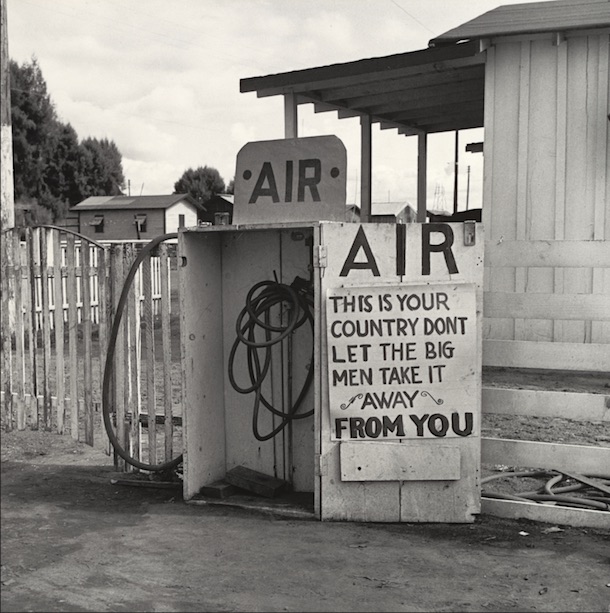

Dorothea Lange Kern County, California 1938

Dowd

#CauseUnkown #DiedSuddenlyNews pic.twitter.com/9xg5zbXnKL

— Ed ☯️Free Thinker & Oracle (@DowdEdward) January 13, 2023

Miscarriages

This is the most shocking testimony I’ve seen since the pandemic began. When will the CDC investigate this? pic.twitter.com/H97IEL68Xq

— TexasLindsay™ (@TexasLindsay_) January 14, 2023

Kelly Victory

https://twitter.com/i/status/1612346904452505600

Bridgen

Something has been going seriously wrong in our country for several years and it has to stop. pic.twitter.com/6e9bQLq3uc

— Andrew Bridgen (@ABridgen) January 14, 2023

Russia can no longer trust any European voice. That is new. Peace talks are no use anymore.

• Europe and the Legitimization of Deception (Patrick Lawrence)

The U.S., having no need of or gift for statecraft, has long practiced what I’ve taken to calling the diplomacy of no diplomacy. You can’t expect much from bimbos such as Antony Blinken or Wendy Sherman, Blinken’s No. 2 at the State Department. All they can do is roar, even if they are mice next to any serious diplomat. But have the European powers now followed along? I fear to ask because I fear the answer. But I must, given recent events. Early last year, when Petro Poroshenko stated publicly that the post-coup regime in Kyiv had no intention of abiding by diplomatic commitments it made in 2014-15 to a peaceful settlement of the Ukraine crisis, a few eyebrows arched, but not over many.

[..] The betrayal of Russia and its president will go without saying. It is a matter of record that Vladimir Putin, who participated directly in the Minsk talks, worked long, long hours in the cause of a settlement that would leave Ukraine stable and unified, a freestanding post–Soviet republic on the Russian Federation’s southwestern order. Here I will remind readers of the animosity Putin expressed in his New Year’s address, three days after Hollande described the Franco–German sting operation in detail: “The West lied to us about peace while preparing for aggression, and today, they no longer hesitate to openly admit it and to cynically use Ukraine and its people as a means to weaken and divide Russia.”

This, a clear reference to the Merkel and Hollande interviews, leaves us with clear and obvious questions. Did Berlin and Paris give Moscow any alternative but to intervene in Ukraine militarily when they sabotaged peace negotiations? While Moscow remains open to talks to end the war, how seriously is it supposed to take any such prospect? Volodymyr Zelensky is forever slamming the door to negotiations with the Russians, but the Ukrainian president is late to the gate: The Germans and French got this done years ago. To betray the diplomatic process as Germany and France have done is also to betray trust as a necessary condition of orderly state-to-state relations. Nations may not fully trust one another but must be able to trust the diplomatic process—to trust the word given in the process of a negotiation.

