Jimmy King Bowie last photo on last birthday Jan 8 2016

“Deflation is upon us and the central banks can’t see it.”

• Beware The Great 2016 Financial Crisis, Warns Albert Edwards (Guardian)

The City of London’s most vocal “bear” has warned that the world is heading for a financial crisis as severe as the crash of 2008-09 that could prompt the collapse of the eurozone. Albert Edwards, strategist at the bank Société Générale, said the west was about to be hit by a wave of deflation from emerging market economies and that central banks were unaware of the disaster about to hit them. His comments came as analysts at RBS urged investors to “sell everything” ahead of an imminent stock market crash. “Developments in the global economy will push the US back into recession,” Edwards told an investment conference in London. “The financial crisis will reawaken. It will be every bit as bad as in 2008-09 and it will turn very ugly indeed.”

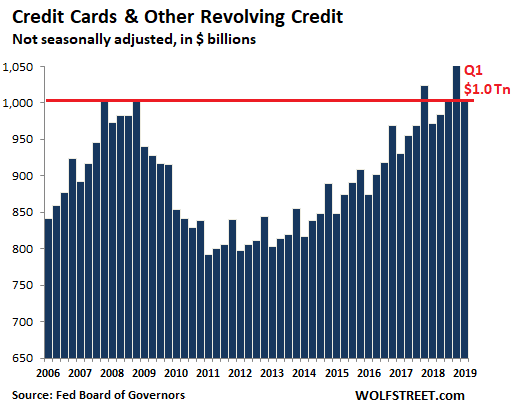

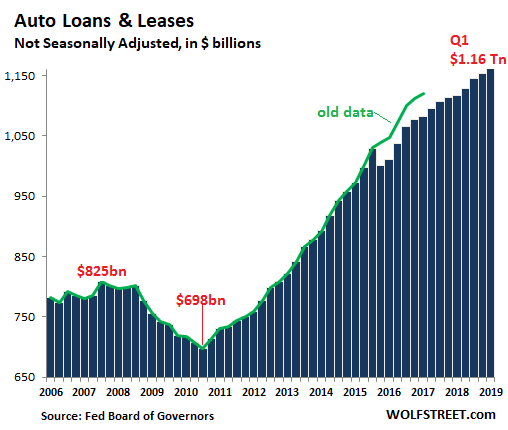

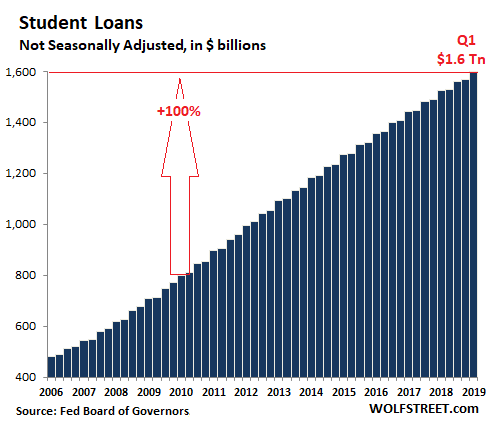

Fears of a second serious financial crisis within a decade have been heightened by the turbulence in markets since the start of the year. Share prices have fallen rapidly and a slump in the cost of oil has left Brent crude trading at barely above $30 a barrel. “Can it get any worse? Of course it can,” said Edwards, the most prominent of the stock market bears – the terms for analysts who think shares are overvalued and will fall in price. “Emerging market currencies are still in freefall. The US corporate sector is being crushed by the appreciation of the dollar.” The Soc Gen strategist said the US economy was in far worse shape than the Federal Reserve realised. “We have seen massive credit expansion in the US. This is not for real economic activity; it is borrowing to finance share buybacks.”

Edwards attacked what he said was the “incredible conceit” of central bankers, who had failed to learn the lessons of the housing bubble that led to the financial crisis and slump of 2008-09. “They didn’t understand the system then and they don’t understand how they are screwing up again. Deflation is upon us and the central banks can’t see it.” Edwards said the dollar had risen by as much as the Japanese yen had in the 1990s, an upwards move that pushed Japan into deflation and caused solvency problems for the Asian country’s banks. He added that a sign of the crisis to come was the collapse in demand for credit in China. “That happens when people lose confidence that policymakers know what they are doing. This is what is going to happen in Europe and the US.”

Read more …

Some confusion stems from counting trade in yuan vs dollars. But remember these are all still official Chinese numbers.

• Chinese Exports Post First Annual Decline Since 2009 (WSJ)

Chinese exports declined for the year, marking their worst performance since 2009, as weak demand continued to weigh on the world’s second-largest economy. Exports, however, fell less than expected in December thanks to a favorable comparison with year-earlier figures. The improved monthly results don’t signal a major recovery this year despite a weaker yuan, economists said. “In the next few months, the comparative price effect will fade out and export growth will recover,” ING Group economist Tim Condon said. “But it’s not going to be as strong as in 2013 or 2014.” According to the General Administration of Customs, China’s exports fell 1.4% in December in dollar terms from a year earlier, after a drop of 6.8% in November.

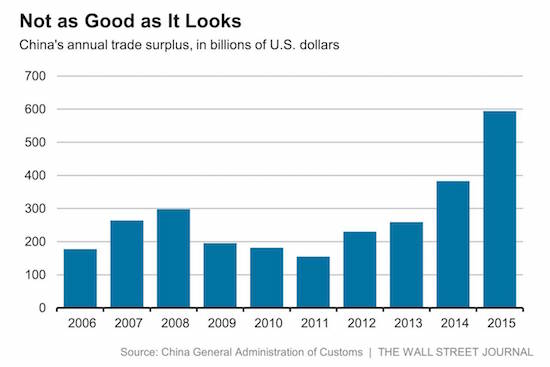

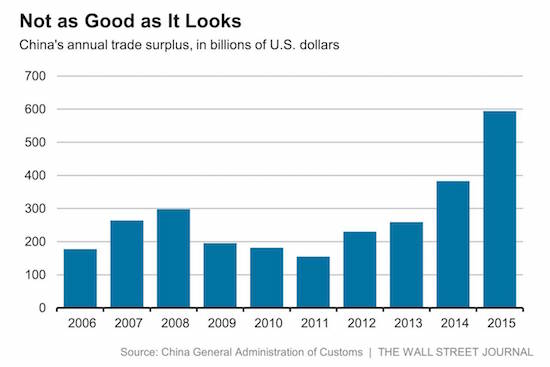

This was a more modest decline than the 8.0% fall forecast by 15 economists surveyed by The WSJ In yuan terms, exports rose last month. Imports last month fell 7.6% from a year earlier, compared with an 8.7% decline in November. The country’s trade surplus widened to $60.1 billion in December from $54.1 billion in November. Last year’s weak Chinese exports and even weaker imports led to a record $594.5 billion annual trade surplus, compared with $382.5 billion in 2014, the agency said, as full-year exports fell 2.8% and imports fell 14.1%. Despite the decline in exports last year, the Asian giant managed to increase its share of global trade. “China’s declining exports in 2015 were mainly due to sluggish external demand on the back of slowing global economic recovery since the financial crisis,” Customs spokesman Huang Songping told reporters Wednesday.

