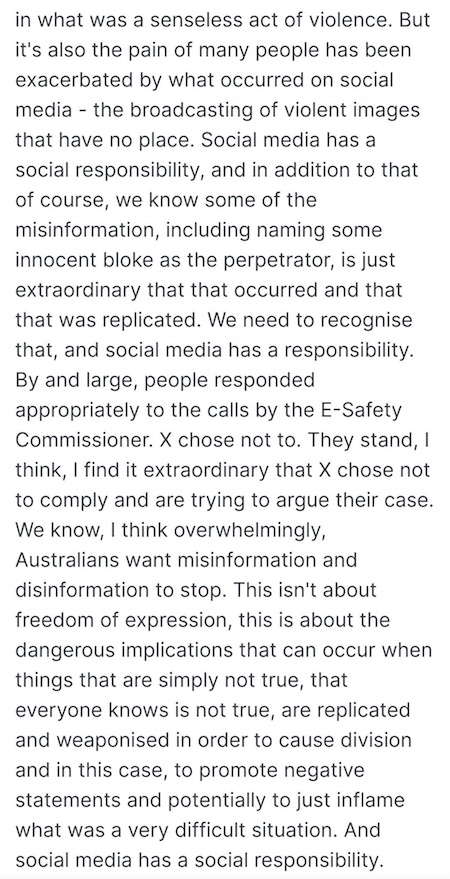

Herri met de Bles Landscape with Saint Christopher 1535 – 1545

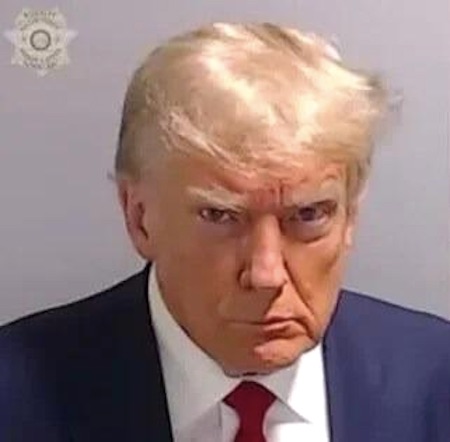

Trump NY

JUST IN: Donald Trump announces he is going to try to win the state of New York during a visit with Union workers at a construction site in Manhattan.

The workers could be heard saying “We Love Trump” as he made the announcement.

“We're very close in New York. I understand…… pic.twitter.com/5hqItz5JyH

— Collin Rugg (@CollinRugg) April 25, 2024

Today proved why Democrats need Trump trapped inside of his cage in court. Every time he escapes, whether it's a construction site or the bodega, as MSNBC said, it's a "dangerous situation." He wins the hearts and minds of crowds, while Biden keeps losing his base. So the… pic.twitter.com/UjohMl7SVe

— Jesse Watters (@JesseBWatters) April 26, 2024

Pecker

https://twitter.com/i/status/1783587614928368048

Immunity

https://twitter.com/i/status/1783600215817163214

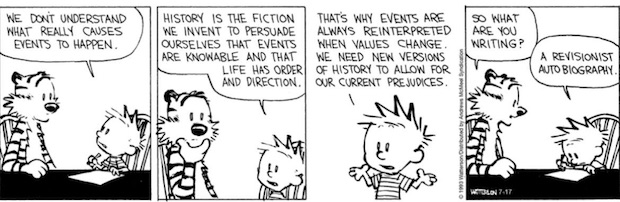

Shallow men believe in luck. Strong men believe in cause and effect. – Ralph Waldo Emerson

Tucker racism

Ep. 98 There is systemic racism in the United States, against whites. Everyone knows it. Nobody says it. How come? pic.twitter.com/hSrU9BPVb4

— Tucker Carlson (@TuckerCarlson) April 24, 2024

Bannon Rickards

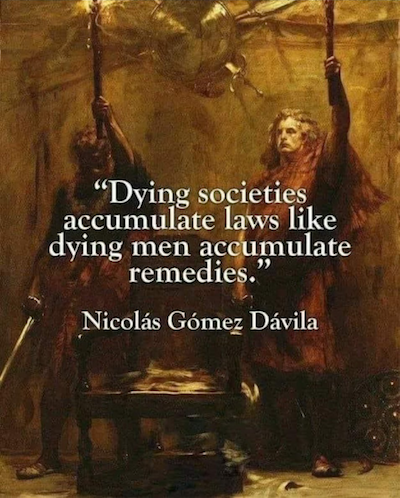

“Americans have sat on their butts and allowed the destruction of civility, the rule of law, the Constitution, and their nation.”

