Russell Lee Bike rack in Idaho Falls, Idaho 1942

Burning down the house.

• “This Is The Worst Global Dollar GDP Recession In 50 Years” (ZH)

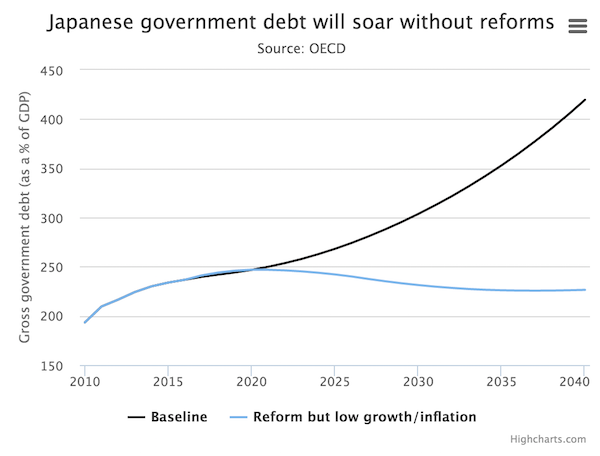

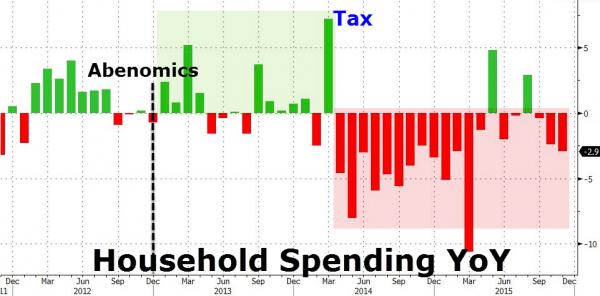

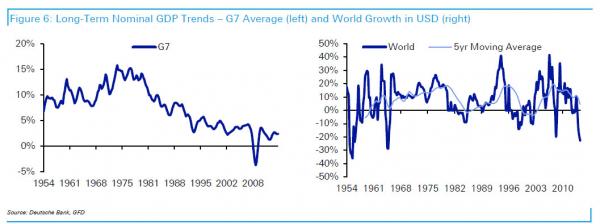

The following brief summary of the global economic situation should, once and for all, end all debate about whether the world is “recovering” or is now mired deep in a recession. From DB’s 2016 Credit Outlook:

“Debt has continued to climb since the crisis with Global Debt/GDP still on the rise, with no obvious sign of when this rise stops for many major countries. Indeed much of the post GFC increase in debt has been raised on the back of the commodity super-cycle which is currently unraveling in EM and the US HY market. Outside of this, the US overall has de-levered to some degree but even there debt levels remain very high relative to all of history excluding the GFC period. With limited tolerance from the authorities to see defaults erode the huge debt burden, the best hope for a more normal financial system is for activity levels to increase so we can slowly grow the economy into the debt burden. However this requires strong nominal GDP growth and we continue to see the opposite.

The left hand graph of Figure 6 looks at a global weighted average of Nominal GDP growth in the G7. On this measure we are still seeing historically weak activity. In dollar terms the situation is even worse. The right hand chart of Figure 6 shows a much more volatile global NGDP series which converts the size of each economy in dollar terms and then looks at the growth rate YoY. With the recent strength in the USD we are seeing a huge global dollar nominal GDP recession – the worst since the 1960s. Whilst this might not be a series that is followed, it does show the sharp contraction of dollar activity levels in the global economy over the last year or so which has to have ramifications given it’s the most important global financial market currency.”

What DB did not point out but is obvious, is that the synthetic dollar squeeze of the past year has made the global collapse now even worse than what was experienced during the great financial crisis, and it is getting worse by the day. And so, with the world trapped in the worst USD-based GDP recession in 50 years, here is the question for Yellen: with every other central bank easing and the Fed tightening, what happens to i) the USD in the future and ii) to future world growth in USD.

