Roy Lichtenstein Crying girl 1964

“.. If the above forecast of a major fall in the population as well as a substantial increase in debt is even vaguely accurate, Italy is on its way to the Dark Ages..”

• This Is Why The Global Collapse Will Be Devastating (von Greyerz)

“The ECB (European Central Bank) just had its 20th birthday. But there is really nothing to celebrate. The EU is in a total mess and the Euro, which was launched on January 1, 1999, is a failed currency. Every president of the ECB has had to deal with fires that had very little to do with price stability but were more a question of survival. Most of these fires were a lot more serious than the candles in the Euro cake above which Draghi is trying to blow out. During the Frenchman Trichet’s watch, he had to deal with the Great Financial Crisis that started in 2006…

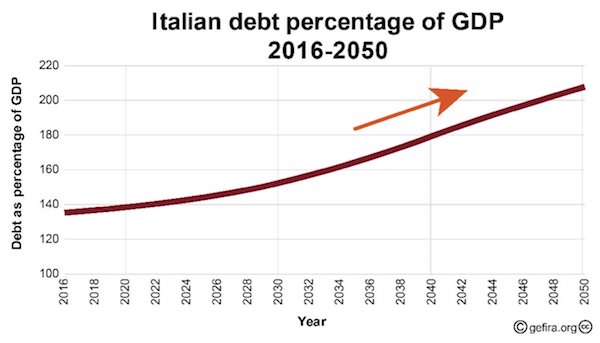

[..] The EU now has major economic and/or political problems in many countries. Italy’s new coalition government is a protest against the EU and Euro. With debt to GDP already the highest in Europe, the new regime will exacerbate the problems. Lower taxes and higher spending will guarantee that. As the chart below shows, Italian debt to GDP is already 140%. By 2050 this is projected to grow to 210%. As interest rates go up, servicing the growing debt will soon absorb all tax revenue. Italy will be bankrupt long before 2050 and default on all its debt.

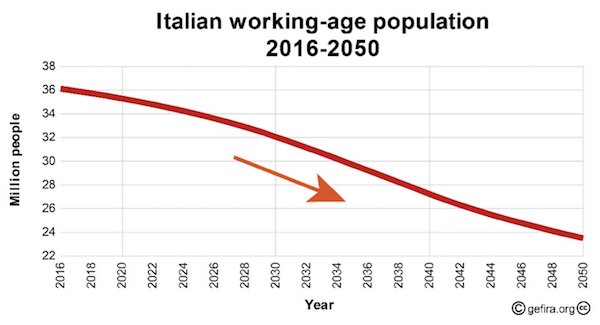

Between now and 2050, the Italian working age population is forecast to decline by 1/3, from 36 million to 24 million. There will be a lot less people to pay for a much higher debt.

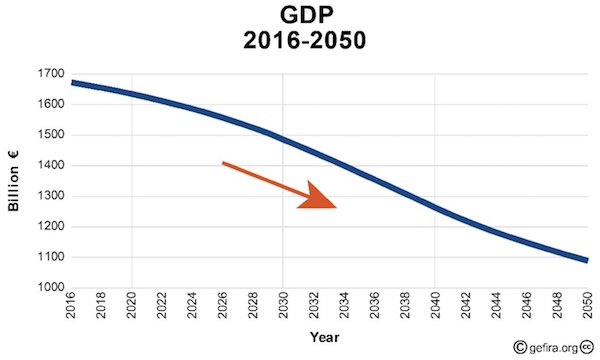

The consequences of massive debt, economic stagnation and population decline will be a much lower GDP, which is expected to decline 35% by 2050.

If the above forecast of a major fall in the population as well as a substantial increase in debt is even vaguely accurate, Italy is on its way to the Dark Ages. I must stress here that I find it so sad that this glorious country is suffering so much already and will suffer a lot more. Personally I love Italy — the people, the food, the architecture, the history and the Giola di Vivere (joie de vivre) of the Italians. It will be so tragic to see all of this disintegrate. Hopefully it will take a long time, although, sadly, the crisis might actually be around the corner.

