Vasily Polenov Moscow courtyard 1878

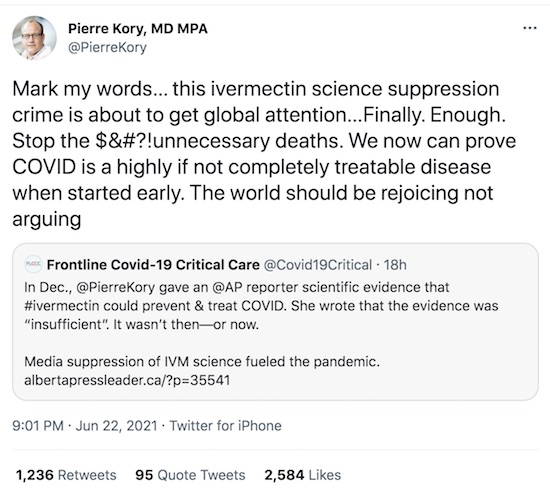

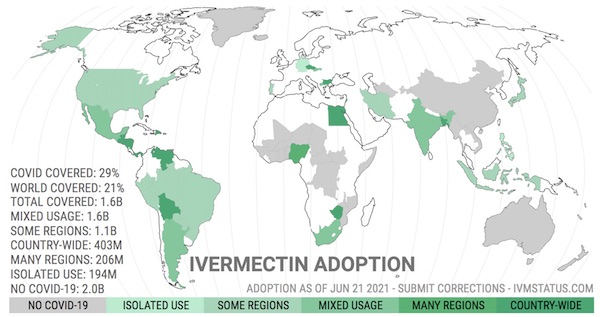

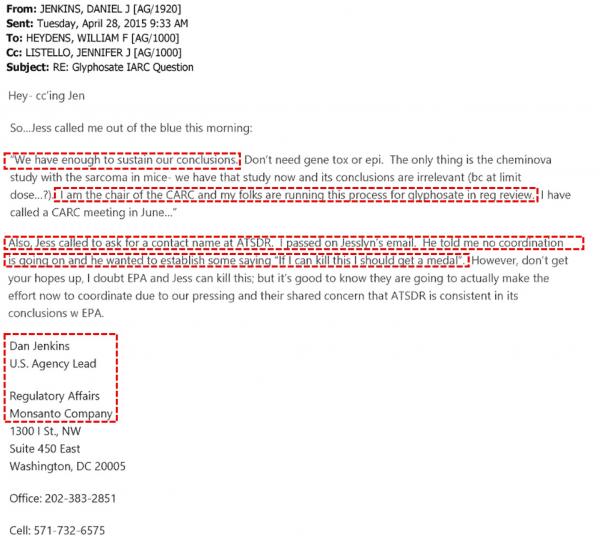

A drug safely used by an estimated 3 billion people has been relabeled a horse dewormer. This is a dangerous campaign. Lives are being lost.

• The FDA Is Begging You Not to Take Horse Dewormer for Covid-19 (RS)

“You are not a horse. You are not a cow,” the Food and Drug Administration tweeted on Saturday alongside a link to a page on their website explaining “Why you should not use Ivermectin to treat or prevent Covid-19.” Why? Because Ivermectin, a medication usually reserved for deworming livestock, is responsible for a spike in poison control calls in Mississippi as people duped by conspiracy theories have purchased the drug and ingested it, hoping it will treat or prevent Covid-19 — something the drug is not proven to do. According to an alert issued by the Mississippi Department of Health on Friday, 70 percent of all recent calls to poison control in the state “have been related to ingestion of livestock or animal formulations of ivermectin purchased at livestock supply centers.”

Although most callers (85 percent) only reported mild symptoms, one person was advised to seek additional treatment. “Animal drugs are highly concentrated for large animals and can be highly toxic in humans,” the alert said. Ivermectin is sometimes used in humans to treat parasites or scabies, but in much smaller doses than are given to livestock. The calls have clearly baffled health officials in the state. “I think some people are trying to use it as a preventative which is really kind of crazy,” Dr. Thomas Dobbs, Mississippi’s state health officer, said. “So please don’t do that.”

