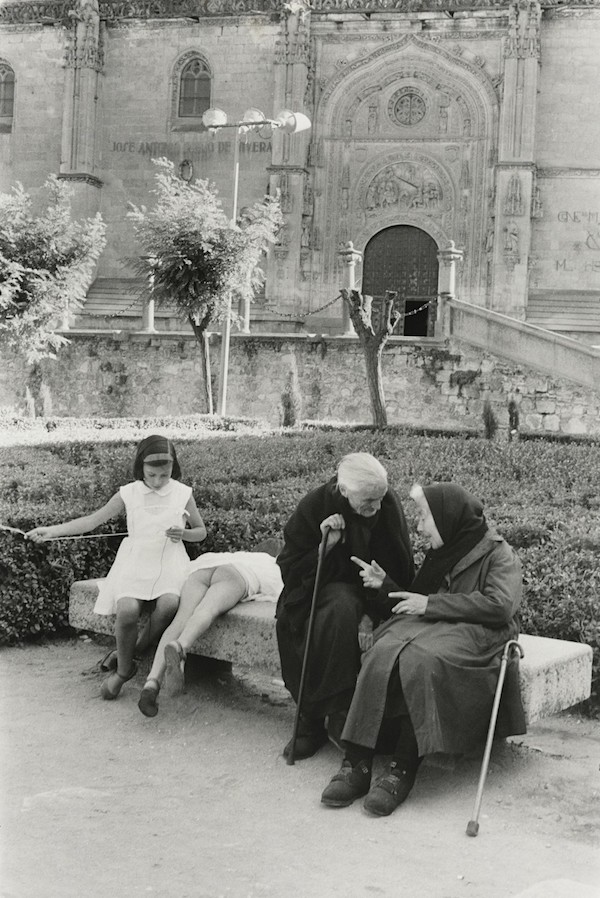

Henri Cartier Bresson Salamanca, Spain 1963

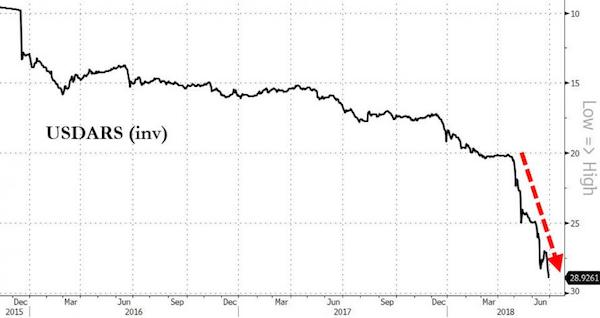

Kellyanne Conway leaves 2 months before the election, US cities are still on fire, using convalescent plasma becomes legal, Rahm Emanuel is dug up from whatever hole he was in, and the FBI failed to inform the Trump team about foreign interference in their campaign. In other words, normal weekend. Maybe it was the last one for a while.

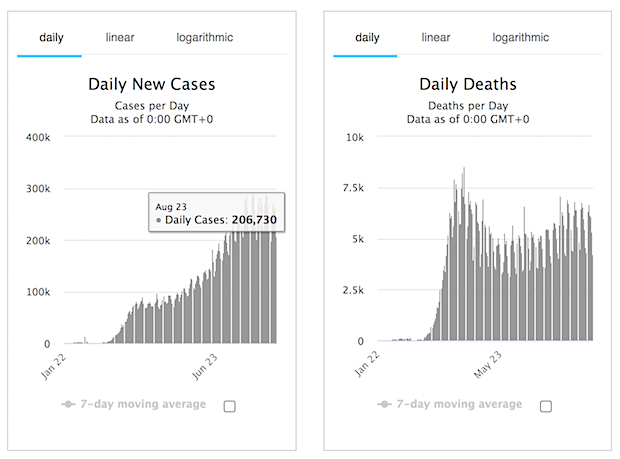

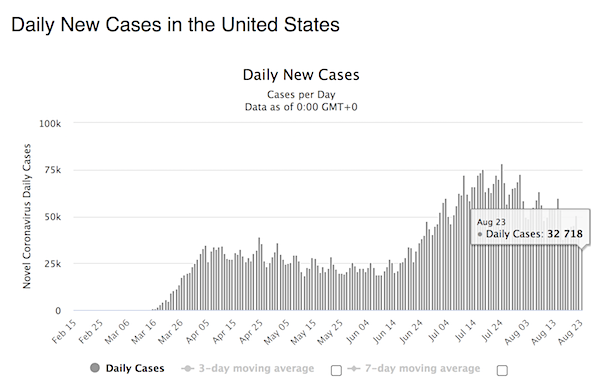

Weekend numbers don’t mean much.

