Pablo Picasso Dora Maar 1937

Tucker Harmeet

I joined @TuckerCarlson to discuss how our government — through the FBI and other agencies — told social media companies to censor speech regarding election matters before and after the 2020 elections — and @facebook & @Twitter cheerfully complied, affecting the election outcome. pic.twitter.com/YVRtol26pC

— Harmeet K. Dhillon (@pnjaban) August 26, 2022

“I want to believe that the political forces will rise to the occasion..”

Just come out and say: look, this is not inevitable, it’s a political decision. Not from Madrid, but from Brussels. Or actually not Brussels either, but Washington. And Davos.

• EU Should Brace For ‘Winter Of Great Suffering’ – Spanish Minister (RT)

European countries supporting Ukraine against Russia should brace for a full suspension of natural gas supplies by Moscow during the upcoming winter, Spanish Defense Minister Margarita Robles has warned. “We are going to have a winter of great suffering,” the cabinet member told Radio National on Wednesday, adding: “in Europe, we have to work hard to be ready to deal with it.” Robles claimed that Russian President Vladimir Putin is already throttling the supply of gas to the continent, apparently referring to the reduction in deliveries by Russian energy giant Gazprom. The company has blamed external factors for the loss of capacity, noting that Ukraine is refusing to pump gas through one of the routes running through its territory.

Gazprom has also pointed to the sanctions-related delay in returning a German-made turbine for the Nord Stream 1 pipeline, following maintenance. European nations, meanwhile, have accused Moscow of reducing the flow for political motives. The EU, which has pledged to remove Russian fossil fuels from its energy mix within the coming years, in retaliation for Russia’s attack against Ukraine, is facing a severe gas shortage, with alternatives to proving more expensive and less accessible. Robles went on to claim that Putin “cannot win” in the gas standoff, but acknowledged that parties represented in the Spanish parliament may not support gas rationing, which the EU leadership has recommended for all member states. “I want to believe that the political forces will rise to the occasion,” she said. The minister pledged continued Spanish support for Kiev, and asserted that the unity of NATO and the EU were as strong as ever amid the West’s confrontation with Russia.

By Forbes.

• Europe Branded ‘Third World’ Economy (RT)

The fallout of the sanctions imposed on Russia over the conflict in Ukraine has turned Europe into “the third world of the Western world economies,” a senior contributor to Forbes magazine has claimed. “These days, the European stock market is the worst in the Western world,” under-performing the US by ten basis points, Kenneth Rapoza pointed out in his article on Tuesday. “The most significant headwind” for such a state of affairs has been the “Russian sanctions on energy as punishment for its war with Ukraine,” Rapoza insisted. Those restrictions “set off a massive commodity price spike that’s hurt the European economy the most,” he added.

The author advised investors against putting their money into Europe, at least until Brussels figures out how to compensate for the massive reduction in energy supply from Russia, and how to mitigate the harmful impact of its own sanctions. If there’s no ceasefire in Ukraine soon, chances are that “Europe becomes so desperate this winter and supply chains so stretched that it has no choice but to relax some sanctions or convince non-EU partners to relabel and transship Russian commodities to look in [compliance] with their own rules, but really doing an end-around,” he wrote. Until some solution is provided, Europe will remain “the third world of the Western world economies,” Rapoza stressed, saying that this was how one investor on Twitter had recently described the situation on the continent to him.

The author also asked Vladimir Signorelli the head of US-based consulting firm Bretton Woods Research to comment on the idea of Europe becoming “the Third World of Western economies.” “They’re certainly heading that way,” Signorelli acknowledged. “And you have the Greens still opposing nuclear in Germany. I just don’t understand them. They are on the fast track to a third-world energy program.” Only China is now “worse as an investment” than Europe, Rapoza claimed, citing Beijing’s “heated political fight” with Washington, internal struggle within the Chinese political elites and the country’s harsh Covid-19 curbs.

“..unless the Government does take much more effective action to help people, there will be widespread civil unrest.”

• UK Gov’t Warned of “Civil Unrest” Over People Unable to Pay Energy Bills (SN)

Energy executives in the UK have warned the government that the country faces the prospect of mass civil unrest as a result of people being unable to afford their heating and electricity bills this winter. The government is being asked to approve “radical” COVID-style bailouts for small businesses which face total ruination as a result of soaring energy costs. “Energy company bosses have warned ministers they fear civil unrest if nothing is done to cushion the blow of rising bills,” reports the Telegraph. One senior industry figure said that when people “realize how bad this is going to get,” they could take their anger to the streets in the form of violent demonstrations. The comments are similar in nature to those made by campaigner Tom Scott, who is urging people to refuse to pay their bills, and says social disorder is on the horizon.

