P�a�b�l�o� �P�i�c�a�s�s�o� P�o�r�t�r�a�i�t� �o�f� �Ambroise Vollard� �1910

When liquidity vanishes the dollar rises.

• Anatomy of a Crisis: A Strong Dollar and Disappearing Liquidity (Palisade)

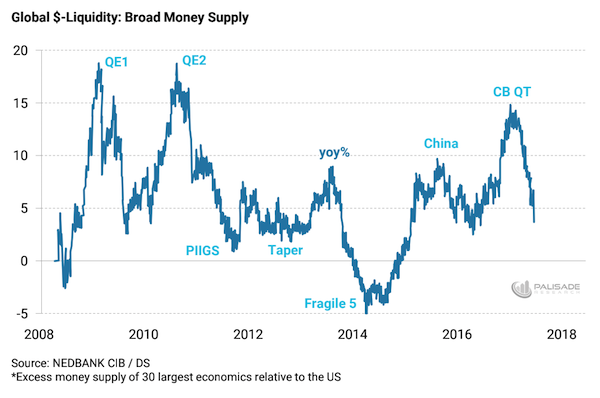

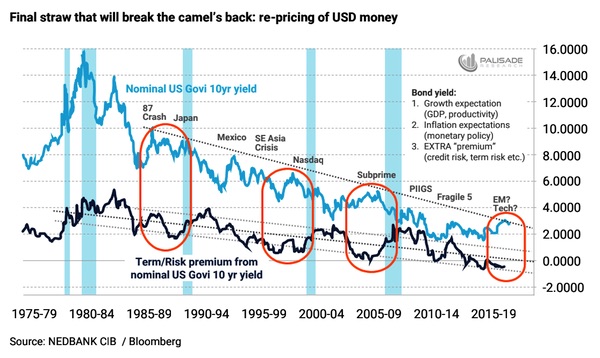

Since March – the dollar’s rallied over 7%. And it’s caused the Emerging Markets to implode. But the bigger problem is what lies ahead. And that’s a global dollar shortage – which the mainstream continues to ignore. . . I’ve touched on this a couple months back. Wondering when the mainstream would start to realize that the stronger the dollar gets – the more pressure global economies will feel. I wrote. . . “This is going to cause an evaporation of dollar liquidity – making the markets extremely fragile. Putting it simply – the soaring U.S. deficit requires an even greater amount dollars from foreigners to fund the U.S. Treasury. But if the Fed is shrinking their balance sheet, that means the bonds they’re selling to banks are sucking dollars out of the economy (the reverse of Quantitative Easing which was injecting dollars into the economy). This is creating a shortage of U.S. dollars – the world’s reserve currency – therefore affecting every global economy.”

Since then, things have only gotten worse. . . First: Jerome Powell – the Fed Chairman – issued a statement at the end of June that they would actually increase the amount of rate hikes over the next two years. This means they’re tightening even faster. Second: the U.S. Treasury increased their debt-borrowing needs to the highest since the financial crisis – which was over a decade ago. Therefore, they will need even more dollars to fund their spending. “The department expects to issue $329 billion in net marketable debt from July through September, the fourth-largest total for that quarter on record and higher than the $273 billion estimated in April [a 17% increase], the Treasury said in a report Monday. The department’s forecast for the October-December quarter is $440 billion, bringing the second-half borrowing estimate to $769 billion, the highest since $1.1 trillion in July-December 2008…”

And third: China’s growth is slowing down. Meanwhile the Emerging Markets are draining their U.S. dollar reserves even faster because of the strengthening dollar. So, in summary: as global dollar liquidity continues drying up, there will be a wave of ‘risky’ positions being dumped and ‘dollar disease’ (selling assets to raise dollars to pay back debts) worldwide. . . What we know is true from Economics-101 is that the lower the supply and the greater the demand equals a higher price. And as the pool of USD keeps drying up – then the price of the dollars must rise. This translates into higher offshore dollar funding (higher interest rates). Which is killing dollar indebted countries and corporations – like Turkey today.

[..] I think future financial historians will scratch their heads wondering why markets today continued discounting this serious dollar-shortage problem. The easy money years post-2008 fueled a massive debt bubble – causing asset prices all over to rise. But the market isn’t expecting the tight money years today to cause asset prices to fall. It’s like they think that drinking alcohol today will make them feel good – but don’t believe they’ll be hungover tomorrow. So, what’s next? I believe the U.S. dollar will continue rallying because of all that I mentioned above. As Hedge Funds, institutions, and investors continue unloading their Emerging Market positions – things will only get worse.

