This is Trump’s Trump Card. Stop the empty rhetoric, and stop the warfare. If he can do that, he’ll go down in history as a great president.

• Trump: Only ‘Fools’, ‘Stupid People’, See Good Ties With Russia as Bad (BBG)

Facing calls to strike back at Russia for what U.S. intelligence agencies have termed Moscow’s interference with the 2016 U.S. presidential election campaign, Donald Trump instead suggested warmer relations between the two countries. The president-elect took to Twitter on Saturday to discuss the potential U.S.-Russia relationship under his administration, a day after U.S. spy chiefs briefed him on the Russian measures they said were directed by President Vladimir Putin. “Having a good relationship with Russia is a good thing, not a bad thing,” Trump said in a series of three tweets. “Only ‘stupid’ people, or fools, would think it is bad! We have enough problems around the world without yet another one.” “When I am President, Russia will respect us far more than they do now,” Trump assured his 19 million Twitter followers.

On Friday, top U.S. intelligence officials met with the president-elect at Trump Tower in New York to present evidence that Putin personally ordered cyber and disinformation attacks on the U.S. campaign. Putin developed “a clear preference” for Trump to win, the agencies said in a declassified summary of their findings. The agencies said they “assess Putin and the Russian government aspired to help President-elect Trump’s election chances when possible by discrediting Secretary Clinton and publicly contrasting her unfavorably to him,” according to the report. “All three agencies agree with this judgment. CIA and FBI have high confidence in this judgment; NSA has moderate confidence,” the report said. “Moscow will apply lessons learned from its Putin-ordered campaign aimed at the U.S. presidential election to future influence efforts worldwide, including against U.S. allies and their election processes.”

On Saturday, posts from the Twitter account of the Russian Embassy in the U.K. dismissed the report, calling it “a pathetic attempt at tainting Americans’ vote by innuendo couched in Intel new-speak.” “All accusations against Russia are based on ‘confidence’ and assumptions,” Alexey Pushkov, a member of the Russian Parliament’s upper house, said on Twitter. As Trump’s transition team did in a statement in December, Pushkov drew a parallel with the U.S. intelligence finding of the early 2000s that Iraq’s Saddam Hussein had weapons of mass destruction. The report was released shortly after intelligence chiefs briefed Trump on their findings that Russia was responsible for the hacking of Democratic Party computers and the leaking of e-mails damaging to Democratic presidential nominee Hillary Clinton. Russia has repeatedly denied the accusations.

Trump said negligence by the DNC had allowed the hacking to go ahead. “Only reason the hacking of the poorly defended DNC is discussed is that the loss by the Dems was so big that they are totally embarrassed!” Trump tweeted on Saturday. By contrast, “the Republican National Committee had strong defense!” he said — although the intelligence report said that Russia had targeted both major parties.

Read more …

I guess kudo’s are due to the Boston Globe, generally in the same false news camp as the WaPo and NYT, for publishing this.

• At Home and Abroad, Obama’s Trail of Disasters (BGlobe)

As he prepares to move out of the White House, Barack Obama is understandably focused on his legacy and reputation. The president will deliver a farewell address in Chicago on Tuesday; he told his supporters in an e-mail that the speech would “celebrate the ways you’ve changed this country for the better these past eight years,” and previewed his closing argument in a series of tweets hailing “the remarkable progress” for which he hopes to be remembered. Certainly Obama has his admirers. For years he has enjoyed doting coverage in the mainstream media. Those press ovations will continue, if a spate of new or forthcoming books by journalists is any indication. Moreover, Obama is going out with better-than-average approval ratings for a departing president. So his push to depict his presidency as years of “remarkable progress” is likely to resonate with his true believers.

But there are considerably fewer of those true believers than there used to be. Most Americans long ago got over their crush on Obama, as they repeatedly demonstrated at the polls. In 2010, two years after electing him president, voters trounced Obama’s party, handing Democrats the biggest midterm losses in 72 years. Obama was reelected in 2012, but by nearly 4 million fewer votes than in his first election, making him the only president ever to win a second term with shrunken margins in both the popular and electoral vote. Two years later, with Obama imploring voters, “[My] policies are on the ballot — every single one of them,” Democrats were clobbered again. And in 2016, as he campaigned hard for Hillary Clinton, Obama was increasingly adamant that his legacy was at stake. “I’m not on this ballot,” he told campaign rallies in a frequent refrain, “but everything we’ve done these last eight years is on the ballot.” The voters heard him out, and once more turned him down.