But Italy is just one of many countries which will collapse in coming years. Spain is in a similar situation and the prime minister has just been kicked out. Greece’s problems have never been resolved and this fine country is also bankrupt and so are the Greek banks. I could go on with Portugal, France, Ireland, the UK and many others. Most of these countries have insoluble problems. It is only a matter of degree and time when the EU/Eurozone house of cards comes down.

To make tariffs threats credible.

• If Trump Wants To Win A Trade War, The Market Has To Crash – Goldman (ZH)

[..] to maintain leverage in negotiations, the Administration must convince trading partners that the US intends to impose trade restrictions. However, and this is the key part, “it is unlikely that the White House can convince trading partners that tariff threats are credible without also convincing financial markets.” In other words, for Trump’s trade negotiations to be successful, and for US trade partners to take a flip-flopping Trump credibly, the market has to crash. Incidentally, this makes sense when one considers that when Trump officially launched the trade war with China in early April, the president explicitly warned that stocks “may take a hit”, and told investors to prepare for “pain” in the market, a statement which promptly became a self-fulfilling prophecy and sent the market sharply lower.

The other consequence is that markets may tumble not as an effect, but as a cause of the trade war: after all Trump needs to be taken seriously, and that could mean another slide in the S&P. Goldman agrees as much: “… we do not expect trade policy risks to fade anytime soon. While we think that financial market sentiment around trade issues is unlikely to become as negative again as it was in early April, when the President floated the possibility of tariffs on another $100 billion in imports from China, we do not expect markets to become entirely comfortable with the outlook for trade policy, either.”

The punchline: “The challenge that the White House faces is that, to maintain leverage in negotiations, trading partners must believe that the US intends to follow through with proposed actions like tariffs. However, repeated threats begin to lose credibility unless they are followed up with action.” In short, just as China said earlier, the US can’t have its cake and eat it too: Trump can’t have trade war, or the threat thereof, and record high stocks.

It’s going to be public. But can the Fed afford to damage Deutsche?

• Deutsche Bank Faces Another Challenge With Fed Stress Test (R.)

Deutsche Bank AG will face another challenge this month when the Federal Reserve publishes the results of a “stress test” on the bulk of its U.S. operations for the first time. Germany’s largest lender is already facing challenges with U.S. bank regulators and in financial markets, with its stock price falling to historic lows on Thursday. Standard & Poor’s downgraded its credit rating to BBB+ from A- on Friday. The downgrade came after reports earlier in the week that the Fed designated one of Deutsche Bank’s U.S. businesses as “troubled” last year, something a person with knowledge of the matter confirmed to Reuters on Friday. The Fed’s stress test results, expected to be released sometime this month, will be the next big public barometer of Deutsche Bank’s financial strength.

It could be difficult for a bank with a subsidiary on the “troubled” list to pass the scenarios, according to a person familiar with the tests who was not authorized to speak publicly. That is because the capital, liquidity and risk management failures that would land a bank on the list are similar to those that lead banks to flunk the stress test, the person said. The Fed has been examining how the biggest U.S. banks would handle a range of adverse economic and market scenarios since 2009, requiring many to shore up their capital buffers and risk management controls. But this is the first year it will publicly release results of six foreign lenders, including Deutsche Bank, after requiring them to create consolidated U.S. holding companies with ring-fenced capital. The Fed tested those new entities last year in a trial run, the results of which are confidential.

Austerity eats people.

• The Big Con: How Neoliberals Convinced Us There Wasn’t Enough To Go Around (G.)

