Harris&Ewing Painless Dentist, Washington, DC 1918

Not looking good.

• Most of US Domestic Manufacturing Now in Technical Recession (Tonelson)

[..] the durable goods sub-sector – which represents more than half of domestic manufacturing – entered a technical recession (six months or more of cumulative real output decline), and several industries within durable goods extended their slumps. Here are the manufacturing highlights of the Federal Reserve’s new release on April industrial production:

• According to the Fed, constant dollar manufacturing production in April topped March’s level by just 0.01%. March’s real manufacturing output growth was revised up from 0.13% to 0.29%, but February’s initially revised 0.22% decrease was revised down to a 0.24% drop.

• As a result, after-inflation manufacturing output is 0.54% smaller than last November. Moreover, since January, this production has advanced by only 0.05%.

• The April Fed figures also show that durable goods manufacturing entered a technical recession (with real production down cumulatively by 0.32% since October), and such downturns grew longer in several critical durable goods sub-sectors. In particular,

• although inflation-adjusted automotive output rose by a healthy 1.30% on month in April, its production is still 4.22% lower than in July, 2014;

• thanks to a 0.85% monthly decrease in real output in April, machinery production is now down 0.52% since last August;

“The thing about bubbles is that speculators often realize stocks are overpriced, but think they’ll get out before the crash.”

• When Fools Rush In… (Reuters)

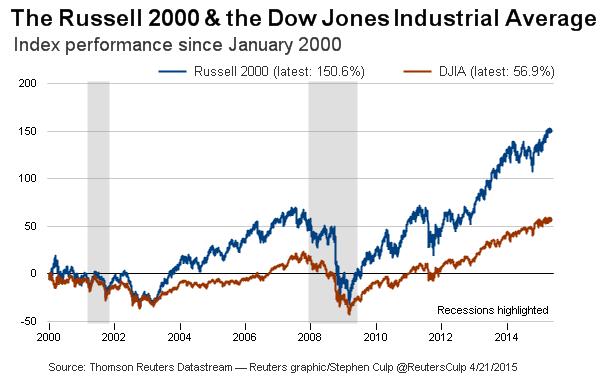

If you want to see the greater fool theory in action, look no further than at what’s happening in the stock market. Since the year 2000 the average small-cap stock in the Russell 2000 Index is up 151% while the average blue chip in the Dow Jones Industrial Average has gained only 57%. As a result, small-cap stocks now seem absurdly overpriced. According to investment research firm MSCI, the average small-cap stock’s price-earnings ratio is 29. The historical average P/E for stocks is about 15.

That’s why GMO, a well-respected mutual fund shop, recently put out one of its grimmest forecasts for small stocks — returns of -1% annualized for the next seven years or -3.2% after deducting inflation. High quality blue chips, by contrast, are expected to deliver 2.7% a year. Yet investors keep pouring money into small-caps. According to Morningstar, small-cap exchange traded funds have experienced $3.3 billion in inflows in 2015 while large-cap ones have seen $35.9 billion in outflows in 2015. The thing about bubbles is that speculators often realize stocks are overpriced, but think they’ll get out before the crash. Both fools and angels know that’s always easier said than done.

“Banks will give secured car loans at around 4% while their cost of funds is really 0%. This is the widest spread since the Panic of 1899.”

• The Coming Crash of All Crashes – but in Debt (Martin Armstrong)

Why are governments rushing to eliminate cash? During previous recoveries following the recessionary declines from the peaks in the Economic Confidence Model, the central banks were able to build up their credibility and ammunition so to speak by raising interest rates during the recovery. This time, ever since we began moving toward Transactional Banking with the repeal of Glass Steagall in 1999, banks have looked at profits rather than their role within the economic landscape. They shifted to structuring products and no longer was there any relationship with the client. This reduced capital formation for it has been followed by rising unemployment among the youth and/or their inability to find jobs within their fields of study.

