Wyland Stanley Transparent Car, General Motors exhibit, San Francisco 1940

And nothing else matters one bit.

• For Most American Families, Wealth Has Vanished (Yahoo!)

If you re a typical family, you re considerably poorer than you used to be. No wonder the recovery feels like a recession. A new study published by the Russell Sage foundation helps explain why many families feel like they re falling behind: They actually are. The study, which measures the average wealth of U.S. households by income level, reveals a startling decline in wealth nationwide. The median household in 2013 had a net worth of just $56,335 – 43% lower than the median wealth level right before the recession began in 2007, and 36% lower than a decade ago. There are very few signs of significant recovery from the losses in wealth suffered by American families during the Great Recession, the study concludes.

Not surprisingly, lower-income households have lost a larger portion of their wealth than those with higher incomes. Wealth generally comes from two types of assets: financial holdings and real estate. Financial assets have more than recovered ground lost during the recession, thanks largely to a stock-market rally now in its sixth year. The S&P 500 index, for instance, has hit several new record highs this year and is up more than 25% from the peak it reached in 2007. Home values, however, are still about 18% below the peak reached in 2006, according to the S&P/Case-Shiller index. Since wealthier households tend to hold more financial assets, they ve benefited the most form the stock-market recovery, which itself has been assisted by the Federal Reserve s super-easy monetary policy.

Fed policy has been intended to help typical homeowners and buyers too, by pushing long-term interest rates unusually low and, in theory, goosing demand for housing. But a housing recovery is taking much longer to play out than the reflation of financial assets. That’s part of the reason the top 10% of households have held onto more of their wealth than the other 90% during the past 10 years.

Wall Street insists.

• Fed Officials Say Rate Hike Plan Intact Despite Weak US Data (Reuters)

The Federal Reserve should remain on track to raise interest rates later this year despite the U.S. economy’s weak start to the year and a stock market sell-off this week, two Fed officials said on Thursday. In separate events in Frankfurt and Detroit, St. Louis Fed President James Bullard and Atlanta Fed President Dennis Lockhart said U.S. monetary policy might need to be adjusted in light of the economy’s steady improvement since the 2007-2009 financial crisis. “Now may be a good time to begin normalizing U.S. monetary policy so that it is set appropriately for an improving economy over the next two years,” Bullard said at a conference in the German financial hub.

The comments came amid a spate of weak U.S. economic data that prompted major analyst firms to scale down their growth this week. Fed policymakers also lowered their growth forecasts at last week’s policy-setting meeting. Investors have followed suit, sending shares on Wall Street down for four consecutive trading sessions. The challenge now, Lockhart said, is to sort out whether recent weakness in exports, manufacturing and capital investment indicate the start of an economic slowdown or other temporary factors such as the soaring value of the U.S. dollar. Lockhart said he is confident for now that the weakness is “transitory,” and still regards it as highly likely that the Fed will raise rates at either its June, July or September meetings.

“We’re still on a solid track … The economy is throwing off some mixed signals at the moment and I think that is going to be passing or transitory,” Lockhart said in an interview with CNBC from a Detroit investment conference. The conflicting signals are partly familiar – seasonal softness that often accompanies severe winter weather – and partly uncharted. The Fed, for example, now finds itself moving in a divergent direction from other major global central banks, planning a rate hike at a time when Europe and Japan are still flooding markets with liquidity, and other central banks are cutting rates. That has driven the value of the dollar steadily higher, and Lockhart said he, for one, was caught off guard by how much that currency move has apparently impacted U.S. exports and manufacturing..

You think?

• China Stocks May Be In Serious Bubble (MarketWatch)

Some say that when the average “mom-and-pop” retail investors get back into the stock market, it could be time to get out. But what about when even teenagers start buying? China has entered a new stock frenzy, like something out of America in the Roaring 20s or the dottiest days of the dot-com bubble, with trading volumes continuing to push to new record highs. On Wednesday, combined trading on the Shanghai and Shenzhen markets hit 1.24 trillion yuan ($198 billion), the seventh straight session in which turnover surpassed the 1 trillion yuan mark. By comparison, the New York Stock Exchange typically saw $40 billion-$50 billion a day in trading during the first two months of this year.

