Harold Steggels Essex landscape 1932

What he was elected on. Why should the US be dependent on imports for all of its steel?

• Trump’s Steel And Aluminum Tariffs Trigger Market Sell-Off In US, Asia (G.)

World stock markets have tumbled after Donald Trump said the United States would impose tariffs of 25% on steel imports and 10% on imported aluminum next week. The threat of a trade war with China and higher goods prices led to a sharp sell-off in Wall Street on Thursday, causing Asian markets to take fright on Friday. The Nikkei index in Japan fell 2.4%, Hong Kong and South Korea were down 1.6%, and the ASX200 in Sydney was off 1% in early afternoon trading. Asian steelmakers bore the brunt. South Korea’s Posco fell 3% and Japan’s Nippon Steel 4%. Michael McCarthy of CMC Markets in Sydney said it was a “sharp reminder of the initial negative reaction to the election of Mr Trump ..

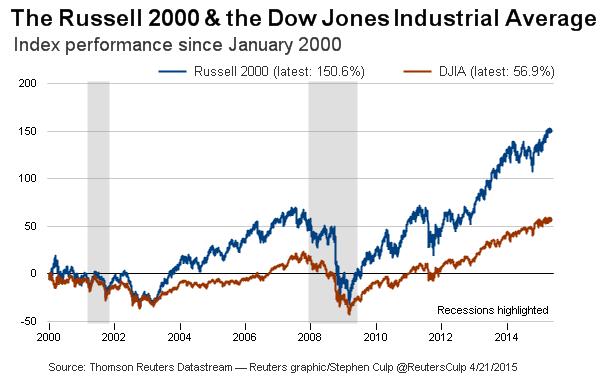

… An explanation may come, but the initial market interpretation of the move is rank populism. The lack of structure makes anticipating further measures and possible responses to retaliatory moves difficult to predict.” The Dow Jones Industrial Average had initially fallen more than 570 points, with heavy losses for manufacturers like Caterpillar and Boeing. The index closed down 420 points and the S&P 500 and Nasdaq both dropped on the day. Trump campaigned on the promise of protecting the US steel industry but until now has done little to make good on those promises. At a meeting with US industry officials at the White House, he vowed to rebuild American steel and aluminum industries, saying they had been treated unfairly by other countries for decades.

The move is likely to increase tensions with China, whose top trade official, Lui He, is in Washington for trade talks. “People have no idea how badly our country has been treated by other countries, by people representing us that didn’t have a clue,” Trump said at a White House press conference attended by executives from the steel and aluminum industries. “Or if they did, then they should be ashamed of themselves because they’ve destroyed the steel industry, they’ve destroyed the aluminum industry, and other industries, frankly, when you look at all the plants, the car plants, automobile plants that moved down to Mexico for no reason whatsoever, except we didn’t know what we were doing. So we’re bringing it all back.”

Bloomberg claims that “..it looked like the global economy was running on all cylinders ..” No it didn’t.

• Trump’s Tariffs Throw a Wrench in the Global Trading System (BBG)

Just when it looked like the global economy was running on all cylinders, President Donald Trump injected a degree of risk to the otherwise favorable outlook. The U.S. president announced on Thursday plans to impose 25% tariffs on imported steel and 10% tariffs on foreign aluminum, with more details to be unveiled next week. American equities cratered for a third day as fears of a trade war spread and expectations for U.S. economic growth weakened a bit. The move to protect American metals producers threatens to raise prices for consumers and businesses that buy goods made with the raw materials. That will have implications for a U.S. central bank that’s debating how fast to raise interest rates this year.

“If tariffs go up, it will, at the margin, tend to put more upward pressure on prices, and those upward pressure on prices will have to be considered by the monetary authority,” New York Fed President William Dudley said in a speech in Brazil on Thursday. The extent of any economic damage will depend on the fine-print of Trump’s new policies and the severity of countries’ retaliation. Some economists worried the move might presage a shift toward an era of more economy-inhibiting protectionism just when it looked like the growth headwinds were fading. “It is possible that a more aggressive shift in policy is under way that could undermine the pro-growth tilt of fiscal policy, harming the U.S. and global economic expansions,” JPMorgan analysts wrote in a research note after Trump’s announcement.