As a political leader, Obama has been a disaster for his party. Since his inauguration in 2009, roughly 1,100 elected Democrats nationwide have been ousted by Republicans. Democrats lost their majorities in the US House and Senate. They now hold just 18 of the 50 governorships, and only 31 of the nation’s 99 state legislative chambers. After eight years under Obama, the GOP is stronger than at any time since the 1920s, and the outgoing president’s party is in tatters. Obama urged Americans to cast their votes as a thumbs-up or thumbs-down on his legacy. That’s what they did. In almost every respect, Obama leaves behind a trail of failure and disappointment.

Read more …

Yes, even the NYT lets slip a line or two about the lack of evidence in the ridiculous US intelligence ‘report’. The article should have stopped at that, but continues in a sort of Macchiavellian spirit (actually uses the term too), trying to save some face.

• Russians Ridicule US Charge That Kremlin Meddled to Help Trump (NYT)

Spies are usually thought of as bystanders who quietly steal secrets in the shadows. But the Russian versions, schooled in techniques used during the Cold War against the United States, have a more ambitious goal — shaping, not just snooping on, the politics of a nation that the Soviet-era K.G.B. targeted as the “main adversary.” That at least is the conclusion of a declassified report released on Friday that outlines what America’s top intelligence agencies view as an elaborate “influence campaign” ordered by President Vladimir V. Putin of Russia aimed at skewing the outcome of the 2016 presidential race. But the absence of any concrete evidence in the report of meddling by the Kremlin was met with a storm of mockery on Saturday by Russian politicians and commentators, who took to social media to ridicule the report as a potpourri of baseless conjecture.

In a message posted on Twitter, Alexey Pushkov, a member of the defense and security committee of the upper house of the Russian Parliament, ridiculed the American report as akin to C.I.A. assertions that Iraq had weapons of mass destruction: “Mountain gave birth to a mouse: all accusations against Russia are based on ‘confidence’ and assumptions. US was sure about Hussein possessing WMD in the same way.” Margarita Simonyan, the editor in chief of RT, a state-funded television network that broadcasts in English, who is cited repeatedly in the report, posted her own message on Twitter scoffing at the American intelligence community’s accusations. “Aaa, the CIA report is out! Laughter of the year! Intro to my show from 6 years ago is the main evidence of Russia’s influence at US elections. This is not a joke!” she wrote.

Even Russians who have been critical of their government voiced dismay at the United States intelligence agencies’ account of an elaborate Russian conspiracy unsupported by solid evidence. Alexey Kovalev, a Russian journalist who has followed and frequently criticized RT, said he was aghast that the report had given so much attention to the television station. “I do have a beef with RT and their chief,” Mr. Kovalev wrote on Twitter, “But they are not your nemesis, America. Please chill.”

Read more …

And Bryan McDonald finished off what the NYT started: “..it appears that we should swallow how RT succeeded where the combined might of CNN, NBC, CBS, The WaPo and the NYT and others failed in influencing the US election.”

• How RT Became The Star Of CIA, FBI & NSA’s Anticlimactic ‘Big Reveal’ (McD)

The eagerly awaited Director Of National Intelligence’s (DNI) report “Assessing Russian Activities and Intentions in Recent US Elections” didn’t need such a long winded title. They could have just called it: “We Really Don’t Like RT.” Almost every major western news outlet splashed this story. But it was probably the New York Times’ report which was the most amusing. America’s “paper of record” hailed the DNI’s homework as “damning and surprisingly detailed.” Then a few paragraphs later admitted the analysis contained no actual evidence. Thus, in a few column inches, the Gray Lady went from describing the DNI’s release as something conclusive to conceding how it was all conjecture. “The declassified report contained no information about how the agencies had collected their data or had come to their conclusions,” the reporter, one David E. Sanger, told us.

