Russell Lee Levee at Bird’s Point, MO during the height of the flood January 1937

Mostly, it feels like a useless waste of time to wonder why everyone, and certainly economists of all flavors, no matter what gross incompetences they may accuse each other of, so blindly and slavishly talk only of different ways towards the one and same overarching goal: growth. There is a lot of talk about Keynes and stimulus and QE, as well as the pros and cons of each, but only when it comes to discussing the best and worst ways to achieve growth, not to discuss the notion itself. As if we cannot even imagine anything else than something that plainly can’t be.

But from time to time I must return to the theme, because I think it underpins everything that goes wrong with us today and that will leave us gasping for dear life – if we’re lucky enough to be alive – in our futures. Not only does nothing grow forever, our economies haven’t actually grown for decades, and present attempts to resurrect growth are leading us into a deadly quagmire of nigh unlimited lying, data manipulation and Edward Bernays-based spin that can only lead to depths of misery which might perhaps quite easily have been avoided (not that we know, the question is never asked).

And I keep on asking myself: why do we do it? What Do We Want To Grow Into? Why do we refuse to take a breath and a step back so we can ask ourselves why it is that we’re chasing growth? Why is the growth meme and mantra idea so ubiquitous that it’s so hard to find anything anyone has suggested as an alternative? There’s steady state economics, of course, John Stuart Mill, Georgescu-Roegen, Herman Daly, but that field is, for my taste, too strongly linked to Mill’s “The end of growth leads to a stationary state”, while in my view a stationary state is as incompatible with physics, let alone the human brain, as perpetual growth is. Still, at least these guys have scrutinized the issue, which puts them light years ahead of most “experts” who seem to discard it as unworthy of their lofty brainpower .

I was thinking about it all again after finishing yesterday’s Japan Is A Step Or Two Ahead Of Us . If you look at Japan today, you see a government that is going to very desperate Abenomics lengths to “return to growth”; they’re issuing bonds to such an abandon nobody wants them anymore, so the central bank is the only buyer; they’re pumping “money” (what’s in a name) into their economy with equal abandon even if their national debt is beyond belief; they’ve managed to kill people’s savings because people have nothing else left to live on; and there are still no results on the horizon, only “hope”.

But what are Japan’s realistic prospects? The generation of Japanese that made Japan rich in the 1970s and 1980s are now older, and the next generation after them is much smaller in numbers, so the country has a fast ageing population. It also has close to no domestic sources of fossil energy, it needs to import almost all oil and gas, and its nuclear power has turned into a nightmare after Fukushima. There may be some promise in tidal, solar and wind, but the overall picture is clear: relative to total population, there are far fewer productive age Japanese, and they will have to produce with almost certainly far less, and assuredly far more expensive, fossil fuels and – as a result – total energy resources. So why does Tokyo insist on hammering in the growth idea? Where is it supposed to come from?

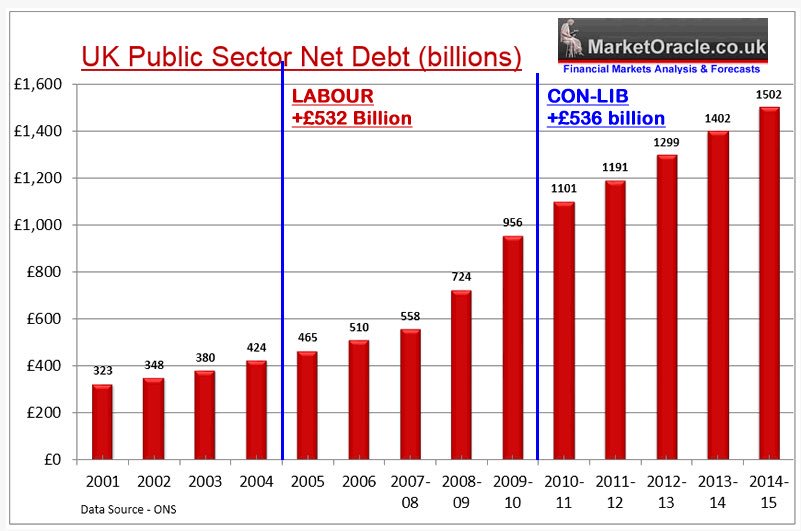

If our politicians and economists et al were honest with us, in Japan and elsewhere, they would acknowledge that if we look at the rise in debt numbers since about 1980 (pick a date), there’s no escaping the notion that debt has risen faster than economic growth. That means we have borrowed our way into alleged growth for decades now. And the only forward we see, when looking at that, is to borrow more, get deeper into debt, because we feel we need the growth we haven’t actually seen other than in PR driven reports, so much we’re willing to risk our own future well being to achieve it? How does that make you feel smart? What is it about it that makes you feel better?

Whether you look at Japan or the US or Europe or even China today, how can you not at least ponder the idea that it’s precisely the incessant focus on growth that is making us poorer? And that there is a logical end to the delusion that we will return to growth just because we want to if only we incur enough debt on top of what we already have? We doesn’t Japan get ready for a future in which it will have much less in the way of luxury, cars, petrol and plasma TVs, but can still have a reasonable standard of living if only it plays its cards right? Growth is the wrong card to play for the rising sun right now, the stars are not aligned well enough. And it’s not the sole choice for Japan, just the only one its leaders will consider, because that keeps them in their cushy seats as long as it takes, while a not-all-growth approach might threaten those seats. And who can blame them; like our own “leaders”, they’ve never learned, or thought about, anything else.