“But China’s export performance is better than other major economies in the world.” Few economists see a huge export turnaround ahead, however, with exports no longer as important for China as they used to be. December’s improved outbound data may reflect a one-time boost as companies rushed to meet year-end orders. While business sentiment in Germany picked up recently, confidence surveys in the U.S. have weakened. And on the import side, domestic demand and global commodity prices remain weak. “Demand may not be a big driver,” said Standard Chartered Bank economist Ding Shuang.

Read more …

“..there was roughly $750 billion of capital outflow in 2015. No wonder the currency is under pressure.”

• China’s Hefty Trade Surplus Is Dwarfed by Outflows (WSJ)

China’s fat trade surplus should be a source of comfort. But juxtaposed against falling reserves, it actually sends an alarming message about the degree of capital flight. The surplus swelled by 55% in 2015, to $595 billion, figures released Wednesday showed. This news isn’t as good as looks. For one, it doesn’t reflect a boom in exports, which for the full year actually fell by 2.8%. The surplus widened because imports fell even more, by 14.1%. Moreover, it raises a question: How did China manage to post a decline of $513 billion in foreign-exchange reserves last year? Since a trade surplus brings foreign currency into the country, and most exporters turn that currency over to the central bank, it should boost reserves by a corresponding amount. That reserves fell suggests fund outflows large enough to overwhelm even that trade surplus.

To get a full picture, more variables must be accounted for. Full-year data isn’t yet available for China’s foreign direct investment, overseas direct investment and services trade deficit. But based on numbers currently available, and adding the trade surplus, a rough estimate of total net inflows from trade and direct investment in 2015 comes to about $379 billion. This must be compared with the fall in reserves. In fairness, this decline was exaggerated by the stronger dollar, which makes China’s holdings in other currencies less valuable when they are reported in dollar terms. Taking these valuation effects into account, and based on estimates of the composition of its mostly secret portfolio, China may have sold a net $375 billion of reserves in 2015. Putting these two figures together, it appears that there was roughly $750 billion of capital outflow in 2015. No wonder the currency is under pressure.

Read more …

“It’s just a shame they had to go to such lengths to achieve this. The question is what asset class will be the next target for the speculators?”

• China Predicts Painful Year In 2016 As Trade Slumps (Guardian)

Weak demand for Chinese goods will continue to hurt the country’s economy in 2016, according to officials, despite better than expected trade figures that helped shore up stock markets in Asia Pacific. China’s trade volume fell 7% in 2015 compared with the previous year, Chinese customs said on Wednesday, as slowing growth in the world’s second-largest economy and plunging commodity prices took their toll. Although imports slumped 13.2% and exports were down 1.8%, the numbers surprised the markets where economists had been forecasting a much weaker reading. Helped by further action from Beijing to stabilise the yuan and dampen fears of a devaluation, equity markets in the region initially bounced back after days of volatile trading.

The Shanghai Composite index was up slightly at 4am GMT while the Australian ASX/S&P200 index looked set to snap eight straight days of losses by surging more than 1%. In Japan, the Nikkei was up 2.4% and Hong Kong’s Hang Seng was also up more than 2%. However, customs spokesman Huang Songping warned at a news conference that China’s trade faced “many challenges” in 2016 due to weak external demand. One of the main reasons for China’s lower exports in 2015 was weak external demand, he added. The 5% fall in the value of the yuan since last August had helped support exports but the impact would begin to fade, he said. Earlier, the People’s Bank of China held the line on the yuan for a fourth straight session on Wednesday while putting the squeeze on offshore sellers of the currency.

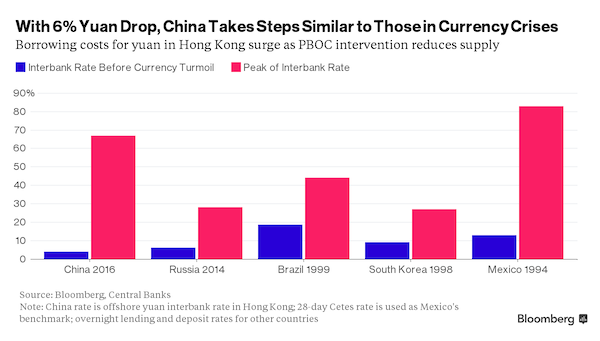

The central bank has also used aggressive intervention to engineer a huge leap in yuan borrowing rates in Hong Kong, essentially making it prohibitively expensive to short the currency. The result has been to drag the offshore level of the yuan back toward the official level, closing a gap that had threatened to get out of control just a few days earlier. Confusion about China’s policy had stoked concerns Beijing might be losing its grip on economic policy, just as the country looks set to post its slowest growth in 25 years. Chris Weston at IG Markets in Melbourne welcomed a more stable day of trading but cautioned that Beijing may have delayed another outbreak of volatility by driving up funding costs in Hong Kong and making it impossible to short the yuan.

“What counts is the fact Chinese authorities have achieved their goal of converging the onshore and offshore yuan, with stability in the ‘fix’ and they have even seen a positive session in the equity markets,” he said. “It’s just a shame they had to go to such lengths to achieve this. The question is what asset class will be the next target for the speculators?”

Read more …

Objects in mirror are bigger than they appear.

