Marcel Duchamp The king and queen surrounded by swift nudes 1912

As Trump flunks his emergency, Xi flunks his economy. I’ll wait for the shouting match over the first to settle over the weekend.

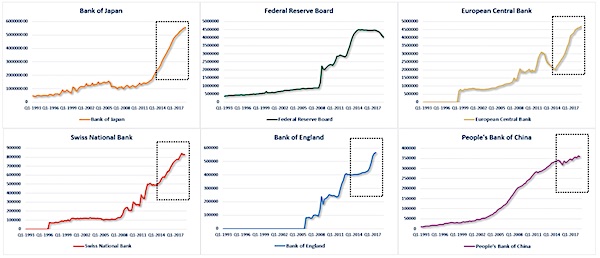

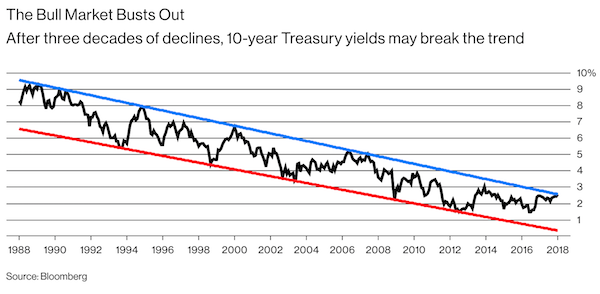

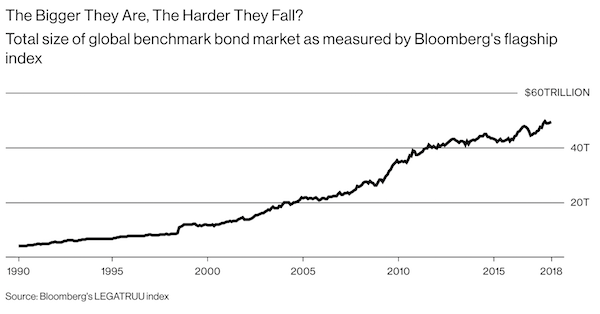

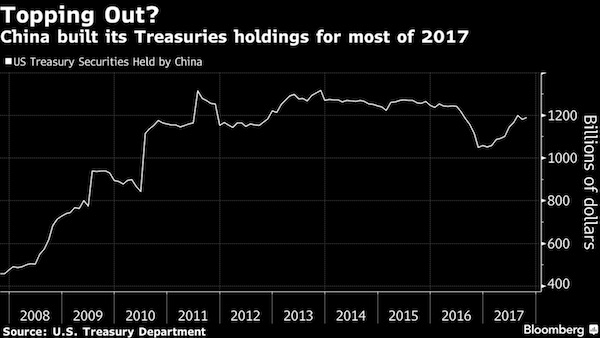

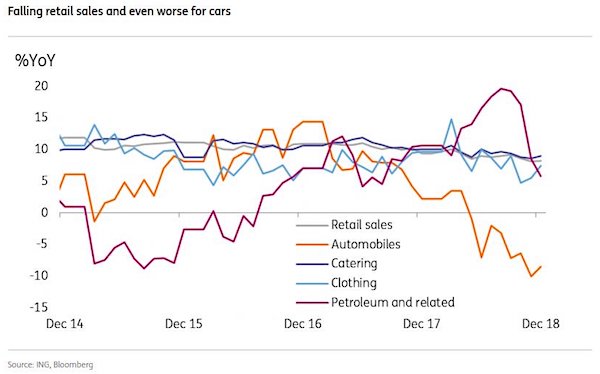

This is from the New York Fed’s Liberty Street Economics. The second graph is not from their piece, but very much to the point. After all that new debt, China’s transition to a consumer economy is faltering. So people are clamoring for rate cuts and more stimulus. But do they realize how much stimulus China has already neede to get where it is today?

