Marion Post Wolcott Coal miner waiting for lift home, Capels, West Virginia 1938

No, you can’t just look at mortality numbers and say everything’s okay. We hardly know a thing, but we do know that. Try morbidity: “More Than Half Of All COVID19 Patients Found To Have Damaged Hearts”.

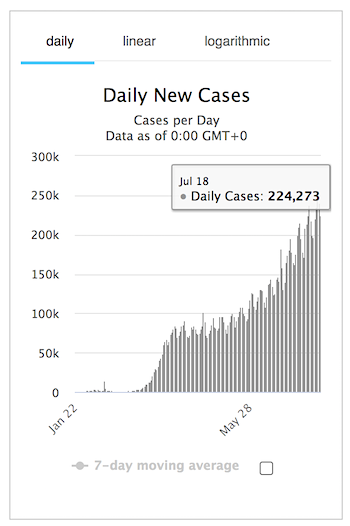

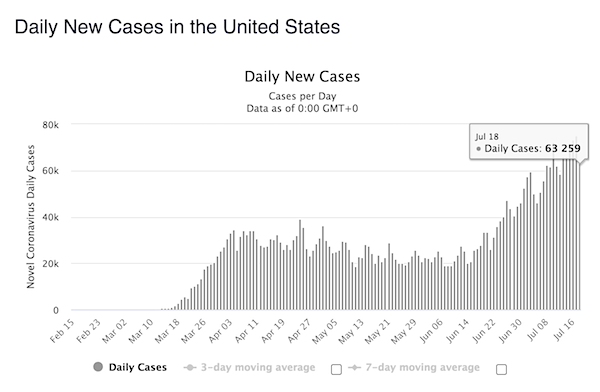

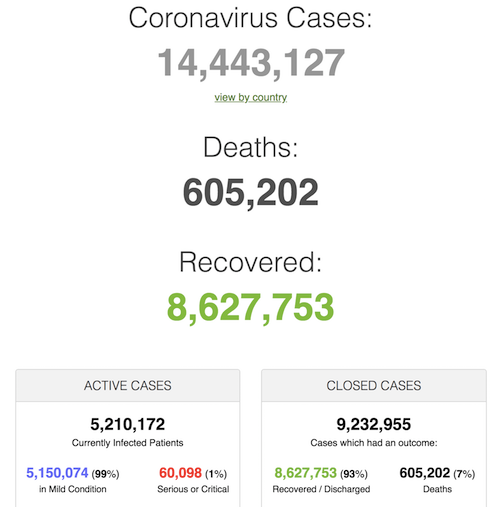

I’ve seen reports this morning of new record numbers, but Worldometer doesn’t reflect that. A surge in US deaths was also reported.

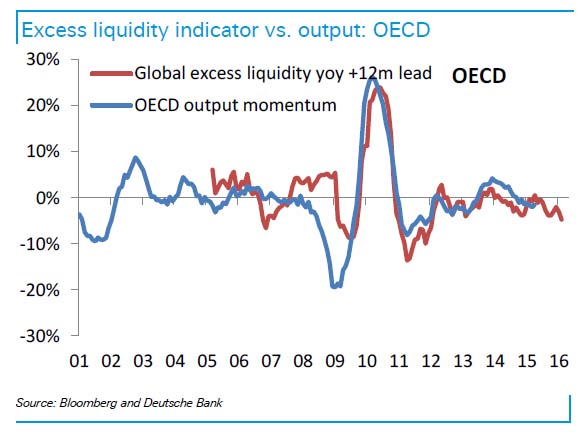

Hussman

Though R0 of #SARSCoV2 (#COVID19) wasn’t quite as high as first estimated, I have to say that the Jan 24 “Holy Mother of God” thread from @DrEricDing ranks among the best public-service Twitter posts ever. It’s just a shame the clear risks were dismissed.https://t.co/oha6cbv5MI

— John P. Hussman (@hussmanjp) July 19, 2020

“55 per cent of patients had an abnormality. One in seven patients were found to have severe abnormalities..”