• Behind Chinese Yuan’s Tiny Drop, Indications of True Crisis Lurk (BBG)

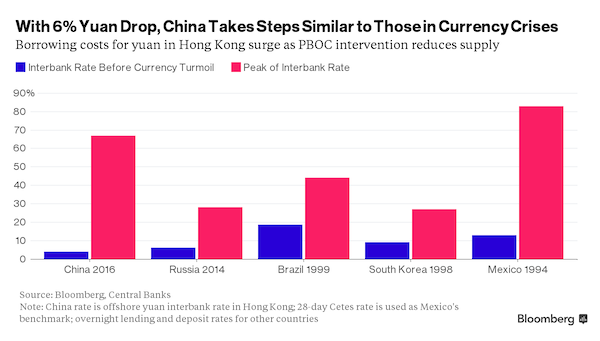

The Chinese yuan’s 6% decline over the past five months is hardly anyone’s idea of a crisis. On average it comes out to a drop of less than 0.04% a day. But behind the scenes, Chinese policy makers are unleashing a torrent of measures to stabilize the currency and prevent it from tumbling. Added up, these efforts rival some of the biggest currency defenses seen in emerging markets over the past two decades. Here’s a quick look at the central bank’s most aggressive steps. Hong Kong has become a key focal part for policy makers. Over the last two days, they bought enough yuan there to push overnight borrowing costs for the currency to a record 67% on Tuesday from just 4% at the end of last week. These rates, designed to discourage speculators, are even higher than those at the peak of Russia’s defense of the ruble in 2014 and Brazil’s intervention in 1999.

In propping up the exchange rate, the People’s Bank of China also burnt through more than half a trillion of dollars in foreign reserves in the past 12 months, cutting them to $3.3 trillion. The draw-down was almost equivalent to the entire stockpile of Switzerland, the world’s fourth largest holder. Regulators also went to great lengths to tighten capital controls, cracking down on illegal money transfers and restricting lenders from conducting some cross-border transactions. Among its emerging-market peers, the yuan remains one of the top-performing currencies over the past year against the dollar, yet Chinese policy makers are acting with an increasing sense of urgency. At stake is the financial stability of the world’s No. 2 economy – disorderly depreciation could fuel more capital outflows, which already approached $1 trillion in the 12 months through November. “They are really trying to stop the panic,” said Lucy Qiu at UBS Wealth Management said.

By intervening in the Hong Kong market, the PBOC is forcing the offshore rate to converge toward the stronger onshore rate in an effort to anchor expectations among overseas investors. Officials also stressed that the aim is to keep the yuan basically stable against a basket of currencies, rather than pegging it against the rising dollar. Deterring speculators and attracting investors with off-the-chart rates can help contain a currency crisis, but it can also send an economy into a tailspin by cutting companies and consumers off from credit. That is unlikely to be the case in China. The yuan loan increase in Hong Kong would have less impact on the mainland’s economy, where the benchmark seven-day interbank rate remains stable at about 2.4%.

Read more …

Job losses will be a major China issue in 2016. Beijing will try and force companies to hire large groups of people, but that’s sure to backfire.

• Chinese Shipyards Vanish With Appetite for Consuming Iron Ore (BBG)

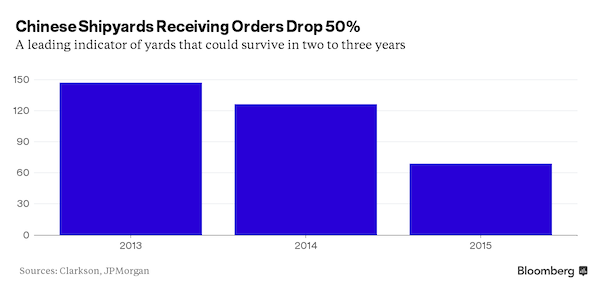

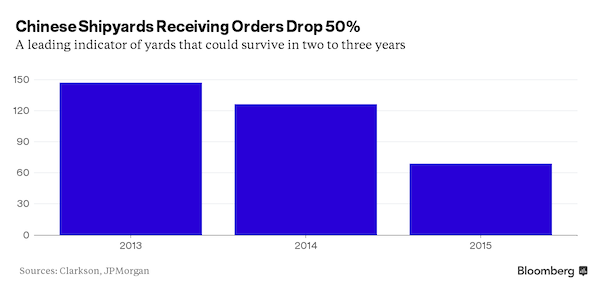

The weakening yuan and China’s waning appetite for raw materials have come around to bite the country’s shipbuilders, raising the odds that more shipyards will soon be shuttered. About 140 yards in the world’s second-biggest shipbuilding nation have gone out of business since 2010, and more are expected to close in the next two years after only 69 won orders for vessels last year, JPMorgan analysts Sokje Lee and Minsung Lee wrote in a Jan. 6 report. That compares with 126 shipyards that fielded orders in 2014 and 147 in 2013. Total orders at Chinese shipyards tumbled 59% in the first 11 months of 2015, according to data released Dec. 15 by the China Association of the National Shipbuilding Industry.

Builders have sought government support as excess vessel capacity drives down shipping rates and prompts customers to cancel contracts. Zhoushan Wuzhou Ship Repairing & Building last month became the first state-owned shipbuilder to go bankrupt in a decade. “The chance of orders being canceled at Chinese yards is becoming greater and greater,” said Park Moo Hyun at Hana Daetoo Securities in Seoul. “While a weaker yuan could mean cheaper ship prices for customers, it still won’t be enough to lure back any buyers. Chinese shipbuilders won’t be able to revive even if you try breathing some life into them.” The Baltic Dry Index, which measures the cost of transporting raw materials, dropped 39% last year and hit a historical low Dec. 16.

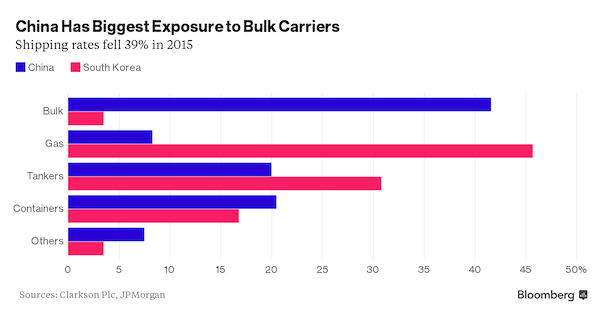

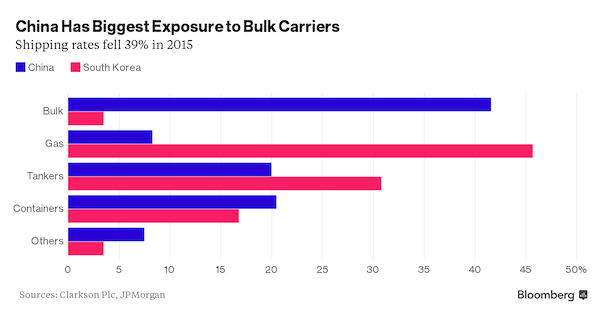

Aggravating the situation is Chinese shipyards’ heavy reliance on bulk carriers, which are used to haul commodities from iron ore to coal and grain. Bulk ships accounted for 41.6% of Chinese shipyards’ $26.6 billion orderbook as of Dec. 1, according to Clarkson, the world’s largest shipbroker. That compares with a 3.5% share at South Korean shipyards, which have more exposure to the tankers and gas carriers that are among the few bright spots in a beleaguered shipping industry.

