Edward Hopper Summer interior 1909

And then QE ends.

• Buybacks Are The Only Thing Keeping The Stock Market Afloat (CNBC)

Stocks right now are hanging by a thread, boosted by a bonanza of corporate buying unrivaled in market history and held back by a burst in investor selling that also has set a new record. Both sides are motivated by fear, as corporations find little else to do with their $2.1 trillion in cash than buy back their own shares or make deals, while individual investors head to the sidelines amid fears that a global trade war could thwart the substantial momentum the U.S. economy has seen this year. “Corporate cash is going to find a home, and it’s either going to be in buybacks, dividends or M&A activity. What it’s not going to be is in capex,” said Art Hogan, chief market strategist at B. Riley FBR.

“Individuals are looking at the turbulence we’ve seen this year that we had not seen last year. That creates its own sort of exit sign for investors who don’t want to deal with that.” The numbers showing where each side put their cash in the second quarter are striking. Companies announced $433.6 billion in share repurchases during the period, nearly doubling the previous record of $242.1 billion in the first quarter, according to market research firm TrimTabs. Dow components Nike and Walgreens Boots Alliance led the most recent surge in buybacks, with $15 billion and $10 billion, respectively, last week. In all, 31 companies announced buybacks in excess of $1 billion during June.

At the same time, investors dumped $23.7 billion in stock market-focused funds in June, also a new record. For the full quarter, the brutal June brought global net equity outflows to $20.2 billion, the worst performance since the third quarter of 2016, just before the presidential election. The selling is particularly acute in mutual funds, which saw $52.9 billion in outflows during the quarter and are typically more the purview of the retail side.

“People think their savings and pensions are safe because of rising share prices. They do not realise it is all a con-trick.”

• Stock Markets Look Ever More Like Ponzi Schemes (Murphy)

The FT has reported this morning that: “Debt at UK listed companies has soared to hit a record high of £390bn as companies have scrambled to maintain dividend payouts in response to shareholder demand despite weak profitability.” They added: “UK plc’s net debt has surpassed pre-crisis levels to reach £390.7bn in the 2017-18 financial year, according to analysis from Link Asset Services, which assessed balance sheet data from 440 UK listed companies.” So what, you might ask? Does it matter that companies are making sense of low-interest rates to raise money when I am saying that government could and should be doing the same thing?

Actually, yes it does. And that’s because of what the cash is being used for. Borrowing for investment makes sense. Borrowing to fund revenue investment (that is training, for example, which cannot go on the balance sheet but still adds value to the business) makes sense. But borrowing to pay a dividend when current profits and cash flow would not support it? No, that makes no sense at all. Unless, of course, you are CEO on a large share price linked bonus package and your aim is to manipulate the market price of the company. It is that manipulation that is going on here, I suggest. These loans are being used to artificially inflate share prices.

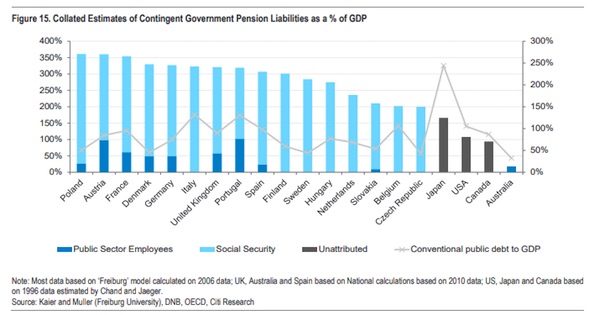

The problem is systemic. In the US the problem is share buybacks, which I read recently have exceeded $5 trillion in the last decade, meaning that US companies are now by far the biggest buyers of their own shares. That is, once again, market manipulation. And this manipulation does matter. People think their savings and pensions are safe because of rising share prices. They do not realise it is all a con-trick. And companies claim that their pension funds are better funded as a result of these share prices, and so they are meeting their obligations to their employees when that too is a con-trick. They may be insolvent when the truth is known, so serious is the fraud.

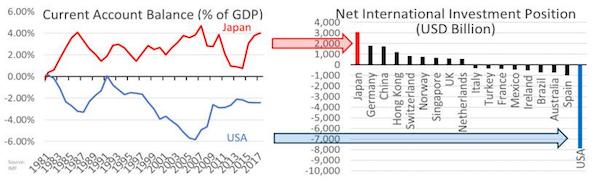

Japan plays a strange role in the global economy. It won’t be able to keep that up much longer. The Bank of Japan has many options; none are good.