Australia just experienced one of the biggest mining booms in world history. But even at the peak of that boom, there was no talk of the wonderful opportunity we finally had to invest in world-class mental health or domestic violence crisis services. Nor was there much talk from either major party about how the wealth of the mining boom gave us a once-in-a-generation opportunity to invest in remote Indigenous communities. Nope, the peak of the mining boom was not the time to help those who had missed out in decades past, but the Howard government thought it was a great time to introduce permanent tax cuts for high-income earners. These, of course, are the tax cuts that caused the budget deficits we have today.

Millions of tonnes of explosives were used during the mining boom to build more than 100 new mines, but it wasn’t just prime farmland that was blasted away in the boom, it was access to the middle class. At the same time that Gina Rinehart was becoming the world’s richest woman on the back of rising iron-ore prices, those on the minimum wage were falling further and further behind their fellow Australians. Australia isn’t poor; it is rich beyond the imagining of anyone living in the 1970s or ’80s. But so much of that new wealth has been vacuumed up by a few, and so little of that new wealth has been paid in tax, that the public has been convinced that ours is a country struggling to pay its bills.

Convincing Australians that our nation is poor and that our governments “can’t afford” to provide the level of services they provided in the past has not just helped to lower our expectations of our public services and infrastructure, it has helped to lower our expectations of democracy itself. A public school in Sydney has had to ban kids from running in the playground because it was so overcrowded. Trains have become so crowded at peak hours that many people, especially the frail and the disabled, are reluctant to use them.

Relax capital controls when nobody has any money left to get out of the bank.

• Greece Relaxes Capital Controls To Prove Worst Of Turmoil Is Over (G.)

Greece is to take a substantial step towards easing capital controls – restrictions associated with the worst days of economic crisis – as it prepares to exit its current bailout programme. Signalling that confidence is gradually returning to the country’s banking system, the leftist-led government has doubled the amount depositors will be able to withdraw from their accounts as of Monday. “As is usually the case with the economy, this is about psychology,” said a senior official at the Bank of Greece. “The relaxation is as much about boosting confidence among investors and savers as showing banks can now afford to work under normal conditions.” Barely three months before its third international bailout programme expires, the country once at the epicentre of the euro crisis is keen to prove its financial turmoil is over.

Under the new rules, the limit on cash withdrawals from local banks will be raised from €2,300 to €5,000 per month. Business transactions will also be facilitated, with cash transfers abroad being doubled to €40,000 a month. The Greek finance ministry said it had similarly decided to increase the amount depositors can take abroad, in euros or foreign currency, from €2,300 to €3,000 per trip. From 1 July, banks will be allowed to accept customer orders for money transfers overseas for up to €4,000 bi-monthly. In a statement the finance ministry said the aim was to fully lift restrictions “as soon as possible” while ensuring macroeconomic and financial stability.

“serious and systemic non-compliance” of anti-money laundering laws more than 53,000 times…”

• Australia’s Commonwealth Bank Agrees To $530M Fine Over Money-Laundering (AFP)

The Commonwealth Bank Monday agreed to the largest civil penalty in Australian corporate history to settle claims it breached anti-money laundering and counter-terrorism financing laws. The Aus$700 million (US$530 million) fine – which is subject to court approval – comes after mediation between the nation’s biggest lender and the country’s financial intelligence agency AUSTRAC. It follows the bank being taken to court last August for “serious and systemic non-compliance” of anti-money laundering laws more than 53,000 times, with AUSTRAC filing 100 further claims in December. CBA was also accused of failing to adequately monitor suspected terrorist financiers.

“While not deliberate, we fully appreciate the seriousness of the mistakes we made,” said CBA chief executive Matt Comyn in a statement. “Our agreement today is a clear acknowledgement of our failures and is an important step towards moving the bank forward. On behalf of Commonwealth Bank, I apologise to the community for letting them down.” The bank, which in the fallout has replaced senior leadership overseeing financial crimes and pumped millions of dollars into improving its systems, also agreed to pay AUSTRAC’s Aus$2.5 million legal fees.