The VELOCITY of money peaked with our ECM 1998.55 turning point from which we warned of the pending crash in Russia. The damage inflicted with the collapse of Russia and the implosion of Long-Term Capital Management in the end of 1998, has demonstrated that the VELOCITY of money has continued to decline. There has been no long-term recovery. This current mild recovery in the USA has been shallow at best and as the rest of the world declines still from the 2007.15 high with a target low in 2020, the Federal Reserve has been unable to raise interest rates sufficiently to demonstrate any recovery for the spreads at the banks between bid and ask for money is also at historical highs. Banks will give secured car loans at around 4% while their cost of funds is really 0%. This is the widest spread between bid and ask since the Panic of 1899.

We face a frightening collapse in the VELOCITY of money and all this talk of eliminating cash is in part due to the rising hoarding of cash by households both in the USA and Europe. This is a major problem for the central banks have also lost control to be able to stimulate anything.The loss of traditional stimulus ability by the central banks is now threatening the nationalization of banks be it directly, or indirectly. We face a cliff that government refuses to acknowledge and their solution will be to grab more power – never reform.

“..grandparents prey on their grandchildren..”

• Are You Ready For The Coming Debt Revolution? (Bill Bonner)

There is a specter haunting America… and all the developed nations of the world. It is the specter of a debt revolution. We left off yesterday talking about how the economy of the last 30 years – and especially that of the last six years – has favored the old over the young. “Rise up, ye young’uns,” we as much as said, “you have nothing to lose but your parents’ debts.” We showed how the value of U.S. corporate equity, mainly held by older people, had multiplied by 28 times since 1981. That was no honest bull market in stocks; it was a market sent soaring by an explosion of credit. But what did it do for young people whose only assets are their time and their youthful energy? Alas, the real economy has increased by only five times over the same period.

And when you look more closely at work and wages, the specter grows grimmer and more menacing. Average hourly wages have barely budged in the last 30 years. And average household incomes have fallen – from $57,000 to $52,000 – in the 21st century. But as our fingers came to rest yesterday, there was one question hanging in the air, like the smoke from an exploded hand grenade: Why? Was this huge shift – of trillions of dollars of wealth from young working people to old asset holders – an accident? Was it just the maturing of a market economy in the electronic age? Was it because China took the capitalist road in 1979? Or because robots were competing with young people for jobs? Nope… on all three counts.

First, old people, not young people, control government. Ultra-wealthy campaign funders like Sheldon Adelman and the Koch brothers were all born in the 1930s. The big money comes from wealthy geezers like these, eager to buy candidates early in the season when they are still relatively cheap. Old companies fund most Washington lobbyists, too. And old people decide elections: There are a lot of them… and they vote. They know where the money is. Second, the government – doing the bidding of old people – restricts competition, subsidizes well-entrenched industries, raises the cost of employing young people, and directs its bailouts, cheap credit, and contracts to the graybeards. Third, the credit-based money system increases the profits and prices of existing capital. It encourages borrowing and spending.

This rewards the current generation while pushing the costs into the future. None of this was an accident. None of it would have happened without the active intervention of the old folks, using the government to get what they could never have gotten honestly. This is not the same as saying they were completely aware of what they were doing and what consequences their actions would have. We doubt the Nixon administration had any idea what would happen after it tore up the Bretton Woods monetary system in 1971. It was behind the eight ball, fearing foreign governments would call away America’s gold. Few in the White House realized they had made such a calamitous mistake when the president ended the convertibility of the dollar into gold.

And yet it created a world in which parents and grandparents could prey on their grandchildren… for the next 44 years. And it’s still not over. The new credit money – which could be borrowed into existence with no need for any savings or gold backing – was just what old people needed. We have estimated that it increased spending by about $33 trillion over and above what the old, gold-backed system would have allowed.

Rates must rise first.

• Exit Strategy, Part One: ZIRP (Mehrling)

The Fed has announced plans to raise rates in the imminent future, but the market does not believe it. Why not? Conventional wisdom appears to be that the Fed will chicken out, just as it did during the so-called Taper Tantrum. The Fed has signaled its appreciation that “liftoff” will involve increased volatility, and has stated its resolve this time simply to let that volatility happen, but markets don’t believe it. I want to suggest a slightly different source of disconnect, concerning expectations about what exactly will happen in the monetary plumbing when the Fed raises rates. Case in point is the recent Credit Suisse memo, apparently the first of a series, that forecasts “a much larger RRP facility–think north of a trillion” whereas the FOMC itself “expects that it will be appropriate to reduce the capacity of the [RRP] facility soon after it commences policy firming”.