He then reached further into his bag of tricks to warn how it is “bound to be attacked by skeptics.” Yes, those skeptics. Aren’t they awful? Like, imagine not accepting an intelligence document at face value? Especially when it warns that a nuclear armed military superpower is interfering in the American democratic process, but then offers not a smidgen of proof for its assertions. Not to mention how it appears to have been put together by a group of people with barely a clue about Russia. For instance, RT progams such as “Breaking The Set” and “The Truthseeker” are mentioned in a submission supposed to be about how RT supposedly cost Hillary Clinton the US Presidential Election. But both of these programmes went off air around two years ago. And, back then, Clinton wasn’t even the Democratic Party candidate for the 2016 contest.

[..] So how bad is this report? You’d have to say on a scale of 1-10, it’d be eleven. The core message appears to be that having a point of view which is out of sync with the liberal popular media is considered a hostile act by US spooks. And it’s specifically the liberal press’ worldview they are defending here. Now, it’s up to you to judge whether this support, from state actors, is justified or not. The DNI’s submission is ostensibly the work of highly qualified intelligence experts, but everything you learn about RT comes from publicly available interviews and Tweets posted by this channel’s own people. Yet, we are supposed to believe how the best Russia brains of three agencies – the CIA, FBI and NSA – laboured to produce this stuff? That said, the latter doesn’t appear to be fully on board, offering “moderate” confidence, in contrast to the other’s “high confidence.”

Approximately a third of the document centers on RT. And it appears that we should swallow how RT succeeded where the combined might of CNN, NBC, CBS, The WaPo and the NYT and others failed in influencing the US election. Not to mention the reality where 500 US media outlets endorsed Clinton and only 25 President-elect Donald Trump. It’s time to scream: “stop the lights!” [..] The DNI’s report is beyond bad. And it’s scary to think how outgoing President Obama has stirred up a nasty diplomatic battle with Russia based on intelligence so devoid of insight and quality. There is nothing here which suggests the authors have any special savvy or insight. In fact, you could argue how a group of students would’ve assembled something of similar substance by simply reading back issues of The New York Times. But the biggest takeaway is that it’s clear how the calibre of Russia expertise in America is mediocre, if not spookily sparse. And while this report might be fodder for amusement, the actual policy implications are nothing short of dangerous.

Read more …

And that’s by no means only true for Britain.

• No One Can Afford To Stop The New Consumer Credit Crisis (G.)

Consumer debt has raised its ugly head again. According to the latest figures, the total has soared back to a level last seen just before the 2008 financial crash. To the untrained eye, the dramatic increase in spending using credit cards and loans might appear to prefigure a disaster of epic proportions. Excessive consumer debt played a big part in the collapse of Northern Rock, and looking back, this landmark banking disaster appears to have been the harbinger of an even bigger catastrophe when, a year later, Lehman Brothers fell over. This is not a view shared by the Bank of England, which says it need only keep a watching brief. Its complacency is born of forecasts of the ratio between household debt and GDP made by the Office for Budget Responsibility.

At the moment, the household debt to GDP ratio is around 140%, compared with almost 170% in 2008. The OBR’s latest analysis predicts that, over the next five years, the combination of consumer and mortgage debt will rise only gradually and fall well short of its pre-crisis peak. There is nothing wrong with judging household debt as a proportion of annual national income to gauge sustainability and the likelihood that borrowers can afford to pay it back. There is nothing wrong with it as long as you assume that GDP has been evenly shared out since the crash and that the people doing the borrowing have higher incomes, thanks to the higher GDP, to cope with repayments. Except that the Bank of England knows most people’s incomes have flatlined for years. It need look no further than official figures, which make it clear that the vast majority have missed out on the gains from GDP growth.

