Edouard Manet Osny, The road-menders, Rue de Berne 1878

My friend Jesse Colombo is right to point out the impact of imploding asset bubbles is the main takeaway. But I think even more than that, it’s who will be the main victims of that: those who have no assets. The losses will land on their shoulders.

• America’s 1% Hasn’t Had This Much Wealth In 100 Years (MW)

It’s not fashionable to wear flapper dresses and do the Charleston, but 1920s-style wealth inequality is definitely back in style. New research says America’s ultra-rich haven’t held as much of the country’s wealth since the Jazz Age, those freewheeling times before the country’s finances shattered. “U.S. wealth concentration seems to have returned to levels last seen during the Roaring Twenties,” wrote Gabriel Zucman, an economics professor at the University of California, Berkeley. Zucman said all the research on the issue also points to large wealth concentrations in China and Russia in recent decades. The same thing is happening in France and the U.K., but at a “more moderate rise,” the paper said.

In 1929 — before Wall Street’s crash unleashed the Great Depression — the top 0.1% richest adults’ share of total household wealth was close to 25%, according to Zucman’s paper, which was distributed by the National Bureau of Economic Research. Those rates plunged in the early 1930s and continued dropping to below 10% in the late 1970s, findings show. Rates have been on the rebound since the early 1980s, and are currently close to 20%. It’s become especially hard to measure the full extent of riches these days. “Since the 1980s, a large offshore wealth management industry has developed which makes some forms wealth (namely, financial portfolios) harder to capture,” the paper added.

MarketWatch photo illustration/iStockphoto, Everett Collection

[..] Millions of Americans live paycheck to paycheck; the recent federal government’s partial government shutdown forced some federal workers to food pantries, and cast a harsh light on Americans’ lack of savings. Jesse Colombo says people should be more worried about issues other than the current gap between the rich and poor. “America’s wealth inequality is not a permanent situation, but a temporary one because the asset bubbles behind the wealth bubble are going to burst and cause a severe economic crisis,” he added. “My argument is that our society should be worrying more about these asset bubbles than the temporary inequality.” “What is the common denominator between U.S. wealth inequality during the Roaring Twenties and now?” he said. “A massive stock market bubble.”

The inevitable fall-out of a press that no longer reports the news, but manufactures it.

• Senate Has Found No Direct Evidence of Trump-Russia Conspiracy (NBC)

The Senate Intelligence Committee’s investigation into the 2016 election has uncovered no direct evidence of the Trump campaign conspiring with Russia, Democrats and Republicans on the committee told NBC News. But different parties’ investigators in the probe, which is winding down, disagree over the implications of a pattern of contacts between Trump associates and Russians. Last week, Sen. Richard Burr, the panel’s Republican chairman, told CBS News that, while more facts may be uncovered, “If we write a report based upon the facts that we have, then we don’t have anything that would suggest there was collusion by the Trump campaign and Russia.” Democratic Senate investigators told NBC News on condition of anonymity that Burr’s characterizations, while accurate, lacked context. One aide said, “We were never going find a contract signed in blood saying, ‘Hey Vlad, we’re going to collude.'”

For MS(NBC), Russigate has been a major investment. And they’re still trying to squeak past it by saying an official report will take many more months etc., but it’s done as far as the Senate is concerned. And Mueller has given zero indication of having anything collusion-related.

• NBC Has A Hard Time Accepting There’s No Collusion (ZH)

We knew this day was coming, but watching an MSNBC anchor and guest pundits squirm during a live Tuesday morning update in which NBC News intelligence and national security correspondent, Ken Dilanian, read aloud that the Senate Intelligence Committee admits it has found “no direct evidence” of collusion between President Trump and Russia, is a segment that itself perhaps belongs to the history books. Mediaite described of the “stunned” MSNBC host’s demeanor: “The report met surprise first, then skepticism, with Jackson and her guests.” They awkwardly and visibly try to make sense of hard and unambiguous reporting that runs contrary to everything being parroted in the MSNBC echo chamber over the past 2 years.

To drive home the explosive significance of the findings, Dilanian noted just how long the ‘collusion’ incessant drumbeat has lasted: “After two years and interviewing more than 200 witnesses, the Senate intelligence Committee has not uncovered any direct evidence of a conspiracy between the Trump campaign and Russia,” said Dilanian. “That’s according to sources on both the Republican and the Democratic side of the aisle.” And in a prior NBC News article Tuesday morning, Dilanian spelled out: “After two years and 200 interviews, the Senate Intelligence Committee is approaching the end of its investigation into the 2016 election, having uncovered no direct evidence of a conspiracy between the Trump campaign and Russia, according to both Democrats and Republicans on the committee.”

