Andrew Wyeth Christina’s world 1948

Excellent from David McWilliams on what the euro has done to Italy.

• Why Italy Had To Say Goodbye To The Dolce Vita (David McWilliams)

Sometimes it is not appreciated quite how industrial Italy is. It has long been Europe’s second-biggest manufacturing power, beaten only by Germany. Italy is far more industrial than France or the UK. In some areas of design and high-quality manufacturing, Italy is still without peer. However, since it gave up the lira and adopted the euro – in effect Germany’s currency – things have gone pear-shaped. This economic calamity is driving Italian politics, leading many to question the euro and Italy’s membership of it. From 1945 to 1995 there was an understanding that Italy would devalue the lira. This is what Italy did. Traditionally, it devalued the lira every few years. This kept Italian industry competitive.

For example, when Italy joined the European Monetary System, in 1979, the exchange rate was 443 lire per Deutschmark. By 1990, the year of German reunification, the rate was 750 lire to the Deutschmark. By 1995 it was 1,000 lire to the Deutschmark. In the 1992 currency crisis the lira fell to a low of 1,250 against the Deutschmark before recovering a bit. The gradual fall in the value of the lira was a price that the Italians were prepared to pay for industrial success. Contrary to the dogma spouted by Europe’s central bankers, Italian devaluations worked particularly well. From 1979 to 1998, Italian industrial production outpaced that of Germany by more than 10%. Italian equities outperformed German equivalents by 16% – after having taken into account the devaluations.

So not only was Italian industry growing faster than German industry, aided by lira devaluations, but also the return on capital in Italy was higher than in Germany. This is because if the stock market of a country is outperforming another country’s, it implies that the capital that is deployed in the faster-growing country is being deployed more efficiently. Therefore, not only was Italy growing more quickly than Germany, but it was more efficient too. Then came the euro. Since Italy joined the single currency, almost to the day, its industry has gone backwards. Having outperformed German stocks during the period of the lira, Italian stocks have underperformed German stocks by a whopping, bankruptcy-inducing 65%.

During the half-century when Fellini was writing the story of postwar Italian success, the Italian stock market almost always returned more than the German stock market. Once Italy joined the euro that stopped almost overnight. Deep in the economy, the strictures imposed by the euro have destroyed much of Italian industry. For example, having outgrown Germany’s industrial output in the 1980s and 1990s by 10%, Italian factory output since Italy joined the euro has lagged Germany’s by 40%.

Hard to summarize this long Zero Hedge piece. Depending on where you look, Italy may not be all that weak.

“If you owe the ECB €10 billion, you have no leverage. If you owe the ECB €426 billion, you have all the leverage.”

• An Italian Exit May Be Rome’s Best Option – JPMorgan (ZH)

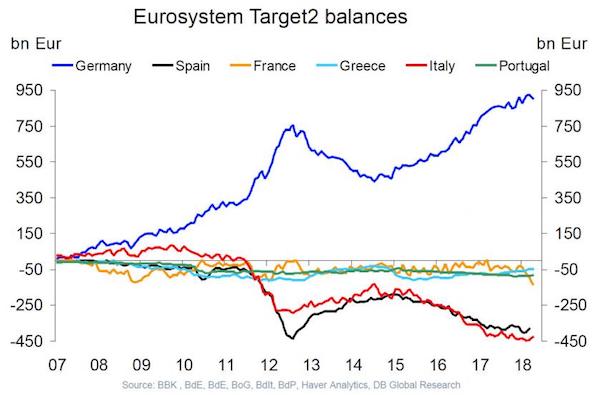

[..] with €426BN, Italy has the highest Target2 deficit with the Eurosystem (Spain is a close second with €377BN) any discussion about an Italian euro exit raises concerns about costs. [..] due to QE induced cross border flows since 2015, Target2 balances have exploded since the launch of the ECB’s QE (and third Greek bailout in 2015), and surpassed the previous extremes from the depths of the euro debt crisis in the summer of 2012.

[..] a euro exit by a debtor country would represent more of a cost to creditor countries such as Germany rather than to the exiting country itself. And, as shown in the chart above, Germany sure has a lot of implicit accumulated costs, roughly €1 trillion to be precise, as a result of preserving a currency union that allowed German exporters to benefit from a euro dragged lower by the periphery, relative to where the Deutsche Mark would be trading today. But here the analysis gets slightly more complex, as Target2 does not provide the full picture of potential costs (or benefits, assuming a scorched earth approach). As JPMorgan writes, the Target2 liabilities of a debtor country give only a partial picture of the cost to creditor nations from that debtor country exiting.

