John Swope Trees in fog (Chile) 1939

Dr. Martin on DaszaK

Dr Martin points the finger squarely at Britain's Peter Daszak as the architect of the weaponization of the virus against humanity: pic.twitter.com/jmzVfFCnBs

— Robin Monotti (@robinmonotti2) July 10, 2021

LIES.

• Things To Know Before You Allow Your Child To Get The Covid-19 Vaccine (Con.)

COVID-19 for children IS LESS THAN A FLU. This is a very well known fact among the experts, and yet, it’s been systematically hidden in mainstream Media. Still, if you follow mainstream Media, you’ll get the impression that there’s a need to get children vaccinated anyhow, based on three premises:

1) Children need to be vaccinated to help to avoid infection of adults

2) These new vaccines have no long term adverse effects

3) There is consensus in the scientific community about the safety of these new therapies1) Children need to be vaccinated to help to avoid infection of adults IT IS A LIE that children need to take part in the effort to reduce transmission by getting inoculated, BECAUSE IT IS ADMITTED BY the manufacturers that it doesn’t prevent transmission, it only reduces symptoms. You can find that admission in the documents of the trials and on the manufacturer’s websites. Whenever you hear that “transmission is cut by these therapies”, it comes from scientists (which are really LOBBYISTS, once you take the time to research their conflicts of interest). You will never find an assertion about these vaccines granting immunity BY THE COMPANIES THEMSELVES. The simple fact is that the TRIALS WERE EXPRESSLY DESIGNED only to try to “search for” reduction of symptoms, which clearly means no immunity was found: otherwise that would have been the focus of their research. And to top all of this, the number of cases of vaccinated patients dying with COVID-19 shows, if anything, that transmission is not halted by the injections.

2)These new vaccines have no long term adverse effectsIT IS A LIE that these new “vaccines” have no long term effects, for the simple reason that it’s an assertion that’s impossible to certify without time passing by. The mere fact that somebody would guarantee that no long term effects are possible SHOULD RAISE YOUR CONCERNS regarding the trustworthiness of that official. And yet that’s what you hear from most of them. Usually you also get some of them even saying that mRNA vaccines have decades of research. EXACTLY! That doesn’t mean decades of guaranteed safety. On the contrary, mRNA vaccines had never been approved before, EXACTLY BECAUSE OF SAFETY ISSUES.

3)There is consensus in the scientific community about the safety of these new therapies IT IS A LIE that there is consensus in the scientific community around the safety of the new vaccines. You are led to think that, because the ones raising the alarms are systematically censored and not invited on TV. Find the thousands of doctors saying otherwise and you’ll easily prove that CONSENSUS IS THE BIGGEST LIE OF THEM ALL. Please, don’t take these accusations against mainstream Media lightly. Confirm by yourself that actually, for whatever reason, Media has been “protecting” the reputation of what actually are their main sponsors. As such, it is cautious to—in the very least—postpone the vaccination of your child for a year so and see how it goes. The vaccine adverse reporting systems in United States and Europe have registered several cases of heart problems developed among young people.

No matter how low the risk of this is, don’t you think that your children deserve the opportunity to decide for themselves ONCE THEY’RE ADULTS if they want to join a trial for an experimental therapy? Because YES: the manufacturers have been granted with an Emergency Use Authorization only, and it is as such that they state that their “products” are strictly on trial phase until the end of 2022. TECHNICALLY & PRACTICALLY, these vaccines, no matter how beneficial they can be, are an experiment performed on humans on the largest scale ever witnessed. We all hope the end results are good, but under no circumstance it’s reasonable to bet on that when the future health of our children is at stake. This is absolutely not about vaccine hesitancy. This is about responsible parenthood.

Long essay by Karl.

Can’t repeat this often enough these days:

“..80% of all people had pre-existing resistance and, absent severe co-morbid issues that could kill them literally at any time were never at material risk..”

• Well-Deserved Consequences (Denninger)

Going back to the start of Covid-19 there were several things that were apparent: Not everyone was susceptible to a serious or fatal outcome irrespective of age or medical status. Diamond Princess proved this conclusively. It was ignored. We later conclusively and scientifically proved that approximately 80% of all people had pre-existing resistance and, absent severe co-morbid issues that could kill them literally at any time were never at material risk. If you let the virus into nursing homes it will kill a lot of people. Kirkland proved that conclusively. We not only ignored that we called the employees of said places “heroes” and did not demand they isolate away from the general population, paying them whatever we had to in order to get them to do it, even when we had a wild excess of hotel space in which we could have as we had (foolishly) locked down basically all travel and leisure activity.