Jay Powell gets a warm welcome.

• S&P 500 Breaks Below 100-Day Average Technical Inflection Point (BBG)

The stock market is flirting with a technical inflection point again. The S&P 500 Index briefly broke below its 100-day moving average Thursday, sinking as much as 2% after President Donald Trump said the U.S. will impose harsh tariffs on steel and aluminum imports. The announcement added fuel to a fire that’s been smoldering since last month’s selloff, as investors continue to worry about rising inflation and interest rates. That anxiety has brought the market close to collapsing through the line of defense the moving average represents.

“You’ve broken down below the halfway point, now you’re toying below the initial high after the collapse, and you’ve gotten into all sorts of technical problems,” Jim Paulsen, chief investment strategist at Leuthold Weeden, said by phone. “Breaking some technical averages here is starting to scare people.” The S&P 500 fell 1.1% to 2,684.02 as of 3:27 p.m. in New York, after going as low as 2,659.65. The index is down about 2.5% on the week. Before February’s correction, the gauge hadn’t touched the 100-day barrier since last August. And while the market is recovering some of Thursday’s losses late in the session, it still risks closing below the line for the third time in a month.

Causation and correlation.

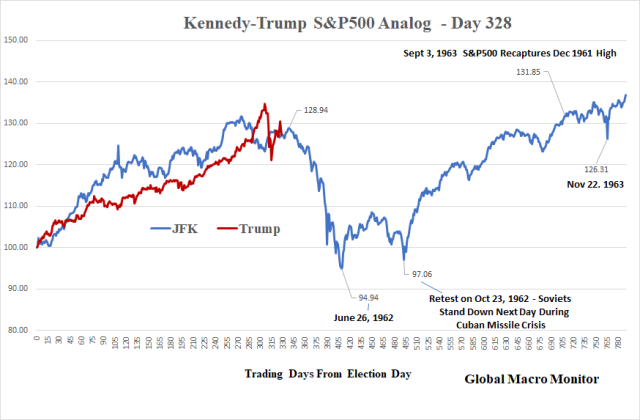

• JFK-Trump S&P500 Analog Chart (MW)

Last month, MarketWatch used a chart overlay to illustrate how the stock market under John F. Kennedy has closely followed its performance over the same time frame with Donald Trump in the White House. Fast forward three weeks and, as of Wednesday’s close, the S&P 500, in relative terms, sat almost exactly where it did at this point during Kennedy’s administration. If the trend persists—a HUGE if, of course—prepare for some rather steep losses in the coming weeks. Perhaps it’s already started, with the Dow Jones Industrial Average down nearly 600 points at its Thursday low.

“After 328 trading days since election day, the Trump S&P 500 sits right on top of the JFK S&P 500,” the blogger behind the Global Macro Monitor wrote. ”The index, 328 trading days after the election day of each president, is less than five basis points within one another. Rather stunning, don’t you think?”

Trump needs Democrat support on this. Where are they?

• NRA Members On Trump Gun Control Plans: ‘Every Word Of It Was A Betrayal’ (G.)

NRA members have branded Donald Trump’s plans for stricter gun control legislation “stupid” and a “betrayal” after the president suggested reforms on Wednesday. In an open meeting with congressional Democrats and Republicans, Trump embraced raising the age limit on purchasing certain weapons and suggested that law enforcement should be allowed to confiscate people’s guns before going through due process in a court. Joe Biggs, an Austin, Texas-based NRA member and chief executive of Rogue Right, a conservative news website, was among those unimpressed by the proposal. “That’s the stupidest fucking thing I’ve ever heard in my life. Hopefully he was just having a momentary brain fart, a lapse of judgment,” Biggs said.

He added: “Hopefully someone pulled him into the back and said: ‘You’ve just lost half your base by saying something that stupid.’” During the meeting Trump called for a “beautiful” bill which would expand background checks on gun purchases and restrict young people from purchasing certain weapons. But it was his suggestion that in some cases law enforcement should be allowed to “take the guns first, go through due process second” – that most alarmed gun owners on the right. “You spend your whole life on the right and you always think that Democrats are going to be the ones who take your guns,” Biggs said. “And then you hear President Trump say: ‘Oh we’re gonna take your guns and go through due process later.’” Biggs said he would vote for another candidate in the 2020 presidential election if Trump pushed through his reforms.