• A Japanese Tsunami Out Of US CLOs Is Coming (HC)

Japan is at the very centre of the global financial system. It has run current account surpluses for decades, building the world’s largest net foreign investment surplus, or its accumulated national savings. Meanwhile, other nations, such as the US, have borrowed from nations like Japan to live beyond their own means, building net foreign investment deficits. We now have unprecedented levels of cross-national financing.

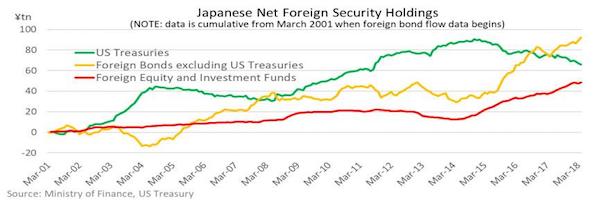

Much of Japan’s private sector saving is placed in Yen with financial institutions who then invest overseas. These institutions currency hedged most of their foreign assets to reduce risk weighted asset charges and currency write down risks. The cost of hedging USD assets has however risen due to a flattening USD yield curve and dislocations in FX forwards. As shown below, their effective yield on a 10 year US Treasury (UST) hedged with a 3 month USDJPY FX forward has fallen to 0.17%. As this is below the roughly 1% yield many financial institutions require to generate profits they have been selling USTs, even as unhedged 10 year UST yields rise. The effective yield will fall dramatically for here if 3 month USD Libor rises in line with the Fed’s “Dot Plot” forecast for short term rates, assuming other variables like 10 year UST yields remain constant.

As Japanese financial institutions sell US Treasuries, which are considered the safest foreign asset, they are shifting more into higher yielding and higher risk assets; foreign bonds excluding US treasuries as well as foreign equity and investment funds. This is a similar pattern to what we saw prior to the last global financial crisis. In essence, Japan’s financial institutions are forced to take on more risk in search of yield to cover rising hedge costs as the USD yield curve flattens late in the cycle. Critically as the world’s largest net creditor they facilitate significant added liquidity for higher risk overseas borrowers late into the cycle.

I follow these flows closely. One area I think is rather interesting is US Collateralised Loan Obligations (CLOs) which Bloomberg reports “ballooned to a record last quarter thanks in large part to unusually high demand from Japanese investors”. CLOs are essentially a basket of leveraged loans provided to generally lower rated companies with very little covenant protection. Alarmingly, some US borrowers have used this debt to purchase back so much of their own stock that their balance sheets now have negative net equity. A recent Fed discussion paper shows in the following chart that CLOs were the largest mechanism for the transfer of corporate credit risk out of undercapitalised banks in the US and into the shadow banking sector. Japanese financial institutions have been the underwriter of much of that risk in their search for yield.

“This reduction in costs is financed by pensioners and savers who are forced to invest in these debt instruments, often by institutional mandate.”

• The Eurozone’s Coming Debt Crisis (Lacalle)

The European Central Bank (ECB) has signaled the end of its asset purchase program and even a possible rate hike before 2019. After more than 2 trillion euros of asset purchases and a zero interest rate policy, it is long overdue. The massive quantitative easing (QE) program has generated very significant imbalances and the risks far outweigh the questionable benefits. The balance sheet of the ECB is now more than 40 percent of the eurozone GDP. The governments of the eurozone, however, have not prepared themselves at all for the end of stimuli. They often claim that deficits have been reduced and risks contained. However, closer scrutiny shows that the bulk of deficit reductions came from lower cost of government debt.

Eurozone government spending has barely fallen, despite lower unemployment and rising tax revenues. Structural deficits remain stubborn, and in some cases, unchanged from 2013 levels. In other words, the problems are still there, they were just hidden for a while, swept under the rug of an ever-expanding global economy. The 19 eurozone countries have collectively saved 1.15 trillion euros in interest payments since 2008 due to ECB rate cuts and monetary policy interventions, according to German media outlet Handelsblatt. This reduction in costs is financed by pensioners and savers who are forced to invest in these debt instruments, often by institutional mandate.

However, that illusion of savings and budget stability will rapidly disappear as most Eurozone countries face massive amounts of debt coming due in the 2018–2020 period and wasted precious years of quantitative easing without implementing strong structural reforms. The recent troubles of Italian banks are just one precursor of things to come. Taxes rose for families and small and medium-sized enterprises, while current spending by governments barely fell, competitiveness remained poor, and a massive 1 trillion euro in nonperforming loans raises doubts about the health of the European financial system.

