Fred Stein Little Italy New York 1943

It’ll take Europe a while to recover from Trump.

• Trump Tells ‘Confidants’ US Will Leave Paris Climate Deal (R.)

U.S. President Donald Trump has told “confidants,” including the head of the Environmental Protection Agency Scott Pruitt, that he plans to leave a landmark international agreement on climate change, Axios news outlet reported on Saturday, citing three sources with direct knowledge. On Saturday, Trump said in a Twitter post he would make a decision on whether to support the Paris climate deal next week. A source who has been in contact with people involved in the decision told Reuters a couple of meetings were planned with chief executives of energy companies and big corporations and others about the climate agreement ahead of Trump’s expected announcement later in the week. It was unclear whether those meetings would still take place.

“I will make my final decision on the Paris Accord next week!” he tweeted on the final day of a G7 summit in Italy at which he refused to bow to pressure from allies to back the landmark 2015 agreement. The summit of G7 wealthy nations pitted Trump against the leaders of Germany, France, Britain, Italy, Canada and Japan on several issues, with European diplomats frustrated at having to revisit questions they had hoped were long settled. [..] Although he tweeted that he would make a decision next week, his apparent reluctance to embrace the first legally binding global climate deal that was signed by 195 countries clearly annoyed German Chancellor Angela Merkel. “The entire discussion about climate was very difficult, if not to say very dissatisfying,” she told reporters. “There are no indications whether the United States will stay in the Paris Agreement or not.”

Is optimism your friend?

• New Home Prices Are Over 50% Higher In Canada Than The US (BD)

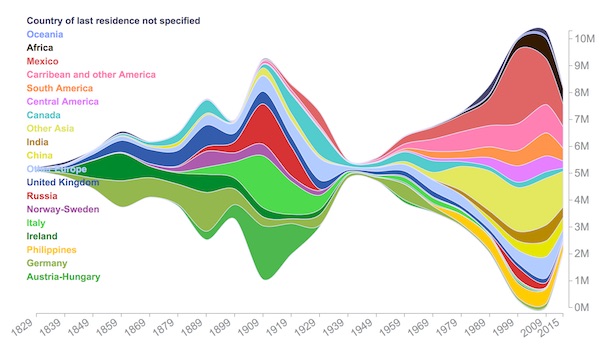

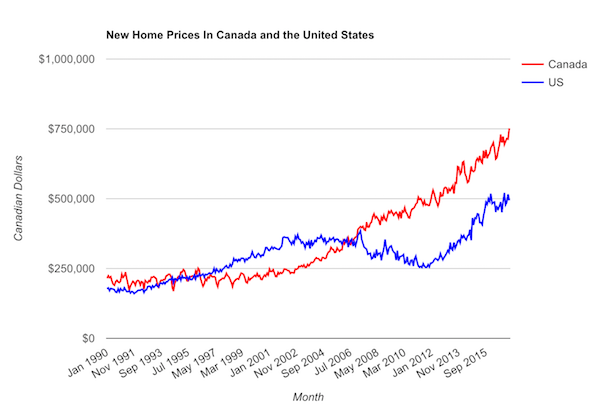

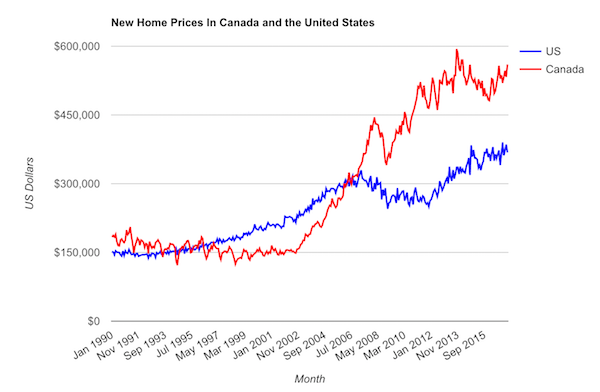

The price of new homes is quickly diverging in Canada and the US. Data from the Canadian Housing and Mortgage Corporation (CMHC) show that new homes are selling for substantially more than the same time last year. Meanwhile south of the border, data from the US Bureau of Census show that new home prices are on the decline. This has lead to an even wider gap between the average price of a new home in Canada and the US. The price of a new home across Canada is up for the second month in a row. The average sale price in April was CA$751,881 (US$559,123). This represents an 11% increase from the same time last year, when measured in Canadian dollars. When compared in US dollars, that increase drops to a much more conservative 2.64%. Even after factoring in the loonie’s decreased buying power in Canada, new home prices still climbed.