Housing bubble vs stock market bubble. Pick your fave toxin.

• Speculators Will Make Hay From Great Australian Economic Crash (Steve Keen)

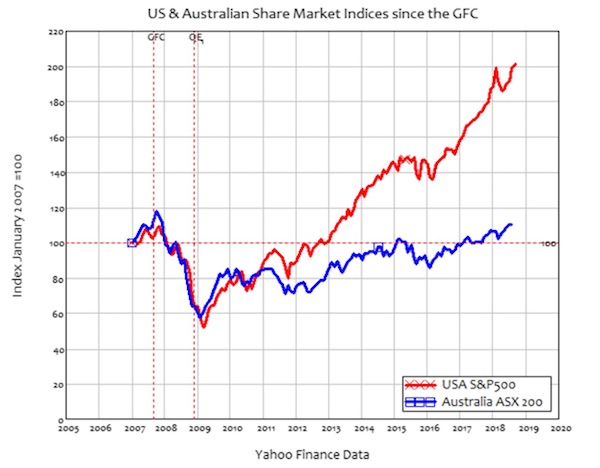

For years, Australia has been seen as the goose which laid the golden egg for workers, migrants and investors. Ironically, as America’s casino closes, it will eventually end up as a speculator’s paradise.\ The performance of the Australian stock market relative to its American equivalent since the Global Financial Crisis (GFC) shows the difference between a country where Quantitative Easing (QE) – the buying of bonds by the central bank to drive bond prices up and interest rates down, and thus encourage firms to invest and financial institutions to buy shares – was practiced and one where it was not. It’s both a warning about what could happen when the Fed starts to unwind QE, and a perverse opportunity to profit when Australia’s central bank, the RBA (Reserve Bank of Australia) inevitably starts its own QE program.

Since Australia avoided the GFC, and its rate of economic growth has been twice as fast as America’s post-crisis (an average 2.7 percent per year, versus 1.3 percent for the US), you might expect Australia’s stock market to have done better than America’s. In fact, it’s performed much worse: the main Australian index, the ASX, still hasn’t returned to its mid-2000s peak, while the US S&P500 has more than doubled its pre-crash level, and it’s almost four times as high as it was in the deepest depths of 2009. The timing of the US stock market recovery is instructive: it began in February 2009, just three months after the Federal Reserve began “QE1” (the first of three episodes of Quantitative Easing), when it promised to net buy bonds from the financial sector to the tune of $1 trillion per year ($80 billion per month).

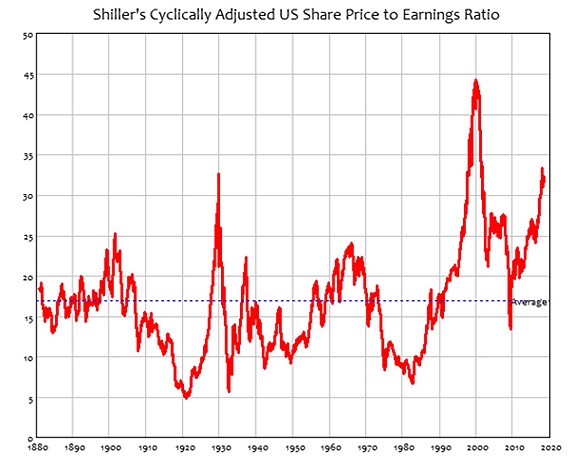

With the Fed buying a trillion bucks worth of bonds every year, thus giving the financial sector one trillion in cash per year in place of its interest-earning bonds, the only place the financial sector could stash that dough in search of a return was the stock market. This was the intention of the policy of course: to drive share prices higher in order to stimulate the economy. Aside from the fact it’s made the wealthier even wealthier as a direct effect of government policy, and cost far more than a direct boost to the poor would have done, it’s worked a treat: according to Robert Shiller’s “Cyclically Adjusted Price to Earnings Ratio,” it’s driven America’s stock market to its second-highest peak in history, higher than the 1929 bubble, second only to the DotCom maximum in 2000, and more than twice its long-term average.

Can’t hide behind declassified docs.