Read more …

How is Xi going to save his banks? Hard to see.

• China’s Banks Could Be The Next Big Problem (MarketWatch)

While China’s equity turbulence appears to have temporarily paused, its main equity indices are now 15% lower since the start of the year, despite Beijing remaining committed to its policy of market intervention. In some ways the government’s hands are tied from last year’s stock buying as it now has a substantial position to protect. Added to this, the original reason the party could not let its bull market die remains due to the potential political fallout from losses after it effectively orchestrated the bubble. But in attempting to solve one problem, are policy makers just sowing the seeds of another? Attention is now turning to the collateral damage from official intervention to support stocks, in particular to the banks. Analysts are questioning the cost to China’s state-owned yet overseas-listed banks, which have once again been called up for national service.

The concern is that by acting as a buyer of last resort to prop up the stock market, this sets up China’s banks to be the next fault line in the economy. In a new report, rating agency Fitch warns of a clear conflict between banks struggling to manage state strategic roles and their profit goals. How much intervention has come this year is still unknown, but last July after the initial stock market rout 17 banks, including the big five, were reported to have lent $200 billion. There is also a pattern here. Last summer state-owned banks had to play another strategic role as they were strong-armed by the central government into a 3.2 trillion yuan debt-for-bond swap to help bail out local authorities. The list of troubled assets needing help is unlikely to end there. The central government has prioritized cleaning up struggling state-owned enterprises, which, according to SocGen, includes some 30% that are bankrupt with 23 trillion yuan in liabilities.

Given this accumulation of questionable assets at the behest of the state, investors might feel somewhat anxious in case there ultimately is a reckoning. While Fitch notes these initiatives will harm profits, it does at least expect the central government rather than non-sovereign shareholders will be the banks’ main source of funds if they do need additional capital. If investors suspected that they would be forced to repeat the scenario from the global financial crisis when Western banks raised fresh capital from shareholders with deeply discounted share issues, stock prices would be vulnerable to steep falls. Fitch’s sanguine assumption of the central government stepping in depends on how much capital China’s banks may need.

Analyst Charlene Chu at Autonomous Economics, estimates this figure could be as high as $7.7 trillion of new capital in the next three years. Such a figure would send the government debt-to-GDP ratio skyrocketing, which at around 22% is usually used to reaffirm China’s robust financial position. Another issue is that in China the overlap between corporates and the state can often make it difficult to get a true financial picture. For instance, hugely profitable state banks in recent years have by some estimates accounted for 50% of the net profits of all listed Chinese companies. This could mean if China’s banks had to recognize a substantial increase in bad debts, another wild card is the impact on the central government’s fiscal position through lost tax revenue.

Read more …

The yuan can shake the entire region.

• Yuan Jolt May Prompt Looser Policies in Australia, Singapore (BBG)

The extreme jolt financial markets received this year from a weakening yuan is spurring speculation that central banks from Singapore to Australia will be forced to loosen policy. The Monetary Authority of Singapore may widen the band within which it guides the local dollar if the currencies of its major trading partners and competitors become “extremely volatile,” said Mirza Baig at BNP Paribas. Central banks in Australia, Taiwan and India are most likely to respond by cutting interest rates, said Mansoor Mohi-uddin at RBS. Weaker-than-estimated yuan fixings last week heightened concerns that China’s economic slowdown is accelerating and triggered a global market rout. About a year ago, foreign-exchange markets were hammered when Switzerland surrendered its three-year-old cap on the franc against the euro and nations from Canada to Singapore unexpectedly eased monetary policy.

“The depreciation of the RMB is clearly creating large financial shocks,” said Baig, who is based in Singapore. “One thing that we are considering – although this doesn’t enter into our forecast – is that the RMB becomes more of a free-floating, more volatile currency. Then local central banks are also likely to adopt a more laissez-faire kind of approach towards currency management.” China stepped up its defense of the yuan, buying the currency in Hong Kong on Tuesday, according to people familiar with the matter. Betting against the yuan will fail and calls for a large depreciation are “ridiculous” as policy makers are determined to ensure the currency’s stability, Han Jun, the deputy director of China’s office of the central leading group for financial and economic affairs, said Monday in New York. The State Bank of Vietnam has already moved this year to a more market-based methodology in setting a daily reference rate versus the dollar.

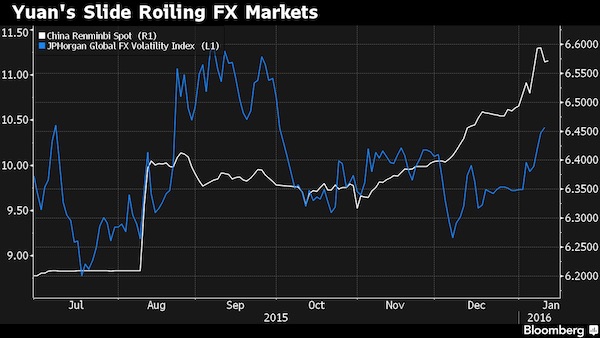

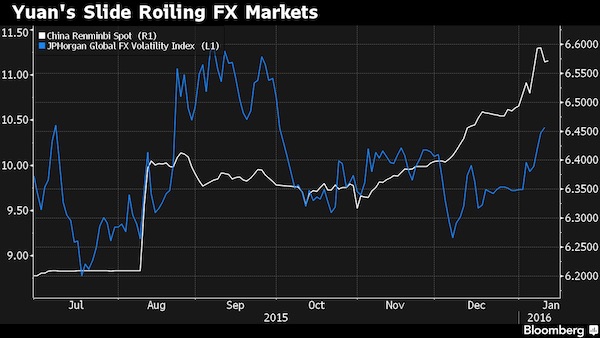

“They’re now forced to change their currency regime to make it more in tune with day-to-day fluctuations in markets,” Baig said. While BNP Paribas expects Singapore’s central bank to maintain its monetary policy, there is a risk that it may widen its band ”in response to elevated financial market volatility,” Baig said. The Monetary Authority of Singapore guides the local currency against an undisclosed basket and adjusts the pace of appreciation or depreciation by changing the slope, width and center of a band. It refrains from disclosing details of the basket, the band, and the pace of appreciation or depreciation. The yuan probably has the third-highest weighting in the basket, exceeded only by the U.S. dollar and Malaysian ringgit, Baig said. A JPMorgan gauge of currency volatility rose to 10.42% Monday, the most since September. “The more volatile and weaker yuan is set to be more of a risk to regional central banks’ outlooks than higher Fed interest rates this year,” RBS’s Mohi-uddin said.

