Pablo Picasso Sleeping girl 1935

Very close to what I’ve been saying.

• Free Money Socialism (Henrich)

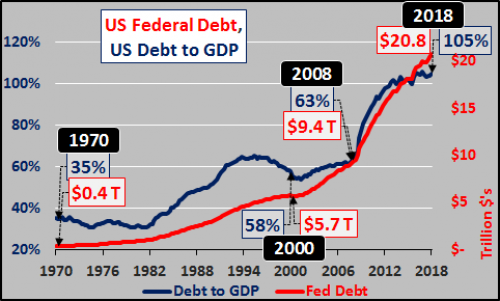

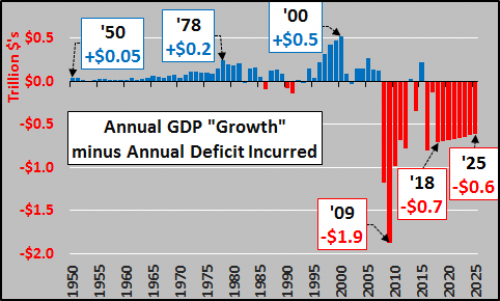

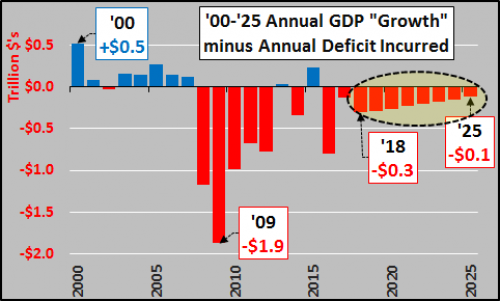

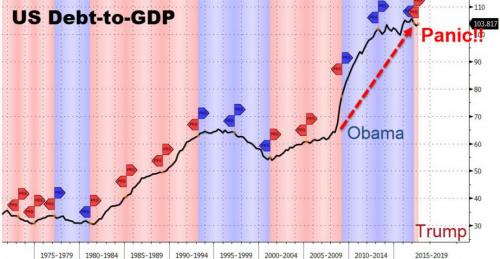

According to Jay Powell the Fed’s primary mission is now to “sustain the economic expansion.” I’ve never used the term “manipulation” before, but let’s just be clear what “sustain the economic expansion” really means: To prevent natural market forces from taking hold. That’s manipulation. Business cycles are natural. They serve a purpose, they lay the foundation for new growth, they weed out the excess, they permit for a reset of an aging expansion, for a renewed flourishing of innovation, new solutions, creativity, and yes growth. Of course because of all this recessions bring about temporary pain, but nobody wants pain anymore, and hence central bankers with hero magazine covers have now taken on a new role, that of preventing a recession altogether.

No more cleansing, no more resets, but only ever more excess and propagating the notion that they alone can prevent the cleansing process from taking place with their favorite and only method: Free Money. Oh yes, the free money whores are here again. Hurry back into stocks: “Now, interest rates are coming down en masse. Investors who adjusted their portfolios for a high-rate environment must readjust. That means leaning into growth stocks again, scouring Asia for opportunities, and earning income from investments that won’t succumb to the low-rate trend and will also hold up in a shaky economy”. Barron’s calls the Fed flip flop “graceful”. I call it disgraceful.

Just stop. It’s 2019, wealth inequality is higher than ever, corporate debt is higher than ever, and growth is slowing. Innovation is hampered by a system that has benefitted the few which have grown into bloated monopolies, and the entire system itself remains held afloat by massive and ever more expending debt. After all there is zero intellectual integrity to anything that is being propagated. In recent times Fed chairs have bemoaned rising wealth inequality, oh how un-American it all is, and rising corporate debt being a threat to the economy, but then they proceed to again exacerbate both by promising more easy money, their default solution in the misguided attempt to bail investors out from all pain and any bad decisions.

For everyone whining about socialism: It already exists.

It’s called central banking.

Socialism for the top 1%.— Sven Henrich (@NorthmanTrader) April 21, 2019

“The key in the analysis is what is called notional. They are so far out of the money that they are said to mean nothing. But in a crisis the notional can become real.”