• America: Goodbye my Country (Paul Craig Roberts)

A Warning to America: 25 Ways the US is Being Destroyed | Explained in Under 2 Minutes pic.twitter.com/qwmBO8DmMt

— Western Lensman (@WesternLensman) April 22, 2024

I would add several more. For example, the independence of doctors requires private practice. Private practice is being destroyed systematically by medical insurance, malpractice insurance, Medicare, Big Pharma, and the US Congress which panders to Big Pharma for campaign contributions. Medical doctors are being forced into becoming employees for HMOs where they have to follow their employer’s protocols or be fired. This means that they must abandon the Hippocratric Oath and follow the profit-enhancing practices of their employer HMOs. Big Pharma provides software for diagnosis and treatment, and doctors have to prescribe according to what Medicare and insurance companies will pay a percentage of the billing amount. Even doctors in private practice find that what they can prescribe and what operations they can perform is limited to insurance and medicare decisions.

During the orchestrated “Covid pandemic,” the entire propaganda operation was geared toward maximizing Big Pharma’s profits from the Covid “vaccine” and to cancelling people’s control over their own health care by imposing “vaccine” mandates. This was the first exercise in the imposition of mass tyranny in the Western World. Individual countries had experienced tyranny, but never before the entire Western world simultaneously. In order to maximize Big Pharma’s profits and impose mass tyranny, it was necessary to prohibit two safe, effective, known preventatives and cures for Covid–hydroxychloroquine and Ivermectin. Doctors who successfully used these cures and preventatives to protect their patients were subject to persecution by medical authorities and governing boards. Some were fired from their HMO jobs and university medical schools, some were stripped of their licenses, some were prosecuted. In order to mass inject people with an untested “vaccine” under an emergency use order the requirement was that there were no cures.

So, the fact that there were cures had to be suppressed. The utterly corrupt US medical establishment, the whore media and the Western governments suppressed the cures and ridiculed them as “horse medicine.” If the Western peoples were not so insouciant, so gullible, so trusting of “authorities,” so utterly stupid and incapable of thinking for themselves, there would have been no orchestrated “Covid pandemic” and no mass vaccination, which is against all medical protocols in the face of a pandemic. According to all available scientific evidence to date, the “Covid vaccine” has killed and destroyed the health of more people than the Covid virus. The corrupt “authorities” have done their best to cover this up, but as I have reported the coverup has failed. Still nothing is being done about it. Nothing can be done as long as Congress is dependent on campaign contributions from corporations. “Our” representatives are really representatives of those interest groups that fund election campaigns.

Congress reports to them, not to us. The idiot US Supreme Court actually ruled that corporations had a legitimate Constitutional right to purchase the US government. This ruling converted a government that represented the people into one that represented the political campaign contributors. Another addition I would make is the destruction of manners. Try to find today any sign of the manners I grew up with or the civilization that existed. Even when I was in my 20s, when a woman entered the room, the men stood up. Car and restaurant doors were opened for women. Women were helped into their seat at the table. Only when women were seated did men sit down. Men were trained to be gentleman, and ladies to be ladies. No gentleman ever used a four-letter word in a woman’s presence, and no woman ever spoke one. Listen to the barbaric youth today. Even the terms ladies and gentlemen have passed out or have been driven out of use.

[..] Today in the Disunited States we have a government in power that was not elected; instead it used control over the blue cities in swing states and the whore American media to steal the election. Massive amounts of evidence was provided by experts that the election was stolen, but this was strongly denied by the whore media, and experts were prosecuted for making the facts known. Today America is governed by an illegitimate tyrannical regime, and nothing has been done about it. The Republican Party is useless. Only Trump soldiers on with four orchestrated criminal indictments and a number of civil cases arrayed against him. The media, Democrats, and Rino Republicans are all against him. Only the people are for him, and the people are powerless. They don’t even have the vote as the Democrats made clear by stealing the last two elections. Those prosecuting Trump have no concern that they are destroying America’s reputation and reducing the power of all future presidents, making them even more subservient to the deep state.

America’s only representative–Donald Trump–is so overloaded with criminal and civil prosecutions that he has no time to campaign and even as a billionaire is overwhelmed with the legal costs of defending himself from obvious nonsensical charges.The legal profession, the law schools, the bar associations, the Congress, the courts, the media stand aside as if they are not also endangered and as if the weaponization of law isn’t a foundation of tyranny. What we are witnessing most certainly is the transformation of American law into a weapon for subjecting the American population and eliminating anyone who dares to protest or challenge the tyrannical ruling establishment. This is the reason that the United States of America is a totally dead and buried formerly free nation. Americans have sat on their butts and allowed the destruction of civility, the rule of law, the Constitution, and their nation.

Interesting discussion. To be continued.

