Eugène Delacroix Les femmes d’Alger 1834

Trump is going to need something earth-shattering to turn the election around. Sidney Powell promises exactly that – “I’m going to release the Kraken” -, but let’s see it. The legal team says they have people from inside Dominion on record. Bring them on.

• “Never Bet Against Me” (York)

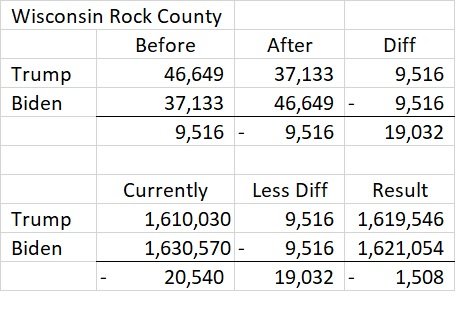

It was definitely an optimistic scenario and one at odds with the current state of the race. Wisconsin has already been called for Joe Biden, who has a lead of 20,546 votes. Arizona has just been called for Biden, with a lead of 11,390 votes. Georgia has not been called yet and is headed for a recount, the hand recount that Trump wanted, with Biden leading by 14,057 votes. North Carolina, on the other hand, looks good for Trump. Although it has not yet been called, the president leads Biden by 73,244 votes.

Then, there are Michigan and Pennsylvania. Both have been called for Biden, who has a 148,382-vote lead over Trump in Michigan and a 54,273-vote lead over Trump in Pennsylvania. There is no way that many votes for Trump could appear, so the president’s hope is for the protests to work — so far, they haven’t — and also, in Pennsylvania, for a judicial victory over the state Supreme Court’s unilateral decision to extend the deadline in which mail-in votes could be received. That is a case Trump should definitely win — the state court completely ignored the legislature’s constitutional authority to make such decisions — but that does not mean it will make much difference in the vote totals.

Indeed, the picture looks bleak for the president. As he spoke on Thursday, GOP strategist Karl Rove, Hugh Hewitt, and this newsletter noted that it is impossible, or all but impossible, for him to come back in enough states to win the election. At one point in the conversation, the president seemed to consider and then quickly reject the idea of losing. “I’m a guy who realizes — five days ago, I thought, ‘Maybe,'” he said, pausing for just a second. “But, now I see evidence, and we have hundreds of affidavits,” referring to the testimonials included in his lawsuits.

Democrats and their allies in the press, of course, are demanding that Trump drop his legal challenges. They are nothing more than a “temper tantrum” by the president and Republicans, Senate Minority Leader Chuck Schumer said Thursday. On the other hand, many in the GOP would prefer to let the process run its course. But one voice on the Left is also arguing that the litigation should go ahead. “Americans should not worry about these suits,” wrote Jed Shugerman, a professor at Fordham Law School, in a Washington Post op-ed. “Indeed, we should welcome them.” Shugerman said he does not believe the various Trump suits have any merit and indeed thinks they will all be thrown out of court. That, he said, would highlight their shortcomings.

But then: “It is also a bad idea, as a general matter to object to election law litigation. In two years, or four years — and possibly in two months in Georgia — the shoe may be on the other foot. It would look hypocritical to condemn the very idea of challenging an election result now, only to turn around and do so in different (albeit more legitimate) circumstances.” Whatever the case, Trump is forging ahead. When I asked him how quickly he might turn things around, he said, “I don’t know. It’s probably two weeks, three weeks.” He knows the situation. He has heard many people tell him it’s over and time to concede. But at the very least, it is important for his most devoted supporters to see him fighting to stay in office. And he closed with a good-natured warning for everyone who has told him there is no hope: “Never bet against me.”

Sidney Powell: “I’m going to release the Kraken”

Michael Flynn attorney Sidney Powell says she has “staggering” statistical evidence and testimony to show Dominion voting machines altered ballots and this deception stems back to Venezuela, Cuba, and China. She’s says “I’m going to release the Kraken.” pic.twitter.com/50mQdHnOuS

— Daniel Chaitin (@danielchaitin7) November 13, 2020

Million MAGA March in DC this weekend.

• McEnany, Navarro Say Trump Expects To Serve Second Term (ZH)

Press Secretary Kayleigh McEnany has earned even more scorn from her MSM reporter-adversaries over the past couple of days for sharing poll-watcher affidavits calling into question the results in Michigan and other swing states that broke away from the Dems’ “blue wall” back in 2016. Now, after Peter Navarro said earlier that he’s operating on the assumption that there will be a second term for President Trump, Press Secretary Kayleigh McEnany confirmed in comments to the press on Friday morning that President Trump is operating under the assumption that he’s headed for a second term. “We are moving forward here at the White House under the assumption that there will be a second Trump term…we think he won that election,” Navarro said earlier, adding that any “speculation” about what Joe Biden might do is moot at this point.