Squirrel

One of my personal heroes pic.twitter.com/ucPSrGYBAj

— Gabe Hudson (@gabehudson) August 22, 2020

Why make this such a big deal? Can’t the doctors just do it?

• Trump Announces Emergency Authorization For Convalescent Plasma (JTN)

President Trump at a Sunday evening press conference announced an emergency authorization of convalescent plasma amid the ongoing battle against the COVID-19 pandemic. “The FDA has issued an emergency use authorization … for a treatment known as convalescent plasma. This is a powerful therapy that transfuses very, very strong antibodies from the blood of recovered patients to help treat patients battling a current infection,” Trump said. “It’s had an incredible rate of success. Today’s action will dramatically expand access to this treatment,” the president said. White House Press Secretary Kayleigh McEnany on Saturday night had tweeted the the president would hold a Sunday event “concerning a major therapeutic breakthrough on the China Virus.”

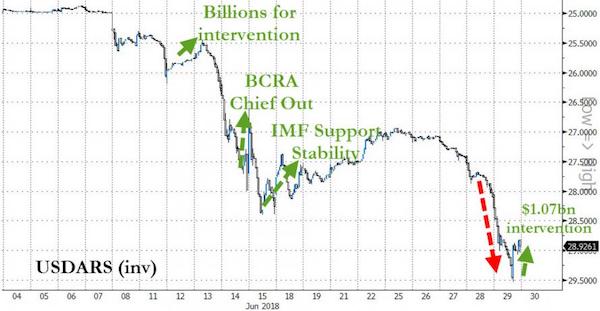

From well before Trump’s announcement.

“The distribution system got approved and built; the trial protocols did not. They never began.”

• 97,000 People Got Convalescent Plasma. Who Knows if It Works? (Wired)

As of Monday, August 17, a nationwide program to treat Covid-19 patients with a fluid made from the blood of people who’d recovered from the disease—so-called convalescent plasma—had reached 97,319 patients. That’s a huge number of people, considering that nobody really knows whether convalescent plasma actually works against Covid-19. A spontaneously generated, self-assembling group of clinicians and cross-disciplinary researchers that built the nationwide program to ensure “expanded access” to convalescent plasma also created protocols for randomized, controlled trials, the gold standard for evidence in science.

They hoped to test plasma’s ability to prevent disease after exposure, its capacity to treat Covid-19—and what Michael Joyner, an exercise physiologist at the Mayo Clinic who was instrumental in setting up the expanded-access network, called a “Hail Mary” protocol to try to help people who are severely ill, on ventilators. The distribution system got approved and built; the trial protocols did not. They never began. There are plenty of reasons to think plasma might help fight Covid-19. Physicians have used it for more than a century; it’s made by taking blood from people who’ve recovered from a disease and spinning it in a centrifuge down to a frothy, yellow liquid that contains the sum total of the donor’s immune response—molecules that attack all invading germs, and some that specifically target all the individual pathogens the donor has ever encountered.

But actual rigorous trials of the stuff are rare. Dozens of randomized, controlled clinical trials are underway—tests that systematically compare the same kinds of people at similar stages of the disease who get convalescent plasma to those who don’t. Even without that rigor, this year tens of thousands of people received plasma for Covid-19. It played out as a one-on-one decision between physicians and patients, not a population-scale experiment designed to elicit knowledge about its efficacy. A preprint from the expanded-access group, not yet peer-reviewed, recounts the outcomes of more than 35,000 of these recipients at hundreds of hospitals. It retroactively splits that population into groups based on when in their illness they got plasma, or how laden the plasma was with the antibodies that actually do the disease-fighting.

Let Big Pharma chime in.

• China Has Given Potential Coronavirus Vaccine To Key Workers Since July (G.)

The Chinese government has been administering a coronavirus vaccine candidate to selected groups of key workers since July, a senior health official has said. Zheng Zhongei, the head of the National Health Commission’s science and technology centre, told state media organisation CCTV on Sunday the government had authorised “emergency use” of a Sars-Cov-2 vaccine for workers including health workers and border officials. The country has gone seven days without reporting a locally transmitted case, and border workers are considered to be in a high-risk category, said Zheng, who leads the vaccination development taskforce.