In this way the core European powers have condemned all of us to an unstable, dangerous world—and so are guilty of betraying all of us—our security, our futures, our desire for a stable, peaceable world order. There are, of course, the Ukrainians. The majority of them wanted a peace deal from the start. Poroshenko was roundly defeated in Ukraine’s 2019 elections because he failed to deliver one. You would never know this from the Western press, but Zelensky succeeded him with a 70–odd percent majority of the vote precisely because he promised to negotiate a settlement in direct talks with Putin. Now the nation lies in ruins, its economy having cratered by 30 percent last year, 30 million of its people displaced, and its war dead to be counted in the tens of thousands. I see no argument against counting this a major consequence of the Franco–German design of deception.

“And so now Russia has to demilitarise all NATO ground forces..”

• Help! The Beatles to Save America? (Batiushka)

The West has lost the Battle of Soledar. 25,000 Ukrainian and western mercenaries lie dead. Artemovsk is about to fall with all its fortifications. Where next? A limited policing operation all started with the Russian wish to protect its people in two Russian provinces in the far east of the Ukraine. This soon had to be extended to four Russian provinces, two more added from the south-east of the Ukraine, so linking up with the much-persecuted Crimea. That had been Russian until 1954, just as all the east of the Ukraine was Russian until 1922 and the far west Polish, Hungarian and Romanian until 1939 – the Ukraine is a uniquely Communist creation. And then there was the Russian wish to prevent the Ukraine from becoming an American base, specifically for its ballistic missiles and nuclear weapons, and also to protect the many Russian speakers elsewhere in the Ukraine from hate-filled Nazi persecution of them. The project and the aim were all relatively modest.

Then it all changed: “If the West continues to pump the Ukraine full of weaponry out of impotent rage, or a desire to exacerbate the situation…then that means our geographical tasks will move even further from the current line.” -Sergey Lavrov, Foreign Minister of Russia. So it all became an operation, forced on Russia by the aggressiveness of Washington, to take back, directly or indirectly, more or less the whole of the Ukraine. This was not because Russia is fighting against the Ukraine, or against the EU, or against NATO, or against ‘the West’, or even against the USA, but against the neocons, who pull the money-strings, in Washington. And so now Russia has to demilitarise all NATO ground forces (cowardly NATO naval and air forces are hiding) and ultimately to denazify the whole Western world. It is actually on its way to doing that. Certain types of NATO equipment are in short supply.

And despite strict Western censorship, more and more Western people are realising that the Ukraine, the most corrupt country on earth, is simply not worth a penny of their taxes, let alone billions, let alone living in hunger or cold: ‘Eat or heat’, as they say in the strikebound UK. What the Western world, which is ruled over by a bunch of neocons in Washington, has never understood, is that this is an existential war for Russia and therefore Russia will fight to the end, if the neocons force it too. And although the neocon elite likes to consider that this is an existential war for the US, it is not, let alone for the peoples of Western Europe. Find a single ordinary Western person who is voluntarily willing to die for the Ukraine. You will not find a single one. (Western mercenaries die only for money, not for the Ukraine). This Western crusade is existential only for the neocon fantasy ideology, that ‘The West is Best’ and that ‘History Has Ended’ (with our triumph). And here there is a problem.

“Joe Biden said he would be the most transparent president in American history…”

• More Classified Documents Found At Biden’s Delaware Home (ZH)

Another day, another report of President Biden having classified documents scattered all over the place – as opposed to a safe at Mar-a-Lago. And of course as vice president when he took them, he had no authority to declassify – unlike a president. In the latest ‘document-gate’ development, the New York Times reports that ‘additional pages of classified information’ were found at President Biden’s Delaware home on Thursday, hours after a White House statement acknowledging that a classified document was found in a storage area ‘adjacent to the garage’ of his Wilmington home, which Biden’s aides reportedly discovered the night before. The news comes after Attorney General Merrick Garland appointed a special counsel this week to investigate Biden’s handling of classified materials.