• More Than Half Of All COVID19 Patients Found To Have Damaged Hearts (ND)

An international survey of heart scans in people treated for COVID-19 found that 55 per cent of patients had an abnormality. One in seven patients were found to have severe abnormalities. The study adds further evidence to the emerging picture of COVID-19 as a disease of the vascular system in a significant number of cases, and not always primarily a respiratory disease. It also suggests that a significant of COVID-19 patients will need to be monitored and assessed for permanent damage to the heart. And it raises questions about the extent to which COVID-19 is a disease you may not fully recover from. The research is from a team at the Centre for Cardiovascular Science, University of Edinburgh, UK. They studied echocardiograms from 1216 patients, aged 52 to 71, 70 per cent of them male.

The patients came from 69 countries across six continents. They were all presumed or confirmed cases of COVID-19 when the echocardiograms were taken (between April 3 and April 20, 2020). An echocardiogram uses ultrasound to show how your heart muscle and valves are working. About three-quarters of the patients (901 of them) had no pre-existing cardiac disease. But 46 per cent of their echocardiograms were abnormal, and 13 per cent were found with severe disease. According to the study: Left and right ventricular abnormalities were reported in 479 (39 per cent) and 397 (33 per cent) patients, respectively. There was evidence of new myocardial infarction in 36 (three per cent), myocarditis in 35 (three per cent), and takotsubo cardiomyopathy in 19 (two per cent). Sixty percent of the scans were performed in an ICU unit or emergency room. About 54 percent of the patients had severe COVID-19. Abnormalities were often “unheralded or severe, and imaging changed management in one-third of patients.”

Study co-author Marc Dweck, consultant cardiologist at the University of Edinburgh, U.K., said in a statement: “COVID-19 is a complex, multi-system disease which can have profound effects on many parts of the body, including the heart. “Many doctors have been hesitant to order echocardiograms for patients with COVID-19 because it’s an added procedure which involves close contact with patients. “Our work shows that these scans are important—they improved the treatment for a third of patients who received them.” Dr Dweck continued: “Damage to the heart is known to occur in severe flu, but we were surprised to see so many patients with damage to their heart with COVID-19, and so many patients with severe dysfunction.”

These local surges can and will occur in many places.

• Coronavirus Spike Continues Amid New Catalonia Restrictions (BBC)

Spain’s north-eastern Catalonia region has again recorded a daily Covid-19 infection figure of more than 1,000, as residents endure new restrictions. Health authorities are trying to halt this week’s surge, which has led to four million people around Barcelona being asked to stay home for 15 days. Catalonia’s is the worst of 150 Spanish outbreaks and neighbouring France says closing borders should be discussed. Spain has recorded 260,000 cases and there have been 28,400 deaths. The latest 24-hour figures from the region’s department of health on Saturday record another 1,226 cases, 894 of them in the Barcelona metropolitan area, adding to a surge over the past week. The surge led to tough new measures being announced on Friday.

Although they did not amount to a full lockdown, they have caused considerable concern in a region that was hoping to see an easing of restrictions. The measures, for an initial period of 15 days, include:

• No meetings of more than 10 people in public or private • No visits to nursing homes • Only leave the house for essential activities • Closure of nightclubs and gyms, restrictions on bars and restaurants, suspension of cultural activities and recreational sport

Barcelona bar owner Maria Quintana told AFP: “We’d just started to see things coming back to life with the arrival of a few foreign tourists, so this is a step backwards.”

How to just about literally mix up apples and oranges. And end up with something entirely useless.