And so we go down, incapable of applying our frontal lobes to something as simple as the perpetual growth question, which has long since been answered in physics, to the economics that guide our daily lives. If we can’t do that, what do we deserve? If we refuse to use the very part of our brain that allows us to distinguish between myth and reality, between amoeba and rocket science, between (growth) religion and common sense, then who are we? And what can we expect the future to bring us if we choose to be led by our older, primitive, instead of our younger, more advanced brain? We can do this, but we don’t. We don’t even ask the most elementary questions. If anyone can tell me why, I’m open to suggestions.

• Janet Yellen’s No More Confident Than The Rest Of Us (MarketWatch)

The U.S. economy has now recovered all the jobs it lost from the Great Recession. Industrial production is now higher. But consumer confidence is, depending on your measure, somewhere between 10% to 25% below its 2007 peak. It turns out, Federal Reserve Chairwoman Janet Yellen feels pretty much the same way as other Americans. For example, this is what the world’s most powerful central banker had to say Wednesday when asked if, finally, she’s confident the economy is running above its long-run potential. “When you say confident, I suppose the answer is no, because there is uncertainty,” she said. Yes, she continued, there’s accommodative policy from her Fed, there’s diminished fiscal drag, easing credit conditions, improving household debt finances, rising home prices, rising equity prices. But she returned to the word “uncertainty,” and it didn’t seem like just perfunctory caution.

Yellen also was asked about why the Fed doesn’t see the jobless rate falling at the same rapid rate (which the Fed has misjudged continuously over the last two years). “We may see that as the economy picks up steam and we see further recovery in the labor market that those … let’s call them discouraged workers will return either to unemployment or to employment, and as labor force participation begins to stabilize, the unemployment rate will come down less quickly,” Yellen said. Cheerleader, she’s not. And yet, the Fed’s rate forecasts keep gaining steam. Considering the central bank has basically been at zero for five-and-a-half years, a projection of 1.25% rates in 2015 and 2.5% in 2016 sure isn’t nothing.

So while not impossible, it’s becoming more difficult to reconcile Yellen’s comments with the committee she leads. Try telling that to the market, though. The S&P 500 is at a record and yet bonds are strong as well, with the 10-year yield at 2.60%. There was another comment Yellen made that was instructive. “But I guess I would say it is important, as I emphasized in my opening statement, for market participants to recognize that there is uncertainty about what the path of interest rates, short-term rates, will be, and that’s necessary because there’s uncertainty about what the path of the economy will be,” she said. You’ve been warned. Significantly higher rates may be on the way. Yellen’s just not confident about it.

Read more …

• Yellen Forecasts A Slow Rise In Interest Rates (MarketWatch)

Federal Reserve Chairwoman Janet Yellen was more kitten than lion on Wednesday, sticking to her guns that the central bank can hold short-term interest rates steady until the middle of next year and then raise them gradually, and downplaying recent strong inflation readings. In its latest dot-plot forecast, the Fed did see a slightly faster pace of tightening in the cards. But the slight increase was overlooked by the market that focused more on Yellen’s remark that the recent inflation data was “noisy.” The S&P 500 jumped to a record close following Yellen’s remarks. In contrast to Bank of England Governor Mark Carney, Yellen suggested the Fed is comfortable that it can hold rates steady for a considerable time after it ends its asset purchase program. Last week, Carney warned that the first interest-rate hike could come sooner than the market expected.

Economists said the latest Fed projections point to a first rate hike in June 2015. Short-term interest rates have been steady near zero since December 2008. Zach Pandl, senior interest rate strategist at Columbia Management Investment Advisers, said investors took Yellen’s remarks as “a green light” to continue to expect low bond yields. He said Yellen made some warnings about volatility that were similar to Carney, but not as blunt or forceful. The Fed chairwoman said that investors should not take ultra-low rates for granted.

Read more …

• Janet Yellen Has Learned Nothing In 45 Years! (David Stockman)