Children and young, healthy adults are at little or no risk. It’s not zero, but it’s less than the flu. We now know fewer than 400 people under age 18 have been killed by Covid in the US and virtually all of those who died had unrelated life-threatening medical issues (such as childhood cancers.) For older, more-morbid people it’s another story entirely; they have 1,000x as much danger or more. So what did we do? We closed schools and forced 60 million healthy kids to wear masks. In other words we made children pay for other people’s risk, and we did it by force, screwing all those kids out of months to a year or more of schooling and treating them as plague rats who were responsible for killing their grandmother. Most of the morbid conditions that put you at particular risk are voluntary. Specifically, Type II diabetes and obesity.

We not only lied to kids about their risk we forced children and young adults to bear the cost of voluntary adult behavior. This is particularly monstrous and massively compounds the above point. We allowed the demonization of drugs that had been used safely for decades for other conditions and in fact let them be effectively banned. Was there proof that they worked? Not early on, but so what? The so-called “right to try” that was much-ballyhooed and paraded around for over a decade disappeared instantly under force by every single social media company. Who remembers all the crying mothers in front of Congress and elsewhere begging for access to unproved but possible treatments for their children with rare diseases and the attendant and relentless GoFraudMe cry-room campaigns?

Abortion, a purely-elective procedure undertaken by millions and considered a sacred civil right with its need arising in nearly every case from voluntary adult (irrespective of age) conduct has a higher risk of death than Ivermectin. Where the hell did all those screaming for access to unproven therapies go and why did not that same principle apply here, especially for consenting adults? Lupus and RA patients have taken HCQ as a maintenance drug on a daily basis for over a decade and the safety profile and its contraindications are well-known.

[..] Why didn’t Trump’s HHS — or Biden’s — do it the other way around? You get your $13,000 bonus if the patient walks out of your hospital under his or her own power. If he or she dies the hospital gets nothing. Want to take a bet on how much Ivermectin, Budesonide and HCQ would have been used had the government done that? [..] Here’s reality whether you wish to admit it or not: If 5%, 10% or 50% of the population decides they’ve had enough of this robbery and death then it stops. One hopes the demand is enough. It should be enough, but you have to be willing to back it up just like the Minutemen were on April 19th of 1775.

Google translation has some “woke” problems with he/she/they. Dr. Soumya Swaminathan is a woman.

• Ivermectin. WHO Scientist Faces Death Penalty (Observateur)

On May 25, the Indian Bar Association (IBA) filed a lawsuit against Dr Soumya Swaminathan, WHO Chief Scientist, accusing him of causing the deaths of Indian citizens by deceiving them about the ivermectin. The WHO scientist is accused of making a misleading tweet on May 10, 2021 against the use of ivermectin which resulted in the state of Tamil Nadu removing ivermectin from the protocol the following day. He had just declared this treatment effective against Covid-19. If Dr Soumya Swaminathan is found guilty, then she could be sentenced to death or life imprisonment. Attorney Dipali Ojha, senior lawyer for the Indian Bar Association, threatened Dr Swaminathan with criminal charges “for every death” caused by his acts of commission and omission.

The brief accused Dr Swaminathan of wrongdoing in using his position as health authority to serve the special interests of the lucrative vaccine industry. Ivermectin is an inexpensive drug that is prescribed as an antiparasitic. It has gained popularity for the prevention of covid-19. The WHO and the FDA do not approve ivermectin, but many doctors and scientists believe it to be effective. Some claim that states in India that used ivermectin had much better results and significantly fewer deaths from covid than states in India that did not use ivermectin. In the regions of Delhi, Uttar Pradesh, Uttarakhand and Goa cases fell by 98%, 97%, 94% and 86% respectively. In contrast, Tamil Nadu who chose not to use ivermectin, the number of cases exploded and became the highest in India. Deaths in Tamil Nadu have increased tenfold.

In a test of over 4,000 people in India (over 3,000 took ivermectin) and over 1,000 did not. The results showed that 2% of people who took ivermectin had a covid confirmed by a PCR test and that 11.7% of people who did not take ivermectin had a covid confirmed by a PCR test. The specific charges include conducting a disinformation campaign against ivermectin and posting statements on social and mainstream media to falsely influence the public against the use of ivermectin despite the existence of large amounts of ivermectin. clinical data showing its profound efficacy in the prevention and treatment of covid-19.

