DPC North approach, Pedro Miguel Lock, Panama Canal 1915

The virus has been reported in 81 countries and counting (+ Diamond Princess).

First cases in last 48 hours:

– Chile

– Argentina

– Liechtenstein

– Ukraine

– Gibraltar

– Morocco

– Senegal

– Tunisia

– Latvia

– Jordan

– Andorra

– Portugal

– Indonesia

– Saudi Arabia

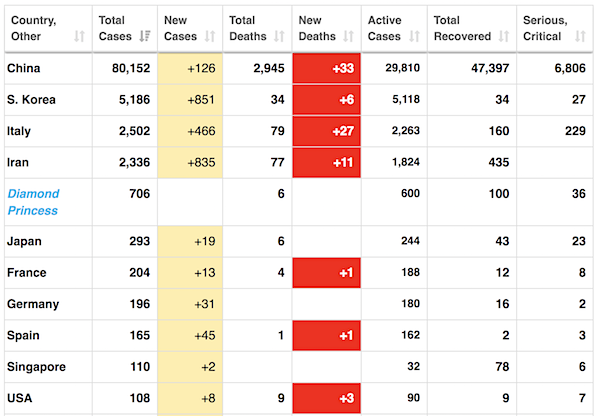

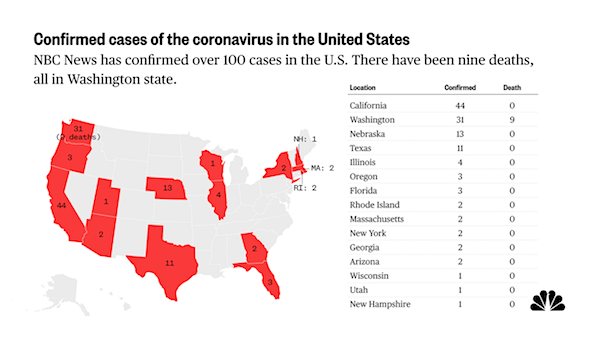

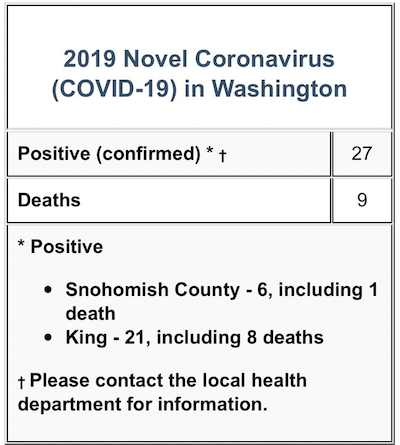

This is from Worldometer (I include them daily, see below), yesterday afternoon. They change to a “new day” at a for me odd time, which would make the numbers unclear. Check the huge increases in cases in Iran, Italy and South Korea -which added aother 435 cases today-. Also, WA state is a cluster. 9 deaths in no time. US cases up to 128 now. Virus may indeed, as has been suggested, have been around for 6 weeks.

• Germany reports 46 new cases

• Iran: 300,000 “volunteers” and soldiers, 54,000 prisoners out on bail

• Oregon officials warn up to 500 cases may be in state already

• Italy mulls cancelling all sporting events for a month

https://twitter.com/i/status/1235068772387418112

From SCMP:

From Worldometer (Note: mortality rate at 6%):

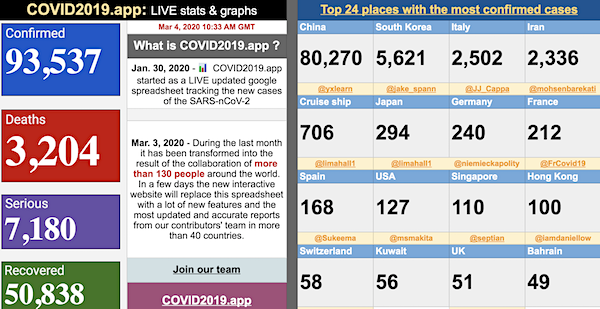

From COVID2019.app:

And of course there’s Joe Biden’s huge win. CNN and the Dems act as if they own the world and he’s about to beat Trump. Last night, CNN switched to one of their people in one of the Super Tuesday states, and he started off saying: “The Republicans are getting vey nervous…”

Why on earth would they, though? I’ve always maintained the Hunter affair makes him unfit, but there’s more. He’s a desperate choice by those who’ve held the reins in the party for decades. We’ll see stuff like this repeated 1000 times:

Here's more on some of the questions Joe Biden faces over his claims of civil rights activism. pic.twitter.com/LKe4juv0Yj

— The Intercept (@theintercept) March 4, 2020

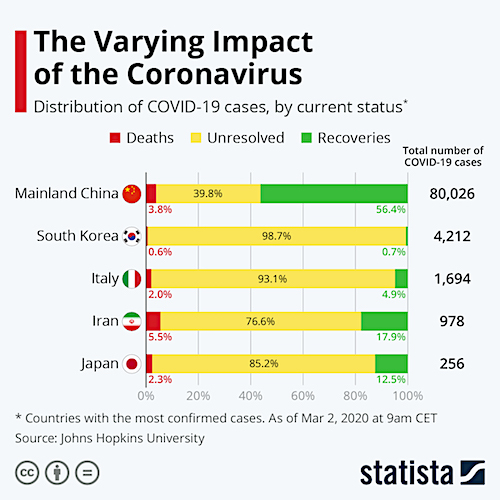

As we already saw yesterday, the mortality rate is very diffrent from one location to another. Much higher in the US and Italy than in South Korea?! Same virus?

• WHO Raises Global Mortality Rate For COVID-19 Up To 3.4% (CNBC)

World health officials said Tuesday the mortality rate for COVID-19 is 3.4% globally, higher than previous estimates of about 2%. “Globally, about 3.4% of reported COVID-19 cases have died,” WHO Director-General Tedros Adhanom Ghebreyesus said during a press briefing at the agency’s headquarters in Geneva. In comparison, seasonal flu generally kills far fewer than 1% of those infected, he said. The World Health Organization had said last week that the mortality rate of COVID-19 can differ, ranging from 0.7% to up to 4%, depending on the quality of the health-care system where it’s treated. Early in the outbreak, scientists had concluded the death rate was around 2.3%.

During a press briefing Monday, WHO officials said they don’t know how COVID-19 behaves, saying it’s not like influenza. They added that while much is known about the seasonal flu, such as how it’s transmitted and what treatments work to suppress the disease, that same information is still in question when it comes to the coronavirus. “This is a unique virus, with unique features. This virus is not influenza,” Tedros said Monday. “We are in uncharted territory.” Dr. Mike Ryan, executive director of WHO’s health emergencies program, said Monday that the coronavirus isn’t transmitting the same exact way as the flu and health officials have been given a “glimmer, a chink of light” that the virus could be contained.

“Here we have a disease for which we have no vaccine, no treatment, we don’t fully understand transmission, we don’t fully understand case mortality, but what we have been genuinely heartened by is that unlike influenza, where countries have fought back, where they’ve put in place strong measures, we’ve remarkably seen that the virus is suppressed,” Ryan said.

Unless you think his job is to transfer money to Fed member bannks.

• Maybe Jay Powell’s Not Cut Out For This Fed Chair Thing (Shazar)

For 10 days, while the markets were cratering as if they themselves had contracted a very serious case of coronavirus, Fed officials made all of their Fed-y reassuring mouth sounds: We’re keeping an eye on things, we’ll do something if it’s warranted, but it’s not yet, so just calm down. And then the markets did, soaring yesterday and continuing that rise today. At least until, after watching everyone else—including the White House, which although it wants to make clear thinks this whole China-virus or whatever things is totally overblown and invented like climate change to hurt the Dear Leader, did think that Jay Powell & co. were doing their typically horrible job containing a thing that Larry Kudlow said was already contained and oh yea doesn’t exist anyway—overreact for a week and a half, the Fed decided it would like to go a little nuts itself.

