Pablo Picasso The old guitarist 1903-4

GDP may look strong, but sentiments are crumbling.

• What the GDP Report Won’t Tell You About the Economy (DDMB)

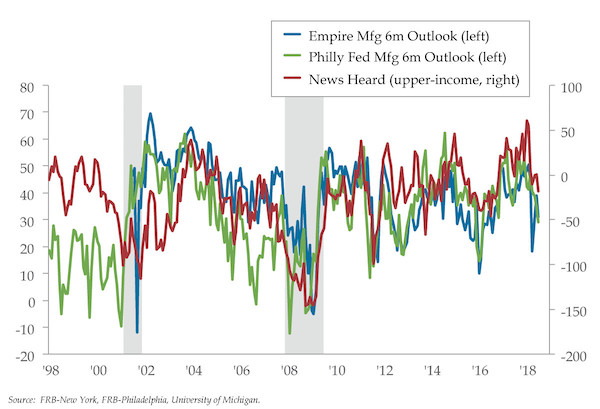

Something is amiss in Corporate America. Both national and regional surveys reveal a sinking sense that the economy’s tailwinds are shifting to headwinds. The downtrodden confidence is a curiosity given many economists’ forecasts calling for second-quarter growth to have accelerated to a 4.2 percent annualized rate, the fastest since 2014. Soft though the survey data may be, the numbers don’t lie. If something doesn’t give – and fast – what follows is sure to be damaging to the real economy. The University of Michigan consumer sentiment survey for July revealed that the business outlook had slumped to the lowest level in over two years.

Odds are pretty good this number was dragged down by those with the highest incomes, many of whom are likely also business owners and corporate executives who’ve been on the front line of the rising costs to run their businesses. But there may be more than meets the eye among those whose incomes rank in the top third of households. While the majority of these respondents expressed concern over the tariffs, what they’re reading, hearing and seeing may be dampening their outlooks even further. As things stand, it’s as if January never happened, a month in which confidence was so high, the “news heard” among high income earners hit a 20-year high. By the beginning of July, “news heard” had slid to minus 18, the lowest in two years.

The six-month, 79-point swing is so severe it rivals August 2011, when the euro crisis shook world markets, Standard & Poor’s stripped the U.S. of its AAA credit rating and households were rattled by the debt ceiling debacle. [..] Consider the starting point for many companies. Last year’s weak dollar and natural disasters had many struggling to satisfy overseas demands and the massive needs required to rebuild. Labor and raw material costs were already on the rise to correct for the imbalances. The tariffs were the insult to injury many manufacturers could simply not afford.

“The actual economic impact will really come down to time,” cautioned Boockvar. “The longer this goes on, the more actual business activity will be negatively affected.” To Boockvar’s point, the collapse in business sentiment suggests many companies don’t foresee the ability to withstand further blows to their ability to profitably conduct business. Businesses are saying as much.

Unbelievable garbage from CNN. That they pay attention to Assange now may be a ominous sign. They straight-faced claim that Assange fled rape allegations in Sweden. He did not. Sweden told him he was free to go to London. Only to turn around and issue a warrant for him.

• Julian Assange Looks For Deal To End ‘Diplomatic Isolation’ (CNN)

Julian Assange walked into the Ecuadorian Embassy in London on June 19, 2012 to claim political asylum. He has been there ever since – a total of 2,230 days – rarely seeing daylight. But multiple sources say his situation is now untenable and he may soon leave, whether he wants to or not. The question is: what will happen to Assange as and when he does walk out of his bolt-hole around the corner from Harrods? The recent indictments issued by US Special Counsel Robert Mueller imply that Assange and WikiLeaks were a conduit for Russian intelligence in distributing hacked Democratic Party emails in 2016. According to the indictment document, “The conspirators (…) discussed the release of the stolen documents and the timing of those releases with Organisation 1 to heighten their impact.”