“There was a major riot in London [in 1990],” said Scott, referring to the poll tax riots. “That’s not something I would like to see, but I think it’s almost inevitable that unless the Government does take much more effective action to help people, there will be widespread civil unrest.” Despite the warnings, Prime Minister Boris Johnson continues to insist that Brits should maintain their support for ‘the current thing’ – by prolonging the war in Ukraine. “We also know that if we’re paying in our energy bills for the evils of Vladimir Putin, the people of Ukraine are paying in their blood,” said Johnson. “And that’s why we know we must stay the course. Because if Putin were to succeed, then no country on Russia’s perimeter would be safe, and… (that) would be a green light for every autocrat in the world that borders could be changed by force,” he added.

Even as many Brits struggle to pay for basic necessities, with food inflation also soaring, Johnson just approved a further £54 million of taxpayer money to be sent to Ukraine to buy new weapons systems. Energy bills are set to soar to £6,522 by next April, a level that threatens to push a third of the country into poverty. “Consultancy Auxilione said the price cap will be three times the current limit of £1,971-a-year,” reports the Daily Mail, with bills having been closer to £1,000 a year before the start of the war in Ukraine. Meanwhile, the UK continues to pursue disastrous ‘net zero’ green energy policies that are unfit for purpose while refusing to allow fracking, which would solve the country’s energy crisis in a heartbeat. Perhaps many Brits will choose to keep warm this winter by lighting fires on the streets instead of paying their heating bills at home.

“..trimming their discretionary budget, delaying a major purchase, driving less, scaling back travel and charitable donations, or deferring savings for the future…”

• Four In Five Canadians Pinching Pennies (RT)

As inflation piles pressure on Canadian budgets, people are spending less, market researcher Angus Reid Institute reported on Monday. The survey shows that four out of five Canadians have cut spending in recent months by either trimming their discretionary budget, delaying a major purchase, driving less, scaling back travel and charitable donations, or deferring savings for the future. This reportedly represents an increase from 74% of respondents in February. Over half of the nation (52%) said they could not manage a sudden expense of more than $1,000. For two in five Canadians, a surprise bonus of $5,000 would be used to alleviate debt pressure. For one in ten, it would immediately go towards daily expenses.

“Regionally, some parts of the country seem to be feeling more financial pain than others,” the report stated, pointing to Saskatchewan and the Atlantic area. Canada’s year-on-year inflation hit a 40-year high in June, with the Consumer Price Index reaching 8.1%. The annual rate of inflation cooled down to 7.6% in July, according to a Statistics Canada report issued on August 16. Inflation has been rising across the developed world amid the worsening energy crunch caused by tight supplies of oil and gas, a situation exacerbated by the sanctions on Russia, a major energy exporter.

“Governments should focus on reducing energy demand wherever possible.”

• Greece’s Price Cushion Tops EU (K.)

Among the 27 European Union member-states, as a percentage of gross domestic product, Greece spends the most on measures designed to mitigate the impact of the energy crisis, according to data by the Brussels-based think tank Bruegel published Wednesday by Bloomberg. The Greek government allocated €6.8 billion, or 3.7% of GDP, from September 2021 to July 2022, to keep energy prices low for households and businesses, ahead of Lithuania (3.6% of GDP) and Italy (2.8%). The four countries that spent the least in terms of GDP were Finland (0.5%), Sweden (0.4%), Ireland (0.2%) and Denmark (0.1%) The funding, as calculated by Bruegel, covers everything from subsidizing tariffs for small businesses in Greece to direct payouts to consumers in Belgium. Some of the money hasn’t yet been spent.

In total, EU governments have spent over €278 billion since last September, with Germany (€60.2 billion) and Italy (€49.5 billion) spending the most in absolute terms. But spending plans have been revised upward since July due to the explosive growth in natural gas prices. The €6.8 billion figure is close to what Finance Minister Christos Staikouras said in interviews last week. Even though Greece got out of an unprecedented debt crisis in 2018, with the end of the third austerity program agreed with its creditors, and still is the EU’s most heavily indebted country by far, it was also one of the biggest spenders on supporting professionals affected by the coronavirus pandemic and the resulting lockdowns. Staikouras mentioned the state has spent a combined €50 billion on the two crises.