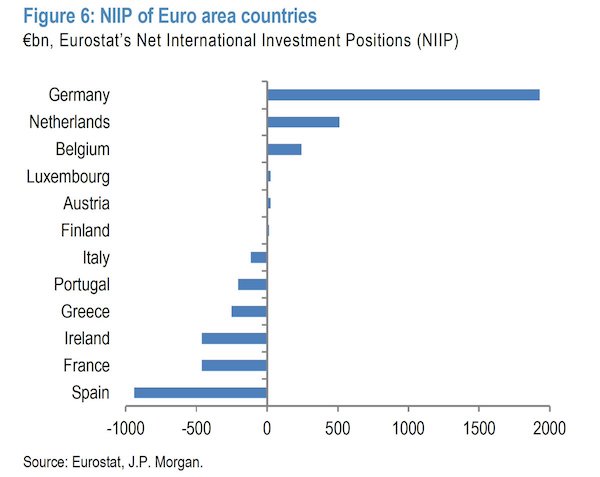

This is because Target2 balances represent only one component of the Net International Investment Position of a country, i.e. the difference between a country’s total external financial assets vs. liabilities. The broader metric that one must use, is of the Net International Investment Position for euro area countries and is shown in the chart below. It shows that contrary to the Target2 imbalance, Italy leaving the euro would inflict a lot less damage to creditor nations than Spain leaving the euro. This is because Spain’s net international investment liabilities stood at close to €1tr as of the end of last year, almost three times as large as its Target2 liabilities. In contrast Italy’s net international investment liabilities were much smaller and stood at only €115bn at the end of last year, around a quarter of its €426bn Target2 liabilities. This, as JPM explains, is because Italy has accumulated over the years more external assets than Spain and should thus be overall more able to repay its external liabilities.

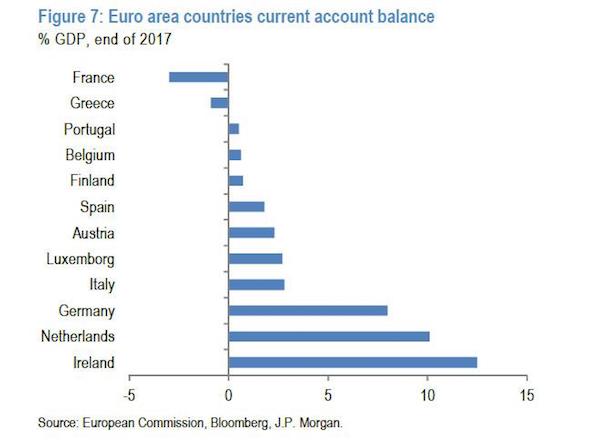

[..] Ironically, the surprisingly low net international investment liabilities of Italy are the result of the persistent current account surpluses the country has been running since the euro debt crisis of 2012, and smaller current account deficits compared to Spain before the crisis. The flipside is that the current account surplus – in theory – also makes it easier for a country like Italy to exit the euro relative to a current account deficit country. This is because the higher the current account deficit of a debtor country, the higher the cost of an exit for this country as the current account deficit would have to be closed abruptly following an exit. Most importantly, this means that as a result of Italy’s decent current account surplus, from a narrow current account adjustment point of view, its own cost of a euro exit should be relatively small.

Merkel has weakened a lot. Italy knows it.

• Angela Merkel Rules Out Debt Relief For Italy (CNBC)

German Chancellor Angela Merkel appeared on Saturday to rule out debt relief for Italy, saying in a newspaper interview that the principle of solidarity among members of the euro zone should not turn the single currency bloc into a debt-sharing union. “I will approach the new Italian government openly and work with it instead of speculating about it intentions,” Merkel told the Frankfurter Allgemeine Sonntagszeitung in an interview to be published on Sunday.

On Friday, Italy swore a populist coalition into power, ending months of political uncertainty that hit global markets in the last week. Newly designated Prime Minister Giuseppe Conte will lead Western Europe’s first anti-establishment government with the aim of cutting taxes, boosting spending on welfare and overhauling EU rules on budgets and immigration. Italy accounts for 23.4 percent of the euro zone’s public debt and 15.4 percent of the bloc’s GDP, according to Eurostat.

Conte has a full agenda.