Good overview. Crises wherever you look.

• The ‘Dirty Dozen’ Sectors Of Global Debt (Rochford)

When considering where the global credit cycle is at, it’s often easy to form a view based on a handful of recent articles, statistics and anecdotes. The most memorable of these tend to be either very positive or negative otherwise they wouldn’t be published or would be quickly forgotten. A better way to assess where the global credit cycle is at is to look for pockets of dodgy debt. If these pockets are few, credit is early in the cycle with good returns likely to lie ahead. If these pockets are numerous, that’s a clear indication that credit is late cycle.

In reviewing global debt, twelve sectors standout for their lax credit standards and increasing risk levels. There’s excessive risk taking in developed and emerging debt, as well as in government, corporate, consumer and financial sector debt. This points to global credit being late cycle. Central banks have failed to learn the lessons from the last crisis. By seeking to avoid or lessen the necessary cleansing of malinvestment and excessive debt, this cycle’s economic recovery has been unusually slow. Ultra-low interest rates and quantitative easing have increased the risk of another financial crisis, the opposite of the financial stability target many central bankers have.

For global debt investors, the current conditions offer limited potential for gains beyond carry. With credit spreads in many sectors at close to their lowest in the last decade, there is greater potential for spreads to widen dramatically than there is for spreads to tighten substantially. Keeping credit duration low, staying senior in the capital structure and shifting up the rating spectrum will cost some carry. However, the cost of de-risking now is as low as it has been for a long time. If the risks in the dirty dozen sectors materialise in the medium term, the losses avoided by de-risking will be a multiple of the carry foregone.

I’d say it’s about time for the British to wake up to the damage May et al are inflicting on the nation.

• UK’s Latest Brexit Proposal Is Unrealistic, Say EU Officials (G.)

A draft of Theresa May’s Brexit plan has already been dismissed as unrealistic by senior EU officials, who say the UK has no chance of changing the European Union’s founding principles. The prime minister is gathering her squabbling ministers at Chequers on Friday for a one-day discussion to thrash out the UK’s future relationship with the EU. But EU sources who have seen drafts of the long-awaited British white paper said the proposals would never be accepted. “We read the white paper and we read ‘cake’,” an EU official told the Guardian, a reference to Boris Johnson’s one-liner of being “pro having [cake] and pro-eating it”. Since the British EU referendum, “cake” has entered the Brussels lexicon to describe anything seen as an unrealistic or far-fetched demand.

May’s white paper is expected to propose the UK remaining indefinitely in a single market for goods after Brexit, to avoid the need for checks at the Irish border. While the UK is offering concessions on financial services, it wants restrictions on free movement of people – a long-standing no-go for the EU. Jean-Claude Piris, a former head of the EU council’s legal service, said it would be impossible for the EU to split the “four freedoms” underpinning the bloc’s internal market, which are written into the 1957 treaty that founded the European project: free movement of goods, services, capital and people. “The EU is in difficulties at the moment; the one and only success which glues all these countries together is a little bit the money and the internal market,” Piris said. “If you fudge the internal market by allowing a third state to choose what they want … it is the beginning of the end.”

Not easy to find the right position on the topic. But Europe seems to show that uncontrolled immigration leads to the rise of right wing movements. Merkal gave birth to Salvini.

• Nassim Taleb Slams “These Virtue-Signaling Open-Borders Imbeciles” (ZH)

As liberals across America continue to attempt to one-up one another with the volume of virtue they can signal, specifically on the question of ‘open borders’ – especially since ‘jenny from the bronx’ victory over the weekend, none other than Nassim Nicholas Taleb unleashed a trite 3-tweet summary of how farcical this argument is…

What intellectuals don’t get about MIGRATION is the ethical notion of SYMMETRY:

1) OPEN BORDERS work if and only if the number of pple who want to go from EU/US to Africa/LatinAmer equals Africans/Latin Amer who want to move to EU/US

2) Controlled immigration is based on the symmetry that someone brings in at least as much as he/she gets out. And the ethics of the immigrant is to defend the system as payback, not mess it up. Uncontrolled immigration has all the attributes of invasions.

3) As a Christian Lebanese, saw the nightmare of uncontrolled immigration of Palestinians which caused the the civil war & as a part-time resident of N. Lebanon, I am seeing the effect of Syrian migration on the place.

