Claude Monet Houses of Parliament (Sun Breaking through the Fog) 1904

Don’t have the impression it’s a great piece of work. But the entire MSM has only one goal: bash anything Trump. A neutral assessment might be appropriate, but where does one get one?

• Trump Plans Tax Bill Signing on January 3 Due to Technical Issue (BBG)

President Donald Trump plans to sign the tax bill on Jan. 3 to ensure automatic spending cuts to Medicare and other programs don’t take effect, according to a House Republican aide familiar with the plans. The White House informed House GOP members of the timetable, following the likely decision by House Republicans to leave the so-called PAYGO provision out of a year-end spending deal to avoid a government shut down before Friday, the person said who asked not to be named because the plan hasn’t been publicly announced. Trump and GOP leaders have repeatedly said the president would sign the legislation before Christmas. White House National Economic Council Director Gary Cohn signaled Wednesday morning that the signing date could be pushed back because of the potential for triggering the cuts.

Under the PAYGO law, automatic cuts to Medicare and other spending categories would be triggered by the tax bill in January because the bill is scored as increasing the deficit by $1.5 trillion over 10 years. Waiting until January means that those cuts would be delayed until 2019, according to budget expert Ed Lorenzen of the Committee for a Responsible Federal Budget. White House officials insisted that no firm timetable had been set. Trump could sign the tax legislation earlier if Congress passed a waiver to the PAYGO rules, but that is unlikely to happen before lawmakers leave Washington for a holiday recess. “I think we’re just working out some of the logistics on that,” Treasury Secretary Steven Mnuchin said Wednesday on Fox News. “He’ll sign it as quickly as he can.”

But wait, wasn’t Trump making Wall Street that much richer?

• Why Wall Street Is Furious At The Trump Tax Plan (ZH)

Back in October 2016, the “millionaire, billionaire, private jet owners” of America’s elitist, liberal mega-cities (A.K.A. New York and San Francisco) celebrated the tax hikes that a Hillary Clinton presidency would have undoubtedly jammed down their throats proclaiming them to be a ‘patriotic duty’. Unfortunately, now that Trump has given them exactly what they apparently wanted…an amazing opportunity to ‘spread their wealth around”…they’re suddenly feeling a lot less patriotic. Of course, as we’ve noted numerous times, while most people across the country and across the income spectrum will benefit from the Republican tax reform package, the folks who stand to lose are those living in high-tax states with expensive real estate as their SALT, mortgage interest and property tax deductions will suddenly be capped. And, as Bloomberg points out today, that has a lot of Wall Street Traders in New York drowning their sorrows in expensive vodka and considering a move to Florida.

“One trader, sipping a Bloody Mary on a morning flight to somewhere more tropical, said he’s going to stop registering as a Republican. En route, he sent more than a dozen text messages ripping the tax bill. A pair of hedge fund managers said the tax bill is too tilted toward corporations, rather than individuals who should get more relief. “My clients are hard-working young professionals on Wall Street. I don’t have a lot of good news for them,” said Douglas Boneparth, a financial adviser in lower Manhattan who counsels people throughout the industry. Most are coming to terms with it. “I don’t think anyone is going to be surprised by the economic reality.” “This provides a clear incentive for financial advisers to go independent,” said Louis Diamond of Diamond Consultants. “We’re hearing from a lot of clients on this; it’s just another reason why it makes a ton of sense, economically, to become self-employed.”

All bubbles have limited lifespans.

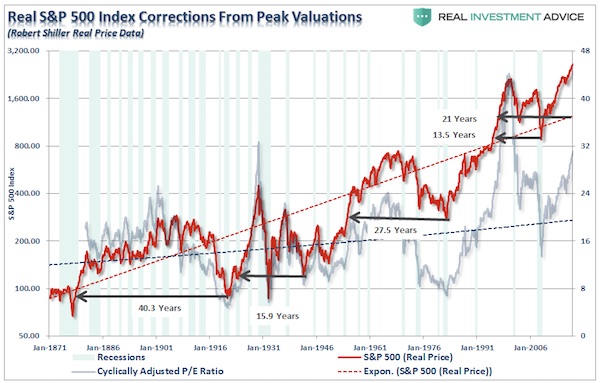

• Peak Valuations and Market Corrections (Rosso)

