Salvador Dali Neo-Cubist Academy (Composition with Three Figures) 1926

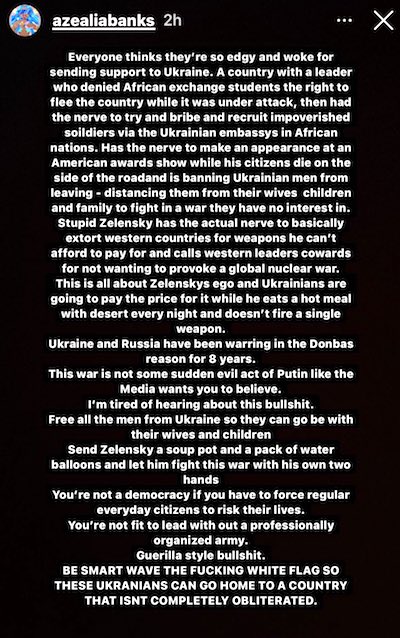

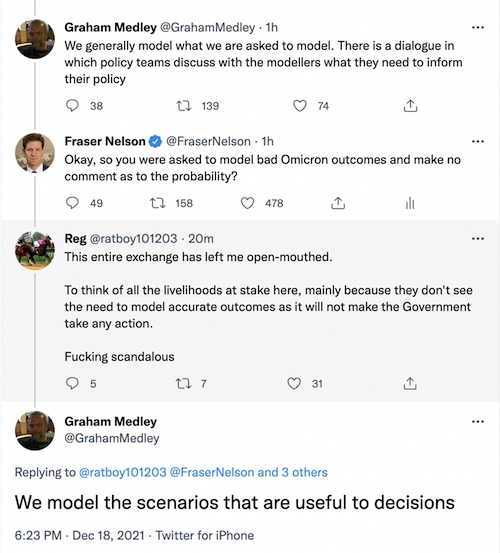

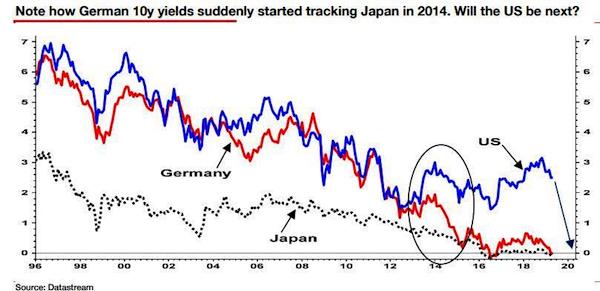

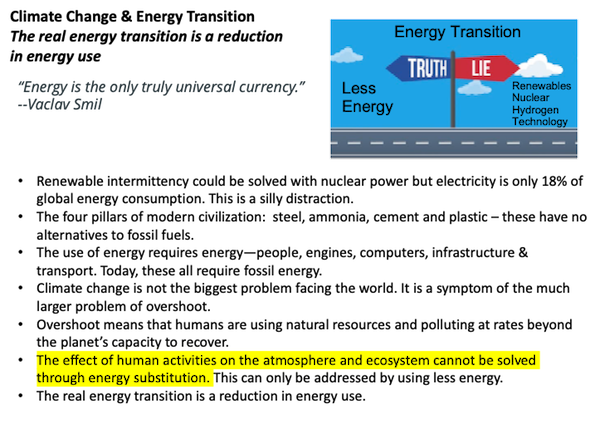

Art Berman @aeberman12

The real energy transition is a reduction in energy use. This will never happen VOLUNTARILY. Another slide from my talk last night at Houston Geological Society.

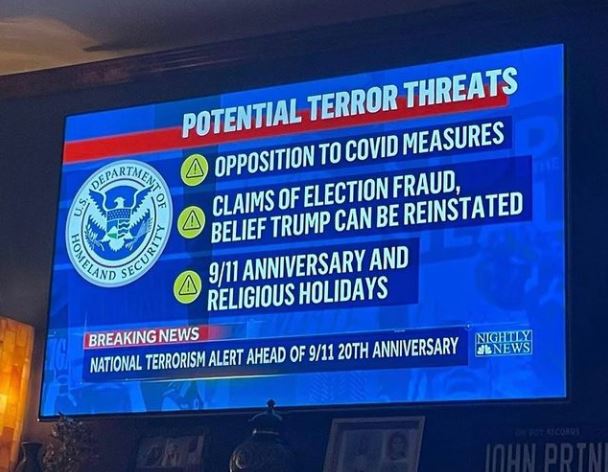

Twitter whistleblower

.@Twitter whistleblower reveals 4000 employees have access to all your personal info and can dox users – and have! Also testified that employees have hijacked users’ accounts pic.twitter.com/McjVYWm11t

— Josh Hawley (@HawleyMO) September 13, 2022

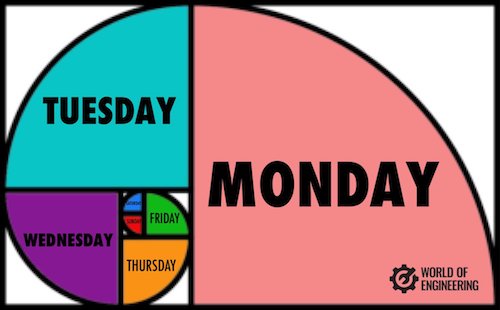

The Fibonacci week. How long do the days feel?

“..the EU began as a group of nations that banded together for mutual economic benefit through the deregulation of trade. Now “they are being corralled together” so their lives will become “colder, poorer, and harder,” she said.”

• Moscow Outlines ‘Diabolical’ Plan By Washington (RT)

Ukraine’s newly published proposal for Western security guarantees is an invitation for the economic self-immolation of the EU, according to Maria Zakharova, the spokeswoman for the Russian Foreign Ministry. The Russian diplomat believes that the proposed international agreement which Kiev released on Tuesday is an economic trap for EU nations set by the US with Ukraine’s assistance. Most of the measures included in the document “are already being implemented” by Kiev’s backers, but Washington’s EU allies are expected to pledge to keep the Ukraine aid money flowing for the foreseeable future, Zakharova said in an interview on Wednesday. If signed, the ‘Kiev Security Compact’ would mean “harsh slavery” for the bloc which it would not recover from anytime soon, she claimed.

“A total commitment to supporting the Kiev regime would simply mean immolation [for the EU]. And this proposal is addressed to nations that are debating how they can live through the winter,” Zakharova said, in reference to the energy shortages that EU member states are struggling to confront. Developed EU nations face an economic and humanitarian disaster after taking directions from the US on how to respond to the crisis in Ukraine, according to the Foreign Ministry spokeswoman. The situation is ironic, she believes, as the EU began as a group of nations that banded together for mutual economic benefit through the deregulation of trade. Now “they are being corralled together” so their lives will become “colder, poorer, and harder,” she said.

