Dorothea Lange Country filling station, Granville County, NC July 1939

Make that a no.

• Is ‘Too Big To Fail’ For Banks Really Coming To An End? (BBC)

Interviewing Alistair Darling in 2011, three years after the financial crisis during which he was chancellor, his most striking answer to me was not about the fear that Britain’s economic system was on the point of collapse. It wasn’t even his worry that ATMs up and down the country might simply stop functioning. Those answers were of course chilling. But they were symptoms of a wider disease. Mr Darling’s most striking answer was the “absolute astonishment” he felt when he asked Britain’s largest banks to account for the risks contained in their businesses – and they were unable to come up with a coherent answer. This total lack of knowledge – coupled with the hubris of profit-taking built on lax credit – went to the heart of the financial crisis. Regulators appeared similarly non-plussed.

Such was the global complexity and lack of governance in the international financial system, when it came to rescuing the banks from having to eat their own sick, the UK government – and many other governments around the world – initially had no idea how large the bill would be. And neither did the banks. The only funding avenues large enough to contain such unquantifiable risks were those provided by central banks and the taxpayer. The alternative was financial meltdown. The numbers turned out to be astronomical. A National Audit Office report in August this year suggested the value of the UK government’s total support for the financial system alone exceeded £1.1tn at its height. Many tens of billions of pounds worth of capital was directly injected into failing banks and building societies.

The rest of that dizzying £1.1tn was the total value of liability insurance – the government guaranteeing banks’ security as lender of last resort. Put simply, the taxpayer had become the guarantor of the global financial system and the banks that are the essential plumbing of that system. In direct capital the UK government (the taxpayer) ultimately had to find over £100bn. More than £66bn was used to rescue the Royal Bank of Scotland (still 80% owned by the government) and Lloyds Bank (still 25% owned by the government). Of that, the sale of two chunks of Lloyds since the last election in 2010 has raised the princely sum of £7.4bn.

For rigging a $5.300.000.000.000 a day market, banks are fined $300.000.000. Remove a few zeroes and it’s like being fined $300 for rigging a $5.300.000 million market. Sounds profitable.

• Banks Poised to Settle With Derivatives Regulator in FX-Rigging Cases (BW)

Banks suspected of rigging the $5.3 trillion-a-day currency market are preparing to reach settlements as early as this week with the main U.S. derivatives regulator, according to a person with knowledge of the cases. The Commodity Futures Trading Commission may levy fines of about $300 million against each firm, depending on the level of their involvement, said the person, who spoke on condition of anonymity because deals haven’t been announced. It’s unclear how many firms may settle with the CFTC as U.K. and U.S. bank regulators prepare to levy related penalties this week, the person said. There was no immediate response to an e-mailed request for comment from the CFTC after normal business hours. The New York Times reported late yesterday on the talks with the agency.

Investigations are under way on three continents as authorities probe allegations that dealers at the world’s biggest banks traded ahead of clients and colluded to rig benchmarks used by pension funds and money managers to determine what they pay for foreign currencies. The U.K. Financial Conduct Authority is poised to reach settlements as soon as this week with six banks, which together have set aside about $5.3 billion in recent weeks for legal matters including the currency investigations, people with knowledge of those talks have said. Barclays, Citigroup, HSBC, JPMorgan, Royal Bank of Scotland and UBSare in settlement talks with the FCA, people with knowledge of the situation have said.

How many years is the investigation going to take?

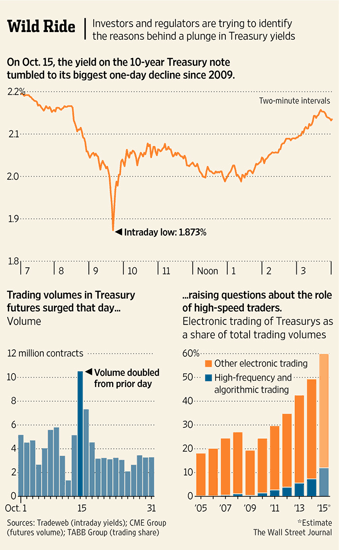

• Bond Swings Draw Scrutiny (WSJ)

The day’s trading was just hitting its stride in New York on the morning of Oct. 15 when bond investors, traders and strategists were stunned by an unusual move in the $12 trillion U.S. Treasury market playing out on their computer screens. The yield on the 10-year Treasury note took a sharp dive below 2% within minutes, and few could understand exactly why. Some dealers immediately pulled the plug on automated trading systems that provided price quotes to customers. Fund managers rushed to convene meetings. Many investors scrambled to pinpoint the reason behind the accelerating decline. “It starts moving faster and faster, and you can’t point to anything,” recalled Mark Cernicky, managing director at Principal Global Investors , which oversees $78 billion. Now, investors and regulators are burrowing into the causes of the plunge in yields to try to understand whether electronic trading and new regulations are fueling sudden price swings in a market that acts as a key benchmark for interest rates, investments and U.S. home loans.