“The Federal Reserve cut its benchmark rate by a half percentage point on Tuesday morning, delivering a booster shot to stem potential economic disruptions from the spreading coronavirus epidemic with its first between-meeting move since the financial crisis…. Fed Chairman Jerome Powell at a press conference following the rate cut said the central bank “judged that the risks to the U.S. outlook have changed materially” and that the Fed “can and will do our part, however, to keep the U.S. economy strong as we meet this challenge.” Well, if Powell’s goal was to get the panic-selling on Wall Street to resume, he did his usual heckuva job.

“Stocks initially shot higher, propelling the Dow Jones Industrial Average up more than 300 points. But within 15 minutes, stocks’ initial gains gave way to jerky up-and-down trading action—with the blue-chip average and Treasury yields falling to session lows after Fed Chair Jerome Powell acknowledged the limits of the central bank’s actions in a press conference…. The Dow fell 510 points, or 1.9%, to 26194, while the S&P 500 and Nasdaq Composite were down 1.7% and 1.6%, respectively. The yield on the 10-year U.S. Treasury note, a benchmark for everything from mortgage rates to student loans, slipped to 1.036%.”

Much of that industry is set to go under.

• Airlines Rush To Boost Demand As Coronavirus Shreds Crisis Playbooks (R.)

The rapid spread of coronavirus cases worldwide is complicating a standard strategy used by airlines when disease, disaster or conflict hit travel destinations: lower fares and redirect flights to trouble-free areas. For now, some airlines have resorted to suspending change fees for new ticket reservations in the hope of winning over hesitant travelers until it becomes clearer where coronavirus outbreaks are localized and which routes could benefit from price drops. While lower fares have proven effective in the past in reviving demand, aviation consultant Samuel Engel said, “The pocketbook only works so far against emotion.” The coronavirus, which emerged in the central Chinese city of Wuhan late last year, has spread around the world, with more new cases now appearing outside China than inside.

JetBlue Airways Corp, which does not fly to Asia, was the first airline to launch free rebooking options last week, as it became clear that cases were not isolated to China. JetBlue pulled together and announced its plan in a matter of hours, President Joanna Geraghty told Reuters. “We tried to put ourselves in the shoes of our customers and think about what we would want if we were, for example, booking a spring-break trip right now,” Geraghty said. U.S. majors have since followed suit with varying waivers on change fees for new reservations to many destinations, a switch from a previous policy that covered only pre-booked flights to areas hardest-hit by the coronavirus.

[..] with none of the offers so far guaranteeing money-back refunds, travelers say the policies are not enough. “I understand that there are a lot of question marks right now for the industry on how this will unfold, but I don’t feel like there’s a truly customer-friendly policy out here,” said Amanda Elman-Kolb of Chicago, who has put on hold plans for a family trip to Europe in August. Declining demand to fly abroad is not limited to U.S. travelers. International travel to the United States will fall 6% over the next three months amid coronavirus concerns, the largest decline since the 2007-2008 financial crisis, the U.S. Travel Association forecast on Tuesday.

And then came cratering demand due to the virus… Putin’s said he’s fine with $40 oil. Few others are.

• Market Mayhem Exposes Fears About Oil Companies (CNN)

Oil prices have plunged into yet another bear market in response to demand destruction caused by flight cancellations, factory shutdowns and slowdowns in passenger traffic. Natural gas is sitting near a four-year low. The commodities crash will intensify the financial stress facing oil and gas companies that have piled on debt to capitalize on the shale boom. Energy stocks, already the biggest losers of last decade, are getting crushed. ExxonMobil and Chevron, two giants built to withstand weak oil, have plunged more than 20% apiece this year. “It’s making an already bad situation worse,” said Spencer Cutter, credit analyst at Bloomberg Intelligence. The pain is more acute among independent exploration and production companies, some of which are highly leveraged.