The Shanghai Composite Index is hovering near its seven-year closing high of 3,691, hit on Tuesday when the index completed a 10-session winning streak. For the year so far, the benchmark is up 13.8%, making it the best-performing major East Asian stock index of 2015 to date, though it still has a way to go to match 2014’s 53% surge. The lure of flush times on the Shanghai market is sweeping in unlikely investors by the hundreds of thousands. This week, both the China Securities Daily and the Beijing Morning Post had dueling reports about recent college graduates and, yes, teenagers buying shares.

Typically these young investors speculate with money given to them by their parents, according to a Great Wall Securities broker quoted in the Beijing Morning Post story. Yet another report, this time by the Beijing News newspaper, relates that at the Beijing trading halls of China Securities Co., “even the cleaning lady” has opened an account to play the market. The data appear to agree with the anecdotes: Within the last week alone, 1.14 million stock account were opened in China, the biggest such surge since June 2007, according to China Securities Depository & Clearing Corp.

“..17 of the absolutely “stupidest statements” made by Wall Street’s best and brightest..

• You’re Playing Liar’s Poker at the Wall Street Casino (Paul B. Farrell)

Yes, you are playing liar’s poker at the Wall Street casino. So how do know Wall Street’s lying? You need this foolproof test. My friends from the anonymous programs use this test all the time. And it really works: “How can you tell when alcoholics and addicts are lying? Their lips are moving!” Same test fits Wall Street, they’re lying when their lips are moving. We have four years of proof and 17 examples. Why’s this test important? The SEC chairwoman recently announced plans to “implement a uniform fiduciary duty for broker-dealers and investment advisers where the standard is to act in the best interest of the investors.” Something Jack Bogle, Vanguard’s founder, has been unable to get government to pass for over 50 years: a fiduciary rule to put the investor ahead of Wall Street insiders. Maybe now he’ll get his wish!

So if you remember nothing else today, here’s your big takeaway: Never trust Wall Street bulls, they’re lying to you over 93% of the time. Behavioral-science research tells us bankers, traders and other market insiders are misleading us, manipulating us the vast majority of the time in their securities reports, PR, ads, speeches, sales material, in their predictions on television, cable shows and when quoted in newspapers and magazines. “Read Bull! 144 Stupid Statements from the Market’s Fallen Prophets,” hit America’s book stores near the end of a 30-month recession a decade ago, after the market wiped out over $8 trillion of the retirement money for 95 million Main Street Americans. The Dow peaked at 11,722 in January 2000, didn’t bottom for 32 months, in October 2002 at 7,286, over 40% down.

We picked 17 of the absolutely “stupidest statements” made by Wall Street’s best and brightest to illustrate their tendency to lie, manipulate, mislead and steal from investors by hook or by crook, using hype, happy talk and all kinds of BS. And it’s guaranteed to happen again in 2015-2016, igniting another market and economic collapse like 2008, which is why the new SEC fiduciary rule would save billions for Main Street in the next round of liar’s poker. Remember, this time is never different, the names change but the BS stays the same, repeating before’ and after every market cycle, never stops, wiping out trillions of our money.

They’re faking it. Everybody is.

• European Central Bank QE Is Masking Eurozone Struggles (MM)

The ECB QE (quantitative easing) regime is officially in full swing. ECB data released last Friday indicated as much. The sovereign bond-buying program began March 9. And in less than two weeks, Eurozone central banks had already purchased €26.3 billion worth of these bonds. At the same time, economic indicators seem to point toward a recovery. Markit’s Purchasing Managers’ Index data released yesterday (Tuesday) revealed Eurozone businesses are at their most optimistic in four years. The EURO STOXX 50 Index – the leading blue-chip index for the Eurozone – is up 21% in 2015. And what’s more, it’s at nearly seven-year highs.

Even the beleaguered euro has stepped off a bit from the precipice of euro-dollar parity . This morning, it was trading at $1.0967. This is after falling to $1.0484 on March 15. This positivity in Eurozone markets all seems unwarranted. The Greek debt crisis , perhaps the biggest problem facing the Eurozone right now, doesn’t have a solution. And Eurozone QE was never built to address it. Eurozone QE is a “confidence trick,” Financial Times columnist Wolfgang Münchau wrote on Sunday. Positive economic data came as a result of falling oil prices , which provided a windfall to the Eurozone, the world’s largest net importer of oil and gas. And those benefits are easily wiped away by any surge in oil prices.