This is Washington’s diabolical plan to destroy what was previously called the common European space. The Ukrainian security proposal was prepared by a group co-chaired by Andrey Yermak, the chief of staff of President Vladimir Zelensky, and former NATO Secretary General Anders Fogh Rasmussen. The 10-page document outlines NATO-like security guarantees for Ukraine by the US and its allies that would benefit Kiev until it formally joins the Washington-led military bloc. It also calls for continued military and financial aid for Ukraine by the guarantors.

“..a “multi-decade” plan of investment, military training, and intelligence sharing to bolster Ukraine’s defensive capabilities as the country pursues full NATO membership.”

• “Prologue To Third World War”: Kremlin Reacts To Security Guarantees For Ukraine (ZH)

Ukraine wants a ‘NATO-esque’ bloc which can be called upon to immediately defend borders with Russia, which was proposed by a working group established by President Volodymyr Zelensky. Crucially it would include the United States and other NATO allies providing Ukraine with “security guarantees”. Kiev officials stressed in unveiling the plan Tuesday that it’s not meant as a replacement for NATO, but as a legally binding alliance to be in place while Ukraine eventually pursues full NATO membership, as Newsweek describes of the proposal: “The Kyiv Security Compact (KSC)—proposed by Andriy Yermak, the head of Zelensky’s office, and former NATO Secretary-General Anders Fogh Rasmussen—would also establish a “multi-decade” plan of investment, military training, and intelligence sharing to bolster Ukraine’s defensive capabilities as the country pursues full NATO membership.”

The Kremlin’s reaction has been swift and fierce, with Deputy Chairman of the Security Council of Russia Dmitry Medvedev warning that it is “really a prologue to the Third World War” if it gets enacted. He described that nuclear holocaust would be the end result. According to a translation of Medvedev’s reaction in state media, which had been posted in a statement to Telegram, he blamed “dull idiots” from “stupid think tanks” for concocting such a “hysterical appeal”. Medvedev wrote: “And then the Western nations will not be able to sit in their clean homes, laughing at how they carefully weaken Russia by proxy. Everything will be on fire around them. Their people will harvest their grief in full. The land will be on fire and the concrete will melt.”

“Yet still the narrow-minded politicians and their stupid think tanks, thoughtfully twirling a glass of wine in their hands, talk about how they can deal with us without entering into a direct war. Dull idiots with a classical education.” He said that already the conflict in Ukraine is sliding into unknown, unpredictable territory of escalation due to the West’s “unrestrained pumping of the Kiev regime with the most dangerous types of weapons.” He added to the statements as follows according to a translation: “The Kyiv camarilla gave birth to a project of “security guarantees”, which are a prologue to the third world war. Of course, no one will give any “guarantees” to the Ukrainian Nazis. After all, this is almost the same as applying Article 5 of the North Atlantic Pact (Washington Treaty) to Ukraine. For NATO – the same shit, only a side view. Therefore, it’s scary.”

Insanity squared.

• US, Ukraine Are In Talks To Transfer Fighter Jets & Longer-Range Missiles (ZH)

The US and its allies are in talks over whether to send Ukraine more advanced weapons in the future, including fighter jets, US defense sources have said, according to the Financial Times. The Kharkiv counteroffensive has apparently emboldened Ukrainian officials to press Washington harder for more advanced and longer-range weapons, now that some degree of success in rolling back Russian forces can be demonstrated. The idea is that if Ukraine’s forces can prove they’ve taken back significant territory with what defense systems the US has provided so far, they can ultimately make the case that the whole of the east and south is within their reach – and even the potential to liberate Crimea while they’re at it – if longer range and more advanced arms are made available.

The Financial Times reports this week that active discussions between the US and Ukraine are underway concerning Kiev’s weapons wish list: “A senior US defense official said Washington and its allies were discussing Ukraine’s longer term needs, such as air defenses, and whether it might be appropriate to give Kyiv fighter aircraft in the “medium to longer term”. To date, the US and its allies have declined to do so. But interestingly and quite tellingly, the report immediately follows with the acknowledgement that Ukrainian leaders are perhaps naturally incentivize to exaggerate battlefield gains at this moment. Here’s more from the FT as the Pentagon offers a “cautiously optimistic” assessment of Ukraine’s ongoing counteroffensives in the east and south:

“Ukrainian military officials have said in recent days they have taken more than 3,000 sq km of terrain in what has become Moscow’s biggest military setback since it was forced to scrap plans to conquer Kyiv. But late on Monday night President Volodymyr Zelenskyy practically doubled those claims as Ukraine’s forces continued to advance.” Something Ukraine has additionally long been asking for is longer-range missile systems. A Monday Wall Street Journal report detailed that Kiev is now requesting from the Pentagon the Army’s Tactical Missile System, or ATACMS, a surface-to-surface missile system with the capability of reaching about 190 miles. This would be far and beyond the range of missiles transferred to Ukraine thus far in the conflict.

The Biden administration in the early months resisted sending longer range missiles, admitting its fears that doing so could draw the US and Russia into direct conflict – given longer range munitions means Ukrainian forces would have the capability of hitting inside Russian territory. This has already happened with Crimea, and even recently with bases inside Russia proper near the border. But now US defense officials are looking over a new strategy proposal and weapons request submitted by Valeriy Zaluzhny, the commander in chief of Ukraine’s force. WSJ details of the document: They argued that Russia has long-range cruise missiles that greatly outdistance the systems in the Ukrainian inventory. A turning point could come if the Ukrainians also had longer-range systems, they argued, specifically mentioning the ATACMS. “The only way to radically change the strategic situation is, without a doubt, for the Armed Forces of Ukraine to launch several consecutive, and ideally, simultaneous counterattacks during the 2023 campaign,” they wrote.

“Sooner rather than later, gloves – velvet and otherwise – will be off. Exit SMO. Enter War.”

• The Kharkov Game-Changer (Escobar)

Wars are not won by psyops. Ask Nazi Germany. Still, it’s been a howler to watch NATOstan media on Kharkov, gloating in unison about “the hammer blow that knocks out Putin”, “the Russians are in trouble”, and assorted inanities. Facts: Russian forces withdrew from the territory of Kharkov to the left bank of the Oskol river, where they are now entrenched. A Kharkov-Donetsk-Luhansk line seems to be stable. Krasny Liman is threatened, besieged by superior Ukrainian forces, but not lethally. No one – not even Maria Zakharova, the contemporary female equivalent of Hermes, the messenger of the Gods – knows what the Russian General Staff (RGS) plans, in this case and all others. If they say they do, they are lying.