Marathon Oil, Devon Energy and Noble Energy have all seen a third of their market values vanish this year. The turmoil has formed deep cracks in the junk bond market. Alarmingly, the gap between high-yield energy debt and ultra-safe government bonds has blown out to levels unseen since 2016, when oil prices crashed to $26 a barrel. The junk ratings for these energy companies aren’t new — only concerns about their financial health are. Cutter found that about one-third of the junk bonds in the Bloomberg/Barclays high-yield energy index are trading at distressed levels (roughly 10 percentage points above benchmark Treasuries, compared with just one percentage point for companies with strong credit ratings). That includes the bonds of companies including Chesapeake Energy, Whiting Petroleum, California Resources and Range Resources.

At those levels, highly leveraged oil and gas producers have effectively been locked out of the junk bond market. To raise cash, they will have to slash costs, sell assets, accept harsh borrowing terms from a hedge fund or seek a financial lifeline through a merger. Some debt-riddled oil companies won’t survive at all. “You could see a wave of bankruptcies,” said Cutter, the Bloomberg Intelligence analyst. The bill is coming due on a mountain of debt in the coming years. North American exploration and production companies have roughly $86 billion of debt maturing by 2024, according Moody’s Investors Services. More than half of those maturities, 62%, are in junk bonds.

“After decades of pursuing balanced development nationwide, China now aims to concentrate resources on the best-performing provincial and municipal economies rather than pumping money into poor areas to help them catch up..”

• China’s Funding Breakdown Emphasises Economic Imbalances (SCMP)

Cash from China’s financial system flowed mainly to the affluent Pearl River and Yangtze River Deltas in 2019, while funding for hard hit rust-belt provinces dried up, according to new figures published by its central bank. The figures offered fresh evidence of an increasing unequal financial landscape in the world’s second biggest economy. Rich areas continue to absorb more funds and talent to become richer, while poor areas lag behind. This imbalance presents a significant challenge for Beijing, as it attempts to navigate the wider issues that come with slowing economic growth.

Guangdong, the economic powerhouse adjoining Hong Kong, topped the list of provincial funding compiled by the People’s Bank of China, receiving 2.92 trillion yuan (US$417 billion) in the form of bank loans, bond issuance, and trust investments. This was 11.4 per cent of the national total. Guangdong accounts for 8.1 per cent of China’s population and 10.9 per cent of economic output. In second place was Jiangsu, China’s second largest provincial economy, which received 2.41 trillion yuan, followed by Zhejiang, another economic heavyweight, on 2.22 trillion. China’s capital of Beijing was the only northern region to feature high up in the rankings, absorbing 1.46 trillion yuan in financial flows. Hubei, meanwhile, the epicentre of the coronavirus, was in 10th position, with funding of 873.4 billion yuan (US$125 billion) last year.

Funding from China’s banking system, the bond market and even the shadow banking network is often key to regional economic growth. China’s southwesterly Yunnan province, for example, registered a nationwide high 8.1 per cent in gross domestic product growth. Over the same period, its fundraising rose by 43.5 per cent year-on-year to 492.6 billion yuan. [..] The disparity is also a product of a shift in policy by the Politburo, the 25-member decision-making body headed by President Xi Jinping, taken last summer. After decades of pursuing balanced development nationwide, China now aims to concentrate resources on the best-performing provincial and municipal economies rather than pumping money into poor areas to help them catch up.

Is this a veiled attack on WikiLeaks?