• New Italy PM Starts Off In Shadow Of His Powerful Deputies (AFP)

Italy’s new prime minister Giuseppe Conte mostly kept quiet on his full first day in office Saturday, while his two powerful deputies took centre stage in setting the tone of the populist government’s policy. Conte, a political novice, was finally sworn in on Friday as the head of a government of ministers from the anti-establishment Five Star Movement and the far-right League, ending months of uncertainty since elections in March. But Conte was a compromise candidate between Five Star leader Luigi Di Maio and the League’s Matteo Salvini – both of whom are now his deputy prime ministers – and he will have to walk a delicate line to push through the anti-austerity and pro-security promises their populist parties campaigned on.

The 53-year-old academic also inherited a daunting list of issues from his predecessor Paolo Gentiloni, including the financial travails of companies such as Ilva and Alitalia, a Group of Seven summit in Canada and a key EU summit at the end of the month, as well as the thorny question of immigration. Immigration is the bugbear of Conte’s interior minister, Salvini, the 45-year-old leader of the anti-immigrant, anti-Islam League. Salvini announced Friday that he would visit Sicily to see the situation for himself at one of the main landing points for refugees fleeing war, persecution and famine across North Africa and the Middle East. “The good times for illegals is over – get ready to pack your bags,” Salvini said at a rally in Italy’s north on Saturday, adding however that he wants to economically assist migrants’ countries of origin.

His comments come after more than 150 migrants, including nine children, disembarked from a rescue ship late Friday in Sicily. Conte attended a military parade alongside President Sergio Mattarella on Saturday, marking Republic Day for the foundation of the Italian Republic in 1946. However the new prime minister has issued few public statements since being appointed. On Saturday he did post on Facebook that he had spoken with German Chancellor Angela Merkel and French President Emmanuel Macron and would meet the two leaders at the G7 summit, where he will be a “spokesman for the interests of Italian citizens”. Conte has also opted to keep the country’s intelligence services under his personal control.

Deputy premier Di Maio, who is serving as economic development minister, also took to Facebook, calling for “entrepreneurs to be left alone”. “Employers and employees in Italy must not be enemies,” he said, promising “I will not disappoint you”. On Saturday evening Five Star held a rally in the centre of Rome with thousands of supporters and all its ministers to celebrate “the government of change”. Di Maio told the crowd that “from today, the state is us”. Five Star’s founder, former comic Beppe Grillo, rang a bell in front of the crowd, saying the sound “marks the fracture between a world that is going away and a new one that is arriving”.

Right. Sure.

• Juncker: EU Won’t ‘Meddle’ In Italy’s Affairs (O.)

Italy, the third-largest economy in the eurozone, has a public debt second only to Greece’s and there was a negative reaction from the financial markets to the League-M5S coalition, which plans to significantly raise public spending. Juncker offered a more placatory tone, suggesting that Brussels and Berlin had learned the lessons of the Greek crisis. He also denied that the eurozone was set on a course for another economic downturn: “The Italians cannot really complain about austerity measures from Brussels. However, I do not now want to lecture Rome. We must treat Italy with respect. Too many lectures were given to Greece in the past, in particular from German-speaking countries. This dealt a blow to the dignity of the Greek people. The same thing must not be allowed to happen to Italy.”

Juncker said that the financial markets’ reaction was “irrational”: “People should not draw political conclusions from every fluctuation in the stock market. Investors have been wrong on so many occasions.” Neither of the coalition parties in the new Italian government campaigned on leaving the euro or the EU, but both have backed such calls in the past and are scathing about the rules that underpin the eurozone. Mujtaba Rahman, a former European commission and UK Treasury official who now works for consultancy the Eurasia Group, warned that as the cornerstone of the coalition government’s platform was fiscal expansion, it was liable to clash with the commission this autumn.

“Though no official estimates have been produced, independent estimates suggest the proposed measures would cost, combined, upwards of €100bn per annum, around 6% of GDP.“If the government were to propose a very expansionary budget, the commission – which provides its opinions and recommendations on member states’ draft budgetary plans – would have to reject it in September. This would be a first, and would set the stage for a real confrontation with Rome,” he said. “A significant deviation from EU-mandated fiscal targets may prompt the commission to open a new Excessive Deficit Procedure, a process designed to give the EU more power to enforce austerity on Rome. Yet the symbolism of this move would only strengthen the Italian government’s domestic standing.”

Poker player?!

• Political Bruiser Sánchez Stuns Spain To Become PM (Spain Report)

Forget about what the new socialist government’s policies are going to be, because no one really knows yet. Forget about who the new ministers are going to be, because no one really knows yet. And forget about how long this government is going to last. No one has a clue right now. What is worthy of note is how Pedro Sánchez has just crushed all of his political opponents in a week. Last Friday, the PSOE had slowly slumped to less than 20% in the polls and he was being written off by columnists and commentators. This Saturday, he will be driven to Zarzuela Palace to be sworn in as the new socialist Prime Minister of Spain [..]