MSNBC anchor Hallie Jackson and her guest panelists’ faces looked visibly confused and uncomfortable as they learned the Senate report is going in the opposite direction of everything MSNBC and other mainstream outlets have been breathlessly reporting on a near 24/7 basis. More importantly, if this is a precursor of what the Mueller report concludes in a few weeks/months, the TV station that built its current reputation on the premise of Russian collusion, may have no option but to go on indefinite hiatus. Watch the segment above, with host Hallie Jackson appearing to grow exasperated by the 2:20 mark:“If and when the president, as he may inevitably do, points to these conclusions and says look, the Senate intelligence committee found I am not guilty of conspiracy… he would be correct in saying that?”

Dilanian noted that while the Republican chair of the committee made what he characterized as “partisan” comments the week prior, it turned out be unanimous fact. “What I found,” he said, “is that Democrats don’t dispute that characterization.” [..] Dilanian also noted the Senate intel committee has access to classified material, which means “if there was an intercept between officers suggesting they were conspiring with the Trump campaign, [the committee] would see that. And that has not emerged.” “So that evidence does not exist, and Trump will claim vindication,” he repeated.

One of the best compilations I've ever seen.

It's a BOMBSHELL. pic.twitter.com/V0oLimbKnT

— Mike (@Fuctupmind) October 29, 2018

McConnell thinks it’s best to be fast in voting it down, before there’s more detailed discussion, for instance about which parts could work and which don’t. He’s probably right.

• Mitch McConnell To Force Senate Vote On Ocasio-Cortez’s Green New Deal (CNBC)

Senate Majority Leader Mitch McConnell said Tuesday that the Senate would vote on the Green New Deal introduced last week by Sen. Edward Markey, D-Mass., and Rep. Alexandria Ocasio-Cortez, D-N.Y. “I’ve noted with great interest the Green New Deal, and we’re going to be voting on that in the Senate to give everybody an opportunity to go on record,” McConnell told reporters. The bill, which is not expected to pass the Republican-dominated upper chamber, could force some Democrats to make a politically awkward calculation. Democratic liberals, including all of the senators currently running for president, have come out in support of the legislation, which calls for generating 100% of the nation’s power from renewable sources within 10 years. Scientists have said that dramatic, immediate action is necessary to stem the catastrophic effects of climate change.

Democratic moderates have been less than enthusiastic about the proposal. House Speaker Nancy Pelosi derisively referred to the House version of the bill as a “green dream,” while only 11 of the 47 senators who caucus with the Democrats have signed on to sponsor the bill. Sen. Sherrod Brown, D-Ohio, who is widely expected to enter into the 2020 race, has declined to say whether he supports the proposal. “I’m not going to take position on every bill that’s coming out,” he said Tuesday, according to Politico. “I support a Green New Deal. I think we need to aggressively support climate change [legislation]. That’s my answer.” Republicans control the Senate, with 53 members of the 100-seat chamber. Democrats control the House of Representatives, but it is not clear if the House will vote on the measure under Pelosi’s leadership.

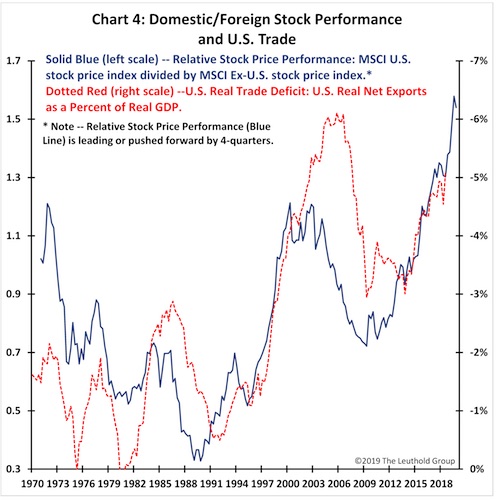

Stocks are up when the deficit is up.

• For The Stock Market, A Trade-War Win May Be A Hollow Victory (MW)

Sometimes losing can pay dividends in unexpected ways, and that seems particularly true in the case of stocks and trade. For the past five decades, the U.S. stock market has comparatively outperformed when the trade deficit widened and vice versa, suggesting that even if the U.S. emerges victorious from its trade war with China, investors may have few reasons to rejoice. At face value, it may seem counterintuitive, but for the U.S., which relies on trade to fuel its economic juggernaut, a deficit can actually be a sign that all is well. “Since at least 1970, U.S. stocks have done best when its trade deficit worsens,” said Jim Paulsen, chief investment strategist at Leuthold Group, who explained that if imports rise, it indicates that domestic consumption is healthy.

