Print your own Assange mask

Not even close.

• The ‘Whistleblower’ Probably Isn’t (Taibbi)

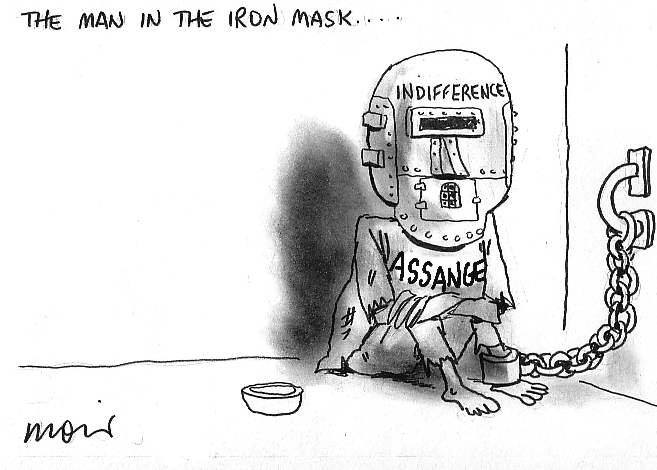

Start with the initial headline, in the story the Washington Post “broke” on September 18th: “TRUMP’S COMMUNICATIONS WITH FOREIGN LEADER ARE PART OF WHISTLEBLOWER COMPLAINT THAT SPURRED STANDOFF BETWEEN SPY CHIEF AND CONGRESS, FORMER OFFICIALS SAY”. The unnamed person at the center of this story sure didn’t sound like a whistleblower. Our intelligence community wouldn’t wipe its ass with a real whistleblower. Americans who’ve blown the whistle over serious offenses by the federal government either spend the rest of their lives overseas, like Edward Snowden, end up in jail, like Chelsea Manning, get arrested and ruined financially, like former NSA official Thomas Drake, have their homes raided by FBI like disabled NSA vet William Binney, or get charged with espionage like ex-CIA exposer-of-torture John Kiriakou.

It’s an insult to all of these people, and the suffering they’ve weathered, to frame the ballcarrier in the Beltway’s latest partisan power contest as a whistleblower. I’ve met a lot of whistleblowers, in both the public and private sector. Many end up broke, living in hotels, defamed, (often) divorced, and lucky if they have any kind of job. One I knew got turned down for a waitressing job because her previous employer wouldn’t vouch for her. She had little kids. The common thread in whistleblower stories is loneliness. Typically the employer has direct control over their ability to pursue another job in their profession. Many end up reviled as traitors, thieves, and liars. They often discover after going public that their loved ones have a limited appetite for sharing the ignominy. In virtually all cases, they end up having to start over, both personally and professionally.

When will the MSM start publishing about the “DNC-UKRAINE SCANDAL”? The Director of the National Anti-Corruption Bureau of Ukraine was convicted in Ukraine for interfering in the U.S. presidential election in 2016…

• DNC Colluded With Ukraine To Boost Hillary By Harming Trump – Report (DWire)

The Blaze has released an audio recording that they recently obtained that appears to show Artem Sytnyk, Director of the National Anti-Corruption Bureau of Ukraine, admitting that he tried to boost the presidential campaign of Hillary Clinton by sabotaging then-candidate Donald Trump’s campaign. The connection between the Democratic National Committee (DNC) and the Ukrainian government was veteran Democratic operative Alexandra Chalupa, “who had worked in the White House Office of Public Liaison during the Clinton administration” and then “went on to work as a staffer, then as a consultant, for Democratic National Committee,” Politico reported.