• Iran Goes For “Maximum Counter-Pressure” (Escobar)

The facts are stark. Tehran simply won’t accept all-out economic war lying down – prevented to export the oil that protects its economic survival. The Strait of Hormuz question has been officially addressed. Now it’s time for the derivatives. Presenting detailed derivatives analysis plus military analysis to global media would force the media pack, mostly Western, to go to Warren Buffett to see if it is true. And it is true. Soleimani, according to this scenario, should say as much and recommend that the media go talk to Warren Buffett. The extent of a possible derivatives crisis is an uber-taboo theme for the Washington consensus institutions. According to one of my American banking sources, the most accurate figure – $1.2 quadrillion – comes from a Swiss banker, off the record.

He should know; the Bank of International Settlements (BIS) – the central bank of central banks – is in Basle. The key point is it doesn’t matter how the Strait of Hormuz is blocked. It could be a false flag. Or it could be because the Iranian government feels it’s going to be attacked and then sinks a cargo ship or two. What matters is the final result; any blocking of the energy flow will lead the price of oil to reach $200 a barrel, $500 or even, according to some Goldman Sachs projections, $1,000. Another US banking source explains; “The key in the analysis is what is called notional. They are so far out of the money that they are said to mean nothing.

But in a crisis the notional can become real. For example, if I buy a call for a million barrels of oil at $300 a barrel, my cost will not be very great as it is thought to be inconceivable that the price will go that high. That is notional. But if the Strait is closed, that can become a stupendous figure.” BIS will only commit, officially, to indicate the total notional amount outstanding for contracts in derivatives markers is an estimated $542.4 trillion. But this is just an estimate. The banking source adds, “Even here it is the notional that has meaning. Huge amounts are interest rate derivatives. Most are notional but if oil goes to a thousand dollars a barrel, then this will affect interest rates if 45% of the world’s GDP is oil. This is what is called in business a contingent liability.”

“John Bolton is kind of a bureaucratic tapeworm” that keeps causing pain and suffering, but never suffering himself – @TuckerCarlson describes Neocon infestation in Washington. pic.twitter.com/PBlKDhP14U

— Vera Van Horne (@VeraVanHorne) June 23, 2019

“If even modestly successful, Libra would hand over much of the control of monetary policy from central banks to these private companies.”

• Facebook’s Libra Cryptocurrency ‘Poses Risks To Global Banking’ -BIS (G.)

Facebook’s plan to operate its own digital currency poses risks to the international banking system that should trigger a speedy response from global policymakers, according to the organisation that represents the world’s central banks. Although the move of big tech firms such as Facebook, Amazon and Alibaba into financial services could speed up transactions and cut costs, especially in developing world countries, it could also undermine the stability of a banking system that has only just recovered from the crash of 2008. Echoing warnings from many tech experts, the Bank for International Settlements (BIS) said that while there were potential benefits to be made, the adoption of digital currencies outside the current financial system could reduce competition and create data privacy issues.

“The aim should be to respond to big techs’ entry into financial services so as to benefit from the gains while limiting the risks,” said Hyun Song Shin, economic adviser and head of research at BIS. “Public policy needs to build on a more comprehensive approach that draws on financial regulation, competition policy and data privacy regulation.” The warning from the BIS on Sunday comes only days after Facebook announced it would launch its own digital currency, Libra, in 2020. It will allow its billions of users to make financial transactions across the globe in a move that could potentially shake up the world’s banking system.

Chris Hughes, a co-founder of Facebook, last week added his voice to concerns being expressed over big tech’s move into finance, warning that Libra could shift power into the wrong hands. Hughes, who is co-chair of the Economic Security Project, an anti-poverty campaign group, said: “If even modestly successful, Libra would hand over much of the control of monetary policy from central banks to these private companies. If global regulators don’t act now, it could very soon be too late.”

Very easy for a government to counter. Should make one suspicious as to why they don’t.

• Google’s Chrome Web Browser “Has Become Spy Software” (ZH)

Google’s Chrome is essentially spy software according to Washington Post tech columnist Geoffrey Fowler, who spent a week analyzing the popular browser and concluded that it “looks a lot like surveillance software.” Fowler has since switched to Mozilla’s Firefox because of its default privacy settings, and says that it was easier than one might imagine.

