John M. Fox Garcia Grande newsstand, New York 1946

It’s been a few days, but leafing through today’s news, it seems obvious that incompetence once again rules the day. Macron is the first to say he’s sorry for that. Sort of. Still, we should not lose sight of the fact that, as I wrote recently in Little Managers, we don’t elect our ‘Leaders’ to solve pandemics. The best I can do for you is we elect them to make us feel rich, which is why they focused for far too long, as the pandemic already raged, on their economies.

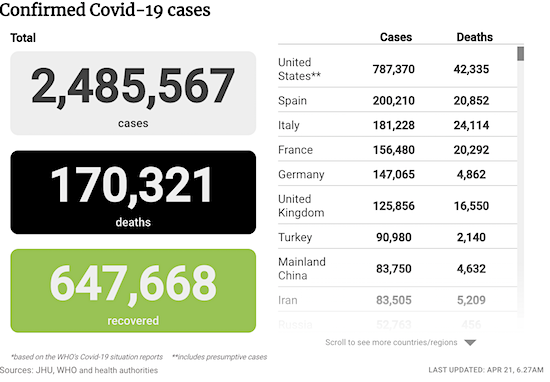

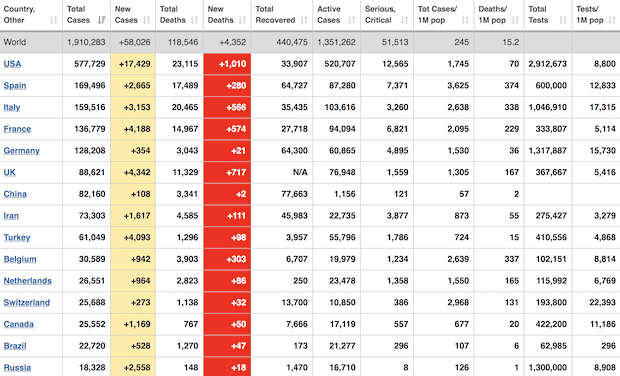

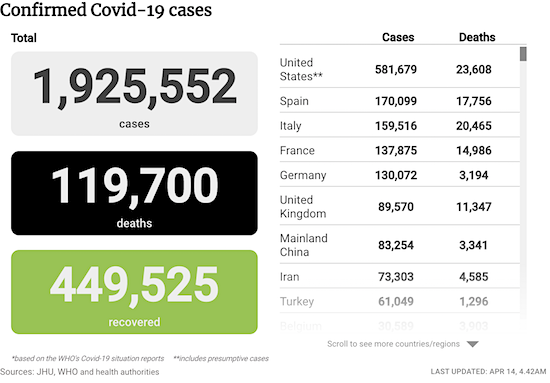

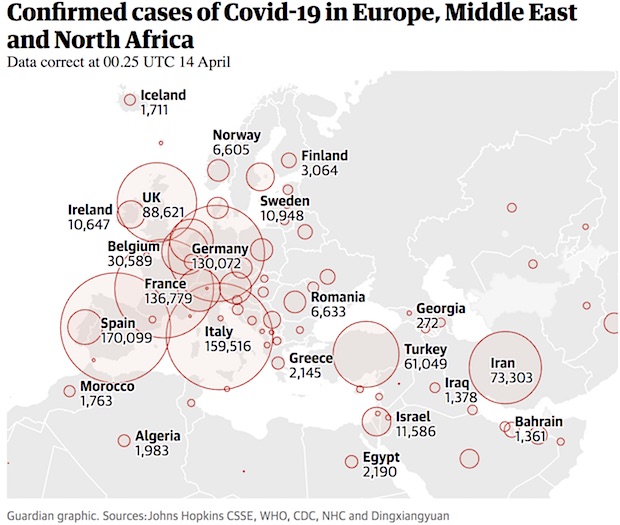

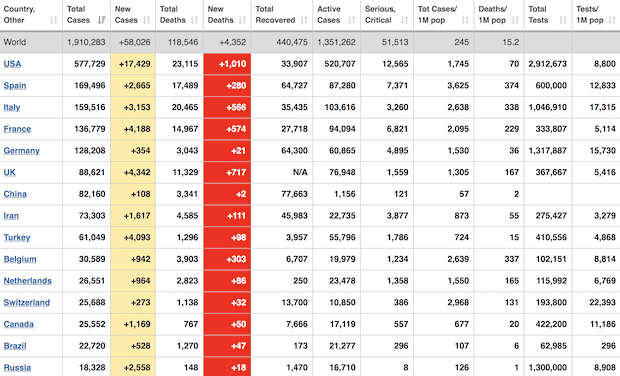

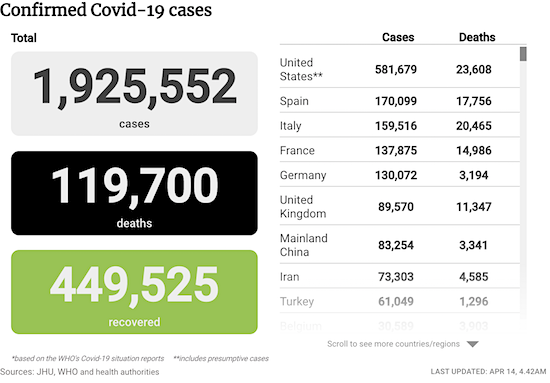

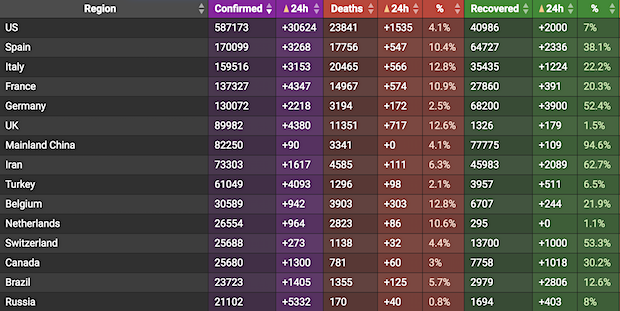

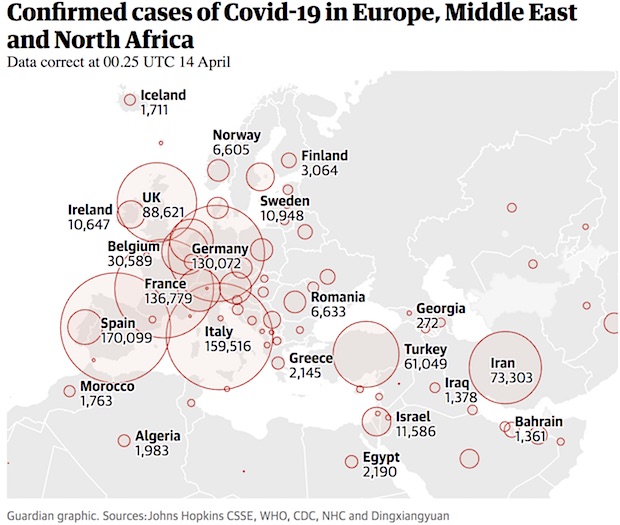

• Over the past 24 hours, the U.S. reported 27,243 new cases of coronavirus and 1,555 new deaths, raising total to 587,752 cases and 23,765 dead.

1,934,128

• Cases 1,862,584 (+ 72,011 from yesterday’s 1,790,573)

120,437

• Deaths 114,982 (+ 5,328 from yesterday’s 109,654)

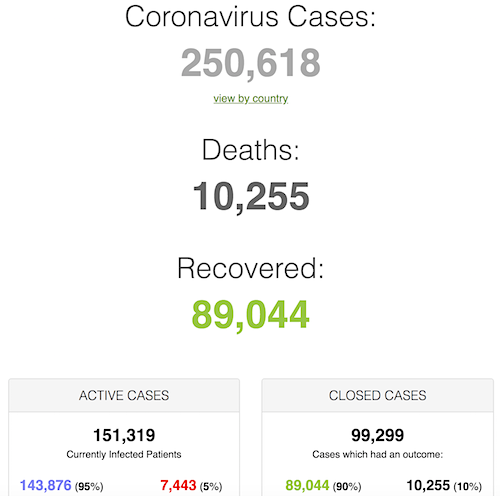

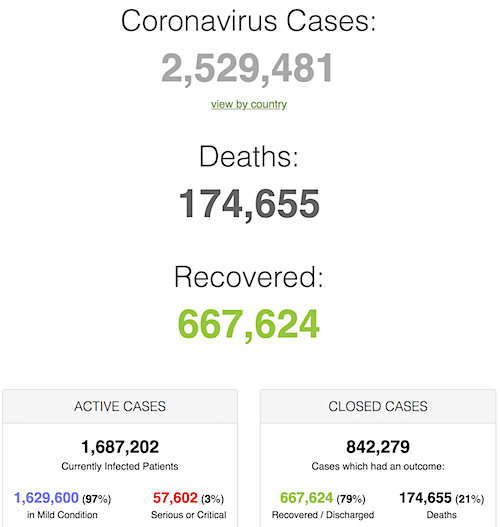

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: mortality rate for closed cases is at 21% !-

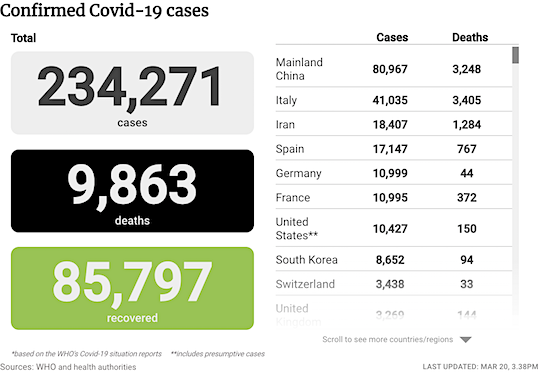

From SCMP:

From COVID19Info.live:

I would certainly pay $37 for a test if it were available. And reliable.

• Getting A Coronavirus Test In Wuhan: Fast, Cheap And Easy (R.)

Coronavirus tests can be difficult to come by in many countries including in hard-hit parts of the United States and Britain, but in Wuhan, the Chinese epicentre of the pandemic, they are fast, cheap and easy to get. My colleagues and I had just arrived in the central city where the novel coronavirus emerged in humans late last year, and as a foreigner I was told that I was required to take a nucleic test to prove that I was free of the potentially deadly flu-like virus. A government official escorted me to the test site, a table outside the entrance of a shuttered hotel. A single medical worker sat there, dressed in a zipped-up hazmat suit and goggles.

She asked for my personal details and told me to sit. She then stuck a swab down my throat, nearly triggering a gag, and then it was over. “You’ll get your results in about one and a half days,” the official said. The test, while not pleasant, took less than three seconds. Wuhan is testing liberally as it tries to get back up and running after lifting a 76-day lockdown last week. The term “nucleic acid test” has become a familiar one in the city of 11 million people, where many companies are asking workers to present test results before they can return to work, although it is not mandatory. At one Wuhan hospital, people only need to spit into a test tube. That test costs 260 yuan ($37) and results are available by mobile app. Since Feb. 21, 930,315 tests have been carried out in Wuhan, according to government data.