A few days ago, Secretary of State Pompeo appeared to crack a joke about a second Trump term, which infuriated the media. According to the press, contesting the vote count isn’t the only strategy for staying in the White House currently under consideration. Trump has reportedly floated the idea of Republican legislatures intervening to pick pro-Trump electors in a handful of key states to deliver him the election in the Electoral College. Still, that story, by the NYT’s Maggie Haberman, one of Trump’s most-hated journos, claimed that Trump “knows it’s over” and that “there is no grand strategy at play”. She also claimed that by sticking with the narrative of victory, Trump is trying to galvanize his supporters for “whatever comes next”.

Some have suggested that the GOP is going along with Trump to ensure that the base comes out to vote in a pair of special elections in January where two GOP senators are facing reelection in Georgia, typically a red state that has seen reams of out-of-state money flow in thanks to Stacy Abrams. Meanwhile, as a “next step”, the NYT claims that Trump plans to seriously discuss running again in 2024. We thought he was going to launch his own digital media company to compete with Fox?

Jack Murphy

This guy knows what’s up pic.twitter.com/1ijhE7rNaV

— Emily✨ (@astateofEmily) November 13, 2020

Voting without ID.

• New Federal Lawsuit Seeks To Toss 800,000 Ballots In Wisconsin (WE)

A federal lawsuit filed by three voters in Wisconsin seeks to have hundreds of thousands of ballots thrown out in three counties, including in the state’s two largest counties, which are Democratic strongholds. The lawsuit filed on Thursday in the U.S. District Court in Green Bay contends that the absentee voting process in Milwaukee County, Dane County (where Wisconsin’s capital of Madison is located), and Menominee County included “illegal votes” and thus must have their presidential election results invalidated. If the long-shot lawsuit succeeds, it would add the state’s 10 Electoral College votes to President Trump’s ledger.

The plaintiffs focus part of their argument on “indefinitely confined voters.” State law allows those self-reporting as indefinitely confined to vote without a photo ID due to confinement to their residence because of age, physical illness, or disability for an indefinite period of time. This year, the number of indefinitely confined voters increased by a striking rate amid the coronavirus pandemic. Last year, some 72,000 voters said they were indefinitely confined. That number reportedly exploded to 243,000 voters this year.

In March, the Dane County clerk drew a flurry of controversy when he said that state’s order met the threshold for voters to list that they were indefinitely confined, thus bypassing the requirement to provide photo ID. Milwaukee County’s clerk offered similar guidance, citing the pandemic. Republicans quickly cried foul, and the Wisconsin Supreme Court later sided with the GOP and said that the “advice was legally incorrect.” Despite the state Supreme Court’s rebuke, a GOP official told the Washington Examiner earlier this week that voters who listed themselves as indefinitely confined and requested an absentee ballot during the primaries automatically received another absentee ballot for the November election without being asked again to provide photo ID.

The Thursday federal lawsuit contends that in addition to Dane and Milwaukee counties, Menominee also encouraged people to request absentee ballots. Menominee is a small, majority-Native American county that is heavily Democratic and cast 1,303 ballots in favor of President-elect Joe Biden to 278 for Trump. The lawsuit also raises issues with absentee ballot witness signatures and the addition of the ballot witness’ addresses on the ballot envelope, another point Republicans have said they are looking into. A Republican source told the Washington Examiner that observers at the polls noticed that “a lot” of the ballot envelopes had been edited by clerks.

The US Military Has Raided And Seized Servers In Germany Tied To The Dominion Election System

Craziest story of the day?!

• Trump’s Anti-ISIS Envoy Misled President About US Troop Numbers In Syria (RT)

When President Donald Trump ordered all but a few hundred US troops withdrawn from Syria, his own diplomats hid the true number of American forces from the president, envoy Jim Jeffrey has revealed in a new interview. “We were always playing shell games to not make clear to our leadership how many troops we had there,” Jeffrey, envoy to the global coalition against Islamic State (IS, formerly ISIS) told Defense One on Thursday. Jeffrey added that the actual number of troops in northeastern Syria is “a lot more” than the 200-400 that Trump agreed to leave behind last year. Trump’s withdrawal appeared to make good on his campaign-trail promise to extricate the US from its “forever wars” in the Middle East.