It appears the crisis is far from over: “Prices will stay high throughout the winter and governments should work with the worst-case scenario assumption that they will not go away even after that,” Bruegel analyst Giovanni Sgaravatti said. “Governments should focus on reducing energy demand wherever possible.”

“..The biggest consumers of electricity will be electric cars with a short range and a high price..”

• Czech President Blames “Green Madness” For Energy Crisis (SN)

Czech President Milos Zeman has blamed “green madness” for the energy crisis and warned that the abolition of cars with internal combustion engines will only prolong the agony. Zeman said the primary cause of the crisis was not the Ukraine war, but “green fanaticism” that has left European countries dependent on energy sources that cannot meet demand. “Whether it’s called the Green Deal or whatever, I’m afraid. However, I won’t be here anymore when we find out where the green madness will take us,” said Zeman. “The abolition of cars with internal combustion engines will lead to the advent of far more demanding electromobility. The biggest consumers of electricity will be electric cars with a short range and a high price,” he added.

The comments were made amidst controversy in the Czech Republic caused by new government regulations which mandate schools, hospitals, and households reduce their temperature by up to six degrees Celsius to save energy. Owners of care homes for the elderly complained that old people cannot live in a 20°C environment without it posing a threat to their health. “It is not permissible for the elderly to spend 100 percent of their time in spaces at 20°C and below. It is life-threatening to bathe frail seniors in a room heated to only 20°C when they get cold quickly,” said Daniela Lusková, vice-president of the Association of Social Service Providers. However, a spokesman for the Ministry of Health insisted that regulations were made in consultation with professional scientific opinion.

Similar rules have already been enforced in Germany, where thermostats in public buildings are being limited to 19 degrees Celsius, and in Spain, where at the height of summer, non-residential buildings can set the temperature no lower than 27°C. Back in May, Italy began rationing electricity to ‘support Ukraine’, with public buildings banned from running air conditioning at lower than 25°C or heating higher than 19°C.

If they allow it for one city…

• Dutch City of The Hague Seeks Exemption From EU Sanctions Against Russia (R.)

The Dutch city of The Hague on Thursday said it would ask for a temporary exemption of EU sanctions against Russia, as it struggles to find a replacement for its contract with Russian gas supplier Gazprom in time. Sanctions imposed by the European Union against Russia following its invasion of Ukraine order governments and other public bodies to end existing contracts with Russian companies by October 10. For The Hague, this means it has to find a new supplier of gas to replace its existing agreement with Gazprom. The city said it held an EU-wide tender in June and July, but failed to attract any bids from potential suppliers.

Individual talks with suppliers were certain to lead to an agreement, alderman Saskia Bruines wrote in a letter to the city council, but not before the Oct. 10 deadline. “We will ask for an exemption for our current arrangement until Jan. 1 2023 to guarantee the safety of supply and to facilitate negotiations,” she said. Bruines said she was confident the delay would be granted, as The Hague had fulfilled the condition of holding a timely tender without a positive result. However, she added that any new contract set to enter into effect on Jan. 1 would be significantly costlier than the city’s current arrangement with Gazprom. The Hague is one of many Dutch municipalities that have an energy contract with Gazprom, but is the first to indicate it will ask for an exemption to the sanctions.

May have to read this twice:

“Scholz reiterated that Berlin had been sending “a lot of weapons” to Kiev and would continue to do so. However, the chancellor also insisted that his main focus was “ensuring that there is no escalation..“

• ‘Absolute Deficit’ In Germany’s Weapons Stock – Foreign Minister (RT)

With German weapons stocks running low, the country’s defense industry should produce arms specifically for Ukraine, Foreign Minister Annalena Baerbock has said. During an interview with ZDF broadcaster on Wednesday, the German minister was asked whether Kiev could win in the conflict with Russia. “We don’t know that,” she replied, but promised that Berlin would “do everything possible” to help Ukraine. However, Baerbock acknowledged that supplying Kiev with arms had become increasingly difficult for Germany as its own military was suffering from a shortage of equipment. “Unfortunately, the situation here is such that we have an absolute deficit in our own stocks,” the Green Party politician said.