“Testing is a good thing,” said Zhao Yan, a emergency medicine doctor and vice president of Wuhan’s Zhongnan Hospital told reporters on a government-organised trip last week. “If you’re an enterprise with 500 employees and you want to start working again, you test everybody.” Across China, officials are simplifying and speeding up the process to obtain a nucleic acid test, even though questions persist about its accuracy. Some Chinese doctors have pushed to raise requirements for discharging hospitalised patients from two negative nucleic acid tests to three. Cities including Beijing have required some arriving travelers to present test results when entering. China has not yet indicated it will require testing for large swathes of the population.

Read more …

There go the dreams of reopening your economy.

• South Korea Confirms 111 Cases Of Coronavirus Reinfection (KT)

South Korea has confirmed 111 cases of coronavirus reinfection (as of Sunday noon) with most cases reported in Daegu and North Gyeongsang Province, two epicenters of the domestic outbreak. Jung Eun-kyeong, director of Korea Centers for Disease Control and Prevention (KCDC), said on Sunday the organization was exploring possible causes of reinfection. “For now it is uncertain what led to reinfection � revived virus that survived treatment or fresh exposure to the virus after recovery,” Jung said. The director said an extensive research was under way and the KCDC would share the result with WHO and other nations battling coronavirus.

Earlier health authorities here have said the virus was highly likely to have been reactivated, instead of the people being reinfected, as they tested positive again in a relatively short time after being released from quarantine. They also said the COVID-19 virus may remain latent in certain cells in the body and attack the respiratory organs again once reactivated. A COVID-19 patient is deemed fully recovered after showing negative results for two tests in a row within a 24-hour interval. The country’s COVID-19 infections reported 32 additional virus cases, bringing total infections to 10,512.

Read more …

Oh no. No sirree. The system is bringing itself down, not the virus. This is like you take a house so decrepit that it should long have been condemned, and then you blame a storm when it finally collapses.

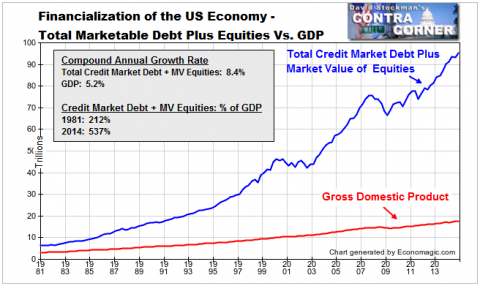

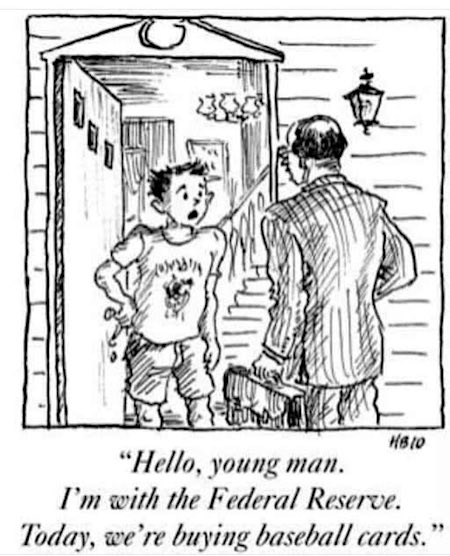

• How Coronavirus Almost Brought Down The Global Financial System (Tooze)

In the third week of March, while most of our minds were fixed on surging coronavirus death rates and the apocalyptic scenes in hospital wards, global financial markets came as close to a collapse as they have since September 2008. The price of shares in the world’s major corporations plunged. The value of the dollar surged against every currency in the world, squeezing debtors everywhere from Indonesia to Mexico. Trillion-dollar markets for government debt, the basic foundation of the financial system, lurched up and down in terror-stricken cycles. On the terminal screens, interest rates danced. Traders hunched over improvised home workstations – known in the new slang of March 2020 as “Rona rigs” – screaming with frustration as sluggish home wifi systems dragged behind the movement of the markets.

At the low point on 23 March, $26tn had been wiped off the value of global equity markets, inflicting huge losses both on the fortunate few who own shares, and on the collective pools of savings held by pension and insurance funds. What the markets were reacting to was an unthinkable turn of events. After a fatal period of hesitation, governments around the world were ordering comprehensive lockdowns to contain a lethal pandemic. Built for growth, the global economic machine was being brought to a screeching halt. In 2020, for the first time since the second world war, production around the world will contract. It is not only Europe and the US that have been shut down, but once-booming emerging market economies in Asia. Commodity exporters from Latin America and sub-Saharan Africa face collapsing markets.

[..] What Europe and the US have succeeded in doing is to flatten the curve of financial panic. They have maintained the all-important flow of credit. Without that, large parts of their economies would not be on life support – they would be stone dead. And our governments would be struggling with a financial crunch to boot. Maintaining the flow of credit has been the precondition for sustaining the lockdown. It is the precondition for a concerted public health response to the pandemic. During major crises, we are reminded of the fact that at the heart of the profit-driven, private financial economy is a public institution, the central bank. When financial markets are functioning normally, it remains in the background.

But when they threaten to break down, it has the option of stepping forward to act as a lender of last resort. It can make loans, or it can buy assets from banks, funds or other businesses that are desperate for cash. Because it is the ultimate backer of the currency, its budget is unlimited. That means it can decide who sinks and who swims. We learned this in 2008. But 2020 has driven home the point as never before.