At the time, bond-market analysts attributed the fall in yields to weak U.S. economic data, shaky European markets and hedge funds scrambling to cover wrong-way bets. But many investors felt that didn’t fully explain why the yield on the 10-year Treasury note tumbled to its biggest one-day decline since 2009. When yields fall, prices rise. Regulators and other experts are examining deep-seated shifts in trading since the financial crisis, which could help explain the unusual size of the move in a market many investors rely on for its relative stability. “What happened on Oct. 15 is the result of things that had been building for a while,” said Alex Roever, a strategist at J.P. Morgan Chase & Co. who follows the government-bond market. The Federal Reserve, Treasury and Commodity Futures Trading Commission are looking at that day’s trading activity, according to people familiar with the situation. One focus is the role of high-speed electronic trading in the bond market, although regulators haven’t yet drawn any conclusions, these people said.

More trouble for Tokyo.

• China, Japan And An Ugly Currency War (Steen Jakobsen)

There’s increasing risk we’ll soon see a “significant paradigm shift” from China in its attitude to the strength of its currency. So says Saxo Bank’s Chief Economist, Steen Jakobsen. He says we’re about to see a full-scale currency war, notably between China and Japan, two of the world’s greatest exporting countries. There are a number of important world meetings over the coming few weeks and the Chinese will be “very vocal”, says Steen, as it’s getting increasingly worried about its loss of growth momentum. The yuan has strengthened significantly in recent weeks while the yen has declined substantially. The country’s determined, he says, to refocus and maintain its export share of total growth.

And Washington just sits by and lets it happen all over again.

• Subprime Credit Card Lending Swells (CNBC)

Consumers with dinged credit are back in a borrowing mood, and lenders are more than happy to give them new credit cards, according to new data. Since the Great Recession ended five years ago, consumers have been gradually taking on more debt and lenders have been accommodating them, easing up on tighter standards. Much of the growth has been in so-called non-revolving credit, especially car loans, thanks to record low interest rates. But revolving credit—mainly in the form of credit cards—is picking up. And the biggest growth in new credit cards is coming from so-called subprime borrowers whose credit scores are less than 660, according to the latest Equifax data.

Through July of this year, banks handed out cards to 9.8 million subprime consumers, a six-year high and an increase of 43% from the same period last year. Another 7.8 million cards have been issued to subprime borrowers by retailers this year, up 13% from 2013 to an eight-year high. Lenders are also giving subprime borrowers higher credit limits. Bank-issued card limits jumped to $12.7 billion for the first seven months of the year—up 4% from the same period a year ago to a six-year high. Retailers lifted their card limits by 16% to $6.8 billion, an eight-year high. Part of the growth is the result of an easing of the tighter standards that followed the 2008 credit bust after the boom of the early-2000s. Now that banks have repaired the damage from billions of dollars in bad debts, they’re better able to take on more risk. A stronger job market is also putting more consumers in a borrowing mood, according to economists at Wells Fargo.

Chinese fake numbers have distorted the market for years.

• Why Iron Ore’s Meltdown Is Far From Over (CNBC)

Iron ore prices have dived an eye-watering 44% this year and there’s no respite ahead for the metal, according to Citi, which forecasts double-digit declines in 2015. The bank on Tuesday slashed its price forecasts for the metal to average $74 dollars per ton in the first quarter of next year, before moving down to $60 in the third quarter. It previously forecast $82 and $78, respectively. “We expect renewed supply growth to once again drive the market lower in 2015, combined with further demand weakness,” Ivan Szpakowski, analyst at Citi wrote in a report, noting that prices could briefly dip into the $50 range in the third quarter. The price of spot iron ore fell $75.50 this week, its lowest level since 2009, according to Reuters.

Price declines in the first half of this year were driven by rapid growth in export supply, which has slowed in the second half of the year. In recent months, deteriorating Chinese steel demand and deleveraging by traders and Chinese steel mills has dragged the metal. Iron ore is an important raw material for steel production. However, iron ore supply growth will return in the first half of next year, Citi said, as industry heavyweights Rio Tinto, BHP Billiton and Vale rev up expansions and Anglo American’s Minas-Rio iron ore project in Brazil ramps up. Meanwhile, demand out of China – the world’s biggest buyer of iron ore – will remain under pressure due subdued steel demand. Demand for steel is being compressed due to tighter credit conditions and an uncertain export outlook.