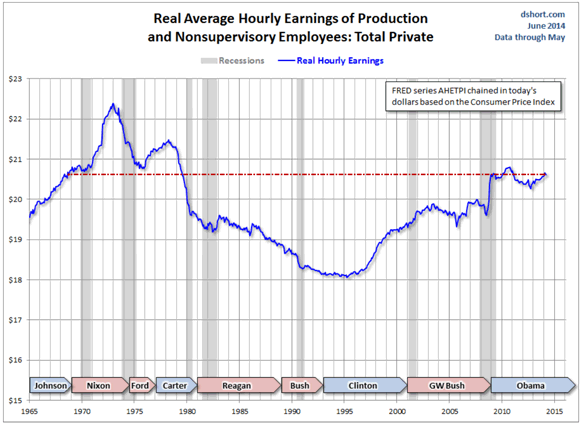

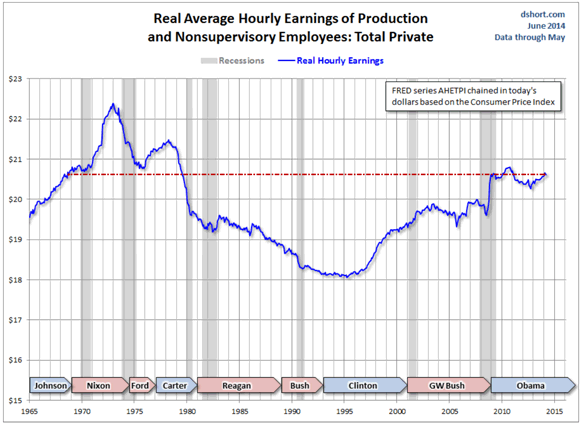

Mish Shedlock today published a truly scintillating graph by Doug Short on the 50-year trend in real hourly earnings for wage workers. This was in conjunction with yesterday’s releases on the CPI, which is back to 2% even on the official measure, and real hourly wages, which were down on a year-over-year basis—notwithstanding $700 billion of Fed QE bond buying in the interim. [..] As the graph shows, inflating wages and costs at home didn’t work as Tobin predicted and for obvious reasons: even then it was evident that there were about 3 billion peasant farmers in the world who could be mobilized into a cheap industrial work force under the right conditions. And that “condition”, in fact, was exactly what Milton Friedman, the so-called anti-Keynesian doctor, ordered. Professor Friedman was an arrogant and naïve academic who could not have understood politics if it hit him in the head with a 2X4.

The “floating dollar” that he urged upon Nixon at Camp David had nothing to do with “price discovery” on the free market; instead, it became an instant “dirty float” whereby foreign governments pegged their currencies at sub-economic levels in order to implement a mercantilist export -based development model. Currency pegging, in turn, taught even Mao’s Little Red Book reading successors about the wonders of domestic monetary expansion and pell mell credit creation. After all, every dollar of China’s current $4 trillion hoard of US dollar “reserves” was off-set by the equal emission of more RMB. In short, after 1971 the entire world got caught up in a monetary delusion. Namely, the misbegotten notion that sustainable economic growth can be achieved by relentless credit expansion at home and a continuous race to the currency bottom aboard. It is only a matter of time before this entire house of cards begins to collapse, and the signs are already abundant in the two chief practitioners – China and Japan

Read more …

A few get rich, the rest must borrow to make ends meet. Until the ends no longer meet.

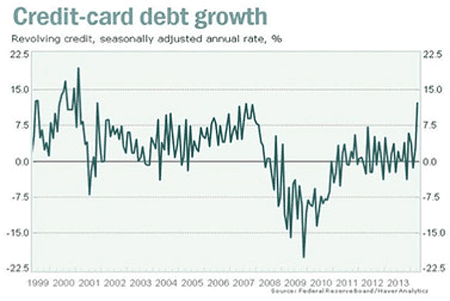

• Americans Are Getting Into Debt – Just To Get By (Minyanville)

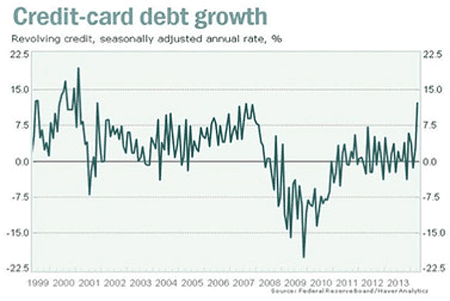

Nowhere has the unequal nature of the post-banking-crisis recovery raised more concerns for the long-term sustainability of the U.S. economy than in the clear rise of non-discretionary consumer credit. While the “haves” have fully returned to their pre-crisis behavior of paying for everything from higher education, cars and luxury homes with cash, and fully leveraging their investment portfolios, the rest of the consumer sector has changed dramatically over the past six years. Upper-middle class “aspirational wealthy” families who were overexposed to the housing bubble continue to see debt of all kinds as a negative. Rather than using lower interest rates to purchase larger homes, if not vacation homes, they have instead opted to convert their 30-year mortgages to 10- and 15-year loans with essentially equal monthly payments terms.

Lower interest rates have translated into faster loan amortization rather than economic growth. Well into the recovery, the focus of the upper-middle class remains on less, rather than more, credit, and — thanks to demographics — less, rather than more, home, too. Further down the credit spectrum, the world of consumer debt has changed even more profoundly. For the “have-nots,” the continued absence of wage growth has resulted in an unprecedented boom of non-discretionary credit. Ordinary life in America now simply requires more debt rather than less to live. It is needs, not wants, that are behind the post-banking-crisis growth in consumer credit. The clearest example of non-discretionary credit growth today is in higher education. With tuition costs rising far above wage inflation, and families no longer willing to take out home equity loans to fill the gap, lower- and middle-class students have no choice today but to borrow for college.

A completed FAFSA (Free Application for Federal Student Aid) form is as much a prerequisite to college entry as four years of high school English and math. For those entering college, it is not a question of whether they will borrow, but rather how much. But higher education is not the only place in our economy where non-discretionary credit is now the norm. The same condition today exists with car sales, too. With the average car on the road more than 11 years old, it’s no longer if Americans will replace their cars, but how. Here, again, non-discretionary credit fills the void. With savings low, few Americans can afford much more than the down payment on a new car. Financing, whether in the form of a loan or a lease, is the only way low- and middle-class Americans can afford a new or used car.

