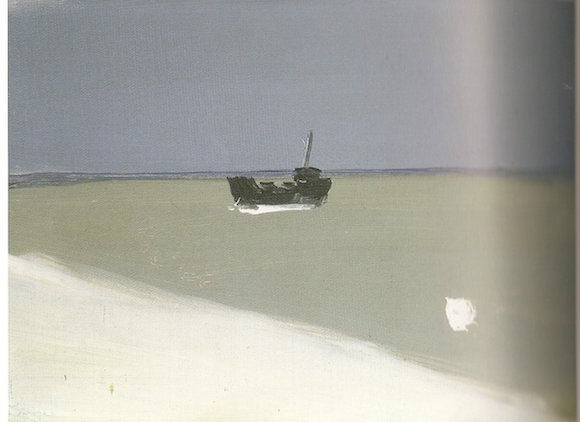

Nicolas de Staël Mer du nord 1954

Punxsutawney Phil Hammond, the UK chancellor, presented his Budget yesterday and declared five more years of austerity for Britain. As was to be expected. One doesn’t even have to go into the details of the Budget to understand that it is a dead end street for both the country and for Theresa May’s Tory party.

So why the persistent focus on austerity while it becomes clearer every day that it is suffocating the British economy? There are many answers to that. Sheer incompetence is a major one, a lack of empathy with the poorer another. Conservative Britain is a class society full of people who dream of empire, and deem their class a higher form of life than those who work low-paid jobs.

When you see that the British Parliament has even voted that animals don’t feel pain or emotions, you’d be tempted to think it’s a throwback all the way back to the Middle Ages, not just the British Empire. They’re as lost in time as Bill Murray is in Groundhog Day. Only worse.

But perhaps incompetence is the big one here. The inability to understand that if your economy is not doing well, you need to stimulate it, not drain even more of what’s left out of it. The people in government don’t understand economics, and therefore rely on economic theory for guidance. And the prevailing theories of the day prescribe bloodletting as the cure, so they bloodlet (let blood?). Let it bleed.

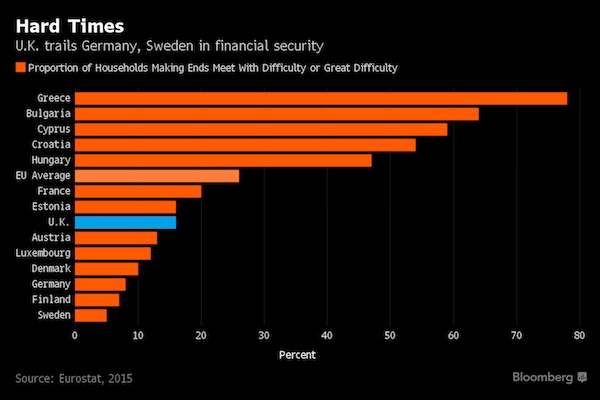

This is not a British problem, it’s pan-European if not global. Neither is the UK Tory party the only one being killed by it, all Conservative parties share that faith. They’re just lucky that their left wing opponents have all committed hara kiri, and joined their ranks when it comes to economics. All of Europe’s poorer have lost the voices that were supposed to speak for them, to economic incompetence.

Obviously, the US democrats did their own hara kiri years ago. One might label -some of- Bernie Sanders’ views left-wing, but he’s trapped in a system that won’t let him breathe.

All of this leads me to question the following:

A letter in the Guardian published on Sunday called on Chancellor Philip Hammond, ahead of his budget presentation on Wednesday, to end austerity in the UK. It is signed by 113 people, a veritable who’s who from the academic field, one -economics- professor after another. They include people like Joe Stiglitz, Steve Keen, Dave Graeber.

Looking at the letter itself, and then the entire list, makes me wonder: I’m sure you all mean well, guys, but I think perhaps you should first of all ask yourselves how it is possible that such a large group of well-educated ladies and gentlemen has become so utterly sidelined over time when it comes to major economic decisions, has allowed itself to be sidelined.