[..] global diversification has enhanced portfolio returns this year. Spreading wealth among different markets and sectors has allowed investors to capture strong equity performance. You see, on the trend higher, investors may seek to employ a series of risk horses to fully participate in the race. Fixed income or bonds, and cash equivalents do a good job of helping investors manage risk through bear markets as they are negatively correlated to stocks. On the way down, stocks across markets connect and head south in sync; some fall faster than others. Unfortunately, when stock diversification is needed the most, it fails. With current valuations and stock prices extended well beyond their long-term trends, investors must be aware of reversions that have the probability of wiping out a decade or longer in gains.

Stock diversification will not protect you if or when this occurs (let me know if you’ve heard this from your broker’s research hub as of late; I bet you haven’t). Strategists for big-box financial retailers are consistently wishy-washy when it comes to the current unsustainable altitude of stock prices. It’s not in their best interest to take a stand. It would be a death knell for their careers. Recently, one of the paunchiest of the brethren shared on CNBC: Stocks are “slightly overvalued;” followed by – “that doesn’t mean you should do anything here.” Perfect. Well done. That’s how seven-figure compensation packages are earned, folks. When it comes to retail investors, time is as or more precious a commodity as money; we at RIA consistently write and research the math of investment losses to make sure you remain emotionally grounded and don’t allow greed to blind your judgment. We are not afraid to outline the risks inherent in extended markets.

Personally, I’m not willing to give up a decade or two to break even. Are you? Don’t worry about your friendly neighborhood talking heads. They’ll continue to collect big paychecks and hefty year-end bonuses as long as they play senior managements’ game. A broker’s research department superstar spokesperson is paid handsomely to point out when markets reach new highs but rarely expound on how long it takes to achieve or in most cases, reclaim them. A big-box financial retail investment strategist’s primary role is to forge and fortify a firm’s presence or brand and help front-line brokers keep investors fully invested through rough market cycles, nothing more.

It’s different this time, though….

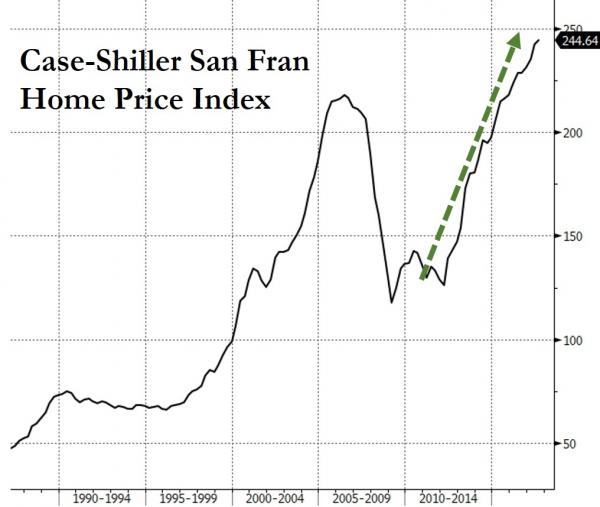

• Silicon Valley Homes Going For Nearly $2 Million Over Asking Price (ZH)

If you’re still holding out hope that the following chart is anything but another massive housing bubble in the making then you should probably ignore the disturbing evidence to the contrary that we’re about to present below… Back in 2005/2006, one of the key signs that housing markets across the country were overheating was the number of houses that, thanks to soaring demand from speculators, were suddenly selling at prices well in excess of their asking price. That said, as a local CBS affiliate in San Francisco points out, the premiums of 2005/2006 pale in comparison to homes in Silicon Valley today that are selling for as much as $1-$2 million over their original asking prices.