Read more …

That’s a big fall.

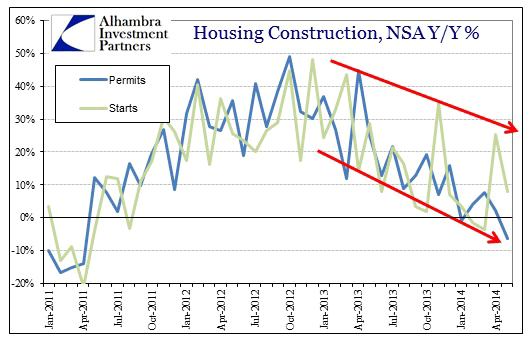

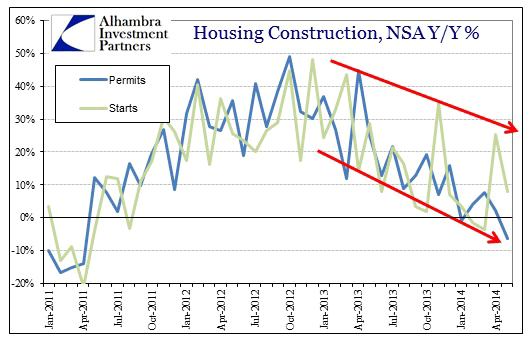

• No Snow In May, But Housing Construction Continued To Taper Away (Alhambra)

When home sales rose M/M (slightly) in April for the first time in 2014, the NAR theorized it as the turnaround signal. Their reasoning for it was strange in the context of basic, intuitive economics (meaning non-textbook). Rising prices on too few available homes for sale was supposed to signal more construction, as this shortage narrative was perhaps the only way to explain the dramatic slide in sales without admitting exasperation with finance.

“We’ll continue to see a balancing act between housing inventory and price growth, which remains stronger than normal simply because there have not been enough sellers in many areas. More inventory and increased new-home construction will help to foster healthy market conditions,” Yun added.

Given the dramatic rise in inventory of for-sale homes in that very same month, it was a curious appeal. You can understand the price mechanics, as more construction should lead to that increasing supply and thereby reducing the so-called price squeeze, but all of that ignores the basic fact that if home prices are not affordable at this level then reducing the price appreciation rate will not fix that problem. It will only make it worse at a slower rate. Companies with actual money interest in building houses are not lining up to do so. Again, that is contrary to what would be the typical, intuitively economic response to a supply bottleneck. Instead, home construction continues to slip, and do so in a rather straight line.

Read more …

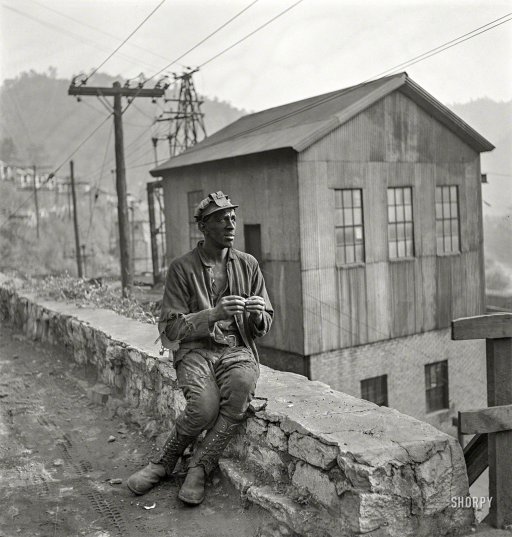

So many areas in America have died. No wonder when “since 2001, the United States has lost more than 56,000 manufacturing facilities”.

• The Death Of The Rust Belt (Michael Snyder)

Since 2001, the United States has lost more than 56,000 manufacturing facilities. That is absolutely astounding. Most of those jobs have gone overseas. That is why it seems like most of our products say “Made in China” these days. They are getting rich while our communities suffer, and then we have to beg the Chinese to lend our money back to us. Meanwhile, we have a permanent epidemic of unemployment in this country. Back in the 1980s, over 20% of the jobs in the U.S. were manufacturing jobs. Today, only about 9% of the jobs in the U.S. are manufacturing jobs. And an astounding number of our young men are just sitting at home instead of doing something productive. As I wrote about the other day, one out of every six men in their prime working years (25 to 54) do not have a job at this point. Also, the%age of working age Americans not participating in the labor force is up to 37.2% – a 36 year high.

Not only that, but the quality of our jobs has also steadily declined as we have lost good paying manufacturing jobs to overseas workers. Right now, half the country makes $27,520 a year or less from their jobs. No wonder the middle class is dying. And of course there is so much more that could be said about this. For even more numbers about our manufacturing decline, please see my previous article entitled “Shocking Facts About The Deindustrialization Of America That Everyone Should Know”. These problems were not created overnight, and they are not going to be solved overnight either. But as a nation, we have got to understand that we cannot consume our way to prosperity. That is only going to result in even more debt. Instead, we have got to make the decision to produce our way to prosperity. In other words, we have got to start making stuff in this country again. That may sounds “crazy” to a lot of people, but it is possible. We have just got to have the willingness to do it.