American new home builders aren’t seeing such steep climbs in sale prices. Actually, they aren’t seeing climbs at all. The average price of a new home in the US was CA$495,271 (US$368,300). This represents a 3% decline from the same time last year, when measured in US dollars. In Canadian dollars, this was a 0.49% decline from the same time last year. Both forms of measurement show declining home prices in the US, curious since their economy is in a much better state than Canada right now. New homes are trading at substantially higher values in Canada than the US in April. The average new home in April 2017 was 51% higher in Canada than the US. The same time last year, prices in Canada were only 36% higher. It appears in a post-crash United States, new home buyers are taking much more conservative strides. In a hasn’t-crashed-in-decades Canada, new home buyers are optimistic about future values.

When markets don’t function, i.e. there is no price discovery, why would there be volatility?

• Low Volatility Is Market’s Most Significant Danger (BBG)

Of all the dangers in the world of finance, the enduring low level of market volatility is the most significant. How quiet is quiet? Recently, the six-month realized volatility for the S&P 500 dipped to 6.7 percent, lower than even the period leading up to the financial crisis of 2008-09. During the mid-’90s, volatility was as low as it is now, but the size, complexity and interlinkages of financial market exposures were far less significant. Now, fluctuations are severely muted, and thus send a false signal of safety to both investors and policy makers who misread the calm as an “all clear” sign, dismissing the events above as insufficiently relevant. The result is an inability to appreciate how quickly market conditions can change, especially as trading strategies that capitalize on quiet markets become vulnerable to unwind, serving to amplify a risk-off event.

[..] There is an important debate in markets now about the causes of low realized volatility. A decline in the correlation among stocks, a global economy on more stable footing and a decline in perceptions of systemic risk (a euro-zone unraveling, for example) are among the factors. We should appreciate the importance of money flows as well. According to ETF.com, the exchange-traded fund industry is on pace for $500 billion in new asset growth in 2017. These vehicles can provide cheap, liquid access to market risk exposures. They simply put the money received to work in passive fashion, without evaluating the risk/return trade-off. The flows themselves are a factor in the positive returns and the low volatility that, in turn, attract additional flows.

What results is a dangerous circularity. Recall the period of wonderful outcomes preceding the financial crisis. The demand for housing spurred price appreciation, which enabled mortgage credit to be supplied at increasingly generous terms. The most suspect credit cannot default if the value of the collateral keeps appreciating and, as a result, the supply of credit keeps expanding. The fear of missing out is also supremely powerful. The conservative individual becomes less so when he or she sees a neighbor flipping houses with success. Similarly, the conservative lender is forced to compete with more aggressive suppliers of credit. For lenders, not being accommodative enough during the go-go years can amount to an existential business question.

Today’s risks differ meaningfully from those of a decade ago. However, the excess amount of capital chasing opportunity at increasingly aggressive terms is similar. The competition to put money to work, then, like now, results in low volatility. Investors are in danger of misinterpreting this tranquility as conveying safety when crowded positioning is resulting in more, not less, risk. While spending money on hedging is especially difficult in a seemingly benign environment, investors should be actively vigilant to market risks, devoting time to an action plan that helps protect portfolio wealth against the inevitable return of volatility.

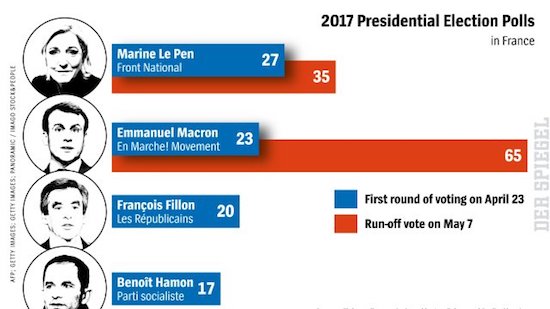

Different polls have very different numbers.