The Biden camp has pushed back against accusations that their failure to disclose the document find the day before the 2022 midterms amounts to election interference. “They also defended their decision not to be fully forthcoming about the matter. The White House has been criticized over its public disclosures, including why it did not reveal the discoveries much earlier, and why, when it acknowledged on Monday that some classified files had been found at Mr. Biden’s office on Nov. 2, it had not indicated that more had been found at his house the next month. Mr. Biden’s lead personal lawyer, Bob Bauer, said in a statement on Saturday that Mr. Biden’s legal team had tried to balance being transparent with “the established norms and limitations necessary to protect the investigation’s integrity.” -NYT”

According to Biden’s lead lawyer, DOJ investigators needed ‘time’ to complete their inquiry, and revealing certain details publicly before more information emerged could cause earlier statements to be “incomplete.” “That’s your version of events,” said White House spox Karine Jean-Pierre on Friday when asked if the White House did not disclose the original findings until they were reported by CBS News earlier this week. “Look, I want to very clear: There’s a process here, we are going to respect that process,” she added. What a load of horseshit.

“The timing of the revelation of the document discovery is indeed curious,” said former Rep. Chris Carney (D-PA), a longtime Biden ally and former intelligence officer, per The Hill. “President Biden must be accountable and accept responsibility for this awkward episode. The most important thing here is not preventing political embarrassment, it’s protecting our nation’s security.” “Look, this happened Nov. 2nd. Joe Biden said he would be the most transparent president in American history. Why are we just now learning this? CBS did a great job uncovering this or we would never know,” said Oversight Chairman James Comer (R-KY) in a CBS interview earlier this week.

COVER UP: On Thursday, the White House said SIX TIMES the search for classified documents was complete.

More classified documents were just discovered. pic.twitter.com/X8qwe7ZlZM

— RNC Research (@RNCResearch) January 14, 2023

“Hur looks like a fixer for the Democrats and the Deep State..”

• Nunes Worries Biden Special Counsel May Be Biased (WFB)

Attorney General Merrick Garland on Thursday praised Robert Hur, the special counsel he appointed to investigate President Joe Biden’s handling of classified records, as an “even-handed” prosecutor with a “long and distinguished career.” But a top Republican who dealt with Hur during his last stint at the Justice Department has a much less glowing opinion. In 2018, Hur was part of the Justice Department team that worked to stifle a House Republican probe of the agency’s investigation into the Trump campaign’s links to Russia. According to Justice Department emails reviewed by the Washington Free Beacon, Hur, who served as principal associate deputy attorney general, helped draft a letter to Republicans on the House Intelligence Committee in January 2018 to block a report—the so-called Nunes memo—that poked holes in the government’s investigation of the Trump campaign.

Hur’s work to shut down the memo, which years later has been largely vindicated, casts doubt on his ability to impartially investigate Biden, according to the memo’s Republican author, former House Intelligence Committee chairman Devin Nunes. “Hur looks like a fixer for the Democrats and the Deep State,” Nunes told the Free Beacon. Justice Department officials mounted an aggressive campaign to block the release of the Nunes memo, claiming it would have a “damaging impact” on national security. They also dismissed allegations that investigators had abused the Foreign Intelligence Surveillance Act, saying they were “unaware of any wrongdoing related to the FISA process.” Emails show that Hur proposed edits and other changes to the Justice Department’s letter to House Republicans.

Garland appointed Hur, who now works in private practice, to investigate “the possible unauthorized removal and retention of classified documents or other records” discovered at Biden’s home in Delaware and at his former think tank office in Washington, D.C. Garland said he was “confident that Mr. Hur will carry out his responsibility in an even-handed and urgent manner.” But according to Nunes, it’s hardly clear that the special counsel will maintain neutrality. “Before Hur even begins as special counsel, Congress should use a subpoena to force him to explain his role in obstructing the House Intelligence Committee’s FISA abuse investigation, targeting our staff and my lawyers, and helping to write an utterly false letter trying to stop the release of the Nunes memo,” said Nunes.

Anything Hunter is crazy.