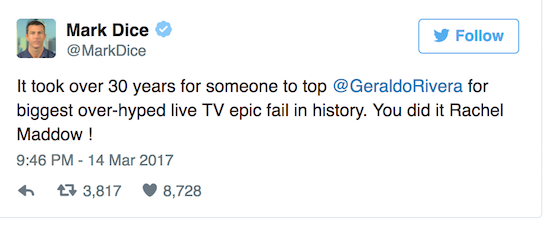

“You wouldn’t get your chemotherapy at a feed store,” Dobbs added. “You wouldn’t treat your pneumonia with your animal’s medication. It can be dangerous to get the wrong doses of medication, especially with something meant for a horse or a cow.” But the obvious risks of humans ingesting Ivermectin haven’t stopped people at Fox News — including hosts Laura Ingraham, Sean Hannity, and Tucker Carlson — from dangerously suggesting that it is a safe and effective treatment for Covid-19, as Rachel Maddow pointed out on her Friday night show where she showed clips of Fox personalities pushing the drug consistently over the last six months.

Very little is clear. Only thing to do is keep people from being infected. And the vaccines don’t do that:

..an internal document from the C.D.C. states that some 35,000 vaccinated people experience symptomatic coronavirus infections each week..

• How Does Covid-19 Affect The Brain? (NatGeo)

If SARS-CoV-2 doesn’t infect brain cells, how is so destructive to cognition? There are two leading hypotheses. The first is that the infection somehow triggers inflammation in the brain. Some COVID-19 patients have suffered encephalitis, or swelling of the brain, which can cause confusion and double vision, and in serious cases, speech, hearing, or vision problems. If left untreated, patients can develop cognitive problems. Viruses like West Nile and Zika can cause encephalitis by directly infecting the brain cells, but how COVID-19 may lead to brain inflammation is less clear. An immune response run amok, known as autoimmunity, might be to blame for some instances of inflammation throughout the body, including the brain.

When the immune system is fighting a disease like COVID-19, it unleashes antibodies to do battle against the infection. But sometimes a person’s immune system becomes hyperactive and instead starts making self-attacking antibodies, known as autoantibodies, which can contribute to inflammation and blood clots. These autoantibodies have been found in the cerebrospinal fluid of COVID-19 patients with neurological symptoms. In the Columbia study, researchers found clusters of microglia—special immune cells in the brain whose job is to clear out damaged neurons—that appeared to be attacking healthy neurons. The phenomenon is called neuronophagia. Most of these rogue microglia were in the brain stem, which regulates heartbeat, breathing, and sleeping.

The researchers think these microglia may get activated by signaling molecules called inflammatory cytokines found in patients with severe COVID-19. These molecules are supposed to help regulate the immune system, but some people’s bodies release too many inflammatory cytokines in response to a viral infection. When researchers at Stanford looked at brain tissue from eight patients who died of COVID-19, they also observed signs of inflammation compared to 14 control brains. Using a technique called single-cell RNA sequencing, they found that hundreds of genes associated with inflammation were activated in brain cells from COVID-19 patients compared to controls.

They also noted molecular changes in the cerebral cortex, the part of the brain involved in decision-making and memory that suggested signaling imbalances in neurons. Similar imbalances have been seen in patients with Alzheimer’s disease. The results were published in Nature in June. A second explanation for cognitive issues is that COVID-19 may restrict blood flow to the brain and deprive it of oxygen. In patients who have died of COVID-19, researchers have found evidence of brain tissue damagecaused by hypoxia, or the lack of oxygen.

Slow but sure take-up by serious medical journals.

Science Direct (Elsevier). Current Research in Translational Medicine

Volume 69, Issue 4, October 2021, 103309

• Potential Use Of Ivermectin For Treatment And Prophylaxis Of SARS-CoV-2 (SD)

Ivermectin performs its function mainly through inhibition of nuclear transport mediated by the imported heterodimer a/b1 , which is responsible for the translocation of proteins of several viral species (Human Immunodeficiency Virus, type 1- HIV1, and Simian Virus 40 – SV40; a known oncogenic DNA), and such translocation is, in turn, essential for viral replication [7,8]. This inhibition appears to affect a considerable number of RNA viruses. It has recently been shown that ivermectin inhibits the replication of the SARS-CoV-2 virus in vitro [8, 9], although it is not clear how this occurs. However, since the causal agent of COVID-19 is an RNA virus, the interference with the same proteins and molecular processes described above can reasonably be expected.