First: something to take monthly doesn’t meet even the most flexible defiition of “vaccine”. Second, why not find out what the problem is before injecting more of the stuff?

• Can Long Covid Be Cured By A Monthly Dose Of The Vaccine? (DM)

Even as Covid cases continue to climb, the Government’s plan to lift all remaining restrictions in a matter of days is still on track for a single reason: the vaccine has severely weakened the link between infections, hospitalisations and deaths. Yet, amid the optimism, another concern has cast a shadow – the rising diagnoses of long Covid, the debilitating condition that leaves sufferers battling symptoms for months after being infected. More than a million Britons are said to be living with lingering problems, from breathlessness to brain fog, and that figure could double by the end of the summer, say experts. With no effective drug treatments yet discovered, there has been little hope for those living with the worst difficulties – until now.

In a world first, British scientists are set to explore giving long Covid patients monthly doses of the Covid vaccine, in an effort to combat the chronic condition. The first stage of the study was given the green light on Friday: later this year, 40 long Covid sufferers will be offered at least two extra jabs. Funding has been offered by several of the major vaccine developers, and if the pilot is successful the scientists involved have been told they can recruit thousands more patients. Speaking exclusively to The Mail on Sunday, Dr David Strain, senior clinical lecturer at the University of Exeter Medical School, who will lead the trial, says the manufacturers are interested in funding the study after early research showed that long Covid symptoms were significantly reduced after patients had a jab.

Dr Strain said: ‘Many saw a dramatic improvement within days of their jab. Their fatigue disappeared, they were able to walk further without feeling breathless. ‘Some said it was the closest to normal they’d felt since they first caught Covid. ‘In an earlier study we saw this lasted for about a month after the first dose, but then symptoms return. ‘The same pattern was seen when people went for their second jab. We want to find out whether, over time, offering regular doses can make this change permanent.’

A monthly dose of that then? ha ha.

• 1/4-Dose Of Moderna Covid Vaccine Still Rouses A Big Immune Response (Nature)

A little bit of coronavirus vaccine goes a long way towards generating lasting immunity. Two jabs that each contained only one-quarter of the standard dose of the Moderna COVID vaccine gave rise to long-lasting protective antibodies and virus-fighting T cells, according to tests in nearly three dozen people1. The results hint at the possibility of administering fractional doses to stretch limited vaccine supplies and accelerate the global immunization effort. Since 2016, such a dose-reduction strategy has successfully vaccinated millions of people in Africa and South America against yellow fever2. But no similar approach has been tried in response to COVID-19, despite vaccine shortages in much of the global south.

“There’s a huge status quo bias, and it’s killing people,” says Alex Tabarrok, an economist at George Mason University in Fairfax, Virginia. “Had we done this starting in January, we could have vaccinated tens, perhaps hundreds, of millions more people.” In the earliest trial of Moderna’s mRNA-based vaccine, study participants received one of three dose levels: 25, 100 or 250 micrograms3. The top dose proved too toxic. The low dose elicited the weakest immune response. The middle dose seemed to offer the best balance: it triggered strong immunity and had acceptable side effects. That 100-microgram dose ultimately became the one authorized for mass use in dozens of countries. But Moderna scientists later showed that a half-dose seemed to be just as good as the standard dose at stimulating immune protection4.

To find out whether a low dose might offer protection, scientists analysed blood from 35 participants in the original trial. Each had received two 25-microgram jabs of vaccine 28 days apart. Six months after the second shot, nearly all of the 35 participants had ‘neutralizing’ antibodies, which block the virus from infecting cells, the researchers reported in a preprint published on 5 July1. Participants’ blood also contained an armada of different T cells, both ‘killer’ cells that can destroy infected cells and a variety of ‘helper’ cells that aid in general immune defence. Levels of both antibodies and T cells were comparable to those found in people who have recovered from COVID-19.

“It is quite remarkable — and quite promising — that you can easily detect responses for that long a time,” says Daniela Weiskopf, an immunologist at the La Jolla Institute for Immunology (LJI) in California and a co-author of the study, which has not yet been peer reviewed. Corine Geurts van Kessel, a clinical virologist at the Erasmus University Medical Center in Rotterdam, the Netherlands, who was not involved in the study, agrees. “It’s rather good news,” she says. “Even with a low dose, you can prime your own immune system in quite a nice way.”

Twitter thread.