Read more …

Abe needs to make currency worthless …

• Abenomics Fails to Shake Japan Firms’ Addiction to Cash (Bloomberg)

Japanese firms boosted their cash stockpile to a record in the first quarter, underlining challenges Prime Minister Shinzo Abe faces a year and a half into his drive to reflate the economy. Nonfinancial companies’ holdings of cash and deposits rose 4.1% to 232 trillion yen ($2.3 trillion) at the end of March, while they increased borrowing from private banks at the slowest pace since the final quarter of 2012, a Bank of Japan report showed yesterday. Households kept more than half of their assets in cash and deposits. Firms’ reluctance to plow cash into projects at home increases the urgency for Abe to deliver on promises to boost the growth potential of Japan’s economy with his “third arrow” of Abenomics. With domestic prospects limited, direct investment overseas jumped 21% from a year earlier – a 10th straight quarter of double-digit gains. “Companies and households are still not convinced about Abenomics,” said Kazuhiko Ogata, chief Japan economist at Credit Agricole in Tokyo.

“Abe has to show he can boost the economy by implementing, not just compiling, the growth strategy, and the BOJ may have to do more to boost the economy and sentiment.” [..] The tendency to stick to cash suggests BOJ Governor Haruhiko Kuroda’s efforts to stoke risk-taking has yet to gain much traction in an economy that he’s trying to steer out of 15 years of deflation. Kuroda has said encouraging companies and households to make investments is a key transmission channel for the central bank’s unprecedented easing to achieve a goal of stable 2% inflation. Abe plans to cut the corporate tax rate in stages from the fiscal year starting April, lowering it below 30% in a few years, as he seeks to boost Japan’s competitiveness and attract foreign investment. The task for the prime minister is to overcome opposition from vested interests as he tries to unshackle businesses in the medical and agricultural sectors. He also needs to find revenue to fund the lower corporate levy, or risk worsening the world’s heaviest debt burden.

Read more …

It just got worse. This is not a selloff anymore, it’s a (garbage) dump.

• Japan Bond Selloff Looms as Post Office Joins Pension Fund’s Cuts (Bloomberg)

Prime Minister Shinzo Abe’s success in spurring inflation risks triggering a Japanese government debt selloff as the second-biggest JGB holder may begin switching to higher-yielding assets. Japan Post Holdings sold an unprecedented 15.7 trillion yen ($154 billion) of the notes in the fiscal year ended March 31. It has about 178.9 trillion yen remaining. That’s more than double the total of all domestic bond holdings at Government Pension Investment Fund, the third-largest owner, which is shifting into stocks and overseas securities. The appeal of notes that offer the world’s lowest yields is waning as Abe’s stimulus policies succeed in spurring the fastest consumer-price increases since 1991. Citigroup expects Japan Post’s units to offload as much as 63.8 trillion yen of the debt and increase the weight of equities as it readies for an expected listing next year.

The postal service’s President Taizo Nishimuro may address the issue at a monthly press conference as early as next week. “The portfolio review at Japan Post Bank and Japan Post Insurance will definitely follow the GPIF overhaul,” said Kazuhiko Ogata, the Tokyo-based chief Japan economist at Credit Agricole. “It’s the next big event that has the potential to shake the markets as they reduce JGB buying and boost stock and foreign debt holdings.” JGB allocations at Japan Post Bank and Japan Post Insurance fell to a record low of 62.4% and 60.3% respectively last fiscal year, according to earnings statements. While GPIF doesn’t disclose a breakdown, its 71 trillion yen of domestic debt at the end of last year comprised 55% of total holdings.

Read more …

• ‘Damaging Deflation’ Threatens Euro Zone (CNBC)

The euro zone economy is set to grow in 2014 after two painful years of contraction, according to a new report from EY, but the professional services firm warned that the threat of deflation dogging the region persists. The region will grow 1.1% this year, according to EY’s summer euro zone forecasts, followed by expansion of 1.5% in 2015. Growth is seen picking up pace between 2016 and 2018. Strengthening exports and a pickup in domestic demand will drive a return to “modest” investment growth, EY said, but warned the recovery is likely to be felt more in some countries than others.

“Recent developments in the euro zone underline that a gradual recovery is continuing, but that it remains divergent across member states,” Tom Rogers, senior economic adviser to the EY Eurozone Forecast, said in a press release. “Countries that have done the most to improve competitiveness are reaping the rewards, but others are continuing to lag.” However, Rogers said he was concerned about the weakness of price growth that could push the euro area into a “damaging deflationary spell”. The threat of deflation has been at the front of European policymakers’ minds over recent months. The European Central Bank (ECB) announced extraordinary measures to tackle the issue at its most recent policy meeting, including imposing a negative interest rates on banks for their deposits.

Read more …

Big words from all sides, but in the end trade seeks its own rules.