However, these studies were conducted at concentrations substantially higher than expected in the plasma and lungs of humans who receive the approved dose of ivermectin. Pharmacokinetic and pharmacodynamic studies suggest that in order to achieve the plasma concentrations required for in vitro antiviral efficacy, it would be necessary to administer doses up to 100 times higher than approved for human use. However, increasing the dose/kg of body weight may be a strategy to increase efficacy, the increase of the risk of toxicity is not conclusive. Currently, there is a noteworthy absence of efficacious treatments for patients with early infection. Although most patients present mild or moderate symptoms, up to 5-10% may have a bad disease progression, so there is a pressing need for effective drugs to be administered early in the course of infection, even before the appearance of severe symptoms, i.e. when the course of the disease is more modifiable to prevent disease progression and longer-term complications.

In fact, it is known that the earlier the antiviral therapies are started, the greater the benefits for patients, in both influenza [15] and SARS infections [16], as well as, more generally, for all infections. Given the need to find an effective drug that can mitigate the harmful consequences of COVID-19, a large number of studies are being carried out in order to assess the effectiveness of different existing drugs, including ivermectin, with promising results. This narrative review summarizes and outlines the evidence-based effectiveness and safety of ivermectin in patients with SARS-CoV-2 infection, recommending the drug for the treatment of COVID-19 especially in the early stages of the disease.

American Journal of Therapeutics: July/August 2021

• Ivermectin for Prevention and Treatment of COVID-19 Infection (AJT)

Ivermectin is a well-known medicine that is approved as an antiparasitic by the World Health Organization and the US Food and Drug Administration. It is widely used in low- and middle-income countries (LMICs) to treat worm infections. Also used for the treatment of scabies and lice, it is one of the World Health Organization’s Essential Medicines. With total doses of ivermectin distributed apparently equaling one-third of the present world population, ivermectin at the usual doses (0.2–0.4 mg/kg) is considered extremely safe for use in humans. In addition to its antiparasitic activity, it has been noted to have antiviral and anti-inflammatory properties, leading to an increasing list of therapeutic indications.8

Since the start of the SARS-CoV-2 pandemic, both observational and randomized studies have evaluated ivermectin as a treatment for, and as prophylaxis against, COVID-19 infection. A review by the Front Line COVID-19 Critical Care Alliance summarized findings from 27 studies on the effects of ivermectin for the prevention and treatment of COVID-19 infection, concluding that ivermectin “demonstrates a strong signal of therapeutic efficacy” against COVID-19.9 Another recent review found that ivermectin reduced deaths by 75%. Despite these findings, the National Institutes of Health in the United States recently stated that “there are insufficient data to recommend either for or against the use of ivermectin for the treatment of COVID-19,”and the World Health Organization recommends against its use outside of clinical trials.

Ivermectin has exhibited antiviral activity against a wide range of RNA and some DNA viruses, for example, Zika, dengue, yellow fever, and others.13 Caly et al14 demonstrated specific action against SARS-CoV-2 in vitro with a suggested host-directed mechanism of action being the blocking of the nuclear import of viral proteins that suppress normal immune responses. However, the necessary cell culture EC50 may not be achievable in vivo.16 Other conjectured mechanisms include inhibition of SARS-CoV-2 3CLPro activity(a protease essential for viral replication), a variety of anti-inflammatory effects,19 and competitive binding of ivermectin with the viral S protein as shown in multiple in silico studies. The latter would inhibit viral binding to ACE-2 receptors suppressing infection. Hemagglutination via viral binding to sialic acid receptors on erythrocytes is a recently proposed pathologic mechanism that would be similarly disrupted. Both host-directed and virus-directed mechanisms have thus been proposed, the clinical mechanism may be multimodal, possibly dependent on disease stage, and a comprehensive review of mechanisms of action is warranted.

You can’t force people. And you shouldn’t be trying.

• Stop The Mandates Or People Die (Denninger)

Better watch this one folks and let it sink in.