Incomes per head have barely recovered since 2008 and are only marginally ahead. Figures put together by the TUC last year from the official annual survey of hours and earnings paint an even gloomier picture. If they are only half right, the capacity of workers on low and average pay to manage debt payments is significantly diminished. It has estimated that, nationally, workers are more than £2,000 a year worse off after inflation is taken into account than they were in 2008 and more than £4,000 worse off in London. This should tell the central bank and the Treasury that a rise to £192bn in unsecured consumer debt in November – only a little short of the £208bn peak – is most definitely a cause for concern. And it therefore makes no sense to brush aside fears about rising debt levels by pointing to higher GDP. A debt-to-GDP figure is just not that relevant when the incomes of the people taking on the debt are stagnant.

Read more …

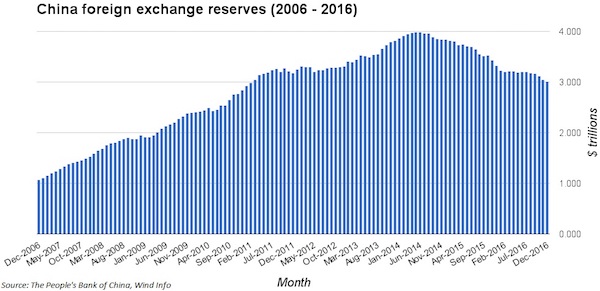

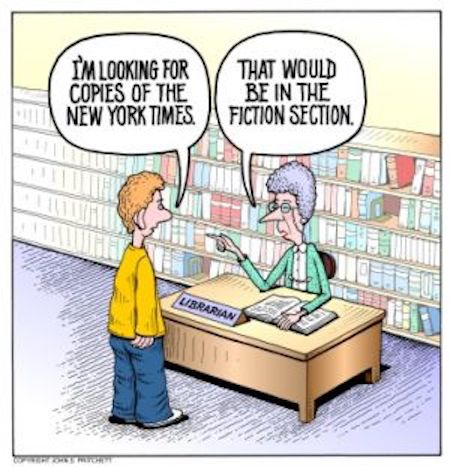

Beijing counting down the days till january 20. It still has $3 trillion left, but 90% or so of that is not available.

• China’s Foreign Exchange Reserves Fall To Lowest Since February 2011 (R.)

China’s foreign exchange reserves fell for a sixth straight month in December but by less than expected to the lowest since February 2011, as authorities stepped in to support the yuan ahead of U.S. President-elect Donald Trump’s inauguration. China’s reserves shrank by $41 billion in December, slightly less than feared but the sixth straight month of declines, data showed on Saturday, after a week in which Beijing moved aggressively to punish those betting against the currency and make it harder for money to get out of the country. Analysts had forecast a drop of $51 billion. For the year as a whole, China’s reserves fell nearly $320 billion to $3.011 trillion, on top of a record drop of $513 billion in 2015. While the $3 trillion mark is not seen as a firm “line in the sand” for Beijing, concerns are swirling in global financial markets over the speed with which the country is depleting its ammunition to defend the currency and staunch capital outflows.

Some analysts estimate it needs to retain a minimum of $2.6 trillion to $2.8 trillion under the IMF’s adequacy measures. If pressure on the yuan persists, analysts suspect China will continue to tighten the screws on outflows via administrative and regulatory means, while pouncing sporadically on short sellers in forex markets to discourage them from building up excessive bets against the currency. But if it continues to burn through reserves at a rapid rate, some strategists believe China’s leaders may have little choice but to sanction another big “one-off” devaluation like that in 2015, which would likely roil global financial markets and stoke tensions with the new Trump administration. The yuan depreciated 6.6% against the surging dollar in 2016, its biggest one-year loss since 1994, and is expected to weaken further this year if the dollar’s rally has legs.

Adding to the pressure, Trump has vowed to label China a currency manipulator on his first day in office, and has threatened to slap huge tariffs on imports of Chinese goods. That has left Chinese eager to get money out of the country, creating what some researchers describe as a potentially destructive negative feedback loop, where fears of further yuan falls spur outflows that pile fresh pressure on the currency. “For 2016 as a whole we estimate total capital outflows to have been around $710 billion,” Capital Economics’ China economist Chang Liu told Reuters in an email. Capital Economics estimated net outflows in November and December alone were $76 billion and $66 billion, respectively.