It’s hard to actually be bullish on the Eurozone even with economic data providing a thin veneer of Eurozone confidence. The situation in Greece is worse and more contentious than it has ever been. And QE, a policy aimed at bringing on a recovery, is hardly what it’s cracked up to be. The benefits of Eurozone QE are illusory. This surge in Eurozone optimism is built on a false premise that a largely impotent policy will be the saving grace for a struggling Eurozone. But a closer look at how Eurozone QE works should shatter all those illusions…

Bloomberg made that one up.

• No, Greece Is NOT The Most Unhelpful Country Ever, IMF Says (MarketWatch)

The IMF on Thursday denied a report that officials view Greece as the most unhelpful country the organization had ever dealt with in its 70-year history. “There is no basis in fact for that contention. No such remark was made,” said IMF spokesman William Murray at a news conference. Bloomberg had reported on March 18 that IMF officials had told their euro-area colleagues that Greece stands out as its worst client ever. “I wish they had checked with us before that story was published,” Murray said. IMF managing director Christine Lagarde had a “constructive” conversation Wednesday with Greece’s prime minister Alexis Tsipras, Murray said.

“They had a constructive conversation that focused on next steps in taking forward the policy discussions related to the IMF’s continued support of Greece’s reform program,” Murray said. Greece is locked in talks with the IMF and European creditors on a deal on economic reforms that would unlock €7.2 billion in aid. Greece needs the funding as it faces several major debt repayments in early April. On Wednesday, Greece’s central bank Governor Yannis Stournaras said in London that further debt relief was needed to boost economic growth. Stournaras said exiting the single currency union wasn’t an option for the Hellenic Republic.

“..give Greece a bit of leeway to announce its reform proposals, give it some easy wins that it can implement in the next week or two.”

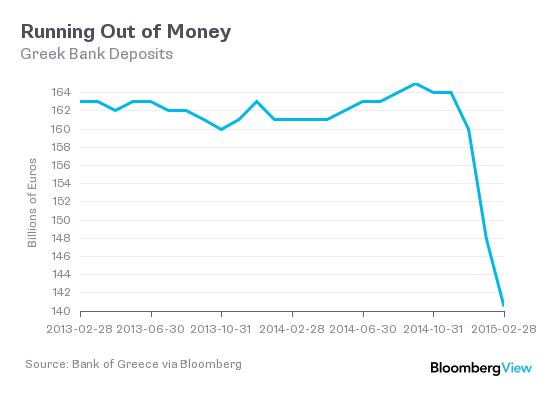

• Greek Bank Deposits Plunge to 10-Year Low (Bloomberg)

Greek bank deposits plunged to their lowest level in 10 years in February as a political standoff between the government in Athens and the country’s creditors raised the prospect of a possible euro exit. The deposits of households and businesses fell 5% in February to €140.5 billion, their lowest level since March 2005, according to Bank of Greece data released on Thursday. Greeks have pulled about €23.8 billion from banking system in the past three months, 15% of the total deposit base. Greek lenders are depending on Emergency Liquidity Assistance controlled by the European Central Bank to stay afloat as depositors flee.

The country’s creditors have given Prime Minister Alexis Tsipras, elected in January on a platform to end austerity, a Monday deadline to present enough details of a new economic plan to convince them to release more bailout funds. “What we’re likely to see is over the course of the next few weeks is still the drip-feed of liquidity,” said Janet Henry, chief European economist at HSBC Holdings Plc in London, in a Bloomberg TV interview. “We could get more of the ELA, that’s essential to keep the banking system afloat; they could give Greece a bit of leeway to announce its reform proposals, give it some easy wins that it can implement in the next week or two.”

The ECB Governing Council on Wednesday made more than €1 billions of ELA available to Greek lenders, its latest move to defer a financial meltdown. That raised the limit to just over €71 billion. Bank of Greece governor Yannis Stournaras, who is also an ECB Governing Council member, acknowledged at a speech in London on Wednesday that the crisis has unsettled the banking system, saying that there has been “some outflow of deposits due to uncertainty.” While officials including Stournaras and Finance Minister Yanis Varoufakis said bank system deposits stabilized after a Feb. 20 agreement that extended the country’s loan accord to the end of June, outflows picked up again last week, when about 1.5 billion euros left the system.

