Byron In Chinatown, Pell Street, New York 1900

The US is slowly coming to terms with the numbers representing its reality. And unlike fast food, they need to be fed the news in little bites.

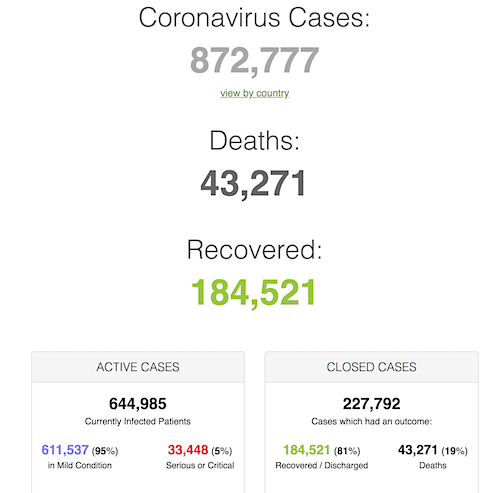

• Cases 872,777 (+ 73,054 from yesterday’s 799,723)

• Deaths 43,271 (+ 4,551 from yesterday’s 38,720)

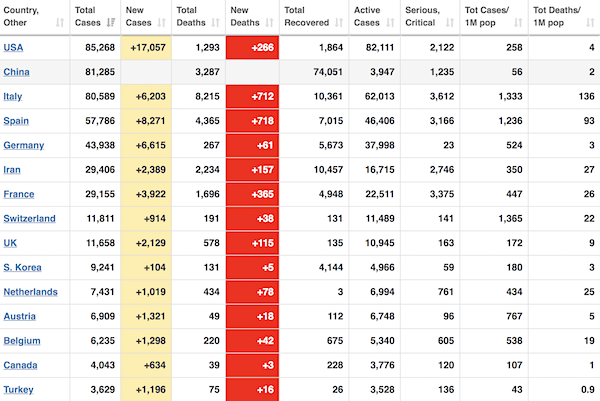

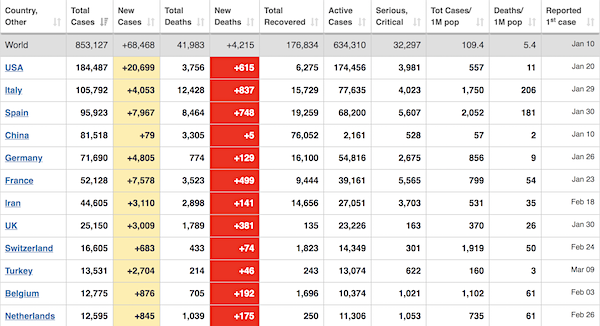

From Worldometer yesterday evening -before their day’s close-.

From Worldometer -NOTE: mortality rate for closed cases is at 19% –

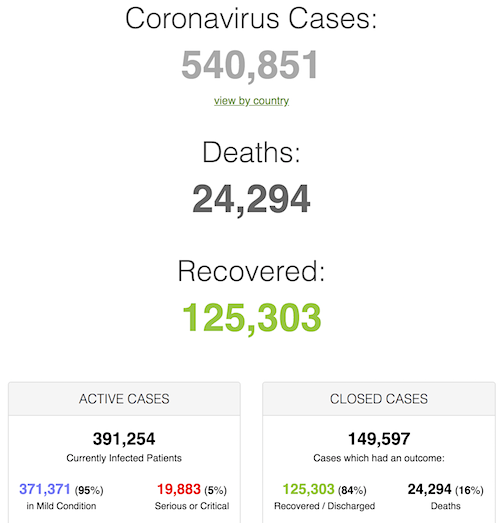

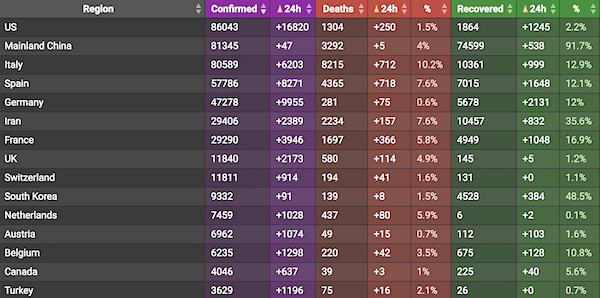

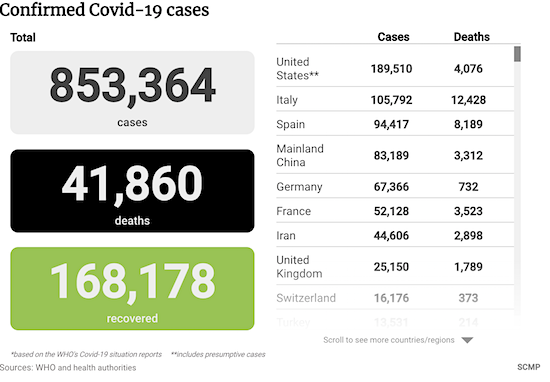

From SCMP:

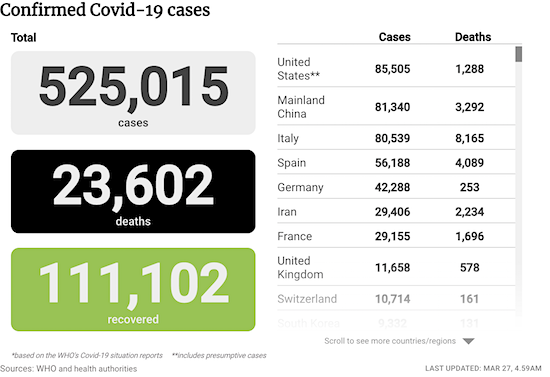

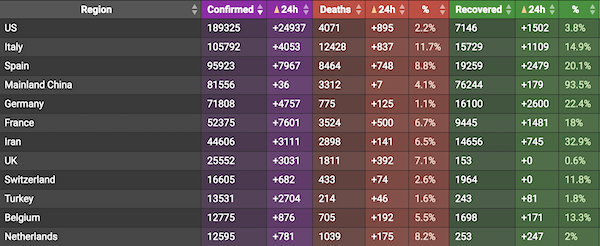

From COVID2019Live.info:

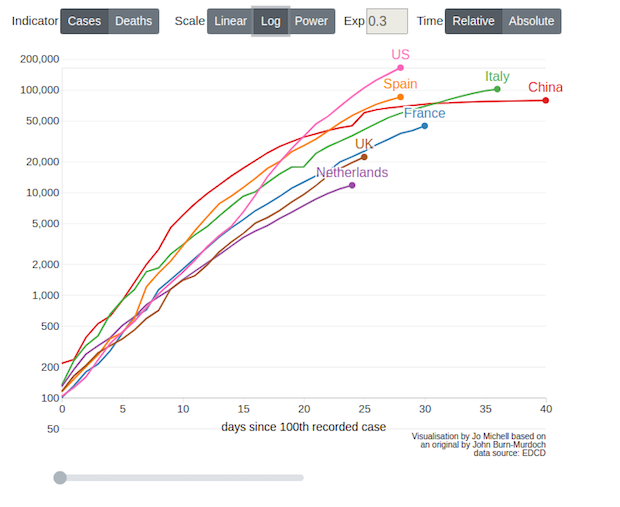

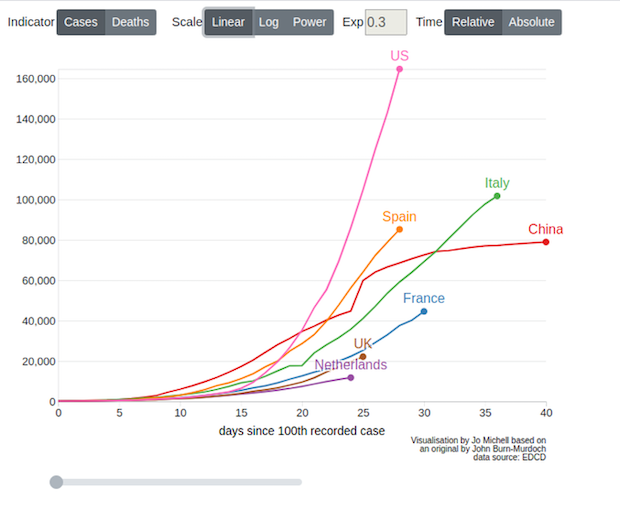

A good representation by Jo Michell of how the FT graph (see below) can be made clearer by tweaking between log scale and linear scale.

Log scale corona:

Linear scale corona:

Best story of the day for this day.

• Greek Mothers, Grandmas and Wives to Enforce Quarantine As Police Struggle (GR)

Greek Prime Minister Kiriakos Mitsotakis who was among the first EU leaders to implement a strict quarantine in Greece, in now transferring the authority of enforcing the quarantine to Greek women. The decision took most by storm but police sources say it was planned since a few weeks ago, when police was needed to help in hospitals in vital positions for the fight against Coronavirus. The PM made his decision known with a tweet in the early hours of Wednesday:

“Police will continue to assist in enforcing the quarantine if needed on a case by case basis, but this won’t be its primary responsibility,” a Greek official clarified. The amendment to the current quarantine law transfers the power of issuing the necessary permits primarily to mothers and grandmothers, as well as wives and sisters where there in no mother or grandmother.

“A checkpoint on Patission street. Groups of 3-4 women will be assembling in each neighbourhood during rush-hour to check cars and individuals if they are on the street legally.” Credit: Greek Government handout

“Women have been defending the Greek household for thousands of years, since the Ancient times when every Greek woman was the protector of ‘estia’” noted the President of the Hellenic Republic Katerina Sakellaropoulou. It is also true that women and especially Greek women are also experts on discovering germs and dirt where you think there is none, so this might be another skill that comes in handy. “If one person of the household is infected the whole family is in danger, notes Antonia Parisi who sees this as a necessary step for a family’s wellbeing. “Women are best to protect the family” adds the shop owner and mother of two from Piraeus, Greece.