Read more …

Trump will be willing to negotiate, but there’s doesn’t seem to be much, if any, room for China to move.

• The Growing Threat to Global Trade: a Currency War (Forsyth)

While Trump has talked of imposing a so-called border tax on imports or tariffs, currencies are at the nexus of trade and are the quickest means to try to influence trade flows. In that regard, he has threatened to declare China a “currency manipulator” on Day One of his administration for allegedly pushing down the yuan to gain an export advantage. The risk is that this will escalate into a currency war, with both sides attempting to gain a trade advantage, and that it ultimately ends up disrupting global trade and financial markets. As with any war, this one should be avoided at all costs. But the events of the past year suggest never say never. [..] China, of course, is central to Trump’s strategy to reduce the U.S. trade deficit.

Harris writes that this includes three actions: naming China a currency manipulator; bringing trade cases against it under the WTO and U.S. rules; and using “every lawful presidential power to remedy trade disputes if China does not stop its illegal activities, including its theft of American trade secrets.” In addition, last week the president-elect named Robert Lighthizer as U.S. trade representative, adding him to the hawkish team of Peter Navarro, director of the new National Trade Council, and Commerce Secretary-designate Wilbur Ross. While the U.S. and China may find common ground on environmental regulation in China, given the unbreathable air in Beijing and other cities, Harris thinks it’s unlikely China would concede that it is manipulating its currency.

“China is currently fighting to prevent currency weakness, selling its foreign currency reserves to offset private capital flight from the country,” he continues. China’s reserves have fallen by about $1 trillion, to just over $3 trillion as of November; the latest data, due this weekend, will be closely watched to see how much Beijing’s cache has been depleted. That said, “some academics in China are suggesting the country should respond to being declared a ‘manipulator’ by letting the currency float, triggering even more weakness,” adds Harris. Other observers see such a course as dangerous. Danielle DiMartino Booth, writing in her latest Money Strong missive, quotes Leland Miller, president of China Beige Book, a private research group, that the last thing Beijing wants is a floating yuan.

“It would hurt them much more than anyone else and be greeted with massive retribution from every corner of the world. There would be countervailing devaluations and would cause global contagion,” he contends. “It would also be a major blow to [President] Xi’s credibility during a politically sensitive year, since he’s pledged to not float the currency. And it would NOT stanch outflows; all it would do is exacerbate them.”

Read more …

The independent Fed talking politics?!

• Fed’s Powell Urges Congress to Take Another Look at Volcker Rule (BBG)

Federal Reserve Governor Jerome Powell urged Congress to rewrite the Volcker Rule that restricts proprietary trading, while urging “a high degree of vigilance” against the buildup of financial risks amid improving U.S. growth. “What the current law and rule do is effectively force you to look into the mind and heart of every trader on every trade to see what the intent is,” Powell said Saturday at the American Finance Association meeting in Chicago. “Is it propriety trading or something else? If that is the test you set yourself, you are going to wind up with tremendous expense and burden.” Powell’s comments compare to Fed Chair Janet Yellen, who has supported the sweeping bank rules of the 2010 Dodd-Frank Act in the wake of the global financial crisis. President-elect Donald Trump has vowed to dismantle Dodd-Frank. The Volcker Rule restricts banks with taxpayer-backed deposits from making certain types of speculative “proprietary” trades.

“We don’t want the largest financial institutions to be seriously engaged in propriety trading,” Powell said. “We do want them to be able to hedge their positions and create markets.” Powell said that the Volcker Rule, as enacted by U.S. lawmakers, doesn’t achieve that goal. “I feel the Congress should take another look at it.” In the text of his remarks, Powell urged more monitoring of financial risks following a period of record low interest rates, citing commercial real estate as one area of concern. “More recently, with inflation under control, overheating has shown up in the form of financial excess,” Powell said. “The current extended period of very low nominal rates calls for a high degree of vigilance against the buildup of risks to the stability of the financial system.”

Read more …

Is this simply the Fed trying to pass on the blame?

• New Policies Coming To America Could Take Weight Off Fed: Powell (R.)