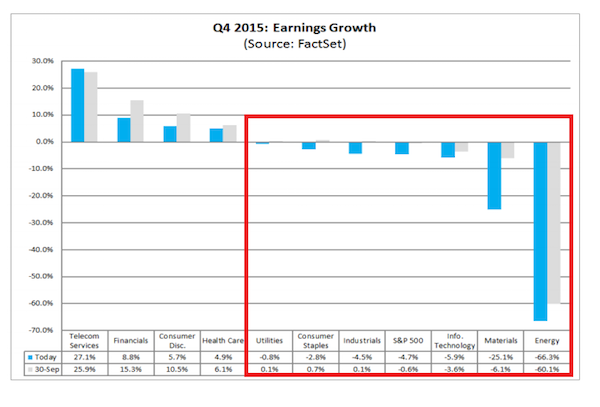

“..of the 25 consumer discretionary companies that have issued earnings outlooks for the fourth quarter, none of them met or exceeded the Wall Street consensus at the time.”

• New Year’s Hangover For Wall Street: Earnings Season Misery (MarketWatch)

Investors didn’t have a lot to celebrate on New Year’s Eve, but that doesn’t mean Wall Street’s start to 2016 won’t suffer a hangover thanks to the upcoming earnings season. U.S. stocks finished last year on a somber note with both the Dow Jones and the S&P 500 snapping multiyear winning streaks. Only the Nasdaq escaped the year unscathed, turning in a 5.7% gain on the year. After a dreary 2015 for stocks, it appears the upcoming earnings season is only going to prolong that misery. Once again weighed down by the energy and materials sectors, the S&P 500 is expected to see a decline in earnings of 4.7% from the year-ago period, according to John Butters at FactSet.

The only sectors expected to see any gain in fourth-quarter earnings are telecom, financials, consumer discretionary and health care. That expected decline in S&P 500 earnings looks to eat into gains made in the previous year’s fourth quarter. In 2014, fourth-quarter earnings rose just less than 4% from the year-ago period, according to FactSet. Quarterly earnings per share for the S&P 500 peaked at $30.33 in the fourth quarter of 2014. Now, that’s expected to drop to $29.38 a share for the fourth quarter of 2015. Additionally, of the 25 consumer discretionary companies that have issued earnings outlooks for the fourth quarter, none of them met or exceeded the Wall Street consensus at the time.

What jobs? “Beijing instructed state-owned business to offer jobs to around 300,000 soldiers that it is making redundant..”

• China’s Factories In The Grip Of Longest Contraction In Six Years (Ind.)

China gave global investors a miserable welcome to 2016 when the world’s second-largest economy revealed yesterday that its industrial output contracted yet again in December – marking the longest losing streak for Chinese factories since 2009. The official purchasing managers’ index (PMI) survey of Chinese manufacturers came in at 49.7, up slightly on the previous month. But any reading below 50 signals contraction and this was the fifth month in a row of decline for China’s factories. Fears about the rapid slowing in the Chinese economy, the main motor for international GDP growth since the global financial crisis, dragged down global stock markets in 2015. And China’s waning demand for commodity imports hammered emerging market economies from Brazil to South Africa.

But analysts said continued industrial production contraction would prompt more stimulus from the Beijing authorities to avert a “hard landing”. “Monetary policy will stay accommodative and the fiscal policy will be more proactive,” argued Zhou Hao of Commerzbank in Singapore. The Chinese central bank has already cut interest rates six times since November 2014 to support growth. It has also reduced banks’ reserve requirements, freeing them up to lend more to businesses. Analysts at Nomura said there was a “medium to high” likelihood of more monetary easing later this month. The PMI index of industrial employment fell slightly in December, and Liu Liu, an economist at China International Capital Corporation, said concerns over jobs would force the hand of the authorities: “As steel, coal and other over-capacity industries close more factories, the employment situation will likely remain grim, calling for a greater role of fiscal policy.”

