Jean-Michel Basquiat Untitled 1982

Time for legal action against Sweden and the prosecutors.

• Swedish Prosecutors Drop Julian Assange Rape Investigation (AP/R.)

Swedish prosecutors said on Friday they would drop a preliminary investigation into an allegation of rape against WikiLeaks founder Julian Assange, bringing to an end a seven-year legal standoff. “Chief Prosecutor Marianne Ny has today decided to discontinue the preliminary investigation regarding suspected rape concerning Julian Assange,” the prosecutors office said in a statement. Assange, 45, has lived in the Ecuadorian Embassy in London since 2012, after taking refuge there to avoid extradition to Sweden over the allegation of rape, which he denies. He has refused to travel to Stockholm, saying he fears further extradition to the US over WikiLeaks’ release of 500,000 secret military files on the wars in Afghanistan and Iraq. In 2015 lawyers for Julian Assange have claimed victory after a Swedish prosecutor bowed to pressure from the courts and agreed to break the deadlock in the WikiLeaks founder’s case by interviewing him in London.

“Stop making housing into an asset.” “Make housing a place for people to actually live.”

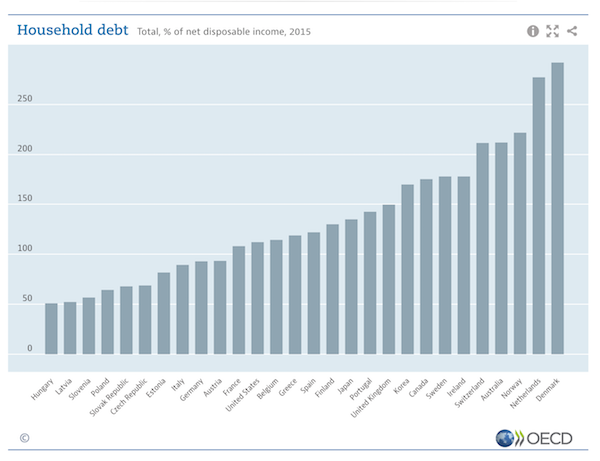

• Australia Economy Among ‘Walking Dead Of Household Debt’ – Steve Keen (NCA)

Australia has become the “walking dead of debt” due for a financial reckoning that could shock the housing market “bubble” within months. That’s according to “anti-economist” Professor Steve Keen who defines Australia as a “zombie to be” given soaring personal debt that has created a government-induced property bubble ripe to burst. “Australia has simply delayed its day of reckoning,” he told news.com.au in reference to the global financial crisis that shocked many countries around the world from 2008 but left the lucky country relatively unscathed after a series of government interventions. The Kingston University Professor claims first homeowners grants rolled out by successive governments have artificially kept prices high creating a form of “instant prosperity” that politicians are loath to stop.

“The housing bubble makes the politicians look good because A, people are feeling wealthier, and B … people are borrowing money to spend,” he said. “Then the government runs a balanced budget and looks like it really knows what it’s doing” “It hasn’t got a f***ing clue frankly, because what’s actually happening is the reason it’s making that money is credit is expanding,” he said. “It’s the old classic story, you’re criticising a party because someone’s laced the punchbowl. You try to take the punchbowl away from the party you’re a very unpopular person but you need to because what’s actually happening is people are getting intoxicated with credit”. His latest book, Can We Avoid Another Financial Crisis? argues Australia, along with Belgium, China, Canada and South Korea, is a “zombie” economy sleepwalking into a crunch that could come between 2017 and 2020.

“Both [Australia and Canada] will suffer a serious economic slowdown in the next few years since the only way they can sustain their current growth rates is for debt to continue growing faster than GDP,” he writes. [..] For Prof Keen, the solution for governments to an overheated housing market is obvious: “Stop making housing into an asset.” “Make housing a place for people to actually live. So you go back to saying ‘what’s desirable is affordable houses’ and affordable means it doesn’t cost a first homebuyer more than three or four years’ income to get a property,” he said. As for those struggling to get on the ladder in the meantime? “The only thing you can do in the middle is say I’m just not going to join in, and if it happens on a collective level …. it’s game over for the bubble because the bubble only works if more people keep taking out more leverage.”