• CDC Acknowledges Mixing Up Coronavirus Testing Data (Hill)

The Centers for Disease Control and Prevention (CDC) acknowledged Thursday that it is combining the results from viral and antibody COVID-19 tests when reporting the country’s testing totals, despite marked differences between the tests. First reported by NPR’s WLRN station in Miaimi, the practice has drawn ire from U.S. health experts who say combining the tests inhibits the agency’s ability to discern the country’s actual testing capacity. “You’ve got to be kidding me,” Ashish Jha, director of the Harvard Global Health Institute, told The Atlantic. “How could the CDC make that mistake? This is a mess.”

Viral tests — commonly referred to as PCR tests as most of them use a process known as polymerase chain reaction — are used by health professionals to determine whether or not a person is currently infected with the disease. During the pandemic, viral tests have been the most effective way of being able to diagnose a positive case of COVID-19. They are what state governments have been counting to track the number of confirmed cases of the virus they have. Antibody, or serology, tests serve a different purpose. Unlike viral tests that are taken by nose swab or saliva sample, antibody tests examine a person’s blood to see if their immune system has created antibodies to combat COVID-19. These tests allow doctors to see if someone has previously been exposed to the virus.

As the push for widespread testing in the U.S. has strengthened, antibody tests have been widely produced, many experts have balked at saying that antibodies equate to immunity from COVID-19. Serology tests are also less accurate than PCR tests, increasing the chances for a false negative. Moreover, a negative test means different things for either test. A negative PCR test indicates to physicians that the patient isn’t currently ill with the disease. But, a negative serology test means that the patient has most likely not been exposed to or infected with COVID-19. “The viral testing is to understand how many people are getting infected, while antibody testing is like looking in the rearview mirror. The two tests are totally different signals,” Jha told The Atlantic. [..] According to reports, several states, including Pennsylvania, Georgia, Texas and Florida, have also been combining the results of the two tests.

“I wouldn’t want any mixed messages going out there to any adversaries that they can take advantage of an opportunity, if you will, at a time of crisis,”

Ha ha! You don’t think they know?

• US Defense-Readiness A Concern As Troop COVID-19 Cases Surpass 20,000 (ZH)

Months ago the USS Theodore Roosevelt carrier disaster which saw over 1,000 crew members infected with COVID-19, cutting short its mission in the western pacific also amid public controversy and division within the Navy’s ranks over the handling of the crisis, made it clear that the Pentagon is keenly aware that US national security could be deeply impacted by the pandemic. During that prior saga China even boasted that its own warships in the region were coronavirus-free, prompting US generals to issue their own statements of continued full military readiness. But new infected case numbers put out by Military Times reveals the Department of Defense (DoD) is continuing to fight an uphill battle on this front: “Coronavirus cases are up more than 20 percent in service members this week, to 20,212, as the military’s battle against the pandemic continues to mirror the challenges civilian leaders are facing across the country.”

Military officials have downplayed this grim milestone of over 20,000 US military cases, including three deaths and 425 hospitalizations, as reflective of the rest of the general population. Like the civilian population, military cases have more than doubled since April. “From the first soldier diagnosed in South Korea at the end of February, it took until early June for the military to see 10,000 cases. The next 10,000 cases took six weeks,” Military Times writes. It’s likely that similar to what was observed in USS Roosevelt cases, most military personnel with coronavirus are asymptomatic, but the DoD has struggled to break this down and provide public data. One likely explanation for the rise in military cases is that most major installations are located in states like Texas, which has seen spiking numbers across the population.

[..] In April, when tensions with China in the East and South China Seas were growing, also after the Roosevelt supercarrier was temporarily taken out of commission by outbreak among the crew, Joint Chiefs Chairman General Mark Milley issued a stern warning to enemies. “We’re still capable and we’re still ready no matter what the threat,” Milley said at the time. “I wouldn’t want any mixed messages going out there to any adversaries that they can take advantage of an opportunity, if you will, at a time of crisis,” he added. “That would be a terrible and tragic mistake if they thought that.”

