Pablo Picasso The bathers � 1918

US arms producers eye their ultimate bid for trillions in development fees. But Russia is not fazed at all.

“Let’s wait until our partners mature sufficiently to hold a level, meaningful conversation on this topic..”

• Russia Suspends INF Treaty In ‘Mirror Response’ To US – Putin (RT)

President Vladimir Putin says Moscow is halting its participation in the Cold War-era INF nuclear agreement after Washington’s decision to suspend it. Russia will develop missiles previously forbidden under its terms. “Ours will be a mirror response. Our US partners say that they are ceasing their participation in the treaty, and we are doing the same,” the Russian president said in Moscow on Saturday in reference to the Intermediate-Range Nuclear Forces Treaty (INF). “They say that they are doing research and testing [on new weapons] and we will do the same thing,” Putin said during a meeting with Foreign Minister Sergey Lavrov and Defense Minister Sergey Shoigu.

The Russian leader emphasized that while Moscow’s offers on modernizing the 1987 treaty and making it more transparent “are still on the table,” no more talks should be initiated with the Americans to try and save it. “Let’s wait until our partners mature sufficiently to hold a level, meaningful conversation on this topic, which is extremely important for us, them, and the entire world,” Putin said. In December, the Trump administration threatened to quit the agreement, which limits nuclear and conventional land-launched missiles with a range between 500 and 5,500km within 60 days, unless Russia stopped allegedly violating it with its 9M729 missile, which Washington claims exceeds the permitted range.

Moscow denied that it had broken the treaty, and offered additional mutual inspections during failed talks in Geneva last month. On February 1, Washington officially confirmed that the bilateral agreement signed by Mikhail Gorbachev and Ronald Reagan will be suspended for 180 days. Washington also signaled intentions to entirely withdraw from it afterwards. During the meeting in front on the cameras on Saturday, Lavrov insisted that Moscow “attempted to do everything we could to rescue the treaty.” This included “unprecedented steps going far beyond our obligations,” he said, accusing Washington of systematically undermining the INF Treaty at least since the late 1990s.

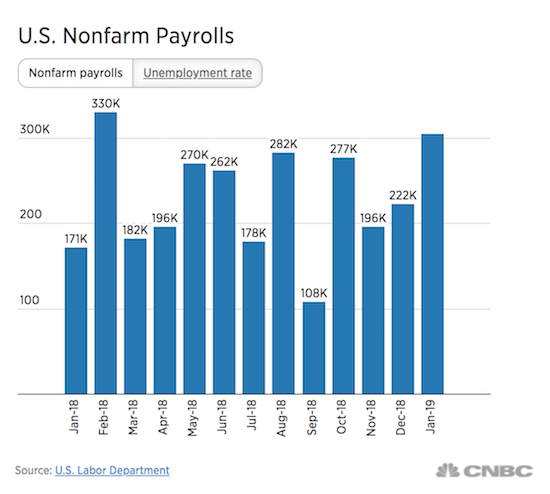

“December’s big initially reported gain of 312,000 was knocked all the way down to 222,000..”

• US Payrolls Surge By 304,000, Smashing Estimates Despite Shutdown (CNBC)

Job growth in January shattered expectations, with nonfarm payrolls surging by 304,000 despite a partial government shutdown that was the longest in history, the Labor Department reported Friday. The unemployment rate ticked higher to 4 percent, a level where it had last been in June, a likely effect of the shutdown, according to the department. However, officials said federal workers generally were counted as employed during the period because they received pay during the survey week of Jan. 12. On balance, federal government employment actually rose by 1,000. Economists surveyed by Dow Jones had expected payrolls to rise by 170,000 and the unemployment rate to hold steady at 3.9 percent.

In all, it was a powerful performance at a time when economists increasingly have said they expect growth to slow in 2019. January marked 100 months in a row of positive job creation, by far the longest streak on record. Stock futures and Treasury yields jumped in response to the better-than-expected report. The news was not all good, though, as data revisions pushed previous numbers lower. December’s big initially reported gain of 312,000 was knocked all the way down to 222,000, while November’s rose from 176,000 to 196,000. On net, that took the two months down by 70,000, bringing the three-month average to 241,000. That’s still well above the trend that would be common this far into an economic expansion dating back 9 1/2 years.