Chalupa was working directly with the Ukrainian embassy in the United States to raise concerns about Trump campaign chairman Paul Manafort and, according to Politico, she indicated that the Embassy was working “directly with reporters researching Trump, Manafort and Russia to point them in the right directions.” The Ukrainian embassy political officer who worked at the embassy at the time, Andrii Telizhenko, stated that the Ukrainians “were coordinating an investigation with the Hillary team on Paul Manafort with Alexandra Chalupa” and that “the embassy worked very closely with” Chalupa. The Blaze highlighted an email from WikiLeaks from Chalupa to Louise Miranda at the DNC:

“Hey, a lot coming down the pipe. I spoke to a delegation of 68 investigative journalists from Ukraine last night at the Library of Congress, the Open World Society forum. They put me on the program to speak specifically about Paul Manafort. I invited Michael Isikoff, who I’ve been working with for the past few weeks, and connected him to the Ukrainians. More offline tomorrow, since there was a big Trump component you and Lauren need to be aware of that will hit in the next few weeks. Something I’m working on that you should be aware of.” The Blaze then reported that Sytnyk, who eventually “was tried and convicted in Ukraine for interfering in the U.S. presidential election in 2016,” released a “black ledger” on Manafort during the 2016 presidential election that eventually led to Manafort’s downfall.

Republicans drowning in donations.

• Bob Woodward: GOP Senators ‘Choking’ On Trump-Ukraine Scandal (WE)

Veteran journalist Bob Woodward said Republican senators are “choking” on President Trump’s Ukraine scandal. At his second appearance in Spokane, Washington, in as many days, the famed Watergate sleuth discussed the precarious situation GOP lawmakers find themselves in as Trump faces controversy for encouraging foreign countries to investigate Joe Biden, a political rival, and his son Hunter. “I know Republican senators, and they are choking on this,” Woodward said on Friday, according to the Spokesman-Review. “Whether they say that’s too much, I don’t know.” Some Republicans in the upper chamber have begun to break ranks after Trump openly encouraged Ukraine and China to investigate the Bidens on Thursday.

Among those who have vented publicly are Maine Sen. Susan Collins, Nebraska Sen. Ben Sasse, and Utah Sen. Mitt Romney, as well as Texas Rep. Will Hurd in the House. Trump, who claims his overtures were about corruption and not crippling a political opponent in the 2020 election, repeatedly castigated Romney on Saturday, even calling for his impeachment. In a discussion with college students on Thursday, Woodward said the situation for Trump is getting “more serious each day” and predicted that impeachment in the House “is almost certainly going to happen to Trump.” He added, “But then there’s a trial in the Senate.”

On Friday, Woodward acknowledged that Trump encouraging foreign countries to investigate the Biden family is “probably not criminal,” but he nonetheless referred to the controversy as being wide in scope. Speaking of the House impeachment inquiry, Woodward said, “They’re looking through a keyhole, and it’s a panorama.” Woodward also noted how some Republicans in the Senate are seeing an advantage from the Democrats’ impeachment venture. He mentioned that Sen. Lindsey Graham, a former Trump critic who has become one of his most vociferous defenders, is seeing an influx of donations. Woodward said the South Carolina Republican told him he “couldn’t count the money fast enough.”

Erdogan blames the US for not establishing the safe zone.

• In Last Minute Call, Erdogan Agrees To Meet Trump Over Syria ‘Safe Zone’ (ZH)

Turkish President Tayyip Erdogan again threatened this weekend to initiate a military incursion into northeast Syria, where US-backed Syrian Democratic Forces (SDF) are based (and bolstered locally by small American bases), saying an offensive “both on land and air” would come “as soon as today or tomorrow.” Like many threats of an “imminent” invasion, it appears this proverbial can will be kicked further down the road, as presidents Trump and Erdogan held a “last minute” phone call on Sunday, where it appears the two leaders came to some level of an understanding. They discussed Turkey’s proposed “safe zone” east of the Euphrates in Syria — which Erdogan has long urged a resistant Washington to cooperate militarily on — and though exact details of the exchange weren’t published, they agreed to meet in Washington next month upon Trump’s invitation.