“If I don’t show up for my job, as I just explained to you, people die. On Saturday night at 10 p.m. I got a page. I did not want to go to work. Somebody was having a very critical problem, they were dying. I worked until 6 a.m. the next day. If I had not of showed up, there would have been nobody to do my job. These guys can’t show up to their job, and I’m sorry, your jobs are not as important as mine.” There are tens if not hundreds of thousands of people just like him They’re everywhere in the health care system. They have unique skills without which the system does not function, and when you need those skills you need them now, not later. There is no “later”; there is either now or death. Take someone on dialysis. This is not a “robotic procedure”; each patient has specific levels of various drugs and their specific metabolic reactions to them that must be individually managed.

The people who do that job are not replaceable on short notice, if at all. If you need dialysis and do not get it, you die. This is not a “maybe” or “might die” you WILL die with absolute, 100% certainty. Things happen at odd hours of the day and night. Most real medical emergencies are not scheduled — heart attacks, strokes, car wrecks, gunshots and similar. They happen when they happen and either someone is there to respond to it and deal with it or the person in question dies. Those hundreds of thousands of people who are utterly essential to people not dying every single day — hundreds if not thousands who will otherwise die if those employees refuse to show up — and exactly zero of those people can be compelled to work. This is America. It is not the Soviet Union. It is not North Korea.

NOBODY is a slave and EVERYONE has the right to say “**** you” and walk out. EVERYONE. ALL THE TIME. Then there are of course both cops and firefighters. You want someone to put your house out if its on fire, right? What if the firefighters say “**** you” to a jab mandate and quit? Who’s going to put the fire out? Do you even have a wrench to get the hydrant open, say much less the correct fittings and hose? What happens when your child is in that burning house and there is no firefighter to put it out? He or she dies. You cannot arrest and jail someone for quitting their job or refusing a mandate and being fired. All employment is voluntary, no matter how “essential” the position. THERE ARE NO EXCEPTIONS and there is no way to replace the people who do these jobs without which hundreds of people per day WILL DIE.

Therefore you have a choice to make America and you have to make it NOW. You will stand up and stop these mandates. You will do it now. You will do it or every single person who dies as a result of your failure to do so, and the refusal of others to consent, is YOUR responsibility. Not their person who quits — YOURS. THEY are not slaves. THEY cannot be compelled to consent. THEY have NO obligation to put up with your bull****. You’d better get this through your thick ******n skull RIGHT NOW. YOU are why that person who needs dialysis will be dead. YOU are why the person who is in critical trouble in a hospital and there is no perfusionist available right now will die. YOU either stop this madness, right now, by whatever means are necessary, without exception from top to bottom or YOU are responsible for those deaths and those deaths WILL come.

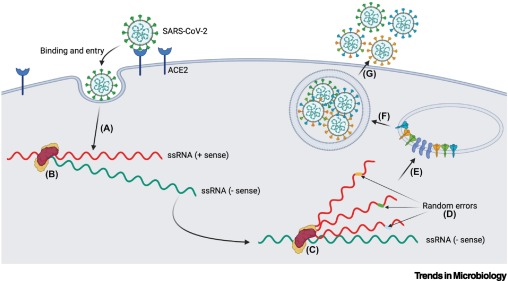

“While replication-associated mutations generate small changes in the viral genome, recombination may introduce more important modifications, leading to dramatic changes in the phenotype of SARS-CoV-2..”

• Molecular Determinants of SARS-CoV-2 Variants (Cell)

Accumulation of genomes with replication-associated random mutations within the same cell has the potential to generate a heterogeneous mix of viral proteins, including spike protein, which brings into question the true diversity of the spike on the surface of individual virions and subsequent tissue-level spread of SARS-CoV-2 and its variants. If a more orderly molecular process to regulate the homogeneous distribution of spike protein variants on individual virions exists, it remains to be identified. Regular RNA sequencing analyses are unable to identify these differences since they can only be captured by ultra-high-resolution single-virion protein sequencing, the technology for which is in its infancy.