• CIA Has Been Attacking Multiple Chinese Bodies For 11 Years (PDaily)

A hacking group affiliated with the US Central Intelligence Agency (CIA) has been attacking multiple Chinese bodies for 11 years, a new report found. According to the report by Chinese tech giant 360 Security Technology released on Tuesday, the attack by the group, coded by 360 Security as APT-C-39, has conducted a series of attacks against China’s aviation industry, scientific research institutions, petroleum industry, large-scale internet companies, and government bodies for more than a decade. The report analyzed “Vault7,” a trove of documents on cyber weapons disclosed by WikiLeaks in 2017. The report said that the group started launching advanced persistent threat (APT) attacks against China as early as September 2008 and they mainly targeted provincial regions like Beijing, Guangdong, and Zhejiang.

The Chinese tech giant was able to make the link thanks to Joshua Adam Schulte, a former CIA employee who played a core role in developing many of the CIA’s hacking tools and cyberspace weapons and participated in the development of Vault 7. Schulte provided evidence to 360 Security Technology and the trove of documents, the authenticity of which was confirmed by US prosecutors, became key to confirming that APT-C-39 was affiliated with the CIA, the Global Times reported, It has been proven repeatedly that the United States has been conducting large-scale, organized, and indiscriminate cyber theft and surveillance activities against foreign governments, businesses, and individuals, China’s defense ministry spokesperson said at a press conference on Friday.

“..she will not be able claim the privilege against self-incrimination on the original alleged offenses since the statute of limitations has passed.”

• Court: Clinton Must Testify On Email Scandal (Turley)

In a remarkable turnaround, Hillary Clinton will have to testify after all on the email scandal. Clinton has never been subject to true examination on the issue under oath. Instead, she was allowed to meet with investigators shortly before being cleared during the Obama Administration. D.C. District Court Judge Royce C. Lamberth ruled that her prior answers were insufficient and cursory. One interesting twist is that she will not be able claim the privilege against self-incrimination on the original alleged offenses since the statute of limitations has passed. While she would have been unlikely to do so, she would have evoked on a crime that could be prosecuted.

Ironically, it will be the Trump Administration that will have to defend her in opposing such demands since they are handling the litigation as it relates to her prior public service as Secretary of State. This surprising order follows the disclosure by watchdog group Judicial Watch last December that the FBI released “approximately thirty previously undisclosed Clinton emails.” Judicial Watch has argued that the State Department “failed to fully explain” where they came from. Lamberth decided that Clinton has not answered the troubling questions related to her email system:

“As extensive as the existing record is, it does not sufficiently explain Secretary Clinton’s state of mind when she decided it would be an acceptable practice to set up and use a private server to conduct State Department business. The court believes those responses were either incomplete, unhelpful, or cursory at best. Simply put, her responses left many more questions than answers.” While I expect that Clinton will have a lot of “I do not recall” answers given the passage of time, such examinations come at a risk of false statements under oath. Moreover, Judicial Watch can refresh her money with documents.

“..Hillary Clinton could potentially fight a ruling that she must sit for a sworn deposition before a federal judge, but she would have to ask Attorney General William Barr for help..”

• Napolitano: Hillary Clinton Faces A Catch-22 Over Private Email Server (Fox)

Former Secretary of State Hillary Clinton could potentially fight a ruling that she must sit for a sworn deposition before a federal judge, but she would have to ask Attorney General William Barr for help, Fox News senior judicial analyst Judge Andrew Napolitano explained Tuesday. In an interview on “Fox & Friends,” Napolitano said that the former presidential candidate would have to ask Barr to file an appeal on her behalf because the Department of Justice (DOJ) lawyers would be representing her in the matter. [..] “Judicial Watch has been trying to get copies of these documents [under The Freedom of Information Act]. When they looked at the documents, some of which have been prepared by Mrs. Clinton, you heard what the judge said: the answers were deceptive, misleading, and generated more questions than they answered.