• Over 60% Of All New Debt Created Globally In Past Decade Was In China (NYFed)

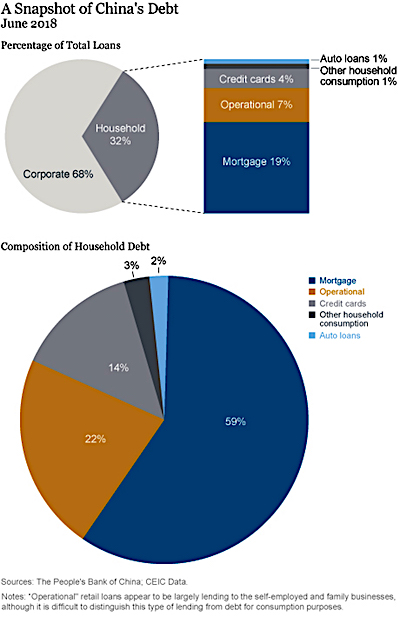

Although there has been a notable deceleration in the pace of credit growth recently, the run-up in debt in China has been eye-popping, accounting for more than 60 percent of all new credit created globally over the past ten years. Rising nonfinancial sector debt was driven initially by an increase in corporate borrowing, which surged in 2009 in response to the global financial crisis. The most recent leg of China’s credit boom has been due to an important shift toward household lending. To better understand the rise in household debt in China and its implications for financial stability and China’s economic performance, it is important to examine the expansion in household credit, how the rise in debt compares to international experience, and the associated risks.

The growth of China’s household debt reflects a natural evolution in financial sector deepening and has grown in two waves. The first occurred during the late-1990s following major financial reforms and the privatization of China’s housing stock. The second wave began in the wake of the global financial crisis and has witnessed much more rapid growth, with debt increasing by nearly $5.7 trillion, or nearly 30 percent of China’s GDP. In fact, household lending overtook corporate borrowing in early 2018 to become the largest driver of aggregate loan growth in China. New household lending now accounts for roughly half of new loans.

Glad someone’s keeping count.

• Worms Turning (Jim Kunstler)

[..] late this week, William Barr was confirmed as a new Attorney General, meaning the extreme case of bureaucratic constipation in that department may be resolving in a shitstorm of counter-revelations and prosecutions in what amounted to an attempted coup d’etat. A lot of the evidence for that is already public and overwhelming. It includes:

• Using FBI counter-intelligence assets improperly and illegally.

• Using fabricated “opposition research” provided by Mrs. Clinton to obtain warrants to spy on her election opponent, and failing to verify it as evidence (according to strict “Woods” procedures) submitted to FISA court judges.

• Recruiting Britain’s MI6 to spy on US citizens as a work-around from US laws prohibiting US Intel from spying on Americans.

• Setting up the notorious Trump Tower meeting to entrap Donald Trump Jr., using a Russian lawyer, Natalia Veselnitskaya, in the employ of Fusion GPS, Mrs. Clintons oppo research contractor.

• Orchestrating leaks of secret FBI proceedings to the news media to feed a Russia collusion hysteria.

• Malicious prosecutions by Special Counsel Robert Mueller and egregious political conflicts-of-interest among Mr. Mueller’s team of prosecutors.

• Coverup of the Uranium One scheme facilitated by Robert Mueller and Deputy Attorney General Rod Rosenstein.

• A scheme to surreptitiously and illegally record conversations with Mr. Trump once he became president.

• Conspiring to bury multiple inquires into illegal conduct of Mrs. Clinton, her employees and associates by failing to obtain evidence and allowing it to be destroyed.

• Misconduct in office by former CIA chief John Brennan, former National Security Director James Clapper, former AG Loretta Lynch, and members of President Obama’s White House inner circle.

Tie in this one with Jim Kunstler’s list above.