Mr. Rajoy is likely not the only political leader who needs a stiff drink this weekend. Pedro Sánchez has just left Pablo Iglesias—who nine days ago thought his biggest problem was an absurd internal ballot about his new luxury home—sitting in the dust in the fight for the Spanish left. Two years ago, with the sudden appearance and meteoric rise of Podemos, Mr. Iglesias’s stated strategic goal was not to win the election but to dominate the Spanish left. He just lost that race. Pedro Sánchez has just left Ciudadanos leader Albert Rivera rabbiting on incessantly about wanting a new general election instead of the socialists “unfairly” grabbing power, because Mr. Rivera is—or was—doing rather better in the polls than the rest.

But rabbit on is all he can do for now because, just like nine days ago, in the real world Ciudadanos still only has 32 seats in Congress. And Pedro Sánchez has just left the powerful leader of the Socialist Party in Andalusia, Susana Diaz, well, in Andalusia. This might be the sweetest victory of all for the new Prime Minister, because it was she who wielded her considerable internal and establishment influence in October 2016 to oust Mr. Sánchez as leader of the PSOE, allowing Mariano Rajoy to be reappointed Prime Minister after a year of national stalemate unbroken by two general elections.

Again: Pedro Sánchez, written off by some as being too handsome to have any interesting ideas, has, somewhere along the way, learnt to execute political hit jobs that have left all of his major political opponents staggering, and sent what was a confident conservative party that had only just passed a new budget—two days previously—scurrying into opposition, wounded. In a week. Whatever happens next in Spanish politics, do not underestimate Pedro Sánchez.

More division.

• Europe: Confront Trump or Avoid a Costly Trade War (NYT)

Despite its name, the European Union is not generally a model of unity. If Mr. Trump was banking on internal division stymieing the European response, he picked an opportune moment. Britain is consumed with domestic sniping over its pending departure from the European Union, making it a bit player in these proceedings. Italy has been immersed in the operatic political drama at which it excels, only Friday swearing in a new government after inconclusive elections in March. The incoming government presents a coalition of two populist parties that have expressed disdain for the European Union and the shared euro currency, stoking fears that the bloc will be presented with a new challenge to its cohesion.

Spain just swapped governments. Germany is headed by a chastened chancellor Angela Merkel following her own lengthy struggles to form a government after elections last fall. The French president has been frustrated in his attempts to forge greater political unity within the bloc. “Europe is in disarray,” said Nicola Borri, a finance professor at Luiss, a university in Rome. “It’s even difficult to understand who is in power in Europe.” In deliberating how to respond to Mr. Trump’s tariffs, the key schism appears to run between Germany and the rest of the bloc. “I don’t think there is a unified consensus for how to deal with the Americans,” said Meredith Crowley, an expert on international trade at the University of Cambridge in England. “The Germans benefit from open markets globally, so they don’t want to throw up more barriers to free trade.”

That’s quite the statement. What if Beijing said the same about the US?

• US Wants Structural Changes To China’s Economy: Mnuchin

The United States wants trade talks in Beijing this weekend to result in structural changes to China’s economy, in addition to increased Chinese purchases of American goods, U.S. Treasury Secretary Steven Mnuchin said on Saturday. U.S. Commerce Secretary Wilbur Ross arrived in Beijing on Saturday with an interagency team of U.S. officials for talks on long-term purchases of U.S. farm and energy commodities, just days after Washington renewed its threats to impose tariffs on Chinese goods.

The purchases are partly aimed at shrinking the $375 billion U.S. goods trade deficit with China. Mnuchin, speaking at a G7 finance leaders meeting in Canada where he was the target of U.S. allies’ anger over steel and aluminum tariffs, said the China talks would cover other issues, including the Trump administration’s desire to eliminate Chinese joint venture requirements and other policies that effectively force technology transfers.

It’s election time.

• Uber’s ‘Business Is Finished’ In Turkey, Erdogan Says (R.)

Turkey’s President Tayyip Erdogan has said ride hailing app Uber is finished in Turkey, following pressure from Istanbul taxi drivers who said it was providing an illegal service and called for it to be banned. About 17,400 taxis operate in Istanbul, home to about a fifth of Turkey’s population of 81 million people, and since Uber entered the country in 2014 tensions have risen sharply. Erdogan’s statement came after new regulations were announced in recent weeks tightening transport licensing requirements, making it more difficult for drivers to register with Uber and threatening a two-year ban for violations.