Earlier this week Beijing instructed state-owned business to offer jobs to around 300,000 soldiers that it is making redundant as part of its restructuring of the People’s Liberation Army. Industrial export orders shrank for the 15th month in a row, with the index in December coming in at 47.5. Exports have made a negligible contribution to China’s GDP growth since the financial crisis, with almost all the expansion being driven by investment spending and household consumption. But some interpreted Beijing’s slight loosening of the yuan’s peg with the dollar last year as an attempt to bolster Chinese exports.

Reform has become just a word. Xi will not let go. Before you know it we’ll be looking at Xibenomics.

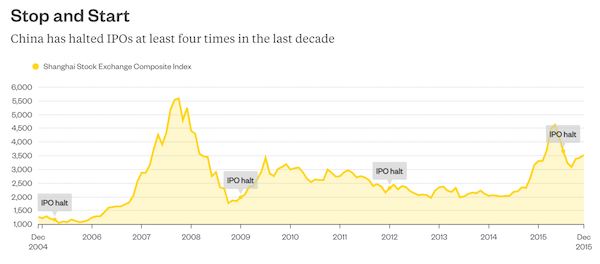

• How a Turbulent Year Derailed China’s Reform (WSJ)

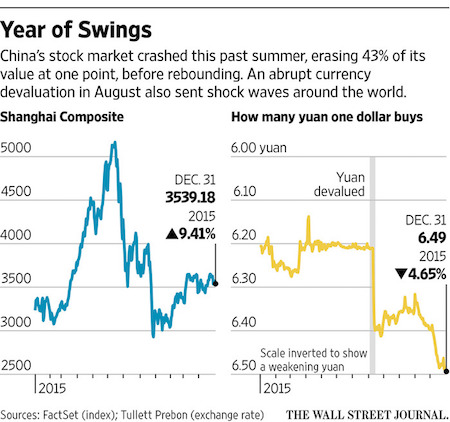

China had one of the best-performing stock markets in the world in 2015. Yet it was a dismal year for Chinese markets. Chinese stocks suffered an unprecedented summer crash that wiped out 43%, or $5 trillion, of their value at one point. That was followed by an abrupt 2% currency devaluation in August that sent shock waves through global markets. Bold reforms seen as crucial to Beijing’s efforts to turn around a slowing economy, such as a modern stock-listing system and lighter capital controls, stalled as the market turmoil unnerved authorities. The episodes demonstrate the stresses China is experiencing as it tries to shift its economy from one fed by debt and heavy industry into one driven by consumption.

For investors, the events of 2015 jolted their faith in China’s capacity to continue driving global growth. Authorities have backtracked on financial liberalization and roiled the country’s finance industry with investigations into brokers, traders and regulators in an effort to apportion blame for the stock market’s sharp pullback. “Recent volatility in the stock market and currency markets has eroded political support for market-oriented reforms and shaken confidence in the leadership’s economic-management skills,” said Eswar Prasad, a Cornell University professor and former China head of the IMF. The year doesn’t look so bad when measured from beginning to end: The Shanghai Composite Index was up 9.4% in 2015. The small-cap Shenzhen market was up more than 63%.

But the middle of the year was a mess. China’s top leaders began 2015 with high hopes for reform and for the stock market, which was then rallying, fueled by margin lending and monetary easing from the central bank. Now, Beijing enters the new year in a cautious mood, making it harder to carry out the overhauls that the government and analysts believe are necessary to keep the Chinese economy growing. “Without bold reforms, the economy will slow further, capital flight will intensify and the yuan will weaken more, which will erode confidence further,” said Chaoping Zhu, economist at UOB-Kay Hian Holdings, a Singapore-based brokerage.

Beijing needs cash.