After slumping more than 10 percent over the past month, during which it admitted losing financial records for almost 20 million customers, CBA’s share price rallied 1.44 percent on the settlement to close at Aus$69.69. The scandal is only the latest issue to damage the reputation of Australian banks, which have been under intense scrutiny amid allegations of dodgy financial advice, life insurance and mortgage fraud, and rigging benchmark interest rates. Last week, ANZ Bank was accused of “cartel arrangements” over a multi-billion-dollar capital raising, along with its advisers Deutsche Bank and Citigroup. They face potential criminal charges.

Germany blows up the EU in slow motion.

• Merkel’s Comeuppance is Europe’s – and the World’s – Misfortune (Varoufakis)

The causal link between Germany’s two political headaches has an economic basis. Trump understands one thing well: Germany and the eurozone are at his mercy, owing to their increasing dependence on large net exports to the US and the rest of the world. And this dependence has grown inexorably as a result of the austerity policies that were first tried out in Greece and then implemented in Italy and elsewhere.

To see the link, recall the “fiscal compact” to eliminate structural budget deficits that Germany insisted upon as a condition of agreeing to bailout loans for distressed governments and banks. Then note that this pan-European austerity drive took place against the backdrop of massive excess savings over investment. Finally, note that large excess savings and balanced government budgets necessarily mean large trade surpluses – and thus the increasing reliance of Germany, and Europe, on massive net exports to the United States and Asia. In other words, the same incompetent policies that gave rise to the xenophobic, anti-Europeanist Italian government also bolstered Trump’s power over Merkel.

Europe’s inability to get its own house in order has engendered a new Italian majority that is planning to expel a half-million migrants, blowing fresh winds into the sails of militant racists in Hungary, Poland, France, Britain, the Netherlands, and, of course, Germany itself. Meanwhile, with Europe too enfeebled to tame Trump, the US will aim to force China to deregulate its financial and tech sectors. If it succeeds, at least 15% of China’s national income will gush out of the country, adding to the deflationary forces that are breeding political monsters in Europe and in the US.

And still no UN emergency meeting. The shame will not wash away.

• Dozens Drown After Migrant Boat Sinks Off Tunisia Coast (G.)

At least 47 people died and 68 others were rescued after their migrant boat sank off Tunisia’s southern coast, according to the country’s defence ministry. Authorities said about 180 people, of both Tunisian and other nationalities, were hemmed in onboard the vessel. A survivor said the captain had abandoned the boat after it hit trouble in order to escape arrest. “I survived by clinging to wood for nine hours,” he told Reuters from a hospital in the city of Sfax where people were arriving in search of relatives and friends. Flavio Di Giacomo, a spokesman for the International Organisation for Migration (IOM), warned on Twitter that the final number of missing was still not known.

Tunisia has recently seen growing use of its coasts by human traffickers ferrying migrants from Africa to Europe, as Libyan authorities have cracked down on similar activity on their own shores. Tunisia has been suffering from an economic crisis since the toppling of Zine al-Abidine Ben Ali as president in 2011, which led to rocketing unemployment and inflation. In a separate incident, nine people including six children were killed off the coast of Turkey on Sunday after their speedboat sank, the Turkish coast guard said. By 30 May, the IOM had recorded 32,080 people as having reached Europe by boat in 2018 and around 660 as having died or gone missing in the attempt.

And there’s always more.

• Six Children, Three Adult Migrants Drown Off Turkish Coast (AFP)

Nine migrants, including six children, seeking to head to Europe in a speedboat drowned on Sunday when the vessel sank off Turkey’s Mediterranean coast, state media reports said. The boat hit trouble off the Demre district of Turkey’s Mediterranean Antalya province, a popular holiday spot, the state-run Anadolu news agency said. Five were rescued while one person was still missing, it added. Two adults, one woman and six children lost their lives, it said. The Dogan news agency said that they were seeking to head illegally to Europe but their planned route was not immediately clear. The nearest EU territory is the small Greek island of Kastellorizo to the west which lies off the Turkish resort of Kas.