Hmmm. I would tend to agree, but HCQ is not harmless in large doses. Not sure dragging in Pearl Harbor and party politics helps much either.

• Hydroxychloroquine Should Be Available Over The Counter (TH)

It is time to take the bull by the horns to conquer the Wuhan virus. Drastic action is necessary, like on December 8, 1941 after Japan bombed Pearl Harbor. President Trump should order immediate public access to hydroxychloroquine (HCQ) by making the medication available over-the-counter (OTC). Liberals have interfered with public access to this medication for COVID-19 through the old-fashioned route of requiring a prescription and then having a pharmacist fill or reject the prescription. Millions of Americans do not visit physicians, and cannot obtain a prescription for HCQ if they did. Even if you have been exposed to COVID-19, you cannot obtain a prescription for HCQ in most states because regulators prohibit dispensing it without a positive test result, which typically cannot be obtained until late in the progression of the disease.

No one credibly doubts that HCQ is safe, and safer than many medications currently available OTC. No one credibly doubts the dozens of studies showing that early use of HCQ, pre-exposure and immediately after exposure to COVID, has helped many overcome this dreaded disease. Americans do not need a prescription to obtain hundreds of medications which once required a prescription. Nexium, Prevacid, Prilosec, Claritin, Flonase, and Primatene Mist are medications that have been shifted from Rx to OTC in recent years, not because the medical establishment pushed for the change, but because of public demand for it. No demand is higher at this time than for a medication which helps prevent against COVID. Yet Americans are not being allowed to access the medication which they want and need, and instead are being told by FDA and state officials that they cannot have it.

Last month the Oregon pharmacy board, for example, blocked HCQ access as follows: “Prescription orders for chloroquine or hydroxychloroquine for the prevention or treatment of COVID-19 infection may only be dispensed if written for a patient enrolled in a clinical trial by an authorized investigator.” They based their ban on an improper statement issued by FDA, which is controlled by opponents of Trump’s reelection. Of course, many government officials in Oregon are against Trump, too. Every state board of pharmacy or medicine is controlled by left-leaning government workers who, by and large, despise President Trump and hope he loses in November. They are accomplishing their dream by choking off public access to HCQ.

Current official number is 271,000. Why is he saying this now?

• Rouhani Estimates 25 Million Infected In Iran (JTN)

Iranian President Hassan Rouhani on Saturday belatedly acknowledged the toll coronavirus has taken on his country, reporting 25 million Iranians may have been infected and 14,000 have died. The staggering number means the estimated COVID-19 cases in Iran are nearly double the rest of the world’s infections and represent about 30 percent of Iran’s population. Rouhani also suggested the worst is not over, warning as many as 35 million more citizens could be infected before the pandemic ends. Tehran began new restrictions on Sunday, with many public places closed and religious gatherings canceled. “Our estimate is that so far 25 million Iranians have been infected with this virus and about 14,000 have lost their lives,” Rouhani said. Rouhani’s office said the number of infections was based on an “estimated scenario” from the health ministry.

There’s no law there against firing an entire group of people just because they organized?

• Icelandair Sacks All Cabin Crew, Says Spare Pilots Must Take Over (Ind.)

From Monday, every crew member on every Icelandair flight will be a pilot. The Icelandic national airline been negotiating with the Icelandic Cabin Crew Association (Flugfreyjufelag Islands/FFI) for months over new contracts in response to the coronavirus pandemic. In June, the two sides signed a five-year agreement that, according to Icelandair, involved “increasing productivity and flexibility”. The carrier has made similar deals with the pilots’ and engineers’ unions. But 10 days ago, cabin crew voted against the proposals by a majority of 73:27. Icelandair now says negotiations have broken down: “It has now become evident that a mutually agreed conclusion will not be reached.”