“And if exports go up, it means foreign demand is strong. So when we have a trade deficit, it means the U.S. is doing better,” he said. A trade balance is the difference between how much a country sells and buys from abroad, and a deficit is often viewed as a negative, chiefly as it means a country is spending more than it is making. But as the chart below demonstrates, U.S. stocks vis-a-vis foreign equities have done quite well notwithstanding all the depressing headlines over the years about how the rest of the world is taking advantage of the U.S.

And Labour wants part of the Green New Deal fame too. But what do any of these people really know about physics, about energy? It all still looks like a typical dumb politics approach: we’ll get rich while going green, promise!

• Labour To Set Out Plans To Decarbonise UK, Fulfil Green Jobs Pledge (G.)

Labour is to set out how the UK can move swiftly to a decarbonised future to tackle the unfolding climate crisis and put “meat on the bones” of its promise to create hundreds of thousands of high-skilled, unionised green jobs. Trade unionists and industry leaders will come together with academics, engineers and public institutions to build detailed regional plans setting out the challenges and opportunities ahead. The proposal, due to be outlined on Wednesday by Rebecca Long-Bailey, the shadow business secretary, will involve a national call for evidence and a series of regional events to build “a detailed action plan” to maximise the benefits of moving to a zero-carbon future.

“A decade of austerity and decades of neoliberalism have left many in our country asking: what is Britain for?” Long-Bailey told the Guardian. “This has been brought into focus by the government’s handling of Brexit, which is at its core deeply pessimistic, with nothing to say about the future.” She said a future Labour government would oversee an economic revolution to tackle the climate crisis, using the full power of the state to decarbonise the economy and create hundreds of thousands of green jobs in struggling towns and cities across the UK. “We believe that together, we can transform the UK through a green jobs revolution, tackling the environmental crisis in a way that brings hope and prosperity back to parts of the UK that have been held back for too long.”

[..] Long-Bailey said Labour was determined to move beyond rhetoric about a green revolution and work out exactly how that could be achieved, and how it could translate to new well-paid, unionised jobs across the UK. “We’re launching an unprecedented call for evidence about what this means for your town, your city, your region,” she said. “We want to bring unions, industry, universities, the public sector and others together to build this vision out into a practical reality.” Labour says a key plank of its plan will be to ensure a “just transition” to high quality green jobs for those currently working in carbon-emitting industries. To do that it will have to persuade its trade union backers, who represent people in high-carbon industries, that there is a viable economic alternative.

More liberalism! No matter that it played a big role in Britons voting for Brexit. These people are one-dimensional.

• Mark Carney: Brexit Is The First Test Of A New Global Order (G.)

Brexit is an acid test of whether it is possible to reshape globalisation in a way that offers the benefits of trade while allaying public fears about the erosion of democracy, the governor of the Bank of England, Mark Carney, has said. Speaking in London, Carney said the ramifications of the UK’s departure from the EU would be felt around the world and would determine whether it was possible to shrug off rising protectionism in favour of a new era of international cooperation. The governor cited trade tensions and the result of the 2016 referendum as examples of fundamental pressures to reorder globalisation. “It is possible that new rules of the road will be developed for a more inclusive and resilient global economy. At the same time, there is a risk that countries turn inwards, undercutting growth and prosperity for all.”

Carney’s recent comments about Brexit have highlighted the short-term risks to the economy of leaving the EU next month without an agreement in place, but he used his speech on the state of the global economy to provide a more upbeat assessment. “In many respects, Brexit is the first test of a new global order and could prove the acid test of whether a way can be found to broaden the benefits of openness while enhancing democratic accountability,” he said, speaking at a Financial Times event in London. “Brexit can lead to a new form of international cooperation and cross-border commerce built on a better balance of local and supranational authorities. In these respects, Brexit could affect both the short and long-term global outlooks.”

Just trying to make friends, I guess. Best of all, he has no idea it could just as well be him on that guillotine.

• EU’s Verhofstadt Suggests Brexiteers Could ‘End Up On The Guillotine’ (Ind.)