“Erdogan expressed Turkey’s unease with U.S. military and security bureaucracies not doing what is required by the agreement between the two countries, the presidency said, adding that the two men agreed to meet,” Reuters reported of the call. As we reported previously, Turkey’s military is reportedly on high alert, ready to carry out the Turkish president’s orders on short notice, after a longtime military build-up along the border. “We will carry out this operation both on land and air as soon as today or tomorrow,” Erdogan said on Saturday. “We gave all warnings to our interlocutors regarding the east of Euphrates and we have acted with sufficient patience,” the Turkish president added.

He further slammed the prospect of cooperating with the US on a US-Turkey administered safe zone “a fairytale” given Washington’s recalcitrance regarding Syria’s Kurds, the ethnic group’s militias of which Turkey considers “terrorists”. The Kurdish dominated and US-backed Syrian Democratic Forces (SDF) has vowed it will treat any invading Turkish soldiers as an act of war. In a statement the SDF said it would “not hesitate to turn any unprovoked (Turkish) attack into an all-out war” to defend its region in northeast Syria, according to Reuters.

Given what Dominic Cummings thinks of Farage, hard to see him taking up a job with much publicity.

• Arise, Commissioner Farage! (Pol.eu)

London may not be planning to nominate a commissioner to Brussels but if it does, some say there’s only one option: Nigel Farage. Conservative MP Steve Baker told the Telegraph’s Chopper Brexit Podcast that the Brexit Party member of the European Parliament would be the obvious choice to be the U.K.’s European commissioner, if Brexit is delayed and the country is able to nominate one. “I think we should appoint somebody with about twenty years experience … we should appoint somebody who’s incredibly well-known throughout the institutions, somebody who can be absolutely relied upon at all times to support our exit from the European Union,” he said.

“And therefore I unashamedly back Nigel Farage to be our next European commissioner in the event, in the unfortunate event, should it transpire, though I think it unlikely, that we have to remain in.” Baker, who leads the pro-Brexit European Research Group of MPs in the U.K. parliament, said the idea would be “inspired by the film Armageddon,” referring to a 1998 science fiction movie. There is a scene where “they’re trying to save the world, and so what they do is they land on the asteroid, and they put a nuclear weapon in the heart of the asteroid, and Nigel Farage is that nuclear weapon,” Baker said. “I’ve reason to think he might say that he would accept such an offer,” Baker added, while noting that “my sympathy for Nigel Farage, which has not always been at very high levels, has dramatically increased the more that I am demonized.”

A traumatized people. Too easily forgotten.

• Brexit Border Talk Stirs Up Bad Memories In Northern Ireland (G.)

Remnants of Hurricane Lorenzo unleashed wind and rain from the Atlantic across the area, a rural pocket of County Fermanagh that marks Northern Ireland’s border with the Republic. “Stay back, stay high, stay dry,” advised the authorities, and residents duly hunkered down. Lorenzo passed without major damage. [..] Around Gortmullan, businesses and ordinary people were left wondering if – and where – to seek cover, a dilemma dating from the 2016 referendum result that now thrummed with urgency. “We’re setting up new companies on both sides of the border,” said Liam McCaffrey, CEO of Quinn Industrial Holdings, which supplies building materials.

Customs checks would be bad enough, but Johnson’s apparent plan to give the Stormont assembly a veto over trading arrangements verged on surreal, said McCaffrey. Power sharing in Northern Ireland collapsed in January 2017 and shows little sign of reviving. “The future of how we trade is to be decided every four years by an assembly that hasn’t sat in three years? Bizarre.” Such was the challenge of Storm Boris. Perhaps it was hot air, a plan destined for oblivion to be superseded by who knows what. Or perhaps it was a blast of what is to come in a no-deal crash-out, or a deal negotiated in the next few weeks or after a general election. The uncertainty was head spinning.