Wait till house prices start falling.

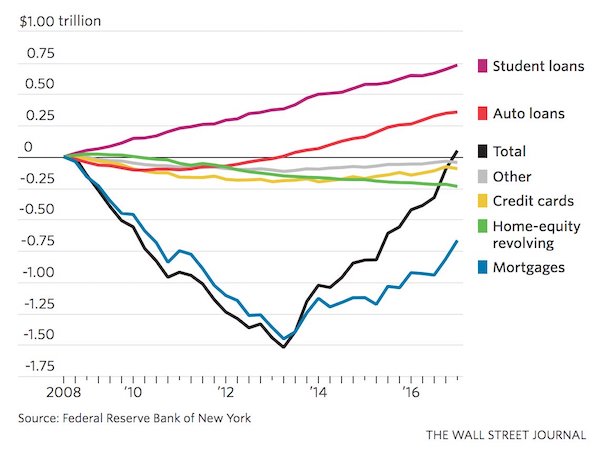

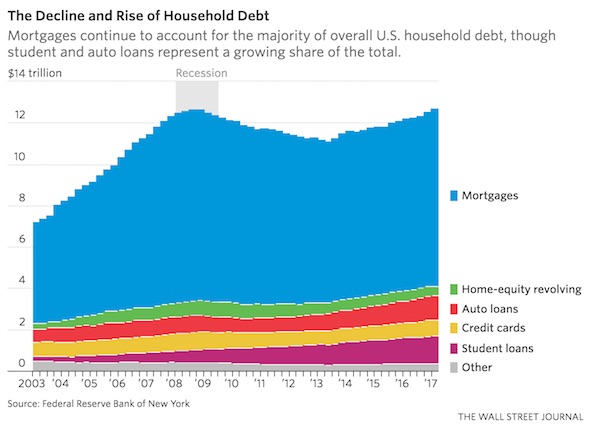

• US Household Debt Hit Record in First Quarter (WSJ)

The total debt held by American households reached a record in early 2017, exceeding its 2008 peak after years of retrenchment against a backdrop of financial crisis, recession and modest economic growth. Much has changed over the past 8.5 years. The economy is larger, lending standards are tighter and less debt is delinquent. Mortgages remain the largest form of household borrowing but have become a smaller share of total debt as consumers take on more automotive and student loans. “The debt and its borrowers look quite different today,” New York Fed economist Donghoon Lee said. He added: “This record debt level is neither a reason to celebrate nor a cause for alarm.” The total-debt milestone, announced Wednesday by the Federal Reserve Bank of New York, was a long time coming.

Americans reduced their debts during and after the 2007-09 recession to an unusual extent: a 12% decline from the peak in the third quarter of 2008 to the trough in the second quarter of 2013. New York Fed researchers, looking at data back to the end of World War II, described the drop as “an aberration from what had been a 63-year upward trend reflecting the depth, duration and aftermath of the Great Recession.” In the first quarter, total debt was up about 14% from that low point as steady job gains, falling unemployment and continued economic growth boosted households’ income and willingness to borrow. The New York Fed report said total household debt rose by $149 billion in the first three months of 2017 compared with the prior quarter to a total of $12.725 trillion.

The pace of new lending slowed from the strong fourth quarter. Mortgage balances rose from the final three months of 2016, while home-equity lines of credit were down. Automotive loans rose, as did student loans, but credit-card debt fell along with other types of debt. The data weren’t adjusted for inflation, and household debt remains below past levels in relation to the size of the overall U.S. economy. In the first quarter, total debt was about 67% of nominal gross domestic product versus roughly 85% of GDP in the third quarter of 2008. Balance sheets look different now, with less housing-related debt and more student and auto loans. As of the first quarter, about 68% of total household debt was in the form of mortgages; in the third quarter of 2008, mortgages were roughly 73% of total debt. Student loans rose from about 5% to around 11% of total indebtedness, and auto loans went from roughly 6% to about 9%.