The politicians pushing Brexit should be careful not follow in the footsteps of revolutionary leaders who “ended up on the guillotine”, the European Parliament’s Brexit chief has said. At a press conference in Strasbourg Guy Verhofstadt compared Boris Johnson and Jacob Rees-Mogg to Georges Danton and Maximilien Robespierre – leading figures in the French revolution who were ultimately executed by their former comrades. He said it was “important to remind” the senior Conservatives that their historical counterparts had ended up losing their heads.

“I know that within the Tory party the hard Brexiteers are compared to the leaders of the French revolution. I think Gove is Brissot, and Boris Johnson is Danton, and Rees-Mogg is compared to Robespierre,” Mr Verhofstadt said. “We should not forget that the efforts of these men were not appreciated by the common man they claimed to represent – because they all ended up on the guillotine. So that’s important to remind [them].” His comments come a week after European Council president Donald Tusk caused a story in the UK by saying there was a “special place in hell” for Brexiteers who had advocated leaving the EU without a serious plan of how to do it.

44 days.

• Theresa May’s Brexit Tactic: My Way Or A Long Delay (G.)

Theresa May’s high-stakes Brexit strategy may have been accidentally revealed after her chief negotiator Olly Robbins was overheard in a Brussels bar saying MPs will be given a last-minute choice between her deal and a lengthy delay. The prime minister has repeatedly insisted that the government intends to leave the EU as planned on 29 March, and urged MPs to “hold our nerve”, while she tries to renegotiate changes to the Irish backstop. “So our work continues,” she told MPs on Tuesday. “Having secured an agreement with the European Union for further talks, we now need some time to complete that process. The talks are at a crucial stage. We now all need to hold our nerve to get the changes this house requires and deliver Brexit on time.”

But Robbins, the most senior civil servant involved in the Brexit process, was overheard by a reporter from ITV, holding a late-night conversation in which he appeared to suggest she would wait until March – and then give MPs the choice between backing her, or accepting a long extension to article 50. According to the broadcaster, Robbins said the government had “got to make them believe that the week beginning end of March … extension is possible, but if they don’t vote for the deal then the extension is a long one.” The tactic appears to be aimed squarely at members of the backbench Tory European Research Group (ERG), who may fear Brexit could ultimately be cancelled altogether, if MPs accept a delay.

“The issue is whether Brussels is clear on the terms of extension,” Robbins was overheard saying. “In the end they will probably just give us an extension.” On the backstop, Robbins appeared to confirm that the government’s initial plan was for the backstop, which effectively keeps the UK in a customs union, to form a temporary “bridge” to the long-term trading relationship. “The big clash all along is the ‘safety net’,” Robbins said. “We agreed a bridge but it came out as a ‘safety net’.”

I don’t think Monbiot should be writing about this, not his field. But nobody else does, either, and the issue will re-appear very very bigly if Brexit becomes reality.

• Dark Money Is Pushing For A No-Deal Brexit. Who Is Behind It? (Monbiot)

In Britain, for example, we now know that the EU referendum was won with the help of widespread cheating. We still don’t know the origins of much of the money spent by the leave campaigns. For example, we have no idea who provided the £435,000 channelled through Scotland, into Northern Ireland, through the coffers of the Democratic Unionist party and back into Scotland and England, to pay for pro-Brexit ads. Nor do we know the original source of the £8m that Arron Banks delivered to the Leave.EU campaign. We do know that both of the main leave campaigns have been fined for illegal activities, and that the conduct of the referendum has damaged many people’s faith in the political system.

But, astonishingly, the government has so far failed to introduce a single new law in response to these events. And now it’s happening again. Since mid-January an organisation called Britain’s Future has spent £125,000 on Facebook ads demanding a hard or no-deal Brexit. Most of them target particular constituencies. Where an MP is deemed sympathetic to the organisation’s aims, the voters who receive these ads are urged to tell him or her to “remove the backstop, rule out a customs union, deliver Brexit without delay”. Where the MP is deemed unsympathetic, the message is: “Don’t let them steal Brexit; Don’t let them ignore your vote.”

So who or what is Britain’s Future? Sorry, I have no idea. As openDemocracy points out, it has no published address and releases no information about who founded it, who controls it and who has been paying for these advertisements. The only person publicly associated with it is a journalist called Tim Dawson, who edits its website. Dawson has not yet replied to the questions I have sent him. It is, in other words, highly opaque. The anti-Brexit campaigns are not much better. People’s Vote and Best for Britain have also been spending heavily on Facebook ads, though not as much in recent weeks as Britain’s Future.

He has 84 of the 350 seats in congress… And is propped up by the Catalans.