• Putin Advisor Wants “Anti-Dollar Alliance” To Halt US Aggression Abroad (ZH)

While the great US spin and distraction machine is focused elsewhere, Russia is already preparing for the next steps. Which brings us to Putin advisor Sergey Glazyev, the same person who in early March was the first to suggest Russia dump US bonds and abandon the dollar in retaliation to US sanctions, a strategy which worked because even as the Kremlin has retained control over Crimea, western sanctions have magically halted (and not only that, but as the Russian central bank just reported, the country’s 2014 current account surplus may be as high as $35 billion, up from $33 billion in 2013, and a far cry from some fabricated “$200+ billion” in Russian capital outflows which Mario Draghi was warning about recently). Glazyev was also the person instrumental in pushing the Kremlin to approach China and force the nat gas deal with Beijing which took place not necessarily at the most beneficial terms for Russia.

It is this same Glazyev who published an article in Russian Argumenty Nedeli, in which he outlined a plan for “undermining the economic strength of the US” in order to force Washington to stop the civil war in Ukraine. Glazyev believes that the only way of making the US give up its plans on starting a new cold war is to crash the dollar system. As summarized by VoR, in his article, published by Argumenty Nedeli, Putin’s economic aide and the mastermind behind the Eurasian Economic Union, argues that Washington is trying to provoke a Russian military intervention in Ukraine, using the junta in Kiev as bait. If fulfilled, the plan will give Washington a number of important benefits.

Firstly, it will allow the US to introduce new sanctions against Russia, writing off Moscow’s portfolio of US Treasury bills. More important is that a new wave of sanctions will create a situation in which Russian companies won’t be able to service their debts to European banks. According to Glazyev, the so-called “third phase” of sanctions against Russia will be a tremendous cost for the European Union. The total estimated losses will be higher than €1 trillion. Such losses will severely hurt the European economy, making the US the sole “safe haven” in the world. Harsh sanctions against Russia will also displace Gazprom from the European energy market, leaving it wide open for the much more expensive LNG from the US.

Read more …

An entire industry dying from megalomania and visions of grandeur. Beautiful to watch.

• Is All Hope Lost For Container Shipping? (CNBC)

China’s rejection of a game changing container shipping alliance has deepened pessimism in an industry plagued by overcapacity, analysts say. A tie-up between shipping giants Maersk, CMA CGM and Mediterranean Shipping to pool their vessels, dubbed the P3 Alliance, fell apart after China’s Ministry of Commerce rejected the plan late Tuesday. The proposal, announced nearly a year ago, aimed to save costs in an industry overwhelmed by a glut of supply and slowing demand. The announcement came as a surprise as the U.S. Federal Maritime Commission and the European Commission had not raised objections. “The status quo in the container shipping industry is not working. We’re in year six of a ten-year downturn for container shipping. The P3 alliance was an attempt to change the industry dynamic and longer-term investors will now look at this and say the industry has lost hope for any change,” Jonathan Windham, head of Asia ex-Japan transport and infrastructure research at Barclays, told CNBC.

China’s Commerce Ministry rejected the plan on the basis that it believed the alliance would control 47% of the Asia-to-Europe container shipping market and would not protect consumer interests. The parties “failed to demonstrate that the alliance would bring more benefit than harm, or that it is in line with the public interest,” it said on its website. The container shipping industry has suffered from a huge imbalance between demand and the number of vessels in recent years. Earlier this year, analysis group Alphaliner forecasted a 3 percentage point gap between global supply and demand for 2014, based on projected supply growth of 7.6% and demand growth of 4.6%.

Read more …

Is it lip service or does he really believe it?

• Premier Li Says China’s Economy Won’t Suffer Hard Landing (Reuters)

Chinese Premier Li Keqiang said on Wednesday that China’s economy would not suffer a hard landing and would continue to grow at a medium to high pace in the long term without strong stimulus. Li made the comments during a speech in London’s financial district on the final day of a visit which has yielded trade and investment deals worth 14 billion pounds ($23.76 billion) and strengthened Britain’s bid to become the dominant center for the Western trade in offshore yuan. Li said he expected China’s economy, the world’s second-largest behind the United States, to grow at a minimum clip of 7.5%, confounding critics, including the International Monetary Fund (IMF), who say the country’s rapid growth may eventually falter. “There have been some discussions saying that the Chinese economy is slowing down, they are worried whether the Chinese economy will head to a hard landing. Here I will be very frank and I will also make this point very solemnly: this will not happen,” Li said through a translator.

Li’s comments were echoed by People’s Bank of China Governor Zhou Xiaochuan. At an event later in London, Zhou said he was confident that steady growth and financial stability would ensure market confidence in China’s currency, the yuan, officially known as the renminbi (RMB). [..] On Wednesday, Li used his speech to stress that Beijing would not resort to “strong stimulus” to meet its growth targets but would instead rely on smart and targeted measures. “We have the ability to maintain this targeted approach,” Li said in his speech. “We will not resort to strong stimulus, but rather smart and targeted regulation to ensure that major economic indicators, including the 7.5% growth target, remain and ensure a sustained rate in the future.” Earlier this month, the IMF recommended that China adopt an economic growth target of about 7% for 2015, rather than the government’s 7.5% target. The IMF also urged the authorities to avoid further stimulus measures and concentrate on curtailing financial risks.

Read more …

“The efficient-market hypothesis”, how on earth can it still exist?