As it stands, what may be inferred with a reasonable degree of certainty is that a line – Svyatogorsk-Krasny Liman-Yampol-Belogorovka – can hold out long enough with their current garrisons until fresh Russian forces are able to swoop in and force the Ukrainians back beyond the Seversky Donets line. All hell broke loose – virtually – on why Kharkov happened. The people’s republics and Russia never had enough men to defend a 1,000 km-long frontline. NATO’s entire intel capabilities noticed – and profited from it. There were no Russian Armed Forces in those settlements: only Rosgvardia, and these are not trained to fight military forces. Kiev attacked with an advantage of around 5 to 1. The allied forces retreated to avoid encirclement. There are no Russian troop losses because there were no Russian troops in the region.

Arguably this may have been a one-off. The NATO-run Kiev forces simply can’t do a replay anywhere in Donbass, or in Kherson, or in Mariupol. These are all protected by strong, regular Russian Army units. It’s practically a given that if the Ukrainians remain around Kharkov and Izyum they will be pulverized by massive Russian artillery. Military analyst Konstantin Sivkov maintains that, “most combat-ready formations of the Armed Forces of Ukraine are now being grounded (…) we managed to lure them into the open and are now systematically destroying them.” The NATO-run Ukrainian forces, crammed with NATO mercenaries, had spent 6 months hoarding equipment and reserving trained assets exactly for this Kharkov moment – while dispatching disposables into a massive meat grinder.

It will be very hard to sustain an assembly line of substantial prime assets to pull off something similar again. The next days will show whether Kharkov and Izyum are connected to a much larger NATO push. The mood in NATO-controlled EU is approaching Desperation Row. There’s a strong possibility this counter-offensive signifies NATO entering the war for good, while displaying quite tenuous plausible deniability: their veil of – fake – secrecy cannot disguise the presence of “advisers” and mercenaries all across the spectrum.[..] This is an existential war. A do or die affair. The American geopolitical /geoeconomic goal, to put it bluntly, is to destroy Russian unity, impose regime change and plunder all those immense natural resources. Ukrainians are nothing but cannon fodder: in a sort of twisted History remake, the modern equivalents of the pyramid of skulls Timur cemented into 120 towers when he razed Baghdad in 1401.sIf may take a “hammer blow” for the RSG to wake up. Sooner rather than later, gloves – velvet and otherwise – will be off. Exit SMO. Enter War.

“Winning a battle is one thing; winning a war another.”

• Why Russia Will Still Win, Despite Ukraine’s Gains (Scott Ritter)

The Ukrainian battle plan has “Made in Brussels” stamped all over it. The force composition was determined by NATO, as was the timing of the attacks and the direction of the attacks. NATO intelligence carefully located seams in the Russian defenses and identified critical command and control, logistics, and reserve concentration nodes that were targeted by Ukrainian artillery, which operates on a fire control plan created by NATO. In short, the Ukrainian army that Russia faced in Kherson and around Kharkov was unlike any Ukrainian opponent it had previously faced. Russia was no longer fighting a Ukrainian army equipped by NATO, but rather a NATO army manned by Ukrainians.

Ukraine continues to receive billions of dollars of military assistance, and currently has tens of thousands of troops undergoing extensive training in NATO nations. There will be a fourth phase, and a fifth phase … as many phases as necessary before Ukraine either exhausts its will to fight and die, NATO exhausts its ability to continue supplying the Ukrainian military, or Russia exhausts its willingness to fight an inconclusive conflict in Ukraine.

[..] In the end, I still believe the end game remains the same — Russia will win. But the cost for extending this war has become much higher for all parties involved. The successful Ukrainian counteroffensive needs to be put into a proper perspective. The casualties Ukraine suffered, and is still suffering, to achieve this victory are unsustainable. Ukraine has exhausted its strategic reserves, and they will have to be reconstituted if Ukraine were to have any aspirations of continuing an advance along these lines. This will take months. Russia, meanwhile, has lost nothing more than some indefensible space. Russian casualties were minimal, and equipment losses readily replaced.

Russia has actually strengthened its military posture by creating strong defensive lines in the north capable of withstanding any Ukrainian attack, while increasing combat power available to complete the task of liberating the remainder of the Donetsk People’s Republic under Ukrainian control. Russia has far more strategic depth than Ukraine. Russia is beginning to strike critical infrastructure targets, such as power stations, that will not only cripple the Ukrainian economy, but also their ability to move large amounts of troops rapidly via train. Russia will learn from the lessons the Kharkov defeat taught them and continue its stated mission objectives.

The bottom line – the Kharkov offensive was as good as it will get for Ukraine, while Russia hasn’t come close to hitting rock bottom. Changes need to be made by Russia to fix the problems identified through the Kharkov defeat. Winning a battle is one thing; winning a war another. For Ukraine, the huge losses suffered by their own forces, combined with the limited damage inflicted on Russia means the Kharkov offensive is, at best, a Pyrrhic victory, one that does not change the fundamental reality that Russia is winning, and will win, the conflict in Ukraine.

The IAEA can’t speak. Ukraine=NATO.

• Ukraine Has Put World On Brink Of ‘Nuclear Catastrophe’ – Moscow (RT)

Ukraine’s attacks on the Zaporozhye Nuclear Power Plant are creating an unacceptable risk, the chairman of the State Duma, Vyacheslav Volodin, said on Tuesday. Moscow will act to prevent a disaster from happening, while the US does not seem to care about the potential damage to Ukraine and its European NATO allies, the speaker of the Russian parliament has said. “Kiev’s terrorist actions are putting the world on the brink of a nuclear catastrophe. We cannot allow this to happen,” Volodin said, opening the legislature’s autumn session. While the US may be far away from the plant, “their NATO allies in Europe stand to suffer” in case of a radioactive release, Volodin noted, adding that the US government and EU parliaments are silent about the threat, but many other states around the world share Russia’s concern about the situation.

Russia has controlled Europe’s largest nuclear power plant since March. Attacks on the facility started in July, with the Russian Defense Ministry documenting more than 30 artillery and drone strikes, as well as two attempts by Ukrainian commandos to storm the plant, one during the visit of an International Atomic Energy Agency (IAEA) mission earlier this month. Kiev has accused Moscow of staging the shelling to make Ukraine look bad, even though its military eventually admitted to targeting the area.

IAEA Director General Rafael Grossi, who personally led the mission to inspect the plant, said on Monday that both Russia and Ukraine are “interested” in a proposal for a local ceasefire and a security zone around the ZNPP. All of its six reactors are currently offline, due to the ongoing artillery threat. Moscow has rejected any notion of withdrawing its troops from the area, however, with the Kremlin saying that the only discussion at this time is “about forcing the Ukrainian side to stop the barbaric shelling” of the premises. In his remarks on Tuesday, Volodin said, “time has once again shown the correctness of the decision” by President Vladimir Putin to send troops into Ukraine in February.

“The European Commission has reportedly backpedaled on the gas price cap and is currently working on a mechanism to tax the windfall profits of energy companies.”