It appears to be the first confirmation of vaccine use by China outside clinical trials. There were no details on which particular vaccine candidate was used or how many people received it, but Zheng said it had been administered in line with the law, under powers that allow limited use of the unapproved vaccines during serious public health events. “We’ve drawn up a series of plan packages, including medical consent forms, side-effect monitoring plans, rescuing plans, compensation plans, to make sure the emergency use is well regulated and monitored,” Zheng said, adding that they planned to “scale up” the testing to other groups before autumn and winter.

[..] In June the Chinese government called for volunteers among employees of state-owned companies who travel overseas frequently, to test two vaccines. State-owned China National Biotec Group (CNBG) has since been approved to start human testing of its vaccine in the United Arab Emirates, Bahrain, Peru, Morocco and Argentina, and the company said about 20,000 people were taking part in the overseas trials. SinoVac and CanSino Biologics are also conducting overseas trials in Russia, Indonesia, and Brazil. Last week a planeload of Chinese mine workers was refused entry to Papua New Guinea, over government concerns about an apparent vaccination trial.

We know where the FBI stands.

• Graham: FBI Docs Show ‘Double Standard’ For Clinton And Trump Campaigns (Fox)

Following the release of recently declassified documents, Senate Judiciary Chairman Lindsey Graham, R-S.C., says he believes the FBI showed a double standard in its investigations into reports of foreign interference at the campaigns of Hillary Clinton and now-President Trump in the lead-up to the 2016 presidential election. Calling it “the ultimate double standard,” Graham said that the documents reveal that leaders at the FBI sought to give the Clinton campaign a defensive briefing before it could pursue a FISA warrant related reports that a Clinton operative was connected to foreign government. “The FBI finds out about a plot by a foreign government to lobby her campaign and funnel millions of dollars into the Clinton campaign illegally,” Graham said on Fox News’ “Sunday Morning Futures.” “

They want a FISA warrant against a Clinton operative who is connected to the foreign government. What happens? The FBI seventh floor says we’re not going to let you get a warrant. And to you defensively, brief the Clinton campaign.” But instead of doing the same for the Trump campaign, the FBI opened the Crossfire Hurricane operation and pursued a number of FISA warrants against people working with Trump’s campaign. While Graham would not reveal which foreign government wanted to assist Clinton in getting elected, he said that FBI leadership shot down a request for a FISA warrant until Clinton was briefed on the matter. “They never did to Trump,” Graham said. “As a matter of fact, not only did they not tell Trump, they used a generic briefing to spy on Trump.”

“The FBI did the right thing by briefing Clinton and failed to do the right thing by never specifically briefing President Trump about their concerns,” Graham said in a statement released earlier on Sunday. Earlier this month, Senate Homeland Security Committee Chairman Ron Johnson, R-Wis., issued a subpoenaed to the FBI and Director Christopher Wray as part of its broad review into the origins of the Russia investigation. The subpoena, obtained by Fox News, demands that he produce “all records related to the Crossfire Hurricane investigation.”

If Rahm Emanuel speaks for you, you know you’re in trouble.

• This Will Be The Year Of The Biden Republican – Rahm Emanuel (CNBC)

Democratic presidential nominee Joe Biden has a chance to replicate an election strategy that helped elect Republican icon Ronald Reagan to the White House almost four decades ago, longtime Democratic politician Rahm Emanuel told CNBC on Friday. Emanuel, appearing on “Closing Bell,” said he believes that the former vice president can win over disaffected Republicans with a platform that has moderate language to get behind. “This will be the year of the Biden Republican,” said Emanuel, citing the appearances of John Kasich, former governor of Ohio, Colin Powell, secretary of State under President George W. Bush, and Cindy McCain, widow of Sen. John McCain, among other GOP members at the Democratic National Convention this week.

“Joe Biden will be a president we will all be proud to salute,” Powell said in his message. “With Joe Biden in the White House, you will never doubt that he will stand with our friends and stand up to our adversaries — never the other way around.” Emanuel likened Republican voters mobilized against President Donald Trump to “Reagan Democrats,” the White, traditional blue-collar voters who crossed party lines to help elect Reagan to two terms as president. Reagan defeated then-Democratic incumbent Jimmy Carter in a landslide. The California Republican carried 44 out of 50 states in the 1980 contest and 49 states in the 1984 race.