The German defense industry should therefore “produce hardware specifically for Ukraine,”instead of the country having to share weapons from its own arsenal. Baerbock said she understood the desire of Vladimir Zelensky’s government to receive more arms, but insisted that Berlin also needed to think of the future. They must be prepared for the conflict in Ukraine to continue in 2023, she warned. Germany’s Iris-T anti-aircraft missile system will be supplied to Kiev in the coming weeks, with more weapons deliveries expected by the end of the year, “so that the Ukrainians can defend themselves,” she stated.

Since the launch of Russia’s military operation in Ukraine six months ago, German Chancellor Olaf Scholz has faced criticism for his apparent reluctance to send weapons that were promised to Ukraine. Berlin has so far supplied artillery pieces, shoulder-fired rockets, and anti-aircraft self-propelled guns, but not the more sophisticated air-defense systems and artillery radar hardware desired by Kiev. Last week, Scholz reiterated that Berlin had been sending “a lot of weapons” to Kiev and would continue to do so. However, the chancellor also insisted that his main focus was “ensuring that there is no escalation” in Ukraine. On Monday, the German Defense Ministry said it had reached the “acceptable limit” of what it could deliver to Kiev without depleting its own stockpiles.

“Kiev initially appeared willing to accept a neutral status, but was later emboldened by Western military aid.”

• Medvedev Envisions Military Junta In Kiev (RT)

Former Russian president Dmitry Medvedev predicted that the Ukrainian military may stage a coup in Kiev to do what the civilian government refuses to do – negotiate peace with Russia. Medvedev, who is now deputy chair of the Russian National Security Council, outlined the scenario as one of two options that he believes to be viable for Ukraine. The other was if the government of President Vladimir Zelensky changed its tune and agreed to Russia’s terms for ending hostilities. Either way, Russia will get what it wants from Ukraine, the official said. Moscow declared the demilitarization and ‘denazification’ of Ukraine as the goals of its military operation in the country. Kiev initially appeared willing to accept a neutral status, but was later emboldened by Western military aid.

Zelensky now insists that defeating Russia on the battlefield and retaking all the land that was under Kiev’s control before 2014 is the only possible option for his country. The assessment by Medvedev apparently came in response to a Wednesday article in the Guardian, which made predictions for how the Ukrainian crisis could develop over the next six months. Dan Sabbagh, the British newspaper’s defense and security editor, offered five predictions that he considers likely. The expectations included a deadlocked conflict and a reduction in the intensity of hostilities, a campaign of sabotage by Ukrainian special forces and a renewed refugee crisis during winter. The Russian official said that any scenario for the conflict that would predict a victory for Kiev was “crystal-clear lies and demagoguery.”

“..the BRICS countries are opening up to Russia, offering the opportunity for the country to overcome the consequences of sanctions..”

• Russia and India No Longer Need US Dollar – BRICS President (RT)

Russia and India don’t need the US dollar in trade, having turned to national currencies to conduct mutual settlements, BRICS International Forum President Purnima Anand told reporters on Wednesday. “We have implemented the mechanism of mutual settlements in rubles and rupees, and there is no need for our countries to use the dollar in mutual settlements. And today a similar mechanism of mutual settlements in rubles and yuan is being developed by China,” she said. “That means that the BRICS countries are opening up to Russia, offering the opportunity for the country to overcome the consequences of sanctions,” Anand added, as quoted by RIA news agency. The BRICS president said mutual trade between India and Russia had grown fivefold over the past 40 years.

Moscow supplies a rapidly growing volume of oil to India, and in return gets large quantities of agricultural products, textiles, medicines and other products. Anand also noted that New Delhi considers itself a neutral party in the current sanctions war between the West and Russia, and despite sanctions pressure, will continue cooperation with Moscow “in any areas where necessary.” “When Russia’s military operation in Ukraine began, naturally there was pressure on India to stop importing Russian oil. But the Ministry of Foreign Affairs had to reject this pressure. The Russian side was assured that supplies would not be stopped and the sanctions regime would in no way affect the relationship between our countries,” the forum head stressed. BRICS an international socio-economic and political forum incorporating five member nations: Brazil, Russia, India, China and South Africa.

“..Americans are “slaves” to the U.S. Constitution..”

• “Reclaim America from Constitutionalism” (Turley)

It appears that we may finally to be coming out of the campaign on the left to “pack the court” with a liberal majority. That is good news. The problem is that many on the left have turned their ire on the Constitution itself as the root of all evil in our country. In a New York Times essay, law professors Ryan D. Doerfler of Harvard and Samuel Moyn of Yale are calling for the Constitution to be “radically altered” to “reclaim America from Constitutionalism.” In order to accomplish this dubious objective, they call for shifting from the “Pack the Court” to “Pack the States.” The attack on “constitutionalism” is chilling but these professors are not the first to lash out at our Constitution as the scourge of social justice.