• Top Hungarian Official Predicts Easing Of Sanctions (RT)

The EU will review the sanctions on Russia and could lift some of them as soon as this autumn, Hungarian State Secretary for Foreign Affairs and Trade Tamas Menczer predicts. The restrictions imposed on Russian trade to punish it for attacking Ukraine have failed to change Moscow’s behavior and actually rewarded it with increased revenues, after they triggered a spike in energy prices, the MP said during an appearance on M1 TV on Tuesday. Meanwhile, the European countries that imposed the sanctions are facing energy shortages. “Reality knocks on the door of every country,”Menczer said, explaining why he believes the sanctions will be lifted sooner rather than later. Member states are set to review their sanctions policies later in the autumn.

The Hungarian MP confirmed that his country, which criticized the EU’s drive to decouple the economy of the bloc from Russian energy, opposed the idea of introducing a price cap on gas bought from foreign nations. He called the proposal absurd and impractical, citing Moscow’s promises to cut supplies to customers that try to dictate the price. The European Commission has reportedly backpedaled on the gas price cap and is currently working on a mechanism to tax the windfall profits of energy companies. Brussels is also urging EU nations to impose various energy-saving measures to better prepare for peak consumption during the winter. Last week, Hungarian Parliament Speaker Laszlo Kover claimed that the EU is the “loser” in the Ukraine conflict due to the economic damage caused by the sanctions.

“..as much as 70% of the funding due between 2021 and 2027 may be withheld from Hungary owing to non-compliance..”

The European Commission will recommend withholding funds from the Hungarian government over allegations of corruption in the country, Bloomberg claimed on Wednesday, confirming earlier reports in the Hungarian press. The assessment is expected to be unveiled as soon as Sunday. The EU launched a probe against Hungary shortly after its prime minister, Viktor Orban, shored up his domestic position by winning the April general election in a landslide. The investigation was triggered under a recently adopted EU law that links payments of subsidies to member states to their compliance with the bloc’s rule-of-law norms.According to Bloomberg’s sources, the European Commission is almost ready to release its conclusions. The executive body is to recommend slashing the funding pending improvement in adherence to the norms, senior EU officials told the agency.

The final decision will be made within three months after the report is released, with a qualified majority of votes by the bloc’s members required to adopt it. Brussels may give Budapest a grace period of up to three months to follow its recommendations and to implement a number of measures that the Hungarian government promised to enact to alleviate the EU’s concerns, according to Bloomberg. According to EUobserver, a publication specializing in covering EU policies, as much as 70% of the funding due between 2021 and 2027 may be withheld from Hungary owing to non-compliance. The total sum would amount to over €40 billion, according to the Bloomberg report. The Orban government was blocked from accessing the EU money during the probe.

The anti-corruption measures that Budapest proposed in late August include creating a new authority to oversee the spending of EU funds and amending Hungarian laws on public procurements. The country’s justice minister, Judit Varga, met EU officials last week to discuss the package. The timeline for the release of the graft report was first revealed by the Hungarian newspaper Nepszava on Tuesday evening. Its sources said that 20% of EU subsidies were at risk of being suspended unless Budapest meets Brussels’ demands. The punishment, if implemented, would be the first case of its kind. The EU leadership has voiced concerns about the rule of law in several Eastern European countries, most notably Hungary and Poland.

Half the world population.

• Summit With Putin, Xi Will Showcase Alternative To Western World: Kremlin (AFP)

A regional summit this week where Russian President Vladimir Putin will meet China’s Xi Jinping and other Asian leaders will showcase an “alternative” to the Western world, the Kremlin said Tuesday. Putin and Xi will be joined by the leaders of India, Pakistan, Turkey, Iran and several other countries for the summit of the Shanghai Cooperation Organisation (SCO) in the Uzbek city of Samarkand on Thursday and Friday. The SCO — made up of China, Russia, India, Pakistan and four ex-Soviet Central Asian countries — was set up in 2001 as a political, economic and security organisation to rival Western institutions. The meeting will be part of Xi’s first trip abroad since the early days of the coronavirus pandemic and comes with relations between Russia and the West shattered by the conflict in Ukraine. “The SCO offers a real alternative to Western-centric organisations,” Kremlin foreign policy advisor Yuri Ushakov told reporters in Moscow.

“All members of the SCO stand for a just world order,” he said, describing the summit as taking place “against the background of large-scale geopolitical changes”. The SCO, he said, “is the largest organisation in the world, it includes half the population of our planet”. Putin will hold talks with Xi, Iranian President Ebrahim Raisi and Pakistani Prime Minister Shehbaz Sharif on Thursday, Ushakov said, before attending the main session of the summit on Friday. On Friday he will also meet with Indian Prime Minister Narendra Modi, Turkish President Recep Tayyip Erdogan and Azerbaijani leader Ilham Aliyev. “The meeting with Xi is of particular importance, major international and regional topics will be discussed,” including the conflict in Ukraine and growing Russia-China economic ties, Ushakov said.

History lesson.

• Ukraine Had A Huge Influence On The Soviet Union (Negopodin)

Even now, many pages in the history of the Soviet Union remain a mystery. One of these concerns the ethnic composition of the country’s leadership. Such information was not published by the Party’s Central Committee until 1989, and biographies of members of the governing bodies during the entire Soviet period were not released until 1990, just before the dissolution of the USSR. All of these documents confirmed that many of its statesmen, politicians, diplomats, as well as military and intelligence officers, had been born in Ukraine. However, information about their ethnic origin was often omitted. Also, many of those who originated from Ukraine were registered as ‘Russian’ or simply as ‘Soviet’. This is why it is so difficult to assess the full scope of political influence Ukrainians had on the decision-making process in the Soviet Union.

It is true that Ukrainians contributed a great deal to building socialism. If we round them all up, we see that there had always been very large numbers of people from Ukraine in the top tiers of power. Two of them, Nikita Khrushchev and Leonid Brezhnev, ruled the country as general secretary of the Communist Party’s Central Committee. The country’s final ruler, Mikhail Gorbachev, was the descendant of Ukrainian peasants who had moved to Stavropol. [..] The Ukrainian Soviet Socialist Republic was managed by local elites, which is completely at odds with the modern myth of Ukraine having been an ‘oppressed nation’ in the Soviet Union. Moreover, so many Ukrainians held key positions in the Soviet government that any allegations made by the present-day Ukrainian authorities about the Ukrainian SSR struggling under the yoke of the Russian SFSR and being de facto Soviet Russia’s colony simply don’t have a leg to stand on.

On the contrary, by the 1950s, the Ukrainian SSR had become a full-fledged statelet that had its own constitution and flag and even parliament. In fact, its structure mirrored that of the government of the Soviet Union itself. Ukraine’s policy was determined by the Communist Party of Ukraine with the Politburo being its highest body of power; its legislative branch was represented by the Supreme Council (this later became the Verkhovna Rada); and executive power was wielded by the Council of Ministers.