• Sceptical Supreme Court Could Hand Trump Partial Victory In Immunity Case (ZH)

After two and a half hours, the Supreme Court has finished hearing arguments on whether a former president is immune from criminal prosecution. Reading the tea-leaves of the comments has left most believing that SCOTUS will fail to grant former President Trump the full immunity he is seeking (choosing instead to narrow the protections for former presidents), but are likely to issue a ruling that could further delay his trial on charges of conspiring to overturn the 2020 election. That would be a partial win for the former President. As Axios reports, a definitive ruling against Trump – a clear rejection of his theory of immunity that would allow his Jan. 6 trial to promptly resume – seemed to be the least likely outcome. A majority of the justices seemed inclined to rule that former presidents must have at least some protection from criminal charges, but not necessarily the “absolute immunity” Trump is seeking.

The core distinction during oral arguments came down to a president’s official vs. unofficial actions. — and which of Trump’s efforts to overturn the 2020 election results were official vs. unofficial. The most likely outcome might be for the high court to punt, perhaps kicking the case back to lower courts for more nuanced hearings. That would still be a victory for Trump, as Sam Dorman reports via The Epoch Times that the outcome of this appeal could delay lower court proceedings in President Trump’s Washington trial as well as his cases in Georgia and Florida. It’s unlikely that the Supreme Court, which is expected to release a decision in June, will write an opinion that delays his ongoing criminal “hush money” trial in New York. The bottom-line is that no clear, concise majority opinion emerged this morning. But there may be five justices willing to kick the can down the road – and that’s enough for Trump, at least for now.

“Only Michael Cohen would portray himself in terms of a witness simply trying to share evidence of a crime..”

• Court to Decide Trump Contempt Sanction (Turley)

I will confess that there are at times a level of contempt expressed in my columns. However, today will be the first time that a column becomes a legal matter for contempt. Among the ten postings by former president Donald Trump being raised by Manhattan District Attorney Alvin Bragg in his contempt sanction is the use of a quotation from one of my columns. In a hearing on the gag order Tuesday morning, Judge Juan Merchan reserved any final decision. On April 15, Trump quoted my New York Post column from the day before titled “A serial perjurer will try to prove an old misdemeanor against Trump in an embarrassment for the New York legal system.” Trump posted the title while attaching a link. There is an interesting aspect to this controversy that captures the problem with Judge Merchan’s gag order.

In addition to continually appealing on television to oppose Trump’s election and to discuss his testimony in this case, Cohen has also lashed out against critics and coverage, including my own columns. I have been a critic of Cohen since the time when he was still working as counsel for Trump. Cohen has continued to attack some of us with vulgar postings while posting mocking pictures and attacks on Trump, including running commentary on the trial. In one posting, Cohen posted an insulting attack on myself and others who have raised questions about the Manhattan case while objecting that he is entitled to the protection of the gag order because he is a witness. Only Michael Cohen would portray himself in terms of a witness simply trying to share evidence of a crime.

Cohen has raised money on being the antagonist of Donald Trump. He has cultivated his professional wrestling style as a type of trash-talking, chair-throwing thug to liberal cable programs. Judge Merchan has allowed him to use the gag order to shield him from criticism as he heaps abuse on Trump both as a candidate and a defendant. That includes, like Trump, responding to these very columns, including my own, on the case. I have previously criticized these gag orders on constitutional grounds.

“.. ‘public servants’ in the United States dole out trillions of unregulated dollars, but can be ‘purchased’ for mere millions of dollars..”

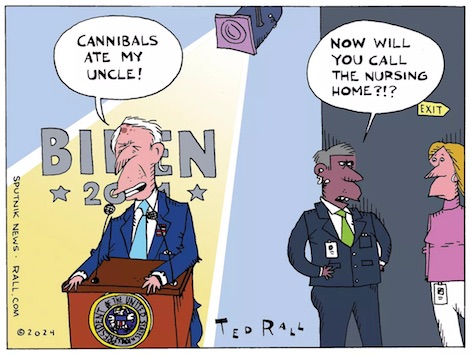

• Hillary Clinton and Marc Elias Are Afraid of 2024 Trump Win (Sp.)

Hillary Clinton has once again evoked the specter of “Russian collusion” and warned the audience of Marc Elias’ “Democracy Docket” podcast that Donald Trump’s role model is no one but Russian President Vladimir Putin. According to Clinton, the danger of a Trump victory to the US democracy is acute, given that Republicans would do whatever it takes to win the 2024 elections, starting with narrowing the electorate, purging votes, creating confusion at polling stations and even weaponizing artificial intelligence (AI). “Probably can’t even imagine what they’re going to do with artificial intelligence and other cyber-attacks on voters in terms of the messages that they will get, sometimes deliberately, to confuse them. You know, different polling places, different days to vote, different times of voting — I mean, whatever they can do to mess people up,” the former secretary of state claimed.