• Chinese State-Owned Finance Firm Goes Global To Raise Funds (SCMP)

One of China’s state-owned finance firms is looking global amid the country’s economic slowdown, planning to raise funds abroad and engage foreign partners as it improves corporate governance and beefs up risk control. Changchun Urban Development Investment Holding (Group) was given a BBA1 rating by Moody’s and a BBB+ by Fitch Ratings. Both credit rating agencies saw the company as having a stable outlook. The company was set up by combining state assets in Changchun, capital city of northeastern Jilin province. Changchun Urban Development is one of thousands of local-government-backed financing vehicles – state-owned entities that raise funds for local governments to finance costly infrastructure and public facility works.

While the firm will be China’s fourth such vehicle to issue debt overseas – after the Qingdao City Construction Investment Group, Beijing Infrastructure Investment and Zhuhai Da Hengqin Investment – it will be the first in the northeast region to do so. “Changchun Urban Development will extend business coverage overseas. We are prepared against the impact of the United States Federal Reserve’s interest rate hike, while we don’t rule out the possibility of issuing foreign debt in the short term,” its CEO Gao Feng said. Chinese companies tend to choose Hong Kong, Singapore and Europe as their destinations in issuing debt, but Changchun Urban Development said markets in South Korea and Japan were also options as both countries were keen to invest in China’s northeast region.

Being rated by foreign credit rating agencies was one way to improve corporate governance, the company said. It has opened investment companies in Changchun and Beijing and is setting up a brokerage unit in Hong Kong. The Hong Kong unit was preparing a roadshow to promote its debt issue plans, Gao said. “We will make big moves in both the domestic and overseas markets to lower costs and will launch an initial public offering to optimise corporate governance,” Gao said. “We’re not short of money, but we lack good partners. We need to know investors and they need to have qualified resources in overseas markets, which would help the company go abroad and participate in China’s ‘One Belt, One Road’ initiative.”

Bullishness prevails based on perceived continuing central bank largesse.

• 2015: Peak Cognitive Dissonance (Noland)

The year 2015 was extraordinary. Incredibly, despite powerful confirmation of the bursting global Bubble thesis, market optimism remained deeply entrenched. All leading strategists surveyed in December by Barron’s remained bullish – some were borderline crazy optimistic. Optimism withstood a commodity price collapse. Crude, the world’s most important commodity, crashed almost 35% to an eleven-year low, much to the peril of scores of highly leveraged companies and countries. The Bloomberg Commodities Index dropped 25%, its fifth straight year of declines. Copper fell 24%, with platinum and palladium down about 30%. In agriculture commodities, wheat fell 20%, with soybeans and corn down about 10%. Coffee sank 25%.

Bullishness persevered through deepening EM turmoil and a crisis of confidence. The Brazilian real dropped about a third (worst year since 2002), and Brazil’s sovereign debt suffered major losses. Brazil’s corporate debt market was pummeled (Petrobras, Vale, BTG, Samarco, etc.) while confidence in the nation’s major banks and government waned. Russia and Turkey showed further deterioration. Fragility surfaced in EM linchpin Mexico. Currencies suffered generally throughout EM – Latin America, Asia, the Middle East, Eastern Europe, etc. Collapsing currency peg regimes saw almost 50% devaluations for the Azerbaijani manat and Kazakh tenge. Argentina devalued the peso 30% versus the dollar. Throughout EM, dollar-denominated debt became a market concern.

Optimism survived the major financial tumult that unfolded in China. Early 2015 stimulus efforts stoked “Terminal Phase” excess in Chinese equities, a Bubble that came crashing down in a 40% summer drubbing. An August yuan devaluation destabilized markets across the globe. Aggressive (invasive) monetary, fiscal and regulatory measures somewhat stabilized equities and the yuan, at the heavy cost of extending “Terminal Phase” excess throughout the Credit system (i.e. corporate debt and “shadow banking”). The yuan posted a 4.5% 2015 decline against the dollar, the worst performance since 1994. The “offshore yuan” trading in Hong Kong dropped 5.3%.