The SARS-CoV-2 genomic mutation rate in humans is estimated at 0.8-2.38 x 10-3 nucleotide substitutions per site per year largely based on analysis of sequencing data archived in public repositories. Emerging studies are attempting to confirm this mutation rate using experimental investigations. By comparison, mutations rates for influenza A virus and Middle East respiratory syndrome CoV (MERS-CoV) are 2.3 x 10-3 and 1.12 x 10-3 nucleotide substitutions per site per year, respectively. Human CoVs (HCoV)-OC43 and HCoV-229E have an average mutation rate of 3-6 x 10-4 nucleotide substitutions per site per year. Emerging experimental data suggest that SARS-CoV-2 is capable of mutating and accumulating changes when facing a new cell type, albeit in the absence of immune surveillance in a single-cell-type infection model. A clinical study also reported the rapid evolution of SARS-CoV-2 variants in the presence of antibodies from convalescent plasma therapy. While random errors during replication may induce genetic mutations in SARS-CoV-2, multiple extrinsic factors, such as individual and population-level immunity, play a vital role in the selection of these variants. More research is warranted to fully understand the cellular and molecular drivers of genomic mutation and selection in SARS-CoV-2. As SARS-CoV-2 accumulates new genetic changes, we shall need to reassess the mutation rate to better understand the contribution of replication-associated random mutations and its impact on SARS-CoV-2 transmission and emergence of new variants.

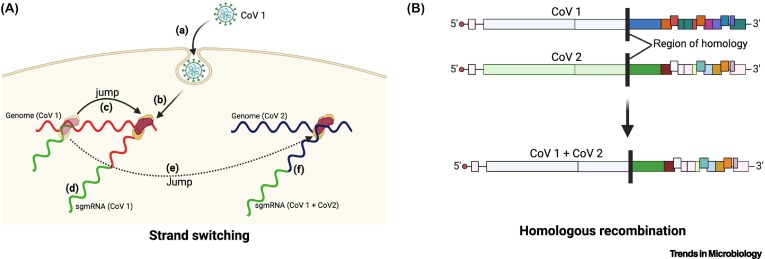

Figure 1 Replication-Associated Generation of Severe Acute Respiratory Syndrome Coronavirus 2 (SARS-CoV-2) Variants.

While replication-associated mutations generate small changes in the viral genome, recombination may introduce more important modifications, leading to dramatic changes in the phenotype of SARS-CoV-2 (Figure 2). Discontinuous transcription of CoV genomes enables recombination in a cell coinfected with more than one CoV species or variant via ‘strand switching’ by the viral RdRp (Figure 2A). This process leads to the production of chimeric subgenomic RNA and proteins. Chimeric proteins may have consequences for the fate of infected cells and for cellular and tissue tropism of progeny virions. As technology evolves, we might be able to track the spread of individual virions, along with deciphering the heterogeneity of their composition.

Figure 2 Recombination-Induced Variants.

Dr. Robert Malone and Peter Navarro.

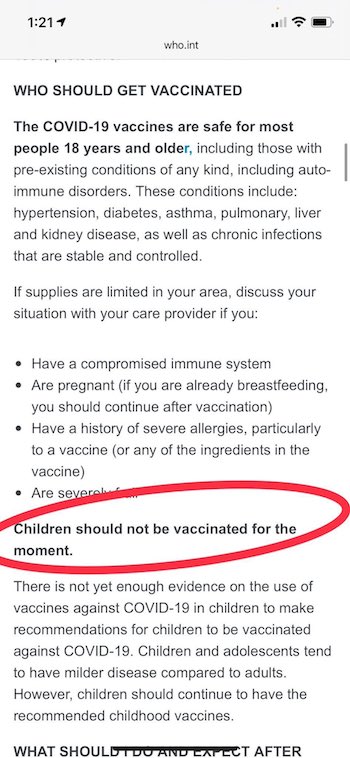

• Biden Team’s Misguided And Deadly Covid-19 Vaccine Strategy (WT)

The Biden administration’s strategy to universally vaccinate in the middle of the pandemic is bad science and badly needs a reboot. This strategy will likely prolong the most dangerous phase of the worst pandemic since 1918 and almost assuredly cause more harm than good – even as it undermines faith in the entire public health system. Four flawed assumptions drive the Biden strategy. The first is that universal vaccination can eradicate the virus and secure economic recovery by achieving herd immunity throughout the country (and the world). However, the virus is now so deeply embedded in the world population that, unlike polio and smallpox, eradication is unachievable. SARS-CoV-2 and its myriad mutations will likely continually circulate, much like the common cold and influenza.