Trump, who referred to Syria in 2018 as “sand and death,” angered a host of Pentagon chiefs and diplomats when he announced the near-total pullout from the country last October. Defense Secretary Jim Mattis resigned in protest when Trump first announced withdrawal plans in 2018, and Jeffrey said on Thursday that the decision was “the most controversial thing in my fifty years in government.” Jeffrey’s predecessor, Brett McGurk, also handed in his notice when Trump revealed the pullout. Taking over from McGurk, Jeffrey and his team routinely misled the president to ensure that “there was never a Syria withdrawal.” Even before he signed up to work for the Trump administration, Jeffrey’s opposition to the president was well known.

Shortly after Trump was named as the Republican candidate in 2016, Jeffrey signed a letter declaring that the businessman and TV host “would be the most reckless president in American history.” The letter’s other signatories included a host of Bush administration security officials, who helped shape the policies that destabilized the Middle East and gave rise to Islamic State. Despite his open and secret opposition to Trump’s policies, Jeffrey told Defense One that the president’s “modest” approach to the Middle East has yielded better results than George Bush’s military interventionism or Barack Obama’s apologetic overtures to Muslim leaders while arming extremist militias in Syria. Trump, by contrast, has managed to put together a political alliance between Israel and a number of Gulf states, while maintaining relations with Iraq and focusing pressure on Iran. Conflict in the region is frozen in a “stalemate,” Jeffrey noted. “Nobody really wants to see President Trump go, among all our allies,” he said. “The truth is President Trump and his policies are quite popular among all of our popular states in the region. Name me one that’s not happy.”

Tucker.

• Joe Biden’s Agenda Is Meant For America’s Unhappy Rich Ladies (Fox)

We’re told that Joe Biden is our president-elect and he will shuffle into the White House in January with something called a “mandate.” If that’s true, what exactly is he going to do with this mandate? That’s an interesting question, but almost no one is asking it. Instead, our news media is busy swarming Rudy Giuliani, a former mayor who hasn’t held public office in decades, because he has questions about some of the voting that took place last week. Therefore, he’s an imminent threat to the republic requiring blanket coverage. But whatever you do, do not cover the guy that you claim is president. The Biden people are fine with this, by the way. They don’t want to deal with the media either, so they’re not. On Tuesday, Ryan Lizza of Politico noticed “[D]iscouraging signs about the Biden team and press access so far.

“[N]o regular transition briefings, no readout of calls with foreign leaders … no open press access to the candidate and his people,” Lizza wrote. “This is a break with tradition.” Of course, it is a break with tradition and it’s worrisome, but you’re not allowed to notice it. Biden supporters immediately screamed at Ryan Lizza to shut up. So what exactly is going on behind this news blackout veiling Joe Biden from public view? Well, pretty much exactly what you expect: They are busy rewarding the forces of repression that made these election results possible. Guess who’s first in line? You guessed it, the tech monopolies. They did their job. They shutdown one side, protected the other.

And now it’s time for the reward. In one of his first acts as president elect, Joe Biden named a man called Ron Klain to be his chief of staff. Now, Klain worked for Biden before and is a close ally. That’s the story that you’ve read about why he got the job. But that’s not why he got the job. Ron Klain is also a lobbyist for Big Tech. Four years ago, he joined the executive council of Silicon Valley’s lobbying arm in Washington. Ron Klain was not chosen for his success as a public servant. We know that because last year, he acknowledged that the Obama administration, where he was a senior official, totally mishandled the swine flu pandemic, the one that came before this one.

“Schiff, as he usually does when he moves his mouth, was lying..”

• Biden, Media, CIA, Schiff: Biden Emails “Russian Disinformation” (Greenwald)

Congressman Adam Schiff, the Chairman of the House Intelligence Committee and, not coincidentally, the single most shameless pathological liar in the U.S. Congress by a good margin, appeared on CNN with Wolf Blitzer on October 16 to discuss The New York Post story about Hunter Biden’s emails. The CNN host asked him a rhetorical question embedded with baseless assumptions: “does it surprise you at all that this information Rudy Giuliani is peddling very well could be connected to some sort of Russian government disinformation campaign?” Schiff stated definitively that it is: “we know that this whole smear on Joe Biden comes from the Kremlin,” adding: “clearly, the origins of this whole smear are from the Kremlin, and the President is only too happy to have Kremlin help in amplifying it.”