That’s a pretty big disconnect. Pozsar and Sweeney (authors of the CS memo) think about the exit from ZIRP (Zero Interest Rate Policy) from the perspective of wholesale money demand, which they insist is “a structural feature of the system” and “the dominant source of funding in the US money market”. Before the crisis, that money demand was funding the shadow banking system, largely through the intermediation of repo dealer balance sheets. Now, it is funding the Fed’s balance sheet, largely through the intermediation of prime money funds and US bank balance sheets, both of which issue money-like liabilities and invest the proceeds in excess reserves held at the Fed. The big problem that now looms is that neither prime money funds nor banks want that business any more.

Capital regulations have made the bank side of the business unprofitable, and looming requirements that prime money funds mark to market (so-called floating NAV rather than constant NAV) will force them out of the business as well. Where is that money demand going to go? Pozsar and Sweeney say it will go directly to the Fed, causing the swelling of the Reverse Repo Facility pari passu with the shrinking of excess reserves. The mechanism will be a shift from prime money funds and bank deposits into government-only money funds, which will absorb the flow by accumulating RRP.

In other words, the Fed will not be able to shrink its balance sheet as part of this first stage of exit from quantitative easing. It will only be able to shift the way that balance sheet is funded–much less excess reserves held by banks, much more RRP held by government-only money funds. Nevertheless, because this shift will allow the Fed to regain control over the Fed Funds rate, it will accept that consequence. Exit from ZIRP comes before exit from QE.

“China is not trying to destroy the old boys’ club — they are trying to join it.”

• Why Most Gold Bugs Are Dead Wrong (Jim Rickards)

One of the most persistent story lines among gold bugs and market participants who foresee the collapse of the dollar goes something like this: China and many emerging markets including the other BRICS are looking for a way out of the global fiat currency system. That system is dominated today by the U.S. dollar. This dollar dominance allows the U.S. to force certain kinds of behavior in foreign policy and energy markets. Countries that don’t comply with U.S. wishes find themselves frozen out of global payment systems and find their banks unable to transact in dollars for needed imports or to get paid for their exports. Russia, Iran, and Syria have all been subjected to this treatment recently. China does not like this system any more than Russia or Iran but is unwilling to confront the U.S. head-on.

Instead, China is quietly accumulating massive amounts of gold and building alternative financial institutions such as the Asia Infrastructure Investment Bank, AIIB, and the BRICS-sponsored New Development Bank, NDB. When the time is right, China will suddenly announce its actual gold holdings to the world and simultaneously turn its back on the Bretton Woods institutions such as the IMF and World Bank. China will back its currency with its own gold and use the AIIB and NDB and other institutions to lead a new global financial order. Russia and others will be invited to join the Chinese in this new international monetary system. As a result, the dollar will collapse, the price of gold will skyrocket, and China will be the new global financial hegemon. The gold bugs will live happily ever after. The only problem with this story is that the most important parts of it are wrong. As usual, the truth is much more intriguing than the popular version.

Here’s what’s really going on. As with most myths, parts of the story are true. China is secretly acquiring thousands of tons of gold. China is creating new multilateral lending institutions. No doubt, China will announce an upward revision in its official gold holdings sometime in the next year or so. In fact, Bloomberg News reported on April 20, 2015, under the headline “The Mystery of China’s Gold Stash May Soon Be Solved,” that “China may be preparing to update its disclosed holdings…” But the reasons for the acquisition of gold and the updated disclosures, if they happen, are not the ones the blogosphere believes. China is not trying to destroy the old boys’ club — they are trying to join it.

Precious little has been reported on Kerry’s trip to Sochi, even though it was a big turnaround.