[..] some Greeks are not happy by the move. Most complain that Greek mothers and wives are way stricter in accepting fair reasoning to go out during a pandemic. “I don’t know if I will ever see the light of the day,” says Petros Kakavas from Peristeri, Athens who in absence of a mother and a grandmother has to ask his wife for permission to leave the house. In ancient Sparta the male fighters’ health was a responsibility of their mothers and wives. It is since then, we have the saying behind every strong man there is an even stronger woman. But sometimes history just repeats itself.

I got a lot of criticism on my Fauci article 2 days ago, thought I merely connected two things he said over the space of two days, which meant 200 million Americans would become infected. That number is still not mentioned for some reason, but soon it will have to be. For now 240,000 deaths are the new normal.

• White House Predicts 100,000 To 240,000 Will Die In US From Coronavirus (CNBC)

President Donald Trump prepared Americans for a coming surge in coronavirus cases, calling COVID-19 a plague and saying the U.S. is facing a “very, very painful two weeks.” “This could be a hell of a bad two weeks. This is going to be a very bad two, and maybe three weeks. This is going to be three weeks like we’ve never seen before,” Trump said at a White House press conference Tuesday. White House officials are projecting between 100,000 and 240,000 deaths in the U.S. with coronavirus fatalities peaking over the next two weeks. “When you look at night, the kind of death that has been caused by this invisible enemy, it’s incredible.” The U.S. has more coronavirus cases than any other country across the globe with 184,000 confirmed infections, according to data compiled by Johns Hopkins University.

New York has now become the new epicenter of the outbreak in the world with 75,795 confirmed cases as of Tuesday morning, more reported infections than China’s Hubei province where the coronavirus emerged in December. Earlier in the day, New York Gov. Andrew Cuomo said the outbreak in the state may not peak for three weeks. “I’m tired of being behind this virus. We’ve been behind this virus from day one,” the governor said in Albany. “We underestimated this virus. It’s more powerful, it’s more dangerous than we expected.” Trump, who grew up near New York City’s Elmhurst hospital in Queens, said no one can believe officials are setting up refrigerator trucks as temporary mortuaries outside the hospital. Trump said New York “got a late start” in rolling out its mitigation efforts.

New York City is setting up a handful of makeshift field hospitals to house coronavirus patients at the Jacob K. Javits Center, in Central Park and at the tennis courts in Queens that host the U.S. Open. De Blasio said the city is working with the federal government, the hotel industry and various other businesses to turn other buildings into potential medical facilities. More than 1,000 people in New York City alone have already died from the coronavirus, according to data updated at 5 p.m. ET by the NYC Health Department. “This is going to be the roughest three weeks we’ve ever had in this country,” Trump said. “I wanted as few as a number of people to die as possible. And that’s all we’re working on.”

US coronavirus deaths:

3/1 2

3/2 6

3/3 9

3/4 11

3/5 12

3/6 17

3/7 19

3/8 21

3/9 26

3/10 31

3/11 38

3/12 41

3/13 49

3/14 58

3/15 65

3/16 87

3/17 111

3/18 149

3/19 195

3/20 263

3/21 323

3/22 413

3/23 541

3/24 704

3/25 938

3/26 1195

3/27 1588

3/28 2043

3/29 2419

3/30 3004

Now 4076

“At least 400 people died TODAY in New York because of the coronavirus.

We have refrigerated trucks now set up all over the city to hold the bodies.

The morgues are at capacity.

Absolutely heartbreaking day.”

• Putin Asked Trump If He Needed Help & He Accepted (RT)

A cargo plane loaded with medical supplies and protection equipment may depart for the US by the end of Tuesday, the Kremlin said, after a phone call between US President Donald Trump and Russian President Vladimir Putin. The issue of protective gear was raised during the Monday phone talks, with Putin asking if the US needed help and Trump accepting, Kremlin spokesman Dmitry Peskov told reporters on Tuesday. Moscow suggested the aid in anticipation that the US will be able to return the favor if necessary, once its manufacturers of medical and protective equipment catch up with demand, Peskov said. The current situation “affects everyone without exception and is of a global nature,” he added. “There is no alternative to acting together in the spirit of partnership and mutual assistance.”

On Monday, Trump told reporters at the White House press briefing that “Russia sent us a very, very large planeload of things, medical equipment, which was very nice.” The comment left everyone scratching their heads, as no one in the US seemed to know anything about the plane in question. It appears the US president was referring to the aid arranged on the phone call as something that had already happened. Peskov chastised “some of the American side” who “at least did not contribute to the prompt resolution of technical issues” regarding the agreed-upon delivery, which could explain the delay. Official data shows the US has been among the nations hardest-hit by the Covid-19 pandemic, with almost 175,000 confirmed cases and 3,416 deaths as of Tuesday afternoon – overtaking China, where the contagion originated in December. Italy still has the highest death toll in the world, at 12,428.