She went on to say that if Trump wins the presidential election in 2024 he would turn into a full-fledged “authoritarian” or “dictator”, who wants to kill his opposition, suppresses the freedom of speech, takes bribes in pay-to-play schemes, and doesn’t believe in the rule of law. Clinton’s outlandish claims expose her as nothing short of a projectionist, according to Wall Street analyst and investigative journalist Charles Ortel, who has been examining the Clinton Foundation’s alleged fraud and pay-to-play scheming for several years. “Hillary Clinton and Marc Elias are both disgraces to the legal profession and mere servants of corrupt donors who plainly understand that ‘public servants’ in the United States dole out trillions of unregulated dollars, but can be ‘purchased’ for mere millions of dollars, often routed via leaky ‘charities,’ or off-market ‘business’ deals and media gigs,” Ortel told Sputnik.

“So far, the known record indicates that Elias, acting for the 2015/16 Clinton campaign and likely working directly with Hillary, rigged the Democratic primaries to favor Hillary and deny Bernie a running shot at winning the Democratic nomination,” the analyst continued. “Then, Elias (likely under direction from Hillary and her corrupt donors) contracted the manufacture of bold lies attempting to link Trump to Russia in the ‘Steele Dossier’ and hyped their deep connections in media and academia to inflate a massive web of deception that hampered the Trump presidency, instigated impeachments of Trump, interfered in the 2020 election, the 2022 election and now in the 2024 election. “If Trump and the GOP win the White House and Congress this year, that could spell serious legal troubles for both Hillary and Marc, the analyst presumed.

Clinton’s claim about Trump’s apparent desire to “kill” his opposition could trigger inconvenient parallels with a string of unexplained deaths around Team Clinton, according to Sputnik’s interlocutor. While Hillary is peddling the idea of the GOP’s forthcoming “election disinformation,” one should recall how she tried to evade scrutiny during the “emailgate” scandal concerning classified government information which ran through her unprotected server, the analyst pointed out. The former secretary of state permanently deleted 33,000 of those emails insisting they were “personal and private”. “Hillary Clinton is an adept liar and mistress of attempting to destroy incriminating evidence,” Ortel said. “In this, she has legions of co-conspirators who have woven fanciful tales of her decades of ‘public service’ without explaining how she managed to convince a major law firm— Williams & Connolly—-to defer collecting millions in legal fees through Bill Clinton’s presidency or how the Clinton family scored millions of dollars in off-market book and speech deals.”

What is it with Dems and Secret Service protection? Nobody questioned it before..

• Democrats Want Donald Trump ‘Killed,’ Alan Dershowitz Warns (ET)

Retired Harvard Law professor Alan Dershowitz suggested that Democrat officials want former President Donald Trump to get killed by taking away his Secret Service protection. Rep. Bennie Thompson (D-Miss.) introduced legislation last week that would remove Secret Service protection for people who are convicted of felony or state crimes. The lawmaker mentioned that a “former president” could be an individual whose protection would be terminated if he’s found guilty in four cases. But Mr. Dershowitz, a former constitutional law professor and criminal defense lawyer, asserted in an interview with Newsmax over the weekend that Mr. Thompson’s legislation is “ridiculous” and “means they want him killed because he’s obviously a target.”

“We live in an age where everybody is in danger. Look, Bobby Kennedy ought to be getting Secret Service protection, but certainly Donald Trump needs to get Secret Service protection. He’s not going to jail, but if he goes to jail obviously the law requires Secret Service protection,” Mr. Dershowitz said, referring to President Trump. It comes as President Trump faces a criminal trial in which prosecutors allege that he falsified business records during the 2016 campaign to cover up negative news stories. The trial is scheduled to last around six to eight weeks in total, while opening arguments started Monday. Judge Juan Merchan, who is overseeing the case, “is going to bluff, fine and threat, but he’s not going to throw Donald Trump in jail,” Mr. Dershowitz said. “That would be a guaranteed victory … I don’t think it’s going to happen.”

A press release issued by Mr. Thompson’s office said that with President Trump’s cases, there is now an opportunity for Congress to reform the U.S. Secret Service’s protective mission “by automatically terminating Secret Service protection for those who have been sentenced to prison following conviction for a federal or state felony—clarifying that prison authorities would be responsible for the protection of all inmates regardless of previous Secret Service protection.”

“Unfortunately, current law doesn’t anticipate how Secret Service protection would impact the felony prison sentence of a protectee—even a former president. It is regrettable that it has come to this, but this previously unthought-of scenario could become our reality,” Mr. Thompson said, referring to the former president’s 91 state and federal charges. “Therefore, it is necessary for us to be prepared and update the law so the American people can be assured that protective status does not translate into special treatment—and that those who are sentenced to prison will indeed serve the time required of them,” he added in the news release.