“Chinese manufacturing exports have improved in recent months, helping to boost steel demand for machinery, metal products, etc. However, with European growth having slowed such positive momentum is unlikely to continue,” Szpakowski said. ANZ also substantially downgraded its 2015 price forecast for iron ore this week. However, it was not quite as bearish as Citi. The bank, in a report published on Monday, said the metal will not breach $100 a ton again, forecasting prices to average $78 next year, 22% lower than its previous estimate. “Recent trip to China highlights that demand conditions are more challenging than we thought,” ANZ said.

I bet he thinks he’s awfully smart.

• The Ghosts of Juncker’s Past Come Back to Haunt Him (Spiegel)

Jean-Claude Juncker’s first public appearance as the new European Commission president was a symbolic one. Early this month, he traveled to Frankfurt to present former German Chancellor Helmut Kohl’s new book in the luxury hotel Villa Kennedy. Called “Aus Sorge um Europa” – “Out of Concern for Europe” – the book warns that the pursuit of national interests represents a danger to the European ideal. And Juncker is quick to endorse Kohl, a man he calls “a friend and role model.” “Kohl is right in deploring the fact that we are increasingly sliding down the slope toward reflexive regionalism and nationalism,” Juncker said. It is certainly not the first time Juncker has uttered such a sentence. Indeed, his delivery of the message has often been even more direct. “I’ve had it,” he erupted during an EU summit in December of 2012, for example. “80% of the time, only national interests are being presented. We can’t go on like this!”

Such sentiments have served Juncker well throughout his career and have helped transform the politician from tiny Luxembourg into a well-known defender of Europe. Now, though, at the apex of his European career, Juncker and his beloved European Union are facing a significant problem. And it is one that has led even advisors close to Juncker to wonder whether he may soon have to step down from his new position, despite having taken office only recently. Last week, several media outlets, including the Munich-based Süddeutsche Zeitung, published the most detailed accounts yet of the tricks used – and the eagerness brought to bear – by Luxembourg officials to help companies avoid paying taxes. The strategies were often developed together with company leaders and served to entice multinationals to set up shop in Luxembourg. The tiny country on Germany’s western border, for its part, benefited from tax revenues it wouldn’t otherwise have seen. It was, in short, a reciprocal relationship.

But it was also a relationship that was disadvantageous for Luxembourg’s EU partners – and for European cooperation itself. Many of the companies that set up shop in Luxembourg, after all, no longer paid taxes in their home countries where they produced or sold the lion’s share of their products.

But with the Spiegel editorial board turning against him, how long can Jean-Claude last?

• It’s Time to Put Juncker on the Hot Seat (Spiegel Ed.)

Can the European Commission be led by a man who transformed his own country into a tax oasis? [..] The European Union has a problem – and a serious one at that. On the surface, the issue is about the tax avoidance schemes in Luxembourg that were engineered during former Prime Minister Jean-Claude Juncker’s tenure. And about the billions of euros in revenues lost by other EU countries as a result. But the true problem in this affair actually runs a lot deeper. At issue is just how seriously we take the new European democracy that Juncker himself often touts. The criticism of Juncker came less than a week after he took office. Leaked tax documents released last Wednesday by the International Consortium of Investigative Journalists showed how large corporations have taken advantage of loose policies in Luxembourg to evade paying taxes. At a time of slow economic growth and tight national budgets, sensitivity has grown in large parts of the EU over countries that facilitate legal tax evasion.

Juncker is fond of pointing out proudly that he was Europe’s first “leading candidate,” and the first to be more-or-less directly elected as president of the European Commission. Across Europe, many celebrated it as the moment when more democracy came to the EU. Unfortunately, optimism blinded people to one salient fact: European politicians themselves never took this newfound democracy particularly seriously. In contrast to the United States, where getting to know the candidates is a matter of course, the EU never had any intent of truly introducing its leading politicians to the people. This has created a situation in which a person like Juncker can effectively lead two lives. One as an (honest) proponent of the EU and the other as a cunning former leader of an EU member state who promoted Luxembourg’s self-interest by blocking treaties that would have forced the country to adopt stricter tax policies.

Mo talks his book.