But if you thought they area housing market couldn’t get any more outrageous, consider a home on Colorado Avenue in Palo Alto. It listed for $2.9 million, but sold for $3.9 million, $1 million over asking price. Another home on Anacapa Drive in the Los Altos hills listed for $2.8 million, but sold for $4.5 million. That is $1.67 million over asking. Finally, there is this home on University Avenue in Los Altos that listed at $7.9 million, but sold for $1.8 million over asking. In 2017, 10 homes in the mid-Peninsula area sold for $1 million over asking. Six of those listings belonged to Deleon Realty.

Where does the money come from that’s used to buy bitcoin?

• Bitcoin Is Biggest Bubble Of Them All, And It’s The Fed’s Fault – Ron Paul (CNBC)

He’s taken on President Donald Trump and the Federal Reserve. Now, libertarian former congressman Ron Paul is taking on bitcoin. According to Paul, cryptocurrencies have become an asset that rivals the bubble he sees in stocks. “I think it’s going to continue to do exactly what it’s doing. It’s going higher and it’s going lower,” he said Tuesday on CNBC’s “Futures Now.” “We can look at what’s happening now, which to me is a climactic end of QEs.” Paul, who has done commercials touting currency competition for a company that benefits from bitcoin’s rise, views the crypto craze as a side effect of central banks doing several rounds of quantitative easing to cope with the last financial crisis. “I look at the problems we face. I think they’re gigantic and people are desperate and looking everywhere. Why would they buy bonds that pay negative interest rates? Why would they buy stocks, and say well this time it’s different? ” asked Paul.

“Cryptocurrency is a reflection of the disaster of the monetary dollar system.” Paul, who’s also a medical doctor and former Republican presidential candidate, argues that cryptocurrencies are in an “exponential bubble” where trying to calculate its real value is extremely difficult. Bitcoin, the largest of the cryptocurrencies, has been trading above $17,000. He hasn’t been able to pinpoint when a plunge could happen in cryptocurrencies or the stock market. But Paul says the danger is real. “They’re both big bubbles in the sense that it occurred because there was excessive credit. But if you look at the curves, I think that the cryptocurrency curve looks more threatening,” Paul said.

Looks like ‘we are tech’ was always a losing argument.

• Uber Loses EU Court Fight as Judges Take Aim at Gig Economy (BBG)

Uber Technologies Inc. will be regulated in European Union countries as a transport company after the bloc’s top court rejected its claim to be a digital service provider, a decision that could increase legal risks for other gig-economy companies including Airbnb. While the EU Court of Justice’s ruling covered UberPop – which used drivers without taxi licenses and has already been shuttered in many countries due to the legal issues – it’s a real blow as the first definitive finding that Uber must be regulated by transport authorities. The decision clarifies for the first time that connecting people via an app to non-professional drivers forms an integral part of a transport service. It rejects Uber’s view that such services are purely digital and could fuel further scrutiny of other gig-economy firms.

Paris regulators are already clamping down on Airbnb, treating the home-rental service more like a hotel, and British food-delivery start-up Deliveroo is in the spotlight for its treatment of workers. In the EU judges’ view, “the most important part of Uber’s business is the supply of transport – connecting passengers to drivers by their smartphones is secondary,” said Rachel Farr at law firm Taylor Wessing. “Without transport services, the business wouldn’t exist.” Uber has argued that it’s a technology platform connecting passengers with independent drivers, not a transportation company subject to the same rules as taxi services. The case has been closely watched by the technology industry because of its precedent for regulating the gig economy, where freelancers make money by plying everything from spare rooms to fast-food deliveries via apps on smartphones and PCs.

“After today’s judgment innovators will increasingly be subject to divergent national and sectoral rules,” said Jakob Kucharczyk, of the Computer & Communications Industry Association, which speaks for companies like Uber, Amazon.com, Google and Facebook. “This is a blow to the EU’s ambition of building an integrated digital single market.” While the ruling is valid EU-wide, it remains limited to Uber’s services and won’t directly affect other disputes Uber is facing over how its drivers are treated. One such case is pending at the U.K. court of appeal.

You don’t really need to be a genius to see this.

• Gloomy Brexit Forecasts For UK Are Coming True, Says IMF (G.)