• US Wakes Up To New -Silk- World Order (Pepe Escobar)

The real Masters of the Universe in the U.S. are no weathermen, but arguably they’re starting to feel which way the wind is blowing. History may signal it all started with this week’s trip to Sochi, led by their paperboy, Secretary of State John Kerry, who met with Foreign Minister Lavrov and then with President Putin. Arguably, a visual reminder clicked the bells for the real Masters of the Universe; the PLA marching in Red Square on Victory Day side by side with the Russian military. Even under the Stalin-Mao alliance Chinese troops did not march in Red Square. As a screamer, that rivals the Russian S-500 missile systems. Adults in the Beltway may have done the math and concluded Moscow and Beijing may be on the verge of signing secret military protocols as in the Molotov-Ribbentrop pact.

The new game of musical chairs is surely bound to leave Eurasian-obsessed Dr. Zbig “Grand Chessboard” Brzezinski apoplectic. And suddenly, instead of relentless demonization and NATO spewing out “Russian aggression!” every ten seconds, we have Kerry saying that respecting Minsk-2 is the only way out in Ukraine, and that he would strongly caution vassal Poroshenko against his bragging on bombing Donetsk airport and environs back into Ukrainian “democracy”. The ever level-headed Lavrov, for his part, described the meeting with Kerry as “wonderful,” and Kremlin spokesman Dmitry Peskov described the new U.S.-Russia entente as “extremely positive”.

So now the self-described “Don’t Do Stupid Stuff” Obama administration, at least apparently, seems to finally understand that this “isolating Russia” business is over – and that Moscow simply won’t back down from two red lines; no Ukraine in NATO, and no chance of popular republics of Donetsk and Lugansk being smashed, by Kiev, NATO or anybody else. Thus what was really discussed – but not leaked – out of Sochi is how the Obama administration can get some sort of face-saving exit out of the Russian western borderland geopolitical mess it invited on itself in the first place.

Who leaks what, and why?

• Tsipras Told Lagarde Greece Could Not Pay IMF (Kathimerini)

The Greek government is hoping that it will be able to reach a technical agreement with lenders this week, paving the way for it to receive the funds that would allow it to continue meeting its obligations. The difficulty the coalition is facing in servicing its debt and paying pensions and salaries was highlighted by events a few days ago, when – as Kathimerini can reveal – Prime Minister Alexis Tsipras wrote to IMF Managing Director Christine Lagarde to inform her that Athens would not be able to pay the €750 million due to the Fund on May 12 unless the ECB allowed Greece to issue T-bills. Kathimerini understands that the letter, sent on Friday, May 8, was also delivered to European Commission President Jean-Claude Juncker and ECB President Mario Draghi.

Sources also said that Tsipras called US Treasury Secretary Jack Lew to inform him of the situation. It was only over the weekend that a decision to pay the IMF was taken after it emerged that Greece could use some €650 million denominated in Special Drawing Rights issued by the IMF and held in a reserve account to meet the debt repayment. The government provided another €90 millions from other sources to make the payment on May 12. An internal IMF memo leaked by Channel 4 in the UK indicated that Fund officials see Greece’s negotiations with its lenders as being finely balanced. They note that some progress has been made but that the “process is still problematic” as Greek negotiators seem to have “limited room” for maneuver and staff at the institutions do not have access to ministers in Athens.

The note sees progress in the areas of value-added tax, tax administration and an insolvency framework but says that there have been no advances at all in other areas, including on setting new fiscal targets. The IMF officials also express concern that the government is reversing some of the reforms implemented in previous years, especially in terms of the labor market. The memo also raises again the issue of the sustainability of Greece’s debt, saying that there is an “inverse relationship” between the reforms being asked of Greece and the sustainability of its debt. The note, however, says that the Fund is not “pushing European partners to consider a debt relief.”

He had always already chosen his path.

• Alexis’s Choice (Macropolis)

Alexis Tsipras seems to have chosen his path. Whether he will manage to reach the end of it is another matter, but the prime minister’s decision to shake up Greece’s negotiating team and to issue a common statement with European Commission President Jean-Claude Juncker last week made it clear that he prefers the option of agreeing with lenders rather than being left in limbo, or worse. Securing a deal will be some feat. The suggestion last week that the red lines on pensions and labour market reform may be crossed would mean Tsipras entering treacherous territory. It is worth remembering that less than six months ago, his predecessor Antonis Samaras was unwilling – or not able – to pass pension and labour reforms through Parliament, triggering the early presidential election and national vote.