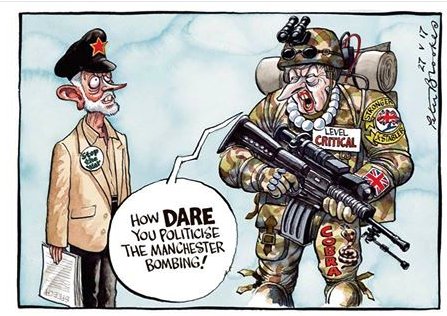

• Jeremy Corbyn Within Striking Distance Of No. 10 (Mirror)

In the first week of the General Election campaign our ComRes poll for the Sunday Mirror gave Theresa May a magic 50% of the vote. She looked unstoppable. Today’s ComRes poll shows Jeremy Corbyn has narrowed her lead to 12 points , six points up on two weeks ago. As the man who invented the Swingometer says he’s never seen swings like it. If the PM goes into polling day on June 8th with this kind of lead she would not be unhappy. It would give her an overall majority of 62. Not the landslide she wished for perhaps, but with enough MPs to get her own way every time. But we are still 11 days from polling day – and on present form that’s enough for Mr Corbyn to pick up another 12 points. And that puts him in striking distance of No10. Our survey puts the Conservatives on 46%, Labour on 34% and the Lib Dems down two points on 8%.

Ukip are unchanged in fourth place at 5%. But the most striking findings are that the Labour leader’s personal ratings are up in every category while Mrs May’s are down in all but one. Mrs May’s Dementia Tax on the elderly and her U-turn over how to pay for it has clearly boomeranged. The Manchester bombing appears to have had little effect on voting intention. Mrs May is still way ahead of Mr Corbyn as being best to deal with terrorism. But she’s five points down on two weeks ago. Only a fifth of voters say she is most likely to protect elderly people dependent on social care while Mr Corbyn scores 43%. Curiously the mess she made of the Dementia Tax has not damaged her among voters aged 65 plus with nearly seven in ten saying they will still vote for her. But Mr Corbyn is ahead in every age group until pollsters get to those 44 or older.

“..what comes next will be an era in which there is a new order..”

• Fourth Turning’s Neil Howe: We Are In The 1930s, “Winter Is Coming” (Mauldin)

From the Balkans to the US, walls are going up, not down, according to demographer and The Fourth Turning author Neil Howe. Speaking to a packed crowd at Mauldin Economics’ Strategic Investment Conference in Orlando, Howe said we are reliving many of the same trends and changes of the 1930s. “Worldwide, people are losing trust in institutions,” he said. “Trust in the military, small business, and police is still there. But trust in democracies, media, and politicians is dropping.” When was the last time we saw these changes and the rise of right-wing populism?” he asked. “The 1930s.” Howe’s statement is borne out of a June 2016 Gallup poll. When poll takers were asked how much confidence they had in institutions in American society, the results were troubling.

Just 15% said they had a “great deal” of confidence in the US Supreme Court. Banks trailed behind at 11%, followed by the criminal justice system (9%), newspapers (8%), and big business (6%). Meanwhile, just 16% expressed a “great deal” of confidence in the presidency, with that number plummeting to 3% for Congress. In his keynote, Howe shared his forecasting logic: “My method is to step back and realize one thing: There is something we know about the world in 20 years’ time. The people who live there will be all of us, 20 years older and playing a different role. I call this ‘looking along the generational diagonal.’ The critical thing to remember about the current crisis period is that what comes next will be an era in which there is a new order.

According to the Strauss-Howe generational theory, as this new order takes root, individualism declines and institutions are strengthened. “History is seasonal, and winter is coming,” Howe has said. But after winter, comes spring. As the American Revolution was followed by calm, as the Civil War was followed by reconstruction and a gilded age, and as the Great Depression and World War II were followed by an age of peace and prosperity, so too will this crisis period be followed by a calm, stable era. It’s simply a matter of time.

Russiagate.

• We’re Dealing With a New Type of War Lie (Swanson)

The “Russian interference in the 2016 United States elections” even exists as a factual event in Wikipedia, not as an allegation or a theory. But the factual nature of it is not so much asserted as brushed aside. Former CIA Director John Brennan, in the same Congressional testimony in which he took the principled stand “I don’t do evidence,” testified that “the fact that the Russians tried to influence resources and authority and power, and the fact that the Russians tried to influence that election so that the will of the American people was not going to be realized by that election, I find outrageous and something that we need to, with every last ounce of devotion to this country, resist and try to act to prevent further instances of that.” He provided no evidence. Activists have even planned “demonstrations to call for urgent investigations into Russian interference in the US election.”