Military plane carrying masks and other #coronavirus supplies departs #Russia for the #US pic.twitter.com/mPMRNncXpC

— Ruptly (@Ruptly) April 1, 2020

Steve Keen: “an editorial in The Hill by Richard Vague, who is Pennsylvania’s acting Secretary of Banking and Securities. Richard was a highly successful banker, the co-founder of two major personal-finance-oriented companies Juniper Financial, and First USA Bank, and then CEO of the energy marketing company Energy Plus. He is a patron and a close friend. He is the author of “A Brief History of Doom” (2019), which I regard as the best history of financial crises ever written–far better than Kindleberger and Mackay.”

• How To Rescue Our Coronavirus-Infected Economy From Collapse (Richard Vague)

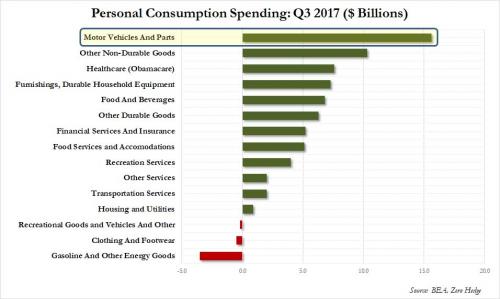

The U.S. government should implement a program of monthly checks of $1,000 for three months — a timeframe which could be extended — to individuals above 18 and below some income threshold, say $200,000. A one-time check is not enough. The continuity of these payments is the most central, critical recommendation. Even if Americans stay cooped up, they can and should be encouraged to spend across the board, including on things like restaurant gift certificates, since the restaurant industry alone now estimates up to 7 million job losses. Even ten years after the Great Recession, households and businesses still have near-record levels of debt and, with this GDP collapse, will now be drowning in that debt.

The U.S. government should institute an immediate three-month moratorium on payments of mortgages, credit cards and student debt, along with a similar moratorium policy for business loan payments. This should be extended beyond three months if necessary. Having spent much of my career in banking, I view this approach as feasible, as long as regulators have the guidance to allow it. As part of this, the federal government would implement this policy for government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, for government-guaranteed student loans and other lending programs that have its full or partial backing; the loans could be extended or restructured to accommodate this, and borrowers could continue to pay if they chose. Regulators also should work with the industry to put together other prudent forms of loan forbearance.

The government should implement a three-month moratorium on all rent payments, and establish a fund to extend money to landlords to accommodate this rent forbearance. It should implement a three-month moratorium on all federal tax payments, which could be extended if necessary. It should commit to cover all healthcare costs associated with the coronavirus, structured such that care providers can bill the government directly so no forms or reimbursements would be required of individuals. It also will be necessary to provide capital support for select, troubled industries beyond the airline, hotel and cruise ship industries. This part does not need to be a handout; it can take the form of a preferred equity investment. It will soon need to provide substantial support to states and local governments. This program will not provide a result that is perfect in its fairness, but the need to move quickly far outweighs that consideration.

The S&P 600 doesn’t include the mega-caps and even with all the stimulus in the world, there has been virtually no bounce at all. This is the index that tells you what is going to happen with the economy. Deep recession, minimal recovery. pic.twitter.com/pL2ofVVmhq

— David Rosenberg (@EconguyRosie) March 31, 2020

From a right wing source. A different view on this topic: “On March 1, 2003, the NPS became the Strategic National Stockpile (SNS) program managed jointly by DHS and HHS. With the signing of the BioShield legislation, the SNS program was returned to HHS for oversight and guidance. In 2018, oversight of Strategic National Stockpile was transferred to HHS/ASPR from HHS/CDC.”

What does the move from CDC to Assistant Secretary for Preparedness and Response entail?

• Obama’s Failure To Resupply Respirators In Federal Stockpile (JTN)

The Strategic National Stockpile, America’s giant medical storage closet for a terrorist or biological crisis, once boasted more than 100 million respirator masks to protect doctors, nurses and other frontline health care workers in case of a contagion. But when the COVID-19 pandemic started a few months ago, the supply had dwindled down to just 12 million fitted masks, known as N95 respirators, and 30 million surgical masks, a supply deemed to be less than 2 percent of what the nation would need for full-blown pandemic. The tale of how such a critical supply lapsed, leading the Trump administration to scramble for 500 million new masks in the midst of pandemic, is one of government neglect and competing priorities that began in 2009.

That’s when the Obama administration drew down nearly 97 million of the masks to deal with the H1N1 swine flu pandemic, effectively protecting frontline medical workers from a virus that infected more than 60 million Americans. But when it was over, the administration decided not to fully restock the respirators, choosing to spend its $600 million annual budget for the stockpile on other priorities such as key drugs and vaccines to deal with smallpox, anthrax and the like, experts said. There is really “no answer why the supplies were not replenished because the N95 masks are invaluable tools for preparedness and it was important that they be restocked,” said Charles Johnson, President of International Safety Equipment Association, whose members make supplies for the stockpile.