Assange has always maintained that he did not receive them from the Russian government. He told Fox News in January 2017: “Our source is not the Russian government, and it is not a state party.” A member of Assange’s legal team, Jennifer Robinson, told CNN this week: “WikiLeaks has made very clear they were not engaged in any way with the Russian state with respect to that publication. There is no connection between WikiLeaks and any of those who have been indicted.” His lawyers argue that all Assange did was publish the hacked emails, as did other media, after being in contact with a hacker called Guccifer 2.0. The Special Counsel alleges that Guccifer 2.0 was a cover for Russian intelligence, saying in the indictment that on July 14th [2016], Guccifer 2.0 sent WikiLeaks an encrypted attachment that contained “instructions on how to access an online archive of stolen DNC documents.”

Whether a sealed indictment awaits Assange in relation to the Russian hacking investigation is unknown. But according to US officials, charges have been drawn up relating to previous WikiLeaks disclosures of classified US documents. Assange would face arrest if/when he leaves the embassy because he skipped bail in 2012 – when Swedish authorities were seeking his extradition to face accusations of rape. Last year Sweden suspended the investigation, but Assange’s lawyers fear his arrest would be swiftly followed by a US extradition request. Assange maintains his innocence.

This feels like too little too late. We know all this, we have for a long time. And it’s worse: as I wrote in May in I am Julian Assange, the Guardian engaged in an active smear campaign against Assange then. So does CNN -see above. That’s much more relevant than that they don’t defend him.

• In Refusing To Defend Assange, Mainstream Media Exposes Its True Nature (CJ)

Last Tuesday a top lawyer for the New York Times named David McCraw warned a room full of judges that the prosecution of Julian Assange for WikiLeaks publications would set a very dangerous precedent which would end up hurting mainstream news media outlets like NYT, the Washington Post, and other outlets which publish secret government documents. “I think the prosecution of him would be a very, very bad precedent for publishers,” McCraw said. “From that incident, from everything I know, he’s sort of in a classic publisher’s position and I think the law would have a very hard time drawing a distinction between The New York Times and WikiLeaks.” Do you know where I read about this? Not in the New York Times.

“Curiously, as of this writing, McCraw’s words have found no mention in the Times itself,” activist Ray McGovern wrote for the alternative media outlet Consortium News. “In recent years, the newspaper has shown a marked proclivity to avoid printing anything that might risk its front row seat at the government trough.” So let’s unpack that a bit. It is now public knowledge that the Ecuadorian government is actively seeking to turn Assange over to be arrested by the British government. This was initially reported by RT, then independently confirmed by The Intercept, and is today full mainstream public knowledge being reported by mainstream outlets like CNN.

It is also public knowledge that Assange’s asylum was granted by the Ecuadorian government due to a feared attempt to extradite him to the United States and prosecute him for WikiLeaks publications. Everyone from President Donald Trump to Attorney General Jeff Sessions to now-Secretary of State Mike Pompeo to ranking House Intelligence Committee member Adam Schiff to Democratic members of the US Senate have made public statements clearly indicating that there is a US government interest in getting Assange out of the shelter of political asylum and into prison.

The state of the media is something to behold. Can it slide even further? You bet.

• Round the Bend (Jim Kunstler)

Some people you just can’t reason with, especially the hell-spawned man-beast who personally directed Russian “meddling” and “interference” in our election and stole certain victory from president-designee Hillary. (I know this because The New York Times and The Washington Post said so.) Another astonishment: in his testimony before the Senate Foreign Relations Committee this week, Secretary of State Mike Pompeo said the US would not recognize Crimea as part of Russia and would demand the return of the region to Ukraine. Not to put too fine a point on it, Mr. Pompeo is pissing up a rope on that one. Russia will not give up its warm-water naval bases on the Black Sea anymore than the US will return its San Diego naval installation to Mexico, and Mr. Pompeo knows it.

So do the posturing idiots on the senate committee, who apparently forgot that our own government officials fomented the 2014 Ukrainian coup that prompted Russia to annex Crimea and its military assets in the first place. How many of you feel a gnawing disgust and contempt for both sides of the US political spectrum? The news, day and night, reveals a nation unable to think, unable to discern reality from fantasy, avid to dissemble and lie about absolutely everything, eager to support any racketeering operation designed to fleece its own citizens, and utterly ignoring the genuine problems that can drive us into a new dark age.