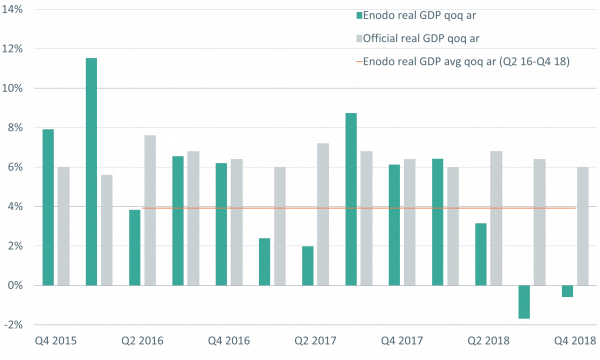

“Real GDP fell by 1.7 percent and 0.6 percent in Q3 and Q4 respectively compared with the official figures showing growth of 6.4 percent and 6 percent..”

• Big Trouble in Little China (Schmid)

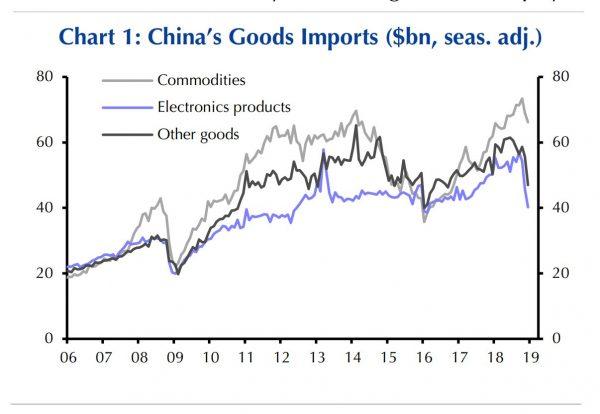

There are those who think “China will take over the world” with its technocratic central planning. Then there are those who say its debt bubble is so gigantic, the economy will crash and burn. The truth, probably, lies somewhere in the middle. And it looks like we are getting closer to know the truth. Official GDP growth, is of course on track at 6.6 percent for the year 2018, stellar among industrial and even emerging economies. But nobody believes these figures, even though they are the worst since 1990. “Real GDP fell by 1.7 percent and 0.6 percent in Q3 and Q4 respectively compared with the official figures showing growth of 6.4 percent and 6 percent,” Enodo Economics chief economist Diana Choyleva wrote in a note to clients about the annualized growth during the past two quarters of 2018. According to Choyleva, China is experiencing an unofficial recession.

While this doesn’t mean the crash and burn scenario is unavoidable, the flurry of official and unofficial economic indicators flashing red make the “take over the world” scenario quite unbelievable for the intermediate future. No matter which official indicator you look at, the Chinese economy is in decline. Retail sales growth is barely above 5 percent, the lowest level since 2003 with automobile sales crashing 13 percent. Total imports in U.S. dollar terms are down 7.6 percent in December of 2018 as compared to the year before.

The main problem of the Chinese economy is debt and overcapacity. Debt has blown up to 300 percent of GDP through the state-controlled banking system. The financing went into building trains, roads, airports, apartments, shipyards, anything that can be built. And while some of the stuff is undoubtedly useful, a lot of it is not. If it’s not useful or sustainable, it won’t generate the returns necessary to service said debt. This problem could have been nipped in the bud, but Chinese central planners wanted ever more steel mills and high speed trains and push back the day of reckoning when most of the unprofitable companies would go bankrupt. So in order to keep the gravy train running, more debt had to be issued to build more stuff.