As a result, it has decided to “permanently terminate the employment of its current cabin crew members and permanently discontinue the employment relationship between the parties”. The airline says it has been “exploring other options regarding safety and service onboard its aircraft”. From 20 July pilots who are currently not required for flying duties will be assigned “responsibility for safety on board”. Passengers are warned: “Services will continue to be at a minimum, as it has since the impact of Covid-19 started.” Icelandair is now seeking new cabin crew, and is reported to be in talks with staff who lost their jobs when Wow Air collapsed in 2018. The cabin crew union said a strike would begin at once.

Key: “Huawei was told that geopolitics had played a part, and was given the impression that it was possible the decision could be revisited in future, perhaps if Trump failed to win a second term..”

• Pressure From Trump Led To 5G Ban, Britain Tells Huawei (G.)

The British government privately told the Chinese technology giant Huawei that it was being banned from Britain’s 5G telecoms network partly for “geopolitical” reasons following huge pressure from President Donald Trump, the Observer has learned. In the days leading up to the controversial announcement on Tuesday last week, intensive discussions were held and confidential communications exchanged between the government and Whitehall officials on one side and Huawei executives on the other. As part of the high-level behind-the-scenes contacts, Huawei was told that geopolitics had played a part, and was given the impression that it was possible the decision could be revisited in future, perhaps if Trump failed to win a second term and the anti-China stance in Washington eased.

Senior Huawei executives have gone public since Tuesday’s decision saying that they hope the British government will rethink, apparently encouraged by the results of back-channel contacts. The government’s private admissions are out of kilter with public statements last week by ministers, who said Huawei had been banned because of new security concerns raised by the National Cyber Security Centre (NCSC), which is part of GCHQ. In the Commons, Oliver Dowden, the secretary of state for digital, culture, media and sport, said new sanctions forbidding the sale of US-produced components to Huawei – meaning the Chinese company will have to source them from elsewhere – had changed the balance of security risk.

Not if the Democrats can help it.

• Trump Wants “Full & Speedy Withdrawal” From Afghanistan (ZH)

Amid a substantial US pullout from Afghanistan, the administration still doesn’t have a proper US Ambassador for that country. Reports, however, are that the short list includes a long-time war critic, Will Ruger. Though not nominated yet, Ruger is undergoing vetting, and has been meeting with officials. The Vice President for Research and policy at the Charles Koch Institute, Ruger has frequently advocated ending the Afghanistan War. Though the US is heading toward ending that war anyhow, with so many officials taking a wait and see approach, having a proper ambassador who is known to want a pullout would be a clear signal the administration intends to complete the process.

According to Politico: Ruger, a Naval Reserve officer who served a year in Afghanistan a decade ago, is aligned with the president’s thinking about the U.S. footprint in the Middle East and the wars in Afghanistan and Syria, and has been especially vocal about getting out of Afghanistan. “President Trump has correctly concluded that a full and speedy withdrawal of our troops is imperative,” he wrote in the American Interest in late May. “Our national interest isn’t served by continuing to wage a futile battle but by exiting it.” The US is well ahead of its pullout schedule, down to about 8,500 troops in Afghanistan. Officials sayt hey want 4,000 by the election, and some are saying a complete pullout is possible by then.

This is what the Trump campaign is going to push. Way before Robert Mueller became Special Counsel, it was abundantly clear there was no there there. It was clear in early January 2017 at the latest. And look what happened after. There’s no way to keep this out of the elections anymore.

Also: “Christopher Steele’s “Primary Sub-Source” Was His Own Employee” (Not some Russian Kremlin insider). And that employee greatly disagreed with how Steele used his comments. It was all made up.

• NYT Russiagate Propaganda Shredded By Strzok Comments (ZH)

Statement and documents from Sen. Lindsey Graham’s office: WASHINGTON – Today, as part of the Senate Judiciary Committee’s ongoing investigation into the Crossfire Hurricane investigation and related FISA abuses, Chairman Lindsey Graham (R- South Carolina) released two recently declassified documents that significantly undercut the reliability of the Steele dossier and the accuracy and reliability of many of the factual assertions in the Carter Page FISA applications. “I’m very pleased the investigation in the Senate Judiciary Committee has been able to secure the declassification of these important documents,” said Chairman Graham. “I want to thank Attorney General Barr for releasing these documents and allowing the American People to judge for themselves.