The IMF has strongly defended its gloomy forecasts for the UK after Brexit, saying pre-referendum warnings of slower growth were coming true. Christine Lagarde, the fund’s managing director, said the vote to leave the EU in June 2016 was already having an impact and Britain’s weaker growth this year was in contrast to accelerating activity in the rest of the world. Speaking at the Treasury as the IMF announced the results of its annual health check of the UK economy, Lagarde hit back at those who lambasted the fund when predictions of an immediate post-referendum recession failed to come to pass. “We feared that if Britain decided to leave, it would most likely entail a depreciation of sterling, higher inflation leading to a squeeze on disposable income and a reduction in investment,” she said.

“People said ‘Oh those experts’, but we are seeing the narrative we identified as a potential risk being rolled out as we speak. This is not the experts speaking, it’s what the economy is demonstrating.” The IMF trimmed its forecast for UK growth this year from 1.7% in October to 1.6%, and said it expected the economy to grow by 1.5% in 2018. It was one of several economic forecasters to say the UK would suffer a downturn should voters back leaving the EU. Last year, the fund had said growth for 2017 would be 1.1%, before raising the forecast to 2%. Since the turn of the year, Lagarde said activity had slowed notably and the UK’s recent performance was a disappointment in the light of the best showing by the global economy since the financial crash.

A deliberate mess?

• Bank of England To Allow EU Banks To Operate Unchanged After Brexit (G.)

The Bank of England plans to allow European banks to maintain their UK operations under current rules following Brexit, in a direct challenge to European Union regulators to adopt the same policy towards UK-based banks. The Bank said it wanted to press ahead with assessing the risks posed by the 177 banks and insurance companies based in the European Economic Area that have branches in London, following the agreement between Theresa May and EU officials to move to the second stage of Brexit talks. In a move that pre-empts trade talks between the UK and EU, the Bank said it would assess each foreign bank’s branch operation to decide whether it needed to be converted into a subsidiary, which effectively separates it from its overseas parent with its own capital.

Banks domiciled in the EEA will be keen to maintain UK branches, which are cheaper to run and come under more direct head office control. They also maintain their chief regulator in their home country. Most branches are expected to retain their current status despite needing to satisfy stringent rules. The BoE said it would carry out a broad assessment of the risks posed by branches, though it would rely heavily on cooperation with regulators across the EU. Branches that are considered to pose a systemic risk to London’s financial centre could be forced to convert to being subsidiaries. The Treasury is expected to give the Bank additional powers to supervise foreign bank branches in the UK, a job largely done by regulators based inside the EU.

Some pro-Brexit campaigners are expected to view the move as throwing away a major bargaining chip in trade talks. The UK might have threatened to block EU access to facilities in the City as the price of concessions in other areas, such as manufacturing and fishing rights. However, Mark Carney, the Bank’s governor, told MPs on the Treasury select committee on Wednesday that the decision to allow EU banks to continue operating under existing UK rules had been taken on the assumption that a “high degree of supervisory cooperation with the EU” would continue after Brexit.

Desperate?!

• UK PM May Heads to Poland to Seek Brexit Ally After Firing Her Deputy (BBG)

Fresh from sacking her trusted deputy, U.K. Prime Minister Theresa May heads to Poland on Thursday to attempt to get close – but not too close – to its new government. May was forced to tell First Secretary of State Damian Green to resign Wednesday afternoon after an inquiry into his behavior found he’d made misleading statements over pornography found on his parliamentary computer by police nearly a decade ago. Green is the third Cabinet minister to quit in two months. A couple of recent Brexit-related successes mean the prime minister is better equipped to handle Green’s departure than she might have been a month ago: The European Union has agreed to move negotiations on to the next phase, and late Wednesday, May’s flagship Brexit Bill completed the detailed scrutiny stage of its journey through the House of Commons.

Still, his departure leaves her without her closest ally in Cabinet. The flight to Warsaw will give May a chance to consider how she manages without him. She’ll be accompanied by her most senior ministers for a summit where she’ll promise cooperation on defense and security as part of a charm offensive to win friends in Europe before negotiations on post-Brexit trade start in March. But Poland’s rift with the EU over judicial reforms – and its government’s fears of a shortfall in EU funding after Britain leaves the bloc – threaten to overshadow the meeting with new Polish Prime Minister Mateusz Morawiecki. “The prime minister will raise her concerns with the prime minister when they meet,” May’s spokesman James Slack told reporters in London.