Read more …

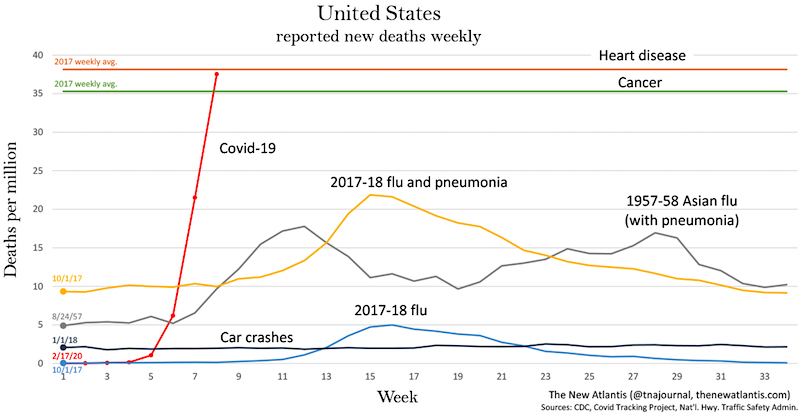

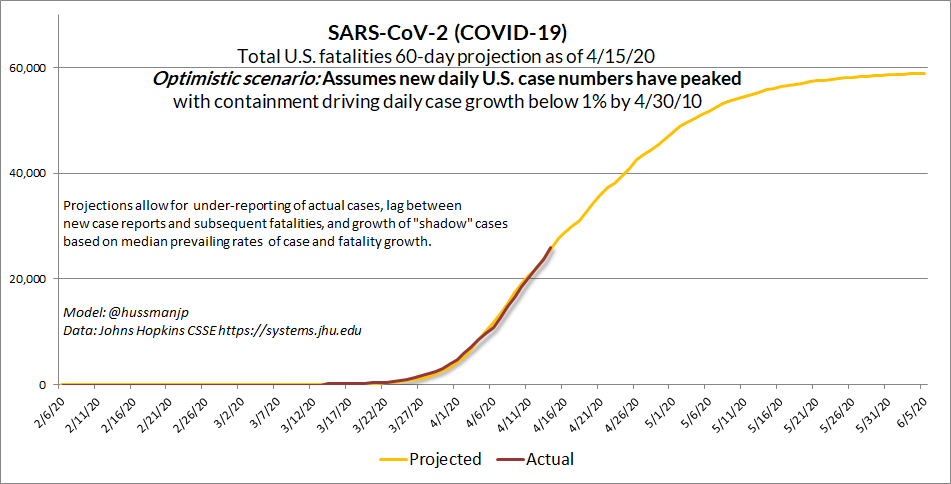

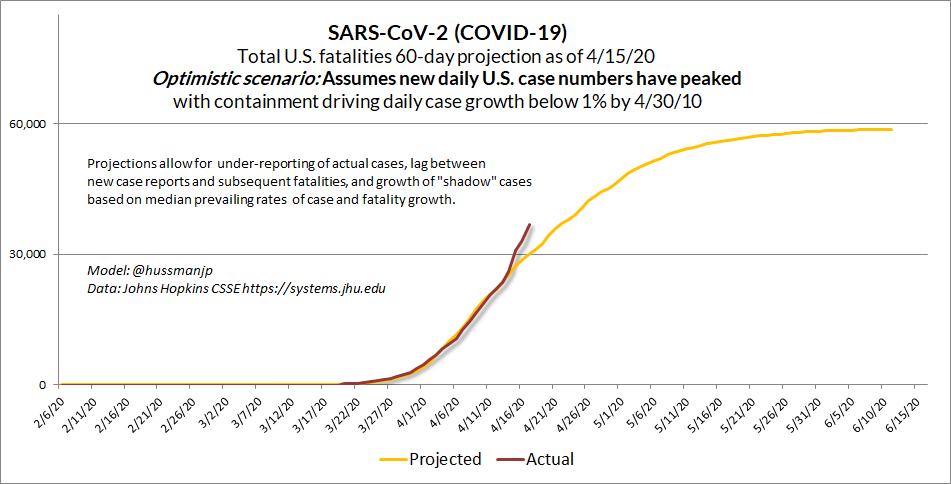

Where are Dr. Fauci’s 200,000 deaths?

• US Coronavirus Death Toll Tops 23,000 (R.)

U.S. deaths from the novel coronavirus topped 23,000 on Monday, according to a Reuters tally, as officials said the worst may be over and the outbreak could reach its peak this week. The United States, with the world’s third-largest population, has recorded more fatalities from COVID-19 than any other country. There were a total of nearly 570,000 U.S. cases as of Monday with over 1.8 million reported cases globally. Deaths reported on Sunday numbered 1,513, the smallest increase since 1,309 died on April 6. The largest number of fatalities, over 10,000, was in New York state with the concentration in and around New York City, the most populous U.S. city with about 8.4 million people.