Our study explaining the pathophysiology of acute COVID has been published by ERJ, the flagship scientific journal of the European Respiratory Society @ERSpublications. Here, we describe how severe COVID-19 is NOT a viral pneumonia, but a post-viral autoimmune attack of the lung. The target of this autoimmune attack is Annexin A2, a phospholipid-binding protein, which acts as a cofactor for tPA, ensuring integrity of the pulmonary vasculature and promoting lung elasticity. Antagonism of Annexin A2 would cause lung blood clots, pulmonary edema, and ARDS. In essence, anti-Annexin A2 would cause all the hallmark pulmonary pathology already identified on autopsy among severe cases of acute COVID-19. Autoantibodies to this lung protective protein were already identified among hospitalized SARS patients.

Furthermore, Annexin A2 is also expressed in the vasculature of the brain. Therefore, antagonism of Annexin A2 can cause microvascular stroke and damage to the blood-brain barrier, which would result in neuro-inflammation and long-term neurological injury. The implications for acute COVID-19 are enormous. Not only would it explain why steroids work in this disease, but it would suggest that we should be treating the disease more like other autoimmune diseases of the lung. We have misdiagnosed severe cases of acute COVID-19 as a viral pneumonia, which disregards the established evidence that shows viral load of SARS-CoV-2 is markedly diminished by the time patients develop the respiratory distress that only occurs in second stage of the disease.

We are also misdiagnosing Long COVID, which is also characterized by lung perfusion deficits, pulmonary fibrosis, and various neurologic sequelae. Our next studies will establish whether these autoantibodies are also present among patients with persistent post-COVID symptoms. While we are just beginning to establish this evidence, prothrombotic antiphospholipid antibodies have already been well described by @jasonsknight @RayZuoMD and @YogenKanthi. Anti-Annexin A2 is a known “non-criteria” APL antibody that causes thrombosis.

“Almost everyone who is unvaccinated will catch the coronavirus

Really? As well as everyone who IS vaccinated?

• Greece’s Coronavirus Predictions Show Worsening Epidemiological Picture (GR)

Experts warned the public on Friday that predictions of how the coronavirus will develop in Greece over the next couple months are very worrying. The most optimistic forecast for the month of August shows that Greece will diagnose 3,000 new cases of the coronavirus daily. A professor of pulmonology, Nikos Tzanakis, appeared on SKAI TV on Friday to warn the public of the likelihood that coronavirus cases will continue to rise sharply through August and the coming months. “In August we may have 3,000 cases of coronavirus per day in the most favorable scenario, 4,000 cases is the most probable — but there is even the possibility of 6,000 cases a day in the worst case scenario,” Tzanakis outlined, showing the full range of predictions for the development of the coronavirus in Greece.

“Almost everyone who is unvaccinated will catch the coronavirus. It is mathematically certain that a child who returns from summer camp will infect all of the relatives it comes in contact with in a matter of minutes,” continued the professor, illustrating how severe the situation is and the increased transmissibility of the delta variant of the virus. “In order for summer camps to function safely, they must be turned into social bubbles, health measures must be tightened and visits must be completely banned,” Tzanakis said of the popular children’s pastime. He continued by analyzing why it is so important that summer camps do not receive any visitors. According to pulmonologist, if a single asymptomatic adult visits and gives coronavirus to their child, 100 more children will likely come down with the virus.

This concept of a “social bubble” can and should also be applied to adult activities over the summer, said Tzanakis. If an individual visits an island and stays with their friend group, it is unlikely that they will catch the coronavirus according to the expert. By sticking to a “social bubble,” and not going large parties, people can stay safe from the virus while still having fun. The fact that Greece’s coronavirus predictions are so disheartening is likely due to the delta variant and the country’s vaccination campaign, which is slowing down despite new incentives being introduced for young people to get the vaccine.

Novavax.

• Don’t Fool with the Diversity of Mother Nature (McCullough)

In a report from Niesen and colleagues from the Mayo Clinic, a worrisome finding has been reported. Among populations that were > 25% vaccinated, there was a reduced genetic diversity of SARS-CoV-2 strains. While the authors appeared to imply this was a good finding, other experts disagree. Anytime diversity is reduced in biological systems, it leads to instability in ecological systems. It can be the breeding ground for large evolutionary changes, including large mutations and more aggressive variants. Niesen also found that there was a much greater degree of immunity or “epitopes” on B-cells and T-cells among those unvaccinated, implying that immunity was far more robust than those vaccinated.