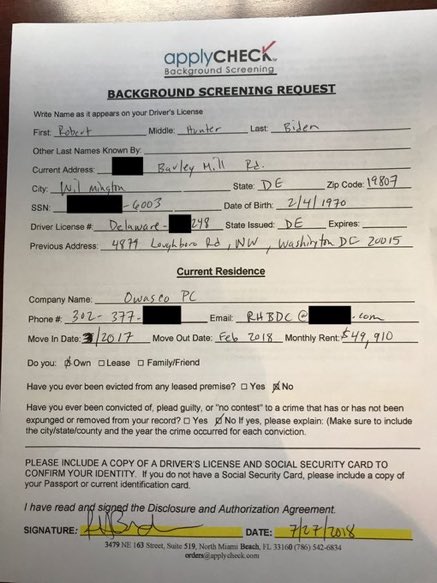

• Hunter Biden Lived At Delaware Home Where Classified Docs Were Kept (NYP)

Disgraced first son Hunter Biden lived off and on at the Delaware home where classified documents from Joe Biden’s time as vice president were found last month — giving him unrestricted access to America’s secrets while he was addicted to drugs, hammering out shady foreign business deals and under federal investigation. The now-52-year-old began listing the Wilmington home as his address following his 2017 divorce from ex-wife Kathleen Buhle — even falsely claiming he owned the property on a July 2018 background check form as part of a rental application. Hunter also listed the home as the billing address for his personal credit card and Apple account in 2018 and 2019, respectively, Fox News Digital reported Friday after reviewing emails from his abandoned laptop.

During the same period, the now-first son was in the grip of a crack cocaine addiction costing thousands of dollars. At one point in August 2018, Hunter was recorded begging his sister-in-law-turned-lover, Hallie Biden, to let him use his credit card points to pay for a stay in rehab. Another former girlfriend of Hunter’s, Zoe Kestan, testified to a federal grand jury in February of last year that the couple stayed for a month in 2018 at the notorious Chateau Marmont hotel in Los Angeles, where — the younger Biden wrote in his 2021 memoir — he “learned how to cook crack” before being “blacklisted” from the property over complaints tied to his drug use. Hunter also frequented prostitutes during this time, dropping more than $30,000 on sex workers between November 2018 and March 2019 alone — making him a possible target for blackmail.

On Thursday, President Biden confirmed that sensitive papers had been found in the locked garage of the home, where he also keeps his vintage 1967 Corvette Stingray. “My Corvette is in a locked garage, OK? So it’s not like they’re sitting out on the street,” the defensive president told reporters when asked about the discovery. On Monday, the White House disclosed an initial batch of classified documents had been uncovered on Nov. 2 by the president’s personal lawyers while clearing Biden’s former office at the Penn Biden Center for Diplomacy and Global Engagement in Washington. sIt’s unclear whether the documents found in Wilmington on Dec. 20 were shipped directly to Biden’s home upon his leaving the vice presidency in January 2017 or if they were initially stored elsewhere rather than given to the National Archives as required by federal law.

How many crack addicts pay that kind of money?

• Hunter Biden Paid $50,000 a Month in Rent for Home Where Docs Were Stored (TPN)

On Monday, classified documents from his time as vice president were found in President Joe Biden’s private office at UPenn. Days later, more classified documents were found stashed in Biden’s garage next to the president’s corvette at his Delaware home which triggered Attorney General Merrick Garland to appoint a special counsel. “Attorney General Merrick Garland has appointed a special counsel to take over the investigation into President Joe Biden’s potential mishandling of classified documents,” CNN reported. “The special counsel is Robert Hur.” There seems to be however, that more is going on than what meets the eye. According to a “Background Screening Request” form that was filled out by Hunter Biden in 2018, the president’s son claimed he owned the Delaware residence where the classified documents were found.