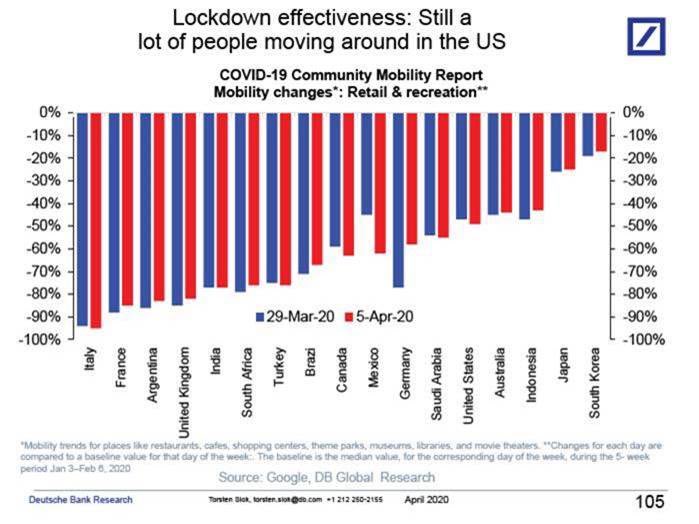

Wyoming reported its first coronavirus death on Monday, the final U.S. state to report a fatality in the outbreak. Sweeping stay-at-home restrictions to curb the spread of the disease, in place for weeks in many areas of the United States, have taken a painful toll on the economy. With businesses closed and curbs on travel, officials and lawmakers are debating when it might be safe to begin reopening some sectors. The Trump administration has indicated May 1 as a potential date for easing the restrictions while urging caution.

Read more …

Stop planning. Make sure you get it right first.

• New York, California, Other States Plan For Reopening As Crisis Eases (R.)

Ten U.S. governors on the east and west coasts banded together on Monday in two regional pacts to coordinate gradual economic reopenings as the coronavirus crisis finally appeared to be ebbing. Announcements from the New York-led group of Northeastern governors, and a similar compact formed by California, Oregon and Washington state, came as President Donald Trump declared any decision on restarting the U.S. economy was up to him. New York Governor Andrew Cuomo said he was teaming up with five counterparts in adjacent New Jersey, Connecticut, Delaware, Pennsylvania and Rhode Island to devise the best strategies for easing stay-at-home orders imposed last month to curb coronavirus transmissions. Massachusetts later said it was joining the East Coast coalition.

“Nobody has been here before, nobody has all the answers,” said Cuomo, whose state has become the U.S. epicenter of the global coronavirus pandemic, during an open conference call with five other governors. “Addressing public health and the economy: Which one is first? They’re both first.” The three Pacific Coast states announced they, too, planned to follow a shared approach for lifting social-distancing measures, but said they “need to see a decline in the rate of spread of the virus before large-scale reopening” can take place. The 10 governors, all Democrats except for Charlie Baker of Massachusetts, gave no timeline for ending social lockdowns that have idled the vast majority of more than 100 million residents in their states. But they stressed that decisions about when and how to reopen non-essential businesses, along with schools and universities, would put the health of residents first and rely on science rather than politics.

Read more …

How on earth do you get this so wrong?

• 30 Union Members Die, Rest Risk Their Lives So Americans Can Eat Meat (HuffPo)

Never has so much been asked of America’s grocery store and meatpacking workers. They are working through a pandemic, getting sick and in some cases even dying so that others can put food on the table. Most of them are doing it for lower wages than other essential workers who continue to do their jobs as coronavirus cases balloon. Many who risk their health each day have been relaying their fears and frustrations to the United Food and Commercial Workers, which represents 1.3 million workers in the U.S. and Canada and is one of the largest private-sector unions in the country.

Marc Perrone, the UFCW’s president, told HuffPost that the union is working hard to keep up with its members’ concerns, as well as those of nonunion workers now highly interested in organizing. For many in the latter category, the pressure of recent weeks has stripped away any sense that they are paid fairly and protected adequately on the job. “We have more leads than we’ve ever had as a union,” Perrone said. “The question is … are we at the tipping point yet? This pandemic ripped gaping holes in the system. Is it going to change the way workers can unify together to make a move?”

The UFCW has emerged as one of the most important labor unions in the coronavirus crisis because of where it represents workers: in grocery stores, meatpacking and processing plants and pharmacies. Few private-sector unions outside of health care would have so many members continuing to clock in because their work is so crucial to the lives of others. The work seems to have come at a steep cost already. The union is still gathering data on infections and deaths among its membership, but Perrone said that around 30 people appear to have died since the pandemic began. In some cases, he cautioned, a COVID-19 diagnosis has not been confirmed yet.

Read more …

Better get some other protein supply in.

• North America Meat Plant Workers Fall Ill, Walk Off Jobs (R.)

At a Wayne Farms chicken processing plant in Alabama, workers recently had to pay the company 10 cents a day to buy masks to protect themselves from the new coronavirus, according to a meat inspector. In Colorado, nearly a third of the workers at a JBS USA beef plant stayed home amid safety concerns for the last two weeks as a 30-year employee of the facility died following complications from the virus. And since an Olymel pork plant in Quebec shut on March 29, the number of workers who tested positive for the coronavirus quintupled to more than 50, according to their union. The facility and at least 10 others in North America have temporarily closed or reduced production in about the last two weeks because of the pandemic, disrupting food supply chains that have struggled to keep pace with surging demand at grocery stores.

According to more than a dozen interviews with U.S and Canadian plant workers, union leaders and industry analysts, a lack of protective equipment and the nature of “elbow to elbow” work required to debone chickens, chop beef and slice hams are highlighting risks for employees and limiting output as some forego the low-paying work. Companies that added protections, such as enhanced cleaning or spacing out workers, say the moves are further slowing meat production. Smithfield Foods, the world’s biggest pork processor, on Sunday said it is indefinitely shutting a pork plant that accounts for about 4% to 5% of U.S. production. It warned that plant shutdowns are pushing the United States “perilously close to the edge” in meat supplies for grocers.