Therefore, he ordered her to be deposed.” “She has never been deposed under oath on this,” he continued. “She was interrogated, but not under oath, in a secret interrogation by the FBI three days before they exonerated her.” Additionally, he noted, this deposition will also be videotaped. “She can’t plead the fifth, right?” asked host Ainsley Earhardt. “She can’t plead the fifth because the statute of limitations to prosecute her for failure to safeguard state secrets has come and gone. She can’t be prosecuted for that,” he replied. “She could be prosecuted if she lies under oath in this deposition. She is represented in the deposition by lawyers form the Justice Department.” “The same Justice Department that would prosecute her if she lies under oath,” he added.

Very true. No authenticity left in the DNC.

• The Establishment Struggles With The “Nightmare” Of Authenticity (Turley)

Heading into Super Tuesday, the media appears at its collective wit’s end. After the victory of Joe Biden in South Carolina, many attempted to portray a new day until the they faced polls in the morning showing Bernie Sanders again surging in states from California to Texas to even Massachusetts (where Elizabeth Warren is struggling to win her own state). Described as the “nightmare scenario,” the media and political establishment in Washington is back to clutching its pearls and speaking of a convention strategy to block Sanders, including Warren whose campaign calls such a move the “final play.”

The continuing support win for Bernie Sanders has sent the D.C. political and media establishment into vapors. On the eve of Super Tuesday, Pete Buttigieg and Amy Klobuchar, Beto O’Rourke all lined up to endorse Joe Biden to try to stop the momentum for Sanders. Others are growing more and more shrill. Democratic strategist James Carville proclaimed the winner to be Valdimir Putin. His point was that both Sanders and Trump continue surging despite unrelenting attacks in the media. The fact is that many in Washington still cannot compute why so many voters will not listen to them about Sanders and Trump. The reason is that they are valued for the one thing that the establishment cannot offer: authenticity.

[..] Authenticity is a word rarely applied to Trump, but it remains his greatest selling point outside Washington. While rarely acknowledged, Trump has fulfilled many of his campaign promises with his push on immigration, the wall, taxes, Jerusalem, renegotiating NAFTA, dropping the Iran deal, rolling back regulations, opening areas like the artic to drilling, finishing the Keystone pipeline, gutting Obamacare and other promises. More importantly, he does not try to pretend what he is not: honest or moral. He openly talks about delivering wealth and having people vote their pocketbooks. He is the ultimate car salesman who you don’t trust but still want to get a good deal from.

Bernie Sanders is genuinely authentic. Indeed, Sanders seems immune from changes from clothing or political styles. There was never a popular time to be socialist but Sanders never budged. To the contrary, he praised Castro and spent his birthday in the Soviet Union during the cold war. He changes his positions at the speed of tectonic plate shifts. That is why you can hate socialism but love Sanders because you know (like Trump) exactly what you are getting. Elizabeth Warren in comparison was known as a pro-corporate, anti-consumer academic for much of her career before being a champion of the downtrodden.

Russia comments from the sidelines for now. Why would it help Europe when the MH17 “trial” is to start next week?

• Russia Says Turkey Does Not Meet Terms Of Pact In Syria’s Idlib (R.)

Russia accused Turkey on Wednesday of failing to meet its obligations under a pact to create a demilitarised zone in Syria’s Idlib province and of helping militants instead. The RIA news agency quoted a Russian defense ministry spokesman as saying “terrorist” fortifications had merged with Turkish outposts in Idlib, resulting in daily attacks on Russia’s Hmeimim air base in Syria. Turkey had amassed troop numbers in Idlib equal to a mechanised division, violating international law, the Russian spokesman said. The Russian accusation came on the eve of a Thursday meeting in Moscow between President Recep Tayyip Erdogan of Turkey and his Russian counterpart, Vladimir Putin. They are expected to try to de-escalate tensions that have brought Turkey and Russia dangerously close to direct military confrontation.

No link to Idlib. Just human pawns.

• Russia Says Turkey Trying To Push 130,000 Refugees From Syria Into Greece (R.)