• FBI Created, Covered Up “Chart” Of Potential Hillary Clinton Crimes (ZH)

The top brass of the Obama FBI went to great lengths to justify their decision not to recommend charges against former Secretary of State Hillary Clinton for mishandling classified information, according to Judicial Watch, which obtained evidence that the agency created a ‘chart’ of Clinton’s offenses. The newly obtained emails came in response to a court ordered Freedom of Information Act (FOIA) request that the DOJ had previously ignored. Via Judicial Watch: “Three days after then-FBI Director James Comey’s press conference announcing that he would not recommend a prosecution of Mrs. Clinton, a July 8, 2016 email chain shows that, the Special Counsel to the FBI’s executive assistant director in charge of the National Security Branch, whose name is redacted, wrote to Strzok and others that he was producing a “chart of the statutory violations considered during the investigation [of Clinton’s server], and the reasons for the recommendation not to prosecute…”

[..] On May 15, 2016, James Rybicki, former chief of staff to Comey, sends FBI General Counsel James Baker; Bill Priestap, former assistant director of the FBI’s counterintelligence division; McCabe; Page; and others an email with the subject line “Request from the Director.” Rybicki writes: By NLT [no later than] next Monday, the Director would like to see a list of all cases charged in the last 20 years where the gravamen of the charge was mishandling classified information. It should be in chart form with: (1) case name, (2) a short summary for content (3) charges brought, and (4) charge of conviction. If need be, we can get it from NSD [National Security Division] and let them know that the Director asked for this personally. Please let me know who can take the lead on this. Thanks! Jim

Page forwards to Strzok: FYSA [For your situational awareness] Strzok replies to Page: I’ll take the lead, of course – sounds like an espionage section question… Or do you think OGC [Office of the General Counsel] should? And the more reason for us to get feedback to Rybicki, as we all identified this as an issue/question over a week ago. Page replies: I was going to reply to Jim [Rybicki] and tell him I can talked [sic] to you about this already. Do you want me to?

Mueller gets nuttier, and the Guardian gladly collaborates. On nothing new. We already knew WikiLeaks told Stone to take a hike. Most importantly, Mueller continues his cowardice vs Assange, because without his empty accusations of Assange, he really has nothing left on collusion. And if Assange could talk, he’d have even less left. And people tell me he’s not a coward.

Under US law, people have the right to defend themselves. Under Robert Mueller’s law, Julian Assange does not. Is that stating it clear enough?

As for Stone, Aaron Maté tweeted about this article: “LOL. The “communications of Roger Stone with Wikileaks” were revealed a year ago. They show WL urging Stone to stop making “false claims of association” between them.”

• Mueller Discloses Evidence Roger Stone Communicated With Wikileaks (G.)

The US Special Counsel, Robert Mueller, disclosed for the first time on Friday that his office has evidence of communications between Roger Stone, a longtime adviser to President Donald Trump, and WikiLeaks related to the release of hacked Democratic party emails. In a court filing on Friday, Mueller’s office said it had gathered that evidence in a separate probe into Russian intelligence officers who were charged by Mueller with hacking the emails during the 2016 US presidential campaign and staging their release. In an email criticising media coverage of Mueller’s filing on Friday, Stone said the evidence was “innocuous Twitter direct messages” that have already been disclosed to the House Intelligence Committee and “prove absolutely nothing”.

Also on Friday, a federal judge placed some limits on what Stone and his lawyers can say publicly about his criminal case brought by the special counsel in the Russia investigation. But the US district judge, Amy Berman Jackson, stopped short of imposing a broad ban on public comments by the outspoken political operative, issuing a limited gag order she said was necessary to ensure Stone’s right to a fair trial and “to maintain the dignity and seriousness of the courthouse and these proceedings”. Stone was indicted last month for lying to Congress about his communications with others about the hacked emails. Mueller did not say at the time that he had evidence of communications with WikiLeaks. Stone, an ally of Trump for 40 years, has pleaded not guilty to the charges.

Stone has previously acknowledged brief exchanges with both WikiLeaks and Guccifer 2.0 but maintains he never had advance knowledge about the release of hacked emails. But Friday marked the first time Mueller indicated he had obtained related evidence, although it remained unclear if the evidence is more substantial than what is publicly known. “The government obtained and executed dozens of search warrants on various accounts used to facilitate the transfer of stolen documents for release, as well as to discuss the timing and promotion of their release,” Mueller’s team wrote in a filing to the US district court in Washington DC. “Several of those search warrants were executed on accounts that contained Stone’s communications with Guccifer 2.0 and with Organization 1.”