• The Return Of The US Dollar (El-Erian)

The US dollar is on the move. In the last four months alone, it has soared by more than 7% compared with a basket of more than a dozen global currencies, and by even more against the euro and the Japanese yen. This dollar rally, the result of genuine economic progress and divergent policy developments, could contribute to the “rebalancing” that has long eluded the world economy. But that outcome is far from guaranteed, especially given the related risks of financial instability. Two major factors are currently working in the dollar’s favour, particularly compared to the euro and the yen. First, the United States is consistently outperforming Europe and Japan in terms of economic growth and dynamism – and will likely continue to do so – owing not only to its economic flexibility and entrepreneurial energy, but also to its more decisive policy action since the start of the global financial crisis.

Second, after a period of alignment, the monetary policies of these three large and systemically important economies are diverging, taking the world economy from a multi-speed trajectory to a multi-track one. Indeed, whereas the US Federal Reserve terminated its large-scale securities purchases, known as “quantitative easing” (QE), last month, the Bank of Japan and the European Central Bank recently announced the expansion of their monetary-stimulus programs. In fact, ECB President Mario Draghi signalled a willingness to expand his institution’s balance sheet by a massive €1 trillion ($1.25 trillion). With higher US market interest rates attracting additional capital inflows and pushing the dollar even higher, the currency’s revaluation would appear to be just what the doctor ordered when it comes to catalysing a long-awaited global rebalancing – one that promotes stronger growth and mitigates deflation risk in Europe and Japan.

Specifically, an appreciating dollar improves the price competitiveness of European and Japanese companies in the US and other markets, while moderating some of the structural deflationary pressure in the lagging economies by causing import prices to rise. Yet the benefits of the dollar’s rally are far from guaranteed, for both economic and financial reasons. While the US economy is more resilient and agile than its developed counterparts, it is not yet robust enough to be able to adjust smoothly to a significant shift in external demand to other countries. There is also the risk that, given the role of the ECB and the Bank of Japan in shaping their currencies’ performance, such a shift could be characterized as a “currency war” in the US Congress, prompting a retaliatory policy response. Furthermore, sudden large currency moves tend to translate into financial-market instability.

Not looking good.

• Fears Of German Recession As Moment Of Truth Looms (CNBC)

Just days before Germany’s much anticipated third quarter gross domestic product (GDP) data is released, business leaders and policy makers warn that the euro zone’s largest economy has lost its competitiveness and is on the brink of a recession. The chair of the German Banking Association, Juergen Fitschen, told CNBC on Monday that it was “undeniable that we have slowed down recently.” “We cannot insulate ourselves against the factors that have contributed to the current state of affairs…But, also, [thereis a] slow recovery in some of our neighboring countries and also a lack o fdemand to finance infrastructure projects in Germany itself,” he said. Speaking to CNBC on the sidelines of a press conference held by the association, he said: “We have to remind ourselves that we have not spared continuing efforts to renew our competitiveness and that is something that applies obviously to our neighboring countries as well,” he continued.

Fitschen’s comments came amid other severe critiques of the German economy and outlook, just days before the release of the GDP data on Friday. Second quarter data in August showed data showed Germany’s economy had lost momentum, contracting for the first time in over a year. Quarter-on-quarter, GDP contracted 0.2%. If the economy contracts again in the third quarter, Germany will technically be in recession. The head of Germany’s influential Ifo economic research institute said that was a distinct possibility on Monday.Speaking to Reuters, Hans-Werner Sinn said that Germany was teetering on the brink of a recession due to weakness in major emerging trading partners. “It is going to be really close,” Sinn warned, saying that surveys by the Ifo institute pointed more towards a recession.

Flipping the west the bird.

• Russia Ends Dollar/Euro Currency Peg, Moves To Free Float (RT)

The Bank of Russia took another step towards a free float ruble by abolishing the dual currency soft peg, as well as automatic interventions. Before, the bank propped up the ruble when the exchange rate against the euro and dollar exceeded its boundaries. “Instead, we will intervene in the currency market at whichever moment and amount needed to decrease the speculative demand,” the bank’s chairwoman, Elvira Nabiullina, said in an interview with Rossiya 24 Monday. The move is edging towards a floating exchange rate, which the bank hopes to attain by 2015. “Effective starting November 10, 2014, the Bank of Russia abolished the acting exchange rate policy mechanism by cancelling the allowed range of the dual-currency basket ruble values (operational band) and regular interventions within and outside the borders of this band,” the bank said in a statement Monday.