[..] The 310-mile border, drawn in 1922 during the partition of Ireland, bristled with military patrols and fortifications during the Troubles. The 1998 Good Friday agreement and the EU’s single market rendered it invisible, helping to seal the peace. [..] A complex web connects the economies on both sides of the border. Trade in goods is worth about £5.2bn. About a third of Northern Ireland’s goods and services exports are sold to the Republic, while about a quarter of its imports come from the south. Downing Street says electronic paperwork and a “very small number” of physical inspections at traders’ premises would limit disruption. Farmers and business leaders dispute that. Some warn of disaster. Diageo, which makes Guinness and Baileys, estimates a hard border could cost it £1.3m, based on an estimate of an hour’s delay for each of the 18,000 beer trucks that traverse the border each year. Smaller businesses with tight margins could face ruin.

How could this ever happen? “The parties anticipate that this agreement will not be made part of any public record. If the United States receives a Freedom of Information Act request or any compulsory process commanding the disclosure of the agreement, it will provide notice to Epstein before making that disclosure.”

• An Actual Conspiracy Kept Jeffrey Epstein’s Accomplices out of Prison (MJ)

But not limited to: It was just a four-word phrase, a bit of plain contractual verbiage, but even now, more than a decade later, Spencer Kuvin has a hard time expressing just how bizarre it was. “It’s incredibly odd language,” said Kuvin, an attorney in Florida. “I’ve never seen it before in a non-prosecution agreement.” Kuvin and I were talking about the infamous and inexplicable 2007 plea deal offered by then–US Attorney Alexander Acosta, last seen slinking out of the Labor Department’s back door. Kuvin had represented three of Epstein’s victims at the time of the agreement, and Kuvin is still exercised about the deal, in particular its brief immunity clause that continues to protect Epstein’s co-conspirators.

According to a ruling by US District Judge Kenneth Marra in February 2019, “from between about 1999 and 2007, Jeffrey Epstein sexually abused more than 30 minor girls…at his mansion in Palm Beach, Florida, and elsewhere in the United States and overseas.” The ruling goes on to describe a child sex ring: “In addition to his own sexual abuse of the victims, Epstein directed other persons to abuse the girls sexually. Epstein used paid employees to find and bring minor girls to him. Epstein worked in concert with others to obtain minors not only for his own sexual gratification, but also for the sexual gratification of others.”

But back in 2007, Epstein was charged only with procuring an underage girl for prostitution, having struck an unbelievable sweetheart deal with Acosta. Epstein served 13 months in a Palm Beach County jail, of which six days a week were spent on work release in his high-rise office, a limo chauffeuring him to and from jail. He was also required to register as a sex offender. The deal on its face is incredibly favorable to Epstein. If you look closer, things get even better for him:

“The United States also agrees that it will not institute any criminal charges against any potential co-conspirators of Epstein, including but not limited to Sarah Kellen, Adriana Ross, Lesley Groff, or Nadia Marcinkova.” The four women named had allegedly helped recruit underage girls for Epstein at his direction. But that four-word phrase “but not limited to” gave a free pass to anybody who would have helped Epstein acquire or traffic underage girls for sex. How could the government agree to immunize “any potential co-conspirators” of an alleged serial child rapist? The question is at the center of so many conspiracy theories surrounding Epstein’s life and death.

Me when I see this, I’m thinking Dante’s Ninth Circle of Hell.

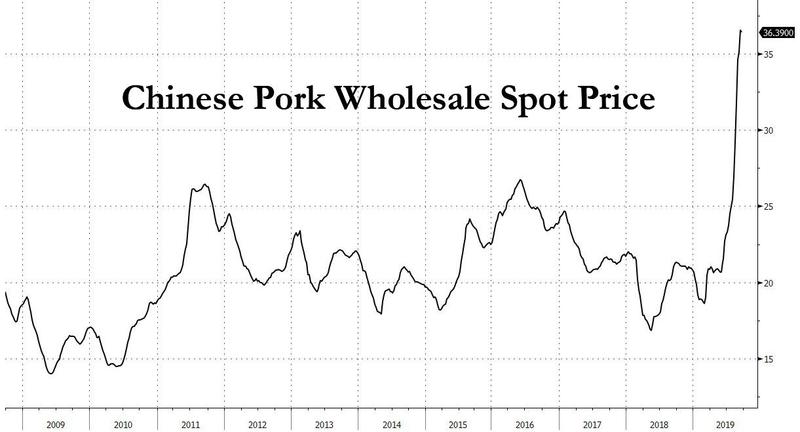

• Chinese Farmers Raise Mutant Pigs The Size Of Polar Bears (ZH)