Can we finally try to understand this, all of us?

• Why Government Surpluses Is A Terrible Idea – Steve Keen (Renegade)

In this Renegade Short, Professor Steve Keen explains why the government isn’t supposed to balance its accounts like a household.

TomDickHaria.

• How Can The Greeks Save More Money? A Monetary Parable. (Steve Keen)

The EU’s “Stability and Growth Pact” has as one of its primary rules that “The Member States undertake to abide by the medium-term budgetary objective of positions close to balance or in surplus…” I explore what this objective implies in the context of a model of the economy of “TomDickHaria”: what happens to its collective GDP where one member tries to achieve the surplus goal set out in the “Stability and Growth Pact?

The Troika makes sure Greece will keep drowning.

• Greek Parliament Approves More Austerity Measures Amid Protests (DW)

All 153 lawmakers in Prime Minister Alexis Tsipras’ governing coalition backed the legislation that includes new pension cuts and lower tax breaks, which are expected to save Greece €4.9 billion ($5.4 billion) until 2021. All opposition lawmakers present in the 300-seat chamber rejected the package required by international lenders before the release of more aid. Athens needs the bailout funds to repay €7.5 billion of debt maturing in July this year. Relief measures will only kick in if Greece meets fiscal targets stipulated by its creditors. “Our country is being turned into an austerity colony,” leading opposition conservative Kyriakos Mitsotakis said during debate on the bill, describing added cuts as a “nightmare” for low-earners.

Tsipras countered that its passage would enable Greece from summer next year to stand on its own feet, without the intervention of creditors such as the IMF. He accused the opposition of constantly warning of a catastrophe that “hasn’t come.” Government spokesman Dimitris Tzanakopoulos told Skai TV that Greek creditors the IMF and Germany were “in the final stretch of very tough negotiations” over a compromise that should allow Greece to return to bond markets in 2018. Thursday’s austerity package lowers the income tax exception from €8,600 down to about €5,700 but increases benefits for low-income tenants, parents with children and subsidies for child care. Public stakes are to be reduced through sales of holdings in Greece’s PPC electricity utility, railways, Athens’ international airport and the Thessaloniki port.

Same as it ever was. Fantasy numbers have ruled the day for many years.

• Trump Aims to Balance Budget With Deep Cuts, Bullish Growth Projections (WSJ)

President Donald Trump next week will propose the U.S. can balance the federal budget over 10 years with substantial cuts to safety-net programs such as food stamps and other anti-poverty efforts, combined with a tax and regulatory overhaul that speeds up the nation’s economic growth rate, a senior White House budget official said. The president’s budget, due for release Tuesday, will spare the two largest drivers of future spending—Medicare and Social Security—leaving trillions in cuts from other programs. That includes discretionary spending cuts to education, housing, environment programs and foreign aid already laid out by the administration, in addition to new proposed reductions to nondiscretionary spending like food stamps, Medicaid and federal employee-benefit programs.

The budget release, which will be unveiled while Mr. Trump is visiting Europe and the Middle East, shows how his economic policy team is trying to forge ahead on his agenda even as distracting political controversies, such as the recent firing of FBI director James Comey, swirl around Washington. On Thursday, Treasury Secretary Steven Mnuchin testified on Capitol Hill, his first such appearance since his February confirmation, where he expressed confidence Congress could advance a revamp of the tax code this year. House Republicans held their first hearing on the proposed tax overhaul, following a series of meetings between lawmakers and top administration officials Wednesday.