Democrats must not only attract Republican voters who want to put Trump out of office at the end of his first term, but retain those voters under the party’s big tent, said Emanuel, who served as White House chief of staff under former President Barack Obama. He made the same case in a Wall Street Journal opinion piece Saturday, saying that suburban voters in areas of Arizona, North Carolina and Pennsylvania, battleground states that Trump won in 2016, can be flipped. The lack of support for a “Green New Deal” and “Medicare for All” in the Democratic platform helps the party balance between the desires of the moderate and more progressive members, Emanuel said on CNBC.

With a broad coalition of support that stretches from four-star generals to Black Lives Matter supporters, Biden can leverage his decades of governing experience in Washington to “culturally move them into a comfort zone,” he said. “My view is you don’t want this to be a transactional election,” the former Chicago mayor said. “You want this to be the opportunity of a transformational election.”

.@JaymalGreen launches on Rahm Emanuel on #msnbc. #Chicago pic.twitter.com/UzLOx5zDSE

— Trope o. Phobe (@Tropophobe) February 11, 2017

Maybe Sirota can get a speaking slot at the RNC.

• Corporate Dems Want You To Shut Up While They Get Loud (Sirota)

No doubt, you have been told to keep quiet. Just put on your big boy pants, they say, and find the impulse control to at least muzzle yourself for the next 72 days until the election happens. After that, fine — then and only then will you maybe be permitted to speak your mind and politely ask the Democratic Party to match its rhetoric with its policy agenda. But until then, you are told to ‘“shut the hell up and grow up,” as former Obama and Mike Bloomberg pollster Cornell Belcher put it during an emblematic MSNBC segment berating progressives. This kind of hectoring has become a defining part of the Democratic Party’s culture. As the late great journalist Bill Greider lamented:

“The way the Democratic Party is run for quite a number of presidential cycles is they pick a nominee in a kind of half-assed process that doesn’t really represent much of anybody and then they tell everybody to just shut up — don’t bring up anything that will complicate life for your nominee… shut up, turn off your brains.” There’s a superficial logic to this call for omerta — after all, Donald Trump is destroying everything and he must be defeated. But here’s the problem: The demand to shut up is only being aimed at the progressive base of the party, while the corporate wing floods the zone with rhetoric that could demobilize voters.

Indeed, at the very moment many good progressives are blunting their criticism and making clear that defeating Trump is of utmost importance, Corporate Democrats aren’t being asked to wait or hold their tongues. In fact, they are doing the opposite: Rahm Emanuel — who has been advising Biden — just went on television to show that the corporate wing of the party is intent on using the stretch run of the Most Important Election Of Our Lifetime™ not to doggedly focus on actually winning the election, but to instead try to predetermine post-election policy outcomes. Emanuel and his ilk depict themselves as evincing a non-ideological “just win, baby” attitude. But they are most decidedly pushing a very clear corporate ideology — and they are doing so in dangerously divisive ways that could depress the big turnout that’s desperately needed to defeat Trump.

It was another violent weekend in the cities. How much longer? And how did this ever become normal?

• The Silence Of Joe Biden And The Dems On The Violence In The Cities (Kass)

Joe Biden, the smiling figurehead who Democrats have nominated for president, closed his party’s virtual convention with a speech that proved two things about him. The man can still ably deliver a well-written speech. And he still has great message discipline. Because he did what the other Democrats did over their four-day infomercial, make constant references to their own virtue and empathy, while portraying President Donald Trump as evil incarnate, a dark lord without virtue and without an empathetic bone in his body. But through all that talk, Biden and the Democrats avoided saying anything about what many Americans are talking about now: The violence, political and otherwise, plaguing American big cities run by liberal Democratic mayors.

The entire country sees the spiking street crime, the 50% increase in murders in some cities, looting in the downtowns, those news videos of people being pulled out of their cars and beaten, knocked out on the sidewalk, and cops pummeled in violent political confrontations. Biden was silent about all that. I wish he hadn’t been. But he was. In his speech, Biden offered a thorough condemnation of Trump, and this memorable line. “My father taught us that silence was complicity,” Biden said. You’ve probably also heard the slogan “silence equals violence.” But my barber, Raffaele Raia, born in Naples, puts it this way: “Chi tace acconsente. He who is silent says ‘yes’. The silence is the consent.”