In the end, Johnson said, the Obama administration chose to use its “limited funds” in other ways and “made the best choices at the time even though his association and others periodically restated their calls to replenish” the N95 masks. That trend continued in the early Trump years as well. The Clinton administration first began to examine a national plan to respond to pandemics and create the federal stockpile in 1990s. But the formal National Strategy for Pandemic Influenza was not officially published until 2005 during the George W. Bush administration, following the anthrax scare in 2001 and the severe acute respiratory syndrome (SARS) in 2002.

[..] According to a Center for Disease Control report published after the 2009 H1N1 pandemic, 39 million N95 masks were initially distributed from the stockpile, followed by 59.5 million more in second wave. According to Johnson, the stockpile originally was about 100 million masks. From April 12, 2009 to April 10, 2010, there were over 60 million cases of H1N1 requiring 274,304 hospitalizations and resulting in 12,469 deaths in the United States. After the H1N1 virus slowed down in 2010, according to Johnson, “it was important to restock.” That did not happen as the national stockpile budget focused on other priorities deemed higher.

Literally every single state appears to have different rules?!

• Do I Have to Pay My Rent or Mortgage During the Pandemic? (DB)

As March winds down, at least 250 million Americans have been told to stay home or “shelter in place” to help stop the spread of COVID-19. Problem is, many can’t help wondering if they can still afford a place to shelter in—if they ever could. Long before the coronavirus pandemic, generous swaths of the United States faced an affordable housing crisis. With millions of Americans losing their jobs and millions more facing unemployment in the near future thanks to a concerted economic shutdown geared at reining in the disease, talk of rent strikes and freezes are in the air.

The Trump administration recently nodded to the problem by ordering a foreclosure moratorium on single-family home mortgages backed by the Federal Housing Administration or obtained through government-owned lenders Fannie Mae and Freddie Mac. Fannie and Freddie have also offered forbearance for borrowers experiencing hardship. And the finance giants have dangled payment relief to indebted apartment building owners who grant respite to renters, a move the Federal Housing Finance Agency estimates could affect 43 percent of the market in multifamily leases. Then there’s the $2 trillion stimulus bill that passed last week, which contains language forbidding evictions and late charges on any property receiving virtually any federal aid.

It also permits those owing money to Fannie or Freddie to request up to six months of forbearance, though it leaves the onus on borrowers to do so. If your home doesn’t fall under one of these categories or programs, and you’re wondering if you owe money to your landlord or lender, the answer is probably yes—at least for now. Still, some state and local governments have moved to stem evictions and foreclosures for everyone, and a few are even freezing rent and mortgage payments entirely. Here’s a breakdown of COVID-19 rules on housing across every state and many large metropolitan areas. This story will be updated as events warrant.

Like, make it even worse?

• Will Shift To Distance Learning Reshape American Education? (JTN)

It likely represents one of the most ambitious, albeit uncoordinated, educational experiments in history: Can you successfully digitize an entire country’s higher education industry very nearly overnight? And if so, what does that say about the future of distance learning? Where does it go from here? Distance education itself is already widespread throughout the United States: The National Center for Education Statistics estimates that in the fall of 2017 there were well over 6.5 million American students enrolled in online programs, nearly a third of all postsecondary students in the country. Nearly half of those were exclusively enrolled in online programs; slightly more than half had “at least one” online course.

When they hear of online education, most people might picture private, for-profit corporations, the ones that build vanilla, office park-like campuses in the suburbs of American cities and whose commercials pop up regularly on network television and YouTube advertisements: Strayer, the University of Phoenix, DeVry University. Yet those establishments form a relatively small minority of the overall online education industry: the NCES says the vast majority of students who attend virtual classrooms do so at more traditional institutions. Not even 15% of all online attendance is done at private, for-profit organizations.

Distance education, then, is very much a concern for legacy institutions, including those known for their idyllic and venerated campus experiences: Schools like Harvard and Princeton and Northwestern and Chicago all have their own exclusively online divisions, while more and more state and regional schools are expanding their digital opportunities. Indeed, the existence of those programs is likely why many American schools were able to transition with (relative) ease to online learning environments. A vital question to ask, then, is: Does this near-total transition to online learning suggest an upcoming major shift in the distance education economy? Will schools be able to use this monumental adjustment to expand online learning and perhaps fundamentally reshape American higher education?

Dr. Wallace Boston, the president of the private, for-profit, online American Public University System, says yes. “I believe we will see an uptick in distance education” following the pandemic, he told Just the News. “The most likely reason that we will see an uptick is that many institutions will want to keep some form of online instruction and infrastructure in the event that this pandemic recycles through again or that there is another event that might require social distancing or quarantines,” he argued. “Some may even view online offerings as strategic opportunities for their institution.”

Before or after they’ve been tested?