TEXT

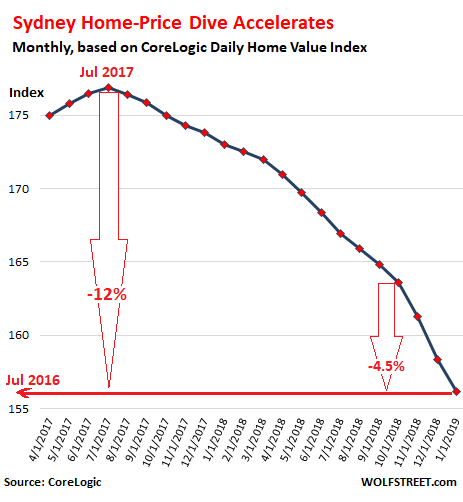

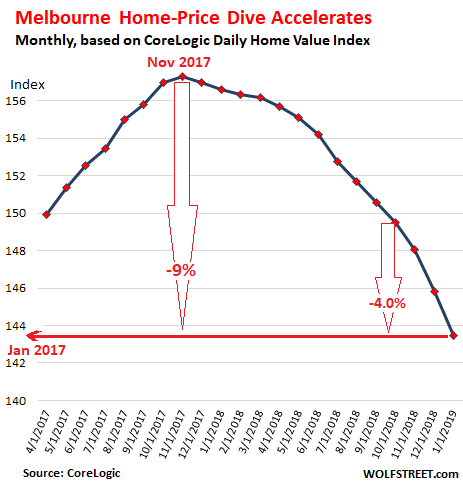

• How Fast Housing Markets in Sydney & Melbourne Are Coming Unglued (WS)

“Can we still describe this as an orderly slowdown in housing conditions?” mused CoreLogic Asia Pacific’s head of research Tim Lawless about the Australian housing market today. Over the last three months, the index for Sydney dropped 4.5%, and the index for Melbourne 4.0%, the “largest rolling quarterly fall since at least the 80’s.” Across the metro area of Sydney, prices of all types of homes combined, according to CoreLogic’s Daily Home Value Index, fell 1.35% in January from December, the third month in a row with a monthly decline of over 1%. The 4.5% decline over the past three months pencils out to an annual rate of decline of 17%. The index is now down about 12% from its peak in July 2017. Note the accelerating decline over the past three months:

The 12% drop from the peak in July 2017 pushed the index back where it been in July 2016 – which shows how crazy and unsustainable the price boom had been on the way up. Now it is getting unwound at a slightly slower pace on the way down. Over the 12-month period through January, the index fell 9.7%, with house prices down 10.9% and condo prices down 6.9%. At the same time, the number of homes of all types listed for sale in the Sydney metro jumped by 24%. [..] In the Melbourne metro, the second largest market in Australia, the housing bust is also taking on momentum, instead of slowing down, but started about four months behind Sydney’s. According to the CoreLogic Daily Home Value Index, since the peak in November 2017, prices of all types of homes fell about 9%, which pushed prices back to January 2017 levels. Note the acceleration over the past three months:

US sanctions deprive Maduro of food and medicine. Seen as a way to create a revolt.

• Venezuela To Sell Gold Reserves To UAE Without Russia’s Help (RT)

Caracas plans to sell 29 tons of gold to the United Arab Emirates in return for euro in cash, Reuters cites a senior government official as saying. The money is needed to provide liquidity for imports of basic goods.

According to the official, the sale of the nation’s gold began with the shipment of 3 tons on January 26, following the export last year of $900 million in unrefined gold to Turkey. The source denied Moscow’s involvement in the operation after rumors circulated this week that mysterious Russian-operated airplanes arrived in the country and planned to leave with Venezuelan gold on board. That is incorrect, according to the official. Caracas reportedly needs cash for imports of basic products that it sells to the population at subsidized prices.A possible explanation for the payment for the gold in euros is US sanctions, which restrict Venezuela’s use of the dollar. Venezuela’s central bank reportedly began to sell gold reserves to allied countries after supplies of unrefined gold from small mines began to run low. The bank held 150 tons of gold in January 2018. By the end of November holdings had fallen to 132 tons between the central bank’s vaults and the Bank of England, according to central bank data. The Bank of England has refused to return an estimated 31 tons of Venezuelan gold worth $1.2 billion. Bankers in Britain are allegedly concerned that Venezuelan officials would sell state-owned gold “for personal gain.”

“..this same mistake was made in Libya, and everyone today recognizes it. We must prevent the same thing happening in Venezuela.”

• Italy Rejects Guaido, Says Venezuela is a Sovereign State (Telesur)

On Thursday the Italian Government withdrew from the position assumed by the European Parliament and informed that it does not recognize Juan Guaido as “president in charge” of Venezuela. “Italy does not recognize the self-proclaimed President Juan Guaido,” Italy’s Undersecretary of Foreign Affairs, Manlio Di Stefano, said. The senior official explained that Italy is “totally against” that a country or a group of countries “can determine the internal policies” of a sovereign State. “This is called the principle of non-intervention and is enshrined by the United Nations,” Di Stefano said. He also expressed the Italian Government’s concern to prevent a warlike confrontation in the South American nation and stressed that “this same mistake was made in Libya, and everyone today recognizes it. We must prevent the same thing happening in Venezuela.”