Read more …

The size of this “industry” is bearable only because we keep it hidden.

• Smithfield Shuts US Pork Plant Indefinitely, Warns Of Meat Shortages (R.)

Smithfield Foods, the world’s biggest pork processor, said on Sunday it will shut a U.S. plant indefinitely due to a rash of coronavirus cases among employees and warned the country was moving “perilously close to the edge” in supplies for grocers. Slaughterhouse shutdowns are disrupting the U.S. food supply chain, crimping availability of meat at retail stores and leaving farmers without outlets for their livestock. Smithfield extended the closure of its Sioux Falls, South Dakota, plant after initially saying it would idle temporarily for cleaning. The facility is one of the nation’s largest pork processing facilities, representing 4% to 5% of U.S. pork production, according to the company.

South Dakota Governor Kristi Noem said on Saturday that 238 Smithfield employees had active cases of the new coronavirus, accounting for 55% of the state’s total. Noem and the mayor of Sioux Falls had recommended the company shut the plant, which has about 3,700 workers, for at least two weeks. “It is impossible to keep our grocery stores stocked if our plants are not running,” Smithfield Chief Executive Ken Sullivan said in a statement on Sunday. “These facility closures will also have severe, perhaps disastrous, repercussions for many in the supply chain, first and foremost our nation’s livestock farmers.” Smithfield said it will resume operations in Sioux Falls after further direction from local, state and federal officials. The company will pay employees for the next two weeks, according to the statement.

Read more …

Stupid is as stupid does. Come autumn, you’re going to need food. Underpaying essential workers will not help. Raise their wages, and you may even attract a few Americans.

• White House Seeks To Lower Farmworker Pay To Help Agriculture Industry (NPR)

New White House Chief of Staff Mark Meadows is working with Agriculture Secretary Sonny Perdue to see how to reduce wage rates for foreign guest workers on American farms, in order to help U.S. farmers struggling during the coronavirus, according to U.S. officials and sources familiar with the plans. Opponents of the plan argue it will hurt vulnerable workers and depress domestic wages. The measure is the latest effort being pushed by the U.S. Department of Agriculture to help U.S farmers who say they are struggling amid disruptions in the agricultural supply chain compounded by the outbreak; the industry was already hurting because of President Trump’s tariff war with China.

“The administration is considering all policy options during this unprecedented crisis to ensure our great farmers are protected, and President Trump has done and will do everything he can to support their vital mission,” a White House official told NPR. The nation’s roughly 2.5 million agricultural laborers have been officially declared “essential workers” as the administration seeks to ensure that Americans have food to eat and that U.S. grocery stores remain stocked. Workers on the H-2A seasonal guest-worker program are about 10% of all farmworkers. The effort to provide “wage relief” to U.S. farmers follows an announcement Friday by the USDA to develop a program that will include direct payments to farmers and ranchers hurt by the coronavirus. Trump said Friday that he has directed Perdue to provide at least $16 billion in relief.

Read more …

Well, at least he did it. Where are the others?

• In Mea Culpa, Macron Extends France’s Lockdown Until May 11 (R.)

French President Emmanuel Macron on Monday announced he was extending a virtual lockdown to curb the coronavirus outbreak until May 11, adding that progress had been made but the battle not yet won. Following Italy in extending the lockdown but announcing no immediate easing of restrictive measures as in Spain, Macron said the tense situation in hospitals in Paris and eastern France meant there could be no let-up in the country. Since March 17, France’s 67 million people have been ordered to stay at home except to buy food, go to work, seek medical care or get some exercise on their own. The lockdown was originally scheduled to end on Tuesday.

“I fully understand the effort I’m asking from you,” Macron told the nation in a televised address at the end of the lockdown’s fourth week, adding the current rules were working. “When will we be able to return to a normal life? I would love to be able to answer you. But to be frank, I have to humbly tell you we don’t have definitive answers,” he said. Schools and shops would progressively reopen on May 11, Macron said. But restaurants, hotels, cafes and cinemas would have to remain shut longer, he added. International arrivals from non-European countries will remain prohibited until further notice. Macron, whose government has faced criticism over a shortage of face masks and testing kits, said that by May 11, France would be able to test anyone presenting COVID-19 symptoms and give nonprofessional face masks to the public.

Macron also said he had asked his government to present this week new financial aid for families and students in need. Acknowledging his country had not been sufficiently prepared early on to face the challenges posed by the outbreak of the new coronavirus, Macron appeared to seek a humble tone in contrast to the war-like rhetoric of his previous speeches. “Were we prepared for this crisis? On the face of it, not enough. But we coped,” he said. “This moment, let’s be honest, has revealed cracks, shortages. Like every country in the world, we have lacked gloves, hand gel, we haven’t been able to give out as many masks as we wanted to our health professionals.”

The French, long accustomed to being told their high taxes paid for the “best healthcare in the world,” have been dismayed by the rationing of critical drugs, face masks and equipment and have watched with envy the situation in neighbouring Germany. Macron’s acknowledgment of the shortcomings was broadly well-received. “It’s not every day you hear a president offer a mea culpa and dare say ‘we have no definitive answers.’ Reassuring and necessary sincerity,” analyst Maxime Sbaihi of the think tank GenerationLibre said.

Read more …

You have to read this to believe it. Mind you, I read a note earlier that said 200 flights came into to Heathrow yesterday from all over the globe, including China, Italy, Spain, whose passengers were barely checked if at all.