• Judge Rules FBI Must Address Measures Taken To Verify Steele Dossier (ZH)

The FBI has been dealt a major blow after a Washington DC judge ruled that the agency must respond to a FOIA request for documents concerning the bureau’s efforts to verify the controversial Steele Dossier, before it was used as the foundation of a FISA surveillance warrant application and subsequent renewals. US District Court Judge Amit Mehta – who in January sided with the FBI’s decision to ignore the FOIA request, said that President Trump’s release of two House Intelligence Committee documents (the “Nunes” and “Schiff” memos) changed everything.

Considering that the FBI offered Steele $50,000 to verify the Dossier’s claims yet never paid him, BuzzFeed has unsuccessfully tried to do the same to defend themselves in a dossier-related lawsuit, and a $50 million Soros-funded investigation to continue the hunt have turned up nothing that we know of – whatever documents the FBI may be forced to cough up regarding their attempts to verify the Dossier could prove highly embarrassing for the agency. “[I]f Mr. Steele could get solid corroboration of his reports, the F.B.I. would pay him $50,000 for his efforts, according to two people familiar with the offer. Ultimately, he was not paid.” -NYT

What’s more, forcing the FBI to prove they had an empty hand will likely embolden calls to disband the special counsel investigation – as the agency’s mercenary and politicized approach to “investigations” will be laid all the more bare for the world to see. Then again, who knows – maybe the FBI verified everything in the dossier and it simply hasn’t leaked. That said, while the FBI will likely be forced to acknowledge the documents thanks to the Thursday ruling, the agency will still be able to try and convince the judge that there are other grounds to withhold the records.

In January, Mehta blessed the FBI’s decision not to disclose the existence of any records containing the agency’s efforts to verify the dossier – ruling that Trump’s tweets about the dossier didn’t require the FBI and other intelligence agencies to act on records requests. “But then the ground shifted,” writes Mehta of Trump declassifying the House memos. “As a result of the Nunes and Schiff Memos, there is now in the public domain meaningful information about how the FBI acquired the Dossier and how the agency used it to investigate Russian meddling.” [..] “It remains no longer logical nor plausible for the FBI to maintain that it cannot confirm nor deny the existence of documents,” Mehta wrote.

Doesn’t feel like McGahn has tons of dirt.

• White House Counsel “Cooperating Extensively” With Obstruction Probe (ZH)

Update: Trump has commented on the story, saying he allowed McGahn “and all other requested members of the White House Staff” to fully cooperate with the Special Counsel. He also notes that the White House has given over one million pages of documents adding “No Collusion, No Obstruction. Witch Hunt!”

White House counsel Donald McGahn II, has been quietly cooperating “extensively” with special counsel Robert Mueller in his probe of possible collusion between the Trump campaign and Russia, according to an explosive New York Times report published Saturday afternoon. Sources told the Times that McGahn has had at least three voluntary interviews with Mueller’s team totaling 30 hours, in which he discussed accounts of multiple episodes at the center of Mueller’s probe into whether President Trump obstructed justice, as well as the president’s furor toward the Russia investigation and the ways in which he urged McGahn to respond to it. For a lawyer to share so much with investigators scrutinizing his client is unusual.

Lawyers are rarely so open with investigators, not only because they are advocating on behalf of their clients but also because their conversations with clients are potentially shielded by attorney-client privilege, and in the case of presidents, executive privilege. Among the episodes McGahn reprotedly discussed with investigators is Trump’s firing last year of former FBI Director James Comey and the president’s repeated urging of Attorney General Jeff Sessions to claim oversight of the special counsel despite his recusal from Russia probes. McGahn was also centrally involved in Trump’s attempts to fire the special counsel, Robert Mueller, himself which investigators might not have discovered without him.

Downgrades add to the downfall.

• Erdogan Says US Has Launched ‘Attempted Economic Coup’ (Ind.)

Turkey’s president has accused America of launching an “attempted economic coup” as the country’s currency continues to reel following US economic sanctions. Recep Tayyip Erdogan told thousands of supporters in Ankara: “Today some people are trying to threaten us through the economy, through interest rates, foreign exchange, investment and inflation. “We are telling them: we’ve seen your games, and we are challenging you.” And, in a clear swipe at US president Donald Trump he added: “We did not and will not surrender to those who act like a strategic partner but make us a strategic target.”