Getting serious.

• Charting Greece’s Draining Coffers (Bloomberg)

When Dutch Finance Minister Jeroen Dijsselbloem raised the possibility that Greece might need to impose capital controls in a radio interview last week, it seemed like a crazy indiscretion. Why would a senior member of the euro establishment effectively tell people “Hey, we’re considering locking your money inside the country, so you might want to get your euros out while you still can,” and risk accelerating outflows from the country’s already enfeebled banking system? And when the European Central bank decided yesterday to grant more than €1 billion of extra funds to Greece’s banks, it was hard to divine the motivation for the altruism. Was it a carrot to incentivize the government to get serious about meeting the demands of its creditors? Or was it an emergency infusion, acknowledging that Greece is fast running out of money as well as time? The following chart, based on data just released by the Bank of Greece, hints strongly at the latter explanation:

So the Greek banking system had just a bit more than 140 billion euros at the end of February. That’s down almost 15% since the end of November, suggesting bags of capital are fleeing the country as fast as their little legs can carry them. And while extrapolation is an imperfect science, taking the trend from November and running it to the end of this month suggests there could be as little as €133 billion left at the current pace of withdrawals, which would be the lowest in more than a decade. So the reason Dijsselbloem is talking about capital controls may be because the authorities are mulling last-resort, worst-case scenarios as the banking system bleeds out. And the reason the ECB has suddenly become more accommodative might not be a gesture of friendship to Greek Finance Minister Yanis Varoufakis; it might be because its lender-of-last-resort duties are compelling it to act. Today’s figures, though, suggest Greek depositors are voting with their bank balances on the increasing risk of Grexit.

Inevitable when you don’t understand what inflation is.

• Bank of Japan Under Pressure As Inflation Stalls (CNBC)

Japan’s consumer inflation eased in February for a seventh straight month increasing expectations that the Bank of Japan (BOJ) will have to undertake further stimulus measures to achieve its price target. The consumer price index (CPI) rose 2.0% in February from the year-ago period, government data showed on Friday, compared with Reuters’ forecast for a rise of 2.1% and down from a 2.2% rise in January. Excluding the effects of the consumption sales tax hike in April, the nationwide consumer price index was flat in February after increasing 0.2% in January. That marks the first time since May 2013 that it stopped rising. “I think this will keep the pressure on the Bank of Japan to keep their foot on the accelerator,” Joe Zidle, portfolio strategist at Richard Bernstein Advisors, told CNBC.

“You’ve had this split between the BOJ and the government over quantitative and qualitative easing and I think this is going to force the to keep the spigots open.” “This is an economy thats showing data point after data point that its too weak to stand on its own,” he added. Many analysts believe the trend will continue. “The Tokyo CPI result suggests that the nationwide core CPI will probably remain flat yoy in March. However, electricity and gas charges are expected to start declining from April onwards, putting larger downward pressures on the core CPI inflation rate going forward,” it said in a note.

“..Yemen is very difficult terrain, as the British learned in the Aden crisis..”

• Saudi Battle For Yemen Exposes Fragility Of Global Oil Supply (AEP)

The long-simmering struggle between Saudi Arabia and Iran for Mid-East supremacy has escalated to a dangerous new level as the two sides fight for control of Yemen, reminding markets that the epicentre of global oil supply remains a powder keg. Brent oil prices spiked 6pc to $58 a barrel after a Saudi-led coalition of ten Sunni Muslim states mobilized 150,000 troops and launched air strikes against the Iranian-backed Houthi militias in Yemen, prompting a furious riposte from Tehran. Analysts expect crude prices to command a new “geo-political premium” as it becomes clear that Saudi Arabia has lost control over the Yemen peninsular and faces a failed state on its 1,800 km southern border, where Al Qaeda can operate with near impunity.