So I despise these virtue-signaling open-borders imbeciles.

Silver Rule in #SkinInTheGame

Mutti’s holding centers.

• Merkel Dodges Political Bullet With Controversial Migrant Deal (AFP)

German Chancellor Angela Merkel survived a bruising challenge to her authority with a compromise deal on immigration but faced charges Tuesday that it spelt a final farewell to her welcoming stance toward refugees. In high-stakes crisis talks overnight, Merkel had put to rest for now a dangerous row with her hardline Interior Minister Horst Seehofer that had threatened the survival of her fragile coalition government. In separate statements, Merkel praised the “very good compromise” that she said spelt a European solution, while Seehofer withdrew a resignation threat and gloated that “it’s worth fighting for your convictions”.

In a pact both sides hailed as a victory, Merkel and Seehofer agreed to tighten border controls and set up closed holding centres to allow the speedy processing of asylum seekers and the repatriations of those who are rejected. They would either be sent back to EU countries that previously registered them or, in case arrival countries reject this – likely including frontline state Italy – be sent back to Austria, pending an agreement with Vienna. CSU general secretary called the hardening policy proposal the last building block “in a turn-around on asylum policy” after a mass influx brought over one million migrants and refugees.

But criticism and doubts were voiced quickly by other parties and groups, suggesting Merkel may only have won a temporary respite. Refugee support group Pro Asyl slammed what it labelled “detention centres in no-man’s land” and charged that German power politics were being played out “on the backs of those in need of protection”. Bernd Riexinger of the opposition far-left Die Linke party spoke of “mass internment camps” as proof that “humanity got lost along the way” and urged Merkel’s other coalition ally, the Social Democrats (SPD), to reject the plan.

And Merkel made Kurz possible, too.

• Austria Says To ‘Protect’ Its Borders After German Migrant Deal (AFP)

Austria’s government warned Tuesday it could “take measures to protect” its borders after Germany planned restrictions on the entry of migrants as part of a deal to avert a political crisis in Berlin. If the agreement reached Monday evening is approved by the German government as a whole, “we will be obliged to take measures to avoid disadvantages for Austria and its people,” the Austrian government said in a statement. It added it would be “ready to take measures to protect our southern borders in particular,” those with Italy and Slovenia. German Chancellor Angela Merkel reached a deal Monday on migration with her rebellious interior minister, Horst Seehofer, to defuse a bitter row that had threatened her government.

Among the proposals is a plan to send back to Austria asylum seekers arriving in Germany who cannot be returned to their countries of entry into the European Union. Austria said it would be prepared to take similar measures to block asylum seekers at its southern borders, with the risk of a domino effect in Europe. “We are now waiting for a rapid clarification of the German position at a federal level,” said the statement, signed by Austria’s conservative Chancellor Sebastian Kurz and his allies of the far-right Freedom party, Vice Chancellor Heinz-Christian Strache and Interior Minister Herbert Kickl. “German considerations prove once again the importance of a common European protection of the external borders,” the statement said.

Wonder what the strategy meetings were like.

• Is Facebook A Publisher? In Public It Says No, But In Court It Says Yes (G.)

Facebook has long had the same public response when questioned about its disruption of the news industry: it is a tech platform, not a publisher or a media company. But in a small courtroom in California’s Redwood City on Monday, attorneys for the social media company presented a different message from the one executives have made to Congress, in interviews and in speeches: Facebook, they repeatedly argued, is a publisher, and a company that makes editorial decisions, which are protected by the first amendment. The contradictory claim is Facebook’s latest tactic against a high-profile lawsuit, exposing a growing tension for the Silicon Valley corporation, which has long presented itself as neutral platform that does not have traditional journalistic responsibilities.

The suit, filed by an app startup, alleges that Mark Zuckerberg developed a “malicious and fraudulent scheme” to exploit users’ personal data and force rival companies out of business. Facebook, meanwhile, is arguing that its decisions about “what not to publish” should be protected because it is a “publisher”. In court, Sonal Mehta, a lawyer for Facebook, even drew comparison with traditional media: “The publisher discretion is a free speech right irrespective of what technological means is used. A newspaper has a publisher function whether they are doing it on their website, in a printed copy or through the news alerts.” [..] Mehta argued in court Monday that Facebook’s decisions about data access were a “quintessential publisher function” and constituted “protected” activity, adding that this “includes both the decision of what to publish and the decision of what not to publish”.