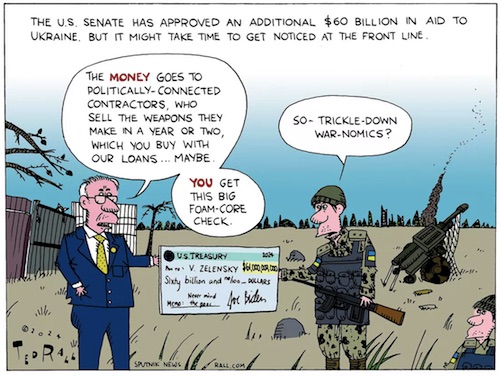

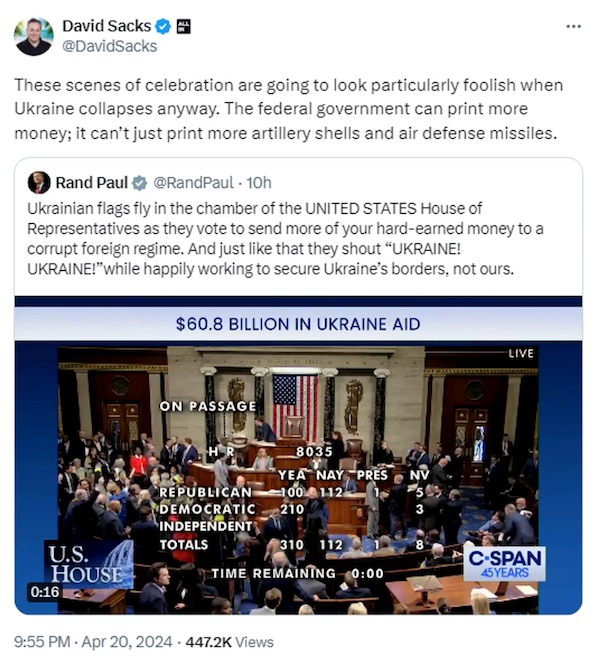

“..Speaker Johnson and many congressional Republicans snubbed their own voters on Ukraine funding for two reasons: ignorance and ideology..”

• Pollster: ‘Deep State’ Wanted Trump’s Imprint On Failed Ukraine Policy (Sp.)

Most Americans hold a realistic view of the unfolding Ukraine conflict and want their government to prioritize domestic economic and national security interests, according to Patrick Basham, head of Democracy Institute, a politically independent research organization based in Washington and London. Basham likewise does not rule out that Republican presidential frontrunner Donald Trump has been played by the US “deep state” into supporting the unpopular Ukraine aid package. Sputnik: US Congress’ decision to back Joe Biden’s $61 billion aid package for Ukraine to fight its war against Russia has been met with disapproval from US voters on both sides of the political aisle, according to your new poll. Why did Mike Johnson and some of his fellow Republicans in the House decide to snub the GOP’s base on Ukraine?

Patrick Basham: Speaker Johnson and many congressional Republicans snubbed their own voters on Ukraine funding for two reasons: ignorance and ideology. These Republican politicians, along with the majority of American congressmen and senators, are abysmally ignorant about the state of the war in Ukraine. They do not realize that Ukraine has been defeated; many of them even believe Ukraine can still win the military contest with Russia. They are also adherents to a foreign policy ideology that is at odds with the perspective held by the overwhelming majority of conservative and Republican voters in America. The politicians are neoconservatives who divide the world into black and white, good and bad nations.

They believe that American and Western military and economic power can and should remove from power foreign governments that America dislikes – and, crucially, that the removal of these governments will be met with approval from those formerly ruled by them. Although these costly interventions consistently fail, they are advertised as projects to advance democracy, freedom, and prosperity. In striking contrast, most Republican voters (and most Americans) hold a more realistic view of American power. They want Washington to prioritize American interests (especially economic and national security) abroad. As such, they are deeply reluctant to put American soldiers in harm’s way for little, if any, apparent benefit to America, and they are also acutely sensitive to the horrendous economic cost of waging a prolonged overseas war.

Sputnik: Your survey has also indicated that Donald Trump’s support for Speaker Mike Johnson failed to sway the American opposition to funding the Ukrainian conflict. Nonetheless, Sen. Lindsey Graham claimed that Trump’s support helped ram the Ukraine package through Congress. What’s your take on Trump’s role in advocating the provision of Ukraine aid in the form of a loan and backing Johnson’s Ukraine bill? Patrick Basham: Trump’s support for Johnson helped to make the Ukraine bill more palatable to some Republican congressmen. Trump provided political cover for those Republican politicians afraid of attacks from “America First” critics within their own party. I presume that Trump’s principal goal was to shore up Johnson’s overall position within the Republican caucus in the House of Representatives so that during the election campaign Republicans would not experience yet another drawn-out, politically painful exercise to choose a new speaker.

Raising Arizona.

