Pablo Picasso Bathers with a toy boat 1937

The war on savings and pensions continues unabated. Central banks are in so deep there’s no way out anymore. But what happens when you want to, or have to, retire?

• The Giant Sucking Sound of Financial Repression (WS)

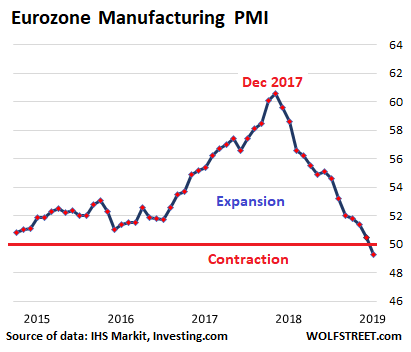

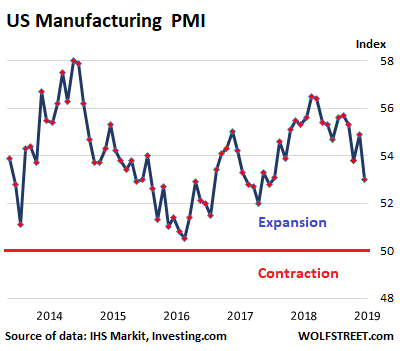

It’s called interest-rate repression. Or more poetically, financial repression. It’s where central banks manipulate interest rates down to where investments with little credit risk, such as Treasury securities, FDIC-insured savings accounts and CDs, pay little or no interest, or pay less interest than the rate of inflation. People such as savers and retirees, and institutions such as pension funds, that depend on this cash flow have lost their income stream. In addition, the purchasing power of their principal is getting gradually wiped out by inflation. How much money are we talking about? In the US alone, this interest rate repression impacts nearly $40 trillion. This includes savings products, Treasury securities, municipal bonds, and high-grade corporate debt.

$40 Trillion with a T. A 2% reduction across the board cuts this income by $800 billion a year. And this has had an impact. Central banks have accomplished this interest-rate repression by pushing short-term rates to zero or below zero, and by buying bonds and other assets to push long-term rates down too. These were emergency measures during the Financial Crisis that have become the “new normal,” as it has been called. This new normal has been going on for over a decade now. Other central banks, including the ECB and the Bank of Japan, pushed their policy rates below zero. This, in addition to vast asset buying binges by those central banks, produced $13 trillion in negative yielding bonds. But that’s a different universe of idiocy that we’re not going to get into today. We’re going to stick to US conditions.

To the Fed’s credit, it is the only major central bank that has raised its policy-rate target a bit, from near-zero to a range between 2.25% and 2.5%, which are still historically low rates. But it is under immense pressure by Wall Street and by the White House to cut rates again. So now we have this situation where short-term Treasury yields are low, and long-dated Treasury yields are even lower. How much money are we talking about here? Let’s see. There are $22 trillion in Treasury securities. They’re held by individuals and institutions, including insurance companies, pension funds, and the Social Security Trust Fund. Then there is high-grade corporate debt. The category of triple-A to single-A-rated debt is about $3.3 trillion. These yields have been pushed down too.

Then there are $3.8 trillion in municipal bonds outstanding. Many of them trade below US Treasury yields. For example, the GO bonds of California, which is not exactly a paragon of fiscal rectitude. During trading last Thursday, the California 10-year yield was 1.76%. This was about one-third of a percentage point below the US Treasury 10-year yield of 2.08% on the same day. Then there are $9.4 trillion in savings products, mostly savings accounts and CDs at banks. There are also about $3 trillion in checking accounts, payroll accounts, etc., but they’re not included here. These are just savings products. So let’s add these categories up: They amount to $39 trillion.

“There is no shortage of money in the market.”

• Dutch Bank ING Warns Against Further ECB Money Printing (R.)

Ralph Hamers made his plea as central banks redouble efforts to keep the cost of borrowing at historic lows to buoy the economy, a policy that weighs on bank profits and makes it costly to hold deposits. “I don’t think QE is a recipe to support an uncertain environment,” Hamers told journalists, referring to so-called quantitative easing to print fresh money. “There is no shortage of money in the market.” Although bankers have previously made similar complaints, Hamers’ blunt comments carry weight because his bank is one of Europe’s largest, with 38 million customers. ING, the largest Dutch bank, cautioned on Thursday that rock-bottom interest rates would pressure future earnings, as it announced a 1.4 billion euro net profit in the second quarter of the year.