“My tests of Chrome vs. Firefox unearthed a personal data caper of absurd proportions. In a week of Web surfing on my desktop, I discovered 11,189 requests for tracker “cookies” that Chrome would have ushered right onto my computer but were automatically blocked by Firefox. These little files are the hooks that data firms, including Google itself, use to follow what websites you visit so they can build profiles of your interests, income and personality. Chrome welcomed trackers even at websites you would think would be private. I watched Aetna and the Federal Student Aid website set cookies for Facebook and Google. They surreptitiously told the data giants every time I pulled up the insurance and loan service’s log-in pages.

And that’s not the half of it.= Look in the upper right corner of your Chrome browser. See a picture or a name in the circle? If so, you’re logged in to the browser, and Google might be tapping into your Web activity to target ads. Don’t recall signing in? I didn’t, either. Chrome recently started doing that automatically when you use Gmail. -Washington Post”

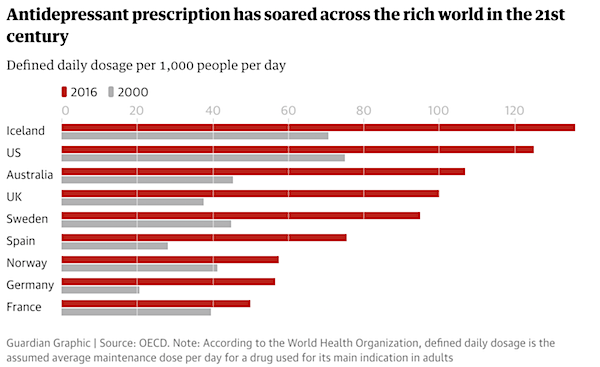

Iceland?!

• Austerity, Inequality Fuelling Mental Illness – Top UN Envoy (G.)

Austerity, inequality and job insecurity are bad for mental health and governments should counteract them if they want to face up to the rising prevalence of mental illness, the UN’s top health envoy has said. In an exclusive interview with the Guardian to coincide with a hard-hitting report to be delivered to the UN in Geneva on Monday, Dr Dainius Puras said measures to address inequality and discrimination would be far more effective in combatting mental illness than the emphasis over the past 30 years on medication and therapy. “This would be the best ‘vaccine’ against mental illness and would be much better than the excessive use of psychotropic medication which is happening,” said Puras, who as the UN’s special rapporteur on health reports back to the UN human rights council in Geneva.

He said that since the 2008 financial crisis, policies that accentuated division, inequality and social isolation have been bad for mental equilibrium. “Austerity measures did not contribute positively to good mental health,” he said. “People feel insecure, they feel anxious, they do not enjoy good emotional wellbeing because of this insecurity situation.” “The best way to invest in the mental health of individuals is to create a supportive environment in all settings, family, the workplace. Then of course [therapeutic] services are needed, but they should not be based on an excessive biomedical model.”

Puras said there had been an overemphasis on trying to cure mental illness like physical illness, through “good medicine”, without thinking about the social factors that cause or contribute to some mental disorders. The prescription of psychotropic drugs to deal with mental illness, particularly antidepressants, has soared across the developed world in the past 20 years.

What do Americans understand these days?

• Republicans Don’t Understand Democrats – and Vice Versa (Atl.)

Unfortunately, the “Perception Gap” study suggests that neither the media nor the universities are likely to remedy Americans’ inability to hear one another: It found that the best educated and most politically interested Americans are more likely to vilify their political adversaries than their less educated, less tuned-in peers. Americans who rarely or never follow the news are surprisingly good at estimating the views of people with whom they disagree. On average, they misjudge the preferences of political adversaries by less than 10 percent. Those who follow the news most of the time, by contrast, are terrible at understanding their adversaries. On average, they believe that the share of their political adversaries who endorse extreme views is about 30 percent higher than it is in reality.

Perhaps because institutions of higher learning tend to be dominated by liberals, Republicans who have gone to college are not more likely to caricature their ideological adversaries than those who dropped out of high school. But among Democrats, education seems to make the problem much worse. Democrats who have a high-school degree suffer from a greater perception gap than those who don’t. Democrats who went to college harbor greater misunderstandings than those who didn’t. And those with a postgrad degree have a way more skewed view of Republicans than anybody else. It is deeply worrying that Americans now have so little understanding of their political adversaries. It is downright disturbing that the very institutions that ought to help us become better informed may actually be deepening our mutual incomprehension.

And that’s just in one airline.