• Trump Allies Charged In Arizona Election Interference Case (Sp.)

Trump allies Mark Meadows, Rudy Giuliani, and Jenna Ellis are among 18 people charged in an election interference case in the state of Arizona, court documents revealed. “Defendants’ attempts to declare Unindicted Co-conspirator 1 and Pence the winners of the 2020 Presidential Election contrary to voter intent and the law, involved numerous other charged and uncharged co-conspirators,” the filing said on Wednesday. Former President Donald Trump is listed as an unindicted co-conspirator in the filing. The defendants are accused of trying to overturn the results of the 2020 presidential election in the state of Arizona, the court documents stated.

In February, a US federal appeals court ruled that Trump is not immune from prosecution in his 2020 election interference case, which Trump appealed to the US Supreme Court. The US Supreme Court is scheduled to decide whether Trump is immune from being prosecuted as a former US president on Thursday. In August 2023, a Fulton County grand jury indicted Trump on 13 felony counts related to his alleged attempts to overturn the results of the 2020 presidential election. Trump has pleaded not guilty to the charges in Georgia over the 2020 presidential election. Trump faces a total of 91 charges in four criminal cases that Republicans say are an attempt by the Democratic establishment to prevent him from returning to the White House. The most serious charges carry penalties of up to 20 years in prison. If the punishment were to be determined by adding up the terms, he could be behind bars for more than 700 years.

“..the cost now of living in America has risen by about $11,434, give or take, in comparison to when Biden took office.”

• Biden Rushes Aid to Ukraine As US Cost of Living Skyrockets (Miles)

American households in 2024 are spending an extra $11,434 annually to maintain a similar standard of living to the one they enjoyed just three years ago. That’s according to a new study by Republican members of the US Senate Joint Economic Committee who examined consumer price data to arrive at an analysis of the impact of inflation from state to state. In some parts of the country the cost of living increase stood at a comparatively modest $8,500 per year, while in states like California and Colorado it approached $15,000. The Biden White House rejected the study as one-sided, pointing to attendant wage increases across the economy. Still, recent polling suggests most Americans don’t feel the increased income makes up for the rise in inflation, and economic issues remain at the forefront of voters’ concerns with November’s presidential election less than seven months away.

Geopolitical consultant and founder of Global Perspective Consulting David Oualaalou pointed to the troubling data during an appearance on Sputnik’s The Critical Hour program Wednesday, questioning the US president’s focus on foreign policy amidst a grim economic outlook for millions of Americans. “The fact that [the US] keeps sending more money to Ukraine [and] it’s already a failed state, what is it for?” asked the author and global speaker. “We have been taking money out of average Americans that are paying taxes. I hope your listeners understand — and this is a sad reality — that the cost now of living in America has risen by about $11,434, give or take, in comparison to when Biden took office.” “And why? Because we are taking money out of Americans and giving it to the corrupted government in Ukraine.” he insisted. “I saw those images of the incompetent members of Congress waving the Ukrainian flag inside Congress. Well to me it became like, why don’t you go and represent Ukraine?

Shame on our politicians. But, again, until the structure of our system has changed, nothing is going to change fundamentally.” Former US President Dwight D. Eisenhower famously warned Americans about the emergent US military-industrial complex during his farewell address in 1961. What’s less well known is that an earlier draft of the speech referred to a “military-industrial-congressional complex.” Eisenhower reconsidered the term out of fear of offending Washington lawmakers, but the designation makes clear legislators’ key role in what the former leader considered a corrupt and dangerous phenomenon. Military contractors make up one of the largest political lobbies in Washington; recently, a study found lawmakers who voted to pass a recent National Defense Authorization Act received four to five times more in donations from the defense industry than those who did not. The promise of campaign cash creates a powerful incentive for congress members to vote to fund more war.

“We have nothing to show but conflicts,” said Oualaalou. “We do not sell anything to the rest of the world except conflict and weapons. And at some point when the world is shifting, like what we are witnessing right now, most countries are going to say, ‘sorry, we are not interested in buying what you have to sell.'” Recently the African country of Chad has threatened to order US troops stationed in the country to leave. The move comes after the neighboring country of Niger made a similar request. The United States has, so far, refused to comply, having invested significant amounts of money there as a hub for military and surveillance activity in the region.

It’s not about winning. It’s about fighting.

• Biden Team Doubts US Aid Will Help Ukraine Win – Politico (RT)

US officials are not convinced that another $61 billion in American assistance for Ukraine will be enough for it to prevail in the conflict against Russia, Politico has reported. President Joe Biden signed a $95 billion foreign aid package on Wednesday, which also included funding for Israel and Taiwan. The Senate voted on the legislation earlier this week, ending a standoff between the Democrats and the Republicans that had dragged on since the autumn. “Battlefield dynamics [in the Ukraine conflict] have shifted a lot in the last few months,” Politico reported on Wednesday, citing unnamed members of the Biden administration. This happened partially because the stalemate in Congress led to Ukrainian forces running low on weapons and ammunition, the sources suggested.