Fears about the Niesen findings were confirmed in a paper by Acevedo from Santiago Chile, who reported on the Lambda variant outbreak in Peru, which looks like it clearly occurred as a result of indiscriminate vaccination using the whole killed SARS-CoV-2 Sinovac (Coronovac) vaccine. The Lambda variant, while causing a small outbreak, is notable for having seven mutations in the spike protein – two of which are in the receptor-binding domain and allow complete escape from vaccine immunity. These papers, in aggregate, suggest that mass vaccination into a pandemic is “fooling with mother nature” in a manner that could be catastrophic if the indiscrimination program continues to be forced on the population.

The good news is that on June 30, 2021, in the New England Journal of Medicine, Heath et al. presented the Phase III trial results from Novavax. This antigen-based vaccine does not rely on genetics and should not have the organ toxicities seen with Pfizer, Moderna, and JNJ, and appears to have ~90% vaccine efficacy rates and much better safety data than the genetic vaccines. However, the injection site pain and reactions cannot be minimized. With this as a backdrop, we continue to have a need for early multidrug treatment for COVID-19 for both the vaccine breakthrough cases and the de novo patients.

“Enough! Time to stop this farce and let people travel in peace!”

• Rand Paul To Introduce Bill To End Mask Mandate On Planes (JTN)

Kentucky Sen. Rand Paul says he intends to introduce legislation to scuttle the ongoing federal mask mandate for air travel once the Senate resumes its next session. “When the Senate returns to session, I will be introducing an immediate repeal of the mask mandate on planes,” Paul wrote on Twitter this week. “Enough! Time to stop this farce and let people travel in peace!” The U.S. Transportation Security Administration is enforcing a widespread mask mandate “across all transportation networks throughout the United States, including at airports, onboard commercial aircraft, on over-the-road buses, and on commuter bus and rail systems,” at least through Sept. 13.

OPCW is like Bellingcat: NATO fact checkers.

• OPCW Report On Navalny Makes Contradictory Claims (RT)

The latest OPCW report containing data on its response to the ‘poisoning’ of Russian opposition figure Alexey Navalny has glaring inconsistencies, Moscow says, adding that the chemical weapons watchdog has failed to explain them. Russia will seek clarification from the Organization for the Prohibition of Chemical Weapons (OPCW) on its findings, the country’s envoy to the chemical weapons watchdog Aleksandr Shulgin has announced. The document, presented at the 97th session of the organization’s executive council earlier this week, contains information on the body’s reaction to Navalny’s poisoning back in August 2020.

In it, the OPCW states that its secretariat “deployed a team to perform a technical assistance visit” related to the suspected poisoning of a “Russian citizen” at Germany’s request on August 20. The problem is that on that day, Navalny was only flying from the Russian Siberian city of Tomsk to Moscow. It was on that flight that he first felt ill and was then rushed to a hospital in another Siberian city, Omsk, following the plane’s emergency landing. Russia demanded that the OPCW explain “how this is even possible” and why the organization had previously told the participating states that its team was only sent to Germany in early September, Shulgin said.

“So, what do we have here? When Navalny first felt unwell while still onboard a flight from Tomsk to Moscow, the OPCW experts were already waiting for him in Berlin?” According to the Russian envoy to the OPCW, the technical secretariat of the chemical weapons watchdog has so far failed to provide any answer to these questions. According to Shulgin, Russia has “lots of questions” for the OPCW and will seek “clear answers” to every last one. The revelations also elicited a reaction from the Russian Foreign Ministry’s spokeswoman, Maria Zakharova. She said the glaring inconsistencies in the OPCW report only show that some Western nations, together with Navalny himself, are “going down” with their whole “chemical weapons poisoning story.”

Russia’s problem now. Wonder what that will mean for the poppy trade.

• Say Hello To The Diplo-Taliban (Escobar)

A very important meeting took place in Moscow last week, virtually hush-hush. Nikolai Patrushev, secretary of the Russian Security Council, received Hamdullah Mohib, Afghanistan’s national security adviser. There were no substantial leaks. A bland statement pointed to the obvious: They “focused on the security situation in Afghanistan during the pullout of Western military contingencies and the escalation of the military-political situation in the northern part of the country.” The real story is way more nuanced. Mohib, representing embattled President Ashraf Ghani, did his best to convince Patrushev that the Kabul administration represents stability. It does not – as the subsequent Taliban advances proved.