Over 3.8m barrels a day (b/d) pass through the 18-mile Bab el-Mandeb Strait off Yemen, one of the world’s key choke points for crude oil supply. While there is little likelihood of disruption to tanker traffic, Saudi Arabia is increasingly threatened by Shiite or Jihadi enemies of different kinds. Shiite Houthi rebels have already seized Yemen’s capital, Sanaa, and pose a potential contagion risk for aggrieved Shia minorities across the Saudi border in the kingdom’s Southwest pocket, never an area friendly to the ruling Wahhabi dynasty in Riyadh. The Houthis are well-armed with rocket-propelled grenades and surface-to-air missiles that were either caputured or came from Iran. They have been trained by the Lebanese Hezbollah. “I don’t think air strikes are going to do the job, and it is not clear whether Saudi Arabia is really willing to put boots on the ground,” said Alastair Newton, head of political risk at Nomura and a former intelligence planner for the first Gulf War.

“Nor do I have much confidence in the ability of the Saudis to wage a successful campaign against the Houthis, despite their massive superiority on paper. Yemen is very difficult terrain, as the British learned in the Aden crisis,” he said. The Saudis face an impossible dilemma. The harder they hit the Houthis, the greater the danger of a power vacuum that can only benefit Al Qaeda and Islamic State groupings that already control central Yemen. They are among the most lethal of the various Al Qaeda franchises. A cell from that area was responsible for the Charlie Hebdo attack in Paris. The last 120-strong contingent of US military advisers has been evacuated from the country, while Yemen’s own security apparatus is disintegrating. It is now much harder for the US to coordinate drone strikes or harass Al Qaeda strongholds.

Nothing wild about it.

• Putin Plays Wildcard as Ukraine Bond Restructuring Talks Begin (Bloomberg)

As Ukraine begins bond-restructuring talks, it finds itself face-to-face with a familiar foe: Russia. President Vladimir Putin, who the U.S. and its allies accuse of sending troops and weapons into Ukraine to back a separatist uprising, bought $3 billion of Ukrainian bonds in late 2013. The cash was meant to support an ally, then-President Yanukovych. While his government fell just two months later, Russia was left with the securities. Now, those holdings take on an added importance as Putin’s stance on the debt talks could affect the terms that all other bondholders get in the restructuring. Russia, which is Ukraine’s second-biggest bondholder, has maintained that it won’t take part in any restructuring deal. Here are the three most likely tacks – as seen by money managers and analysts – that Putin’s government could pursue.

Ukraine, after gaining a lifeline from the IMF, included Russia’s bond among the 29 securities and enterprise loans it seeks to renegotiate with creditors before June. Finance Minister Natalie Jaresko has promised not to give any creditor special treatment. The revamp will include a reduction in the coupon, an extension in maturities as well as a cut in the face value, she said. Russian Deputy Finance Minister Sergey Storchak said March 17 that the nation isn’t taking part in the debt negotiations because it’s an “official” creditor, not a private bondholder. If the Kremlin maintains this view, it would be “negative” for private bondholders as “other investors will be more tempted to hold out as well,” according to Marco Ruijer at ING. He predicts a 45% chance of a hold out, while Michael Ganske at Rogge in London says it’s 70%.

There is little precedence of sovereigns and private bondholders taking part in the same talks, given that a nation’s debt considerations include a “foreign-policy dimension,” according to Matthias Goldmann at the Max Planck Institute in Heidelberg, Germany. Ukraine and Russia may need to find an “appropriate forum,” such as the Paris Club, for separate negotiations, he said. Holding out can lead to two outcomes: Russia gets paid back in full after the notes mature in December, or Ukraine defaults. The former option is politically unacceptable in Kiev, according to Tim Ash, chief emerging-market economist at Standard Bank, while the latter would likely start litigation and delay the borrower’s return to foreign capital markets, which Jaresko expects in 2017. “Russia will be holdouts, to try and force a messy restructuring,” Ash said by e-mail on March 19.

Worst idea ever: make Spain’s biggest bank grow bigger. Who’s going to bail them out?

• Spain Urges EU to Remove Barriers to Banking Takeovers (Bloomberg)

Spain, home of the euro area’s largest bank, is pushing the EUto remove obstacles to cross-border mergers of retail lenders. The European Commission should stop national regulators using discretionary powers to hamper tie-ups that strengthen the financial links between euro member states, Alvaro Nadal, chief economic adviser to Prime Minister Mariano Rajoy, said in an interview this week. “One of the problems with monetary union is the lack of risk sharing across the system,” Nadal said. “Imagine if half of Spanish mortgages had been provided by German banks, the crisis would have been very different.” Europe’s retail banking industry should follow the path of the telecommunications industry which has seen a wave of consolidation since EU action facilitated deals, Nadal said.