[..] WikiLeaks and Guccifer 2.0 each published emails and other documents from the Democratic party in 2016 in an operation that Mueller alleges was part of a Kremlin-backed effort to tip the election in favour of then Republican nominee, Donald Trump.

Radio Free Europe presents Russiaphobia on steroids.

Let’s ask Mueller what he thinks.

• Are Russian Trolls Saving Measles From Extinction? (RFE)

Scientific researchers say Russian social-media trolls who spread discord before the 2016 U.S. presidential election may also have played an unintended role in a developing global health crisis. They say the trolls may have contributed to the 2018 outbreak of measles in Europe that killed 72 people and infected more than 82,000 — mostly in Eastern and Southeastern European countries known to have been targeted by Russia-based disinformation campaigns. Experts in the United States and Europe are now working on ways to gauge the impact that Russian troll and bot campaigns have had on the spread of the disease by distributing medical misinformation and raising public doubts about vaccinations.

Studies have already documented how cybercampaigns by the Internet Research Agency – a St. Petersburg “troll farm” that has been accused of meddling in the U.S. 2016 presidential election – artificially bolstered debate on social media about vaccines since 2014 in a way that eroded public trust in vaccinations. Now, the World Health Organization (WHO) is warning that “vaccination hesitancy” has become one of the top threats to global health. It notes a 30 percent rise in measles globally and a resurgence of measles in countries that had once been close to eradicating the disease.

You heard it here first in The Great Discontent.

A communications director says: “She’s built a profile with a savvy way beyond her years..”, but it’s the other way around. Anyone older can not build a profile the way she has because she’s 29 and grew up with social media; it’s not an acquired taste for her.

• Democrats’ Coveted 2020 Prize? An Endorsement From Ocasio-Cortez (G.)

Welcome to the AOC primary. At 29 years old, Congresswoman Alexandria Ocasio-Cortez – already known as “AOC” for short – is too young to be eligible to run for US president. But her phenomenal impact on American politics means that she could play an outsized role in deciding who does. As her fellow Democrats jostle for position ahead of the 2020 primary elections, an endorsement from Ocasio-Cortez is likely to be a widely coveted prize, a guaranteed shot of adrenaline sure to energise her army of millennial voters. But it could also come with perils in the later presidential contest, especially for so-called “centrist” candidates hoping to draw independents and moderate Republicans away from Donald Trump.

In little more than a month, Ocasio-Cortez, whose New York district includes parts of the Bronx and Queens, has taken Washington by storm, overshadowing career politicians who have spent years labouring in the 435-member House of Representatives. Her proposals – among them a Green New Deal to combat climate change and a 70% tax rate on earnings over $10m to tackle economic inequality – have reset terms of debate in the early stages of the Democratic contest. “This is a race to the left,” said Dave Handy, a New York-based political consultant and organiser. “Even if people don’t like her or her policies, they will be racing to get her endorsement because it’s a progressive check mark. She embodies the general direction the party is going in.”

[..] Ocasio-Cortez is also a social media sensation. She has in excess of 3 million followers on Twitter with more engagement than Donald Trump, Barack Obama or Vermont senator Bernie Sanders. Last week a video clip in which she quizzed ethics experts about government corruption became the most watched political video ever posted on Twitter with 37.5m views. It was another demonstration of astonishing clout. Neil Sroka, communications director of the progressive group Democracy for America, said: “She’s built a profile with a savvy way beyond her years, but she also has an agenda that feels right for the moment. AOC does not exist without the bold, inclusive, populist agenda she’s pushing. The vitriol she has inspired speaks to how afraid everyone is; Republicans see her as representing a country they don’t even know how to speak to.”