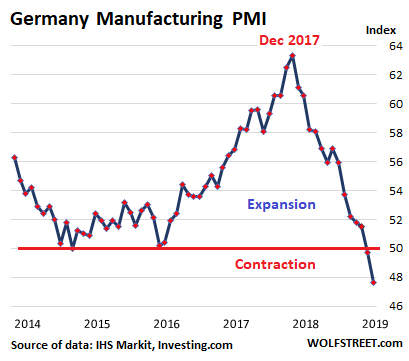

“Looking ahead, we expect that persistently low interest rates will put pressure on net interest income,” Hamers said, referring to the bank’s chief earnings pillar from activities such as lending. European Central Bank President Mario Draghi has all but pledged to loosen monetary policy further amid a continued economic deterioration of Europe’s euro currency bloc, still grappling with the aftermath of a debt crisis. Officials recently told Reuters that an interest rate cut in September appeared certain, while government bond buys were also likely. Draghi recently said the outlook looked bleak as a global trade war hit Europe’s manufacturers.

Did he do it to push Powell?

• Trump’s $300 Billion China Tariff Threat Sends Markets Into Tailspin (G.)

Donald Trump’s surprise decision to escalate the trade war with tariffs on another $300bn of Chinese goods has sent global financial markets into a tailspin. After sharp falls on Wall Street in the wake of the US president’s announcement on Twitter on Thursday, Asian share prices plummeted on Friday morning as growing hopes that the world’s two economic superpowers would be able to reach a deal were dashed. In Tokyo the Nikkei was down 2.3%, with a similar fall in Hong Kong and Shanghai. The Kospi was down 0.8% in Seoul while in Sydney the benchmark ASX200, which passed its pre-global financial crisis all-time high on Tuesday, fell 0.3%. On the commodities markets the price of Brent crude oil plunged 7%, its biggest fall for four years, although it recovered 2.5% on Friday to $62.01.

Trump’s decision was also likely to increase the chances of another cut in US interest rates with the prospect of worsening trade with China forcing the Federal Reserve to loosen monetary policy again in September. It follows Wednesday’s 0.25% reduction, which was widely seen as not being enough to please the president who has been very vocal in calling for lower rates to boost the economy. As a signal of lower rates to come, the 10-year US bond yield fell almost 12 basis points on Thursday to 1.902%, hitting the lowest level since Trump won the presidential election in November 2016. The US dollar also fell and stockmarkets in Europe and the US were braced for a turbulent last day’s trading of the week. The FTSE100 is set to drop 1% at the opening and the Dow 0.3%.

“It’s very logical to conclude that if trade tensions increase, given what Powell said, that would be something he would look at to evaluate a further cut.”

• Rate Cut Odds Surge After Tariff Announcement (ZH)

Earlier today, we wrote a post titled “What Would It Take For The Fed To Not Cut Again?”, with Goldman providing a stylized answer, although in retrospect, the post should have been titled “What Would It Take For The Fed To Cut Again”, as that is what the market was far more concerned about after yesterday’s hawkish Powell press conference. In any case, Goldman hinted at the one specific catalyst that could force the Fed to cut more: “We also see risks in the other direction, especially on a significant escalation of tariffs against China.” To this, we said that “if an acceleration in the trade war with China is what the Fed will need to cut more, it’s pretty clear what that means for the chances of any trade deal between Washington and Beijing, since even Trump now understands that if he keeps escalating trade war with China, Powell will have no choice but to eventually cut to 0% (and lower).”

Just a few hours later, we were proven right in suggesting that an escalation in the trade war is inevitable and imminent when Trump tweeted that he would hike tariffs on $300BN in Chinese imports to 10% starting September 1, ending the tentative ceasefire with Beijing with a bang, and sending risk prices sharply lower. And yes, while Trump did suffer a modest drop in his favorite polling indicator – i.e., the stock market – which “cratered” as much as 1.5% below its all time high – far more importantly Trump also called Powell’s bluff, and effectively forced the Fed to prepare for more rate cuts as the trade war with China – which Powell explicitly highlighted as a condition that would result in more easing – is set to escalate further.