Bullishness endured despite the August global market “flash crash.” And while the summer market dislocation provided important confirmation of mounting fragilities throughout the markets on a global basis, the bulls interpreted the event as further validating their view of unwavering central bank support and liquidity backstops. The Fed’s September flip-flop emboldened speculative excess, with U.S. equities back within striking distance of record highs by early-November.

Tensions between Stournaras and Tsipras have never abated.

• Bank of Greece Governor Warns on Measures as Tsipras Defiant on Pensions (BBG)

Bank of Greece governor Yannis Stournaras gave a stark warning about the risk of Greece failing to reach an agreement with its creditors on a set of measures attached to the country’s bailout as Prime Minister Alexis Tsipras reiterated his government won’t succumb to “unreasonable” demands for additional pension cuts. The EU is now much less prepared to deal with another Greek crisis, Stournaras wrote in an article published in Kathimerini newspaper, in an unusually strong public intervention, as Europe’s most indebted state braces for negotiations with creditor institutions on a set of tough economic steps, including pension and income tax reform. A repeat of the 2015 standoff which pushed Greece to the verge of leaving the euro area would entail risks that the country’s economy may not be able to withstand, the central banker said.

After months of brinkmanship which resulted in the imposition of capital controls last summer, the government of Alexis Tsipras signed a new bailout agreement with the euro area committing Greece to economic overhauls and additional belt-tightening in exchange for emergency loans of as much as €86 billion. Greece will implement the agreement, Tsipras said in an interview with Real News newspaper published Saturday, adding though, that creditors should be aware that the country “won’t succumb to unreasonable and unfair demands” for more pension cuts. Greece will reform its pension system, which is on the “brink of collapse” through “equivalent” measures targeting proceeds equal to 1% of the country’s GDP in 2016, Tsipras said.

The proposals include raising mandatory employer contributions, according to the country’s Labor Minister, George Katrougalos. Creditors oppose an increase in compulsory contributions, as they argue these create a disincentive for hiring workers and declaring incomes.

Negotiations with the troika will be “tough,” and the government is redoubling its efforts to find “diplomatic” support, Katrougalos said in an interview with To Ethnos newspaper, also published Saturday.

Expect no help.

• UK Homeowners Count The Cost As Floods Force Prices To Plummet (Observer)

People trying to sell their properties in flood-hit parts of north-west England have begun dramatically dropping their prices amid fears that houses in some roads have become virtually unsellable. Large homes in and around the Warwick Road area of Carlisle, which in December 2015 experienced its second major flooding episode in a decade, have started to appear on the market for only 60% of their November values – leaving some people wondering whether they will ever be able to move house. After serious flooding elsewhere, house prices have generally recovered within a few years, according to estate agents in affected areas. This is particularly the case in national parks or other locations where there is strong demand for second and holiday homes. Tewkesbury in Gloucestershire was hit by severe floods in 2007 but while prices took an initial dip, average property values in the town soon returned.

It was a similar story in Cockermouth, Cumbria, which was devastated by floods in November 2009. The deluge brought by Storm Desmond flooded 5,000 homes in Cumbria and Lancashire – but this time the effect on house prices could be much longer lasting, say some agents. Simon Brown, a valuer at one of Carlisle’s oldest estate agents, Tiffen & Co, said he did not expect any houses in the affected roads to sell soon unless they were offered at a large discount. “It had been a decade since the last big floods and prices had pretty much recovered. I’m not saying people had been hoodwinked, but they believed the flood defence work had been carried out and that the properties were safe. Now that it has happened again, I can’t see people being keen to buy in these roads again for a good long time, if ever,” he said.