Russia on Tuesday said that Turkey was trying to push 130,000 refugees from Syria into Greece, the Interfax news agency cited the Defense Ministry as saying. The two thirds of these refugees – that Turkey is pushing from temporary camps in Syria – are Afghans, Iraqis and Africans, not Syrians, it added.

In case you didn’t get yet that in Brussels it’s all exclusively about money.

• EU Pledges €700 Million To Help Greece Fight Migrant Influx From Turkey (F24)

European Commission President Ursula von der Leyen said the EU would provide Greece with “all the support needed” as it struggles with an influx of migrants allowed to cross from neighbouring Turkey after Turkish President Recep Tayyip Erdogan warned that “millions” of migrants would soon head for Europe. EU chiefs on Tuesday pledged millions of euros of financial assistance to Greece to help tackle the migration surge from neighbouring Turkey, warning against those wishing to “test Europe’s unity”. Flying by helicopter over the Greek-Turkish border, where thousands of desperate asylum-seekers have tried to break through for days, European Commission President Ursula von der Leyen said the bloc would provide Greece “all the support needed”.

“Those who seek to test Europe’s unity will be disappointed,” von der Leyen said, standing alongside Greek Prime Minister Kyriakos Mitsotakis and the chiefs of the European Council and European Parliament. “We will hold the line and our unity will prevail.” The European Commission president said the bloc would provide 700 million euros ($777 million), half of it immediately, to help manage the migrant situation. In addition, the EU border agency Frontex will deploy a rapid intervention team including an additional 100 guards backed by coastal patrol vessels, helicopters and vehicles, she said. “Our first priority is making sure that order is maintained at the Greek external border, which is also the European border,” von der Leyen told journalists.

“I am fully committed to mobilising all the necessary operational support to the Greek authorities,” she said, adding that Greece was acting as a “shield” for Europe.

Hopeless?!

• Planet Plastic (Rolling Stone)

More than half the plastic now on Earth has been created since 2002, and plastic pollution is on pace to double by 2030. At its root, the global plastics crisis is a product of our addiction to fossil fuels. The private profit and public harm of the oil industry is well understood: Oil is refined and distributed to consumers, who benefit from gasoline’s short, useful lifespan in a combustion engine, leaving behind atmospheric pollution for generations. But this same pattern — and this same tragedy of the commons — is playing out with another gift of the oil-and-gas giants, whose drilling draws up the petroleum precursors for plastics. These are refined in industrial complexes and manufactured into bottles, bags, containers, textiles, and toys for consumers who benefit from their transient use — before throwing them away.

“Plastics are just a way of making things out of fossil fuels,” says Jim Puckett, executive director of the Basel Action Network. BAN is devoted to enforcement of the Basel Convention, an international treaty that blocks the developed world from dumping hazardous wastes on the developing world, and was recently expanded, effective next year, to include plastics. For Americans who religiously sort their recycling, it’s upsetting to hear about plastic being lumped in with toxic waste. But the poisonous parallel is apt. When it comes to plastic, recycling is a misnomer. “They really sold people on the idea that plastics can be recycled because there’s a fraction of them that are,” says Puckett. “It’s fraudulent. When you drill down into plastics recycling, you realize it’s a myth.”

Since 1950, the world has created 6.3 trillion kilograms of plastic waste — and 91 percent has never been recycled even once, according to a landmark 2017 study published in the journal Science Advances. Unlike aluminum, which can be recycled again and again, plastic degrades in reprocessing, and is almost never recycled more than once. A plastic soda bottle, for example, might get downcycled into a carpet. Modern technology has hardly improved things: Of the 78 billion kilograms of plastic packaging materials produced in 2013, only 14 percent were even collected for recycling, and just two percent were effectively recycled to compete with virgin plastic. “Recycling delays, rather than avoids, final disposal,” the Science authors write. And most plastics persist for centuries.

If you read us, please support us. It’s the only way the Automatic Earth can survive. Donate on Paypal and Patreon.

Home › Forums › Debt Rattle March 4 2020