Late today, Bloomberg confirmed as much noting that traders “fixated on a timeline in which Powell seems to suggest cooling trade tensions reduced the need for future rate reductions — and a day later Trump revs the tensions back up”, just as we said he would. “It fits the pattern of a president bent on getting the central bank to submit, many thought”, the Bloomberg authors concluded. “Powell was very careful to say that he was looking at three things, one of which was global growth and the extent to which that is risked by trade tensions,” said Ellen Hazen, senior vice president and portfolio manager for F.L. Putnam, which has $2.2 billion under management. “It’s very logical to conclude that if trade tensions increase, given what Powell said, that would be something he would look at to evaluate a further cut.” Precisely, hence our prediction first thing this morning.

Really? Xi is going to build more bridges to nowhere?

• US Tariffs Risk Reviving Chinese Zombies (R.)

President Donald Trump is threatening new levies on $300 billion of Chinese goods entering the United States, after Shanghai talks proved inconclusive this week. That might not prod Chinese officials into striking a deal, but it is likely to raise some unwelcome zombies. Trump is among those who claim the Chinese economy is on the brink of the abyss. And it’s true that as a truce in trade negotiations gets more elusive the country’s business community is being forced to price in a new status quo. Their country has stumbled into a cold war with the world’s largest economy, a nuclear-armed military colossus that controls the world’s foremost trading currency. But a $13 trillion economy growing at 6.2% is hardly imploding, and a country where private consumption makes up roughly two-fifths of nominal GDP has padding against a downturn in trade.

Tensions exacerbate economic problems of China’s own making, though. There is a massive stack of non-performing debt incurred by government banks that mis-allocated capital after the global financial crisis. And there are still plenty of inefficient state-backed companies that compete with China’s private sector, driving down profitability across the board. If the new 10% tariffs kick in on Sept. 1 as Trump threatened on Thursday, President Xi Jinping may re-open a playbook that reformist officials have been trying to close. The central government has already pushed localities to ramp up infrastructure spending, and there may be more to come. Construction investment creates jobs immediately, and the government can order banks to lend, and order state firms to build.

Trump won’t like this.

• The EU Has New People In Charge. It’s Not Good News For US Tech Firms (CNBC)

New officials at the heart of the EU will likely keep America’s big tech firms under close scrutiny, experts have told CNBC. The European Commission — the EU’s executive arm — has fined companies such as Google for disrespecting its competition rules, it’s asked Ireland to collect unpaid taxes from Apple and is currently investigating Amazon. It has also proposed different laws that seek to limit online content and there’s little evidence that anything will change under the EU’s new leadership. Dexter Thillien, a senior industry analyst at Fitch Solutions, told CNBC via telephone Wednesday that Europe is keen to continue to be seen as the global leading force in tech regulation. Thillien explained that Europe saw a loophole in global tech regulation and felt the need to act.

“Europeans have all the negatives but none of the positives,” he said, referring to the fact that Europe has not created any large tech firms but has had to deal with the presence of Silicon Valley behemoths. “The European Commission has become more assertive making big tech companies pay their fair share of taxes. If anything, the incoming Commission looks even more determined to do so,” Florian Hense, an economist at Berenberg, told CNBC via email. Ursula von der Leyen, the president-elect of the Commission, said during a speech earlier this month that “if (tech companies) are making these profits by benefiting from our education system, our skilled workers, our infrastructure and our social security, if this is so, it is not acceptable that they make profits, but they are barely paying any taxes because they play our tax system.”

A European under Washington’s thumb.

• EU Governments Seek Name For IMF Head (R.)

European Union finance ministers are set on Friday to choose the bloc’s candidate to lead the International Monetary Fund from a list of four names, a spokeswoman for the French government said. The list includes Jeroen Dijsselbloem, the Dutch former head of euro zone finance ministers; Nadia Calvino, the Spanish economy minister; Olli Rehn, the Finnish central bank governor; and Bulgaria’s World Bank chief executive Kristalina Georgieva. Mario Centeno, the Portuguese chairman of euro zone finance ministers, said on Thursday he was pulling out of the race “in this stage of the process”, adding that he would be available if needed for a compromise solution.