The New York Times column called for citizens to view the Constitution as the real enemy and to push to “radically alter the basic rules of the game.” The attack on our Constitution has become something of an article of faith for the far left in recent years. Recently, Georgetown University Law School Professor Rosa Brooks drew accolades for her appearance on MSNBC’s “The ReidOut” after declaring that Americans are “slaves” to the U.S. Constitution and that the Constitution itself is now the problem for the country. CBS recently featured Boston University Professor Ibram X. Kendi, who proclaimed that the Second Amendment was little more than “the right to enslave.” MSNBC commentator and the Nation’s Justice Correspondent Elie Mystal has called the U.S. Constitution “trash” and argued that we should ideally just dump it.

Mystal, who also writes for Above the Law, previously stated that white, non-college-educated voters supported Republicans because they care about “using their guns on Black people and getting away with it.” Doerfler and Moyn make the same case with a twist in seeking to pack the states. They insist that “The real need is not to reclaim the Constitution, as many would have it, but instead to reclaim America from constitutionalism.” Rather than recognize that this document has produced the longest standing and most stable democratic system in history, professors denounced it as a “some centuries-old text” because it stands as a barrier to their social and political agenda. The problem, they suggest, is that many liberals still believe in constitutionalism as opposed to raw majority power.

Why Djokovic can’t play.

• Moderna’s New US Open Sponsorship: Marketing Push Beyond Covid Vaccine (Adage)

Moderna is upping its marketing game with a new US Open sponsorship as the biotech company seeks to raise awareness about the mRNA science that powers its COVID vaccine. The goal of the sponsorship—and a new broader marketing push—is to educate people about how the company is using mRNA for other potential medical breakthroughs that could be used to treat people with cancer, metabolic diseases and other afflictions. Although Moderna has done other sports deals—including sponsoring a “Shot of the Game” promotion with the NBA and NHL to promote COVID booster shots —the US Open pact marks its most extensive sponsorship to date, according to Moderna Chief Brand Officer Kate Cronin. She declined to disclose financial terms but said the deal was signed for one year.

“We want to establish Moderna as a modern leader changing medicine and pioneering mRNA,” she said. And while that means moving the conversation beyond COVID, she said the timing of the US Open—right before the fall season when many people will be getting a COVID booster vaccine—marked the right time to push the broader message. The sponsorship comes as Moderna leverages a new endorsement from Billie Jean King. A new video starring the tennis great pays tribute to “Change Makers,” while referencing her pioneering feats, including changing the way women get paid. The approach ties into Moderna’s tagline “This changes everything.” The video will run as an ad during ESPN’s coverage of the US Open. It was put together by TBWA, Moderna’s lead agency.

Edward Dowd talked about DMED a lot. He’s been banned/censored/silenced.

• Drastic Increase in Non-Infectious Diseases in Military (ET)

A medical Army officer who discovered a sudden increase in disease coinciding with reports of side effects alongside COVID-19 vaccines—which the Army has dismissed as a data glitch—said he faces involuntary separation after being convicted but not punished for disobeying COVID-19 protocol. In January 2022, First Lt. Mark Bashaw, a preventive medicine officer at the Army, started noticing some “alarming signals” within the defense epidemiological database. The Defense Medical Epidemiology Database (DMED), which tracks disease and injuries of 1.3 million active component service members, showed during the pandemic a significant increase in reports of cancers, myocarditis, and pericarditis; as well as some other diseases like male infertility, tumors, a lung disease caused by blood clots, and HIV, Bashaw said.

Several of these illnesses are listed in FDA documentation as potential adverse reactions associated with COVID-19 vaccines, Bashaw told EpochTV’s “Crossroads” program in an interview on Aug. 1. Seeing increases in cases of these illnesses as high as 50 percent or 100 percent in some situations, Bashaw stepped forward as a whistleblower to raise concerns about his findings. Bashaw’s whistleblower declaration, submitted to Sen. Ron Johnson (R-Wis.) who is facilitating the sharing of information from early investigations of COVID-19 products with Congress, said he saw the increasing incidence of these disorders observed in DMED as “very troubling.” Specifically, the number of cancer cases among active service members in 2021 nearly tripled in comparison with the average number of cancer instances per year from 2016 to 2020, Bashaw said in his declaration.