“As a result of the decision the ruble exchange rate will be determined by market factors, which should promote efficiency of the monetary policy of the Bank of Russia and ensure price stability,” the central bank said. Foreign exchange intervention is still at the bank’s disposal, and is ready to use in the case of “threats to financial stability,” according to the statement. Propping up the ruble can cost the Central Bank of Russia billions of dollars per day, coming out of the country’s reserve fund. In October alone, the bank was forced to spend $30 billion to defend the weakening ruble. On November 5, the bank announced it had limited the reserves it is willing to spend to inflate the ruble to $350 million per day in order to slash speculation and volatility. The decision triggered a 3-day plunge for the Russian currency. On Monday, the ruble recovered slightly after Russian President Vladimir Putin assured speculative drops would cease in the near future.

Welcome to the third world.

• Police Use Department Wish List When Deciding Which Assets to Seize (NY Times)

The seminars offered police officers some useful tips on seizing property from suspected criminals. Don’t bother with jewelry (too hard to dispose of) and computers (“everybody’s got one already”), the experts counseled. Do go after flat screen TVs, cash and cars. Especially nice cars. In one seminar, captured on video in September, Harry S. Connelly Jr., the city attorney of Las Cruces, N.M., called them “little goodies.” And then Mr. Connelly described how officers in his jurisdiction could not wait to seize one man’s “exotic vehicle” outside a local bar. “A guy drives up in a 2008 Mercedes, brand new,” he explained. “Just so beautiful, I mean, the cops were undercover and they were just like ‘Ahhhh.’ And he gets out and he’s just reeking of alcohol. And it’s like, ‘Oh, my goodness, we can hardly wait.’ ”Mr. Connelly was talking about a practice known as civil asset forfeiture, which allows the government, without ever securing a conviction or even filing a criminal charge, to seize property suspected of having ties to crime.

The practice, expanded during the war on drugs in the 1980s, has become a staple of law enforcement agencies because it helps finance their work. It is difficult to tell how much has been seized by state and local law enforcement, but under a Justice Department program, the value of assets seized has ballooned to $4.3 billion in the 2012 fiscal year from $407 million in 2001. Much of that money is shared with local police forces. The practice of civil forfeiture has come under fire in recent months, amid a spate of negative press reports and growing outrage among civil rights advocates, libertarians and members of Congress who have raised serious questions about the fairness of the practice, which critics say runs roughshod over due process rights. In one oft-cited case, a Philadelphia couple’s home was seized after their son made $40 worth of drug sales on the porch.

Politicians caught up in their own lies and denials. It shows you what France is made of. Marine Le Pen’s popularity doesn’t come out of nowhere.

• Alleged Sarkozy Plot Rocks French Political Establishment (FT)

Leading figures from France’s two traditional parties have been enmeshed in a fresh political scandal involving former president Nicolas Sarkozy, complicating their attempts to halt voter defection to the far-right National Front. The latest “affair” to rock France’s political establishment involves the chief of staff of President François Hollande, who is already struggling with the lowest popularity ratings of any French leader since the second world war. It also touches François Fillon, a leading figure in the country’s centre-right UMP party and a former prime minister who has stated his determination to run for the presidency in 2017.

The scandal centres on a lunch in June during which Mr Fillon reportedly asked Jean-Pierre Jouyet, Mr Hollande’s chief of staff, to speed up judicial investigations into an alleged UMP cover-up of illegal overspending during the 2012 presidential re-election campaign of Mr Sarkozy, the UMP’s then candidate. “Hit him quickly,” Mr Fillon is alleged to have said to Mr Jouyet, referring to Mr Sarkozy. “If you don’t hit him quickly, you will see him come back.” Mr Sarkozy recently announced his return to French politics, and is campaigning to become head of his party in elections at the end of the month. The move is seen widely as the first step in a longer-term goal of competing for the presidency in 2017. Mr Fillon has vehemently denied the conversation about campaign financing with Mr Jouyet, which was first reported by two journalists at Le Monde, the French daily newspaper.

“I can only see in these incredible attacks an attempt at destabilisation and a plot,” Mr Fillon said on Sunday. He threatened the two Le Monde journalists with legal action and then turned his wrath on Mr Jouyet, accusing him of lying and threatening to take him to court. Mr Jouyet, a close personal friend of Mr Hollande but who also served in the previous centre-right government of Mr Sarkozy, on Sunday admitted he had discussed the alleged illegal overspending issue during the lunch with Mr Fillon – though stopped short of confirming Mr Fillon’s alleged request to speed up the judicial investigations against Mr Sarkozy. Mr Jouyet’s admission, reported by France’s AFP, came just a few days after he had told the news agency that the subject of the UMP campaign financing had not come up during the June lunch with Mr Fillon.