The second assumption is that the vaccines are (near) perfectly effective. However, our currently available vaccines are quite “leaky.” While good at preventing severe disease and death, they only reduce, not eliminate, the risk of infection, replication, and transmission. As a slide deck from the Centers for Disease Control has revealed, even 100% acceptance of the current leaky vaccines combined with strict mask compliance will not stop the highly contagious Delta variant from spreading. The third assumption is that the vaccines are safe. Yet scientists, physicians, and public health officials now recognize risks that are rare but by no means trivial. Known side effects include serious cardiac and thrombotic conditions, menstrual cycle disruptions, Bell’s Palsy, Guillain Barre syndrome, and anaphylaxis.

Unknown side effects which virologists fear may emerge include existential reproductive risks, additional autoimmune conditions, and various forms of disease enhancement, i.e., the vaccines can make people more vulnerable to reinfection by SARS-CoV-2 or reactivation of latent viral infections and associated diseases such as shingles. With good reason, the FDA has yet to approve the vaccines now administered under Emergency Use Authorization. The failure of the fourth “durability” assumption is the most alarming and perplexing. It now appears our current vaccines are likely to offer a mere 180-day window of protection – a decided lack of durability underscored by scientific evidence from Israel and confirmed by Pfizer, the Department of Health and Human Services, and other countries.

Here, we are already being warned of the need for universal “booster” shots at six-month intervals for the foreseeable future. The obvious broader point that militates for individual vaccine choice is that repeated vaccinations, each with a small risk, can add up to a big risk. It’s an arms race with the virus.

Still not sure what they’re mad about, other than lockdowns.

• 100s Of Doctors Sign Open Letter: Need Debate On ‘Flawed Covid Guesses’ (Exp.)

A hundred and thirty three doctors, nurses, psychiatrists paramedics and midwives signed the letter released today which states that despite a “complete lack of widespread approval among health professionals,” of the pandemic policies, “no attempt” has been made to measure the harms of lockdown policies. The letter, also addressed to the Health Secretary and First Ministers for Scotland, Wales and Northern Ireland states: “You have failed to engage in dialogue and show no signs of doing so. You have removed from people fundamental rights and altered the fabric of society with little debate in Parliament.” The signatories, from a broad range of specialities, came forward despite the risk of doing so to both their jobs and reputations.

Founding signatory Dr Ros Jones, a retired paediatric consultant said: “We wrote the letter as a group of healthcare professionals, connected only by our deep concern and shared commitment to “first do no harm.” We can no longer stand by in silence. We are not the first group of medically and scientifically qualified professionals to write in such terms to the Government. In March, 22 eminent scientists publicly called for drastic policy change. We sincerely hope we will be the last who feel the need to write such a letter.” Dr Alan Mordue, another founding signatory said: “To move forward now our governments urgently need to facilitate a wider and open debate within the medical and scientific community, for the short term as we lift restrictions, and the longer term to improve how we manage winter respiratory viruses and pandemics in the future.”

Concerns voiced in the letter include accusations that no Minister responsible for policy “has engaged in an open and full discussion of alternative ways of managing the pandemic,” despite being aware of other medical and scientific viewpoints. It adds the pandemic response policies have caused “significant, permanent and unnecessary harm” to the UK and “must never be repeated.” The letter focuses on 10 areas where the UK’s approach to COVID failed. It argues the nature of the covid threat has been exaggerated, it claims the use of behavioural science to generate fear was “inappropriate and unethical” and it argues the role of asymptomatic spread has been overplayed and used to promote public compliance with restrictions.

Finally it states that restrictions have been imposed with an overreliance on modelling data whilst ignoring real world data. The signatories called for a “sea change within the Government “which must now pay proper attention to those esteemed experts outside its inner circle who are sounding these alarms.”

New normal. I see videos every day from Australia that make me want to vomit.

• Rescue Dogs Shot Dead By NSW Council Due To Covid-19 Restrictions (SMH)

Several impounded dogs due to be rescued by a shelter have instead been shot dead by a rural council in NSW under its interpretation of COVID-19 restrictions, alarming animal activists and prompting a government probe. Bourke Shire Council, in the state’s north-west, killed the dogs to prevent volunteers at a Cobar-based animal shelter from travelling to pick up the animals last week, according to council’s watchdog, the Office of Local Government. “OLG has been informed that the council decided to take this course of action to protect its employees and community, including vulnerable Aboriginal populations, from the risk of COVID-19 transmission,” a spokesman from the government agency said.