“This thing called Uber emerged. That business is finished. That does not exist anymore,” he said in a speech in Istanbul late on Friday. “We have our taxi system. Where does this (Uber) come from? It is used in Europe, I do not care about that. We will decide by ourselves,” added Erdogan, who is running for re-election in three weeks. [..] Uber said that about 2,000 yellow cab drivers use its app to find customers, while another 5,000 work for UberXL, using large vans to transport groups to parties, or take people with bulky luggage to Istanbul’s airports.

The Tories can’t wait to return to Dickens.

• Britain’s Low-Paid Face Decade Of Wage Squeeze (O.)

The wages of 10 million low-paid workers have stalled for two decades and face pressure for a decade to come, according to a bleak assessment of Britain’s future jobs market. Global economic competition, automation, the shift to the gig economy and a widening regional divide will see further pressure placed on the incomes of those earning between £10,000 and £15,000, it warns. The analysis by the Centre for Social Justice (CSJ) thinktank, which is on the political right and chaired by the former Tory leader Iain Duncan Smith, also blamed a chronic national failure to boost skills and education. It will be seen as another warning to Theresa May from Conservative figures to kickstart her domestic agenda.

There have been concerns within the party that the focus on Brexit has led to inaction in other crucial areas that could hold Britain back after its exit from the European Union. The analysis, co-written by Boris Johnson’s former economic adviser and Brexit supporter Gerard Lyons, concludes that wages of those on the lowest salaries stalled long before the 2008 financial crash. It warns that the current evidence shows that most never escape a life on low pay. The centre’s support for action on low pay shows that it is now an issue of concern across the political spectrum, with automation expected to place further pressure on jobs in some low-paid sectors unless new skills and opportunities are developed.

The CSJ report states that 20% of Britain’s 33 million workers earn £15,000 a year or less, and that 50% earn no more than £23,200. Only 10% of employees, or about 3 million people, earn above £53,000 a year. Britain does not compare well with other developed nations when it comes to low pay, it states. Taking data from manufacturing, and giving the US a score of 100, Switzerland topped the table with a pay rate of 155, followed by Norway on 126, Germany on 111 and France on 97. However, the UK was much further behind, on 73.

These people would be better off moving to Poland.

• UK Universal Credit Change To Bar 2.6m Children From Free School Meals (Ind.)

Up to 2.6 million children whose parents are on benefits could be missing out on free school meals by 2022, the shadow education minister will warn. Angela Rayner will tell a GMB union conference on Sunday that the Government’s claims on school meals are “falling apart” after changes to eligibility under Universal Credit (UC). When the system was first introduced in 2013, all children of recipients – who were all unemployed – were eligible for free school meals (FSM), as they would have been under the old system. But in April the criteria was tightened based on income. In England, the net earnings threshold will be £7,400 whereas in Northern Ireland it will be £14,000.

A government technical note published in May said that if the change had not been made, “around half of all (state school) children would become eligible for FSM and the meals would no longer be targeted at those who need them the most”. It said that in 2017 around 1.1 million disadvantaged children were eligible and received a free school meal, some 14 per cent of all state-school pupils. But if the change had not been made the number of additional children who would have been eligible was between 2,300,000 and 2,600,000 by 2022.

And that’s just one animal that we could see.

• Whale Dies From Eating More Than 80 Plastic Bags (AFP)

A whale has died in southern Thailand after swallowing more than 80 plastic bags, with rescuers failing to nurse the mammal back to health. The small male pilot whale was found barely alive in a canal near the border with Malaysia, the country’s department of marine and coastal resources said. A veterinary team tried “to help stabilise its illness but finally the whale died” on Friday afternoon. An autopsy revealed 80 plastic bags weighing up to 8kg (18lb) in the creature’s stomach, the department added. People used buoys to keep the whale afloat after it was first spotted on Monday and an umbrella to shield it from the sun. The whale vomited up five bags during the rescue attempt.

Thon Thamrongnawasawat, a marine biologist and lecturer at Kasetsart University, said the bags had made it impossible for the whale to eat any nutritional food. “If you have 80 plastic bags in your stomach, you die,” he said. Thailand is one of the world’s largest users of plastic bags. Thon said at least 300 marine animals including pilot whales, sea turtles and dolphins, perished each year in Thai waters after ingesting plastic. “It’s a huge problem,” he said. “We use a lot of plastic.” The pilot whale’s plight generated sympathy and anger among Thai netizens. “I feel sorry for the animal that didn’t do anything wrong, but has to bear the brunt of human actions,” wrote one Twitter user.

Home › Forums › Debt Rattle June 3 2018