Many protests have been peaceful. But many have not been. A cop getting his head thumped by a protester using a skateboard as a club isn’t a victim of a peaceful protest. The protests are no longer about the Minneapolis police killing of George Floyd. They’re also not about virtue or empathy. Yet in the midst of this, Americans are encouraged to apply virtue to politics. But searching for virtue in politicians is childlike, like believing in fairy tales, pixies, or like hoping to find a purple unicorn who’ll be your friend forever. Yet rather than search for virtuous purple unicorns, you might consider the words of Bostonian Henry Adams in “The Education of Henry Adams”: “Chaos was the law of nature; Order was the dream of man. Practical politics consists of ignoring facts. Politics, as a practice, whatever its professions, had always been the systematic organization of hatreds.”

[..] Biden and national Democrats can’t acknowledge any of it. They’re desperate to avoid it. They have nothing to say to it. And the conflict inside their party rages on, out on the streets, where America can see it. Trump will roll down that law-and-order road at the Republican virtual convention. He’s a politician, now, too. That’s what politicians do. Like wolves, they take advantage of weakness. But Trump didn’t pave that road he’s on. Biden and the national Democratic Party paved it for him, with silence that is consent.

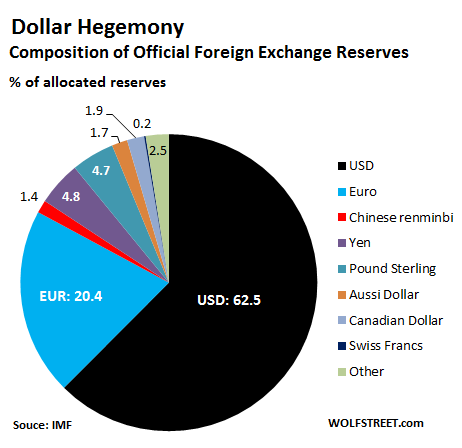

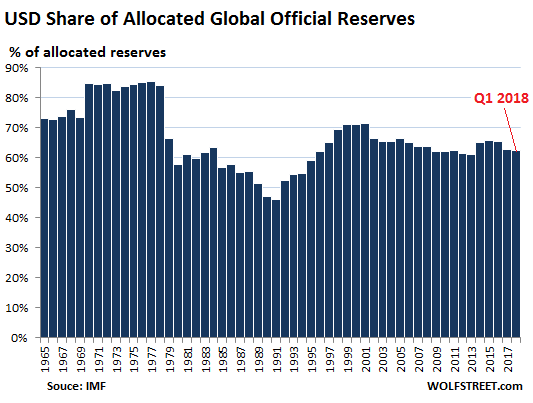

“..any market for Chinese yuan consistent with a role as a global reserve currency would need to exist outside of mainland China.”

• Don’t Discount the Dollar Yet (FP)

If some stories are easier to tell than others, the decline of the U.S. dollar as a reserve currency is one of them. It’s not hard to see why. The cast of characters that avail themselves for the script includes international trade, financial architecture, great-power competition, cycles of history, and even parables from ancient Greece.And on cue, the headlines are again churning out new versions of the familiar fable. New plot lines include the economic fallout of a global pandemic as well as a “capital war” between the United States and China, in which Washington usurps Beijing’s traditionally lonely role as the imposer of the restrictions on how capital can move between their two countries, frightening global investors, who then forsake the fallen dollar. Taken at face value, the headlines suggest that the dollar’s long-awaited dethroning may be here at last.

But the economic forces that thwarted any demise of the dollar in the past persist. They continue to render any end to the dollar’s reserve status today unlikely. In fact, there is a new player keeping it on its throne: the Chinese Communist Party. It’s the latest arrival to the motley crew of conspirators serving, unwittingly, to prevent the currency from leaving its seat. The dollar can’t be displaced with nothing, and mainland China’s currency, the yuan, was once the most-viable something. Global banks planned for it to “inevitably” replace the dollar. Economists speculated about the timing. The country’s growing economy, after all, is the world’s second largest. And Beijing is keen to take steps intended to promote its currency’s use in international trade. Officials in the world’s third-largest economy, the European Union, may voice similar intentions.

But Beijing is not dealing in the currency of a monetary union that, according to research at its own central bank, maybe shouldn’t even exist. “Overall economic structures in euro area countries,” economists at the European Central Bank concluded in 2019, “are still not fully commensurate with the requirements of a monetary union.” Nonetheless, Beijing’s recent actions have eviscerated the yuan’s prospects as a real reserve currency. For a currency to function as an international reserve, global businesses need safe places to put it when it’s not in use. After all, no one wants to sell stuff in exchange for money they’d struggle to safely store. Without safe storage options, like easy-to-access banks or at least low-risk bonds, a currency can become a costly thing with which to do business.