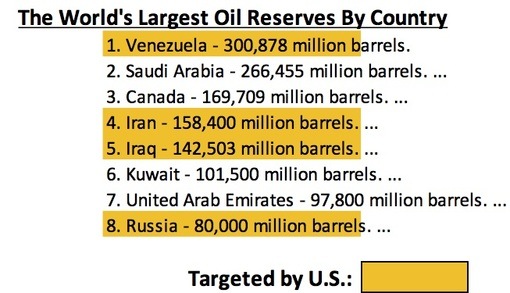

“The American plan is to burn the oil. All of it.”

• The Green New Deal, Capitalism and the State (CP)

Unbeknownst to most Americans, the nation’s forests were clear-cut from coast to coast in the mid-late nineteenth century. Photographs from the era show denuded landscapes— no trees, no animals, and streams still poisoned from the runoff in the present, for as far as the eye can see. The scars from nineteenth and twentieth century strip mining in Pennsylvania draw direct geographical and historical lines to the mountaintop removal that is taking place in West Virginia today. These natural resources produced the bounty of American capitalism every bit as much as the manufacturing prowess of the Second Industrial Revolution. In turn, this combination of low-cost resources, manufacturing prowess and natural borders (the oceans) produced the military might that defines America in the present.

The logic of weapons and weaponry pervades American capitalism. Death and destruction, domination and control, are what America does. The thought that these resources were ever ‘free’ illustrates the power of ideology. With a body count of at least one-hundred million human beings— including genocide against the indigenous population, murdered slaves, coal miners in Appalachia who died from black lung disease, mill workers in Massachusetts and North and South Carolina who died from inhaling cotton fibers, and those killed in American wars for resources, the human toll of American capitalism is staggering.

[..] In the present, the introduction of a Green New Deal as a nonbinding resolution, rather than the creation of a select congressional committee, clarifies the political form of official resistance to environmental resolution. The public pronouncement itself is a call to arms, implying both that the need for environmental resolution is urgent and that it won’t be led from above. Its authors were right to take their case to the people, from whom something akin to a revolutionary movement is required. Complaints over its limited scope miss that until there is such a movement, little progress toward environmental resolution will be made. Current bipartisan American machinations toward Venezuela illustrate the conundrum. Venezuela has the largest proven oil reserves in the world. The U.S. is using state power to ‘liberate’ this oil for the benefit of nominally private multinational oil corporations. The American plan is to burn the oil. All of it.

And why not? It must get messier still.

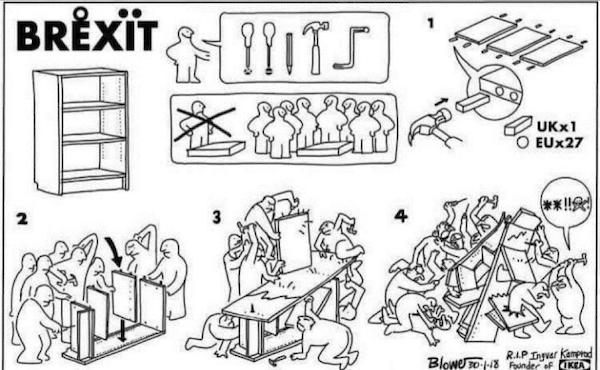

• Corbyn To Hold Brexit Talks With EU’s Barnier And Verhofstadt (G.)

Jeremy Corbyn will hold talks in Brussels next week with Michel Barnier, the EU’s chief negotiator, as he seeks to break the Brexit impasse and persuade Theresa May to sign up to a customs union. The visit is likely to be highly unwelcome in Downing Street, and risks accusations that Labour is pursuing its own shadow negotiations, undermining the prime minister’s hopes of fresh EU concessions. May will be in Brussels in the same week to meet the European commission president, Jean-Claude Juncker. The UK attorney-general, Geoffrey Cox, is expected to travel with her. During a whistle-stop tour of the central figures in the Brexit talks on Thursday, Corbyn is also due to meet the European parliament’s Brexit coordinator, Guy Verhofstadt.

He will also hold talks with senior figures in the socialist group in the European parliament, including Labour MEPs. EU sources said Corbyn was expected to provide further details on his recent conditional offer of support for the prime minister’s deal along with an update on the cross-party talks. Earlier this month, the Labour leader said his party would back the withdrawal agreement, containing the Irish backstop, if May renegotiated the accompanying political declaration on the future relationship. Labour is seeking a permanent and comprehensive UK-wide customs union, a close alignment with the single market and protection for standards and workers’ rights.