If Tsipras is somehow able to agree to a package that includes policies in these two areas, but is also able to pass it through Parliament and keep his government intact, he will have perhaps completed the most impressive balancing act in modern Greek political history. Whether he is able to do it will depend on the content of the agreement. If most of the measures agreed are seen as restoring fairness in the way that the burden of Greece’s fiscal and structural adjustment is shared, he will have some grounds to argue with SYRIZA MPs and members that the compromise is worth making and the anxiety of the last few months has not been in vain.

However, while the party may accept some of the measures – even the creation of a single VAT rate of around 18% for almost all goods and services – it is difficult to imagine SYRIZA’s most radical personalities sitting back and accepting changes that will affect the majority of pensioners or working Greeks. There is a world of difference between slashing high-end supplementary pensions and having to implement a zero deficit rule that will lead to all of these auxiliary payments being cut or abolished – even though the vast majority come to less than €200 per month. Once Tsipras and his party go behind closed doors to mull the details of an agreement with the institutions (if one actually comes about), there can be no guarantee of what state they will be in when they come out.

There may be a mass walkout, or a few of the more principled or ideologically driven MPs could decide to turn their back on the prime minister. The first scenario would probably lead to the collapse of the government (Tsipras is unlikely to turn to PASOK or Potami to save his administration), while the second would allow the wounded prime minister to hobble on. The third option of holding a referendum to throw the decision back to the Greek electorate is a popular idea among many within SYRIZA but is unlikely to be a risk that Tsipras wants to take.

Regurgitating parrots.

• German EconMin Says Greece Can Only Get More Aid If It Reforms (Reuters)

German Economy Minister Sigmar Gabriel warned the Greek government that Greece could only get further funds if it carried out reforms in a German newspaper interview published on Sunday. Greece’s cash reserves are dwindling and negotiations between Prime Minister Alexis Tsipras’s new left-led government and its lenders over a cash-for-reforms deal have been fraught with delays for months. Asked if Greece could still be saved, Gabriel told Bild am Sonntag that this was up to Athens and said a referendum on the necessary reforms could perhaps speed up decisions. On Monday German Finance Minister Wolfgang Schaeuble suggested Greece might need a referendum to approve painful economic reforms on which its creditors are insisting, but Athens said it had no such plan for now.

Gabriel stressed that the government needed to take action in any case: “A third aid package for Athens is only possible if the reforms are implemented. We can’t simply send money there.” He warned about the consequences of Greece quitting the single currency bloc, saying: “A Greek exit would not only be highly dangerous economically but also politically.” Gabriel said if one country were to leave the euro zone, the rest of the world would look at Europe differently: “Nobody would have any confidence in Europe anymore if we break up in our first big crisis. We shouldn’t talk ourselves into a Grexit.”

There are videos playing in Athens subway stations that deal with war reparations.

• Top German Judge Says Greece Has Valid Claim Over WWII Forced Loan (Kathimerini)

A top German judge has said that Greece has a just claim in its demands for Berlin to repay a loan Athens was forced to issue its Nazi occupiers during World War II. In an interview with Der Spiegel magazine published on Saturday, Dieter Deiseroth, a judge at the Supreme Administrative Court, said that the Greek claim for compensation regarding the money given by the Bank of Greece (estimated at some 11 billion euros in today’s money) has a strong basis as “there’s a lot of evidence to suggest it was a loan.” Deiseroth also argued that private claims for compensation are also valid. “Greece has not waived its demands,” said the judge, who added that an absence of legal action from Athens so far does not constitute an abandoning of claims.

Part 3 in a series on Merkel and Greece.