David Godkin, an attorney for Six4Three, later responded: “For years, Facebook has been saying publicly … that it’s not a media company. This is a complete 180.” Questions about Facebook’s moral and legal responsibilities as a publisher have escalated surrounding its role in spreading false news and propaganda, along with questionable censorship decisions. Eric Goldman, a Santa Clara University law professor, said it was frustrating to see Facebook publicly deny that it was a publisher in some contexts but then claim it as a defense in court. “It’s politically expedient to deflect responsibility for making editorial judgements by claiming to be a platform,” he said, adding, “But it makes editorial decisions all the time, and it’s making them more frequently.”

He did pull it off. But it may be too little too late. Biggest no-no: Model 3 was supposed to be $35,000. ended up at $78,000.

• Tesla’s All-Nighter To Hit Production Goal Fails To Convince Wall Street (R.)

Tesla’s burning the midnight oil to hit a long-elusive target of making 5,000 Model 3 vehicles per week failed to convince Wall Street that the electric carmaker could sustain that production pace, sending shares down 2.3% on Monday. Tesla met the target by running around the clock and pulling workers from other projects, workers said. The company also took the unprecedented step of setting up a new production line inside a tent on the campus of its Fremont factory, details of which Chief Executive Elon Musk tweeted last month. Tesla’s heavily-shorted shares rose as much as 6.4% to $364.78 in early trading, but sank after several analysts questioned whether Tesla would be able to sustain the Model 3 production momentum, which is crucial for the long-term financial health of the company.

“In the interim, we do not see this production rate as operationally or financially sustainable,” said CFRA analyst Efraim Levy. “However, over time, we expect the manufacturing rate to become sustainable and even rise.” Levy cut CFRA’s rating on Tesla stock to “sell” from “hold.” Tesla, which Chief Executive Elon Musk hailed on Sunday as having become a “real car company,” said it now expects to boost production to 6,000 Model 3s per week by late August, signaling confidence about resolving technical and assembly issues that have plagued the company for months. Tesla also reaffirmed a positive cash flow and profit forecast for the year. Tesla has been burning through cash to produce the Model 3. Problems with an over-reliance on automation, battery issues and other bottlenecks have potentially compromised Tesla’s position in the electric car market as a host of competitors prepare to launch rival vehicles.

NATO is “justified by the need to manage the security threats provoked by its enlargement.”.

• The New York Times Squares off with the Truth, Again (AHT)

Whenever I’m having a rough day and need a pick-me-up, I turn to The New York Times’ editorial page. It’s always a gas to see how far the empire’s leading propaganda outfit is prepared to go in its mission to pull the wool over we the people’s gullible little eyes. The good editors have come through for me again with their latest entry, “Trump and Putin’s Too-Friendly Summit.” (Original title: “Trump and Putin: Best Frenemies for Life”). No doubt the original headline was deemed rather too impish for such a serious newspaper—it might, for instance, have alerted readers to the fact that the editorial’s content is not to be taken very seriously—and so was understandably jettisoned.

“One would think,” the editors write, “that the president of the United States would let Mr. Putin know that he faces a united front of Mr. Trump and his fellow NATO leaders, with whom he would have met days before the [Putin] summit in Helsinki.” Alas, during said meeting Trump reportedly remarked that “NATO is as bad as NAFTA”—the “free trade” agreement that has succeeded in decimating most of the manufacturing jobs spared by the automation wrecking ball. In other words, Trump does not necessarily think it’s a good idea to encircle Russia with a hostile military alliance whose existence, according to geopolitical expert Richard Sakwa, is “justified by the need to manage the security threats provoked by its enlargement.” (If you haven’t read Professor Sakwa’s comprehensive study of the Ukrainian crisis, Frontline Ukraine, put it at the top of your summer reading list.)

One notes the Turgidsonian delight with which the Times reminds us that, should push come to shove, we’ve got those Russki bastards outgunned. Of course, gullibles like you and I are to pay no mind to the fact that such a confrontation (a military one, for the Times brought up NATO) would almost certainly involve a nuclear exchange, rendering the disparity in manpower that so excites the Times totally meaningless. No, what’s important is that NATO has twenty-nine member states and counting, while the Warsaw Pact was dissolved twenty-seven years ago: ergo, unless he wants the old mailed fist, Putin had better ask “how high?” when we tell him to jump. One would be hard-pressed to come up with a more delusional assessment of where things stand.