Putin in his state of the union announced to his people that Russia can defend itself from any attacks, including nuclear. Western media twist his words; the Guardian claims that “Russia threatens arms race” and even Zero Hedge says :“..the era of the Western world attempting to prevent Russia’s expansion is over.”

That’s all straight from NATO’s playbook.

• Putin On New US Nuclear Stance: If Attacked, Russia Will Use Nukes (RT)

The new US nuclear posture allows a nuclear strike in response to a conventional attack. President Vladimir Putin said Russia, if attacked with nuclear weapons, would not hesitate to respond in kind. The warning came during a state of the nation address delivered by the Russian president on Thursday, in which he presented a number of new advanced strategic weapon systems which, he said, would render all anti-missile capabilities that the US currently has powerless. Putin also mentioned the new American nuclear posture, which has relaxed some rules on when the US is prepared to use its nuclear weapons. “We are greatly concerned by some parts of the new nuclear posture, which reduces the benchmark for the use of nuclear weapons…

..Whatever soothing words one may try to use behind closed doors, we can read what was written. And it says that these weapons can be used in response to a conventional attack or even a cyber-threat,” he said. “Our nuclear doctrine says Russia reserves the right to use nuclear weapons only in response to a nuclear attack or an attack with other weapons of mass destruction against her or her allies, or a conventional attack against us that threatens the very existence of the state.” “It is my duty to state this: Any use of nuclear weapons against Russia or its allies, be it small-scale, medium-scale or any other scale, will be treated as a nuclear attack on our country. The response will be instant and with all the relevant consequences,” Putin warned.

Xi as a stand up comedian.

• China Bans Orwell’s Animal Farm And Letter ‘N’ Amid Anger At Xi (Ind.)

The Chinese government has banned George Orwell’s dystopian satirical novella Animal Farm and the letter ‘N’ in a wide-ranging online censorship crackdown. Experts believe the increased levels of suppression – which come just days after the Chinese Communist Party announced presidential term limits would be abolished – are a sign Xi Jinping hopes to become a dictator for life. The China Digital Times, a California-based site covering China, reports a list of terms excised from Chinese websites by government censors includes the letter ‘N’, Orwell’s novels Animal Farm and 1984, and the phrase ‘Xi Zedong’. The latter is a combination of President Xi and former chairman Mao Zedong’s names.

Search terms blocked on Sino Weibo, a microblogging site which is China’s equivalent of Twitter, include “disagree”, “personality cult”, “lifelong”, “immortality”, “emigrate”, and “shameless”. It was not immediately obvious why the ostensibly harmless letter ‘N’ had been banned, but some speculated it may either be being used or interpreted as a sign of dissent. [..] Facebook, Twitter and YouTube have long been blocked in the country and even Winnie the Pooh recently found himself subject to China’s latest internet crackdown. In July, references to the cartoon bear on Sina Weibo were removed after his image was compared to President Xi.

Our car addiction is deeply rooted. We built our communities around them. Not around ourselves. That is a much bigger problem than what fuel a car uses to power a vehicle 10-20 times heavier than its driver, with a 10% fuel efficiency.

• ‘Cleanest In History’ Diesel Cars Still Pollute Far Above Legal Limits (Ind.)

Over half of diesel cars recently approved for sale in Europe are emitting pollutants far above current legal air pollution limits, despite being marketed as the “cleanest in history”. Analysis of emissions data from nearly 100 car models revealed many vehicles from the new “Euro 6” generation would not be allowed on the market if they were tested today. An investigation by Greenpeace found dozens of these high-polluting vehicles were approved for sale during a “monitoring period” in which there was no limit set on the amount of nitrogen oxide (NOx) they could emit on roads. Many of these vehicles have only gone on sale across Europe in the recent months. The news comes after a German court ruled cities can impose driving bans on certain diesel cars in an effort to deal with the country’s air pollution.