• A French Disaster (Guy Millière)

On April 9, in France, one of the three European countries most affected by COVID-19 — the others being Spain and Italy, 1,341 people died from the Chinese Communist Party virus. For Italy, the main European country affected so far, the figure on April 9 was 610 deaths; for Spain 446, and for Germany 266. While the pandemic has been stabilizing in Italy and Spain — and in Germany seems contained — in France it seems still expanding. Extremely bad decisions taken by the authorities created a situation of contagion more destructive than it should have been. The first bad decision was that, in contrast to European Union fantasies, borders apparently do matter. France never closed them; instead it allowed large numbers of potential virus-carriers to enter the country.

Even when it became clear that in Italy the pandemic was taking on catastrophic proportions, France’s border with Italy remained open. The Italian government, by contrast, on March 10, prohibited French people coming to its territory or Italians going to France, but to date, France has put no controls on its side of the border. The situation is the same on France’s border with Spain, despite the terrifying situation there. Since March 17, it has been virtually impossible to go from France to Spain, but coming to France from Spain is easy: you just show a police officer your ID. The same goes for France’s border with Germany. On March 16, Germany closed its border with France, but France declined to do the same for its border with Germany.

When, on February 26, a soccer match between a French team and an Italian team took place in Lyon, the third-largest city in France, 3,000 Italian supporters attended, even though patients were already flocking to Italy’s hospitals. France never closed its airports; they are still open to “nationals of EEA Member States, Switzerland, passengers with a British passport, and those with residence permits issued by France” and healthcare professionals. Earlier, until the last days of March, people arriving from China were not even subject to health checks. French people in Wuhan, the city where the pandemic originated, were repatriated by a military plane, and, upon their arrival in France, were placed in quarantine. While Air France interrupted its flights to China on January 30, Chinese and other airlines departing from Shanghai and Beijing continue to land in France.

French President Emmanuel Macron summarized France’s official position on the practice: “Viruses do not have passports,” he said. Members of the French government repeated the same dogma. A few commentators reminded them that viruses travel with infected people, who can be stopped at borders, and that borders are essential to stop or slow the spread of a disease, but the effort was useless. Macron ended up saying that the borders of the Schengen area (26 European states that have officially abolished all passport and border control with one another) could not be shut down and raged at other European leaders for reintroducing border checks between the Schengen area member countries. “What is at stake,” he said, seemingly more concerned with the “European project” than with the lives of millions of people, “is the survival of the European project.”

[..] by the end of March, most doctors and caregivers still had no masks. Several doctors fell ill. As of April 10, eight have died from COVID-19 and several others are in critical condition. On March 20, the government’s spokeswoman, Sibeth N’Diaye, incorrectly said that “masks are essentially useless”. At the end of February, France had almost no tests available, and no means of manufacturing them. The government decided to buy tests from China, but by March 19, the number of tests was still insufficient. While Germany performed 500,000 screening tests per week, France was only able to only perform 50,000. Rather than admit that tests were unavailable, or that the government had mismanaged situation, the France’s minister of health, Olivier Veran, announced that large-scale screening was useless, and that France had chosen to “proceed differently”.

Read more …

“..92 homes in the UK reported outbreaks in one day. [..] 2,099 care homes in England have so far had cases of the virus.”

• Older People Being ‘Airbrushed’ Out Of British Virus Figures (BBC)

Many older people are being “airbrushed” out of coronavirus figures in the UK, charities have warned. The official death toll has been criticised for only covering people who die in hospital – but not those in care homes or in their own houses. It comes after the government confirmed there had been virus outbreaks at more than 2,000 care homes in England. Meanwhile, scientific advisers for the government will meet later to review the UK’s coronavirus lockdown measures. The evaluation will be passed to the government – but ministers have said it was unlikely restrictions would change.

On Monday, the UK’s chief medical adviser said he would like “much more extensive testing” in care homes due to the “large numbers of vulnerable people” there. Prof Chris Whitty told the daily Downing Street coronavirus briefing on that 92 homes in the UK reported outbreaks in one day. The Department of Health and Social Care later confirmed 2,099 care homes in England have so far had cases of the virus. The figures prompted the charity Age UK to claim coronavirus is “running wild” in care homes for elderly people. “The current figures are airbrushing older people out like they don’t matter,” Caroline Abrahams, the charity’s director, said.

Ms Abrahams said the lack of personal protective equipment (PPE) and testing is leading to the spread of coronavirus across the care home sector. “We were underprepared for this, we are playing catch-up on getting enough PPE and testing, I’m wondering if the needs of care homes were taken seriously early on,” she said. She joined industry leaders from Marie Curie, Care England, Independent Age and the Alzheimer’s Society in writing a letter to Health Secretary Matt Hancock demanding a care package to support social care through the pandemic. They have also called for a daily update on deaths in the care system.

Read more …

“The home charges up to C$10,000 a month for each resident,..”

Care homes, nursing homes are a major issue. Stories abound from the UK, France, Belgium, Holland, Canada about elderly people being left alone and untested, and their subsequent COVID19 deaths not counted.

• Québec To Ramp Up Care Home Inspections After 31 Die In Montréal Facility (R.)

The Quebec government on Monday said it was putting the safety and general conditions of the province’s 2,600 long-term care and nursing home facilities under the microscope following the deaths of 31 people in a single home for the elderly since March 13. Police and the coroner’s office are investigating the deaths at the Residence Herron, a 139-unit home in Montreal, which has been put under provincial control. Quebec Premier François Legault said health officials had only been informed that the nursing home had a shortage of staff, but not that dozens of residents had died. “[Health officials] didn’t know before Friday night that there were 31 deaths,” Legault told reporters on Monday. “We knew that there were a few deaths, but surely not 31.”