“What have we learned from the release of these two documents by the Department of Justice? Number one, it is clear to me that the memo regarding the FBI interview of the primary sub-source in January 2017 should have required the system to stop and reevaluate the case against Mr. Page. “Most importantly after this interview of the sub-source and the subsequent memo detailing the contents of the interview, it was a miscarriage of justice for the FBI and the Department of Justice to continue to seek a FISA warrant against Carter Page in April and June of 2017. “The dossier was a critical document to justify a FISA warrant against Mr. Page and this DOJ memo clearly indicates that the reliability of the dossier was completely destroyed after the interview with the primary sub-source in January 2017.

Those who knew or should have known of this development and continued to pursue a FISA warrant against Mr. Page anyway are in deep legal jeopardy in my view. “Secondly, the comments of Peter Strzok regarding the February 14 New York Times article are devastating in that they are an admission that there was no reliable evidence that anyone from the Trump Campaign was working with Russian Intelligence Agencies in any form. “The statements by Mr. Strzok question the entire premise of the FBI’s investigation of the Trump Campaign and make it even more outrageous that the Mueller team continued this investigation for almost two and a half years. Moreover, the statements by Strzok raise troubling questions as to whether the FBI was impermissibly unmasking and analyzing intelligence gathered on U.S. persons.

Whitney Webb Biden Strom Thurmond’

“There’s not enough troops in the army, to force the southern people to break down segregation and admit the n—er race into our theaters, into our swimming pools, into our homes, and into our churches.” – Strom Thurmond, Joe Biden’s “good friend”

— Whitney Webb (@_whitneywebb) July 19, 2020

Say and think what you will, but here’s a formidable man. Born in July 1919. He was 6 days short of turning 50 when the first man walked on the moon.

“I think people will discover all sorts of things they can do that they didn’t do before. Maybe they’ll realise it is not such a good idea to get fat; that much of the suffering they get in middle age and later life is caused by just eating too much of the wrong sort of food.”

• The Biosphere and I Are Both In The Last 1% Of Our Lives – James Lovelock (O.)

Is the virus part of the self-regulation of Gaia? Definitely, it’s a matter of sources and sinks. The source is the multiplication of the virus and the sink is anything we can do to get rid of it, which is not at the moment very effective. This is all part of evolution as Darwin saw it. You are not going to get a new species flourishing unless it has a food supply. In a sense that is what we are becoming. We are the food. I could easily make you a model and demonstrate that as the human population on the planet grew larger and larger, the probability of a virus evolving that would cut back the population is quite marked. We’re not exactly a desirable animal to let loose in unlimited numbers on the planet. Malthus was about right. In his day, when the human population was much smaller and distributed less densely across the planet, I don’t think Covid would have had a chance.

How will lockdown affect this prognosis? After this virus, I suspect quite a hefty change will be discernible. I think people will discover all sorts of things they can do that they didn’t do before. Maybe they’ll realise it is not such a good idea to get fat; that much of the suffering they get in middle age and later life is caused by just eating too much of the wrong sort of food. I always find it fascinating how the statistics illustrate that the health of the nation was enormously better at the end of the second world war than it was at the beginning.

Early in your career, you did some research in this field… The first work I did after university was with the Medical Research Council in the department run by the discoverer of the influenza virus, Sir Christopher Andrewes. My job was to measure the number of droplets caused by coughing and sneezing in underground shelters during the second world war. There had been a deadly influenza virus at the end of the first world war and they were mortally afraid of that starting again because the tube was crammed with people.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

A subtle hint:

Support the Automatic Earth in virustime.