Such restrictions on diesel cars – including the clean air zones found in London and other UK cities – tend to focus on older, dirtier car models. However, Greenpeace campaigners emphasised that while newer Euro 6 models are described as “light years away from their older counterparts” many of them still have the capacity to emit high levels of pollutants. Following the so-called “dieselgate” scandal in 2015, which found VW had installed “cheat software” in its vehicles to fool lab emissions tests, there was a widespread push for tough new regulations. In the aftermath of the scandal, testing revealed diesel cars that met the latest “Euro 6” limits for NOx emissions in lab tests were massively exceeding those limits when driving on the road.

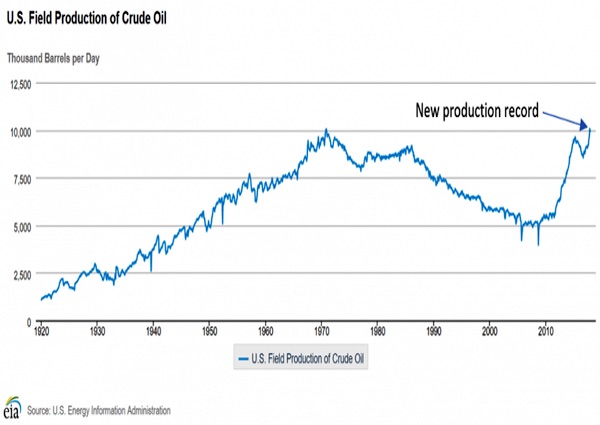

Our old Oil Drum pal Robert. I’d be interested to see how fast and how sharp the shale numbers are expected to start falling.

• US Breaks 47-Year-Old Monthly Oil Production Record (Robert Rapier)

In a recent post, I wrote that the U.S. would almost certainly set a new oil production record this year. I noted that the most recent data from the Energy Information Administration (EIA) showed that last November U.S. oil production exceeded 10 million barrels per day (BPD) for the first time since 1970. This week the EIA revised November’s oil production upward, which pushed it into the #1 spot for monthly production. The revision increased U.S. oil production in November to 10.057 million BPD, just edging out the previous record of 10.044 million BPD from November 1970. However, many new records should be set this year, as the EIA projects that oil production will reach 11 million BPD by year-end.

This would push the U.S. into first place among the world’s oil producers. But depending on how it is measured, the U.S. is already #1. The 2017 BP Statistical Review of World Energy ranks the U.S. #1 in oil production, but that’s because they include natural gas liquids (NGLs), which have surged in the U.S. along with natural gas production. The gains in U.S. oil production are being driven by production gains across tight oil plays in the Bakken and Eagle Ford, and especially the Permian Basin – where oil production is approaching a staggering 3 million BPD.

Are they buying their own?

• Bitcoin’s Plunge in Volume Stirs Questions About Its Popularity (BBG)

Earlier this year, when Bitcoin’s price fell by more than 60% from its record close, a less-noticed Bitcoin figure also plunged: the number of daily transactions. There are many explanations for the fall-off in trading, from software- to news-related. What’s less understood is why the level hasn’t recovered as Bitcoin’s price made a 50% comeback since Feb. 5. That’s left some investors wondering whether the cryptocurrency is waning in popularity. The average number of trades recorded daily has roughly dropped in half from the December highs and touched its lowest in two years last month, even as Bitcoin became a household name and roared back above $10,000.

1) Why does it take a guy to make that case?

2) “$28 trillion would be added to the global economy by 2025” sounds like a male argument. If the only advantage of more women is that the same arguments are made by different voices, why bother?

• Making the Business Case for Gender Equality (PS)

Around the world, gender bias is attracting renewed attention. Through protest marches and viral social-media campaigns, women everywhere are demanding an end to sexual harassment, abuse, femicide, and inequality. But, as successful as the #MeToo and #TimesUp movements have been in raising public awareness, the struggle for parity is far from over. Empowering women and girls is key to achieving all 17 of the United Nations Sustainable Development Goals by 2030. At the moment, however, gender bias remains a significant obstacle to global progress, and it is particularly acute in the workplace. Today, only 5% of S&P 500 companies are led by women, according to Catalyst, a non-profit CEO watchdog.