Referencing Trump’s promotion of The New York Post reporting while at his White House desk, Schiff said: “there it is in the Oval Office: another wonderful propaganda coup for Vladimir Putin, seeing the President of the United States holding up a newspaper promoting Kremlin propaganda.” Schiff, as he usually does when he moves his mouth, was lying: exploiting CNN’s notorious willingness to allow Democratic officials to spread disinformation over its airwaves without the slightest challenge. Schiff claimed certainty about something for which there was and still is no evidence: that the Russians played a role in the procurement and publication of the contents of Hunter Biden’s laptop.

As he also usually does when he publicly lies, Schiff was merely echoing the propaganda of current and former operatives of the CIA and other arms of the intelligence community who abuse their power to interfere in U.S. domestic politics: the very factions over which the Intelligence Committee run by Schiff is supposed to exercise oversight supervision, not serve as their parrot. During the same week as Schiff’s CNN appearance, as Politico reported, “more than 50 former senior intelligence officials signed on to a letter outlining their belief that the recent disclosure of emails allegedly belonging to Joe Biden’s son ‘has all the classic earmarks of a Russian information operation.’”

In that letter from intelligence operatives about The New York Post story — signed by Obama’s former CIA chief John Brennan now of MSNBC (repeatedly caught lying), Obama’s former Director of National Intelligence James Clapper now of CNN (who got caught lying to the Senate about NSA domestic spying), Bush’s former NSA and CIA chief Micheal Hayden now of CNN (who served during 9/11 and the Iraq War), and dozens of other similar professional disinformation agents — the intelligence operatives announced “our view that the Russians are involved in the Hunter Biden email issue,” adding “that our experience makes us deeply suspicious that the Russian government played a significant role in this case.”

“The algorithm appears to subtract votes from one candidate and add them to the other candidate. It’s a feature, not a bug. Weird, a little bit.”

• The Worm in the Machine (Jim Kunstler)

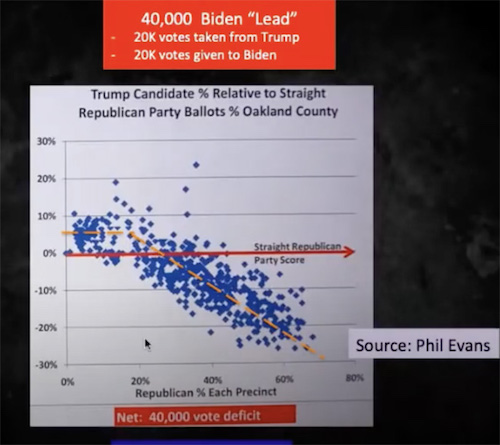

The avatars of good government, Joe Biden, and his righteous Democrats, seem a little bit spooked by the globe-of-silence enveloping Mr. Trump and his lawyers the past few days. The Dems’ narrative at this point, mid-game, is that… “the election was the most secure in the nation’s history” (The New York Times). Anything else is a “conspiracy theory.” Here’s what the Democrats don’t tell you: theories are subject to proof, and proof brings theories into compliance with reality, including, sometimes, the part about conspiracy. Such as a conspiracy to queer the recent election with vote tabulation software and other wizardries. I guess we’ll find out what can be proven, and that is all the president is attempting to do, like anybody with faith in the scientific method. In Oakland County, Michigan, for instance, comprising the northwest suburbs and exurbs of Detroit, the graph shows a mysterious bending of votes off a trend-line at a pretty clear break-point. Each blue square is a voter precinct.

Chart by Dr. Shiva Ayyadurai

The very same plotline is repeated in several other Michigan counties heavily trending for the president in early voting and then swooning mysteriously for Mr. Biden after a four-hour break in action. How to account for this strange occurrence? The worm in the machine, perhaps: a simple algorithm (i.e., set of coded instructions) embedded in the Dominion vote tabulation software — product of a company, to remind you, partially owned by Senator Feinstein’s husband, Richard C. Blum, and represented by lobbyist Nadeam Elshami, Nancy Pelosi’s former chief of staff. It was Mr. Elshami’s mission to visit state legislators around the country and persuade them to adopt (that is, purchase) the Dominion system. The algorithm appears to subtract votes from one candidate and add them to the other candidate. It’s a feature, not a bug. Weird, a little bit.