Almost funny: “At least five people in the cabinet have been charged with serious offences such as rape and rioting. Finance Minister Arun Jaitley said any suggestions there were criminals in the cabinet were “completely baseless. “These are cases arising out of criminal accusations, not cases out of a crime .. ”

• Nearly A Third Of Indian Cabinet Charged With Crimes (Reuters)

Attempted murder, waging war on the state, criminal intimidation and fraud are some of the charges on the rap sheets of ministers Indian Prime Minister Narendra Modi appointed to the cabinet on Sunday, jarring with his pledge to clean up politics. Seven of 21 new ministers face prosecution, taking the total in the 66-member cabinet to almost one third, a higher proportion than before the weekend expansion. At least five people in the cabinet have been charged with serious offences such as rape and rioting. Finance Minister Arun Jaitley said any suggestions there were criminals in the cabinet were “completely baseless. “These are cases arising out of criminal accusations, not cases out of a crime,” he told reporters on Monday, adding that Modi had personally vetted the new ministers. Ram Shankar Katheria, a lawmaker from Agra, was appointed junior education minister yet has been accused of more than 20 criminal offences including attempted murder and promoting religious or racial hostility.

The inclusion of such politicians does not sit easily with Modi’s election promise to root out corruption, and has led to criticism that he is failing to change the political culture in India where wealthy, tainted politicians sometimes find it easier to win votes. “It shows scant respect for the rule of law or public sentiment,” said Jagdeep Chhokar, co-founder of the Association for Democratic Reforms (ADR) which campaigns for better governance. “Including these people in the cabinet is a bad omen for our democracy.”Modi won the biggest parliamentary majority in three decades in May with a promise of graft-free governance after the previous government led by Congress party was mired in a series of damaging corruption scandals.

” ..High energy prices and resistance to fracking are two key reasons why Europe’s economic recovery has lagged the U.S.”

• Energy Is Europe’s ‘Big Disadvantage’: Deutsche Bank Co-Ceo (CNBC)

High energy prices and resistance to fracking are two key reasons why Europe’s economic recovery has lagged the U.S., the joint head of Germany’s largest bank by assets told CNBC. Jürgen Fitschen, co-chief executive of Deutsche Bank, said bureaucracy, education and productivity partially explained Europe’s difficulties, but laid much of the blame on the cost of energy in the region. “It is undeniable that Europe overall faces one very big disadvantage: that is cost of energy,” Fitschen, who is also head of the German Bankers Association, told CNBC in Frankfurt on Monday. “That (low energy prices) has been one of the factors that have stimulated the euphoria and the growth momentum in the States. That is something that cannot be replicated easily in Europe.”

Including taxes, domestic U.S. gas prices fell by 2.2% in 2013 on the previous year to 2.18 U.K. pence (3 U.S. cents) per kilowatt hour (kWh), according to the International Energy Agency. By comparison, Spanish domestic prices rose by 7.8% to 6.93 pence and British prices rose by 7.7% to 4.90 pence respectively. Fitschen said that the shale gas revolution helped explain why U.S. energy prices had fallen. The U.S. has embraced fracking—or hydraulic fracturing—for shale, which has helped lead a revival in some manufacturing industries and helped the country become less reliant on oil and gas imports. However, the process has met with far more opposition in Europe, due to environmental concerns relating to possible seismic tremors and a risk to water supplies.

” .. an extraordinary “merry-go-round” of countries supporting each others’ companies. The US spends $1.4bn a year for exploration in Columbia, Nigeria and Russia, while Russia is subsidising exploration in Venezuela and China, which in turn supports companies exploring Canada, Brazil and Mexico. ”

• Rich Nations Subsidize Fossil Fuel Industry By $88 Billion A Year (Guardian)

Rich countries are subsidising oil, gas and coal companies by about $88bn (£55.4bn) a year to explore for new reserves, despite evidence that most fossil fuels must be left in the ground if the world is to avoid dangerous climate change. The most detailed breakdown yet of global fossil fuel subsidies has found that the US government provided companies with $5.2bn for fossil fuel exploration in 2013, Australia spent $3.5bn, Russia $2.4bn and the UK $1.2bn. Most of the support was in the form of tax breaks for exploration in deep offshore fields. The public money went to major multinationals as well as smaller ones who specialise in exploratory work, according to British thinktank the Overseas Development Institute (ODI) and Washington-based analysts Oil Change International. Britain, says their report, proved to be one of the most generous countries. In the five year period to 2014 it gave tax breaks totalling over $4.5bn to French, US, Middle Eastern and north American companies to explore the North Sea for fast-declining oil and gas reserves.