A push by Washington for more business-friendly regulation and fiscal support for the economy could improve America’s mix of policies which in recent years have relied too much on the Federal Reserve, Fed Governor Jerome Powell said. Powell, speaking on Saturday at a conference, did not mention the incoming Trump administration by name but his comments suggest some Trump policies will be welcomed by U.S. central bankers who have been urging other institutions to do more to help the economy. “We may be moving more to a more balanced policy with what sounds like more business-friendly regulation and possibly more fiscal support,” Powell told an economics conference in Chicago. President-elect Donald Trump, who takes office on Jan. 20, has promised to double America’s pace of economic growth, “rebuild” its infrastructure and slash regulatory burdens.

About half of the Fed’s 17 policymakers factored a fiscal stimulus into their economic forecasts published in December, according to minutes from the Fed’s December policy meeting. That expected stimulus has led several policymakers to say the Fed will likely raise rates more quickly, but Powell said new policies could also ease the Fed’s burden. “Monetary policy (might be) able to hand it off and I think that’s a healthier thing,” he said. “We may be moving to a more balanced policy mix.” Following a Congress-enacted fiscal stimulus during and immediately after the 2007-09 recession, the Fed in recent years has been widely seen as the economic authority working the hardest to help the economy. But throughout 2016, Fed policymakers worried publicly that the U.S. economy was stuck in a low growth path and central banking tools could do little to fix this. Central bankers urged Congress and the U.S. president to pass laws that would help make U.S. businesses and workers more productive.

Read more …

“..it might be more of a matter of Trump not wanting many economists in his administration..”

• Economists Want to Be Members of Donald Trump’s Team (BBG)

Economists aren’t shying away from joining Donald Trump’s administration and would be willing to pitch in if asked, according to former economic policy makers now in academia. “The president will be able to get any economist he asked for,” said Glenn Hubbard, who served President George W. Bush as chairman of his Council of Economic Advisers from 2001 to 2003 and is now dean of Columbia University’s Graduate School of Business. Hubbard spoke Saturday in Chicago at the American Economic Association annual conference. A delay in naming a new CEA chair and reports that the position might go to CNBC commentator Lawrence Kudlow spawned speculation that leading academic economists were reluctant to join a team headed by an avowed skeptic of free trade.

“I don’t see that,” said John Taylor, an economics professor who served in the Bush administration as under secretary of Treasury for international affairs and now teaches at Stanford University. “It’s a pretty exciting time and lots of things are going on,” said Taylor, who worked in three other administrations as well. Alan Krueger, who led the CEA in the White House of President Barack Obama from 2011 to 2013 before passing the torch to incumbent Jason Furman, suggested that it might be more of a matter of Trump not wanting many economists in his administration, rather than the other way around. “I worry more about the demand side than the supply side,” said the Princeton University professor said. The audience laughed.