On balance, and just for now, I’m more disturbed by the side represented by the Democratic Party, aka the “progressives” or “the Resistance,” because they are responsible for politicizing the FBI before, during, and after the 2016 election and that was a dastardly act of institutional debauchery in an agency with the power to destroy the lives and careers of American citizens. The product of that corruption is a dangerous manufactured hysteria inciting hostility and aggression against another nation that could lead to a war that humanity will not recover from.

Austerity leads to right wing support everywhere.

• David Cameron’s Welfare Cuts Led Directly To The Brexit Vote (Ind.)

As the Brexit negotiations roll on, we do see some signs of progress. Our understanding of the underlying causes of the referendum outcome has developed significantly in the last two years. Leave-supporting areas can be easily distinguished from those supporting Remain. Broadly speaking, they are more deprived, have lower levels of income, fewer high status-jobs, a weaker economic structure, and an ageing demographic with lower levels of educational attainment. Further, non-economic factors have also been highlighted as important correlates of support for Brexit . But an open question to economists, though, is what are the economic origins of the relationships between these characteristics and support for Leave?

An important cross-cutting observation that has been made over and over again is that Leave-supporting areas stand out in having an electorate that has been “left behind”, is particularly reliant on the welfare state and is thus exposed to welfare cuts. In a recent paper, I show that austerity-induced reforms, including widespread cuts to the welfare state since 2010, were an important factor behind the decision of many people to shift their political support to UKIP and, subsequently, support Leave in the EU referendum.

The austerity-induced reforms of the welfare state, implemented in the years after 2010, were broad and deep. In 2013, it was estimated that the measures included in the Welfare Reform Act of 2012 would cost every working-age Briton, on average, around £400 per year. Crucially, the impact of the cuts was far from uniform across the UK: it varied from around £900 in Blackpool to just above £100 in the City of London. Aggregate figures suggest that overall government spending for welfare and protection contracted by 16 per cent in real per capita terms, reaching levels last seen in the early 2000s.

What is Bernie thinking?

• An Open Letter to Bernie Sanders: ‘No Bernie, It Wasn’t the Russians’ (MPN)

Let me preface this open letter of sorts that I’m writing to Senator Bernie Sanders. I’m not penning this missive as though I’m a crestfallen supporter, after falling for the okie doke in 2008 and waking up to the deception of Obama, I decided to stop putting my faith in politicians. Rather, I write this article on behalf of Bernie’s legions of supporters and the millions of Americans who put their faith in someone who spoke against the iniquities that are ravaging our nation and our planet as a whole. Bernie, it was your decision to speak against this consolidated graft that is cratering society that captured the imagination of the disaffected and gave people hope that their voices could be heard above the cash extortion that dominates our government.

Instead of continuing your rebellion against the establishment and speaking against the corrosive nature of our politics, you are charting a course towards irrelevance by jumping on this cockamamie #Russiagate narrative. Here is what I don’t get about your decision to glom on to this most ridiculous assertion that 12 Russians had more impact on our elections than the billions of dollars that are spent by corporations and plutocrats to bend elected officials like pretzels. The insinuation the punditry is making is that Americans were duped to vote against their own self-interests because they refused to vote for Hillary Clinton.

Never mind that Hillary was one of the most divisive and disliked politician to run for president in modern American history. Never mind that the DNC essentially rigged the primaries to ensure her victory at your expense. Instead of focusing on the structural and systematic flaws that render our votes irrelevant, fingers are pointed at a manufactured villain halfway around the world in order to distract from the fact that our elections have been hijacked by moneyed interests and entrenched leeches who are sucking the citizenry dry. Whatever efforts Russia might have made to influence our elections were outweighed by a kleptocracy that hacked down our democracy with dark money and self-centered politicians who put their interests above that of the people they purportedly serve.

This one’s for you, bible belt.