That would make the currency bloc’s financial system more resilient to shocks like the real-estate collapse that forced Spain to seek a banking-system bailout in 2012. Nadal said he wants to see measures to promote cross-border bank mergers included in the plans to strengthen the euro financial system being drawn up by the so-called four presidents – the heads of the EU, the commission, the ECB and the finance ministers’ group. Spain still has to sell its majority stake in Bankia, a lender with more than €230 billion of assets, which was bailed out with European funds in 2012. Bankia has cleaned up its books selling non-performing real estate assets to Spain’s bad bank and received more than €22 billion of state aid.

While European banking rules are already harmonized in general terms, national regulators still have discretion in how they apply those rules, said Ricardo Wehrhahn, a Madrid-based managing partner at Intral Strategy Execution, a banking and business consultant.

“Within the margins of the law a regulator can make your life harder,” said Wehrhahn, who has analyzed possible targets in Spain for German lenders. “The French, German and Italian banking markets are particularly difficult to penetrate.” Banco Santander, the euro region’s largest bank by market value, has submitted one of seven non-binding offers for Portugal’s state-owned Novo Banco.

What a great plan! Why didn’t I think of that? The more squids the merrier.

• Deutsche Bank Wins German Backing to Be More Like Goldman (Bloomberg)

Deutsche Bank is winning support from German politicians for a plan to transform the country’s biggest bank into a company more like Goldman Sachs. That would be the result of an option the firm is weighing as it seeks to bolster capital levels and profitability, according to a person with knowledge of the matter, who asked to remain anonymous because the talks are confidential. Exiting retail banking to focus on global fund management and investment banking would cut fewer jobs and deliver the quickest boost to returns among three scenarios under review, said the person. Deutsche Bank co-Chief Executive Officers Anshu Jain and Juergen Fitschen are revamping their strategy after the stock fell 24% last year, the most among the top investment banks.

At stake for Germany, the world’s third-biggest exporter, is maintaining a competitive advantage by having a domestic corporate and investment bank with global reach that can offer local companies access to capital markets. “Deutsche Bank is Germany’s only global player in banking,” Michael Fuchs, the deputy parliamentary leader of Chancellor Angela Merkel’s Christian Democratic Union said by phone from Berlin. “If they decide to restructure their business, we should support them.” The lender would still shrink its investment bank, which is Europe’s largest, in all three scenarios it is considering, according to one of the people. The bank may pare its interest-rate trading business and the prime finance activities that cater to hedge funds, the person said.

The company said on Friday that it would present the results of its strategy review in the second quarter. Politicians might have an interest in Deutsche Bank’s plan because Germany is its single biggest market, making up 34% of the bank’s 31.9 billion euros ($35.1 billion) of revenue last year and accounting for 46% of its 98,138 staff at the end of December, company filings show. If Deutsche Bank has concluded that it’s “economically” better to sell its consumer unit, “we have to accept this,” said Ingrid Arndt-Brauer, chairwoman of the parliamentary finance committee and a member of Merkel’s Social Democratic Party coalition partners.

So what are we going to do?

• Asylum Claims Up 45%, ‘Highest Level For 22 Years’ (BBC)

The number of refugees seeking asylum in developed countries rose by almost half last year to the highest level for 22 years, a UN report says. The UN refugee agency said an estimated 866,000 asylum seekers lodged claims in 2014, a 45% rise on the year before and the highest figure since the start of the war in Bosnia. It said the increase had been driven by the conflicts in Syria and Iraq. Germany received the most applications at 173,000 – 30% of claims in the EU. It was followed by the US, Turkey, Sweden and Italy as the countries with the most claims. Between them, the top five receiving countries accounted for 60% of all new asylum bids among the 44 included in the report. The surge is linked to the spiralling conflicts in Syria and Iraq, which have created “the worst humanitarian crisis of our era,” UNHCR spokeswoman Melissa Fleming said.