“We place importance on respect for the rule of law and we expect all our partners to abide by international norms and standards.” Britain’s rush to forge links with Morawiecki’s populist administration reflects a desire both to win friends for the talks ahead and to reassure former eastern European countries that it will continue to support them against Russian expansionism after Brexit. British troops are already stationed in Poland, and May will announce increased cooperation on cyber security.

You are not sovereign. All your base are belong to us.

• Poland Protests EU ‘Nuclear Option’ Over Judicial Independence (G.)

The Polish government has accused the European commission of a politically motivated attack after the EU’s executive body triggered a process that could see the country stripped of voting rights in Brussels, over legal changes that the bloc claims threaten the independence of the judiciary. In a highly symbolic moment, Poland’s fellow 27 EU member states were advised by the commission on Wednesday that the legislative programme of Poland’s government was putting at risk fundamental values expected of a democratic state by allowing political interference in its courts. The row represents the greatest crisis in the EU since Britain’s decision to leave the EU last year, with the Polish government showing little inclination to back down.

Frans Timmermans, the vice-president of the commission, told reporters in Brussels that in two years 13 laws had been adopted that put at serious risk the independence of Poland’s judiciary and the separation of powers. “Judicial reforms in Poland mean that the country’s judiciary is now under the political control of the ruling majority. In the absence of judicial independence, serious questions are raised about the effective application of EU law,” Timmermans, a former Dutch diplomat, said. “We are doing this for Poland, for Polish citizens.” Poland’s new prime minister, Mateusz Morawiecki, responded on Twitter: “Poland is as devoted to the rule of law as the rest of the EU.” The Polish foreign ministry said in a statement: “Poland deplores the European commission’s launch of the procedure […] which is essentially political, not legal.”

‘Election’ today. Can’t even really call this an election. The goal seems to be to divide the independence vote among multiple parties.

• Catalonia Poised For Hung Parliament In Bitterly Contested Election (G.)

Catalans head to the polls on Thursday to vote in an extraordinary and bitterly contested election that will pit secessionists against unionists and determine the next phase of the long-running campaign for independence from Spain. The election was called by the Spanish prime minister, Mariano Rajoy, at the end of October when the central government took control of Catalonia and sacked the regional government after it staged an illegal independence referendum and made a unilateral declaration of independence. Polls suggest Catalonia is set for a hung parliament, with the pro-independence Catalan Republican Left party (ERC) vying for first place with the unionist, centre-right Citizens party.

With no clear winner in sight, Thursday’s result is likely to lead to coalition negotiations to form a government that will either maintain the drive for independence in some form or defend the constitutional status quo. Tensions remain high in the region following the referendum and the Spanish police’s heavy-handed efforts to stop it. Secessionists believe that Madrid’s imposition of direct rule and the jailing of senior independence leaders could increase support for their cause. Unionists, however, argue that Catalans are sick of the social unrest and economic uncertainty generated by the unilateral actions of the government of deposed regional president Carles Puigdemont.

The exceptional circumstances surrounding the election are compounded by the fact that Puigdemont has been campaigning from Belgium. He fled to Brussels hours before Spain’s attorney general asked for charges of rebellion, sedition and misuse of public funds to be brought against his cabinet almost two months ago. Puigdemont’s former number two, Oriol Junqueras, has been fighting the election from prison, where he and two prominent independence leaders are being held as part of a judicial investigation into October’s events. “This is not a normal election,” Puigdemont told supporters via video link on Tuesday evening as the campaign drew to a close.

A long list of documents. NATO expansion.