Brown described how a large Victorian house that would have sold for more than £270,000 a month ago had just been put on the market for £170,000 in its flood-damaged state by an owner who could not face going through the drying for a second time. “Most outsiders to the city would be amazed at the resilience that the residents have shown, and the way that the community has rallied round to help each other,” he said. “However, the people in the worst affected roads look completely snookered. You can always sell a home if the price is cheap enough, but there must be a growing fear that those in the affected streets will never see their pre-flood values ever again.”

“It’s almost as if you’re living on some other planet..”

• US Midwest Calls In National Guard As Flood Disaster Unfolds

Floods have submerged towns, roads, casinos and shopping malls around the south and midwest for more than three days, prompting governors in Illinois and Iowa to call in the national guard. Sixteen states issued flood warnings covering some eight million people. By Saturday floodwaters had begun to subside in many areas, reopening several important highways, after topping levees in the region late on Friday. But swollen rivers have yet to crest in southern states, alarming governors in Tennessee, Louisiana and Mississippi. At Dardanelle, Arkansas, the National Weather Service recorded the Arkansas river at 41ft, nine feet above flood stage.

Missouri governor Jay Nixon said the overflow off the Mississippi would overtake the records set by “the great flood of 1993”, which killed 50 people, broke hundreds of levees and caused thousands to flee their homes. Nixon visited Eureka and Cape Girardeau in eastern Missouri, where floodwaters caused widespread damage, and announced the federal government had approved his request to declare an emergency to help with the massive cleanup and recovery operation. The governor described the scale of the flood damage as other worldly. “It’s almost as if you’re living on some other planet,” he said, standing near a growing pile of debris in a park in Eureka, about an hour’s drive west of St Louis on the banks of the Meramec river, which flows into the Mississippi. “This is just a tiny fraction of the trail of destruction,” the governor told reporters.

Missouri Flood 2016 – Cape Girardeau – Jan 1st – Aerial Drone 4K Footage

Saudis are trying to provoke warfare, attempting to draw in Iran and Russia.

• Iran’s Leader Vows ‘Divine Vengeance’ Over Cleric’s Execution In Saudi (R/AFP)

Iran’s supreme leader, Ayatollah Ali Khamenei, has renewed his attack on Saudi Arabia over its execution of a leading Shia cleric, saying that politicians in the Sunni kingdom would face divine retribution for his death. “The unjustly spilled blood of this oppressed martyr will no doubt soon show its effect and divine vengeance will befall Saudi politicians,” state TV reported Khamenei as saying on Sunday. It said he described the execution of Sheikh Nimr al-Nimr as a “political error”. “God will not forgive… it will haunt the politicians of this regime,” he said. Saudi Arabia executed Nimr and three other Shia alongside dozens of alleged al-Qaida members on Saturday, signalling it would not tolerate attacks by either Sunni jihadists or members of the Shia minority seeking equality.

Khamenei added: “This oppressed cleric did not encourage people to join an armed movement, nor did he engage in secret plotting, and he only voiced public criticism … based on religious fervour.” In an apparent swipe at Saudi Arabia’s western allies, Khamenei criticised “the silence of the supposed backers of freedom, democracy and human rights” over the execution. “Why are those who claim to support human rights quiet? Why do those who claim to back freedom and democracy support this (Saudi) government?” Khamenei was quoted as saying. The executions sparked protests around the region with a mob storming the Saudi embassy in Tehran and setting fire to part of the building before they were dospersed by the police. In Bahrain, police tear gas to control a crowd of protesters and there were also demonstrations in India and in London. More protests are expected in Iran and Lebanon on Sunday.

“..Iran’s own clerics have already claimed that the beheading will cause the overthrow of the Saudi royal family.”