• 400 Pilots Sue Boeing In Class Action Over 737 MAX Cover-Up (ABC.au)

More than 400 pilots have joined a class action against American plane manufacturer Boeing, seeking damages in the millions over what they allege was the company’s “unprecedented cover-up” of the “known design flaws” of the latest edition of its top-selling jet, the 737 MAX. Boeing’s 737 MAX series— first announced in 2011 and put to service in 2017 — is the fourth generation of its 737 aircraft, a widely popular narrow-body aircraft model that has been a mainstay of short-haul aircraft routes across the globe. By March 2019, the entire global fleet was suspended by a US presidential decree, following the second fatal crash involving a 737 MAX that killed 157 people in Ethiopia.

The first crash involving the 737 MAX jet happened off the coast of Indonesia in October 2018, killing 189 people. In the time since the two fatal crashes, some of the families of the 346 people killed have sought compensation, while aircraft carriers — such as Norwegian Air — have sought compensation from the American manufacturer for lost revenue as a result of the plane’s global ban. This latest lawsuit filed against Boeing marks the first class action lodged by pilots qualified to fly the 737 MAX series, who have alleged that Boeing’s decisions have caused them to suffer from monetary loss and mental distress since the jet’s suspension.

The originating plaintiff, known as Pilot X —who has chosen to remain anonymous for “fear of reprisal from Boeing and discrimination from Boeing customers” — lodged the statement of claim on Friday, which seeks damages for them and more than 400 colleagues who work for the same airline. In court documents seen by the ABC, the claim alleges that Boeing “engaged in an unprecedented cover-up of the known design flaws of the MAX, which predictably resulted in the crashes of two MAX aircraft and subsequent grounding of all MAX aircraft worldwide.” They argue that they “suffer and continue to suffer significant lost wages, among other economic and non-economic damages” since the fleet’s global grounding. The class action will be heard in a Chicago court, with a hearing date set for October 21, 2019.

History lesson” “The Caribbean archipelago was ground zero for U.S. imperial banking.”

• How Wall Street Colonized the Caribbean (BR)

Scrubbed from the pages of glossy coffeetable books, the history of U.S. imperialism can be found in the archives of Wall Street’s oldest, largest, and most powerful institutions. A deep dive into the vaults and ledgers of banking houses such as Citigroup, Inc., and J. P. Morgan Chase and Co. reveals a story of capitalism and empire whose narrative is not of morally pure and inspiring economic growth, technological innovation, market expansion, and shareholder accumulation, but rather of blood and labor, stolen sovereignty and pilfered resources, military occupation and monetary control. Sugar comingles with blood, chain gangs cross spur lines, and the magical abstractions of finance are found vulgarized in the base manifestations of racial capitalism.

This history of bankers and empire is also a Caribbean history. The Caribbean archipelago was ground zero for U.S. imperial banking. Wall Street’s first experiments in internationalism occurred in Cuba, Haiti, Panama, Puerto Rico, the Dominican Republic, and Nicaragua, often with disastrous results—for those countries and colonies, and often for the imperial banks themselves. Yet where there was expansion, there was also pushback. The internationalization of Wall Street was met with local resistance, refusal and revolt. And just as the history of imperialism has been excised from popular narratives, so too has this history of Caribbean anti-imperialism and autonomy. The history of imperial banking and racial capitalism begins at the end of the nineteenth century, at the historical horizon where the project of U.S. settler colonialism that spurred the financing of the West became the enterprise of U.S. territorial colonialism in the Caribbean and Asia.

Buoyed by unprecedented wealth and boosted by the expansionist jingoism following the victory over Spain in the Caribbean and the Pacific, New York City’s bankers and merchants believed that the organization of an imperial banking system—one that could compete with Europe’s long-established institutions—was critical to the global rise of the city and to the consolidation of Wall Street’s position in international finance, trade, and commerce. With these ambitions, bankers and business-people set their sights on asserting control over the trade and finance of the Americas. They sought to control local central banks, establish U.S. branch banks, take over commodity financing, reorganize monetary systems on a dollar basis, and refinance European-funded sovereign debt.

He’s losing it. Beware. Next move will be to suggest Turkey’s under threat, call for patriotism.

• Blow To Turkey’s Erdogan As Opposition Wins Big In Istanbul (R.)