• Should All Americans Be Wearing Face Masks? (JTN)

[California] Gov. Gavin Newsom Tuesday said that the state is considering guidance around whether people beyond the medical profession should wear some sort of mask or face covering, including in professions like grocery store workers. The science is incomplete in this area, according to Newsom, and there is a concern that people will think masks are a replacement for social distancing, which they aren’t. Surgeon General Jerome Adams has said that the practice often leads to increased touching of one’s face and can produce a “false sense of security,” adding that the World Health Organization and the CDC have reaffirmed in the last few days is that they do not recommend the general public wear masks.

“The virus is not spreading in the general community,” Dr. Nancy Messonnier, director of the Center for the National Center for Immunization and Respiratory Diseases, said in a Jan. 30 briefing. “We don’t routinely recommend the use of face masks by the public to prevent respiratory illness. And we certainly are not recommending that at this time for this new virus.” As the cases of COVID-19 grows across America and supplies like face masks and gowns are in short supply, health experts say implementing guidance may take masks away from the health care providers who are on the frontlines of the pandemic. However others believe that masks, even homemade masks, would help reduce the risk of unknowingly spreading the virus through coughs, sneezes, even yawns or simple conversation.

George Gao, director-general of the Chinese Center for Disease Control and Prevention said in an interview with Science magazine that “when you speak, there are always droplets coming out of your mouth.” “The big mistake in the U.S. and Europe, in my opinion, is that people aren’t wearing masks,” Gao said. Meanwhile, Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said on Tuesday that the White House coronavirus task force is also seriously considering guidance that Americans wear masks. “The idea of getting a much more broad, community-wide use of masks outside of the health care setting is under very active discussion at the task force. The CDC group is looking at that very carefully,” Fauci told CNN.

1 GIF zegt meer dan 1000 woorden. pic.twitter.com/NVscTfIzj3

— K. Le Bato (@Koentatweets) March 31, 2020

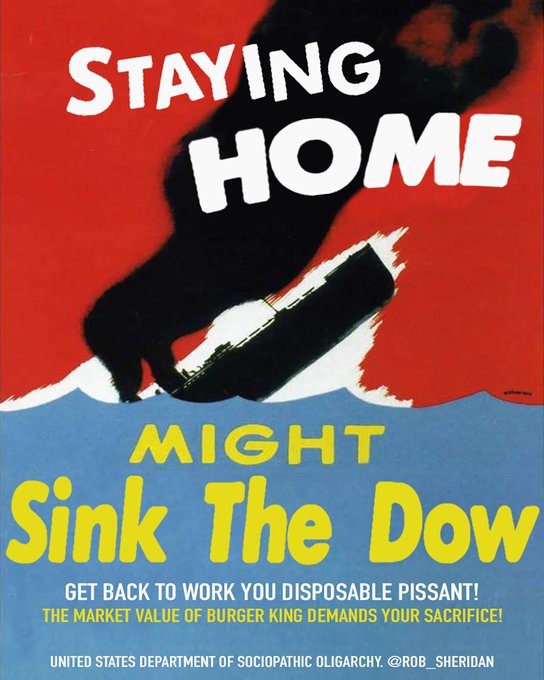

Poor choice of words perhaps? To hide the emptiness implied?

• Fed Will Do ‘Whatever It Takes’ To Help US Economy Likely In Recession (R.)

The Federal Reserve is ready to do more to help a U.S. economy ground to a sudden halt as businesses shutter and people stay home to slow the coronavirus pandemic, San Francisco Fed President Mary Daly said on Tuesday. “The Federal Reserve is prepared to do whatever it takes within our powers to ensure that we are part of the solution of shoring up people over the virus, shoring up the American economy and putting us in the best position to grow again once the virus recedes,” Daly said in an interview with Yahoo Finance. “If we do the right thing and shelter in place and curb the spread of the virus, the economy will be in the best position to bounce back.”

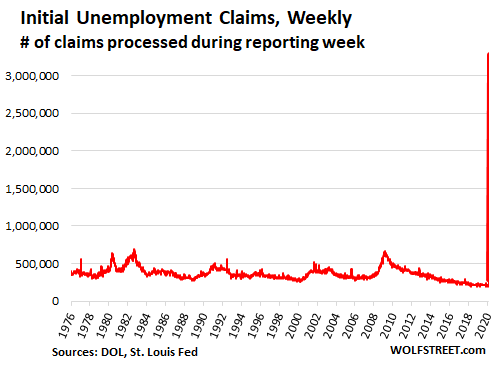

With the coronavirus infecting tens of thousands of Americans and killing hundreds each day, three-quarters of the U.S. population are under orders to stay home except for essential trips to slow the spread of the virus. With businesses laying off millions of workers as demand dries up and states ordering non-essential businesses to close, the economy is likely already in recession, Daly said. The Fed’s job, along with that of the U.S. government that on Friday finalized a $2.2 trillion rescue package, is to provide the support to financial markets, businesses and people who are doing their duty to boost the public health, Daly said. Once the pandemic threat has passed, the Fed’s programs and low interest rates will help drive the economic recovery, she said.