It’s one thing to ask what someone else is doing wrong, it’s another to ask yourself what you have done wrong. My question to y’all would be: where were you? Shouldn’t you have written and/or signed this letter 7 years ago, or 5, even just 3? Isn’t calling on the Chancellor to ‘end austerity now’ a bit late in the game?

Is it even the right call, or should you maybe be calling for him to simply resign (along with the entire cabinet)? After all, what are the odds that the Tories are going to turn on a dime and reverse their entire economic policies? They would look stupid, and they will avoid that like the plague. Here’s that letter:

The Chancellor Must End Austerity Now – It Is Punishing An Entire Generation

Seven years of austerity has destroyed lives. An estimated 30,000 excess deaths can be linked to cuts in NHS spending and the social care crisis in 2015 alone. The number of food parcels given to impoverished Britons has grown from tens of thousands in 2010 to over a million. Children are suffering from real-terms spending cuts in up to 88% of schools. The public sector pay cap has meant that millions of workers are struggling to make ends meet. Alongside the mounting human costs, austerity has hurt our economy.

The UK has experienced its weakest recovery on record and suffers from poor levels of investment, leading to low productivity and falling wages. This government has missed every one of its own debt reduction targets because austerity simply doesn’t work. The case for cuts has been grounded in ideology and untruths. We’ve been told public debt is the outcome of overspending on public services rather than bailing out the banks. We’ve been told that while the government can find money for the DUP, we cannot afford investment in public services and infrastructure.

We’ve been told that unless we “tighten our belts” we’ll saddle future generations with debt – but it’s the onslaught of cuts that is punishing an entire generation. Given the unprecedented economic uncertainty posed by Brexit negotiations and the private sector’s failure to invest, we cannot risk exacerbating an already anaemic recovery with further public spending cuts. We’ve reached a dangerous tipping point. Austerity has failed the British people and the British economy. We demand the chancellor ends austerity now.

If you ask me, Britain reached that ‘dangerous tipping point’ years ago. And talking about ‘an anaemic recovery’ sounds like total nonsense. There is no recovery, as you yourselves make clear with the examples you provide of the consequences of austerity. So why say it?

I don’t know if we can blame individual economists for missing out on the effects of political measures, although when those measures affect economics, we probably should. But regardless, the big game in town these days is politics, not economics. Everywhere there are ‘leaders’ fighting for survival, and it’s telling that Donald Trump is not nearly the most besieged among them.

That Theresa May is still PM of the UK is as surprising as it is ridiculous. But it also points to the lack of coherence and timing among her opponents, including those 113 academics. That once May goes, which could be soon, the Tories get to pick yet another one of their own as PM, is even more ridiculous. To top off the absurdity, the next in line could be Boris Johnson.

A country that finds itself in a quandary as immense as the UK faces post-Brexit vote, should not let one party that had a mere 42% of the vote, run all the plans, decisions and negotiations, be they domestic and/or international. There is no surer way for disaster to ensue. It’s the system itself that fails if that possibility exists, more than that one party.

The UK needs, more than anything, a national government (or something in that vein), an option in which at least a majority of the population is represented. That is much more important than some call for some policy to be halted.

Moreover, everyone should see this in the light of international political developments as a whole. What’s happening in Albion is not an isolated event, and it doesn’t happen under the influence of isolated forces or developments. What happened overnight on Sunday with the failure of Angela Merkel’s attempt to form a German coalition government makes that more obvious than ever.

Traditional political parties, left and right, have been swept out of power all over Europe. Germany is just one more example. The process doesn’t have the same shape, or the same speed, everywhere. But it’s real. It’s due to a mixture of rising inequality, deteriorating economic conditions and no left left to represent the people, the victims, at the bottom of societies. Well, and there’s the incessant lies about economic recovery.

But let’s take a little detour first. Just in order to illustrate the point even more. The Guardian ran a piece, also on Sunday, on newly minted French President Emmanuel Macron and his government and party, that is pretty hilarious.