A breakdown of that figure showed over $1.2bn of British money went to two French companies, GDF-Suez and Total, $450m went to five US companies including Chevron, and $992m to five British companies. Britain also spent public funds for foreign companies to explore in Azerbaijan, Brazil, Ghana, Guinea, India and Indonesia, as well as Russia, Uganda and Qatar, according to the report’s data, which is drawn from the OECD, government documents, company reports and institutions. The figures, published ahead of this week’s G20 summit in Brisbane, Australia, contains the first detailed breakdown of global fossil fuel exploration subsidies. It shows an extraordinary “merry-go-round” of countries supporting each others’ companies. The US spends $1.4bn a year for exploration in Columbia, Nigeria and Russia, while Russia is subsidising exploration in Venezuela and China, which in turn supports companies exploring Canada, Brazil and Mexico.

“The evidence points to a publicly financed bail-out for carbon-intensive companies, and support for uneconomic investments that could drive the planet far beyond the internationally agreed target of limiting global temperature increases to no more than 2C,” say the report’s authors. “This is real money which could be put into schools or hospitals. It is simply not economic to invest like this. This is the insanity of the situation. They are diverting investment from economic low-carbon alternatives such as solar, wind and hydro-power and they are undermining the prospects for an ambitious UN climate deal in 2015,” said Kevin Watkins, director of the ODI. [..] “The IPCC is quite clear about the need to leave the vast majority of already proven reserves in the ground, if we are to meet the 2C goal. The fact that despite this science, governments are spending billions of tax dollars each year to find more fossil fuels that we cannot ever afford to burn, reveals the extent of climate denial still ongoing within the G20,” said Oil Change International director Steve Kretzman.

” .. It’s not for the United States. They want to sell it overseas, and I want to see that stopped.”

• The Real Story Of US Coal: Inside The World’s Biggest Coalmine (Guardian)

In the world’s biggest coalmine, even a 400 tonne truck looks like a toy. Everything about the scale of Peabody Energy’s operations in the Powder River Basin of Wyoming is big and the mines are only going to get bigger – despite new warnings from the United Nations on the dangerous burning of fossil fuels, despite Barack Obama’s promises to fight climate change, and despite reports that coal is in its death throes. At the east pit of Peabody’s North Antelope Rochelle mine, the layer of coal takes up 60ft of a 250ft trough in the earth, and runs in an interrupted black stripe for 50 miles. With those vast, easy-to-reach deposits, Powder River has overtaken West Virginia and Kentucky as the big coalmining territory. The pro-coal Republicans’ takeover of Congress in the mid-term elections also favours Powder River.

“You’re looking at the world’s largest mine,” said Scott Durgin, senior vice-president for Peabody’s operations in the Powder River Basin, watching the giant machinery at work. “This is one of the biggest seams you will ever see. This particular shovel is one of the largest shovels you can buy, and that is the largest truck you can buy.” By Durgin’s rough estimate, the mine occupies 100 square miles of high treeless prairie, about the same size as Washington DC. It contains an estimated three billion tonnes of coal reserves. It would take Peabody 25 or 30 years to mine it all. But it’s still not big enough. On the conference room wall, a map of North Antelope Rochelle shows two big shaded areas containing an estimated one billion tonnes of coal. Peabody is preparing to acquire leasing rights when they come up in about 2022 or 2024. “You’ve got to think way ahead,” said Durgin.

In the fossil fuel jackpot that is Wyoming, it can be hard to see a future beyond coal. One of the few who can is LJ Turner, whose grandfather and father homesteaded on the high treeless plains nearly a century ago. Turner, who raises sheep and cattle, said his business had suffered in the 30 years of the mines’ explosive growth. Dust from the mines was aggravating pneumonia among his Red Angus calves. One year, he lost 25 calves, he said. “We are making a national sacrifice out of this region,” he said. “Peabody coal and other coal companies want to keep on mining, and mine this country out and leave it as a sacrifice and they want to do it for their bottom line. It’s not for the United States. They want to sell it overseas, and I want to see that stopped.”

There’s a pattern here: ” .. the Madrid government contrived to have the plebiscite banned as unconstitutional”.