• Expect More Weasel Words Over Saudi Arabia’s Grotesque Butchery (Robert Fisk)

Saudi Arabia’s binge of head-choppings – 47 in all, including the learned Shia cleric Sheikh Nimr Baqr al-Nimr, followed by a Koranic justification for the executions – was worthy of Isis. Perhaps that was the point. For this extraordinary bloodbath in the land of the Sunni Muslim al-Saud monarchy – clearly intended to infuriate the Iranians and the entire Shia world – re-sectarianised a religious conflict which Isis has itself done so much to promote. All that was missing was the video of the decapitations – although the Kingdom’s 158 beheadings last year were perfectly in tune with the Wahabi teachings of the ‘Islamic State’. Macbeth’s ‘blood will have blood’ certainly applies to the Saudis, whose ‘war on terror’, it seems, now justifies any amount of blood, both Sunni and Shia.

But how often do the angels of God the Most Merciful appear to the present Saudi interior minister, Crown Prince Mohamed bin Nayef? For Sheikh Nimr was not just any old divine. He spent years as a scholar in Tehran and Syria, was a revered Shia leader of Friday prayers in the Saudi Eastern Province, and a man who stayed clear of political parties but demanded free elections, and was regularly detained and tortured – by his own account – for opposing the Sunni Wahabi Saudi government. Sheikh Nimr said that words were more powerful than violence. The authorities’ whimsical suggestion that there was nothing sectarian about this most recent bloodbath – on the grounds that they beheaded Sunnis as well as Shias – was classic Isis rhetoric. After all, Isis cuts the heads of Sunni ‘apostates’ and Sunni Syrian and Iraqi soldiers just as readily as it slaughters Shias.

Sheikh Nimr would have got precisely the same treatment from the thugs of the ‘Islamic State’ as he got from the Saudis – though without the mockery of a pseudo-legal trial which Sheikh Nimr was afforded and of which Amnesty complained. But the killings represent far more than just Saudi hatred for a cleric who rejoiced at the death of the former Saudi interior minister – Mohamed bin Nayef’s father, Crown Prince Nayef Abdul-Aziz al-Saud – with the hope that he would be “eaten by worms and will suffer the torments of hell in his grave”. Nimr’s execution will reinvigorate the Houthi rebellion in Yemen, which the Saudis invaded and bombed this year in an attempt to destroy Shia power there. It has enraged the Shia majority in Sunni-rules Bahrain. And Iran’s own clerics have already claimed that the beheading will cause the overthrow of the Saudi royal family.

What will America do if millions want to move?

• Cuba Santeria Priests See Explosive Migration, Social Unrest In 2016 (Reuters)

Priests offering New Year’s prophecies from Cuba’s Afro-Cuban religion forecast an explosion in migration and social unrest worldwide in 2016. Many on the Caribbean island eagerly wait for guidance from the Santeria religion’s annual forecast. Santeria, with roots in West African tradition brought to Cuba by slaves, is practiced by millions of Cubans. This year, the island’s official association of priests, known as babalawos, predicted an “explosion” of migration and “social unrest provoked by desperation.” The yearly reading is for Cuba and the world at large, but the babalawos did not state which predictions, if any, apply to Cuba specifically.

“The predictions of Ifa (divination system) warn world leaders that if no action is taken, we may lead our people to a massive migration provoked by different things, desperation among them,” priest Lazaro Cuesta told a news conference in Havana. The flow of migrants from the Communist-ruled island jumped by about 80 percent last year as the process of detente between Washington and Havana, announced in December 2014, stirred fears that preferential U.S. asylum rights for Cubans may soon end. Cuesta said war, economic hardship, political conflict and terrorism are sparking worldwide migration. He did not give specifics about the priests’ social unrest prediction, but offered a metaphor: “When you are in your room and it’s really hot, desperation makes you run out of the room. If we give you an air conditioner, you stay put.”

“I can be living in a hot room and I don’t leave running because it’s my room,” Cuesta said. “I’m living alongside everyone else in Cuba, and I’m not leaving.” Based on this year’s forecast, the babalawos recommend “establishing favorable accords with respect to migration policy,” and “reaching a balance between salaries and the high cost of basic necessities.” Earlier this week, Cuban President Raul Castro told the National Assembly, the country’s single-chamber parliament, that an economic slowdown is expected in 2016. Food prices have increased more than 50 percent on the island over the last four years, according to official media. The average salary throughout the island is less than $30 a month. “A person who economically considers himself incapable of living in the place where he is is going to look for a better future somewhere else,” said Cuesta.