• The 2012 Greek-German Breakthrough That Didn’t Come (Kathimerini)

Even after the formation of the pro-bailout government under Antonis Samaras following the June 2012 elections, eurozone hawks continued to press for a clean break from Greece. The same pressure was also being applied within the German government: The “infected limb” camp, led by Finance Minister Wolfgang Schaeuble, tried to convince Chancellor Angela Merkel that a Greek exit from the eurozone was not only manageable but also in Europe’s long-term interest. This was the time the so-called Plan Z (leaked to the Financial Times last year) was also put forward. The circle of officials who knew about this contingency plan for handling a Greek eurozone exit was tiny. Joerg Asmussen, Germany’s former state secretary at the Finance Ministry and a member of the ECB’s executive board since the start of 2012, was one of its main overseers.

Asmussen had briefed Merkel on the plan, but the Chancellery had played no role in designing it. In the opposing camp were those who feared a domino effect, arguing that a Greek exit would lead to the collapse of the eurozone. Asmussen and Merkel’s former adviser, Bundesbank chief Jens Weidmann, told the chancellor that they could not know which of the two camps was right. They questioned whether it was possible to shield Portugal from possible Grexit. Merkel became convinced that the risks of a rupture were unpredictably high. By the time she returned from her summer hiking holiday in northern Italy in mid-August, the chancellor had decided to put an end to all discussion of a Greek exit. However, she still needed a partner in Athens she could count on. A few days later she was due to meet with Samaras in Berlin, to ascertain whether he was someone she could do business with.

A circle jerk that leaves the highest levels invisible.

• Banks Rule the World, but Who Rules the Banks? (Katasonov)

These days, it is already a truism that the hegemony of the US is based on the Federal Reserve System’s (FRS) printing press. It is also more or less clear that the shareholders of the FRS are major international banks. These include not just US (Wall Street) banks, but also European banks (London City banks and several in continental Europe). During the 2007-2009 global financial crisis, the FRS quietly gave out more than $16 trillion worth of credit (virtually interest free) to various banks. The owners of the money gave out the credit to themselves, that is to the main shareholder banks of the Federal Reserve. Under strong pressure from US Congress, a partial audit of the FRS was carried out at the beginning of this decade and the results were published in the summer of 2011. The list of credit recipients is also a list of the FRS’ main shareholders.

They are as follows (the amount of credit received is shown in brackets in billions of dollars): Citigroup (2,500); Morgan Staley (2,004); Merrill Lynch (1,949); Bank of America (1,344); Barclays PLC (868); Bear Sterns (853); Goldman Sachs (814); Royal Bank of Scotland (541); JP Morgan (391); Deutsche Bank (354); Credit Swiss (262); UBS (287); Leman Brothers (183); Bank of Scotland (181); and BNP Paribas (175). It is interesting that a number of the recipients of FRS credit are not American, but foreign banks: British (Barclays PLC, Royal Bank of Scotland, Bank of Scotland); Swiss (Credit Swiss, UBS); the German Deutche Bank; and the French BNP Paribas. These banks received nearly $2.5 trillion from the Federal Reserve. We would not be mistaken in assuming that these are the Federal Reserve’s foreign shareholders.

While the makeup of the Federal Reserve’s main shareholders is more or less clear, however, the same cannot be said of the shareholders of those banks who essentially own the FRS’ printing press. Who exactly are the shareholders of the Federal Reserve’s shareholders? To begin with, let us take a good look at the leading US banks. Six banks currently represent the core of the US banking system. The ‘big six’ includes Bank of America, JP Morgan Chase, Morgan Stanley, Goldman Sachs, Wells Fargo, and Citigroup. They occupy the top spots in US bank ratings in terms of indices such as amount of capital, controlled assets, deposits attracted, capitalisation and profit. If we were to rank the banks in terms of assets, then JP Morgan Chase would be in first place ($2,075 billion at the end of 2014), while Wells Fargo is in the lead in terms of capitalisation ($261.7 billion in the autumn of 2014).