The most natural home for these safe assets denominated in mainland China’s currency would be mainland China. But Beijing imposes capital controls on flows of money in and out of the mainland. These capital controls stymie the development of liquid, globally accessible capital markets that can offer safe assets. Hence any market for Chinese yuan consistent with a role as a global reserve currency would need to exist outside of mainland China.

Not sure what the mystery is. The bottom line, no matter where it turns, is China is stuck until it liberates its currency.

• China’s Mysterious Dollar Dealings (OMFIF)

Considering China’s tensions with the US, Chinese authorities’ and banks’ dollar business is somewhat puzzling. China’s US Treasury holdings decreased to $1.07tn at end-2019, from $1.112tn in mid-2019. Chinese-owned banks globally reduced their reliance on dollar funding by $42.5bn. Since then, China’s holdings of US treasuries have risen to $1.084tn as of May, and banks’ dollar funding climbed $40.7bn in this year’s first quarter. This represents a swing of $80bn, around 8% of Chinese banks’ total cross-border funding. This is particularly surprising as global liquidity, and especially dollar liquidity, started drying up in March in view of the virus-induced global downturn. By the end of Q1, Chinese banks had extended $1.4tn in cross-border loans, two-thirds of total their overseas assets.

Dollar funding amounted to $1tn, half of total liabilities. This represents a funding gap of $400bn. While this might lead to a liquidity crunch, similar to European and Japanese banks, it was deemed manageable thanks to ample official dollar reserves. These could be made available to Chinese banks. Chinese banks’ cross-border dollar business is minor compared to their $40tn in total assets. Hence, the impact on the Chinese economy would be smaller than in the home countries of other global banks, according to the IMF. Deposits are the steadiest source of dollar funding, but are not readily available to Chinese banks. The central banks of China, Russia and Turkey are not covered by the Federal Reserve’s swap facilities. Foreign banks’ US subsidiaries can access the Fed Funds market, but Chinese banks do not appear to have tapped into it.

Their main source of dollar funding is offshore financing, as confirmed by the Bank for International Settlements. Financing is available through a number of channels, mostly interbank borrowing, as well as securitised debt. There are two enigmas regarding China’s dollar business. The first is Chinese banks’ continued purchases of US treasuries and dollar lending and funding. The second is why these banks are seeking to become a major intermediary for dollar financing to emerging market economies through the Belt and Road initiative, to the tune of $600bn by end-2019. At the same time, they have funded themselves in dollars, mostly in offshore centres. The BRI was expected to facilitate renminbi financing, boosting renminbi internationalisation.

Financing for the BRI is granted mainly through domestic lending to Chinese companies involved in BRI projects. Major Chinese banks’ head offices, as well as their Hong Kong branches, offer direct cross-border financing to recipient countries. According to their annual reports, the four main banks (including two policy banks) have extended $150bn each in loans. This lending has not been securitised and stays on the bank’s balance sheet, contrary to the global trend. This prevents foreign investors from buying into BRI projects, even though they were expected to contribute more funding in the initiative’s second phase. What remains are emerging economy dollar-denominated liabilities to Chinese lenders, which will come under scrutiny if countries seek IMF support. Chinese bankers say their emerging economy clients prefer dollar loans. If they provided loans in renminbi, recipients would change them into dollars to enhance fungibility.

Reads like an advertorial.

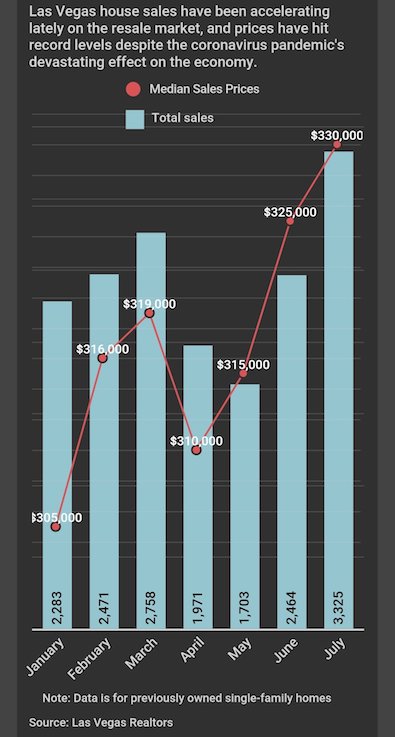

• Las Vegas Housing Market ‘On Fire’ As Economy Limps Along (LVRJ)