“The immediate goal is to stop Ukrainian losses and help Ukraine regain momentum and turn the tide on the battlefield. After that, the goal is to help Ukraine begin to regain its territory,” one of the officials said. “Will they have what they need to win? Ultimately, yes. But it’s not a guarantee that they will. Military operations are much more complicated than that.” A senior Democratic Senate aide also told Politico that the question now is whether more US aid can lead to a Ukrainian victory, or if it would just be enough to fend off Russian forces temporarily. “There’s lots of debate about what a winning endgame for Ukraine looks like at this point,” the source said. The outlet argued that there is a difference between Kiev “winning” by getting “most or all of its territory back” and “not losing,” which means that “Ukraine can hold its lines and advance some but fail to claw back what Russia seized.”

Ukrainian President Vladimir Zelensky’s stance that Kiev should fight until it takes back all of its territory, including Crimea, “commits the US to a much longer conflict with no guarantee Zelensky will achieve his goals,” Politico stressed. Commenting on the $61 billion US military aid package on Wednesday, Kremlin spokesman Dmitry Peskov insisted that “all these new batches of weapons… will not change the dynamics on the front line.” Earlier this week, Russian Defense Minister Sergey Shoigu said that Moscow’s forces currently hold the initiative everywhere along the front line and are capturing more settlements. He estimated Kiev’s losses at half a million troops since the start of the conflict in February 2022.

“Russia currently enjoys “military superiority, if not outright supremacy, along the entire line of contact..”

• Scott Ritter: US Aid for Ukraine Won’t Hamper Russia’s Strategic Advantage (Sp.)

US President Joe Biden recently signed a long-delayed $95 billion package, including $61 billion in aid for Ukraine, into law. At least $13.8 billion of this sum will be used to deliver weaponry, such as long-range ATACMS missiles and F-16 fighter jets. This is “a lot of money” but it will not turn the tide of the conflict, former US Marine Corps intelligence officer and UN weapons inspector Scott Ritter said in an interview with Sputnik. “The $13.8 billion in military assistance that will be provided to Ukraine will be insufficient to basically halt the ongoing Russian advance,” and “to change the outcome on the battlefield,” he stated. The sum will not help the Kiev regime “turn the tide to send Russian forces back to, according to the Zelensky formula, the 1991 borders,” Ritter stressed, recalling that it isn’t just him making this assessment.

“This is the assessment of Ukraine’s Foreign Minister [Dmytro] Kuleba, who has said that at this late stage in the game, there’s no amount of military assistance that can stop the Russian advance. He’s correct,” the Marine Corps intelligence officer underscored. Ritter also cited “talk of magic weapons” for the Zelensky regime, which he said would be of little help. According to him, Russia currently enjoys “military superiority, if not outright supremacy, along the entire line of contact, not just on the front lines, but extending well into the rear areas of the Ukrainian defense areas.” He also explained that after the US weapons are delivered to Ukraine and brought up to the front line, the weaponry “will be subjected to increasing levels of interdiction.”

“Very little of this military assistance will actually make it to the Ukrainian soldiers at the front line, and when it does, this military equipment will be destroyed relatively quickly by the Russians who will be tracking this equipment throughout its entire journey from the West to the front lines,” Ritter pointed out. The former US Marine Corps intelligence officer suggested that Russia would manage to retain its “strategic advantage” on the battlefield “until victory, regardless of the amount of money that the United States, Europe or anybody else pours into Ukraine. Ritter’s remarks come after Kremlin spokesman Dmitry Peskov underlined that the situation on the battlefield is “self-explanatory and unambiguous,” and that “all these new batches of weapons, […] will not change the dynamics at the front line.”

The cost of sanctions.

• Russia To Seize $440 Million From JPMorgan (ZH)

Seizing assets? Two can play at that game… Just days after Washington voted to authorize the REPO Act – paving the way for the Biden administration confiscate billions in Russian sovereign assets which sit in US banks – it appears Moscow has a plan of its own (let’s call it the REVERSE REPO Act) as a Russian court has ordered the seizure of $440 million from JPMorgan. The seizure order follows from Kremlin-run lender VTB launching legal action against the largest US bank to recoup money stuck under Washington’s sanctions regime. As The FT reports, the order, published in the Russian court register on Wednesday, targets funds in JPMorgan’s accounts and shares in its Russian subsidiaries, according to the ruling issued by the arbitration court in St Petersburg. The assets had been frozen by authorities in the wake of the western sanctions, and highlights some of the fallout western companies are feeling from the punitive measures against Moscow.