• Spanish PM May Call Snap Election If Budget Rejected (G.)

Spain’s socialist government could be forced to call a snap general election if rightwing parties and Catalan secessionists make good on their threats to reject the national budget in a key vote on Wednesday. The prime minister, Pedro Sánchez, faces an uphill battle to secure approval for the budget in the face of opposition from critics of his minority government. Sánchez’s PSOE, which holds 84 of the 350 seats in congress, relied on the support of Basque and Catalan nationalist parties to seize power from the conservative People’s party in a confidence vote last year. If, as seems likely, the budget is rejected by rightwing parties as well as the Catalan Republican Left and the Catalan European Democratic party, Sánchez is expected to call a snap general election in April or May.

The next general election is due to be held next year. The prime minister had been banking on the fact that the prospect of an early election – and a possible win for rightwing parties that fiercely oppose Catalan secession – would make the two big Catalan pro-independence parties swing behind the budget. But, speaking to the Guardian and other European media, the Catalan leader, Quim Torra, said the secessionist groupings would not be forced into supporting Sánchez’s budget plans. “Are we meant to approve the budget because we’re afraid of the Spanish right?” said Torra. “Mr Sánchez can obviously decide to call elections whenever he wants – he’s the prime minister. But why would he make dialogue conditional on approving the budget?

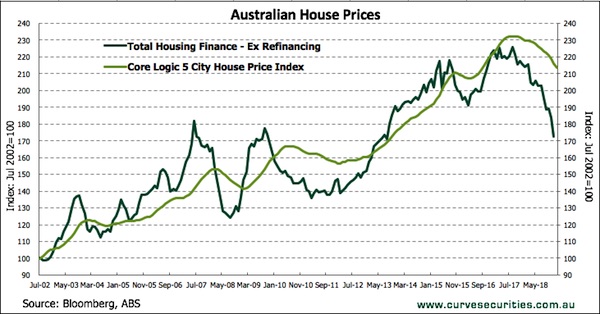

I wouldn’t be surprised if Australia were the first to fall into crisis. It hasn’t had a recession in I think 27 years, and that is like saying a homeowner hasn’t done a proper spring cleaning in decades.

• Australia Rate Cut Calls As Home Loans Fall At Fastest Rate Since GFC (SMH)

The sharpest fall in home loans since the depths of the global financial crisis has prompted calls for the Reserve Bank to slice interest rates and cast doubt over the state of the budget leading into the federal election. As the NAB said the Reserve may have to cut rates within months, figures from the Australian Bureau of Statistics revealed first time buyers and investors deserting the property market in a sign house prices may fall even further. Home loans in December fell by 5.9%. It was the second largest monthly fall since 2008-09 while the annual fall of 19.8% was the worst since the global financial crisis.

Investor loans have tumbled 28% over the past year while those for owner-occupiers have slumped by 16%. Since their peak in mid-2015, investor lending has dropped by almost 48%. First home buyers have been a key part of the market over the past year as they have taken advantage of falling prices but even they are now resisting the chance to enter the market. The number of loans to first time buyers fell 8% in the month to be 12% lower over the past year. NSW and Victoria are leading down the national market with sharp falls in total loan numbers through 2018. It’s not just housing. Business loans dropped by 9.7% in December to be 6.2% lower over the year.

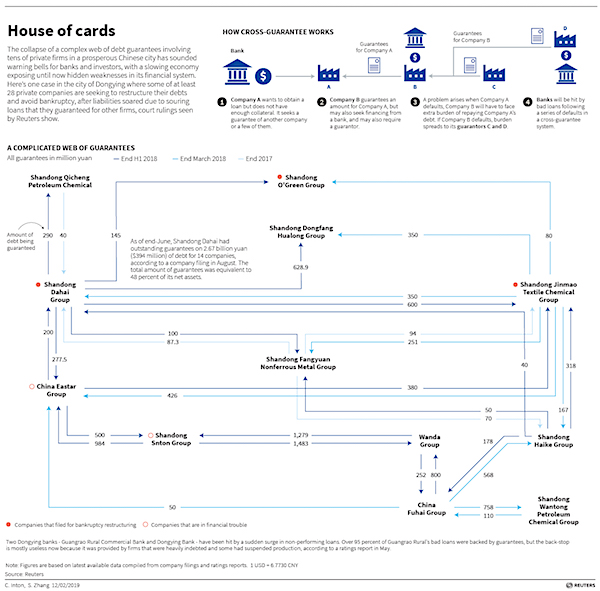

China and borrowing, not a happy marriage: “recovery rates, sometimes estimated at below 16% ..”