The spokesman said the agency was examining the circumstances of the incident to find out whether companion animal and cruelty prevention laws had been broken. The Herald attempted to contact the council administration multiple times, but received no response, and a member of Rural Outback Respite/Rescue – the shelter that was supposed to receive the dogs – declined to comment. A source who is familiar with the arrangement said the shelter volunteers are distressed and had COVID-safe measures in place to handle the dogs, one of which was a new mother. According to NSW Health, there have been no recent locally acquired COVID-19 cases in Cobar, although fragments of the virus have been found in the area’s sewerage system.

The Office of Local Government Minister Shelley Hancock, who has previously faced questions in Parliament over the shooting of animals in council pounds, did not comment. However, animal liberation campaigner Lisa Ryan called for an urgent investigation. “We are deeply distressed and completely appalled by this callous dog shooting and we totally reject council’s unacceptable justifications that this killing was apparently undertaken as part of a COVID- safe plan,” Ms Ryan, Animal Liberation’s regional campaign manager, said.

“It would be better to die under the Taliban’s bullet” than face the crowds again..”

• Afghan Staff At US Embassy Losing Faith In Evacuation Efforts (NBC)

Local staff members at the U.S. Embassy in Kabul are “deeply disheartened” by U.S. evacuation efforts and have expressed a sense of betrayal and distrust in the U.S. government, according to a State Department diplomatic cable obtained by NBC News. The cable, which was sent Saturday, said memos were sent Wednesday inviting Afghan staff members at the embassy to head to Hamid Karzai International Airport in Kabul. It told them to take food and to prepare for difficult conditions. “However, no one anticipated the brutal experience that occurred,” the cable said.

Staffers reported being jostled, hit, spat on and cursed at by Taliban fighters at checkpoints near the airport, it said, adding that criminals were taking advantage of the chaos while the U.S. military tried to maintain order “in an extremely physical situation.” Some staff members reported that they were almost separated from their children, while others collapsed in a crush of people and had to be taken to hospitals with injuries, the cable said. Others said they had collapsed on the road because of heat exhaustion, it said. “It would be better to die under the Taliban’s bullet” than face the crowds again, a staff member was quoted as saying in the cable.

“Happy to die here, but with dignity and pride,” another said, while a third accused the U.S. of prioritizing Afghan government elites with contacts in the U.S., who already had the correct paperwork and other ways to flee the country. A local embassy staff member reported that his home had been tagged with spray paint — a tactic the Taliban have used in the past to identify homes’ occupants for further questioning, the cable said, adding that the family had been forced to flee their home but was unable to get to the airport. Others shared concerns about conditions in Qatar, where many refugees have been flown before they make their way to other locations.

The U.S. began evacuating its citizens, diplomatic staff members and Afghans who aided its mission in the country last week after the Taliban seized control of much of Afghanistan before they finally walked into Kabul last Sunday without firing a shot. A State Department spokesperson said the U.S. has a “special commitment” to local embassy staff members who “have suffered hardship, pain and loss because of their dedication to working with us to build a better future for all Afghans.”

… But They’re Also Not Looking For Her Very Hard

• White House Announces They’ve Lost Kamala Harris (BBee)

In an interview with Morning Joe, White House communications director Kate Bedingfield revealed they have lost Kamala Harris and have no idea where she’s gone, although she admitted nobody is really looking for her all that hard. “Yeah, I dunno. She’s somewhere, I guess. I mean, she didn’t just disappear,” said Bedingfield. “We have some people looking for her I think, but we’re not too worried, honestly. I’m sure she’ll turn up sooner or later.” “Wait, wait, wait,” said the show’s host. “You mean to tell me that in this time of crisis, you have literally no idea where the Vice President of the United States is?”

“Well, it sounds bad when you put it that way,” replied the Communications Director. “I don’t really see how this is a big deal. It’s been kind of nice and quiet around here since she left… we’re not even quite sure what she does, anyway,” she said with a shrug. Anonymous sources have suggested Kamala may be somewhere around Camp David, as locals reported the sound of cackling through the night.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.