The White House’s budget proposal next week builds upon an earlier outline in March that called for a nearly 10% boost in defense funding next year, offset by around $54 billion in cuts for nondefense programs. [..] Among the more controversial elements of the budget will be the administration’s growth forecasts. The White House projects the nation’s economic growth rate will rise to 3% by 2021, compared with the 1.9% forecast under current policy by the Congressional Budget Office. It’s unusual to see the White House’s growth forecasts differ from the CBO and other blue-chip projections by such a large margin over such a long stretch of the 10-year budget window.

Another crazy experiment by the Fed bookworms.

• Get Ready for Quantitative Tightening (Rickards)

Despite yesterday’s market sell-off, the Fed is still on track to raise interest rates in June. Wednesday’s action is no more than a speed bump for the Fed. It will not stop the Fed from moving forward with another 0.25% rate increase. The Fed is embarking on a new path, a path that started several years with QE (quantitative easing). QE is the name for the method the Fed uses to ease monetary conditions when interest rates are already zero. Conventional monetary policy calls for interest rate cuts to stimulate growth and inflate asset prices when the economy is in a recession. What does a central bank do when interest rates are already at zero and you can’t cut them anymore? One solution is negative interest rates, although the evidence from Japan and Europe indicates that negative rates do not have the same effect as rate cuts from positive levels. The second solution is to print money! The Fed does this by buying bonds from the big banks.

The banks deliver the bonds to the Fed, and the Fed pays for them with money from thin air. The popular name for this is quantitative easing, or QE, although the Fed’s technical name is long-term asset purchases. The Fed did QE in three rounds from 2008 to 2013. They gradually tapered new purchases down to zero by 2014. Since then, the Fed has been stuck with $4.5 trillion of bonds that it bought with the printed money. When the bonds mature, the Fed buys new ones to maintain the size of its balance sheet. But now the Fed wants to “normalize” its balance sheet and get back down to about $2 trillion. They could just sell the bonds, but that would destroy the bond market. Instead, the Fed will let the old bonds mature, and not buy new ones. That way the money just disappears and the balance sheet shrinks. The new name for this is “quantitative tightening,” or QT. You’ll be hearing a lot about QT in the months ahead.

Tapering, QT, it’s all just more ‘uncharted territory’.

• ECB Tapering to Cause “Disorderly Restructuring” of Italian Debt, Return to Lira (DQ)

Here’s the staggering scale of the Italian government’s dependence on the ECB’s bond purchases, according to a new report by Astellon Capital: Since 2008, 88% of government debt net issuance has been acquired by the ECB and Italian Banks. At current government debt net issuance rates and announced QE levels, the ECB will have been responsible for financing 100% of Italy’s deficits from 2014 to 2019. But now there’s a snag. Last month, the size of the balance sheet of the ECB surpassed that of any other central bank: At €4.17 trillion, the ECB’s assets have soared to 38.8% of Eurozone GDP. The ECB has already reduced the rate of purchases to €60 billion a month. And it plans to further withdraw from the super-expansionary monetary policy. To do this, according to Der Spiegel, it wants to spread more optimistic messages about the economic situation and gradually reduce borrowing.

[..] By the halfway point of 2018 the ECB would have completed tapering and it would then use the second half of the year to move away from negative interest rates. So far, most current ECB members have shown scant enthusiasm for withdrawing the punch bowl. The reason most frequently cited for not tapering more just yet is their lingering concern about the long-term sustainability of the Eurozone’s recent economic turnaround. The ECB’s binge-buying of sovereign and corporate bonds has spawned a mass culture of financial dependence across Europe, while merely serving to paper over the cracks that began forming — or at least became visible — in some Eurozone economies during the sovereign debt crisis. In many places the cracks are even bigger than they were back then. This is the elephant in the ECB’s room, and by now it’s too big to ignore.