Bashaw’s responsibilities as a preventive medicine officer, with a specialty in entomology, include “participating in fact-finding inquiries and investigations to determine potential public health risk to DoD [Department of Defense] personnel from diseases caused by insects and other non-battle related injuries.” A week after this information was brought out in January in a “COVID-19: Second Opinion” roundtable organized by Johnson, the data in DMED changed, Bashaw said, and all of these troubling spikes in diseases and injuries “seemed to have disappeared and been realigned with previous years.” Curiously, the glitch didn’t affect the data from 2021, which remained the same. Instead, the corrected data saw the data for prior years increased, which made the 2021 data look normal and in line with the running average, Bashaw explained.

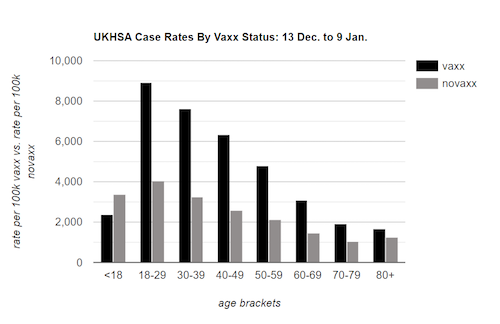

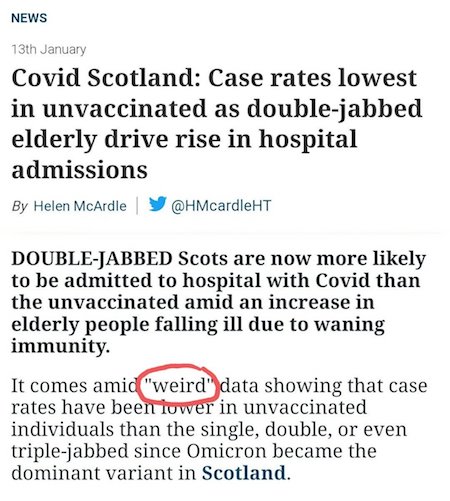

We should add that there are no benefits for anyone below 40. But always potential risks.

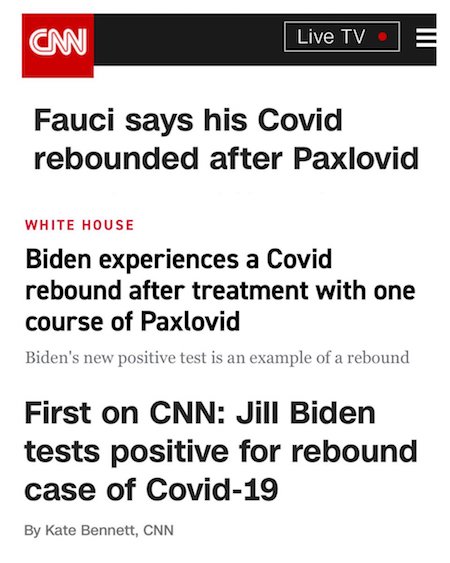

• No Quantifiable Benefits from COVID Drug Paxlovid for People Aged 40 to 65 (CTH)

In April 2022, the Biden administration ordered 20 million doses of Pfizer’s antiviral Covid-19 treatment called Paxlovid.Now a study published in the New England Journal of Medicine shows the medication shows “no measurable benefit” for the treatment of COVID-19 in patients 40 to 65-years of age. WASHINGTON — “Pfizer’s COVID-19 pill appears to provide little or no benefit for younger adults, while still reducing the risk of hospitalization and death for high-risk seniors, according to a large study published Wednesday.

The results from a 109,000-patient Israeli study are likely to renew questions about the U.S. government’s use of Paxlovid, which has become the go-to treatment for COVID-19 due to its at-home convenience. The Biden administration has spent more than $10 billion purchasing the drug and making it available at thousands of pharmacies through its test-and-treat initiative.The researchers found that Paxlovid reduced hospitalizations among people 65 and older by roughly 75% when given shortly after infection. That’s consistent with earlier results used to authorize the drug in the U.S. and other nations. But people between the ages of 40 and 65 saw no measurable benefit, according to the analysis of medical records.”

Zuck doesn’t sound good.