Britain did not field a candidate because it could not come up with a name on time, a European official said. It had been expected to name a candidate and the deadline was extended by a few hours on Thursday to allow it to do so. France is leading the process to select a European candidate. The top job at the Washington-based global lender has historically been filled by a European. Outgoing IMF head Christine Lagarde is taking over from Mario Draghi as European Central Bank president.

is that enough to push through a no-deal Brexit?

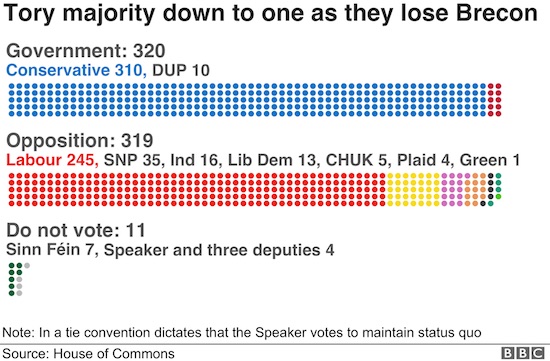

• Boris Johnson’s Commons Working Majority Cut To One (BBC)

The Liberal Democrats have won the Brecon and Radnorshire by-election, leaving new PM Boris Johnson with a Commons working majority of just one. Jane Dodds overturned an 8,038 majority to beat incumbent Conservative Chris Davies by 1,425 votes. Mr Davies stood again after being unseated by a petition following his conviction for a false expenses claim. It was the first electoral test for Mr Johnson just eight days after becoming prime minister. It is the quickest by-election defeat for any new prime minister since World War Two.

Now, with the thinnest possible working majority, he will have to rely heavily on the support of his own MPs and his confidence-and-supply partners the DUP to get any legislation passed in key votes. It was also a bad night for Labour, whose vote share dropped by 12.4% as it was beaten into fourth place by the Brexit Party. The result means the Lib Dems now have 13 MPs. Ms Dodds, who is the Welsh Liberal Democrat leader, said: “My very first act as your new MP when I get to Westminster will be to find Mr Boris Johnson, wherever he’s hiding, and tell him to stop playing with the future of our community and rule out a no-deal Brexit.”

“Paddy should know his place..”

• Expecting Ireland To Be Servile Is Part Of A Long British Tradition (G.)

Boris Johnson’s approach to Ireland is part of an ignoble tradition in British politics. At its heart is the false assumption that superiority in resources and military prowess equates to a superiority in intellectual power and moral rectitude. In short, the idea that might is right and that, ultimately, Paddy should know his place. This assumption shaped and even, at times, dominated, policy on Ireland for centuries before independence. It runs through 19th-century British depictions of the Irish as incapable of self-government, unreliable, lazy and inferior. For Benjamin Disraeli, a British prime minister who shares some personal characteristics with the current incumbent, the Irish were “wild, reckless, indolent, uncertain and superstitious”.

Most obviously, this sense of superiority and a refined “moral” stance was clearly manifest in government policy during the Great Famine of 1845-49, which caused the deaths of more than one million people on the island of Ireland. This consistently damaging strain of thought continued into the 20th century, with British military and economic power often used crudely to address deep-rooted political conflicts in Ireland, which refused, and continue to refuse, to allow for simple solutions. Ireland, the thinking went, should be the handmaiden for glorious Britannia – and this servile position is for Ireland’s own benefit and ultimately serves Irish interests.

Of course, within this particular strain of British political thought, the history of violence and tragedy in Ireland is sometimes portrayed as a product of Irish recalcitrance – a tendency towards disorder and conflict that fails to recognise the beneficence of British policy on the island. Britain, it is often suggested, is a guarantor of Irish stability, addressing and suppressing the inherent conflicts in Irish society, rather than a highly disruptive force that has often recklessly pursued its own interests at a serious cost to its nearest neighbour.

“Tories of influence” told him privately that Leo Varadkar, Ireland’s taoiseach “isn’t bright” and “the Irish will blink”.

• Irish Peace Is Too Precious To Be Squandered By The Brexit Ultras (G.)

In The Ultras, the brutal, brilliant novel by Eoin McNamee set during the Troubles, the protagonist (based on the real-life undercover British intelligence officer Robert Nairac) finds himself in the company of dangerous men like himself. The Ultras plot terrible events and create dark polities while forcing everyone else to live with their consequences. “Ultra meaning beyond,” wrote McNamee. “Ultra meaning extreme.” The so-called war cabinet formed by the new British prime minister, Boris Johnson, and whose course the maverick arch-Brexiteer Dominic Cummings now charts, of course bears no resemblance to the characters in the war of the Ultras imagined by McNamee.