“The now-52-year-old began listing the Wilmington home as his address following his 2017 divorce from ex-wife Kathleen Buhle — even falsely claiming he owned the property on a July 2018 background check form as part of a rental application,” the New York Post reported. On the “Monthly Rent” portion of the form, Hunter Biden claimed he paid $49,910 in rent each month. Town and Country magazine estimates the Delaware home is worth about $2 million which would suggest that if Hunter Biden is truly paying nearly $600,000 a year in rent, he is overpaying by a lot. “In 2018 Hunter Biden claimed he owned the house where Joe Biden kept classified documents alongside his Corvette in the garage ,” reported journalist Miranda Devine.

Was this Hunter Biden’s way of funneling the money he earned with his father’s political connections back to his father? After Hunter’s divorce was finalized in May of 2017, he was included in an email from his business partner James Gilliar about a venture with Chinese state-funded energy company CEFC China Energy. The email stated that Hunter and his partners would receive 20% of the shares in the new business, with 10% going to Hunter’s uncle James Biden and the other 10% being “held by H for the big guy.” Tony Bobulinski, another one of Hunter’s former business partners, claims that he had a meeting with Joe Biden regarding the CEFC venture on May 2, 2017, and that the president was the individual referred to as the “big guy” in Gilliar’s email. Additionally, Gilliar himself confirmed that Joe Biden was the “big guy” mentioned in a message found on the laptop.

“We’re running out of time. If the damage is not repaired, Nord Stream will become unusable for a long time.”

• Nord Stream Must Be Repaired – German State Official (RT)

The governor of the German state of Saxony, Michael Kretschmer, has called for the repair of the sabotaged Nord Stream pipelines, arguing that operators are running out of time before the vital gas link becomes unusable. In an interview with Germany’s Funke Media Group on Saturday, Kretschmer said that while “the issue of Russian gas is not on the table” as long as the conflict in Ukraine is ongoing, Germany must preserve the option to “buy something other than expensive liquefied natural gas after the war.” Therefore the Russian-German consortium responsible for Nord Stream “must ensure that the pipeline can be repaired.” “We’re running out of time. If the damage is not repaired, Nord Stream will become unusable for a long time.”

Germany began importing Russian gas via the Nord Stream 1 pipeline in 2011, until deliveries were halted by Russia’s Gazprom in September after it said EU sanctions were impeding vital maintenance. Its sister pipeline, Nord Stream 2, was due to come online this year, but its certification was indefinitely suspended by Berlin in February, days before Russia launched its military operation in Ukraine. Both lines were rocked by explosions in late September. Ukraine blamed the blasts on Russia and several Western leaders suggested that Moscow carried out the sabotage. sThe Kremlin dismissed the idea that it would sabotage its own pipelines – which were lucrative sources of revenue and leverage over Europe – as “stupid.” President Vladimir Putin blamed the explosions on “the Anglo-Saxons,” a Russian colloquialism for the US-UK transatlantic alliance, arguing that the US in particular benefited from the attack due to its position as a supplier of LNG to Europe.

Western officials privately acknowledge that Russia was unlikely to blame for the sabotage, according to recent reports. Kretschmer’s position on Nord Stream is not a new one. Back in October he declared that while Germany should pursue long-term LNG contracts “from the USA, Qatar and other Arab countries,” it should also “use gas from Russia again” in the future. The governor is a member of former Chancellor Angela Merkel’s CDU party. Both Nord Stream lines were constructed under Merkel’s leadership, but Germany’s current ruling coalition of Social Democrats and Greens has ruled out a return to Russian gas, despite soaring energy prices and the looming prospect of “de-industrialization.”

Who’s going to operate them?

• UK To Send Challenger 2 Tanks To Ukraine, Rishi Sunak Confirms (Az.)

The UK is to send Challenger 2 tanks to Ukraine to bolster the country’s war effort, Prime Minister Rishi Sunak has said, Report informs via BBC. He spoke to Ukraine’s President Volodymyr Zelensky in a call on Saturday, during which he confirmed he would send the equipment and additional artillery systems, No 10 said. Downing Street said the move shows “the UK’s ambition to intensify support.” The BBC understands the initial commitment is for 14 tanks. Around 30 AS90s, which are large, self-propelled guns, are also expected to be delivered. President Zelensky has thanked the UK, saying that the decision to send the tanks “will not only strengthen us on the battlefield, but also send the right signal to other partners”.