Patrushev knew Moscow could not offer any substantial measure of support to the current Kabul arrangement because doing so would burn bridges the Russians would need to cross in the process of engaging the Taliban. Patrushev knows that the continuation of Team Ghani is absolutely unacceptable to the Taliban – whatever the configuration of any future power-sharing agreement. So Patrushev, according to diplomatic sources, definitely was not impressed. This week we can all see why. A delegation from the Taliban political office went to Moscow essentially to discuss with the Russians the fast-evolving mini-chessboard in northern Afghanistan. The Taliban had been to Moscow four months earlier, along with the extended troika (Russia, US, China, Pakistan) to debate the new Afghan power equation.

On this trip, they emphatically assured their interlocutors there’s no Taliban interest in invading any territory of their Central Asia neighbors. It’s not excessive, in view of how cleverly they’ve been playing their hand, to call the Taliban desert foxes. They know well what Foreign Minister Sergey Lavrov has been repeating: Any turbulence coming from Afghanistan will be met with a direct response from the Collective Security Treaty Organization. In addition to stressing that the US withdrawal – actually, repositioning – represents the failure of its Afghan “mission,” Lavrov touched on the two really key points: – The Taliban is increasing its influence in the northern Afghanistan border areas; and – Kabul’s refusal to form a transitional government is “promoting a belligerent solution” to the drama. This implies Lavrov expects much more flexibility from both Kabul and the Taliban in the Sisyphean power-sharing task ahead.

And then, relieving the tension, when asked by a Russian journalist if Moscow will send troops to Afghanistan, Lavrov reverted to Mr Cool: “The answer is obvious.”

One child comes back to bite.

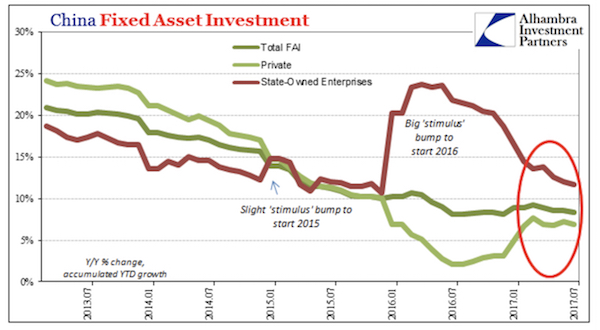

• China: Fragile Giant (Jim Rickards)

President Xi Jinping could quickly lose what the Chinese call, “The Mandate of Heaven.” That’s a term that describes the intangible goodwill and popular support needed by emperors to rule China for the past 3,000 years. If The Mandate of Heaven is lost, a ruler can fall quickly. Even before the crisis, China has had serious structural economic problems that are finally catching up with it. China is so heavily indebted that it’s at the point where more debt does not produce growth. Adding additional debt today slows the economy and calls into question China’s ability to service its existing debt. China also confronts an insolvent banking system and a real estate bubble. Up to half of China’s investment is a complete waste.

It does produce jobs and utilize inputs like cement, steel, copper and glass. But the finished product, whether a city, train station or sports arena, is often a white elephant that will remain unused. The Chinese landscape is littered with “ghost cities” that have resulted from China’s wasted investment and flawed development model. Essentially, China is on the horns of a dilemma with no good way out. China has driven growth with excessive credit, wasted infrastructure investment and Ponzi schemes. The Chinese leadership knows this, but they had to keep the growth machine in high gear to create jobs for millions of migrants coming from the countryside to the city and to maintain jobs for the millions more already in the cities.

The two ways to get rid of debt are deflation (which results in write-offs, bankruptcies and unemployment) or inflation (which results in theft of purchasing power, similar to a tax increase). Both alternatives are unacceptable to the Communists because they lack the political legitimacy to endure either unemployment or inflation. Either policy would cause social unrest and unleash revolutionary potential. China also has serious demographic challenges that will limit future growth… In 1980, China instituted a one-child policy in an effort to control population growth. But the 1980 announcement was really a matter of formalizing an existing policy. The Chinese have a cultural preference for boys over girls. So, when the one-child policy was implemented, the Chinese used pre-natal tests to determine sex and then aborted the girls.

At a more crude level, families kept buckets of water next to birthing beds so that if a girl was born she could be drowned immediately. It is estimated that between 20 million to 30 million baby girls were killed this way, resulting in an equivalent surplus of men over women. These excess men will never find wives in China. Since women can be selective about husbands, it follows that the 30 million excess men will be the least talented and poorest in Chinese society. This cohort is highly prone to antisocial behavior, including alcohol and drug abuse and violence. The demographic time bomb is now detonating. The missing children from thirty or forty years ago are the missing prime age workers of today.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Conspiracy

https://twitter.com/i/status/1413801772452392960

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.