Last Wednesday the Italian Prime Minister, Giuseppe Conte, warned the international community that it is not “prudent” to support one of the opposing parties in Venezuela, since “an invasive attitude would generate more division in the world.” “We do not consider it opportune to rush to recognize investitures that have not gone through an electoral process,” said Conte. Nevertheless, violating international law, and adding to the U.S.-driven coup d’état, the European Parliament approved a resolution Thursday that recognizes Juan Guaido as Venezuela’s “interim president.”

With just 56 days left, great moment to start.

• Whitehall Begins ‘Serious Work’ On Customs Union With EU (Ind.)

Whitehall officials have begun “serious work” on the UK staying in a permanent EU customs union as a route to rescuing the Brexit deal, despite Theresa May ruling out the move, The Independent can reveal. Preparations are underway at a high level, amid a belief the beleaguered prime minister will be forced to offer the potentially crucial compromise to Labour. Ms May has repeatedly rejected a customs union – fearing a further revolt by anti-EU Tories – but some cabinet ministers are pushing her to accept that the red line will have to be dropped if her deal is to be rescued. They believe it could tempt scores of Labour MPs to back the deal when it returns to the Commons, even if Jeremy Corbyn himself still refuses to drop his opposition.

Now a well-placed Whitehall source has told The Independent: “There is serious work going on about a customs union. We need to be prepared, so we are ready if the politics moves in that direction.” Although the prime minister has not yet been won over, she will come under fierce pressure if, as expected, the EU rejects her plea to replace the backstop – before fresh Commons votes in just 12 days’ time. The concession of a customs union is unlikely to be enough to persuade Mr Corbyn to throw his weight what he is determined to brand “a Tory Brexit”, but many Labour MPs are expected to switch sides. Furthermore, despite inevitable Tory outrage, some Conservative MPs could be persuaded that a customs union would make it less likely the Irish backstop they oppose – designed to guarantee an open border – will ever be needed.

“To storm my house with greater force than was used to take down (Osama) bin Laden or El Chapo or Pablo Escobar, to terrorise my wife and my dogs, is unconscionable..”

• Judge Considers Gag Order On Roger Stone And Prosecution (BBC)

The judge overseeing the criminal case against ex-Trump campaign adviser Roger Stone says she is considering a gagging order on both him and the prosecution. Judge Amy Berman Jackson said the case was “a criminal proceeding and not a public relations campaign”. Mr Stone has been charged on seven counts by special counsel Robert Mueller, including witness tampering and lying to Congress. He denies any wrongdoing and has made frequent jibes against Mr Mueller. Mr Stone, 66, a longstanding ally of the president, has previously vowed to resist any gagging order, saying on Tuesday: “I will fight and the deep state is in panic mode.”

Mr Mueller is overseeing an investigation into alleged Russian meddling in the 2016 presidential election and whether Donald Trump’s campaign conspired with Moscow. President Trump denies collusion, calling the investigation “a witch hunt”, and the Kremlin denies any meddling. At a court hearing in Washington on Friday, Judge Jackson cited a number of “extrajudicial statements by the defendant”. She said that if a gagging order was imposed, Mr Stone would still be able to talk to the media about issues not connected to the case. She asked both sides to respond to the possible order by 8 February. The charges against Mr Stone are linked to an alleged Russian-led hack into the emails of Democratic Party officials. The information contained in the emails was released by Wikileaks during the 2016 campaign.

Since his arrest, Mr Stone has given a string of media interviews. He has been highly critical of his arrest, describing it as political theatrics. “To storm my house with greater force than was used to take down (Osama) bin Laden or El Chapo or Pablo Escobar, to terrorise my wife and my dogs, is unconscionable,” he told reporters. He has accused Mr Mueller of running a politically motivated “inquisition”. In an interview with Reuters, Mr Stone dismissed the charges as “process crimes” with no intentional lies. He said any failure to disclose emails or texts had been an “honest mistake”. In a phone interview with conspiracy theorist Alex Jones on his radio programme Infowars, Mr Stone said he intended to “fight for my life”.