Only five deaths are confirmed to have been caused by COVID-19, with the rest under investigation. Legault blamed the situation on “major negligence” over the weekend and said the facility’s management had not cooperated when authorities first tried to probe reports of problems. “I think that what happened in the month of March was that suddenly many of their residents got the COVID-19, many of the employees decided to leave,” he said. The residence is located on Montreal’s West Island and is owned and operated by Katasa Group, which owns six other retirement homes. The home charges up to C$10,000 a month for each resident, according to the Montreal Gazette. The private nursing home touts itself as having “an enviable reputation in the field of residences for retirees in need of special care,” according to its website.

Read more …

Until further- convincing- notice, make that Brazil and every other country.

• Brazil Likely Has 12 Times More Coronavirus Cases Than Official Count (R.)

Brazil likely has 12 times more cases of the new coronavirus than are being officially reported by the government, with too little testing and long waits to confirm the results, according to a study released on Monday. Researchers at a consortium of Brazilian universities and institutes examined the ratio of cases resulting in deaths through April 10 and compared it with data on the expected death rate from the World Health Organization. The much higher-than-expected death rate in Brazil indicates there are many more cases of the virus than are being counted, with the study estimating only 8% of cases are being officially reported.

The government has focused on testing serious cases rather than all suspected cases, according to the consortium, known as the Center for Health Operations and Intelligence. The center and medical professionals have also complained of long wait times to get test results. Health Minister Luiz Henrique Mandetta has said that it is difficult to distribute tests in Brazil because of the size of the country but acknowledges that testing needs to improve. Officially, Brazil’s coronavirus death toll rose to 1,328 on Monday, while the number of confirmed cases hit 23,430, according to health ministry data. As of last Thursday, Brazil had had around 127,000 suspected cases and carried out just short of 63,000 tests, ministry figures indicate. A health ministry official on Monday said more than 93,000 tests are still being processed for results.

Read more …

Russia is not doing well.

• China Tightens Russian Border Checks, Approves Experimental Vaccine Trials (R.)

China has approved early-stage human tests for two experimental vaccines to combat the new coronavirus as it battles to contain imported cases, especially from neighbouring Russia, the new “front line” in the war on COVID-19. Russia has become China’s largest source of imported cases, with a total of 409 infections originating in the country, and Chinese citizens should stay put and not return home, the state-owned Global Times said in an editorial. “Russia is the latest example of a failure to control imported cases and can serve as a warning to others,” said the paper, which is run by the Communist Party’s People’s Daily. “The Chinese people have watched Russia become a severely affected country… This should sound the alarm: China must strictly prevent the inflow of cases and avoid a second outbreak.”

China’s northeastern border province of Heilongjiang saw 79 new cases of imported coronavirus cases on Monday. All the new cases were Chinese citizens travelling back into the country from Russia, state media said on Tuesday. They formed the bulk of new cases on the Chinese mainland, which stood at 89. Heilongjiang’s provincial authority said on Tuesday that it had established a hotline to reward citizens for reporting illegal immigrants crossing into the province. According to a notice, people supplying verified information about illegal cross-border crimes will be granted 3,000 yuan. Those who apprehend the illegal immigrants themselves and hand them over to the authorities will be given 5,000 yuan. As of Tuesday, China had reported 82,249 coronavirus cases and 3,341 deaths. There were no deaths in the past 24 hours.

Read more …

The robots, like the doctors, are on Big Pharma’s payroll.

• China Big Tech Moves Into Healthcare (R.)

China’s biggest corporate showdown has kicked off. Alibaba, Tencent and Ping An Insurance dominate e-commerce, video games and insurance respectively. Now the trio, worth a combined $1 trillion-plus in market capitalisation, is converging on healthcare. Before Covid-19 hit, China’s medical system suffered from chronic under-investment. Healthcare expenditure, of which the government accounts for over half, was just 5.2% of GDP in 2017, data from the World Health Organization show, far lagging 17% in the United States. A big problem is a shortage of general practitioners, resulting in threadbare primary care. It’s geographically unbalanced too; medical resources are concentrated in wealthier urban areas.

Top-tier hospitals, representing just 8% of the country’s total, received nearly half of all patients in 2016, according to research cited by China Renaissance. Alibaba and Ping An, as well as the Tencent-backed WeDoctor, see potential for profit in filling the gaps left by overstretched, overcrowded hospitals. All three offer cheap online consultations, which have spiked in the wake of the coronavirus outbreak. They are racing to develop all-encompassing apps offering diagnosis, prescriptions, referrals, appointment bookings, 1-hour drug delivery and even insurance.

Ping An’s Good Doctor is ahead for now. The app, run by a Hong Kong-listed subsidiary, has 67 million monthly active users as of the end of last year, thanks to a sizable team of in-house doctors and a network of partner hospitals and pharmacies. But Alibaba is beefing up its healthcare arm, also listed in Hong Kong, by reshuffling its pharmaceutical business and appointing a new chief executive. Tencent’s ubiquitous messaging app, WeChat, too has rolled out features like Covid-19 heat maps and hospital appointment bookings. It owns an undisclosed stake in WeDoctor, which is now looking to raise up to $1 billion in a Hong Kong initial public offering this year …

Read more …

It must be possible to run the Automatic Earth on people’s kind donations. Ads no longer pay for all you read, your support has become an integral part of the process.

Thanks everyone for your generous donations.

Support the Automatic Earth. It’s good for your mental health.