The nationalities of those on board have yet to be made clear. Over a million people, many fleeing the war in Syria, crossed to European Union member Greece from Turkey in 2015 after the onset of the bloc’s worst migration crisis since World War II. [..] According to the International Organisation for Migration (IOM), 10,948 people crossed to Greece this year up to May 30, sharply more than in the same period in 2017. Thirty-five people lost their lives using this route so far this year, according to the IOM. As well as migrants from countries such as Syria, Eritrea, Iraq and Afghanistan, the route has been used by Turkish citizens fleeing the crackdown that followed the 2016 failed coup.

Bayer wants to get rid of the bad name Monsanto has. Let’s give Bayer an even worse name.

• Bayer To Close Monsanto Takeover, To Retire Target’s Name (R.)

Germany’s Bayer will wrap up the $62.5 billion takeover of Monsanto on Thursday this week and also retire the name of the U.S. seeds maker, it said on Monday. The German drugmaker had received all required approvals from regulatory authorities, it said in a statement. “Bayer will remain the company name. Monsanto will no longer be a company name. The acquired products will retain their brand names and become part of the Bayer portfolio,” it said. Bayer launched a 6 billion euro ($7 billion) rights issue on Sunday, a cornerstone of the financing package for the deal.

Yeah. We need more air travel. Without counting the externalities.

• Global Airport Capacity Crisis Amid Passenger Boom (AFP)

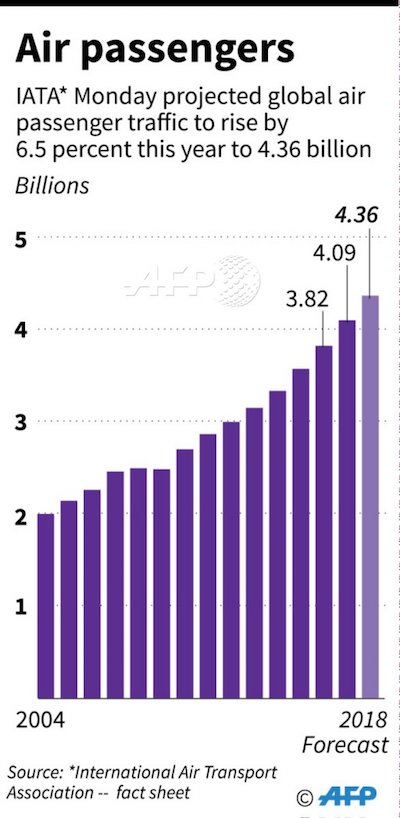

Governments need to urgently tackle a capacity crisis facing airports as demand for international travel grows, but they should be cautious about private sector involvement, airline industry group IATA warned Monday. With passenger levels projected to nearly double to 7.8 billion by 2036, infrastructure such as airports and air traffic control systems were not keeping pace, the International Air Transport Association said. Major airports have sought to address the crisis by managing slots — giving airlines specific operating rights at particular times. But there was still a need for new airports, IATA chief Alexandre de Juniac said at the body’s annual meeting in Sydney.

“We are in a capacity crisis. And we don’t see the required airport infrastructure investment to solve it,” he said, adding that cash-strapped governments were increasingly turning to private firms to increase airport capacity. But he cautioned against privatised airports, warning that they have “not lived up to airline expectations” with many carriers having “far too many bitter experiences”. [..] IATA Monday projected global air passenger traffic to rise by 6.5 percent this year to 4.36 billion, after increases of 7.0 and 7.3 percent in 2016 and 2017 respectively.

Not sure it’s wise to blame this on climate change. The extinction stories come too fast. How about blaming Monsanto and booming air travel?

• Eerie Silence Falls On Shetland Cliffs That Once Echoed Seabirds’ Cries (G.)