Read more …

But just how low can the yuan go?

• In Rush to Exit Yuan, China Traders Buy Sinking Hong Kong Stocks (BBG)

Chinese investors are so desperate to shift their money out of yuan-denominated assets that they’re piling into some of the world’s worst-performing stocks. Mainland buyers purchased Hong Kong shares through the Shanghai stock link for a 10th week last week, even as the Hang Seng Index tumbled 6.7%. Chinese traders held 112.5 billion yuan ($17.1 billion) of the city’s equities by Monday, the most since the bourse program started in 2014, and up by 23.7 billion yuan since late October. With the yuan weakening, investors are looking for a way out, according to Reorient. “By buying Hong Kong stocks, it’s like buying the Hong Kong dollar,” said Uwe Parpart, chief strategist at the brokerage. Mainland investors are expecting “further depreciation and when that’s the case it’s a good idea to get out. If you buy at a certain rate and then the yuan goes down, even when the stock market goes down, you may still be getting ahead in the game.”

Hong Kong and mainland markets are at the epicenter of a global stock slump fueled by concern about China’s sliding currency and economic management. The Hang Seng Index was down 9.2% this year through Monday, while a rout in Shanghai and Shenzhen wiped out more than $1.3 trillion in value. With forecasters expecting the yuan to weaken further against the dollar and restrictions on capital outflows whittling down investment options, the exchange link offers a government-sanctioned way for Chinese traders to own assets in a strengthening currency. “Channels for outflows from mainland China are currently limited,” said Cindy Chen at Citigroup. “I expect the flow to continue.”

Read more …

Result will be zero.

• OPEC Considering Emergency Meeting On Oil Prices (CNN)

After watching the price of crude oil collapse by more than 65% to a 12-year low, there are signs that OPEC may have had enough. Nigeria’s top oil official and OPEC President Emmanuel Kachikwu said the cartel is considering an emergency meeting, perhaps as soon as next month. At issue is whether OPEC would agree to cut production, a move that could help stop the crude price freefall. “I expect to see one. … There’s a lot of energy currently around that,” he told CNN. “I think a … majority in terms of [OPEC] membership are beginning to feel that the time has come to … have a meeting and dialogue again once more without the sort of tension that we had in Vienna on this.” When OPEC last met in the Austrian capital in December, it was bitterly divided and refused to cut output.

The next ordinary meeting is scheduled for June 2. Led by Saudi Arabia, OPEC decided in 2014 to wage a price war with low cost producers in the U.S. and elsewhere in a bid to defend market share. Since then, oil companies have sacked hundreds of thousands of workers, and slashed investment budgets. But the global supply glut continues, thanks in part to China’s slowing economy, and prices have continued to tumble. A strong dollar, which makes oil more expensive around the world, has fueled the slump. Oil prices fell toward $30 a barrel early on Tuesday, having plunged by 16% in 2016 alone, but steadied later to trade little changed on the day. Many OPEC countries are still making money at these prices but others are losing – Nigeria’s production costs are estimated at about $31 a barrel, for example.

And all, including Saudi Arabia, are suffering a huge squeeze on government revenues. Kachikwu said most OPEC members were watching their economies “being shattered,” and something had to give. “We need to… see how we can balance the need to protect our market share with the need for the survival of the business itself, and survival of the countries.” An emergency meeting is no guarantee that OPEC will act to restrain supply, however Iran is eager to boost production this year as soon as Western sanctions are lifted – expected imminently – and it’s hard to see Saudi Arabia working with its big Mideast rival to support oil prices. Saudi Arabia broke off diplomatic relations with Iran last week after its embassy in Tehran was attacked. That attack followed Saudi Arabia’s execution of a prominent Shiite cleric.

Still, the OPEC president believes an agreement of some form is possible. “I think ultimately for the interest of everybody some policy change will happen,” Kachikwu said. “Now will the amount of barrels that you can take out because of that policy change necessarily make that much of a dramatic difference? Probably not, but the symbolism of the action is even more important than the volumes that are taken out of the market.”

Read more …

Lots of private debt in foreign currrencies. The confidence starts to look out of place…

• Saudi Arabia Says It Remains Committed to Dollar Peg (WSJ)

Saudi Arabia will maintain the riyal’s peg to the U.S. dollar, the governor of the country’s central bank said Monday, while criticizing bets against the currency. In a statement posted on the website of Saudi Arabian Monetary Agency, as the central bank is known, governor Fahad al-Mubarak said speculation was driving volatility in the forward market for the Saudi riyal, but the country’s financial and economic fundamentals remained stable. “I would like to reiterate our official position that Saudi Arabian Monetary Agency will uphold its mandate of maintaining the peg, “ the governor said.

The riyal is fixed at roughly 3.75 to the dollar, but one-year forward contracts have hit multiyear highs in the past days—reflecting speculation on a weaker riyal—after the kingdom ran a record budget deficit of nearly $98 billion last year, forcing it to announce late last month spending and subsidy cuts for 2016 to cope with a fall in the global price of oil, the kingdom’s main revenue earner. A sharp fall in the price of oil since the middle of 2014 has put immense pressure on Saudi Arabia’s petrodollar-dependent economy, with some investors betting in recent months that the kingdom would let go of the nearly 30-year old peg as foreign-exchange reserves decline. These have fallen to $635.5 billion at the end of November, down 15% from a peak of $746 billion in August last year, according to the latest central bank data.

Analysts say the central bank has spent billions to maintain the currency peg; in the past, the has worked well for Saudi Arabia, giving it stability as it enjoyed a decade of high-price oil. But income from oil sales has slumped, adding strains to Saudi Arabia’s finances. Abandoning the peg would stretch those dollars as the riyal would weaken. Backing away from peg pledges isn’t unprecedented, however. Officials at the Swiss National Bank, for instance, publicly backed the franc’s link to the euro mere days before the bank stunned markets by abandoning it a year ago. Still, most analysts don’t see Saudi Arabia abandoning its peg in the near- to midterm, as repayment costs for households and corporates that have borrowed in foreign currencies will rise in local-currency terms. Consumer price inflation is likely to accelerate due to a rise in import prices, which the government can ill-afford after cutting subsidies.

And even if the peg were adjusted rather than abandoned, this would add uncertainty about future adjustments, and ultimately make it more vulnerable to speculative attacks. “The peg is a key policy anchor,” said Paul Gamble, senior director for sovereigns at Fitch Ratings. “There is a huge capacity to defend it and a strong political commitment to it.”