[..] As the two countries have clashed, the lira’s value has plummeted: it has now dropped 38 per cent against the dollar since the beginning of the year. On Friday, ratings agencies Standard & Poor and Moody’s downgraded Turkey’s credit rating closer to “junk” status, pointing to currency fluctuations and concerns over central bank independence. A spokesman for Standard & Poor said: “The downgrade reflects our expectation that the extreme volatility of the Turkish lira and the resulting projected sharp balance of payments adjustment will undermine Turkey’s economy. We forecast a recession next year.” He added the agency was predicting that the country’s inflation will hit a potential 22 per cent over the next four months.

When temperatures start dropping, reality will loom.

• No-Deal Brexit May Force Rethink Of Vote – Ex-Civil Service Head (PA)

Britain may have to rethink the decision to leave the EU if the government is unable to strike a Brexit deal with Brussels, a former head of the civil service has said. Bob Kerslake said the consequences of a no-deal exit would be so serious that the UK parliament would have to consider whether it could allow it to go ahead. Lord Kerslake, who has been advising Labour on preparing for government, said that at the very least the article 50 process – under which the UK is set to leave the bloc on 29 March next year – would have to be paused. In those circumstances, the European commission would almost certainly insist on some “re-examination” of the original decision to leave, he said.

His comments came as the government prepares to publish a series of technical notes on preparations for a no-deal Brexit across dozens of areas of British life, from farming to financial services. Kerslake said the measures were “too little, too late” and that the government had not allowed itself enough time to prepare for such an outcome. He told the the BBC Radio 4’s Today programme: “The consequences of a no deal would be so serious as I think parliament would have to seriously consider whether it could contemplate this. “The question people need to ask themselves is, is this a risk that they think we should be taking?

“If the government can negotiate a good deal, then so be it. But if they can’t and we end up in this position, then we have to reopen the question of whether we go forward with Brexit at all. It is not too late to do that. “A pause to reflect would certainly be necessary. I think that is a pretty high probability now. “But I think that pause would need to include – and I suspect this would be insisted on by the commission – some re-examination of the decision itself.”

The only thing that makes sense.

• Putin Urges Europe To Help Rebuild Syria So Refugees Can Return (AFP)

Russian president Vladimir Putin has called on Europe to contribute to the reconstruction of Syria to allow millions of refugees to return home. “We need to strengthen the humanitarian effort in the Syrian conflict,” he said on Saturday, ahead of a meeting with his German counterpart Angela Merkel at the government retreat of Meseberg Palace, north of Berlin. “By that, I mean above all humanitarian aid to the Syrian people, and help the regions where refugees living abroad can return to.” There were 1 million refugees in Jordan, the same number in Lebanon, and 3 million in Turkey, Putin said.

Germany has accepted hundreds of thousands of migrants since 2015 – the height of the migration crisis – which has weakened Angela Merkel politically and split the European Union. “This is potentially a huge burden for Europe,” Putin said. “That’s why we have to do everything to get these people back home,” he added, emphasising the need to restore basic services such as water supplies and healthcare.

More refugees. Great.

• Ecuador Slams Door On Venezuelans (BBC)

Ecuador has brought in new rules to stop Venezuelan migrants entering the country without a passport, leaving many stranded in neighbouring Colombia. Thousands of Venezuelans fleeing their country’s economic and political crisis have been crossing into Ecuador from Colombia using only identity cards. Most are heading south to join family members in Peru and Chile. Colombia has protested against the move, saying vulnerable people will be trapped on its side of the border. In a separate incident, residents of a Brazilian town attacked a Venezuelan migrant camp on Saturday and drove the occupants back across the border. Venezuela has suffered for years from high inflation and the chronic shortage of food and medicines.

More than a million Venezuelan migrants have entered Colombia in the past 15 months, according to official estimates, and more than 4,000 have been arriving at Ecuador’s border every day. Many have been walking or hitching rides for weeks and are exhausted by the time they reach the frontier. [..] With the flow of Venezuelan migrants causing tensions across the region, Peru’s government announced immigration measures similar to Ecuador’s on Friday. Passport requirements for Venezuelans will begin on 25 August. In February, Colombian President Juan Manuel Santos announced a tightening of border controls, resulting in thousands of Venezuelans rushing to crossing points. Brazil, which neighbours Venezuela, has also expressed concerns and temporarily closed the border earlier this month. Violence has flared in the border state of Roraima where thousands of Venezuelans live in precarious accommodation.