New Head Of Macron’s Party Vows To Recapture Its Grassroots ‘Soul’

A fiercely loyal, self-styled “man of the people” has been appointed to lead Emmanuel Macron’s fledgling political movement, La République En Marche (The Republic on the Move, or La REM), promising to recapture the party’s“soul” after a hiatus since the recent election win. Christophe Castaner, 51, a burly member of parliament with a southern accent, styles himself as both in touch with everyday voters and devoted to Macron’s well-oiled communications machine. He was handpicked by the French president to take over the running of La REM.

Castaner, currently a minister and government spokesman, was a Socialist mayor of a picturesque small town in Provence for more than a decade before becoming one of the first politicians to jump ship to Macron’s centrist project in its early days. He grew up in a military family in the south of France, left school before his final exams – which he retook as an adult – and has a reputation for straight-talking. At La REM’s first party congress in Lyon this weekend, Castaner was the lone candidate for the role of party director.

He was picked by Macron at a presidential palace dinner, then confirmed by a group of party members with a show of hands rather than a secret ballot, sparking criticism from the media and political observers about undemocratic internal party practices. A small group of 100 party followers went public last week with an open resignation letter, claiming the party had no internal democracy. Others, including La REM members of parliament, responded that Castaner was “the obvious choice”.

Macron founded his own movement because he saw an opening to defeat all traditional French parties. He won the presidential elections, and only after that organized the movement into an actual political party ahead of parliamentary elections. I’d still like to see someone explain who paid for the campaigns of hundreds of candidate parliamentarians. It’s a mystery. France’s banking and business sector?

Macron has set an example for many people in other countries, provided they can unravel that mystery, of how they, too, can defeat incumbents and other long time power blocks. There are two countries where such tactics have until now not seemed possible: the UK and US. But that, too, will change.

In many other European countries, age-old blocks have already been beaten into submission. Even if many deep state powers in France et al have merely shifted allegiances. As their peers elsewhere will. But that’s just the way things are. It doesn’t negate the huge shifts in politics. Voters all over feel they’ve been had for too long. It’s all part of a tectonic shift. Deteriorating economic conditions will do that for you.

What makes the article on Macron et al so entertaining is the mention of the promise to “..recapture the party’s grassroots “soul”. A political party that’s barely a year old does not have grassroots, let alone a soul. Anyone who thinks otherwise is not thinking. And that is a good thing to keep in mind, because Macron’s example – and success- will inspire similar initiatives in many places, and similar nonsensical narratives.

Ironically, if that’s the right word, the world -or at least the EU- is now Macron’s oyster. Angela Merkel has shown her weaknesses, and she has blinked first, in her failed attempt to form a new cabinet, and she will not recover from that, not with anything remotely like her past clout. Maybe -more than- 12 years as head of state is not such a good idea.

While Macron is a blank sheet without a soul or grassroots, Merkel and her CDU party possess both in spades. It’s just that in today’s world these things tend to easily turn against you. You’re better off without a past that you can be blamed for. Macron has no past. And no soul.

Merkel leaves an enormous void both in Germany and in Europe (even globally). And it’s one thing for her to have become too powerful at home, but it’s quite another for the same to have been allowed on the entire continent. Germany, under any leadership, will remain the only power in Europe that matters, no matter what grand plans Macron devises. And that is the EU’s fatal flaw. If you have 27-28 sovereign countries and you try to order them around all the time, you have a problem on your hands.

There is an inherent contradiction in being both the leader of political union’s strongest country and -simultaneously- of the union as a whole, and Merkel has bitterly failed in addressing, let alone solving, that contradiction. Merkel didn’t create it, true enough, but because she is/was the boss, it is her responsibility to address it. Even if it’s ultimately unsolvable.

In the present setting, any German leader, Angela or someone else, will be voted in by Germans, and focus on their interests, to hold on to these votes. But German interests are not always the same as those of other countries. That means Germany will always come out on top, and more so as time passes. Ever more wealth will flow to Berlin. That’s the fatal flaw, and at present there’s no way out of it.

With Merkel weakened, or soon even gone, lots of voices will speak up across Europe for their countries’ sovereignty, and the attack on them from Brussels. We already have Poland, Czechia and Hungary. Expect a lot more noise from Italy in the run-up to its elections. The power balance that Merkel held together is gone for good.