Sumburgh Head lies at the southern tip of mainland Shetland. This dramatic 100-metre-high rocky spur, crowned with a lighthouse built by Robert Louis Stevenson’s grandfather, has a reputation for being one of the biggest and most accessible seabird colonies in Britain. Thousands of puffins, guillemots, razorbills, kittiwakes and fulmars gather there every spring to breed, covering almost every square inch of rock or grass with teeming, screeching birds and their young. Or at least they used to – for this year Sumburgh Head is a quiet and largely deserted place. Where seabirds once swooped and cried in their thousands, only a handful of birds wheel round the cliffs.

The silence is uncanny – the result of a crash in seabird numbers that has been in progress for several years but which has now reached an unprecedented, catastrophic low. One of the nation’s most important conservation centres has been denuded of its wildlife, a victim – according to scientists – of climate change, which has disrupted food chains in the North Sea and North Atlantic and left many seabirds without a source of sustenance. The result has been an apocalyptic drop in numbers of Arctic terns, kittiwakes and many other birds. “In the past, Sumburgh Head was brimming with birds, and the air was thick with the smell of guano. The place was covered with colonies of puffins, kittiwakes, fulmars, and guillemots,” said Helen Moncrieff, manager of RSPB Scotland’s office in Shetland.

“There were thousands and thousands of birds and visitors were guaranteed a sight of puffins. Today they have to be very patient. At the same time, guillemots have halved in numbers. It is utterly tragic.” This grim description is backed by figures that reveal the staggering decreases in seabird numbers in Shetland, the most northerly part of the British Isles. In 2000, there were more than 33,000 puffins on the island in early spring. That figure dropped to 570 last year and there are no signs of any recovery this year, although it is still early in the season. Similarly, Shetland’s kittiwake population plummeted from over 55,000 in 1981 to 5,000 in 2011, and observers believe those numbers have declined even further in the past few years.

Absolutely wonderful from Jim.

• Notes on Heartache and Chaos (Jim Kunstler)

I was interviewing a couple of homesteaders on an island north of Seattle at twilight last night when they noticed that the twelve-year-old family dog, name of Lacy, had not come home for dinner as ever and always at that hour. A search ensued and they soon found her dead in the meadow a hundred feet behind the house with two big puncture wounds in her body. Nobody had heard a gunshot. We’d just been talking inside and a nearby window was open. They suspect the dog met up with a black-tailed deer buck out there and was gored to death. We hadn’t heard a yelp, or anything. A week ago, an eagle got one of their geese, and some land-based monster got its companion just the other day.

Nature is what it is, of course, and it’s natural for human beings to think of its random operations as malevolent. That aspersion probably inclines us to think of ourselves as beings apart from nature (some of us, anyway). We at least recognize the tragic side of this condition we’re immersed in, and would wish that encounters between its denizens might end differently — like maybe that two sovereign creatures meeting up by sheer chance on a mild spring evening would exchange pleasantries, ask what each was up to, and go on their ways.

Malevolent nature visited me the night before, back home in upstate New York. Something slit the screened window of my henhouse, got inside, and slaughtered two of my birds. Big Red was missing altogether except for a drift of orange feathers. I found Little Blue just outside in a drift of her own feathers, half-eaten. I suspect a raccoon got them, slitting the window screen cleverly with its dexterous hand-like paws — yes, so much like our own clever hands. (In classic after-the-fact human style, I fortified the window with steel hardware cloth the next day.)

It’s the time of year when the wild critters of field and woodland are birthing their young and anxious to procure food for them. Who can blame them for that. Chicken is an excellent dish. I eat it myself, though never my own hens. I actually rescued Little Blue from the clutches of a red-tailed hawk last year as the hawk struggled to get airborne with her and let go as I screeched at it. Blue recovered from the talon punctures and had a good year — one good year on this earth with all its menace, when it is not busy being beautiful.

Home › Forums › Debt Rattle June 4 2018