So, that’s one thing that remains to be proven. How did the algorithm work? Can it be isolated and described? Did its task leave digital footprints? Not all the software geniuses in the USA work for Silicon Valley. Some may be assisting Mr. Trump’s attorneys in figuring this out and constructing cases for the various courts. Since it takes more than a day-and-a-half to bring lawsuits, that may account for the Democrats’ rush to peremptorily discard such formal inquiries and just declare Mr. Biden the winner. Similar ballot tabulation doings show up in the Georgia vote, where a recount is underway, this time with observers and without four-hour mystery pauses. And then there is Pennsylvania.

“Kissinger has killed a lot of friends of mine, beginning in Chile in 1973. He killed a lot of children who look like my children, in Vietnam, Laos, and Cambodia. And he is a personal role model of Tony Blair, to whose incarceration for war crimes and crimes against humanity my own life is now dedicated.”

• The Winner Of The Most Coveted Henry Kissinger Endorsement Is… Joe Biden (RT)

Nixon’s secretary of state and the arch realist of Washington has given his blessing to the former vice president. Let the bombs fall where they may… No matter what happens in the Supreme Court, Joe Biden will always have Henry KissingeThe oldest-living war criminal – Kissinger, not Biden – has made clear his preference for the oldest living senator (Biden claimed during the campaign he’d been in the Senate for 180 years) and perhaps come January the oldest ever president to take the oath. You may not share my religious beliefs, but I consider the continued sulphurous presence of Henry K proof of Satan’s existence on Earth. To my mind, no man since Hitler has more blood on his hands than Kissinger. But I must declare an interest.

Kissinger has killed a lot of friends of mine, beginning in Chile in 1973. He killed a lot of children who look like my children, in Vietnam, Laos, and Cambodia. And he is a personal role model of Tony Blair, to whose incarceration for war crimes and crimes against humanity my own life is now dedicated. From the killing fields of Indo-China, through the years of living dangerously in Suharto’s Indonesia, to the ruins of La Moneda and corpse of Salvador Allende, and to the ghost city of Quneitra in Syria. There is, in fact, no operating theatre of bloody colonialism since the 1960s in which he hasn’t been so steeped in blood that a commemorative statue wouldn’t have been in order. And he’s backed Biden. The “vulgarity” of Donald J. Trump was just TOO much for Henry K.

To Business Insider, “the most famous Secretary of State the US has had” revealed “I like Joe Biden,” whom he described as “thoughtful and moderate.” Just like himself, in fact. When Biden bombs it will be with regret rather than relish. They will be humanitarian bombs, just like Barack O’Bomber’s were. That there will be rather more of them, and in fresh countries too, is something, dear reader, you will have to prepare yourself for. There will be no “Muslim ban,” just the continuation of Muslim-bombing. Including a resumption of Muslim-bombing in the likes of Syria. But these bombers, at least, will be adorned with Black Lives Matter paraphernalia and maybe the rainbow flag painted on their tail-fins for good measure.

“These are two radically different messages in direct opposition to each other, and the parties are no longer “two sides of the same coin..“

• A Breakdown Of This Strange Moment In US History (SCF)

The Old Russian joke that a revolution could “never happen in America because there are no U.S. Embassies in Washington” has now become obsolete. The media, including even the supposedly conservative Fox News, has completely and totally given the election to Biden despite many irregularities. Not to mention, the fact that as these words are being typed – the election is not officially over. If there is one key element to a Color Revolution that must be in place for success it is control of the media. If every TV channel and news site says candidate X is the winner, then he has won regardless of votes and regardless of how many people still use said dinosaur media. They ultimately cast the big final ballot.

The rampant tampering and falsification witnessed (and often self filmed by the perpetrators) during the election looked like something you would expect to see in a “backwards third world hellhole” type of country. The manipulation was rampant, blatant and primitive. This fact can and should be used by the nations at odds with America (Russia, China, Iran, Cuba, Syria, etc.) in perpetuity as proof that the U.S. never had, nor should have, some sort of democracy-based moral authority over anyone else. America’s own Color Revolution delegitimizes any attempts to spread regime change via media elsewhere across the globe. The Dynamic between the Republicans and Democrats has changed forever. The Dynamic between the Republicans and Democrats has changed forever.

Donald Trump has changed the Republican Party, from the party of Businessmen and a defensive Upper Middleclass with a sprinkling of Social Conservatism speaking almost exclusively to a White audience into a populist party that offers a Right Wing emotional vision to the multi-ethnic America that we live in today. The shift in concept of the Republican Party is so severe that Trump’s influence has had the same or maybe even a greater effect that “The Southern Strategy” ever did. Around ten or fifteen years ago it looked like America would evolve into a one-party state due to demographics and the inability of Republicans to appeal to non-Whites. If polls can be trusted, at the very least Trump has doubled the amount of Black Americans who voted for him last time and was able to persuade 1/3 of Latinos to vote for him despite building “The Wall”.