That dismal figure is all the more remarkable when one considers that 73% of global firms allegedly have equal-opportunity policies in place, according to a survey by the International Labour Organization (ILO). Moreover, while research shows a clear link between a company’s gender balance and its financial health, women occupy fewer than 20% of governing board seats in the world’s largest companies. Addressing such deficiencies is both an economic and a moral imperative. A 2015 report by the McKinsey Global Institute found that if women and men played an “identical role in labor markets,” $28 trillion would be added to the global economy by 2025. These global gains would be in addition to the benefits for individual companies.

Firms with greater gender equality are more innovative, generous, and profitable. But, at the current rate of female empowerment, it would take nearly 220 years to close the gender gap. The world cannot afford to wait that long; we need a new approach.

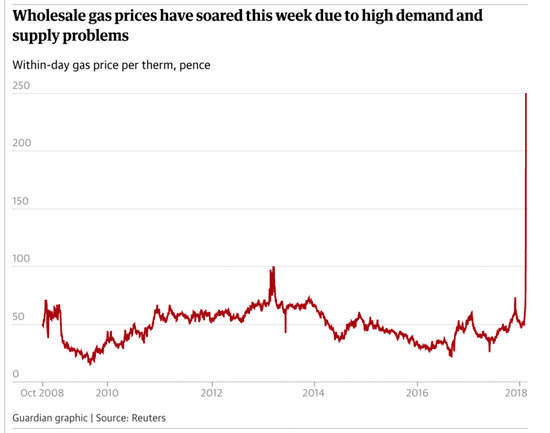

The thrills of the just in time economy.

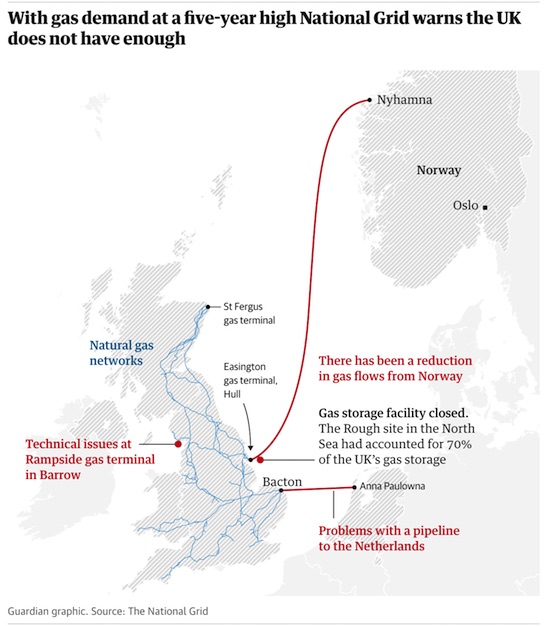

• UK Risks Running Out Of Gas, Prices Soar (G.)

National Grid has warned that the UK would not have enough gas to meet public demand on Thursday, as temperatures plummeted and imports were affected by outages. But the government said households would not notice disruptions to their supply or any increase in energy bills because suppliers, including British Gas, bought energy further ahead. The energy minister Claire Perry said people should cook and use their heating as they would normally. But experts said there was a strong chance that industrial users could experience interruptions to their gas supply. Within-day wholesale gas prices soared 74% to 200p per therm after the formal deficit warning, which acts as a call to suppliers to bring forward more gas.

It is the first time such an alert has been issued since 2010. By lunchtime on Thursday the price had spiked even higher, hitting a high of 275p per therm at one point. National Grid’s forecast for the day initially showed a shortfall across the day of 49.5m cubic metres (mcm) below the country’s projected need of 395.7mcm, which would normally be around 300mcm at this time of year. The gas deficit warning aims to fill the gap, which has since narrowed to 16.5mcm. “We are in communication with industry partners and are closely monitoring the situation,” the company said.

Gas demand is now at a five-year high, according to the market watchers S&P Global Platts. Simon Wood, a gas analyst at the group, said: “There’s a strong chance you’ll see some interruptions for industrial users to balance the system.” Big energy users such as car manufacturers have supply contracts which can be interrupted in return for lower prices. The situation has been compounded by several supply outages, which can relate to very cold weather. There have been problems with a pipeline to the Netherlands, reductions in gas flows from Norway, and technical issues at facilities in the UK, including at the North Morecambe Barrow terminal.

Gas shortage, food shortage. Self-sufficiency, anyone?