In terms of this index, incidentally, Wells Fargo came out on top not only in America, but in the world (although in terms of assets, the bank is only fourth in America and does not even figure in the world’s top twenty). There is some shareholder information on the official websites of these banks. The bulk of the big six US banks’ capital is in the hands of so-called institutional shareholders – various financial companies. These include banks, which means there is cross shareholding. At the beginning of 2015, the number of institutional shareholders of each bank were: Bank of America – 1,410; JP Morgan Chase – 1,795; Morgan Stanley – 826; Goldman Sachs – 1,018; Wells Fargo – 1,729; and Citigroup – 1,247. Each of these banks also has a fairly clear group of major investors (shareholders). These are investors (shareholders) with more than one per cent of capital each and there are usually between 10 and 20 such shareholders. It is striking that exactly the same companies and organisations appear in the group of major investors for every bank.

Above all parties, and above all politics. A unique position.

• Pope Francis Extends Agenda Of Change To Vatican Diplomacy (Reuters)

Pope Francis’ hard-hitting criticisms of globalization and inequality long ago set him out as a leader unafraid of mixing theology and politics. He is now flexing the Vatican’s diplomatic muscles as well. Last year, he helped to broker an historic accord between Cuba and the United States after half a century of hostility. This past week, his office announced the first formal accord between the Vatican and the State of Palestine — a treaty that gives legal weight to the Holy See’s longstanding recognition of de-facto Palestinian statehood despite clear Israeli annoyance. The pope ruffled even more feathers in Turkey last month by referring to the massacre of up to 1.5 million Armenians in the early 20th century as a “genocide”, something Ankara denies.

After the inward-looking pontificate of his scholarly predecessor, Pope Benedict, Francis has in some ways returned to the active Vatican diplomacy practiced by the globetrotting Pope John Paul II, widely credited for helping to end the Cold War. Much of his effort has concentrated on improving relations between different faiths and protecting the embattled Middle East Christians, a clear priority for the Catholic Church. However in an increasingly fractured geopolitical world, his diplomacy is less obviously aligned to one side in a global standoff between competing blocs than that of John Paul’s 27-year-long papacy.

This is reinforced by his status as the world’s first pope from Latin America, a region whose turbulent history, widespread poverty and love-hate relationship with the United States has given him an entirely different political grounding from any of his European predecessors. “Under this pope, the Vatican’s foreign policy looks South,” said Massimo Franco, a prominent Italian political commentator and author of several books on the Vatican. He said the pope has been careful to avoid taking sides on issues like Ukraine, where he has never defined Russia as an aggressor, but has always referred to the conflict between the government and Moscow-backed rebels as a civil war.

China buys the world as its economy is self-destructing. How do you explain that to your grandchildren?

• China’s Amazon Railway Threatens ‘Uncontacted Tribes’ And Rainforest (Guardian)

Chinese premier Li Keqiang is to push controversial plans for a railway through the Amazon rainforest during a visit to South America next week, despite concerns about the possible impact on the environment and on indigenous tribes. Currently just a line on a map, the proposed 5,300km route in Brazil and Peru would reduce the transport costs for oil, iron ore, soya beans and other commodities, but cut through some of the world’s most biodiverse forest. The six-year plan is the latest in a series of ambitious Chinese infrastructure projects in Latin America, which also include a canal through Nicaragua and a railway across Colombia. The trans-Amazonian railway has high-level backing.

Last year, President Xi Jinping signed a memorandum on the project with his counterparts in Brazil and Peru. Next week, during his four-nation tour of the region starting on Sunday, Li will, according to state-run Chinese media, suggest a feasibility study. Starting near Açu Port in Rio de Janeiro state, the proposed track would connect Brazil’s Atlantic coast with Peru’s Pacific coast, via the states of Goiás, Mato Grosso and Rondônia. The logistical challenges are considerable because the line will pass through dense forest, swamps and then either desert or mountains (there are two options for the Peruvian end of the route), as well as areas of conflict between tribes and drug traffickers.

Near the Bolivian border, it will come close to the “Devil’s Railway”, an ill-fated link built in 1912 between Porto Velho in Brazil and Guajará-Mirim in Bolivia. It cost 6,000 lives and was barely used after the collapse of the rubber industry. Financing is likely to come from the China Development Bank, with construction carried out by local firms and the China International Water and Electric Corporation. China’s involvement is partly explained by a desire to reduce freight costs, but it also hopes to create business for domestic steel and engineering firms that have been hit by the slowdown of the Chinese economy.