In one country alone, the cracks are so large that they could end up fracturing the entire single currency project. That country is Italy. Astellon Capital’s report on Italy’s dependence on ECB bond purchases poses the question: If the ECB tapers its purchase of Italian bonds further, who would pick up the slack? The Italian banks, which are themselves deep in crisis mode and whose balance sheets are already filled to the gills with Italian bonds? Hardly. When QE ends, the banks are more likely to become net sellers, rather than net buyers, of Italian debt. The only way for the game to continue is if over the next six years non-banks increase their purchase activity up to seven times that of the past nine years. In other words, the very same investors who have used QE as the perfect opportunity to offload the immense risk of holding Italian liabilities onto the Bank of Italy’s, and then onto the Eurosystem’s, would need to step back into the market in a massive way, just at a time that the country in question is on the verge of a full-blown banking crisis.

No kidding.

• Russia-US Relations Have Become ‘Extremely Paranoid’ – Sberbank CEO (CNBC)

Diplomatic relations between America and Russia have deteriorated to such an extent that contacts between the two countries have become extremely paranoid of one another, the chief executive of Russia’s largest bank has told CNBC. “From what we see here in Russia and from the programs we see from the U.S., the unfolding situation is fairly complex. And there are certain signs of a certain… paranoid attitude to Russia and to every single contact with Russia real or imagined,” Herman Gref, Sberbank CEO, said via a translator. [..] When asked whether Gref harbored any concerns about the consequences of having met with Trump in the past, he replied, “I think the situation has become extremely paranoid for one to suspect that these sort of contacts could lead to political consequences.”

Speaking in January at the World Economic Forum in Davos, Sberbank’s CEO had predicted the Trump administration could re-establish close ties with the Kremlin and expressed his hope the newly-elected U.S. president could mark a “new beginning” for the two countries. On Friday, Gref suggested it was still too early to judge the success of Trump’s presidency however conceded that, for the time-being at least, relations between American and Russia were unlikely to change for the better. Moscow is currently enduring the sharp end of tough international sanctions from Washington[..] . “Well, I have to say that this has had an effect on us in the last two years… The inability to access international markets is painful for us,” Gref said. “You know, sanctions were put in place for political reasons and most likely their removal will also be motivated by politics…

China’s official government paper.

• Western Democracy – As Represented By The US – Is Crumbling (Global Times)

The American elite still refuse to accept Trump after his 100 days in the Oval Office. He is at odds with the mainstream media; insiders have constantly leaked information to the media. Now some commentators have compared the exposure of the Comey memo to the Watergate scandal. As Congress is under Republican control, few believe there will be a move to impeach the president, but these latest revelations will certainly further erode Trump’s presidential authority. At the beginning of the corruption scandal, few believed that South Korean president Park Geun-hye would be impeached either. Could this be a reference for Trump’s case? But evidence of Park’s illegal activities was solid, while it will be more complicated to make determinations over whether Trump obstructed justice and leaked classified intelligence.

To impeach Trump will need more evidence from further investigation. To completely discredit Trump among voters, the present scandal is not enough as it does not add to the negative image of Trump. Many just think Trump often speaks off the cuff, which ends up in silly blunders. If there is a major substantive scandal over and above him speaking out of turn then that will be another thing. But this is not the case at the moment. Every country has its own troubles. The US model represents Western democracy, but it is crumbling, and the resulting social division has become more and more serious. The US Deputy Attorney General Rod J. Rosenstein appointed a special counsel to oversee the investigation into link between Russia and the 2016 US presidential election and related matters on Wednesday.

More juicy details will continue to appear and the rifts may become wider. Trump will become one of the most frequently accused Americans. The US won’t be engulfed by chaos if its president is caught in a lawsuit. Someone has pointed out that no matter how chaotic the White House and Capitol Hill are, the overall operation of the US will not be a major problem as long as the enterprises and social organizations in the country are stable. This is seen as an advantage of the American system. Although American society is relatively stable, the political tumult can’t be taken as an advantage of the US system. The fact is that US politics is in trouble, and the benefits brought by its system are being squandered.

Democracy as a threat to the state.

• Secret Plans To ‘Protect’ France In The Event Of Le Pen Victory Emerge (G.)