“This not only means they are supplied with state-of-the-art weaponry; it also means those weapons are being maintained by other Nato members. ”

• America’s Kurdish Allies Risk Being Wiped Out – By NATO (Graeber)

Remember those plucky Kurdish forces who so heroically defended the Syrian city of Kobane from Isis? They risk being wiped out by Nato. The autonomous Kurdish region of Rojava in Northeast Syria, which includes Kobane, faces invasion. A Nato army is amassing on the border, marshaling all the overwhelming firepower and high-tech equipment that only the most advanced military forces can deploy. The commander in chief of those forces says he wants to return Rojava to its “rightful owners” who, he believes, are Arabs, not Kurds. Last spring, this leader made similar declarations about the westernmost Syrian Kurdish district of Afrin. Following that, the very same Nato army, using German tanks and British helicopter gunships, and backed by thousands of hardcore Islamist auxiliaries, overran the district.

According to Kurdish news agencies, the invasion led to over a 100,000 Kurdish civilians being driven out of Afrin entirely. They reportedly employed rape, torture and murder as systematic means of terror. That reign of terror continues to this day. And the commander and chief of this Nato army has suggested that he intends to do to the rest of North Syria what he did to Afrin. I am speaking, of course, of president Recep Tayyip Erdogan, who is, increasingly, Turkey’s effective dictator. But it’s crucial to emphasize that these are Nato forces. This not only means they are supplied with state-of-the-art weaponry; it also means those weapons are being maintained by other Nato members. Fighter jets, helicopter gunships, even Turkey’s German-supplied Panzer forces – they all degrade extremely quickly under combat conditions.

The people who continually inspect, maintain, repair, replace, and provide them with spare parts tend to be contractors working for American, British, German or Italian firms. Their presence is critical because the Turkish military advantage over Northern Syria’s “People’s Defense Forces” (YPG) and “Women’s Defense Forces” (YPJ), those defenders of Kobane that Turkey has pledged to destroy, is entirely dependent on them. That’s because, aside from its technological advantage, the Turkish army is a mess. Most of its best officers and even pilots have been in prison since the failed coup attempt in 2016, and it’s now being run by commanders chosen by political loyalty instead of competence. Rojava’s defenders, in contrast, are seasoned veterans. In a fair fight, they would have no more problem fending off a Turkish incursion than they had driving back Turkish-backed Jihadis in the past.

Precautionary principle. The only response.

• Rigging the Science of GMO Ecotoxicity (Latham)

Researchers who work on GMO crops are developing special “artificial diet systems”. The stated purpose of these new diets is to standardise the testing of the Cry toxins, often used in GMO crops, for their effects on non-target species. But a paper published last month in the journal Toxins implies a very different interpretation of their purpose. The new diets contain hidden ingredients that can mask Cry toxicity and allow them to pass undetected through toxicity tests on beneficial species like lacewings (Hilbeck et al., 2018). Thus the new diets will benefit GMO crop developers by letting new ones come to market quicker and more reliably. Tests conducted with the new diets are even being used to cast doubt on previous findings of ecotoxicological harm.

The resulting crops are usually called Bt crops. Cry toxins kill insects that eat the GMO crop because the toxin punches a hole in the membranes of the insect gut when it is ingested, causing the insect to immediately stop feeding and eventually die of septicaemia. Cry toxins are controversial. Although the biotech industry claims they have narrow specificity, and are therefore safe for all organisms except so-called ‘target’ organisms, plenty of researchers disagree. They suspect that Cry toxins may affect many non-target species, even including mammals and humans (e.g. Dolezel et al., 2011; Latham et al., 2017; Zdziarski, et al., 2018).

The Cry toxin mode of action, we and others have noted, does not necessarily discriminate between species. Any organism with a membrane-lined gut is, in principle, vulnerable if it consumes the GMO Bt crop. In these Bt crops the leaves, straw, roots, nectar, and pollen, all typically contain Cry toxins. Therefore, most organisms in agricultural landscapes will at some point in their life-cycle be exposed to GMO plant material. As pollinator declines and a more generalised insect apocalypse have revealed, the question of the effects of such crops on biodiversity is far from trivial.

—————

GMO Cry toxins

Cry toxins are a family of highly active protein toxins originally isolated from the gut pathogenic bacterium Bacillus thuringiensis (Latham et al., 2017). They confer insect-resistance and up to six distinct ones are added to GMO corn, cotton, and other crops (Hilbeck and Otto, 2015).