He said the UK’s support was “always strong” and was “now impenetrable”. No 10 said that during the call, Sunak and Zelensky also discussed also recent Ukrainian victories, as well as the “need to seize on this moment with an acceleration of global military and diplomatic support”. Sunak said the Challengers, the British Army’s main battle tank, would help Kyiv’s forces “push Russian troops back”. Built in the late 1990s, the Challenger tank is more than 20 years old, but it will be the most modern tank at Ukraine’s disposal. The tanks will provide Ukraine with better protection, and more accurate firepower.

Any pilots?

• UK To Send Apache Helicopters With Deadly Hellfire Missiles To Ukraine (Az.)

Britain will send attack helicopters armed with deadly Hellfire missiles to Ukraine in a move hailed as a “game-changer”, Report informs via Mirror. The Apache choppers will bolster the country’s desperate fight against Russian invaders, now entering its 11th month. The new package of support, to include tanks, was confirmed yesterday by Prime Minister Rishi Sunak.

“97% of Hungarians reject sanctions that cause serious damage..”

• Almost All Hungarians Oppose Sanctions On Russia (RT)

The overwhelming majority of Hungarians are opposed to sanctions the West has imposed on Russia over Ukraine and believe that they are detrimental to the economy, the nation’s government said on Saturday, citing the results of a countrywide questionnaire, or “consultation.” In a Facebook post, the Hungarian government revealed that “97% of Hungarians reject sanctions that cause serious damage,” adding that “The message is clear: the Brussels sanctions policy must be reviewed.” Szentkiralyi Alexandra, a government spokeswoman, said that the restrictions the EU had imposed on Russia over Ukraine had failed to stop the conflict, but caused a lot of economic issues for Europe. In this vein, Hungarians tend to reject oil restrictions and planned gas sanctions, she noted.

“The people taking part in the consultation say a clear ‘no’ to sanctions that further increase food prices or place additional burdens on European tourism,” Szentkiralyi added. The spokeswoman pointed out that Hungary is the first EU country to poll its citizens about the sanctions’ impact. She also described the consultation as “a guideline for Hungarian public actors,” with the results set to be delivered to EU authorities in Brussels. “This is quite necessary because they want to introduce new sanctions instead of revising the sanctions policy,” Szentkiralyi explained. She went on to thank about 1.4 million people that took part in the survey, noting that detailed results would be released in the near future.

The consultation on the matter was launched in mid-October and included seven questions about sanctions on the oil, gas, raw materials export, and nuclear and tourism spheres. In recent months, the sanctions the West imposed on Russia over the Ukraine conflict have exacerbated Europe’s energy crisis, causing fuel prices and costs of living to surge. Hungary, which is heavily dependent on Russian energy, has long been critical of EU sanctions policy. On Friday, Hungarian Prime Minister Viktor Orban said that by promoting sanctions in the bloc, German politicians had “miscalculated,” but do not have the courage to admit that. Last month, Russian Finance Minister Anton Siluanov said that the sanctions were taking a heavy toll on the European economy. He also claimed the US was the only nation benefiting from them, since it has been selling liquified natural gas to Europe at lucrative prices.

“..Orban has repeatedly suggested that if Brussels does not change its sanctions policies, they will inevitably backfire on the bloc’s economy and energy security…”

• Hungary Can’t Replace Russian Oil And Gas – Official (RT)

Hungary will not be able to replace the oil and natural gas it gets from Russia in the short term, member of parliament and State Secretary for Foreign Affairs, Tamas Menczer, told M1 TV channel on Friday. Menczer said the two fundamental conditions for Hungarian energy security were continued crude imports from Russia and the smooth operation of the Turkish Stream pipeline through which the country receives most of its annual supply of natural gas. “Russian gas accounts for 85% of Hungary’s gas consumption and 65% of oil demand. This cannot be changed overnight,” he explained. According to the official, Hungary is constantly looking for opportunities to diversify supplies, but all the options currently under consideration have drawbacks.