With a baby on the way, a strong credit score and money saved up, Veronica Markowsky figured it was time to buy a house. So the 35-year-old renter recently joined a herd of homebuyers in Southern Nevada and signed papers for a soon-to-be-built house — all while the coronavirus pandemic wreaks havoc on the economy and her Las Vegas bridal shop business. It’s probably not the best time to buy a place, Markowsky said, but she had her reasons. “What’s the worst that can happen?” she said. Las Vegas’ tourism-dependent economy has been devastated by the coronavirus outbreak. But the valley’s housing market, which initially was hit hard by the fallout from the crisis, has been accelerating lately with fast-rising sales and record prices.

The fervor has provided a surprising jolt of commerce in a bleak time. “I didn’t expect any of this kind of activity,” said Tom Blanchard, president of trade association Las Vegas Realtors. By all accounts, record-low mortgage rates — cheap money, essentially — are providing much of the fuel, as they let buyers lock in lower monthly payments. Amid the surge of demand, prices have climbed as the market’s low inventory of available homes further tightens. Southern Nevada has seen record job losses during the pandemic, with much of the pain falling on the service sector, where wages tend to be lower. Who is buying homes amid the turmoil? People who still have jobs, savings and other factors that let them qualify for a mortgage or buy with cash.

All told, the market has gained speed as buyers snap up homes from builders and on the resale market, with sellers fetching multiple bids. “It’s craziness,” Blanchard said. Las Vegas attorney Adam Breeden, who closed his purchase of a newly built house near the M Resort last month, listed his old house in May. He received three offers within three days, he recalled, including one at the full asking price. “I was shocked the market was the exact opposite I thought it would be,” he said.

Lovely dispatch from Athens.

• Summer In The Ailing City: The Purpose Is Life (Maglinis)

The feeling when you look out of the hospital window is that life is out there and it is passing you by indifferently, cold toward your small, insignificant drama. It is as if you have been immobilized in a static parallel universe. At the same time, this gradation of life (people out there, sunbathing on beaches and diving in cool seas and, on the other hand, those of us faced with the unpleasant condition of serious hospitalization – much more so when the person being treated is your child) in turn has its own, internal gradations: We do not all have the same fate, the same experience in the hospital. Some children will never be out of the hospital again.

Normally we should be thankful that, even though they are suffering, our child’s treatments are going well. And indeed you thank God and are thankful for your fate, but the cursed time in the hospital runs torturously slowly. So you look out there, you count the hours spent in the hospital, you count them like drops falling from the intravenous drip, you look at the sun-soaked courtyard of the clinic, the few people walking around, and you realize that even the lucky ones “out there” feel more vulnerable than ever.

But this may be the constant of the summer of 2020: In mid-August, the holiday season in Athens does not have the unguarded carelessness of other summers. Even in times of deep economic crisis, summer, August, was a refuge. Temporary maybe, but it still had something healing about it. This year, the pandemic – with the invisible, tiny enemy that knows no frontline or rear guard, that knows how to bypass obstacles and find forgotten half-open “back doors,” in the summer on the islands, on the crowded shores, even in the deserted city – looks like a well-orchestrated ambush.

But even in the age of imposed social abstinence and distance, “no man is an island,” as the English poet John Donne once wrote. “No man is an island entire of itself; every man is a piece of the continent, a part of the main.” Maybe because it binds us all to the simple truth that no one wants to be sick, no one wants to feel sick, no one wants to accept that they are powerless before nature, which is blind when it comes to your decay, entropy, extinction. No one wants to feel that, deep down, it is another insignificant part of the “whole process” of death and rebirth in nature. Who wants to feel like they are just a cog in a process of wear and tear and not a player in a longevity process?

Normally, every summer, we should all have the right to feel a little like kids again. This year we have no right to such a blessed parenthesis. Some for special reasons and all for the known ones. Another summer will come that will be healing and when we can feel like children again. Our only mission is to endure until another such summer, that will have a few moments of heavenly simplicity. The mask – or even the hospitalization – is just the pretext. The purpose is life .

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

I’m not entirely sure what this means, but it looks nice.

Support the Automatic Earth in virustime.