Turkey’s opposition has dealt President Tayyip Erdogan a stinging blow by winning control of Istanbul in a re-run mayoral election, breaking his aura of invincibility and delivering a message from voters unhappy over his policies. Ekrem Imamoglu of the Republican People’s Party (CHP) secured 54.21% of votes, according to state-owned Anadolu news agency – a far wider victory margin than his narrow win three months ago. The previous result was annulled after protests from Erdogan’s Islamist-rooted AK Party, which said there had been widespread voting irregularities. The decision to re-run the vote was criticized by Western allies and caused uproar among domestic opponents who said Turkey’s democracy was under threat.

On Sunday, tens of thousands of Imamoglu supporters celebrated in the streets of Istanbul after the former businessman triumphed over Erdogan’s handpicked candidate by almost 800,000 votes. “In this city today, you have fixed democracy. Thank you Istanbul,” Imamoglu told supporters who made heart signs with their hands, in an expression of the inclusive election rhetoric that has been the hallmark of his campaigning. “We came to embrace everyone,” Imamoglu said. “We will build democracy in this city, we will build justice. In this beautiful city, I promise, we will build the future.”

The EU has no choice anymore.

• Turkey Warns EU Not To Interfere On Cyprus EEZ Issue (K.)

Turkey has warned the European Union that any intervention on their part on the issue of Cyprus’ Exclusive Economic Zone (EEZ) would negatively affect relations between Greece and Turkey, as well as any prospects for an end to the occupation of the northern part of Cyprus. The warning was made through a non-paper sent to 27 of the EU’s 28 member-states on June 16, Cyprus’ “Fileleftheros” newspaper reports. Turkey didn’t send the note to Cyprus, whose government it does not recognize. The non-paper says the EU would be wise not to act as a judge in the dispute on sea borders and that a similar stance would further discourage efforts to solve the “Cyprus problem” and would cause Greek-Turkish relations to deteriorate.

Turkey claims that the area where one of its drillships has begun exploring for oil and natural gas, soon to be joined by a second, is within Turkey’s continental shelf and that no islands, Cyprus included, can constitute a “full” EEZ. Turkey repeats its views on “equal rights” between Greek- and Turkish-Cypriots, that-is, between the internationally-recognized Republic of Cyprus and the Turkish-occupied north of the island, which Turkey alone has recognized as the “Turkish Republic of Northern Cyprus” and says the best solution is the appointment of a mixed commission with representatives of both sides. Failing that, Turkey says, it is determined to protect the rights of the Turkish-Cypriot resources in the area. The non-paper ends with the hope that, in the decisions to be taken by the EU, “common sense” will prevail.

Greece will not give in.

• Greek Armed Forces On Standby For Turkish Moves In East Med, Aegean (K.)

As Turkey continues with its provocative behavior in the Eastern Mediterranean, despite European Union calls for it to desist from drilling for oil in Cyprus’ exclusive economic zone (EEZ), Greece’s armed forces are on standby to deal with a possible escalation of tensions in the East Med or the Aegean, Kathimerini understands. According to sources, the key question being pondered in Athens is how to react in the event that Turkey decides to conduct seismic research or drilling within Greece’s continental shelf or its EEZ. The biggest concern is about a potential Turkish intervention east of Rhodes and south of Kastellorizo.

On the political level, Athens has done what it can, underlining the potential repercussions of Turkey’s provocative behavior on stability in the broader region. The statement by the EU last week, though vague, was welcomed by Prime Minister Alexis Tsipras as “the first clear and decisive” condemnation of Turkey by the bloc “after decades of violations of international law.” On the operational level, however, it is less clear what Greece’s response should be. The country’s armed forces will be on high alert over the summer as defense officials prepare a series of plans to deal with a possible Turkish intervention. The plans are primarily based on Hellenic Navy maneuvers, as Turkey is currently using research ships and drilling vessels to entrench its presence in the region.

However, the Hellenic Air Force would likely play a supportive role in any response. Asked last week whether Greece can count on military support from the EU or the United States in the event of an incident, Defense Minister Evangelos Apostolakis told reporters that Greece will have to plan to deal with such a scenario independently. “There is no such promise, nor any such issue at the moment, but as I’ve said before, when we need to do something we expect that we will basically be alone.” Athens also holds little faith in promises by French President Emmanuel Macron to send French Navy ships to the Aegean if necessary, as such pledges have been made in the past.