She urged European countries to open their doors, and respond as generously to the current situation as they did during the Balkan wars in the 1990s. “We need countries to step up to the plate,” AFP news agency quoted her as saying. The UNHCR figures do not include the millions of Syrians who have been taken in by countries such as Lebanon and Jordan. Syrians accounted for the most applications for asylum in 2014 – at nearly 150,000 – more than double the 2013 figure of 56,300. More than 215,000 people are estimated to have been killed since the conflict in Syria started in 2011. Iraqis came in second with 68,700 asylum requests, up from 37,300 the year before. Afghans formed the third largest group, followed by citizens of Serbia and Kosovo, and Eritreans, the UNHCR said.

Tom Joad just turned around in his car..

• California’s Epic Drought: One Year of Water Left (Ellen Brown)

Wars over California’s limited water supply have been going on for at least a century. Water wars have been the subject of some vintage movies, including the 1958 hit The Big Country starring Gregory Peck, Clint Eastwood’s 1985 Pale Rider, 1995’s Waterworld with Kevin Costner, and the 2005 film Batman Begins. Most acclaimed was the 1975 Academy Award winner Chinatown with Jack Nicholson and Faye Dunaway, involving a plot between a corrupt Los Angeles politician and land speculators to fabricate the 1937 drought in order to force farmers to sell their land at low prices. The plot was rooted in historical fact, reflecting battles between Owens Valley farmers and Los Angeles urbanites over water rights.

Today the water wars continue, on a larger scale with new players. It’s no longer just the farmers against the ranchers or the urbanites. It’s the people against the new “water barons” – Goldman Sachs, JPMorgan Chase, Monsanto, the Bush family, and their ilk – who are buying up water all over the world at an unprecedented pace. At a news conference on March 19, 2015, California Senate President Pro Tem Kevin de Leon warned, “There is no greater crisis facing our state today than our lack of water.” Jay Famiglietti, a scientist with NASA’s Jet Propulsion Laboratory in La Cañada Flintridge, California, wrote in the Los Angeles Times on March 12th:

Right now the state has only about one year of water supply left in its reservoirs, and our strategic backup supply, groundwater, is rapidly disappearing. California has no contingency plan for a persistent drought like this one (let alone a 20-plus-year mega-drought), except, apparently, staying in emergency mode and praying for rain.

Maps indicate that the areas of California hardest hit by the mega-drought are those that grow a large%age of America’s food. California supplies 50% of the nation’s food and more organic food than any other state. Western Growers estimates that last year 500,000 acres of farmland were left unplanted, an amount that could increase by 40% this year. The trade group pegs farm job losses at 17,000 last year and more in 2015. Farmers with contracts from the Central Valley Project, a large federal irrigation system, will receive no water for the second consecutive year, according to preliminary forecasts. Cities and industries will get 25% of their full contract allocation, to ensure sufficient water for human health and safety. Besides shortages, there is the problem of toxic waste dumped into water supplies by oil company fracking. Economists estimate the cost of the drought in 2014 at $2.2 billion.

And his grave…

• It’s The End Of March And 99.85% Of California Is Abnormally Dry Already (ZH)

With NASA scientists warning about California only having one year of water left, it appears The Kardashians and March Madness continue to distract Americans from the ugly looming reality of water shortages. With summer around the corner, the US Drought Minitoring service reports today that a stunning 99.85% of California is “abnormally dry,” and 98.11% of the state is in drought conditions leaving over 37 million people in harm’s way. As we concluded previously: Right now the state has only about one year of water supply left in its reservoirs, and our strategic backup supply, groundwater, is rapidly disappearing. California has no contingency plan for a persistent drought like this one (let alone a 20-plus-year mega-drought), except, apparently, staying in emergency mode and praying for rain. In short, we have no paddle to navigate this crisis. Several steps need be taken right now.

First, immediate mandatory water rationing should be authorized across all of the state’s water sectors, from domestic and municipal through agricultural and industrial. The Metropolitan Water District of Southern California is already considering water rationing by the summer unless conditions improve. There is no need for the rest of the state to hesitate. The public is ready. A recent Field Poll showed that 94% of Californians surveyed believe that the drought is serious, and that one-third support mandatory rationing.

Second, the implementation of the Sustainable Groundwater Management Act of 2014 should be accelerated. The law requires the formation of numerous, regional groundwater sustainability agencies by 2017. Then each agency must adopt a plan by 2022 and “achieve sustainability” 20 years after that. At that pace, it will be nearly 30 years before we even know what is working. By then, there may be no groundwater left to sustain.