• FBI Warned Facebook Of ‘Russian Propaganda’ In Hunter Biden Laptop Case (OK)

Meta CEO Mark Zuckerberg says Facebook suppressed the distribution of the Hunter Biden laptop story in 2020 after a visit from the FBI. Zuckerberg told Joe Rogan that the FBI had been warning Facebook to beware of incoming “Russian propaganda” before the New York Post released the report on Hunter. Zuckerberg explained on the “Joe Rogan Experience” Thursday: “Basically the background here is the FBI, I think basically came to us — some folks on our team and was like, ‘Hey, um, just so you know, like, you should be on high alert. There was the — we thought that there was a lot of Russian propaganda in the 2016 election. We have it on notice that basically there’s about to be some kind of dump of — that’s similar to that. So just be vigilant.’”

“We just kind of thought, Hey look, if the FBI, which, you know, I still view as a legitimate institution in this country, it’s a very professional law enforcement. They come to us and tell us that we need to be on guard about something. Then I wanna take that seriously.” He says Facebook took a more judicious approach to the story than Twitter: “So our protocol is different from Twitter’s. What Twitter did is they said ‘You can’t share this at all.’ Um, we didn’t do that. If something’s reported to us as potentially, um, misinformation, important misinformation, we also use this third party fact-checking program, cause we don’t wanna be deciding what’s true and false.” To clarify Zuckerberg’s comments, Twitter briefly suspended the New York Post for sharing the story and deleted tweets sharing the hyperlink.

Facebook didn’t remove posts but instead placed the story lower in newsfeeds so that only accounts continuing to scroll could find the link. Meta calls the process “decreased distribution,” a practice critics accuse the company of enforcing on stories that run counter to certain political beliefs. In essence, Zuckerberg provides the defense that while Twitter banned the story, Facebook only buried it. Zuckerberg says Facebook wanted to wait until it could prove Russia did not plant propaganda before allowing mass distribution. Given the impact of the decision, his excuses are hardly valid. First, Facebook interfered in the 2020 presidential election by throttling the story. 16% of Biden voters say they would have voted differently had Facebook and smaller social media platforms not censored a credibly-reported bombshell. Second, it sounds as if the FBI is why Facebook put a specific report under a thorough review process. In that case, there’s another example of Facebook working on behalf of the government.

Zuck (The New York Post story broke in October 2020. The FBI had Hunter’s laptop since at least December 2019.)

The FBI was behind the censorship of the Hunter Biden laptop story.

— Cernovich (@Cernovich) August 25, 2022

Didn’t she leave it in a hotel room? Doesn’t that make it “found” instead of “stolen”?

• Trump Campaign Turned Down Ashley Biden Diary (JTN)

President Donald Trump’s 2020 presidential campaign refused to purchase the diary of President Joe Biden’s daughter and urged its would-be sellers to surrender it to the FBI, court filings show. Aimee Harris and Robert Kurtlander pleaded guilty on Thursday to stealing the diary of Ashley Biden and selling it to the conservative investigative journalism organization Project Veritas. Court filings from the Southern District of New York, which Just the News obtained, reveal that the pair first offered the diary to the Trump campaign but were rebuffed. The filings do not directly identify former President Donald Trump, but the details of the case have been public for months.

“On or about September 6, 2020, AIMEE HARRIS and ROBERT KURLANDER, the defendants, attended a political fundraiser in Florida meant to benefit the campaign of an individual [Trump] who was running for office against [now-President Joe Biden]. HARRIS and KURLANDER attended the fundraiser with the intent of showing the Victim’s stolen property to a campaign representative of [Trump], hoping that the political campaign would purchase it,” read the filings. “On or about September 10, 2020, a representative of [Trump’s] political campaign conveyed to AIMEE HARRIS and ROBERT KURLANDER, the defendants, that the campaign was not interested in purchasing the property and advised HARRIS and KURLANDER to provide the items to the Federal Bureau of Investigation (‘FBI’),” it continued. “KURLANDER texted HARRIS, “[Trump] campaign can’t use it. They want it to go to the FBI. There is NO WAY [Trump] can use this. It has to be done a different way.” The pair later sold the diary to Project Veritas.

Cabot’s tragopan

Cabot's tragopan is a pheasant from mountain ranges in south-east China

Below the beak is a decorative wattle, and there are a pair of blue soft "horns"

These are inflated as part of a courtship display to impress females, you can see that happen here pic.twitter.com/fYxjs2eHg2

— Science girl (@gunsnrosesgirl3) August 25, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.