It was never written down and never given a name, but France had a detailed plan to “protect the Republic” if far right leader Marine Le Pen was elected president, French media have reported. “It was like a multi-stage rocket,” an unnamed senior official told l’Obs magazine. “The philosophy, and the absolute imperative, was to keep the peace, while also respecting our constitutional rules.” [..] L’Obs cited three anonymous sources with knowledge of the emergency plan that would have been put into effect had Le Pen reached the Elysée palace, saying it was devised by a small group of ministers, chiefs of staff and top civil servants. The magazine said the plan was aimed mainly at preventing serious civil unrest and “freezing” the political situation by convening parliament in emergency session and maintaining the outgoing prime minister in office.

Police and intelligence services were particularly concerned by the threat of “extreme violence” from mainly far left protesters in the event of a Le Pen victory as the country would have found itself “on the brink of chaos”. Even before the first round of voting on 23 April, a confidential note drawn up by the intelligence services announced that “without exception, every local public safety directorate has expressed its concern”, Le Parisien reported. Regional police chiefs were asked on 21 April to detail their crowd control and deployment plans, l’Obs said. Under France’s ongoing state of emergency, more than 50,000 police and gendarmes and 7,000 soldiers were already on duty. On 5 May, two days before the second round that Macron won by 66% to Le Pen’s 34%, the national public safety directorate warned in another note that protesters were ready to use “fireworks, mortars and incendiary bombs”.

“If you do what you believe in, you’re strong. It’s when you don’t do what you believe in that you’re weak. And we are strong.”

• What Jeremy Corbyn Whispered In My Ear (Ind.)

When I shook his hand, I told him that I work for a charity and freelance as a journalist, writing on politics and social justice issues. I expressed my disappointment that Labour (and particularly Corbyn himself) doesn’t get a fair hearing from many news outlets. He spoke in my ear: “If you do what you believe in, you’re strong. It’s when you don’t do what you believe in that you’re weak. And we are strong.” The unveiling of Labour’s manifesto today was a display of strength. Labour is promising a Britain that works for everyone, where whole swathes of society aren’t left behind. The transformative manifesto will take the financial burden from the shoulders of those who can least afford to carry it, and place it upon the top 5% of earners and arrogantly tax-dodging corporations.

The Britain we currently live in is untenable for young people, university students, teachers, NHS workers, policemen, the disabled, people with long-term illnesses, people who can’t find work, first-time buyers, and those living in rented accommodation. Britain is working for a wealthy few, and Labour’s manifesto highlights the fact, often forgotten, that this is not inevitable. At Bradford University, a huge cheer went up when Corbyn promised to scrap tuition fees and end hospital parking charges. The scandal of zero hours contracts would be a thing of the past under Labour, as will NHS cuts and rises in VAT and income tax for 95% of earners. The manifesto is a document filled with long-overdue, common sense policies.

It addresses the important questions that accompany the Brexit process, including concerns about the protection of jobs and hard-won workers’ rights. It puts children and young people first, promising to invest in them through a National Education Service rather than rely on the failed academies experiment or a ridiculous and divisive reintroduction of grammar schools. In-work poverty is unacceptable. My partner and I both work two jobs and we struggle to make ends meet. We don’t indulge in avocado toast but finding enough for a deposit on a mortgage is sadly out of reach. The pledge to build one million new homes and introduce a £10 living wage by 2020 is crucial for young couples and for anyone working in poorly paid or part-time jobs, notably in care work and service industry roles. If Labour’s manifesto and the promise of more public ownership will transport us to the 1970s, where do we currently live? 1870, perhaps?

Single payer rules. Supreme.

• Study Of Healthcare Quality In 195 Countries Names The Best And Worst (AFP)

Neither Canada nor Japan cracked the top 10, and the United States finished a dismal 35th, according to a much anticipated ranking of healthcare quality in 195 countries, released Friday. Among nations with more than a million souls, top honours for 2015 went to Switzerland, followed by Sweden and Norway, though the healthcare gold standard remains tiny Andorra, a postage stamp of a country nestled between Spain (No. 8) and France (No. 15). Iceland (No. 2), Australia (No. 6), Finland (No. 7), the Netherlands (No. 9) and financial and banking centre Luxembourg rounded out the first 10 finishers, according to a comprehensive study published in the medical journal The Lancet.