• Chinese Banks Resist Maxing Out Credit Cards (R.)

Chinese banks are wise to resist maxing out their credit cards. Lenders have issued hundreds of millions of them to local consumers, facilitating debt-fuelled shopping sprees. It’s a lucrative but risky supplement to other types of loans, and some now appear to be pulling back. Banks in the People’s Republic issued more than 650 million credit cards as of the third quarter of 2018, up from less than 450 million three years earlier, official data show. Balances payable on cards reached 6.6 trillion yuan ($980 billion), an increase of more than 120% over the same period. Lenders are keen on the business. There’s a big opportunity for growth given relatively low penetration: the average Chinese individual has only half of a credit card, whereas the average American has three.

Plastic can be profitable, too, yielding higher interest rates and fees than typical corporate loans. That boosts net interest margins. Yet a reassessment may be underway, according to analysts at Citi Research. At Shanghai Pudong Development Bank, for instance, credit card lending made up 35% of total new loans in 2017. In the first half of 2018, that figure collapsed to negative 5%. It’s a similar story at China Merchants Bank and other lenders covered by the analysts – although some are still aiming at rapid growth, including Ping An Bank and Postal Savings Bank of China. Household credit stood at around half of GDP by the middle of last year, up from 18% a decade earlier, according to the Bank for International Settlements. Fitch Ratings projects household debt might reach 100% of disposable income by 2020, just below the 105% ratio in the US.

The current economic slowdown could make bankers’ affection for plastic look rash. Individuals tend to default on card debt first, and chasing after them in court is time-consuming, while recovery rates, sometimes estimated at below 16%, compare poorly with between 50% to 60% for corporate borrowers.

Firms guaranteeing each other’s debt. Never seen a bigger Ponzi. Click the pic for a much larger version. It’s brilliant insanity very strongly bordering on fraud.

• China’s Private Firms Hit By Default Contagion (R.)

The collapse in China of a complex web of debt guarantees involving several private firms highlights risks in its financial system and opens up a potentially hazardous front for an economy in the grip of its slowest growth in nearly three decades. It is the last thing Beijing needs as it tries to fight off intensifying pressure on growth from a months-long trade dispute with the United States. Yet, as the government steps up economic support measures and moves to loosen gummed-up funding, it might be inadvertently inflaming financial risks with its call on state banks to sharply boost lending to the private sector.

The warning bells are already sounding in the once-prosperous eastern city of Dongying, a hub for oil refining and heavy industry in Shandong province. Here, at least 28 private companies are seeking to restructure their debts and avoid bankruptcy, mainly due to souring loans that they guaranteed for other firms, court rulings seen by Reuters show. Among the 28 firms are Shandong Dahai Group and Shandong Jinmao Textile Chemical Group, which were on the 2018 top 500 best-run private enterprises in China. For a private firm to get bank loans in China, especially those in traditional, capital-intensive industries, it often needs substantial collateral or the guarantee of another company. The guarantor itself is very likely to have taken on loans guaranteed by other firms.

Wonder how many other countries are protecting themselves this way.

• Russia Takes Steps To Survive Global Internet Shutdown With Its Own Web (RT)

Russia is preparing itself to be disconnected from the World Wide Web. The Lower House of Parliament passed in the first reading a law ensuring the security of the Russian part of the internet. The bill envisions the ‘Runet’ – the Russian segment of the internet – being able to operate independently from the rest of the world in case of global malfunctions or deliberate internet disconnection. The measures to ensure internet stability include the creation of a national DNS system that stores all of the domain names and corresponding IP numbers. The new legislation was drafted in response to the new US cyber strategy that accuses Russia, along with China, Iran, and North Korea, of using cyber tools to “undermine” its economy and democracy.

It also threatens dire consequences for anyone conducting cyber activity against the US. The autonomous system would ensure that Russia doesn’t face a total internet shutdown if relations with the West completely collapse and the US goes as far as cutting off Russian IP addresses from the World Wide Web. Back in 2012, then-US President Barack Obama signed an executive order allowing him to take control of all communications on American soil, including those crucial for the normal operation of the internet. The US National Security Agency actually caused a three-day internet blackout in Syria in November 2012, whistleblower Edward Snowden told Wired magazine. NSA hackers accidently ‘bricked’ one of the core routers while trying to install spyware on it.

Home › Forums › Debt Rattle February 13 2019