“Carter has been an ex-president for 37 years, longer than anyone else in history.”He used those years to redeem himself.

• The Un-Celebrity President (WaPo)

Jimmy Carter finishes his Saturday night dinner, salmon and broccoli casserole on a paper plate, flashes his famous toothy grin and calls playfully to his wife of 72 years, Rosalynn: “C’mon, kid.” She laughs and takes his hand, and they walk carefully through a neighbor’s kitchen filled with 1976 campaign buttons, photos of world leaders and a couple of unopened cans of Billy Beer, then out the back door, where three Secret Service agents wait. They do this just about every weekend in this tiny town where they were born — he almost 94 years ago, she almost 91. Dinner at their friend Jill Stuckey’s house, with plastic Solo cups of ice water and one glass each of bargain-brand chardonnay, then the half-mile walk home to the ranch house they built in 1961.

On this south Georgia summer evening, still close to 90 degrees, they dab their faces with a little plastic bottle of No Natz to repel the swirling clouds of tiny bugs. Then they catch each other’s hands again and start walking, the former president in jeans and clunky black shoes, the former first lady using a walking stick for the first time. The 39th president of the United States lives modestly, a sharp contrast to his successors, who have left the White House to embrace power of another kind: wealth. Even those who didn’t start out rich, including Bill Clinton and Barack Obama, have made tens of millions of dollars on the private-sector opportunities that flow so easily to ex-presidents.

When Carter left the White House after one tumultuous term, trounced by Ronald Reagan in the 1980 election, he returned to Plains, a speck of peanut and cotton farmland that to this day has a nearly 40 percent poverty rate. The Democratic former president decided not to join corporate boards or give speeches for big money because, he says, he didn’t want to “capitalize financially on being in the White House.” Presidential historian Michael Beschloss said that Gerald Ford, Carter’s predecessor and close friend, was the first to fully take advantage of those high-paid post-presidential opportunities, but that “Carter did the opposite.” Since Ford, other former presidents, and sometimes their spouses, routinely earn hundreds of thousands of dollars per speech. “I don’t see anything wrong with it; I don’t blame other people for doing it,” Carter says over dinner. “It just never had been my ambition to be rich.”

One field where EU regulation is very harmful.

• Britain Has One Last Chance To Save Endangered Species (G.)

Ministers may have only 12 months to rescue Britain’s degraded environment and to save its endangered birds and animals. That is the stark conclusion of Michael Clarke, chief executive of the RSPB, who has warned that parliamentary bills – to be published over the next year – will have to make crucial changes to the way our farms and fisheries are run if the wildlife and landscape of the nation are to be rescued from their dangerously depleted condition. “We are on a cusp, and if we fail to act decisively we will pay the price in coming years,” Clarke told the Observer last week. The three forthcoming bills – on agriculture, on fisheries and on the environment – will replace the EU legislation that currently controls our farming, fishing industry and the quality of our air, water and wildlife.

The government has yet to announce what these bills will contain. However, conservationists such as Clarke now fear there is a real risk that one or all of these new pieces of legislation will fail to provide the necessary powers to restore our crisis-hit environment. “Since 1980, across Europe 420 million individual birds have disappeared from the countryside thanks to the practices of modern agriculture,” said Clarke. And that staggering drop is matched by an even more catastrophic decline in insect life over the same period of time, he added. “For years, we could see the lack of insects on our windscreens on summer evenings. It was a smoking gun but there was no hard data – until recent research in Germany showed there had been a 75% decline in its flying insects, figures since matched by Dutch and some UK data. The insects have gone – and so have 420 million birds.”

[..] As to the causes of these declines, the intensification and spread of agriculture and changes in land use take most of the blame – with the EU common agricultural policy (CAP) being considered a particularly destructive agent in this process. The CAP stresses the importance of agricultural output above all else and has helped destroy the homes and food sources of countless birds, animals and insects, said Clarke. Crucially, as Britain prepares to withdraw from the CAP and the EU, the nation has a once-in-a-generation opportunity to put right this damage, said Clarke. About £3bn a year is spent on British farming through CAP, he pointed out.

Home › Forums › Debt Rattle August 19 2018