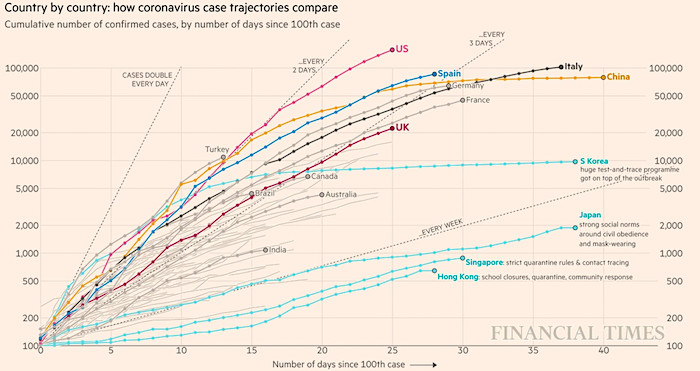

FTCoronaGraphMar31

Is Moon of Alabam going full hippie on us?

• US Virus Cases Off The Scale – But People Can Build Movement From This (MoA)

When John Burn-Murdoch created that daily updated chart he did not anticipate that any country would have more than a 100,000 total cases. That was a reasonable assumption as China, with 1.4 billion inhabitants, stopped the epidemic with less than 85.000 total cases even when it was surprised by the outbreak. As of now the U.S. has 164.435 known cases. It will reach a total number of several dozens of millions and will have several hundreds of thousands of dead caused by the covid-19 disease. Most but not all of those who will die from it will have one or more co-morbid diseases.

The number of death in the U.S. will likely be higher than elsewhere because obesity, diabetes and heart problems are more prevalent in the U.S. than in most other countries. Another reason why the U.S. will have a larger than necessary outbreak is wide mistrust in the authority of the state. A significant number of people will reject stay at home orders or other measures the authorities will have to take. Then there is this: Pouya Alimagham @iPouya – 0:48 UTC · Mar 31, 2020 “The regime doesn’t want to antagonize the religious classes. Thus, it isn’t doing anything about the fact that some religious sites remain open & clerics are encouraging worshippers to come & pray. These gatherings risk exploding #COVID19. I’m talking about the US, not #Iran.”

The U.S. also has many people without health insurance. The many newly laid off people will additionally lose theirs. These people will avoid seeing a doctor or to go to a hospital as the enormous costs would ruin them. The for-profit health system will reject sick persons who are unlikely to be able to pay their bills. The cases of people who die from such circumstance should be put into the death by lack of money category instead of being blamed on something else. Congress has failed to take the necessary measures and to give everyone access to free tests and free care. This will come back to bite everyone as it makes sure that the disease will circulate longer and stronger than in other rich countries.

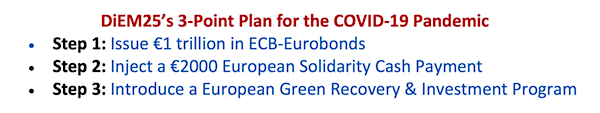

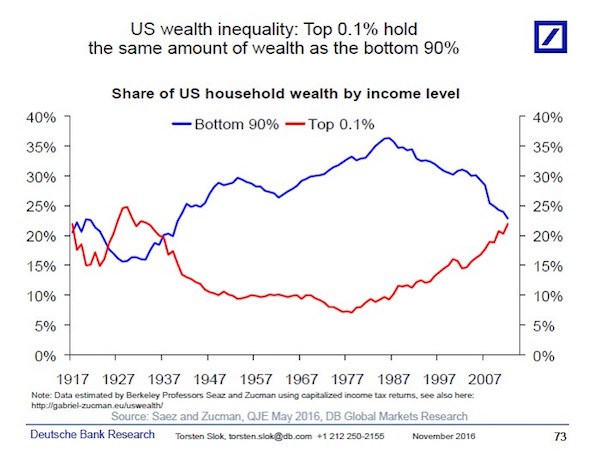

Every crisis is also a chance. Congress has used it to again loot the people and to push more money to the rich. At the same time the powers that be have denied universal healthcare and paid sick leave to those who need it. The covid-19 epidemic is a chance to change that. There are already a number of strikes at Amazon and similar companies over work safety, health care and pay. Rent strikes must now follow. When the bills come in for families with covid-19 cases many more people will get more interested in medicare for all. A movement can be build from these issues. The Sanders campaign should provide a (virtual) platform for it.

The U.S. has enough money to pay for the security of its people. Security is not a military issue. A hugely expensive aircraft carrier with sick sailors is worth nothing. Pandemics are a real security issues and the U.S. has left its people defenseless against them. Cut the aircraft carriers and other insane military spending and invest it in the health of the people. That message will soon be widely understood. We can all help to reinforce it.

Q: how useless is this if you test only some people? Can’t very well adopt the western idea of testing only those who look sick.