“Experts see three possibilities for diversification: we could increase the capacity of the LNG terminal in Croatia…second thing is to start production in the Romanian Neptun gas field…Thirdly, we could import gas from Azerbaijan,” Menczer stated, adding that all three “require much money, time and serious infrastructural developments, so Russian gas cannot be replaced at the moment.” He noted that the rate of filling Hungarian gas storage is approximately twice as high as the average European rate due to long-term contracts with Russian gas exporter Gazprom. Since the start of Russia’s military operation in Ukraine in late February, the EU has imposed sweeping sanctions on Moscow’s energy exports, including a price cap on seaborne oil deliveries, which took effect last month. Budapest demanded and received some exemptions from the embargo. Prime Minister Viktor Orban has repeatedly suggested that if Brussels does not change its sanctions policies, they will inevitably backfire on the bloc’s economy and energy security.

Interesting case. Old vs new media.

• COVID-Narrative Dissenters File Antitrust Action Against Legacy Media (ET)

A coalition of outspoken critics and skeptics of the mainstream narratives on COVID-19 has brought an antitrust lawsuit against some of the world’s largest news organizations, accusing them of working in collaboration to suppress dissenting voices surrounding the pandemic. The lawsuit (pdf), filed on Tuesday in a federal court in Texas, targets The Washington Post, the British Broadcasting Corp (BBC), The Associated Press (AP), and Reuters—all of which are members of the “Trusted News Initiative (TNI),” a self-described “industry partnership” formed in 2020 among legacy media giants and big tech companies.

“By their own admission, members of the TNI have agreed to work together, and have in fact worked together, to exclude from the world’s dominant internet platforms rival news publishers who engage in reporting that challenges and competes with TNI members’ reporting on certain issues relating to COVID-19 and U.S. politics,” the complaint reads. Robert F. Kennedy Jr., a critic of the Biden administration’s COVID-19 vaccination policies, led the lawsuit. He is joined by Creative Destruction Media, Trial Site News, Truth About Vaccines founders Ty and Charlene Bollinger, independent journalist Ben Swann, Health Nut News publisher Erin Elizabeth Finn, Gateway Pundit founder Jim Hoft, Dr. Joseph Mercola, and Ben Tapper, a chiropractor.

The plaintiffs, the lawsuit alleges, are among the many victims of the TNI’s “group boycott” tactic, defined as a coordinated effort to facilitate monopoly by cutting off the competitors’ access to supplies and necessities. In this case, the TNI members are accused of engaging in group boycott—in concert with their big tech partners—against small, independent news publishers by denying them access to internet platforms they need to compete and even survive in the online news market. “As a result of the TNI’s group boycott, [the plaintiffs] have been censored, de-monetized, demoted, throttled, shadow-banned, and/or excluded entirely from platforms like Facebook, YouTube, Twitter, Instagram, and Linked-In,” the lawsuit states.

Can’t get that genie back in the bottle.

• Feds Swing Between Pushing Boosters, Fueling Vax Hesitancy (JTN)

Less than two days after FDA Commissioner Robert Califf credited bivalent COVID-19 boosters with “significant” and “clinically meaningful” reductions in hospitalization and death “in all populations examined,” his own agency gave a new boost to vaccine hesitancy. The CDC and FDA announced an “additional investigation” Friday afternoon into a possible “safety concern for ischemic stroke” in recipients of Pfizer’s bivalent who are 65 and older, even while stating twice in bold that “no change” was recommended “in vaccination practice.” They said the CDC’s Vaccine Safety Datalink provoked their “rapid-response investigation,” which “raised a question” about whether stroke was more likely within 21 days of boosting versus 22-44 days.