• Angry Canary Islanders Brace For An Unwanted Guest: The Oil Industry (Guardian)

In most places the news that you’ve struck oil would be cause to crack open the champagne. But not in the Canary Islands where Spain’s biggest oil company Repsol is due to begin drilling off Lanzarote and Fuerteventura. “Our wealth is in our climate, our sky, our sea and the archipelago’s extraordinary biodiversity and landscape,” the Canary Islands president, Paulino Rivero, said. “Its value is that it’s natural and this is what attracts tourism. Oil is incompatible with tourism and a sustainable economy.” Rivero, a former primary school teacher, is on a crusade against oil and he is not alone. Protest marches have drawn as many as 200,000 of the islands’ 2 million inhabitants on to the streets. The regional government planned to consolidate public opinion with a referendum on 23 November. Voters were to be asked: “Do you believe the Canaries should exchange its environmental and tourism model for oil and gas exploration?”

As with the weekend’s scheduled referendum on Catalan independence, the Madrid government contrived to have the plebiscite banned as unconstitutional and Rivero has now commissioned a private poll he hopes will demonstrate the strength of public opinion. “The banning of the referendum reveals a huge weakness in the system,” said Rivero. “You have to listen to the people. There’s a serious discrepancy between what people here want and what the Spanish government wants. You are allowed to hold consultations under the Spanish constitution and what we wanted to do was completely legal. The problem we have is that some government departments have too close a relationship with Repsol.” Repsol is flush with cash after settling a long dispute with Argentina and is keen to develop what may be the country’s biggest oilfield after winning permission to drill in August. The company believes the fields may contain as much as 2.2bn barrels of oil and is investing €7.5bn to explore two sites about 40 miles (60km) east of Fuerteventura.

Don’t worry be happy, nuke style.

• Fukushima Radiation Found in Pacific Off California Coast (Bloomberg)

Oceanographers have detected isotopes linked to Japan’s wrecked Fukushima nuclear plant off California’s coast, though at levels far below those that could pose a measurable health risk. Volunteer ocean monitors collected the samples that tested positive for trace amounts of the isotope cesium-134 about 100 miles (160 kilometers) west of Eureka, California, the Massachusetts-based Woods Hole Oceanographic Institution said yesterday on its website. Tepco’s Fukushima Dai-Ichi plant, which released “unprecedented levels” of radioactivity during the March 2011 accident, was the only conceivable source of the detected isotopes, Woods Hole oceanographer Ken Buesseler said in the release.

Explosions during the accident, during which three reactors suffered meltdowns, sent a burst of radioactivity into the atmosphere, while water used to cool overheating fuel rods flowed into the ocean in the weeks after the disaster. Lower levels of radiation have continued to trickle into the ocean via contaminated groundwater. The radioactivity detected off the California coast was at levels deemed by international health agencies to be “far below where one might expect any measurable risk to human health or marine life,” according to Woods Hole. It’s also more than 1,000 times lower than acceptable limits in drinking water set by the U.S. Environmental Protection Agency, the organization said.

” .. the background reality is too difficult to contemplate: an American living arrangement with no future.”

• The Fate of the Turtle (James Howard Kunstler)

Anybody truly interested in government, and therefore politics, should be cognizant above all that ours have already entered systemic failure. The management of societal affairs is on an arc to become more inept and ineffectual, no matter how either of the current major parties pretends to control things. Instead of Big Brother, government in our time turns out to be Autistic Brother. It makes weird noises and flaps its appendages, but can barely tie its own shoelaces. The one thing it does exceedingly well is drain the remaining capital from endeavors that might contribute to the greater good. This includes intellectual capital, by the way, which, under better circumstances, might gird the political will to reform the sub-systems that civilized life depends on. These include: food production (industrial agri-business), commerce (the WalMart model), transportation (Happy Motoring), school (a matrix of rackets), medicine (ditto with the patient as hostage), and banking (a matrix of fraud and swindling).

All of these systems have something in common: they’ve exceeded their fragility threshold and crossed into the frontier of criticality. They have nowhere to go except failure. It would be nice if we could construct leaner and more local systems to replace these monsters, but there is too much vested interest in them. For instance, the voters slapped down virtually every major ballot proposition to invest in light rail and public transit around the country. The likely explanation is that they’ve bought the story that shale oil will allow them to drive to WalMart forever. That story is false, by the way. The politicos put it over because they believe the Wall Street fraudsters who are pimping a junk finance racket in shale oil for short-term, high-yield returns. The politicos want desperately to believe the story because the background reality is too difficult to contemplate: an American living arrangement with no future. The public, of course, is eager to believe the same story for the same reasons, but at some point they’ll flip and blame the story-tellers, and their wrath could truly wreck what remains of this polity. When it is really too late to fix any of these things, they’ll beg someone to tell them what to do, and the job-description for that position is ‘dictator’.