Read more …

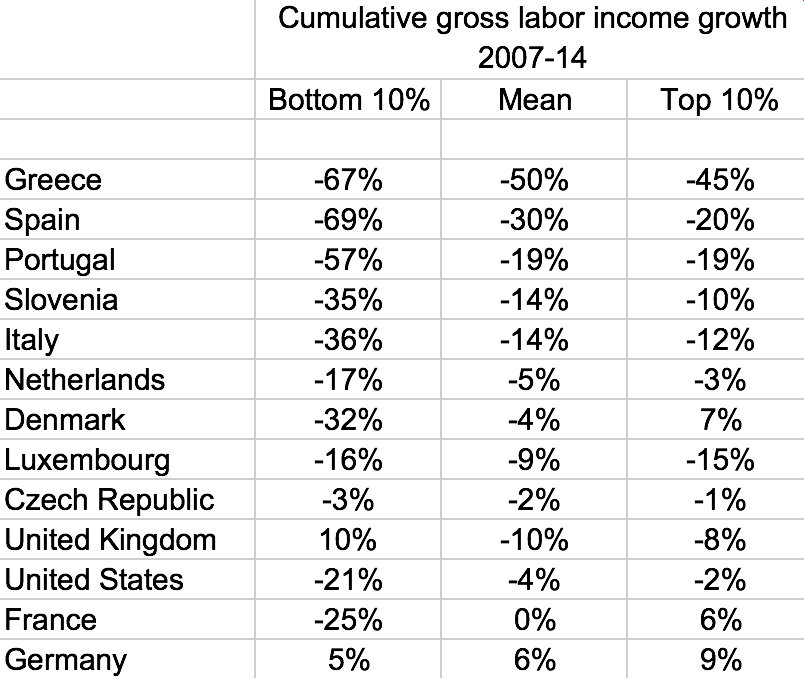

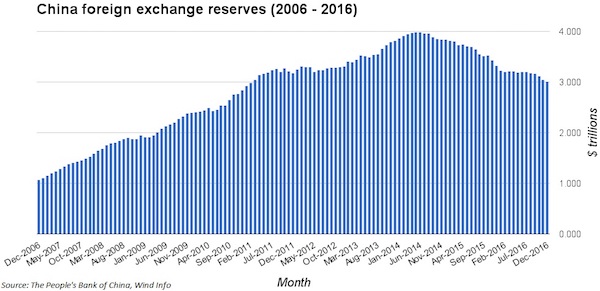

Should have thought of that earlier. Because this has been evident for a very long time: Germany is the biggest beneficiary of the European community – economically and politically.” Just look at the graph I inserted at the bottom of this article.

• EU Collapse ‘No Longer Unthinkable’ – German Vice Chancellor Gabriel (R.)

Germany’s insistence on austerity in the euro zone has left Europe more divided than ever and a break-up of the European Union is no longer inconceivable, German Vice Chancellor Sigmar Gabriel told Der Spiegel magazine. Gabriel, whose Social Democrats (SPD) are junior partner to Chancellor Angela Merkel’s conservatives in her ruling grand coalition, said strenuous efforts by countries like France and Italy to reduce their fiscal deficits came with political risks. “I once asked the chancellor, what would be more costly for Germany: for France to be allowed to have half a percentage point more deficit, or for Marine Le Pen to become president?” he said, referring to the leader of the far-right National Front. “Until today, she still owes me an answer,” added Gabriel, whose SPD favors a greater focus on investment while Merkel’s conservatives put more emphasis on fiscal discipline as a foundation for economic prosperity.

The SPD is expected to choose Gabriel, their long-standing chairman who is also economy minister, to run against Merkel for chancellor in September’s federal election, senior party sources said on Thursday. Asked if he really believed he could win more votes by transferring more German money to other EU countries, Gabriel replied: “I know that this discussion is extremely unpopular. But I also know about the state of the EU. It is no longer unthinkable that it breaks apart,” he said in the interview, published on Saturday. “Should that happen, our children and grandchildren would curse us,” he added. “Because Germany is the biggest beneficiary of the European community – economically and politically.”

Read more …

Thanks, Angela.

• Greeks’ Mental Health Suffering (Kath.)

More than half of Greeks complain of mental health problems, with stress, insecurity and disappointment among the issues most commonly cited, according to the results of a nationwide survey by the National School of Public Health, known by its acronym ESDY. Over half of the 2,005 adults polled (53.9%) said their mental health had not been good over the past month due to stress, depression or other emotional problems. A quarter (24.8%) of respondents, identified poor physical or mental health as causing problems in their daily lives. A total of 15% said they felt insecurity, anxiety and fear, with 14% citing anger and frustration, 9.7% complaining of depression and sadness, 8.2% of stress and 44.6% citing all these ailments.

Four in 10 (42.6%) said they only enjoyed their lives “moderately” and one in 10 said they thought their lives had little or no meaning. The findings came as official figures showed that cases of depression rose from 2.6% of the population in 2008 to 4.7% in 2015. Responding to broader questions about their health and lifestyle, 20% of those polled said their diets had been insufficient over the past month due to low finances. According to health sector experts, however, the repercussions of the economic crisis on citizens’ health are less severe than many had feared. In comments to Kathimerini, Yiannis Kyriopoulos, a professor of health economics at the ESDY, said the findings of the study “simply observe a slowdown in the improvement of health indicators.”

Read more …