They declare that “every day we learn more about the role Russian state-led hacking and information warfare played in the 2016 election.” (March for Truth.) Belief that Russia helped put Trump in the White House is steadily rising in the U.S. public. Anything commonly referred to as fact will gain credibility. People will assume that at some point someone actually established that it was a fact. Keeping the story in the news without evidence are articles about polling, about the opinions of celebrities, and about all kinds of tangentially related scandals, their investigations, and obstruction thereof. Most of the substance of most of the articles that lead off with reference to the “Russian influence on the election” is about White House officials having some sort of connections to the Russian government, or Russian businesses, or just Russians.

It’s as if an investigation of Iraqi WMD claims focused on Blackwater murders or whether Scooter Libby had taken lessons in Arabic, or whether the photo of Saddam Hussein and Donald Rumsfeld shaking hands was taken by an Iraqi. A general trend away from empirical evidence has been extensively noted and discussed. There is no more public evidence that Seth Rich (a Democratic National Committee staffer who was murdered last year) leaked Democratic emails than there is that the Russian government stole them. Yet both claims have passionate believers. Still, the claims about Russia are unique in their wide proliferation, broad acceptance, and status as something to be constantly referred to as though already established, constantly augmented by other Russia-related stories that add nothing to the central claim. This phenomenon, in my view, is as dangerous as any lies and fabrications coming out of the racist right.

Blackwater 2.0

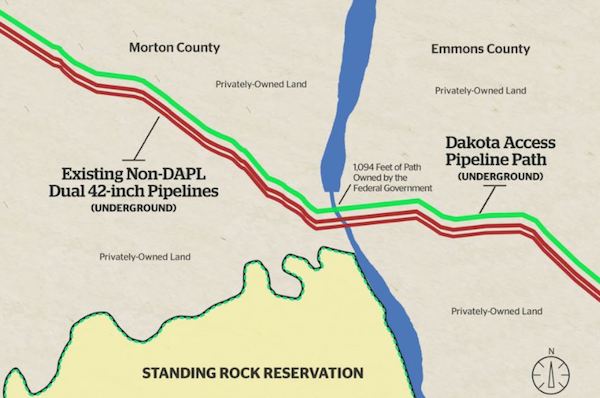

• Private Mercenary Firm Targeted Dakota Access Pipeline Movement (IC)

A shadowy international mercenary and security firm known as TigerSwan targeted the movement opposed to the Dakota Access Pipeline with military-style counterterrorism measures, collaborating closely with police in at least five states, according to internal documents obtained by The Intercept. The documents provide the first detailed picture of how TigerSwan, which originated as a U.S. military and State Department contractor helping to execute the global war on terror, worked at the behest of its client Energy Transfer Partners, the company building the Dakota Access Pipeline, to respond to the indigenous-led movement that sought to stop the project. Internal TigerSwan communications describe the movement as “an ideologically driven insurgency with a strong religious component” and compare the anti-pipeline water protectors to jihadist fighters.

One report, dated February 27, 2017, states that since the movement “generally followed the jihadist insurgency model while active, we can expect the individuals who fought for and supported it to follow a post-insurgency model after its collapse.” Drawing comparisons with post-Soviet Afghanistan, the report warns, “While we can expect to see the continued spread of the anti-DAPL diaspora … aggressive intelligence preparation of the battlefield and active coordination between intelligence and security elements are now a proven method of defeating pipeline insurgencies.” More than 100 internal documents leaked to The Intercept by a TigerSwan contractor, as well as a set of over 1,000 documents obtained via public records requests, reveal that TigerSwan spearheaded a multifaceted private security operation characterized by sweeping and invasive surveillance of protesters.

As policing continues to be militarized and state legislatures around the country pass laws criminalizing protest, the fact that a private security firm retained by a Fortune 500 oil and gas company coordinated its efforts with local, state, and federal law enforcement to undermine the protest movement has profoundly anti-democratic implications. The leaked materials not only highlight TigerSwan’s militaristic approach to protecting its client’s interests but also the company’s profit-driven imperative to portray the nonviolent water protector movement as unpredictable and menacing enough to justify the continued need for extraordinary security measures. Energy Transfer Partners has continued to retain TigerSwan long after most of the anti-pipeline campers left North Dakota, and the most recent TigerSwan reports emphasize the threat of growing activism around other pipeline projects across the country.

Not much use talking to Erdogan. He needs his strongman image to much at home.

• Once-in-a-Generation Hopes Of Cyprus Reunification Appear To Be Dashed (G.)