Third, the state needs a task force of thought leaders that starts, right now, brainstorming to lay the groundwork for long-term water management strategies. Although several state task forces have been formed in response to the drought, none is focused on solving the long-term needs of a drought-prone, perennially water-stressed California.

NOT a mirror version of the visible universe.

• What Is Dark Matter Made Of? Galaxy Cluster Collisions Offer Clues (CSM)

Dark matter may not be part of a “dark sector” of particles that mirrors regular matter, as some theories suggest, say scientists studying collisions of galaxy clusters. When clusters of galaxies collide, the hot gas that fills the space between the stars in those galaxies also collides and splatters in all directions with a motion akin to splashes of water. Dark matter makes up about 90% of the matter in galaxy clusters: Does it splatter like water as well? New research suggests that no, dark matter does not splatter when clusters of galaxies collide, and this finding limits the kinds of particles that can make up dark matter. Specifically, the authors of the new research say it is unlikely that dark matter is part of an entire “dark sector” — a mirror version of the visible universe.

Our galaxy contains hundreds of billions of stars, and there are hundreds of billions of galaxies in the observable universe. There’s also a lot of gas and dust between the stars and the galaxies. But all of those stars, galaxies, gas and dust make up only about 10 to 15% of the matter in the universe. The other 85 to 90% is dark matter. Scientists don’t know what dark matter is made of or where it comes from, only that it doesn’t appear to reflect or radiate light. It does, however, exert a gravitational pull on the regular matter around it. David Harvey, a postdoctoral researcher at the Swiss Federal Institute of Technology Lausanne, is one of many scientists currently trying to figure out what dark matter is made of.

There are lots of ways to go about this, and Harvey decided to see what happens when dark matter collides with itself. To do this, Harvey and his colleagues at the University of Edinburgh, where Harvey did his PhD work, looked at collisions among entire clusters of galaxies, where as much as 90% of the mass involved in the collision is dark matter, according to a statement from the Swiss Federal Institute of Technology Lausanne. “[Galaxy cluster mergers] are incredibly messy,” Harvey said. “You’ve got [the stars], the highest densities of dark matter and hot gas all swirling together.”

“Many of Antarctica’s ice shelves are huge. The one protruding into the Ross Sea is the size of France.” “A number of these ice shelves are holding back 1m to 3m of sea level rise..”

• Antarctic Ice Shelf Thinning Speeds Up (BBC)

Scientists have their best view yet of the status of Antarctica’s floating ice shelves and they find them to be thinning at an accelerating rate. Fernando Paolo and colleagues used 18 years of data from European radar satellites to compile their assessment. In the first half of that period, the total losses from these tongues of ice that jut out from the continent amounted to 25 cubic km per year. But by the second half, this had jumped to 310 cubic km per annum. “For the decade before 2003, ice-shelf volume for all Antarctica did not change much,” said Mr Paolo from the Scripps Institution of Oceanography in San Diego, US. “Since then, volume loss has been significant. The western ice shelves have been persistently thinning for two decades, and earlier gains in the eastern ice shelves ceased in the most recent decade,” he told BBC News.

The satellite research is published in Science Magazine. It is a step up from previous studies, which provided only short snapshots of behaviour. Here, the team has combined the data from three successive orbiting altimeter missions operated by the European Space Agency (Esa). The findings demonstrate the value of continuous, long-term, cross-calibrated time series of information. Many of Antarctica’s ice shelves are huge. The one protruding into the Ross Sea is the size of France. They form where glacier ice running off the continent protrudes across water. At a certain point, the ice lifts off the seabed and floats. Eventually, as these shelves continue to push outwards, their fronts will calve, forming icebergs.

If the losses to the ocean balance the gains on land though precipitation of snows, this entirely natural process contributes nothing to sea level rise. But if thinning weakens the shelves so that land ice can flow faster towards the sea, this will kick the system out of kilter. Repeat observations now show this to be the case across much of West Antarctica. “If this thinning continues at the rates we report, some of the ice shelves in West Antarctica that we’ve observed will disappear by the end of this century,” said Scripps co-author Helen Amanda Fricker. “A number of these ice shelves are holding back 1m to 3m of sea level rise in the grounded ice. And that means that ultimately this ice will be delivered into the oceans and we will see global sea-level rise on that order.”

Home › Forums › Debt Rattle March 27 2015