Looking back on the 2016 election it is easy to see these huge gains, in groups that the Democrats took for granted as “theirs”. In contrast to Trump’s vision of a pro-Consitution, somewhat Libertarian populous party the Democrats have doubled down on hardcore Progressive positions. If the Dems used to represent the working man in a White vs. Blue collar America battle, they have now shifted over to being a Postmodernist circus of race, gender and sexual orientation baiting with a sprinkle of environmentalism via taxation as icing on the cake. These are two radically different messages in direct opposition to each other, and the parties are no longer “two sides of the same coin”, being two slightly different takes on the Liberalism laid down by the Founding Fathers. This is probably why things have gotten so unusually ugly, American politics may have become truly “winner take all”.

“I have great reservations over a justice speaking on issues that are likely to come before him on the Court.”

• Justice Alito Speaks Against Pandemic Restrictions, Other Controversies (Turley)

Justice Sam Alito is making headlines after his speech last night as the keynote at this year’s all-virtual Federalist Society National Lawyers Convention. Alito slammed pandemic measures and attacks on free speech in his remarks to the Convention, including the crackdown on “unfashionable views” in our society. I happen to agree with some of his points, but I have great reservations over a justice speaking on issues that are likely to come before him on the Court. Indeed, I have long been a critic of the Supreme Court justices engaging in public appearances where they hold forth on contemporary issues. I have been particularly critical of the late Justice Antonin Scalia and Associated Justice Ruth Bader Ginsburg who clearly relished appearances before ideologically supportive groups.

Justice Alito addressed attacks on religious liberty and free speech, including citing past cases and disputes before the Court. He also declared “The Covid crisis has highlighted constitutional fault lines” in attacking such rights. Pandemic limits are the subject of petitions before the Court as well as major cases working through the federal system. Alito also launched into liberals who he views as threatening religious rights, noting that “[i]n certain corners, religious liberty is fast becoming a disfavored right.” Alito attacked the Obama administration’s “ protracted campaign” and “unrelenting attack” against the Little Sisters of the Poor.” He also criticized a Washington State for requiring pharmacies to provide emergency contraception. He maintained that such emergency contraception “destroys an embryo after fertilization.”

All of those issues have been and will again be before the Court. Indeed, as Alito was making these ill-considered comments, the Catholic Church was coming before his Court in these very issues. There are a number of cases on the docket and pending review that include issues raised by Alito in his public remarks. Those litigants are entitled to justices who are not speaking publicly (directly or indirectly) on the merits of such claims. [..] It is worth noting that many liberals are objecting to Alito’s speech despite celebrating even more alarming public speeches by Justice Ginsburg during his life. Throughout her career, Justice Ginsburg triggered controversies over public comments where she joked that she would move to New Zealand if Donald Trump is elected. Ginsburg apologized for that controversy. While she expressed “regret” in that instance, it did not deter Ginsburg in continuing to speak publicly and hold forth on contemporary issues. There were speeches that electrified the left and built her persona as the “Notorious RBG.”

Newsflash: it’s not his fault.

• Fauci’s New COVID19 Guidance: ‘Do What You’re Told’ (NYP)

Dr. Anthony Fauci has some new coronavirus guidance: “Do what you’re told.” In an interview Thursday, the coronavirus task force member and infectious disease expert pushed back on the notion that scientists were “authoritarian” for promoting strict lockdowns and social distancing measures. But the 79-year-old suggested the American spirit of independence had gotten in the way and the nation needed to follow their orders, whether they liked it or not. “I was talking with my UK colleagues who are saying the UK is similar to where we are now, because each of our countries have that independent spirit,” Fauci said during a panel with other experts in Washington, DC.

“I can understand that, but now is the time to do what you’re told,” he said, as first reported by CNBC. The longtime director of the National Institute of Allergy and Infectious Diseases has repeatedly clashed with President Trump and his administration, who have dismissed him as “a bit of an alarmist” amid the pandemic. Fauci said Thursday it was unfortunate that America’s scientists had been “lumped into politics” and that people were unwilling to follow their guidance because society was so “divisive.” “All of a sudden, science gets caught in a lot of this divisiveness,” he told the audience.