The best hope yet of reuniting war-partitioned Cyprus has been dashed after reconciliation attempts were brought to an abrupt halt following two years of intense negotiations. The optimism engendered by talks seen as a once-in-a-generation opportunity to unite the Mediterranean island ended when the United Nations special envoy, Espen Barth Eide, announced that he was terminating negotiation efforts. “Without a prospect for common ground, there is no basis for continuing this shuttle diplomacy,” the Norwegian former foreign minister said in a short statement. Eide now enters the long list of diplomats who, for the best part of 50 years, have attempted to solve one of the world’s most intractable diplomatic disputes.

Split between the majority population of Greeks in the south and Turks in the north, Cyprus has been divided since 1974 when Ankara ordered troops to invade the island in response to an Athens-organised coup to unite it with Greece. In Nicos Anastasiades and Mustafa Akinci – the respective leaders of the island’s Greek and Turkish communities – the two sides had found men who were not only moderate and born in the same town – Limassol – but willing to make the sort of concessions necessary to find a solution. Both had got to the point of poring over maps outlining territorial adjustments in a envisaged bi-zonal, bi-communal federation. In January, the first international conference on Cyprus was held at the UN headquarters in Geneva with representatives from Greece, Turkey and Britain – the island’s three guarantor powers.

Hundreds of people are collateral damage.

• US-Led Syria Strikes Kill Scores Of Relatives Of IS Fighters (AFP)

Dozens of relatives of Islamic State group fighters were killed Friday in Syria in US-led strikes, regime or Russian raids, after the UN urged nations striking the jihadists to protect civilians. Raids by the US-led coalition have pounded IS positions across Iraq and Syria since the jihadist group claimed responsibility for the devastating bombing of a concert in Manchester on Monday. Scores of civilians, many of them families of IS members, have been killed in bombing raids in recent days on the eastern Syrian town of Mayadeen, held by IS since 2014. Early Friday, at least 80 relatives of IS fighters were killed in US-led coalition bombardment, according to the Syrian Observatory for Human Rights.

“The toll includes 33 children. They were families seeking refuge in the town’s municipal building,” said Observatory head Rami Abdel Rahman. “This is the highest toll for relatives of IS members in Syria,” he told AFP. Coalition strikes on the town killed 37 civilians on Thursday night after 15 had been killed on Wednesday, according to the Britain-based Observatory. The US military on Friday confirmed that it had struck “near Mayadeen” on May 25 and 26, but said it was “still assessing the results of those strikes”, according to Pentagon spokesman Eric Pahon. The US military insists that it takes every precaution to avoid hitting civilians, but the United Nations on Friday urged parties bombing IS to do more.

No moral values left: “The G7 only managed to “reaffirm the sovereign rights of states to control their own borders and set clear limits on net migration levels.“

• 10,000 Migrants Rescued, Dozens Drown Between Italy And Libya This Week (AFP)

Nearly 10,000 migrants were rescued off the coasts of Italy and Libya this week, as the leaders of G7 gathered for a summit coincidentally held in Sicily. And at least 54 people have drowned in the Mediterranean since Tuesday. Large-scale rescue efforts off the Italian coast on Friday saved 2,200 migrants who risked their lives traveling in unworthy sea vessels to reach Italy. Italian coastguard and commercial boats delivered those rescued to reception centers in Italy. A further 1,200 people were rescued by Libyan ships and taken to Tripoli or Zawiya. Some 6,400 migrants were rescued from the Mediterranean between Tuesday and Thursday. The Italian coastguard also discovered another 10 bodies, bringing to 54 the total number of officially registered deaths this week, officials told AFP.

The biggest tragedy occurred on Wednesday, when 35 migrants drowned, including at least 10 children, after they fell off an overloaded vessel that was hit by a huge wave while being rescued by an aid boat. At least 1,400 people have drowned so far this year trying to make the perilous journey across the sea to Italy, according to UN figures, while more than 50,000 migrants reached Italian coasts, most of them through Libya. Italy has on numerous occasions said that it barely has enough resources to deal with the migrant influx from Libya. The situation has become an EU-wide concern in recent years, with Brussels facing mounting pressure from human rights groups over its handling of the migrant crisis in the Mediterranean.

G7 leaders, who met in Sicily, discussed providing greater assistance to African countries to persuade migrants to stay at home rather than make the dangerous journey across the Mediterranean. However, no concrete plan of action was agreed upon at the end of the two-day summit in Taormina. The G7 only managed to “reaffirm the sovereign rights of states to control their own borders and set clear limits on net migration levels.”