More shame on Britain.

• Refugees At UK Military Base In Cyprus Trapped In Asylum ‘Limbo’ (Guardian)

The British government has been accused of being “deceitful” and dodging its legal responsibilities to a group of refugees whose failing boats washed ashore in a British military zone on Cyprus late last year. The Ministry of Defence has stated that the 114 people who came ashore are the responsibility of Cyprus and, according to the refugees, has said they will be sent to Lebanon, from where their boats set sail, if they do not seek asylum with Cypriot authorities. However, human rights groups say Britain is shirking its legal responsibilities – fearful that the route could be seen as a “back door” to Britain – and coercing people into staying put while paying Cyprus to house and feed them. The Office of the UN High Commissioner for Refugees said a 2003 UK-Cyprus memorandum made it clear that “asylum seekers arriving directly on to the SBA [sovereign base area] are the responsibility of the UK”.

Ibrahim Maarouf, a Palestinian English teacher who fled first from Syria and then from a refugee camp in Lebanon with his wife and two children, said he felt utter despair about his future. “We are being fed and we have a room with a common toilet we share with 15 families,” he told the Observer. “It’s very humiliating to be stuck here and the days are passing and no one will say anything to us. We are without hope. We had had enough of suffering, we wanted to go to Greece, and my aim was to go to Belgium to find work and a new life, but the boat couldn’t handle this trip, so we landed here by mistake. “Cyprus is a poor country, with no work already for people here. We are told we have to apply for asylum here or be sent back. One sick woman was told she could see a doctor, but only if she first agreed that she would seek asylum in Cyprus.

“If I had died under Isis bombs, that was my fate. If I had died in Lebanon, that was my fate. But I would like a chance to have a life. I would ask David Cameron, ‘Don’t make a lesson of me’.” The foreign secretary, Philip Hammond, said in November that the situation had been resolved, as Cyprus had agreed to take the refugees, but that has been denied by lawyers working for the families. Tessa Gregory of the firm Leigh Day, who is acting for several of the families and individuals involved, said there was a “clear breach” of British obligations towards the migrants, who had made land on what was technically British soil, and it was wrong to delegate their fate to Cyprus.

The year starts off with the same indescribable sadness that the previous one ended with. Europe will NOT be able to shake this off or live it down.

• Drowned Toddler Becomes Europe’s First Refugee Casualty Of 2016 (AFP)

A drowned two-year-old boy has became the first known refugee casualty of the year after the crowded dinghy he was travelling in slammed into rocks off Greece’s Agathonisi island. The other 39 passengers, including a woman who had fallen overboard, were rescued after local fishermen raised the alarm. Ten of the survivors were taken to hospital to be treated for hypothermia. The rubber vessel had set off from Turkey in the early morning in windy weather. The charity Migrant Offshore Aid Station (MOAS), which helps save migrants and refugees at sea, deployed its fast-rescue Responder boat to help bring the stranded passengers to safety in a joint operation with the Hellenic coastguard. The toddler’s body was pulled out of the water by fishermen, according to the coastguard.

The refugees, including the child’s mother, were taken to the port of Pythagorio on Samos, the nearest island, which is 50km away. There was no immediate information about their nationalities. “Nothing can prepare you for the horrific reality of what is going on. Today we came face to face with one of the youngest victims of this ongoing refugee crisis. It is a tragic reminder of the thousands of people who have died trying to reach safety in miserable conditions,” said MOAS founder Christopher Catrambone in a statement. Despite the cold and choppy winter waters, large numbers of migrants and refugees are still setting sail from Turkey to make the hazardous journey across the Aegean in the hope of reaching Greece.