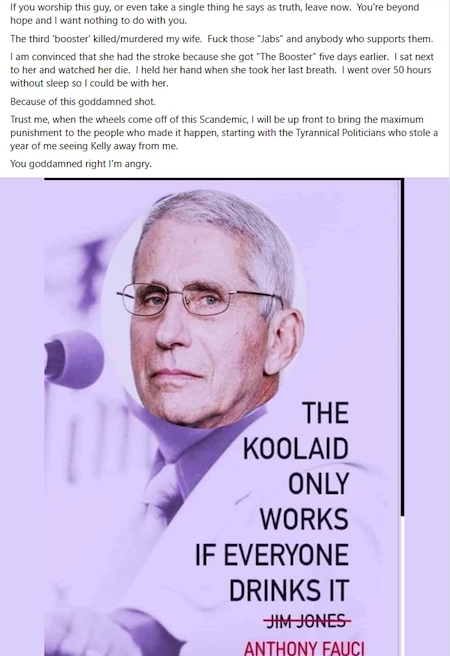

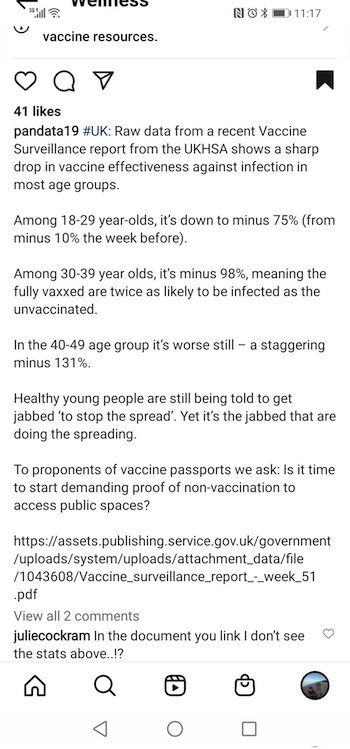

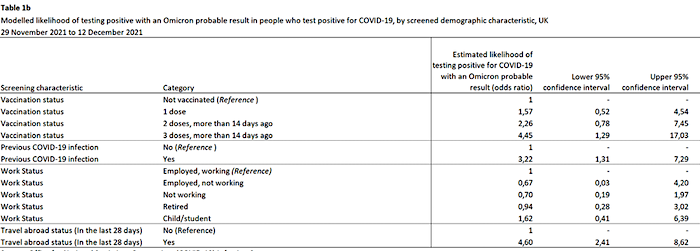

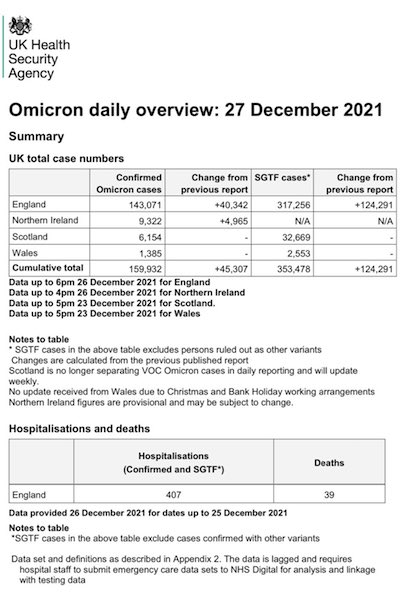

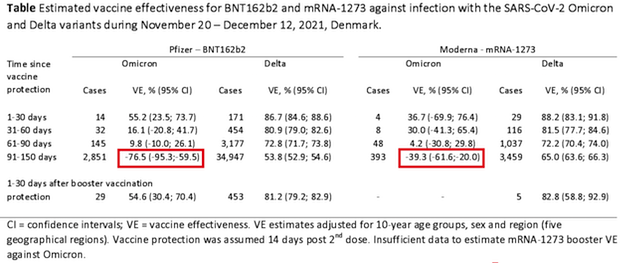

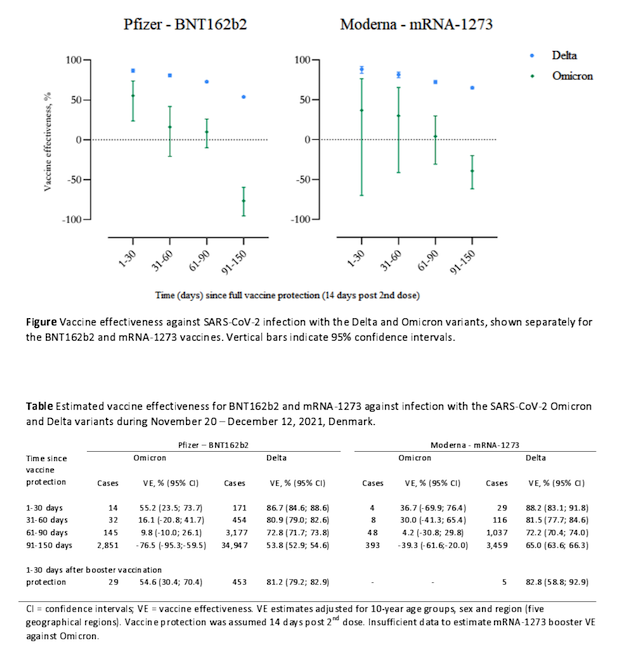

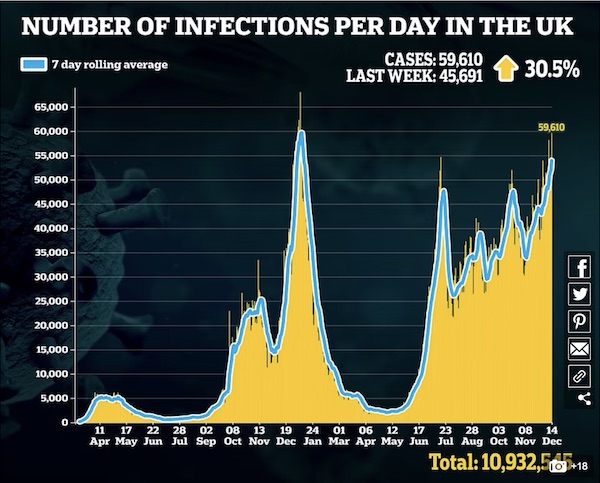