Amid one of the worst food crises in recent memory, Chinese farmers are reportedly trying to breed larger pigs as the African swine fever – less affectionately known as ‘pig ebola’ – has destroyed over 100 million pigs, between one-third and a half of China’s supply of pigs by various estimates, causing pork prices to explode to levels never seen before. As Beijing scrambles to make up for the lost domestic supply with imports, even desperately waiving tariffs on American pork products in what China’s politicians tried to sell to their population (and Washington) as a “gesture of goodwill”, farmers in southern China have raised a pig that’s as heavy as a polar bear.

Once slaughtered, these giant mutant pigs can fetch a, well, giant price on the market. Here’s more from Bloomberg: “The 500 kilogram, or 1,102 pound, animal is part of a herd that’s being bred to become giant swine. At slaughter, some of the pigs can sell for more than 10,000 yuan ($1,399), over three times higher than the average monthly disposable income in Nanning, the capital of Guangxi province where Pang Cong, the farm’s owner, lives.” Soaring pork prices have encouraged small and large farms to experiment with DIY genetic experimentation, in the name of raising pigs that are about 40% heavier than the ‘normal’ weight of 125 kilos.

“High pork prices in the northeastern province of Jilin is prompting farmers to raise pigs to reach an average weight of 175 kilograms to 200 kilograms, higher than the normal weight of 125 kilograms. They want to raise them “as big as possible,” said Zhao Hailin, a hog farmer in the region.”

The entire case is falling to bits.

• Lula’s Prosecutors Request His Release From Prison. He Refuses. (Greenwald)

The same Brazilian prosecutors who for years exhibited a single-minded fixation on jailing former President Luiz Inácio Lula da Silva are now seeking his release from prison, requesting that a court allow him to serve the remainder of his 11-year sentence for corruption at home. But Lula — who believes the request is motivated by fear that prosecutorial and judicial improprieties in his case, which were revealed by The Intercept, will lead to the nullification of his conviction — is opposing these efforts, insisting that he will not leave prison until he receives full exoneration. In seeking his release, Lula’s prosecutors are almost certainly not motivated by humanitarian concerns. Quite the contrary: Those prosecutors have often displayed a near-pathological hatred for the two-term former president.

Last month, The Intercept, jointly with its reporting partner UOL, published previously secret Telegram messages in which the Operation Car Wash prosecutors responsible for prosecuting Lula cruelly mocked the tragic death of his 7-year-old grandson from meningitis earlier this year, as well as the 2017 death of his wife of 43 years from a stroke at the age of 66. One of the prosecutors who participated publicly apologized, but none of the others have. Far more likely is that the prosecutors are motivated by desperation to salvage their legacy after a series of defeats suffered by their once-untouchable, widely revered Car Wash investigation, ever since The Intercept, on June 9, began publishing reports based on a massive archive of secret chats between the prosecutors and Sergio Moro, the judge who oversaw most of the convictions, including Lula’s, and who now serves as President Jair Bolsonaro’s Minister of Justice and Public Security.

The prosecutors’ cynical gambit, it appears, is that the country’s Supreme Court — which two weeks ago nullified one of Moro’s anti-corruption convictions for the first time on the ground that he violated core rights of defendants — will feel less pressure to nullify Moro’s guilty verdict in Lula’s case if the ex-president is comfortably at home in São Paulo (albeit under house arrest) rather than lingering in a Curitiba prison. But this strategy ran into a massive roadblock when Lula demanded that he not be released from prison unless and until he is fully exonerated.