The decision recalls the agencies’ recommended “pause” in Johnson & Johnson’s traditional COVID vaccine in April 2021 following six dangerous blood clots in women. While the VSD signal is “very unlikely” to represent a “true clinical risk,” the agencies said they notified the public in the interest of transparency. Their prior failure to share bivalent data is partially responsible for an unexpected wave of skeptical media coverage this month, which has questioned the effectiveness of boosters that now-outdated Omicron subvariants as well as the reliability of official statistics on COVID. Several outside vaccine advisers, including the editor-in-chief of the New England Journal of Medicine, told CNN Wednesday the agencies hid unfavorable results from them when they were considering whether to recommend Moderna’s bivalent booster for approval.

The U.S. is drastically overcounting COVID deaths and hospitalizations by conflating incidental infections with those that played a meaningful role, former Baltimore public health commissioner Leana Wen wrote in The Washington Post Friday. Tufts Medical Center epidemiologist Shira Doron told Wen that hospitalizations due to COVID “were as low as 10 percent of the total number reported” on some days, while attending physician Robin Dretler at Emory Decatur Hospital estimated 90% of those hospitalized with COVID are there “for some other illness.”

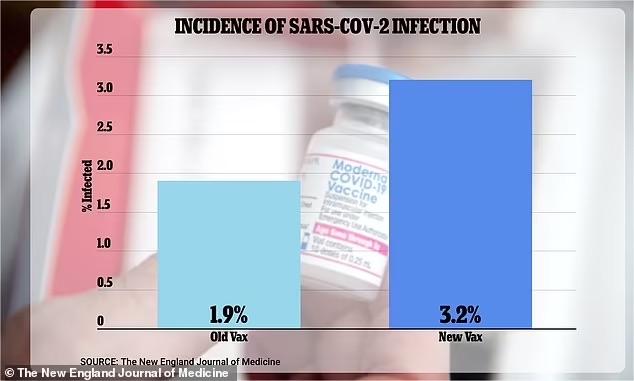

“..3.2 percent of study participants who got the updated bivalent vaccine became infected – compared to just 1.9 percent of those who received the original booster…”

• Moderna ‘Withheld Trial Data’ On Booster Shot To Win $5bn Contract (DM)

Moderna and the Food and Drug Association (FDA) have been accused of concealing data during the approval process for the pharma giant’s bivalent Covid booster. Vaccine advisors who signed off on the updated shot late last year claim they were not shown trial data that indicated the booster was actually less effective at preventing Covid than the older vaccine it was meant to replace. While the early trial results had substantial limitations, ‘disappointed’ and ‘angry advisors say its omission from panel discussions shows a remarkable lack of transparency. US taxpayers ended up shelling out nearly $5billion on the new booster, which was intended to enhance immunity against new variants.

For new vaccines to be approved, both the FDA and Centers for Disease Control and Prevention (CDC) must convene their advisory boards and make presentations to a panel of advisors. This panel of objective reviewers then votes on whether or not to recommend its approval. It is these independent advisors – including infectious disease experts and vaccinologists from Stanford, the University of Pennsylvania and Harvard – who are now raising concerns about the partial information shown to them during approval discussions for the bivalent booster. At both an FDA meeting in June and a CDC advisory panel in September, experts were shown reams of information suggesting that the new bivalent vaccine was more effective than its predecessor.

These results were based on lab tests in which blood taken from bivalent vaxxed people were exposed to omicron and then compared to samples from people vaxxed with the older shot, in order to gauge how well each elicited Covid-fighting antibodies. Other data from the same study was not presented to the panels, however, which looked at actual infections – who caught Covid-19 and who did not. The withheld data indicated that 3.2 percent of study participants who got the updated bivalent vaccine became infected – compared to just 1.9 percent of those who received the original booster.

Water man

The story of "water man" Patrick Mwalua, the man who has been buying and transporting water for long distances to Tsavo West National Park to quench wild animals' thirst

[read more: https://t.co/lgEWf6GgXS]pic.twitter.com/9r6fnK0ZKQ

— Massimo (@Rainmaker1973) January 14, 2023

Ducklings

https://twitter.com/i/status/1614250672668508162

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.