar in their towns … it feels like this has really tapped into something that is growing all the time.” More than 200 miles away, Ingrid Caldironi shares the enthusiasm. She set up the plastic-free Bulk Market in east London last year. It has proven so popular that it is now moving to bigger, permanent premises at the end of the month.

“We have had an amazing response, especially in the last couple of months,” she says. Eckersley and Caldironi are at the vanguard of a burgeoning anti-plastics movement in the UK that has been fuelled by newspaper investigations including the Guardian’s Bottling It series, the Blue Planet television series and a general alarm at the damage plastic is doing to the natural environment. But their enthusiasm is not shared by big supermarkets, which have thus far shown little inclination to reduce their plastic waste. “For a nation of shopkeepers we are lagging behind in this race,” says Sian Sutherland, founder of the campaign A Plastic Planet which led the calls for plastic-free aisles. “The most exciting thing is that politicians and industry are no longer claiming that we can recycle our way out of the plastic problem,” she added. “Banning the use of indestructible plastic packaging for food and drink products is the only answer.”