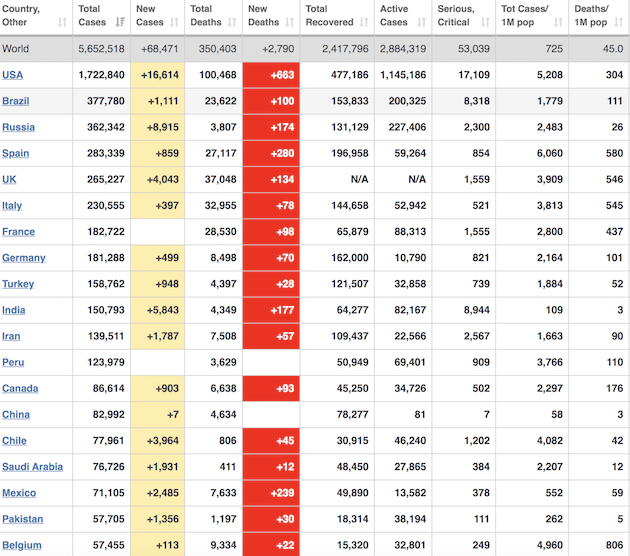

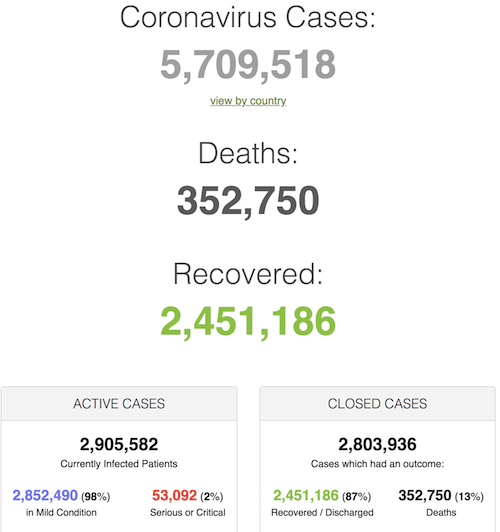

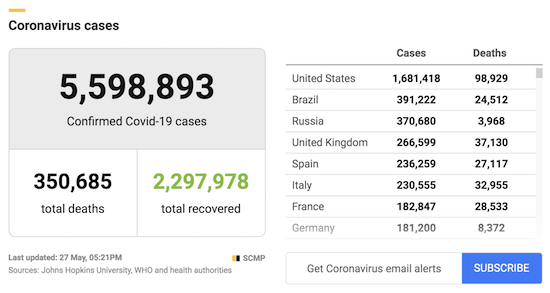

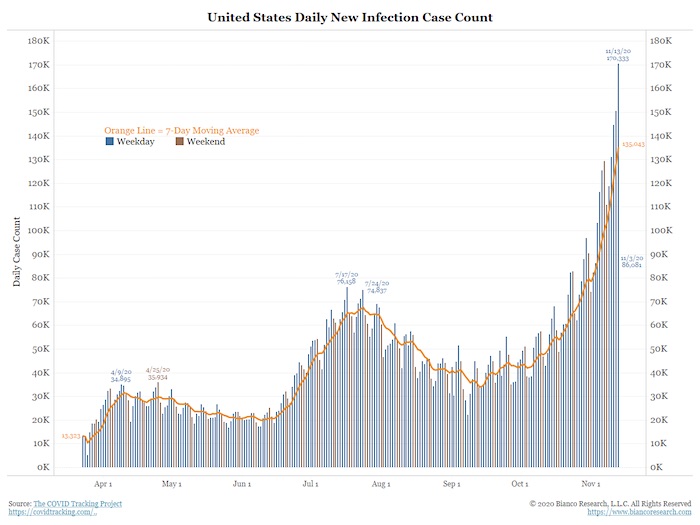

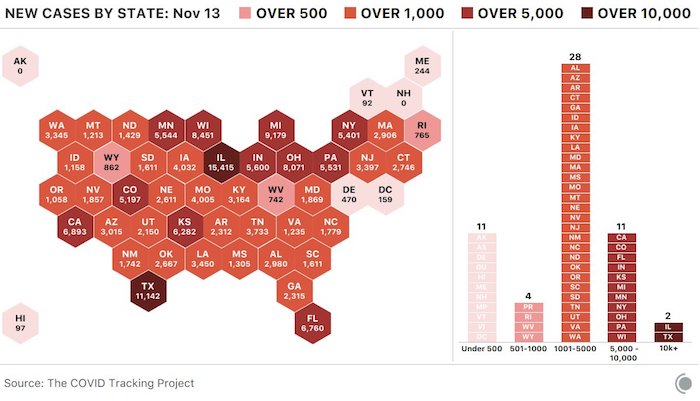

It comes as public health officials and the Trump administration grapple with how to combat new record numbers of daily coronavirus infections. Daily US cases topped 150,000 for the first time Wednesday, while hospitalizations have also hit another all-time high. Fauci said the nation could avoid another round of economically devastating lockdowns if people simply washed their hands, wore a mask and remained socially distant. “It sounds simple in the context of this ominous outbreak, but in fact we can turn it around,” he said.