• Putin Calls Christianity Foundation Of Russian State (AP)

Vladimir Putin says that the adoption of Christianity more than 1,000 years in territory that later became Russia marked the starting point for forming Russia itself. Putin’s comments came Saturday in a ceremony marking the 1,030th anniversary of the adoption by Christianity by Prince Vladimir, the leader of Kievan Rus, a loose federation of Slavic tribes that preceded the Russian state. Speaking to a crowd of thousands of clergy and believers at a huge statue of the prince outside the Kremlin, Putin said adopting Christianity was “the starting point for the formation and development of Russian statehood, the true spiritual birth of our ancestors, the determination of their identity. Identity, the flowering of national culture and education.” The comments underline strong ties between the government and the Russian Orthodox Church.

Book review. Hope the book itself is better. What social media do to people’s brains and social lives is far more relevant.

• Ten Arguments for Deleting Your Social Media Accounts Right Now (Star)

If you’re online these days, you likely sense that something’s wrong with the internet. You probably feel weird about how many times a day you check Facebook or Instagram, and likely a little uneasy about how annoyed or envious you feel when you do. Maybe the hostility online depresses you. Maybe you worry about the next generation, and how anxious they all seem. Maybe you’ve even considered deleting your accounts. This is exactly what Jaron Lanier, a leader in the tech world, says you should do. Right away. Lanier — a pioneer in the world of internet startups, and virtual reality in particular — has long been a critic of the Silicon Valley status quo. In this slim, highly-readable manifesto, he lays out his case against social media. And it is a devastating one.

In 10 simple arguments, the tech insider paints a picture of a wide-scale behaviour modification apparatus driven by social attention — both the carrot of approval and the stick of criticism, which generates the most intensity or “engagement.” “There is no evil genius seated in a cubicle in a social media company performing calculations and deciding that making people feel bad is more ‘engaging’ and therefore more profitable than making them feel good,” he writes. “Or at least, I’ve never met or heard of such a person. The prime directive to be engaging reinforces itself, and no one even notices that negative emotions are being amplified more than positive ones.”

According to Lanier, the social media apparatus has made people into lab rats, placing them under constant surveillance. He believes the process is making people angrier, more isolated, less empathetic, less informed about the world, and less able to support themselves financially. Add to all that: Lanier says this highly tuned behaviour modification system is for rent to anyone looking to influence the public. The constant stream of data, and the algorithms that tweak subsequent efforts to sway people, aren’t just used to sell soap, he notes, but to influence politics.

Wonderful tale. But given the demise of insect numbers, bats must be under severe threat.

• Nature’s Darkness-Creature Has Become Ours, Too (G.)

Here’s a flicker in the periphery. I notice it because of the way it moves; it’s a sort of fast fidget – staccato and angular in movement and path, like a movie projected at the wrong frame rate. It doesn’t swoop like a swallow, or bumble like a moth. The bat moves like a bat, and like nothing else. I’m sitting near my home under some trees, watching the coming night deepen the navy sky. The day has been airlessly hot, and with nightfall relief creeps into the air like a balm. Animals are out – I can hear twitches in the bushes behind me. Young frogs; hedgehogs maybe. Looking for water. Then I notice this bat. Seconds after I see it, I feel it pass so close that it makes my hair move, with it a split-second rustle of papery wings. I shiver.

Bats are just flying mice, people say, except they’re not, at all. Worldwide there are two main groups: Megachiroptera, big-eyed, placid-faced, small-eared – almost anthropomorphic, a man-bat; and Microchiroptera, the opposite. Nature’s darkness-creature has over time become ours, too. Their thorny outline is so conversant with the sinister that we nearly forget why. Light never catches them. They are opaque, darkly anonymous silhouettes into which humans project all manner of eerie ideas. Unwittingly, bats reinforce these with their habits. They haunt churches. Fly by night. Sleep subversively inverted. And the one far-flung species that feeds on blood bears the name “vampire” all too neatly.

This solitary bat flies about me in rapid loops. This one is maybe a noctule, or a pipistrelle. Catching insects perhaps. I worry that it will hit me but it won’t. It sees by echoing its sounds off nearby objects like aerial sonar, and it’s an excellent way to navigate. Those sounds are too high-pitched for the human ear to detect, and so to us, other than those wings, the bat makes no sound. None at all. I watch it. Bats need to catch air under their wings to fly. They can’t lift off like birds: they must drop. Their flight is a fall, arrested again and again with each frantic flap. That’s why they don’t move like anything else. Except, perhaps, a human trying to fly.