• How The US Swindled Russia in The Early 1990s (Zuesse)

Due to a historic data-dump on December 10th, the biggest swindle that occurred in the 20th Century (or perhaps ever) is now proven as a historical fact; and this swindle was done by the US Government, against the Government and people of Russia, and it continues today and keeps getting worse under every US President. It was secretly started by US President George Herbert Walker Bush on the night of 24 February 1990; and, unless it becomes publicly recognized and repudiated so that it can stop, a nuclear war between the US and all of NATO on one side, versus Russia on the other, is inevitable unless Russia capitulates before then, which would be vastly less likely than such a world-ending nuclear war now is.

This swindle has finally been displayed beyond question, by this, the first-ever complete release of the evidence. It demonstrates beyond any reasonable doubt (as you’ll verify yourself from the evidence here), that US President G.H.W. Bush (and his team) lied through their teeth to Soviet President Mikhail Gorbachev (and his team) to end the Cold War on Russia’s side, when the US team were secretly determined never to end it on the US-and-NATO side until Russia itself is conquered. And this swindle continues today, and keeps getting worse and worse for Russians.

Until now, apologists for the US-Government side have been able to get away with various lies about these lies, such as that there weren’t any, and that Gorbachev didn’t really think that the NATO issue was terribly important for Russia’s future national security anyway, and that the only limitation upon NATO’s future expansion that was discussed during the negotiations to end the Cold War concerned NATO not expanding itself eastward (i.e., closer to Russia) within Germany, not going beyond the then-existing dividing-line between West and East Germany — that no restriction against other east-bloc (Soviet-allied) nations ever being admitted into NATO was discussed, at all. The now-standard US excuse that the deal concerned only Germany and not all of Europe is now conclusively disproven by the biggest single data-dump ever released about those negotiations.

When everything is measured in monetary value, nothing will be left in the end.

• Alaska’s Arctic National Wildlife Refuge Now Has A $1 Billion Price Tag (G.)

Years ago, camping in Alaska’s Arctic national wildlife refuge, I watched a herd of caribou – 100,000 bulls, cows and their three-week-old calves – braid over the tundra, moving to a rhythm as old as the wind. “Not many places like this left today,” said my friend Jeff, sitting next to me above an ice-fringed river. And so Alaska senator Lisa Murkowski believes this refuge – 80 miles east of Prudhoe Bay – could generate $1bn over 10 years once it’s opened to oil leasing. She and her Republican colleagues slipped this drilling provision into the Senate Republican tax bill. Murkowski repeatedly says this development would cover just 2,000 acres, “about one ten-thousandth of ANWR”.

The acronym ANWR conveniently deletes the words “wildlife” and “refuge”, with no regard for the polar bears, Arctic fox, musk oxen and migratory ground-nesting birds that come there every summer, some species from as far away as Patagonia. Alaska’s lieutenant governor, Byron Mallott, has said that drilling in ANWR is necessary to deal with climate change. His caddywhompus logic: we need to drill for more oil to raise money to address a problem that’s caused by humanity’s addiction to oil. Why not just say the truth? We want the money. Murkowski adds: “We have waited nearly 40 years for the right technology to come along for a footprint small enough for the environment to be respected.” They have not. Alaskans have been trying to drill here for decades, using one crazy rationale after another.

At one hearing the state’s lone congressman, Don Young, put a blue pen mark on his nose to show how small the industry footprint would be. Clever man. The development would in fact be a spider web of roads, pipelines, well pads and landing strips smack in the middle of the biological heart of the refuge. It would look less like a refuge and more like Prudhoe Bay, where thousands of spills have been reported. Senator Maria Cantwell of Washington says the whole idea is “ludicrous”, noting that the Republican tax plan would add roughly $1.5tn to the national deficit in five years [with the richest 1% of Americans reaping half of the tax cuts]. “I am disturbed,” she says. She should be. Christopher Lewis, a retired BP manager of exploration, has said: “I do not believe that there are any adequate, commercially viable reservoirs in the Arctic refuge.” The reality is “there are other less sensitive and less costly places to explore”.

Brutal.