“..revenues from tests are likely not bogus & very consistent.“

• Elon Musk Says He Tested Positive & Negative For COVID19 In Same Day (RT)

Futurist entrepreneur Elon Musk has expressed doubts about the accuracy of coronavirus tests, after claiming to have been both diagnosed and cleared of the disease on the same day. The SpaceX and Tesla founder wrote on Twitter that he had been administered four tests for the virus over a 24-hour period, leading to contradictory results. “Two tests came back negative, two came back positive. Same machine, same test, same nurse. Rapid antigen test from BD,” Musk said. The tweet sparked a heated debate on social media, with some accusing the billionaire businessman of being “irresponsible” by suggesting that Covid-19 tests are unreliable.

However, Musk paid no attention to the criticism and expressed further skepticism about the testing process in follow-messages. One Twitter user speculated that Musk’s apparent false-positive illustrates why countries are seeing “spikes” of the disease, to which the Tesla CEO responded: “If it’s happening to me, it’s happening to others.” The billionaire also agreed with a comment that noted that “revenues from tests are likely not bogus & very consistent.” Musk said he was taking polymerase chain reaction (PCR) tests from separate labs and that the results would be ready in about a day. He explained that he had symptoms of a “typical cold” but was otherwise not exhibiting any health problems purportedly linked to Covid-19.

The 49-year-old has been an outspoken critic of government response to the spread of the virus. Previously, he denounced lockdown policies adopted in countries around the world, arguing that only at-risk people should quarantine “until the storm passes.” He also said that neither he nor his family will likely take future coronavirus vaccines once they become available, saying that the response to the pandemic has “diminished [his] faith in humanity.”

D614G

• Coronavirus Mutation May Be Achilles Heel For Vaccines To Target (RT)

A new study has found that the very mutation which allowed SARS-CoV-2 to spread so far and wide among the human population may also be an Achilles heel for future vaccines to target. One of the latest strains of coronavirus, and currently the most common in the world, is called D614G. Through tests on hamsters, researchers at the University of North Carolina at Chapel Hill and the University of Wisconsin-Madison have discovered that this particular strain replicates faster and spreads more easily than the original variant, which emerged in China at the beginning of the pandemic. D614G outcompetes and outgrows its Chinese ancestral strain by about 10-fold, courtesy of its spike protein’s enhanced infiltration ability, which allows the virus easy access to human cells.

According to a recent study published on November 12, the disease caused by D614G was found to spread faster but didn’t result in more severe cases, while also being slightly more sensitive to medication including antibody treatments. Yoshihiro Kawaoka, a virologist on the faculty at the University of Wisconsin-Madison, ran a series of experiments using the original and mutated variants of the coronavirus on hamsters, to study both the severity of resulting symptoms after infection and the infectiousness of individual strains. Two groups of hamsters were inoculated with each strain of the virus, and then uninfected animals were placed in nearby cages, with shared air supply. The mutant virus spread to six of the eight newly introduced hamsters within two days, while the original virus strain hadn’t transmitted to any hamsters by day two but spread to the entire group by day four, highlighting the different pace of infection.

Now, however, researchers suspect that this increased infectiousness may in fact be a double-edged sword which could prove to be coronavirus’ undoing. The D614G mutation opens a small access port on the tip of one of the coronavirus crown’s spikes, increasing the rate of infection but leaving the virus core exposed – easy pickings for antibodies, such as the ones contained in the current generation of vaccines. Ralph Baric, professor of epidemiology at the UNC-Chapel Hill Gillings School of Global Public Health, who was previously involved in the development of the remdesivir antiviral drug, says that the unpredictability of coronavirus mutations necessitates ongoing study. He warned that, especially in light of the newly discovered mink SARS-CoV-2 cluster 5 variant in Denmark, studies into the exact mechanics of each mutation are necessary to maximize public health.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.