Yes, her refugee policy backfired, which is no surprise given that she decided on it like some empress. But what may be more important is that her traditional opponent, the left wing SPD, was not only her coalition partner, but it has no ideas that are notably different from her conservatives, and its new head is the former head of the European Parliament.

Where does one turn as a German who doesn’t want all that more EU all the time? Either far left or far right. Everything else has become a homogenous blob, all across Europe. And all of that blob is in favor of imposing ever more austerity on the most unlucky in their societies, because bloodletting is the most advanced treatment they know of.

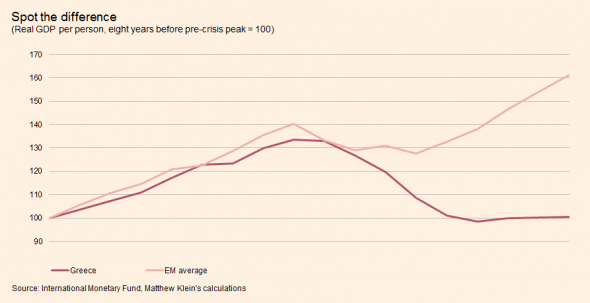

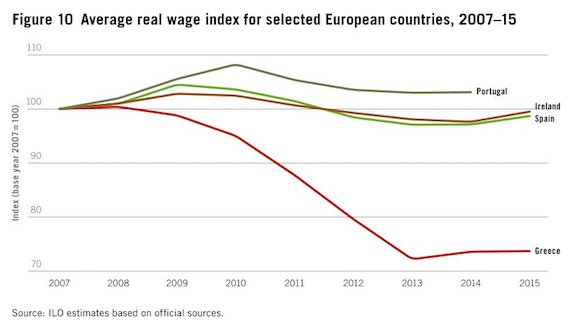

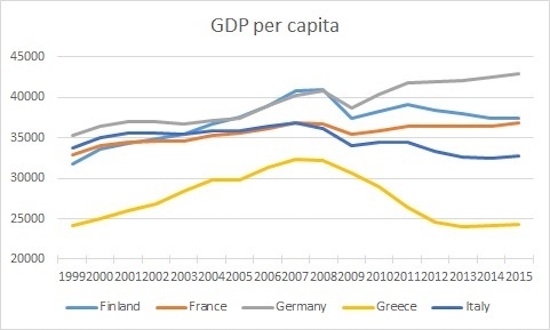

It’s not even so much the financial crisis that has caused a political crisis in Europe, it’s the answers to it, the incompetence. Greece is a far worse-off victim of austerity than Britain is, and Yanis Varoufakis has described very well why that is: an absolute stonewalling refusal to talk about any alternatives to bloodletting. Because austerity is an ideology bordering on religion, executed by people who care much more about their own careers than they do about their people.

Greece is beyond salvation, its economy has been so thoroughly destroyed it will take decades to recover, if it ever can. Britain is set to follow the Greek example. The blame for that will be put on Brexit, not disastrous economic ‘policies’. In the same way that the Greek crisis was blamed on the Greeks, not the German and French banks that treated the country like an overleveraged game of Texas Hold ’em.

After Merkel Europe will fall victim to a vast power vacuum. In effect, today’s already ‘After Merkel’, even if it will take people a while to understand that. The EU is unraveling, and the blame goes to austerity and its incompetent priests. Including Angela. The bloodletters destroy their own economies, and they don’t understand that either.

Merkel hasn’t just demolished Greece, she has, in doing that, fatally undermined the foundations of the EU as well. And Germany. Look, ‘Mutti’ Merkel invited a million refugees to her country, and now refuses to let hundreds of war-traumatized children stuck on Greek islands join their parents in Germany, because she fears it could cost her votes. Talk about priorities. Theresa May does the same as we speak.

There’s a price to be paid for incompetence. It’s a shame that Merkel and Theresa May and Punxsutawney Phil Hammond won’t be the ones paying -the worst of- it.