Read more …

… where confidence really stands.

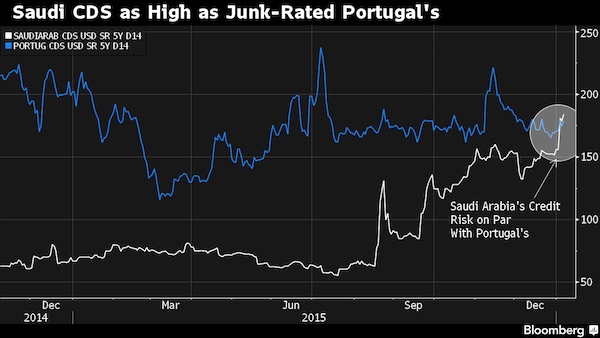

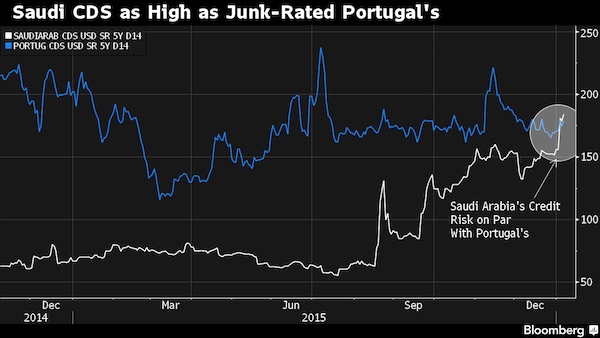

• Saudi Debt Risk on Par With Junk-Rated Portugal as Oil Slides (BBG)

Investors wanting to take out insurance on Saudi Arabia’s debt have to pay as much as they would for Portugal, a nation still saddled with a junk credit-rating five years after an international bailout. The cost of insuring the kingdom’s debt more than doubled in the past 12 months to a 190 basis points, or $190,000 annually to insure $10 million of the country’s debt for five years, the highest since April 2009. That’s almost identical to contracts linked to debt from Portugal, whose rating is seven levels below Saudi Arabia’s Aa3 investment grade at Moody’s Saudi Arabia’s finances are under pressure as it fights a war in Yemen at a time when crude prices are languishing at the lowest level in almost 12 years.

The country, which counts on energy exports for 70% of government revenue, sold domestic bonds for the first time since 2007 last year to help fund a budget deficit that may have been the widest since 1991. Net foreign assets dropped for 10 straight months through November, the longest streak since at least 2006, to $627 billion. “They have huge reserves and extremely low debt, but the question is, how long are oil prices going to stay at this level?” said Anthony Simond at Aberdeen Asset Management. Brent crude, a pricing benchmark for more than half the world’s oil, sank below $35 a barrel last week. It advanced 0.8% to $31.82 a barrel today, rebounding from the lowest level in almost 12 years. The Saudi government, which doesn’t have any outstanding international bonds, said it will choose from options including selling local and international debt and drawing from its reserves to finance an expected 2016 budget deficit of 326 billion riyals ($87 billion).

Read more …

“Global investors withdrew about $52bn from emerging market equity and bond funds in the third quarter of 2015..” Otherwise, Wolf gets lost in his own growth story.

• What Market Turbulence Is Telling Us (Martin Wolf)

Bull markets, it is said, climb a wall of worry. There are certainly plenty of reasons to worry. But markets are no longer climbing, which indicates the bull market is dead. Since markets are already highly valued, that would not be surprising. Standard & Poor’s composite index of the US market has in effect marked time since June 2014. According to Robert Shiller’s cyclically adjusted price/earnings ratio, the US market has been significantly more highly valued than it is at present only during the disastrous bubbles that burst in 1929 and 2000. Professor Shiller’s well-known measure of value is not perfect. But it is a warning that stock market valuations are already generous and that a continued bull market might be dangerous. Still more important, a portfolio rebalancing is under way.

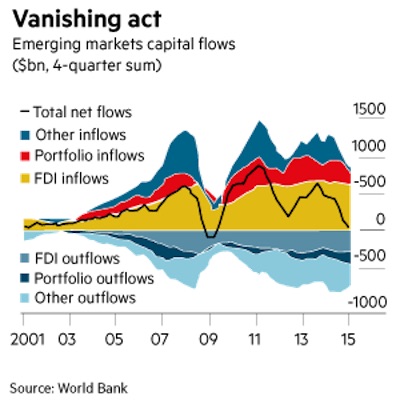

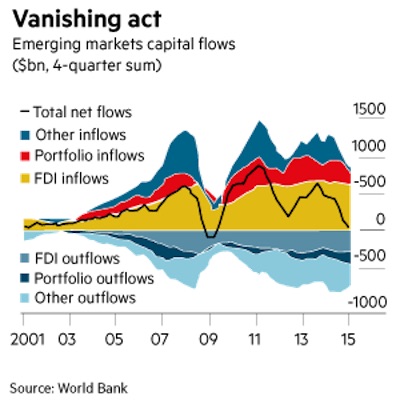

The most important shift is in the perceived economic and financial prospects for emerging economies. As a result, capital is now flowing out of emerging economies. These outflows are driving the strong dollar. Given that, the US Federal Reserve’s decision to tighten monetary policy looks like an important blunder. In its new Global Economic Prospects report, the World Bank brings out the extent of the disillusionment with (and within) emerging economies. It notes that half of the 20 largest developing country stock markets experienced falls of 20 per cent or more from their 2015 peaks. The currencies of commodity exporters (including Brazil, Indonesia, Malaysia, Russia, South Africa), and of big developing countries subject to rising political risks (including Brazil and Turkey), fell to multiyear lows both against the US dollar and in trade-weighted terms.

Global investors withdrew about $52bn from emerging market equity and bond funds in the third quarter of 2015. This was the largest quarterly outflow on record. Net short-term debt and bank outflows from China, combined with retrenchment in Russia, accounted for the bulk of this; but portfolio and short-term capital inflows dried up elsewhere in the third quarter of 2015. Net capital flows to emerging and frontier economies even fell to zero, the lowest level since the 2008-09 crisis. An important feature is not just the reduction in inflows but also the sheer size of outflows from affected economies.

Read more …

The ‘healthy’ British economy has become a mere narrative.