But the sheer velocity and ferocity of their opening salvoes about crashing out of the EU with no deal on October 31 unless the backstop – the insurance policy to avoid a hard border in Ireland – is abolished, raise the kind of alarm that we in Ireland have not felt since the dark years of the Troubles. The political fear is that this new breed of “Brexit Ultras” (Johnson’s cabinet with Nigel Farage’s Brexit party snapping at its heels) could deliberately pursue a no-deal EU exit at the expense of a volatile Irish peace. The sabre-rattling and pre-emptive blame-shifting of course is intended to shore up political support in the UK ahead of a possible general election, but also to intimidate Ireland into abandoning the backstop while shaking the unity of the EU27.

Europe, with its own demons to face, has its red lines too and will not sacrifice the single market or its external borders, or jeopardise the wider integrity of the European project. Ireland, and the fragile peace process that has been built over the past 20 years, falls between these two positions. And while it is still early days for the Johnson premiership, we have a deteriorated state of Anglo-Irish relations following his ascent to power. How real is the damaging rhetoric emanating from London and the anti-Irish tropes spewing from much of the British media? David Yelland, the former editor of the Sun, revealed that he had been shocked when “Tories of influence” told him privately that Leo Varadkar, Ireland’s taoiseach “isn’t bright” and “the Irish will blink”. “It seems, amazingly, that this is the actual policy of HMG under Johnson,” tweeted Yelland. “They are anti-Irish, arrogant, dangerous and wrong.”

Well, actually, they’re going to change hardware: a second flight control computer and a second angle-of-attack sensor. Both of which are altready on board, but not used.

• Boeing To Change 737 MAX Flight-Control Software To Address Flaw (R.)

Boeing Co plans further changes to the software architecture of the 737 MAX flight-control system to address a flaw discovered after a test in June, two people briefed on the matter said late on Thursday. The redesign, first reported by the Seattle Times, involves using and receiving input from both flight control computers rather than one. The move comes in response to an effort to address a problem discovered in June during a Federal Aviation Administration(FAA) simulator test. This is on top of earlier announced changes to take input from both angle-of-attack sensors in the MCAS anti-stall system linked to two deadly crashes that led to a global grounding of the plane.

Boeing still hopes to complete the software redesign by the end of September to submit to the FAA for approval, the sources said. For decades, 737 models have used only one of the flight control computers for each flight, with the system switching to the other computer on the following flight, according to people familiar with the plane’s design. The FAA said in June that it had identified a new risk that would need to be addressed before the plane could be ungrounded. Under a scenario where a specific fault in a microprocessor caused an uncommanded movement of the plane’s horizontal tail, it took pilots too long to recognize a loss of control known as runaway stabilizer, a Boeing official said at the time.

Crazy bag lady.

• Rachel Maddow Ratings Tank After Collusion Narrative Implodes (Ryan)

Once a shining beacon of hope for Russiagate true believers, it looks like Rachel Maddow has left her best days behind her; MSNBC’s conspiracy queen has seen her show plummet to fifth place in cable news ratings. What happened? You rise fast and fall hard in the fickle world of television. Just last April, Maddow overtook Fox News’ Sean Hannity to claim the title of most-watched host across cable news. She had become a reliable source for Russigate aficionados to get their daily dose of crazy. Sadly for Maddow, the latest data released by Nielsen shows her show in fifth place with a total audience of 2.4877 million viewers for July – behind Hannity, Tucker Carlson, Laura Ingraham and The Five (all Fox News shows).

For context, in January this year, Maddow still boasted an audience of nearly 3.3 million, which means she shed around 800,000 viewers in just six months. Maddow was also in fifth place among viewers in the 25-54 age range – the group most-favored by advertisers. Ouch. Once dubbed “the smartest person on TV” by Forbes (really), this is certainly not the big payoff Maddow was expecting, having dedicated three years of her career to breathlessly covering every twist and turn in the anticlimactic Trump-Russia “collusion” drama.

Ship with dolphins.Wall painting from Akrotiri, Thera island (Santorini), Greece.17th century BC.