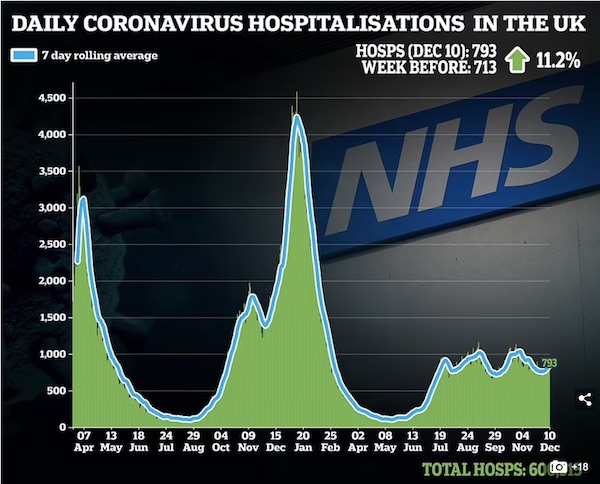

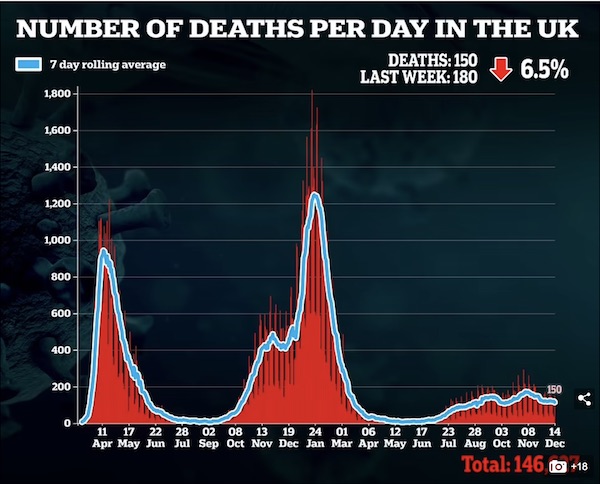

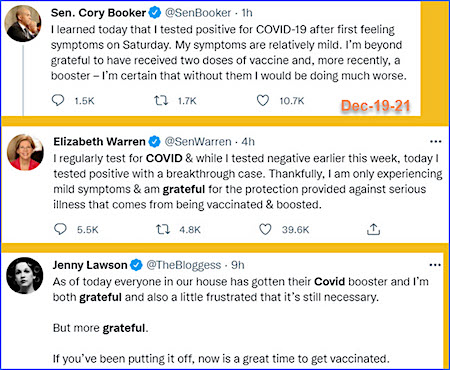

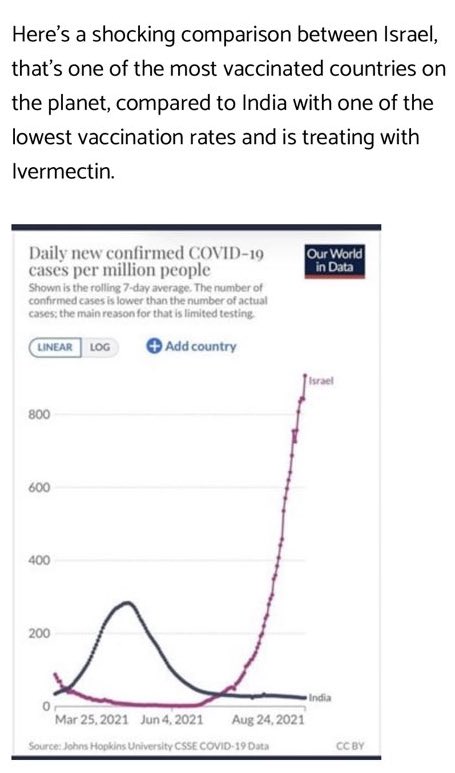

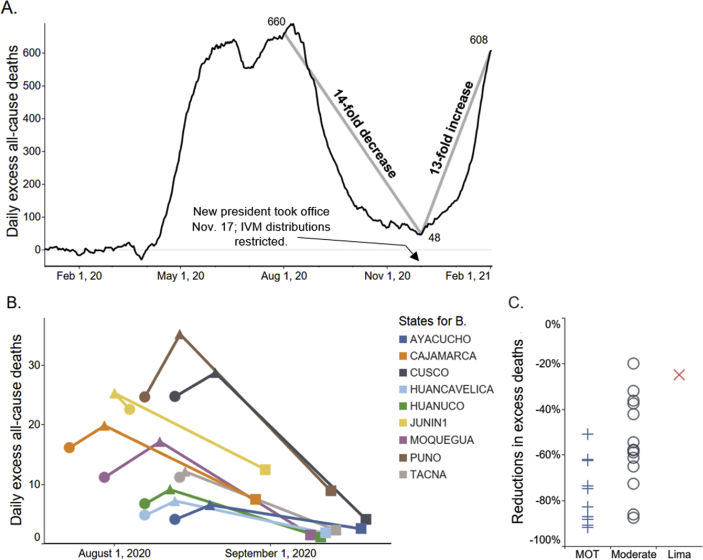

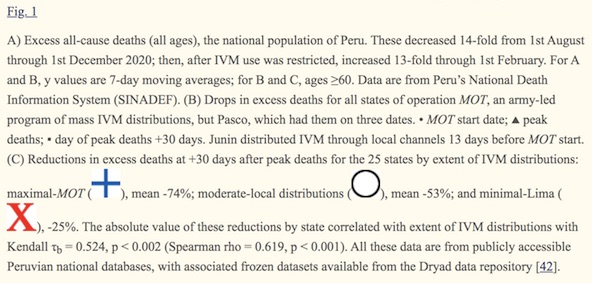

But vaccinate!

• End of Covid in Sight – WHO (RT)