• Economics Faces Long Needed Upheaval (Guardian)

In a manifesto published in April economics students at the University of Manchester advocated an approach “that begins with economic phenomena and then gives students a toolkit to evaluate how well different perspectives can explain it”, rather than with mathematical models based on unreal assumptions. Significantly, Andrew Haldane, executive director for financial stability at the Bank of England, wrote the introduction. The Manchester students argue that: “The mainstream within the discipline (neoclassical theory) has excluded all dissenting opinion, and the crisis is arguably the ultimate price of this exclusion. Alternative approaches such as post-Keynesian, Marxist, and Austrian economics (as well as many others) have been marginalised. The same can be said of the history of the discipline.”

As a result, students have little awareness of neoclassical theory’s limits, much less alternatives to it. The aim, according to the students, should be to “bridge disciplines within and outside of economics”. Economics should not be divorced from psychology, politics, history, philosophy, and so on. Students are especially keen to study issues like inequality, the role of ethics and fairness in economics (as opposed to the prevailing focus on profit maximisation), and the economic consequences of climate change. The idea is that such intellectual cross-fertilisation would help students understand recent economic phenomena better and improve economic theory. From this point of view, everyone stands to benefit from curriculum reform. The deeper message is that mainstream economics is in fact an ideology – the ideology of the free market. Its tools and assumptions define its topics.

If we assume perfect rationality and complete markets, we are debarred from exploring the causes of large-scale economic failures. Unfortunately, such assumptions have a profound influence on policy. The efficient-market hypothesis – the belief that financial markets price risks correctly on average – provided the intellectual argument for extensive deregulation of banking in the 1980s and 1990s. Similarly, the austerity policies that Europe used to fight the recession from 2010 on were based on the belief that there was no recession to fight. These ideas were tailored to the views of the financial oligarchy. But the tools of economics, as currently taught, provide little scope for investigating the links between economists’ ideas and the structures of power.

Read more …

” … we really thought that since this all happened, that something good would come out of it.”

• How General Motors Silenced a Whistle-Blower (BW)

It was close to 3 a.m. on June 6 when Courtland Kelley burst into his bedroom, startling his wife awake. General Motors (GM), Kelley’s employer for more than 30 years, had just released the results of an investigation into how a flawed ignition switch in the Chevrolet Cobalt could easily slip into the “off” position—cutting power, stalling the engine, and disabling airbags just when they’re needed most. The part has been linked to at least 13 deaths and 54 crashes. GM Chief Executive Officer Mary Barra, summoned before Congress in April to answer for the crisis, repeatedly declined to answer lawmakers’ questions before she had the company’s inquest in hand. Now it was out, and Kelley had stayed up to read all 325 pages on a laptop on the back porch of his rural home about 90 miles northwest of Detroit.

The “Valukas Report,” named for former U.S. Attorney Anton Valukas, who assembled it at GM’s request from interviews with 230 witnesses and 41 million documents, blamed a culture of complacency for the more than decade-long delay before the company recalled millions of faulty vehicles. It described employees passing the buck and committees falling back on the “GM nod”—when everyone in a meeting agrees that something should happen, and no one actually does it. On page 93, a GM safety inspector named Steven Oakley is quoted telling investigators that he was too afraid to insist on safety concerns with the Cobalt after seeing his predecessor “pushed out of the job for doing just that.” Reading the passage, Kelley felt like he’d been punched in the gut. The predecessor Oakley was talking about was Kelley.

Kelley had sued GM in 2003, alleging that the company had dragged its feet addressing dangers in its cars and trucks. Even though he lost, Kelley thought that by blowing the whistle he’d done the right thing and paved the way for other GMers to speak up. Now he saw that he’d had the opposite impact: His loss, and the way his career had stalled afterward, taught others at the company to stay quiet. “He stood in the doorway of our bedroom with a stunned look on his face,” Beth Kelley, his wife of 23 years, says. “Maybe we’re just extremely naive, but we really thought that since this all happened, that something good would come out of it.”

Read more …

How many years did it take for US prosecutors to wake up?

• Prosecutors Subpoena Congress Over Insider-Trading Probe (WSJ)

Prosecutors are gathering evidence for a grand-jury probe into whether congressional staff helped tip Wall Street traders to a change in health-care policy, an indication the long-running investigation has entered a more serious phase. Public documents show federal law-enforcement officials and the Securities and Exchange Commission are seeking records and other evidence from the House Ways and Means Committee and a top congressional health-care aide, Brian Sutter, staff director of the Ways and Means Committee’s health-care subpanel. The SEC sent subpoenas to the House committee and Mr. Sutter seeking documents and testimony in the matter, according to documents made public by Rep. David Camp (R., Mich.), who is the committee chairman, and Mr. Sutter.

Separately, the Justice Department issued a subpoena to Mr. Sutter to compel him to testify before a federal grand jury at the U.S. District Court for the Southern District of New York, according to Mr. Sutter’s public disclosure, which was included in the congressional record per House rules. Committee officials wouldn’t say whether Mr. Sutter has testified. The subpoenas are related to criminal and civil investigations examining whether anyone in the government illegally passed along nonpublic information about the health policy that ended up in the hands of traders, according to people briefed on the matter. The probe was sparked by a 2013 Wall Street Journal report that detailed how health-insurance stocks jumped moments before the government announced news favorable to those companies relating to Medicare payments.