• China Starts To Report Asymptomatic Coronavirus Cases (R.)

Chinese health authorities began on Wednesday reporting on asymptomatic cases of the coronavirus as part of an effort to allay public fears that people could be spreading the virus without knowing they are infected with it. China, where the coronavirus emerged late last year, has managed to bring its outbreak under control and is easing travel restrictions in virus hot spots. But there are concerns that the end of lockdowns will see thousands of infectious people move back into daily life without knowing they carry the virus, because they have no symptoms and so have not been tested. Up to now, the number of known asymptomatic cases has been classified, and it is not included in the official data, though the South China Morning Post newspaper, citing unpublished official documents, recently said it was more than 40,000.

In an effort to dispel public fears about hidden cases of the virus, the government has this week ordered health authorities to turn their attention to finding asymptomatic cases and releasing their data on them. Health authorities in Liaoning province were the fist to do so on Wednesday, saying the province had 52 cases of people with the coronavirus who showed no symptoms as of March 31, they said in a statement on a provincial government website. Hunan province said it had four such cases, all of them imported from abroad, it said in a statement on its website. The National Health Commission is due to start reporting aggregate, national data on asymptomatic cases later on Wednesday.

Good for @TuckerCarlson for bringing attention to a study by *Chinese* scientists about the origins of the China virus. Not what you’ll hear from MSM. pic.twitter.com/5zOJPOv2pu

— Tom Cotton (@SenTomCotton) April 1, 2020

Unthinkable now, but soon Americans will be thanking Putin, and thanking Trump.

• How Disinformation Really Works: Russian COVID19 Aid To Italy Smeared (RT)

With over 11,000 deaths and more than 100,000 cases of Covid-19, Italy is currently a country which feels under siege. But this is no impediment to the think tank racket twisting an offer of support for its propaganda purposes. Here’s what happened. The weekend before last, Vladimir Putin called Italian Prime Minister Giuseppe Conte. During the conversation, Conte asked for help, in fighting coronavirus, according to the Kremlin readout which hasn’t been contradicted by Italian officials. Let’s be clear from the outset, there was undoubtably a strong PR, as well as practical, element to Russia’s assistance. However, there were also advantages to Rome from this approach, as the move may have helped to concentrate a few minds among its traditional allies.

Moscow sent teams of “doctors, protective gear and medical equipment” to the stricken country. The detail included 100 military virologists and epidemiologists, along with eight medical teams, according to Russian news outlets. Most importantly, it delivered 600 ventilators. A significant amount given Italy apparently had only about 5,000 of the devices. Indeed, a few days after the Putin/Conte call, the New York Times was writing about Italy’s “ventilator crisis.” There’s usually nothing like a bit of Russian influence to jolt EU and NATO elites into action. As mentioned above, no doubt this was also part of Conte’s reasoning. That said, it’s also worth mentioning that some other Europeans states have tried to help the Italians. Germany and France, in particular, took patients and sent supplies, despite dealing with outbreaks of their own. Yet, many in Italy feel they haven’t done enough.

A few days after the aid landed, a campaign began on Twitter to discredit the Russian initiative. The first I saw of it was a tweet from Oliver Carroll, of London’s Independent newspaper, who presumably speaks Italian (I don’t, so I am relying on his translation). “Some Italians are expressing unease about Putin’s Covid-19 emergency aid,” he wrote. “Acc(ording) to La Stampa, 80 percent of supplies (are) “useless,” (and) sources worry about high-ranking military officers now in (the) country. Russian soldiers (are) free to roam (in) Italy a few steps away from NATO,” the paper stated. “La Stampa says China sent masks (and) ventilators; (but) Russia sent irrelevant equipment used for bacteriological and chemical outbreaks,” Carroll added. “(There is a) belief that Russia … (is) not helping us only for great goodness of its people… now beginning to circulate in broad sectors, military and political.”

Hmm. Italian Ambassador to Russia Pasquale Terracciano says the aid included about 600 medical ventilators. He said the donation was "critically important at this stage of the epidemic."

So is @italyinRussia lying, or is @Lastampa?

https://t.co/VbZxnKkMjH https://t.co/k2myD0iPbF

— Bryan MacDonald (@27khv) March 26, 2020

It must be possible to run the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of it. It has become a two-way street; and isn’t that liberating, when you think about it?

Thanks everyone for your wonderful and generous donations over the past days.

“Our leaders, if they think of empathy at all, think in terms of Steve Martin’s advice: ‘Before you criticize a man, walk a mile in his shoes. That way, when you do criticize him, you’ll be a mile away and have his shoes.’”

Don’t know how widespread this is around Italy but in my quarter of Rome, as the economic toll of #COVID19 increases, people have begun leaving basic groceries – tuna, biscuits, pasta – on benches in the streets. The sign says “this is for whoever needs it.” pic.twitter.com/pRHTElvU68

— gavin jones (@gavinjones10) March 31, 2020

Support us in virustime. Help the Automatic Earth survive. It’s good for you.