• UK Industrial Output Plunges Most in Almost Three Years (BBG)

U.K. industrial production fell the most in almost three years in November as warmer-than-usual weather reduced energy demand. Output dropped 0.7% from the previous month, with electricity, gas and steam dropping 2.1%, the Office for National Statistics said in London on Tuesday. Economists had forecast no growth on the month. The data highlight the uncertain nature of U.K. growth, which remains dependent on domestic demand and services. After stagnating in October and falling in November, industrial production will have to rise 0.5% to avoid a contraction in the fourth quarter. The pound fell against the dollar after the data and was trading at $1.4486 as of 9:35 a.m. London time, down 0.4% from Monday. Manufacturing also delivered a lower-than-forecast performance in November, with output dropping 0.4% on the month.

On an annual basis, factory output fell 1.2%, a fifth consecutive decline. The data follow other reports of weakness in the manufacturing sector. A survey published by Markit this month showed growth cooled in December, suggesting it made little contribution to the economy in the fourth quarter. According to manufacturers’ organization EEF, companies are feeling increasingly pressured by issues such as the strength of the pound. It said on Monday that only 56% of manufacturers say the U.K. is a competitive location, compared with 70% a year ago. Bank of England officials will probably keep their key interest rate at a record-low 0.5% this week. Minutes of the meeting released Thursday may reveal their thinking on the fall in oil prices and worries about China’s economy.

Read more …

CARB is one organization you don’t want to do battle with.

• California Air Resources Board Rejects VW Engine Fix (BBG)

Volkswagen’s work to overcome the emissions-cheating scandal was set back after the California Air Resources Board rejected its proposed engine fix, just a day before Chief Executive Officer Matthias Mueller meets regulators to discuss ways out of the crisis. California spurned the automaker’s December recommendation for how to fix 2-liter diesel engines as “incomplete.” VW said it will present a reworked plan to the U.S. Environmental Protection Agency at a meeting in Washington on Wednesday. Europe’s largest automaker is in the midst of complex technical talks with the California board and counterparts at the EPA about possible fixes for 480,000 diesel cars. The EPA said Tuesday it agreed that VW’s plan can’t be approved. Volkswagen set aside $7.3 billion in the third quarter to help pay for the crisis and has acknowledged this won’t be enough.

“The message from the regulators to VW couldn’t be more clear – you need to come up with a better plan,” said Frank O’Donnell, president of Clean Air Watch, a Washington environmental group. “VW has mistakenly thought it could resolve this on the cheap.” On its website, the state said it determined that there was “no easy and expeditious fix for the affected vehicles.” “Volkswagen made a decision to cheat on emissions tests and then tried to cover it up,” Mary Nichols, chairwoman of the state board, said in an e-mailed statement. “They need to make it right.” Volkswagen responded that it had asked California last month for an extension to submit additional information and data about the turbocharged direct injection, or TDI, diesel engines.

“Since then, Volkswagen has had constructive discussions with CARB, including last week when we discussed a framework to remediate the TDI emissions issue,” VW said in an e-mailed statement. The California board said it and the EPA will continue to evaluate VW’s technical proposals. The rejection closely followed a bumble by CEO Mueller on Sunday, the eve of the North American International Auto Show in Detroit. During an interview with National Public Radio, he appeared to dismiss the crisis by saying Europe’s largest automaker “didn’t lie” to regulators about what amounts to a “technical problem.” When the interview aired Monday morning, VW asked NPR for a do-over, where Mueller blamed a noisy atmosphere for his earlier comments. He apologized on behalf of the automaker, hewing more closely to comments he had made in a Detroit speech on Sunday night.

[..] Fixes prescribed for Europe haven’t translated into U.S. approval because of the tougher emissions standards in North America, which is why Volkswagen had begun cheating in the U.S. in the first place. In Europe, the company’s proposed fix on 8.5 million diesel engines was approved a month ago. For most vehicles in Europe, software upgrades will suffice, while others will get a tube with mesh on one end to regulate air flow. VW estimated that repair would take less than an hour to complete. Germany took the lead on signing off on the technical fix, which encompasses a range of engine sizes including the 2-liter variant now contested in the U.S. In the U.S., beyond developing an effective fix for each of the three types of non-compliant 4-cylinder engines, VW must document any adverse impacts on vehicles and consumers.

Read more …

If you have to look at USA TOday for some sanity….

• First Lady’s Box Should Be Empty At State Of The Union Speech (USA Today)

The White House announced that there will be a seat left vacant in the gallery during Obama’s State of the Union Address “for the victims of gun violence who no longer have a voice.” This old stunt is part of Obama’s campaign for new federal restrictions on firearms ownership, but if he really wanted to provide a voice for those who’ve lost theirs, at least in part, due to his own administration’s policies, he’d have to empty all the seats in the gallery reserved for the first lady and her guests. While trumpeting the private death toll from guns, Obama on Tuesday night will likely ignore the 986 people killed by police in the United States last year according to The WaPo’s database. Many police departments are aggressive — if not reckless — in part because the Justice Department always provides cover for them at the Supreme Court.

Obama’s “Justice Department has supported police officers every time an excessive-force case has made its way” to a Supreme Court hearing, The New York Times noted last year. Attorney General Loretta Lynch recently said that federally-funded police agencies should not even be required to report the number of civilians they kill. To add a Euro flair to the evening, Obama could drape tri-color flags on a few empty seats to commemorate the 30 French medical staff, patients, and others slain last Oct. 3 when an American AC-130 gunship blasted their well-known hospital in Kunduz, Afghanistan. The U.S. military revised its story several times but admitted in November that the carnage was the result of “avoidable … human error.” Regrettably, that bureaucratic phrase lacks the power to resurrect victims.

No plans have been announced to designate a seat for Brian Terry, the U.S. Border Patrol agent killed in 2010. Guns found at the scene of Terry’s killing were linked to the Fast and Furious gunwalking operation masterminded by the Alcohol, Tobacco, Firearms and Explosives (ATF) agency. At least 150 Mexicans were also killed by guns illegally sent south of the border with ATF approval. The House of Representatives voted to hold then-attorney general Eric Holder in contempt for refusing to disclose Fast and Furious details, but Obama is not expected to dwell on this topic in his State of the Union address. On a more festive note, why not save some seats for a wedding party? Twelve Yemenis who were celebrating nuptials on Dec. 12, 2013, won’t be able to attend Obama’s speech because they were blown to bits by a U.S. drone strike.

The Yemeni government – which is heavily bankrolled by the U.S. government – paid more than a million dollars compensation to the survivors of innocent civilians killed and wounded in the attack. Four seats could be left vacant for the Americans killed in the 2012 attack in Benghazi, Libya – U.S. Ambassador Christopher Stevens, Foreign Service Officer Sean Smith, and CIA contractors Tyrone Woods and Glen Doherty. But any such recognition would rankle the presidential campaign of Hillary Clinton, who has worked tirelessly to sweep those corpses under the rug. It would also be appropriate to include a hat tip to the hundreds, likely thousands, of Libyans who have been killed in the civil war unleashed after the Obama administration bombed Libya to topple its ruler, Moammar Gadhafi.