Read more …

• Currency Probe Widens as U.S. Said to Target Markups (Bloomberg)

U.S. prosecutors are broadening their investigation of the foreign-exchange industry as they question salespeople at the world’s biggest banks on their practices, according to two people with knowledge of the matter. The Department of Justice has been asking bankers and clients how much sales teams charge customers to exchange currency, the people said, asking not to be identified because the interviews are private. The move is the first indication prosecutors are probing sales practices. According to more than a dozen current and former salespeople and traders interviewed by Bloomberg News, it’s common to charge what’s known as a hard markup, tacking on a small margin for a salesperson’s services. Some clients who make currency deals infrequently or in small amounts are known to pay little attention to the rates they get. The Justice Department is scrutinizing whether banks committed fraud by failing to disclose the practice properly to customers, the people said.

“Banks should always be transparent with their clients on pricing mechanisms,” said David Woolcock, chairman of the committee for professionalism at ACI, a Paris-based group representing 13,000 traders in 60 countries who helped write the industry’s code of conduct. “This does not sound like it is consistent with best practice nor ethical behavior.” The Justice Department has interviewed sales staff with their lawyers at bank offices in the U.S. over the past two months, according to one of the people. The agency is one of more than a dozen authorities around the world investigating the $5.3 trillion-a-day currency market following allegations that dealers at the world’s biggest banks traded ahead of their clients or colluded to rig the benchmarks that pension funds and money managers use to pay for foreign exchange.

Read more …

And much of the sweet water they do have is so polluted people can’t even stand in it anymore.

• China Must Import More Water Than The US Imports Oil (Simon Black)

In one of the most comprehensive studies ever conducted of China’s bubblicious property market, Professor Gan Li at Texas A&M University estimates that there are a whopping 49 million vacant homes in China right now. As a percentage, this is twice the vacancy rate that the US housing market experienced at the peak of its recent bubble… suggesting that China has a rather painful housing collapse in store. This should be a brutal blow to the economy given that housing comprised 15% of GDP last year. And the slowdown is already apparent. In fact, China’s president Xi Jinping uncharacteristically announced a ‘new normal’ recently, declaring the heady days of 10% GDP growth to be over. His vision of China is moderate growth and less stimulus.

But I’ve identified a far greater problem for China… one that few people are talking about. And frankly I’m not sure they can fix it. We discussed earlier that China does not have the capacity to feed itself. By the estimates of one state official, the country’s agricultural imports require more land to grow than the entire land mass of California. The reasons are simple. For one, China doesn’t have enough fertile land in production to support its population’s growing food demand. Theoretically this is fixable. With a bit of time, patience, and technology, barren soil can be rehabilitated In other words, China doesn’t have enough enough productive land capacity to support its population. But the far greater issue is China’s massive freshwater deficiency. Chief Economist Qian Keming of China’s Agriculture Ministry summed it up by telling the audience at the Third China International Agribusiness Forum:

“Fresh water resources are only 2100 cubic meters per capita, which is only 28% of the world’s average level.” and “The shortage of [water for agricultural irrigation] each year is about 30 billion cubic meters. China imported about 148.6 billion cubic meters of water in 2013, which was equivalent to 38% of China’s agricultural water.”

Here’s that number in perspective: China water imports of 148.6 billion cubic meters last year handily exceeded the 569 MILLION (0.569 billion) cubic meters of oil that the United States imported. Water is THE critical resource in agriculture. Without it, you’re not producing. This makes China’s deficiency a long-term headwind to their food production dilemma. It’s not something they can import their way out of either, because all of this comes at a time of flat (and even declining) yields, particularly from the world’s largest food exporter… which just happens to be the United States of America. After decades of growth, grain yields in the US have topped out. Farmers have managed to extract all that the earth is capable of providing. Many developing markets are no help either. Most people don’t realize that Africa, despite its legendary agricultural potential, is actually a net importer of food.

Read more …

Predicament, conundrum, bind.

• Tepco’s Ice Wall Runs Into Glitch At Fukushima No. 1 (AFP-Jiji,Reuters)

Tokyo Electric Power Co. says the refrigerated ice wall being built to slow the movement of water beneath damaged reactors at the Fukushima No. 1 nuclear plant isn’t working as expected. Tepco said the project, which remains in its early stages, is experiencing a problem with an inner ice wall designed to contain highly radioactive water that is draining from the basements of the wrecked reactors. “We have yet to form an ice plug because we can’t get the temperature low enough to freeze the water,” a Tepco spokesman said Tuesday.

Trenches are being dug for a huge network of pipes under the plant that will have refrigerant pumped through them. If successful, it would freeze the soil and form a physical barrier, significantly slowing the rate at which uncontaminated groundwater flows into the reactor basements and becomes contaminated. “We are behind schedule, but have already taken additional measures, including putting in more pipes, so that we can remove contaminated water from the trench starting next month,” a spokesman said. The coolant used in the operation is an aqueous solution of calcium chloride, which is cooled to minus 30 degrees. The ice wall employs the same technology as the trench project and involves the same contractor, Kajima Corp.

Read more …