Steve wants to abolish the word ‘savings’ with regards to a government. It makes no sense at all.

• When The Swabian Hausfrau Saves (Steve Keen)

Savings is promoted as a private virtue that should be practiced at a national and international level as well. What happens to the economy when it is implemented? Keen explains one of the great economic fallacies: that a government needs to manage its finances like a household, and if the government consistently spends more than it receives in income, the nation’s debt will ultimately become unsustainable, and the nation will go broke. Furthermore he will address why the predominant Neoclassical economic model of banking is dangerously misleading as a guide to how a capitalist economy actually works and was thus incapable of predicting the Great Financial Crisis of 2007.

Hoe much more American does it get?

• 9/11 Fund Running Out Of Money For Those With Illnesses (AP)

The compensation fund for victims of 9/11 is running out of money and will cut future payments by 50 to 70 percent, officials announced Friday. September 11th Victim Compensation Fund special master Rupa Bhattacharyya said she was “painfully aware of the inequity of the situation” but stressed that awarding some funds for every valid claim would be preferable to sending some legitimate claimants away empty-handed. “I could not abide a plan that would at the end of the day leave some claimants uncompensated,” Bhattacharyya said.

Nearly 40,000 people have applied to the federal fund for people with illnesses potentially related to being at the World Trade Center site, the Pentagon or Shanksville, Pennsylvania, after the 2001 terror attacks there, and about 19,000 of those claims are pending. Nearly $5 billion in benefits have been awarded out of the $7.3 billion fund. Bhattacharyya said fund officials estimate it would take another $5 billion to pay pending claims and the claims that officials anticipate will be submitted before the fund’s December 2020 deadline. Absent that funding, officials determined that pending claims submitted by Feb. 1 would be paid at 50 percent of their prior value. Valid claims received after that date will be paid at just 30 percent.

Idea is good, argumentation less so. You can’t expect to be taken too seriously when you write lines like this one: A recent paper shows that companies are more likely to receive subsidies when they make financial contributions to political candidates in the state.

• Subsidies to Amazon Are Uneconomical, Un-American, and Unconstitutional (PM)

Corporate subsidies are a negative-sum game. They foster crony capitalism, hurt productivity growth and inflict great harm on product market competition.

As soon as Amazon announced the location of its new headquarters, an intense media battle started on the rationality of the fiscal subsidies offered by the two chosen states to attract the new headquarters. Was it a good idea for New York and Virginia to offer $1.5 billion and $573 million respectively to stir Amazon’s decision? In each of the two chosen locations Amazon was to invest billions in infrastructure, employ as many as 25,000 people directly (and many more indirectly), and bring billions in new tax revenues. Even the generous fiscal benefits offered by the two locations seem small vis-à-vis the additional fiscal revenues the winning states will enjoy. After all, had Amazon chosen New Jersey over New York, the Empire State would have lost up to $14 billion in new tax revenues over the next 25 years.

Why shouldn’t a state pay a fraction of these enormous benefits to secure Amazon’s headquarters? While appealing, this argument is flawed and—as it turns out—self-defeating. When companies compete for customers, they have to offer better products or lower prices. They are forced to innovate and improve efficiency in production. In economist lingo, product market competition is not a zero-sum game (my gains are equal to your losses), but a positive-sum game (my gains exceed your losses). By contrast, corporate competition for state subsidies is a zero-sum game. Amazon is not going to be more productive in New York than in New Jersey –it will only pay fewer taxes. If companies are successful in pitting one state against another, they will end up paying no state taxes.

As a result, the economy will not be one iota more efficient, and the rest of us will end up paying more taxes to make up for the revenue shortfall. Competition for subsidies also fosters crony capitalism and hurts productivity growth. It fosters crony capitalism because it favors companies that are well-connected, rather than companies that are more efficient.