• UK Food Crisis Looms Without Brexit Deal (BBG)

Brexit would lead to an unprecedented food shortage if the U.K. leaves the European Union without a deal, the CEO of the country’s second-biggest grocer said. “The impact of closing the borders for a few days to the free movement of food would result in a food crisis the likes of which we haven’t seen,” J Sainsbury CEO Mike Coupe said in an interview. “It’s inconceivable to me that there won’t be a solution found.” Tensions are simmering between London and Brussels, with U.K. Prime Minister Theresa May saying Wednesday that no one in her position could ever agree to the draft Brexit treaty published by the EU.

May is seeking to get the EU to sign on to a transition phase at a summit of leaders later this month, but Michel Barnier, the EU’s chief Brexit negotiator, warned Thursday that any such agreement could still unravel before Britain’s scheduled exit in March 2019. Almost half of the food eaten in the U.K. is imported. Trade barriers would be especially damaging to Britain’s fresh-food retailers, who rely heavily on the unencumbered movement of perishable goods throughout the EU. In 2016, the U.K. imported 22.4 billion pounds ($30.8 billion) worth of meat, fish, dairy products, fruit and vegetables, according to the Department for Environment, Food and Rural Affairs.

Hey, don’t keep us from poisoning ourselves. It’s our god-given right.

• Pesticides Put Bees At Risk, European Watchdog Confirms (CNBC)

Wild bees and honeybees are put at risk by three pesticides from a group known as neonicotinoids, Europe’s food safety watchdog said on Wednesday, confirming previous concerns that prompted an EU-wide ban on use of the chemicals. The European Food Safety Authority (EFSA) report, which covered wild bees and honeybees and included a systematic review of scientific evidence published since EFSA’s 2013 evaluation, is seen as crucial to whether the European moratorium on neonicotinoid use remains in place. The updated risk assessment found variations due to factors such as species of bee, exposure and specific pesticide, “but overall the risk to the three types of bees we have assessed is confirmed,” said Jose Tarazona, head of EFSA’s pesticides unit.

The European Union has since 2014 had a moratorium on use of neonicotinoids — made and sold by various companies including Bayer and Syngenta — after lab research pointed to potential risks for bees, which are crucial for pollinating crops. EU nations will discuss a European Commission proposal to ban three neonicotinoids next month in the Plant Animal Food and Feed Standing Committee. “This is strengthening the scientific basis for the Commission’s proposal to ban outdoor use of the three neonicotinoids,” a spokeswoman for the EU executive said.

The whole concept is based on permafrost. Or was.

• ‘Doomsday’ Seed Vault Gets Makeover As Arctic Heats Up (AFP)

Designed to withstand a nuclear missile hit, the world’s biggest seed vault, nestled deep inside an Arctic mountain, is undergoing a makeover as rising temperatures melt the permafrost meant to protect it. Dubbed the “Noah’s Ark” of food crops, the Global Seed Vault is buried inside a former coal mine on Svalbard, a remote Arctic island in a Norwegian archipelago around 1,000 kilometres (650 miles) from the North Pole. Opened in 2008, the seed bank plays a key role in preserving the world’s genetic diversity: it is home to more than a million varieties of seeds, offering a safety net in case of natural catastrophe, war, climate change, disease or manmade disasters.

But warmer temperatures have disrupted the environment around the vault. In an unexpected development, the permafrost, which was meant to help keep the temperature inside the vault at a constant -18 Celsius (-0.4 Fahrenheit), melted in 2016. “The summer season was (warmer) than expected. We had water intrusions in the (access) tunnel that could be related to climate change,” Asmund Asdal, one of the seed bank’s coordinators, told AFP. The Arctic is warming twice as fast as the rest of the planet, scientific studies show. And while Europe is at the moment experiencing a subzero cold spell, the North Pole recently registered above-zero temperatures, 30 degrees higher than normal.

Scientists say warm spells like this are occurring with increasing frequency in the Arctic. Norway recently announced it would contribute 100 million kroner (10 million euros, $12.5 million) to improve the repository in a bid to protect the precious seeds. “We want to be sure that the seed vault will be cold throughout the whole year, even if the temperature continues to increase in Svalbard,” Norway’s Agriculture Minister Jon Georg Dale told AFP.