And so the issue keeps shifting. But it doesn’t get resolved.

• Migrant Arrivals Push Shelters To Breaking Point In Southern Spain (El Pais)

Shelters in the south of Spain are struggling to deal with a huge influx of migrants, many of whom are being left without a proper place to sleep. The arrivals – 1,300 in the past three days – have stretched services to their breaking point with the strain felt particularly hard in Algeciras as well as other municipalities along the coast of Andalusia. The number of undocumented migrants arriving in Spain has doubled since last year. Spain is now the main entry point into Europe, above Italy or Greece. But shelter services have been unable to keep up with the demand, leaving many migrants to sleep in overcrowded centers.

Up to 260 migrants spent the past two nights on the deck of a Maritime Rescue ship, more than 50 huddled together on a small courtyard of a police station in Algeciras, and 90 more jostled for a spot in the port of Barbate. Many more are left to wander the streets of towns like Medina Sidonia and Chiclana after spending the maximum legal 72-hour period in police custody. Immigration officials have traveled to Cádiz to look for a solution to what the Spanish government describes as a “collapse” of services. In a press release, the government said that 400 migrants had nowhere to go and blamed the problem on the former administration of Mariano Rajoy for its “lack of foresight.” “The number of arrivals has not stopped rising since 2017 but despite this nothing was done,” said a spokesperson for the Interior Ministry.

IN NUMBERS

• The number of people arriving by sea has tripled in the past year. Since the beginning of the year, 22,711 migrants have reached Spain, 19,586 by sea.

• Spain has overtaken Greece and Italy as the country which received the highest number of migrants.

• An average of 54 people arrived in Spain by sea each day in the first five months of 2018. That average has since shot up to 220 per day.

• Since the beginning of the year, 294 people have died trying to reach Spain – almost double the figure from the same period last year.

Your donations are now also feeding the people in Mati, where conditions are really bad. I’ll have much more on the Automatic Earth for Athens Fund soon, many new and very positive developments, after a bit of a lull. More donations of course are needed and welcome.

• Number Of Fatalities In Greek Wildfires Rises To 88 (K.)

A 42-year-old woman who was in intensive care after suffering extensive burns in the deadly wildfire that ripped through the coastal town of Mati in east Attica this week died early Saturday morning, raising the number of fatalities to 88. On Friday night, authorities also identified the bodies of the nine-year-old twin girls and their grandparents that went missing after the wildfires. Their bodies were among a group of victims recovered by emergency crews on Tuesday lying close together near the top of a cliff overlooking a beach. The news was reported on broadcaster SKAI by the private investigator the family had hired to find the children. It was confirmed by a reported friend of the family on his Facebook page.

The twins’ father had provided forensic authorities with a DNA sample and appeared on several TV stations seeking help in finding them. A total of 46 adult burn victims are being treated in hospitals in Athens, with nine of them in intensive care. Two children remain in hospital but authorities said their injuries are not life-threatening. Five days after the deadly blaze, there was still confusion over the number of those missing. The Athens Medical School’s Forensics and Toxicology Lab said it has conducted autopsies on 86 bodies, of which only 25 have been identified. As sources explained to Kathimerini, in the first 48 hours after the fires, several authorities wrote up lists of missing persons, which means the same people may have been recorded twice or more.

Since there was no official information on where relatives should report missing persons, police started separate investigations, when the relevant authority in this case would have been the fire service. On Saturday, Dimitra Lambarou, the deputy mayor of Marathonas, which has administrational jurisdiction over the majority of the devastated coastal town on Mati, said she is resigning over the deadly fires. “Since no-one else did it, I will,” she told broadcaster SKAI on Saturday. “I’m really ashamed for all those people who are in positions of responsibility,” she said and accused Marathonas mayor Ilias Psinakis of “not rising to the occasion.”