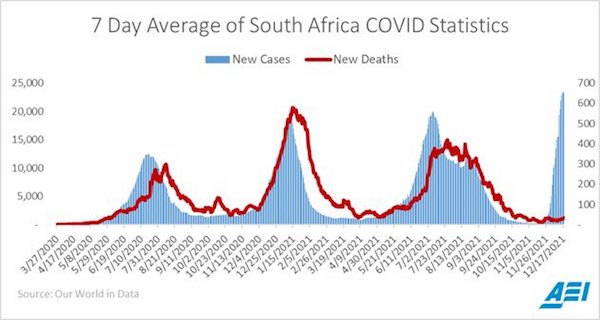

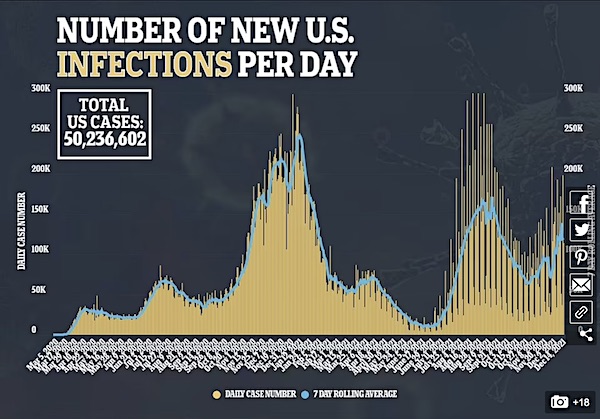

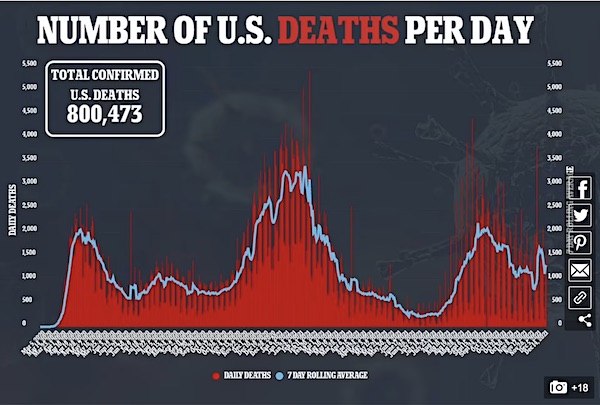

World Health Organization Director General Tedros Adhanom Ghebreyesus declared on Wednesday that the end of the Covid-19 pandemic is close at hand. While the virus is still spreading at the same level as last year, despite mass vaccination, deaths have fallen significantly. “We are not there yet. But the end is in sight,”Tedros said at a press briefing. Claiming that vaccination and other public health measures have reduced the threat posed by the virus, the WHO chief called on governments to push for 100% vaccination of vulnerable people and healthcare workers, and 70% vaccination of the general public.

“A marathon runner does not stop when the finish line comes into view, she runs harder with all the energy that she has left,” he said. “Now is the worst time to stop running.” The impact of vaccines, masks, lockdowns, and other public health measures on the virus’ spread has been a controversial issue, with near-totally vaccinated countries like Singapore still experiencing waves of infection this summer that dwarfed similar spikes in 2021 and 2020. Some 3.1 million cases of Covid-19 were confirmed globally in the week ending September 5, compared to 3.9 million in the same week in 2021, and 1.9 million in the same week in 2020.

Deaths have fallen, however, with 11,000 linked to the virus in the week ending September 5, the lowest weekly total since March 16, 2020. Tedros announced that the WHO would release six policy briefs for governments later on Wednesday, outlining the steps the organization thinks are necessary to avoid “more variants, more deaths, more destruction and more uncertainty.” Among these steps are the aforementioned vaccination push, the maintenance of infection control measures in hospitals, increased testing and sequencing, and the administration of appropriate treatment to patients.

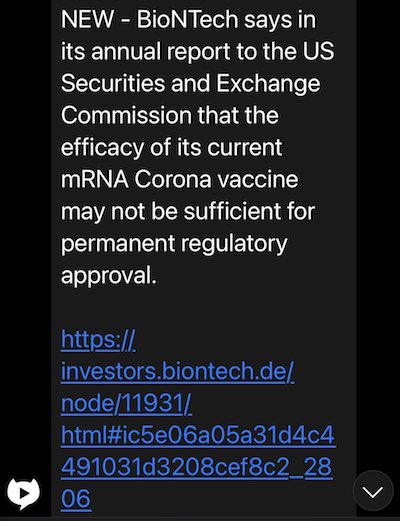

“However, what it will do very effectively, if you got reasonably intact mRNA, is to cause you significant harm. You are playing a game of chance with your immune system and what is in the bottle.”

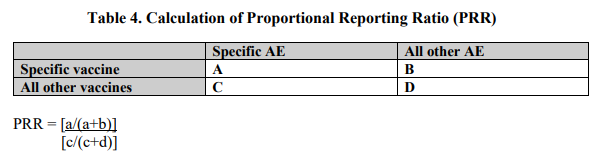

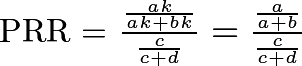

• Why Health Officials Won’t Let Scientists Examine mRNA Vaccine Vials (Mercola)

A 14-minute video (below) that has been overlooked for nearly two years has now resurfaced, exposing stunning information about the COVID-19 jabs and why health officials don’t want individual vaccine vials examined by independent scientists. The reason, it turns out, is because the vials are all different — and the mRNA in the shots “is not intact.” Both of these pose potentially serious problems. In an Aug. 31 Substack article, Steve Kirsch explains: “Even if you are getting 100% intact mRNA which would be really rare, you’re still not getting anything that resembles the virus. So the efficacy as far as PROTECTING you will be next to nothing. “However, what it will do very effectively, if you got reasonably intact mRNA, is to cause you significant harm. You are playing a game of chance with your immune system and what is in the bottle.”

The video notes that members of the European Parliament were only allowed to read the contracts with the drug makers after they’d been heavily redacted. Why the heavy-handed secrecy, even toward legislators? The finding that the mRNA in the shots was of questionable quality was revealed in a British Medical Journal feature investigation article published in March 2021. As explained by the author, journalist Serena Tinari, cyber attackers retrieved more than 40 megabytes of Pfizer COVID-19 jab data from the European Medicines Agency (EMA) in December 2020. The hacked data was subsequently sent to journalists and academics worldwide. It was also published on the dark web. Some of the documents show European regulators had significant concerns over the lack of intact mRNA in the commercial batches sampled.

Compared to the clinical batches, i.e., the shots used in the clinical trial, 55% to 78% of the commercial shots had “a significant difference in % RNA integrity/truncated species.” In one email, dated Nov. 23, 2020, a high-ranking EMA official noted that the commercial batches failed to meet expected specifications, and that the implications of this RNA integrity loss were unclear. In response to the findings, the EMA sent a list of questions and concerns to Pfizer. While we do not know if and how the EMA’s concerns were actually addressed and corrected, the EMA authorized Pfizer’s COVID-19 jab Dec. 21, 2020.

Next please.

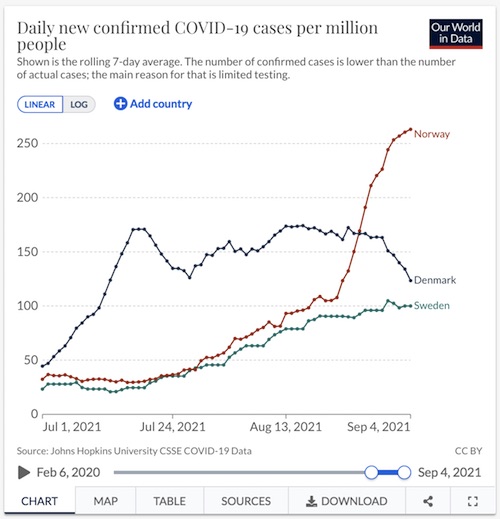

• Denmark ENDS Covid Vaccinations For Almost Everyone Under 50 (Berenson)

Denmark will bar almost everyone under 50 from receiving more mRNA Covid jabs, the Danish Health Authority said yesterday. Denmark had already ended Covid shots for nearly everyone under 18. The new rules go much further. Danes under 50 will only be allowed to receive the shots if they are “higher risk of becoming severely [emphasis added] from Covid-19.” The Danish Health Authority has not yet defined those groups, but they will likely include only a handful of people, such as those receiving cancer treatments that suppress their immune systems. Pregnant women are unlikely to be included.