“We are in that constitutional crisis now, but just at the start of it.”

• Anthony Kennedy and Our Delayed Constitutional Crisis (GP)

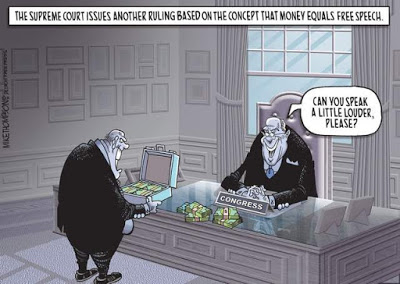

Like “swing vote” Justice Sandra Day O’Connor before him, “swing vote” justice Anthony Kennedy has been one of the worst Supreme Court jurists of the modern era. With swing-vote status comes great responsibility, and in the most consequential — and wrongly decided — cases of this generation, O’Connor and Kennedy were the Court’s key enablers. They • Cast the deciding vote that made each decision possible • Kept alive the illusion of the Court’s non-partisan legitimacy. Each of these points is critical in evaluating the modern Supreme Court. For two generations, it has made decisions that changed the constitution for the worse. (Small “c” on constitution to indicate the original written document, plus its amendments, plus the sum of all unwritten agreements and court decisions that determine how those documents are to be interpreted).

These horrible decisions are easy to list. They expanded the earlier decision on corporate personhood by enshrining money as political speech in a group of decisions that led to the infamous Citizens United case (whose majority opinion, by the way, was written by the so-called “moderate” Anthony Kennedy); repeatedly undermined the rights of citizens and workers relative to the corporations that rule and employ them; set back voting rights equality for at least a generation; and many more. After this next appointment, many fear Roe v. Wade may be reversed. Yet the Court has managed to keep (one is tempted to say curate) its reputation as a “divided body” and not a “captured body” thanks to its so-called swing vote justices and the press’s consistent and complicit portrayal of the Court as merely “divided.”

The second point above, about the illusion of the Court’s legitimacy, is just as important as the first. If the Court were ever widely seen as acting outside the bounds of its mandate, or worse, seen as a partisan, captured organ of a powerful and dangerous political minority (which it certainly is), all of its decisions would be rejected by the people at large, and more importantly, the nation would plunged into a constitutional crisis of monumental proportions. We are in that constitutional crisis now, but just at the start of it. We should have been done with it long ago. Both O’Connor and Kennedy are responsible for that delay.

Image credit: Mike Thompson / Detroit Free Press

A tale of two refugees

Putin: Snowden is free to do whatever he wants

Lenin: I ordered Assange to be gagged and isolated and am coordinating “next steps” with US

• ‘Snowden is the Master of His Own Destiny’ – Russia (TeleSur)

United States President Donald Trump is expected to pressure Russia to hand over NSA whistleblower Edward Snowden in exchange for sanctions relief at the upcoming Trump-Putin summit; however, Russia has emphasized that they “are not in a position” to expel Snowden and will “respect his rights” if any such attempt is made. “I have never discussed Edward Snowden with (Donald Trump’s) administration,” Russian Foreign Minister Sergey Lavrov said to Channel 4 reporters. “When he (Putin) was asked the question, he said this is for Edward Snowden to decide. We respect his rights, as an individual. That is why we were not in a position to expel him against his will because he found himself in Russia even without a U.S. passport, which was discontinued as he was flying from Hong Kong.”

Snowden, who is being prosecuted in the United States for leaking classified documents that showed surveillance abuse by U.S. intelligence agencies, was given political asylum in Russia after his passport was revoked. “Edward Snowden is the master of his own destiny,” Lavrov said. Trump is meeting with Russian President Vladimir Putin on July 16 in Helsinki, where Putin is expected to push for an end to U.S. sanctions. Trump has said he would like better relations with Russia, perhaps as a way of pulling them away from China, but Trump’s opponents in the United States are already applying political pressure on him for holding the summit, in the midst of the tensest U.S.-Russian relations since the height of the Cold War.

The fate of Wikileaks founder Julian Assange also lay in the balance when U.S. Vice President Mike Pence met with Ecuador’s President Lenin Moreno this week. “The vice president raised the issue of Mr. Assange. It was a constructive conversation. They agreed to remain in close coordination on potential next steps going forward,” a White House official said in a statement.

Home › Forums › Debt Rattle July 3 2018