Read more …

Welcome to Europe.

• Population Growth In Africa: Grasping The Scale Of The Challenge (Guardian)

The last 100 years have seen an incredible increase in the planet’s population. Some parts of the world are now seeing smaller increments of growth, and some, such as Japan, Germany, and Spain, are actually experiencing population decreases. The continent of Africa, however, is not following this pattern. Now home to 1.2 billion (up from just 477 million in 1980), Africa is projected by the United Nations Population Division to see a slight acceleration of annual population growth in the immediate future. In the past year the population of the African continent grew by 30 million. By the year 2050, annual increases will exceed 42 million people per year and total population will have doubled to 2.4 billion, according to the UN. This comes to 3.5 million more people per month, or 80 additional people per minute.

At that point, African population growth would be able to re-fill an empty London five times a year. From any big-picture perspective, these population dynamics will have an influence on global demography in the 21st century. Of the 2.37 billion increase in population expected worldwide by 2050, Africa alone will contribute 54%. By 2100, Africa will contribute 82% of total growth: 3.2 billion of the overall increase of 3.8 billion people. Under some projections, Nigeria will add more people to the world’s population by 2050 than any other country. The dynamics at play are straightforward. Since the middle of the last century, improvements in public health have led to a inspiring decrease in infant and child mortality rates. Overall life expectancy has also risen.

The 12 million Africans born in 1955 could expect to live only until the age of 37. Encouragingly, the 42 million Africans born this year can expect to live to the age of 60. Meanwhile, another key demographic variable – the number of children the average African woman is likely to have in her lifetime, or total fertility rate – remains elevated compared to global rates. The total fertility rate of Africa is 88% higher than the world standard (2.5 children per woman globally, 4.7 children per woman in Africa). In Niger, where GDP per capita is less than $1 per day, the average number of children a woman is likely to have in her life is more than seven. Accordingly, the country’s current population of 20 million is projected to grow by 800,000 people over the next 12 months.

By mid-century, the population may have expanded to 72 million people and will still be growing by 800,000 people – every 18 weeks. By the year 2100, the country could have more than 209 million people and still be expanding rapidly. This projectionis based on an assumption that Niger’s fertility will gradually fall to 2.5 children over the course of the century. If fertility does not fall at all – and it has not budged in the last 60 years – the country’s population projection for 2100 veers towards 960 million people. As recently as 2004, the United Nations’ expected Africa to grow only to 2.2 billion people by 2100. That number now looks very out of date.

Read more …

Got to keep wondering what the Olympics will look like. An international podium for protests?

• 3.7 Million Brazilians Return To Poverty Due To Economic Crisis (Xinhua)

Around four million Brazilians have returned to poverty as a consequence of the country’s ongoing economic crisis, local media reported on Monday. The news daily Valor Economico cited data from a recent study carried out by Banco Bradesco, one of the largest private banks in Brazil, which found the crisis pushed around 3.7 million Brazilians back to poverty. The middle class dropped by two%age points to 54.6% during the period of January to November, 2015. Meanwhile, the number of those in the lower class increased to 35%, according to the report. The study also indicates a drop in salaries, with the middle class receiving a monthly income of $407 to $1630 US and that of the poorest stands at $233. Brazil is in the depth of a recession as it grapples with rising unemployment, stagnant growth and soaring inflation. Brazil’s Central Bank has changed its previous prediction for the country’s drop in GDP for 2016 from 2.95% to 2.99%.

Read more …

“Boat captains are now forcing refugees to jump out and swim ashore before steering the dinghies back to Turkey.”

“These people will travel around the whole world just to find an open door.”

• Smugglers Change Tactics As Refugee Flow To Greece Holds Steady (DW)

Looking over pitch-black waters, Pothiti Kitromilidi smokes a cigarette with her eyes fixed on distant streetlights along the Turkish coast. Aside from the stars, little else is visible. It is Friday night, and Kitromilidi, a coordinator for the FEOX Rescue Team, is standing on the southeastern shore of Chios, a Greek island where asylum-seekers have been arriving under the cover of darkness ever since the Turkish Coast Guard increased its presence. Only a few refugees made the crossing in recent days, but Kitromilidi credits bad weather over the authorities, who she says “pretend to work during the week and take weekends off.” Now the seas are calm again and Kitromilidi’s expecting a long night out. She radios back and forth with team members spread out over the area on ATVs and Vespa scooters.

Everyone is waiting as Kitromilidi shines a light into the dark water below. “We don’t see them, we have to hear them,” she said. Then the call comes in: “Boat landed! Boat landed!” Kitromilidi jumps in her car and speeds to the arrival site where 45 Afghans are standing, dripping wet and shivering. The rescue team gets to work, providing dry clothes and emergency thermal blankets with help from a Norwegian humanitarian group, Drop in the Ocean, while Spanish doctors from Salvamento Maritimo Humanitario (SMH) attend to the injured. Amidst screaming children and aching bodies, the chaotic process seems almost streamlined: Wet clothes off, dry clothes on, plastic bags replace wet socks and everyone gets filed onto a bus while volunteers pick up any trash left behind in an impressive display of cross-organizational coordination.

Yet after months of refining their procedures, humanitarian workers in Chios continue facing new challenges as smugglers change tactics under new pressures from Turkey and the European Union. Whenever the flow seems to slow down, large backlogs of refugees arrive in short bursts of time, overwhelming humanitarian services. This past weekend, more than 3,000 people arrive in Chios alone. “The numbers have been stable since the fall and now we are thinking they will stay the same until March,” said Edith Chazelle, Camp management coordinator for the Norwegian Refugee Council. “We are all surprised they are still coming with the cold weather and the rough water.”

Rescue workers also noted most dinghies are no longer being abandoned on Greek beaches. Boat captains are now forcing refugees to jump out and swim ashore before steering the dinghies back to Turkey. On Friday night, FEOX volunteer Mihalis Mierousis swam out to save a baby that was tossed overboard. The infant was less than one year old and survived the ordeal, but Mierousis said the practice might be due to a shortage of dinghies. “Unfortunately, this is not unusual,” he said. “Many people get thrown into the water, and we have to save them this way.” Other rescue workers said smugglers are taking families hostage and forcing fathers to steer dinghies to Chios and back as ransom. Rumors abound.

Read more …