Denmark did not explicitly say the risks of mRNA jabs now outweigh their benefits for healthy people under 50. But that view is implicit in the announcement, which does not merely discourage but actually bans shots for those people, even though Denmark expects “a large wave of [Covid] infection” in the next few months. In other words, the health authority is not stopping shots because Covid has ended. It now believes most people are better off getting the coronavirus than taking more mRNA. The Danish move is particularly significant because Denmark has an excellent national health care system and has aggressively collected data on Covid and vaccines.

Denmark was among the first countries to stop giving Covid shots to healthy children and teenagers. Now other European countries are beginning to follow, with Britain ending mRNA shots for almost all children 10 and under. In yesterday’s announcement of the new policies, Denmark explicitly dropped any effort to halt the spread of the coronavirus and said that it will focus only on protecting people at very high risk: “We expect that a large part of the population will become infected with covid-19 during the autumn, and we therefore want to vaccinate those having the highest risk so that they are protected from severe illness.”

It’s time for science. Before the climate lockdowns come.

Suppose the climate alarms follow the same pattern the Covid ones do. Take it from there.

• Climate Emergency Not Supported by Data: 4 Leading Italian Scientists (DS)

Four leading Italian scientists have undertaken a major review of historical climate trends and concluded that declaring a ‘climate emergency’ is not supported by the data. Reviewing data from a wide range of weather phenomena, they say a ‘climate crisis’ of the kind people are becoming alarmed about “is not evident yet”. The scientists suggest that rather than burdening our children with anxiety about climate change, we should encourage them to think about issues like energy, food and health, and the challenges in each area, with a more “objective and constructive spirit” and not waste limited resources on “costly and ineffective solutions”.

During the course of their work, the scientists found that rainfall intensity and frequency is stationary in many parts of the world. Tropical hurricanes and cyclones show little change over the long term, and the same is true of U.S. tornadoes. Other meteorological categories including natural disasters, floods, droughts and ecosystem productivity show no “clear positive trend of extreme events”. Regarding ecosystems, the scientists note a considerable “greening” of global plant biomass in recent decades caused by higher levels of carbon dioxide in the atmosphere. Satellite data show “greening” trends over most of the planet, increasing food yields and pushing back deserts.

The four scientists are all highly qualified and include physics adjunct professor Gianluca Alimonti, agrometeorologist Luigi Mariani and physics professors Franco Prodi and Renato Angelo Ricci. The last two are signatories to the rapidly growing ‘World Climate Declaration’. This petition states that there is no climate emergency and calls for climate science to be more scientific. It also calls for liberation from the “naïve belief in immature climate models”. In future, it says, “climate research must give significantly more emphasis to empirical science”.

‘Extreme’ weather events attributed by climate models – somehow – to anthropogenic global warming are now the main staple of the climate alarmist industry. As the Daily Sceptic reported on Monday, Sir David Attenborough used a U.K. Met Office model forecast in the first episode of Frozen Planet II to claim that summer Arctic sea ice could be gone within 12 years. But the likelihood of hardy swimming galas over the North Pole by 2035 seems somewhat remote, not least because Arctic sea ice has been growing in many summers since 2012. According to a recent report from the U.S.-based National Snow and Ice Data Center, at the end of August “sea ice extent is likely to remain higher than in recent years”.

EV-No

The electric vehicle hoax-It’s not about saving energy it’s about being able to control you with a push of a button pic.twitter.com/PbfLBzeugf

— Plana Terra (@Mike727health) September 14, 2022

The list of absurdities gets longer.

• 100 staff at Charles III residence sacked

• £200 million tax avoided by Charles on his inheritance

• 1,000 Cancer treatments cancelled for Monday

• Arrests for disapproving of unelected head of state

• Food banks closed on Monday

• UK Sports Body Tells People Not To Ride Bikes During Queen Funeral (RT)

British Cycling has U-turned on its previous “strong recommendation” that people should refrain from using their bicycles during the Queen’s funeral next week. Though the UK government had stressed there was no obligation to cancel or postpone any events during a period of national mourning following the death of Queen Elizabeth II last Thursday, some sports such as football have widely postponed matches as a mark of respect to the monarch. Adopting a similar stance, British Cycling released guidance that said it “strongly recommends that anybody out riding their bike on the day of the state funeral does so outside of the timings of the funeral service and associated processions, which will be confirmed later this week.”

This caused consternation among cyclists, with one noting that the funeral on Monday, September 19, clashes with their work hours. “Is it OK with you if I don’t follow your absolutely ridiculous advice and bike to work? Or would you rather I, as a mark of respect, pollute the air with my car? Maybe I can honk the national anthem on my horn?” they asked.British Cycling has since deleted the section of its guidance that says people shouldn’t cycle at all during the funeral for the 96-year-old Queen, but fresh recommendations have insisted that amateur cyclists should not go on rides with their clubs on Monday. “As a mark of respect to Her late Majesty Queen Elizabeth II, British Cycling’s guidance is that no formal domestic activities should take place on the day of the State Funeral, Monday 19 September,” it stated.

“This includes cycle sport events, club rides, coaching sessions and community programs (such as Breeze rides).”With good weather expected which often prompts long rides with clubs, this has also drawn criticism and has seen the organization dubbed a “joke” with conduct “worthy of the Stasi,” in reference to the former German state security service in operation from 1950 to 1990. Some cyclists have threatened to cancel their membership, with one balking that British Cycling is “an embarrassment at a time when hatred towards cycling feels at an all-time high.”

It’s what she would have wanted. pic.twitter.com/4DC8EtgXnZ

— GrieveWatch (@GrieveWatch) September 13, 2022

Paul&Fauci

Complete exchange between Sen. @RandPaul and Dr. Anthony Fauci at Monkeypox hearing.

Sen. Paul plays @cspanwj clip of Dr. Fauci.

Fauci: "That film that you showed was really taken out of context…Reuters fact-checked, looked at that…"

Paul: "Actually, words don't lie." pic.twitter.com/d9tvNtli87

— CSPAN (@cspan) September 14, 2022

Wesley Clark

"We’re gonna take out seven countries in five years, starting with Iraq, and then Syria, Lebanon, Libya, Somalia, Sudan and finishing off with Iran." #NeverForget911 pic.twitter.com/odHrNgzVpi

— Sarah Abdallah (@sahouraxo) September 11, 2022

Bridge of Hands, Vietnam

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.