• Russians, Chinese Seek Out Greek Properties for Bargains, Visas (BBG)

George Kachmazov, a Russian realtor, is buying up property in Athens. The Moscow-based chief executive officer of real-estate platform Tranio.com has bought a building in the Greek capital and is in the process of acquiring five others with a view to selling apartments to international investors. For Kachmazov, the sales pitch is clear: buying property in Greece can give an investor a so-called golden visa to the country – and with it an entree into much of Europe. What’s more, the country’s real estate market may be poised for a rebound, helping buyers make some money on their purchase. “Greece’s real estate market is one of the remaining few in Europe that hasn’t recovered since the 2008 economic crisis,” Kachmazov said in an interview in Athens.

Prices in Spain, Portugal, Ireland, Poland and Hungary are heading toward pre-crisis levels because of high liquidity in Europe, he said. Kachmazov is among agents making a beeline for Greece to help property hunters from Russia, China, Turkey and elsewhere bet on a market that may be on the cusp of a revival as the country exits its bailout program in August 2018. Property prices in Greece have fallen more than the 25% contraction in the economy since Europe’s sovereign debt crisis began in 2008. Prices of apartments in Athens more than five years old shrank by 45% between 2008 and June 2017, according to Bank of Greece data.

“The belief is that the worst is over and that this is a good time to take advantage of the low prices and to benefit from future capital gains as the market recovers,” said Carrie Law, CEO of Juwai.com, a Chinese international property website. Juwai this year signed an agreement with Warren Buffett’s real estate brokerage firm to advertise homes in the U.S. The average price per square meter in Greece is 2,846 euros ($3,369), according to Germany-based statistics company Statista. That’s almost 1,000 euros cheaper than Portugal, which has a similar golden visa program for property buyers, one and a half times cheaper than in Spain and Germany, and almost three times cheaper than in Italy and Austria. Greece is more expensive than Bulgaria, Croatia, Romania and Estonia.

There are reportedly highly superior facilities lying idle on the mainland. But the EU doesn’t want the refugees there.

• Lesbos Mayor Files Suit Over Conditions At Moria Migrant Camp (K.)

The mayor of the eastern Aegean island of Lesvos has filed suit against all responsible parties over the conditions at the Moria refugee and migrant processing center. Spyros Galinos filed his suit in Lesvos’s Court of Misdemeanors, claiming that the law is being broken at the government-run facility, which is supervised by the military. His action comes two days after foreign media published videos shot covertly inside the camp and showing the squalor and cramped conditions to which thousands of refugees and migrants are being subjected. The mayor stressed that the facility, a former military base, should not be accommodating more than 1,800 people at a time if decent living standards are to be ensured.

“Unfortunately, though, for the past two years and this year especially there is an extremely large number of third-country citizens and vulnerable groups (men, women – among which pregnant women – and children) indiscriminately trapped and cramped together, coming to more than 6,000 individuals,” Galinos said in his lawsuit. He also stressed poor safety and sanitation standards, saying that an inadequate water and sewerage network is putting the lives of the camp’s residents and workers at risk. People living at the camp “every day experience serious psychological problems and have been led to suicide attempts and self-harm, while others are compelled to serious acts of lawlessness in order to survive,” Galinos said.

His suit came just hours after about a dozen people were injured in a brawl that went on for hours between rival groups at the camp and resulted in extensive destruction. The mayor further stressed the impact of conditions at Moria on the lives of the island’s residents, saying that authorities are failing in their duty to control and monitor such a large number of refugees and migrants. Galinos added that overcrowding at the camp has forced hundreds of migrants to move into the main town of Mytilene in search of some kind of shelter, “taking over public spaces, the city’s parks, sidewalks and courtyards of public and municipal buildings.” In the suit, Galinos asks that “all responsible parties” are taken to task over the situation, as “their actions and omissions are malicious and deliberate, and put at risk the desperate and poor people trapped in [Moria’s] illegal facilities.”

“The disruption of social cohesion and the risk of criminal offenses in defense of life and property by a part of the island’s native population is evident and very likely,” Galinos warned. Since the onset of the refugee crisis at the start of 2015, the residents of Lesvos and its mayor have been distinguished for the support they have given to tens of thousands of migrants that have landed on the island’s shores.

Home › Forums › Debt Rattle December 21 2017