Of the 20 countries heading up the list, all but Australia and Japan (No. 11) are in western Europe, where virtually every nation boasts some form of universal health coverage. The United States – where a Republican Congress wants to peel back reforms that gave millions of people access to health insurance for the first time – ranked below Britain, which placed 30th. The Healthcare Access and Quality Index, based on death rates for 32 diseases that can be avoided or effectively treated with proper medical care, also tracked progress in each nation compared to the benchmark year of 1990.

Virtually all countries improved over that period, but many – especially in Africa and Oceania – fell further behind others in providing basic care for their citizens. With the exceptions of Afghanistan, Haiti and Yemen, the 30 countries at the bottom of the ranking were all in sub-Saharan Africa, with the Central African Republic suffering the worst standards of all. “Despite improvements in healthcare quality and access over 25 years, inequality between the best and worst performing countries has grown,” said Christopher Murray, director of the Institute for Health Metrics and Evaluation at the University of Washington, and leader of a consortium of hundreds of contributing experts.

“Dogs and cats and pigs and sheep were counted in Australia before Aboriginal people”

• 50 Years Since Indigenous Australians First ‘Counted’, Little Has Changed (G.)

Sol Bellear, a former rugby league player for South Sydney Rabbitohs and Aboriginal rights activist, sits in the soft autumn sunshine at a cafe intersecting Redfern Park and the oval that remains the spiritual home of his beloved club. He sips a Red Bull “heart starter” and English breakfast tea. And he shakes his head while contemplating the anniversaries of what ought to have been transformative moments for Aboriginal and Torres Strait Islander people – starting with the 1967 “citizenship” referendum that first made their existence in Australia “official”. “Things should be so much better for Aboriginal people. I think the country saw 1967 as the end of the fight,” Bellear says.

“Before 1967, we weren’t counted in the census or anything as people. Dogs and cats and pigs and sheep were counted in Australia before Aboriginal people.” Indigenous people had never previously been officially included among the Australian citizenry, nor counted in the Commonwealth census – so the federal government could not legislate for them. But on 27 May 1967, more than 90% of the Australian electorate voted at the “citizenship” referendum to effectively bring Indigenous people into the Commonwealth. “After the referendum, though, it was like the work was done for the rest of the country and governments – when it was actually just the bloody beginning,” Bellear says. “Every little thing we’ve won since, we’ve had to fight for.”

2017 is also the 25th anniversary of two more critical moments in the story: the Mabo decision – a High Court ruling that led to native title land rights, and former prime minister Paul Keating’s landmark “Redfern speech” (“We committed the murders – we took the children from their mothers”). It was Bellear who introduced Keating at Redfern Park. This was the first time an Australian prime minister had frankly, without qualification, acknowledged the violence, sickness, dispossession and ongoing oppression that colonialism had imposed on Indigenous people. Yet a quarter of a century on, Bellear says his country remains deaf to all the non-government reports into Indigenous lives – and to the savage critiques of Commonwealth policies that purported to make them better.

[..] Aboriginal and Torres Strait Islanders constitute some 3% of the country’s overall population – yet in 1991, they comprised 14% of Australia’s prisoners. A quarter of a century later, that figure was up to 27% – while more than 150 Indigenous people had died in custody in the intervening 25 years. In some parts of Australia, many more young Indigenous men complete prison terms than high school. The Indigenous rate of imprisonment is 15 times the age-standardised non-Indigenous rate. As Thalia Anthony pointed out in her 2015 book Indigenous People, Crime and Punishment, rates of Indigenous incarceration in Australia today match those of black imprisonment in apartheid South Africa.

Home › Forums › Debt Rattle May 19 2017