Done deal. Unless prices go to $20.

• ‘Paddle in Seattle’ Arctic Oil Drilling Protest Targets Shell (BBC)

Hundreds of people in kayaks and small boats have staged a protest in the north-western US port city of Seattle against oil drilling in the Arctic by the Shell energy giant. Paddle in Seattle was held by activists who said the firm’s drilling would damage the environment. It comes after the first of Shell’s two massive oil rigs arrived at the port. The firm wants to move them in the coming months to explore for oil off Alaska’s northern coast. Earlier this week, Shell won conditional approval from the US Department of Interior for oil exploration in the Arctic. The Anglo-Dutch company still must obtain permits from the federal government and the state of Alaska to begin drilling. It says Arctic resources could be vital for supplying future energy needs.

A solar-powered barge – The People’s Platform – joined the protesters, who chanted slogans and also sang songs. “This weekend is another opportunity for the people to demand that their voices be heard,” Alli Harvey, Alaska representative for the Sierra Club’s Our Wild America campaign, was quoted as saying by the Associated Press news agency. “Science is as clear as day when it comes to drilling in the Arctic – the only safe place for these dirty fuels is in the ground.” The protesters later gathered in formation and unveiled a big sign which read “Climate justice now”. They mostly stayed outside the official 100-yard (91m) buffer zone around the Polar Pioneer, the Seattle Times newspaper reports. Police and coastguard monitored the flotilla, saying it was peaceful.

The demonstrators are now planning to hold a day of peaceful civil disobedience on Monday in an attempt to shut down Shell operations in the port, the newspaper adds. The port’s Terminal 5 has been at the centre of a stand-off between environmentalists and the city authorities after a decision earlier this year to allow Shell use the terminal as a home base for the company’s vessels and oil rigs. Shell stopped Arctic exploration more than two years ago after problems including an oil rig fire and safety failures. The company has spent about $6bn on exploration in the Arctic – a region estimated to have about 20% of the world’s undiscovered oil and gas.

Agriculture killed off women’s equal status. And we’re still paying a dear price for that.

• Early Human Societies Had Gender Equality (Guardian)

Our prehistoric forebears are often portrayed as spear-wielding savages, but the earliest human societies are likely to have been founded on enlightened egalitarian principles, according to scientists. A study has shown that in contemporary hunter-gatherer tribes, men and women tend to have equal influence on where their group lives and who they live with. The findings challenge the idea that sexual equality is a recent invention, suggesting that it has been the norm for humans for most of our evolutionary history. Mark Dyble, an anthropologist who led the study at University College London, said: “There is still this wider perception that hunter-gatherers are more macho or male-dominated. We’d argue it was only with the emergence of agriculture, when people could start to accumulate resources, that inequality emerged.”

Dyble says the latest findings suggest that equality between the sexes may have been a survival advantage and played an important role in shaping human society and evolution. “Sexual equality is one of a important suite of changes to social organisation, including things like pair-bonding, our big, social brains, and language, that distinguishes humans,” he said. “It’s an important one that hasn’t really been highlighted before.” The study, published in the journal Science, set out to investigate the apparent paradox that while people in hunter-gatherer societies show strong preferences for living with family members, in practice the groups they live in tend to comprise few closely related individuals.

The scientists collected genealogical data from two hunter-gatherer populations, one in the Congo and one in the Philippines, including kinship relations, movement between camps and residence patterns, through hundreds of interviews. In both cases, people tend to live in groups of around 20, moving roughly every 10 days and subsisting on hunted game, fish and gathered fruit, vegetables and honey. [..] The authors argue that sexual equality may have proved an evolutionary advantage for early human societies, as it would have fostered wider-ranging social networks and closer cooperation between unrelated individuals. “It gives you a far more expansive social network with a wider choice of mates, so inbreeding would be less of an issue,” said Dyble. “And you come into contact with more people and you can share innovations, which is something that humans do par excellence.”

Home › Forums › Debt Rattle May 17 2015