Specifically, The FT notes that the dispute centers on $439mn in funds that VTB held in a JPMorgan account in the US. When Washington imposed sanctions on the Kremlin-run bank, JPMorgan had to move the funds to a separate escrow account. Under the US sanctions regime, neither VTB nor JPMorgan can access the funds. In response, VTB last week filed a lawsuit against the New York-based group to get Russian authorities to freeze the equivalent amount in Russia, warning that JPMorgan was seeking to leave Russia and would refuse to pay any compensation. The following day, JPMorgan filed its own lawsuit against the Russian lender in a US court to prevent a seizure of its assets, arguing that it had no way to reclaim VTB’s stranded US funds to compensate its own potential losses from the Russian lawsuit.

Yesterday’s decision sided with VTB, ordering the seizure of funds in JPMorgan’s Russian accounts and “movable and immovable property,” including its stake of a Russian subsidiary. JPMorgan said it faced “certain and irreparable harm” from VTB’s efforts, exposed to a nearly half-billion-dollar loss, for merely abiding by U.S. sanctions. The order was the latest example of American banks getting caught between the demands of Western sanctions regimes and overseas interests. Last summer, a Russian court froze about $36mn worth of assets owned by Goldman following a lawsuit by state-owned bank Otkritie. A few months later the court ruled that the Wall Street investment bank had to pay the funds to Otkritie. The tit-for-tat continues.

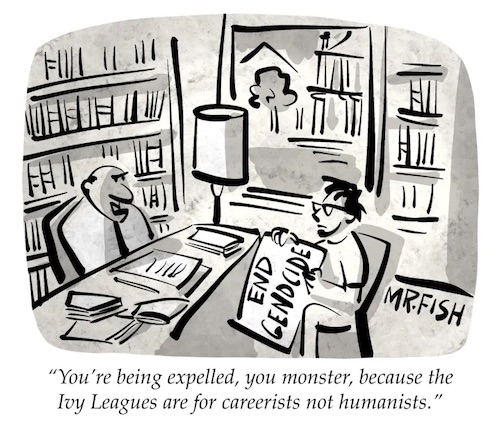

“..witnesses who said that Weinstein had assaulted them, but whose accusations weren’t part of the charges against him..”

• Harvey Weinstein Conviction Overturned On Appeal (ZH)

A New York Court of Appeals has overturned Harvey Weinstein’s 2020 conviction on felony sex crime charges, for which he was sentenced to 23 years in prison. In a 4-3 decision, the court found that the trial judge in the disgraced mogul’s case had made a critical error, allowing prosecutors to call a series of women as witnesses who said that Weinstein had assaulted them, but whose accusations weren’t part of the charges against him, the NYT reports. In 2020, Lauren Young and two other women, Dawn Dunning and Tarale Wulff, testified about their encounters with Weinstein under a state law that allows testimony about “prior bad acts” to demonstrate a pattern of behavior. But the court in its decision on Thursday said that “under our system of justice, the accused has a right to be held to account only for the crime charged.”

Citing that decision and others it identified as errors, the appeals court determined that Mr. Weinstein, who as a movie producer had been one of the most powerful men in Hollywood, had not received a fair trial. The four judges in the majority wrote that Mr. Weinstein was not tried solely on the crimes he was charged with, but instead for much of his past behavior. -NYT The decision was determined by one vote on a majority female panel of judges, who in February held a searching public debate over the fairness of the original trial. Weinstein was convicted of raping aspiring actress Jessica Mann at a DoubleTree hotel in 2013 when she was 27-years-old, and forcing oral sex on former production assistant Mimi Haleyi, then 28, at his apartment in 2006.

Now, Manhattan DA Alvin Bragg, who’s currently prosecuting former President Donald Trump, will have to decide whether to seek a retrial of Weinstein – who remains in an upstate prison in Rome, NY at the moment. It’s unclear how the decision will affect his future. In 2022, he was convicted by a California court of raping a woman in a Beverly Hills hotel and sentenced to 16 years in prison. The jury found Weinstein guilty of rape, forcible oral copulation, and sexual penetration by foreign object involving a woman known as Jane Doe 1.

The 2022 jury acquitted Weinstein of a sexual battery charge made by a massage therapist who treated him at a hotel in 2010, and was unable to reach a decision on two allegations, including rape, involving Jennifer Siebel Newsom, the wife of California’s Democratic governor Gavin Newsom. She was known as Jane Doe 4 in the trial, and had testified to being raped by Weinstein in a hotel room in 2005. Weinstein was convicted of sexually abusing over 100 women – and was convicted of assaulting two of them in the New York case. “That is unfair to survivors,” said actress Ashley Judd, the first actress to come forward with allegations against Weinstein, the NYT’s Jodi Kantor reports. “We still live in our truth. And we know what happened.”

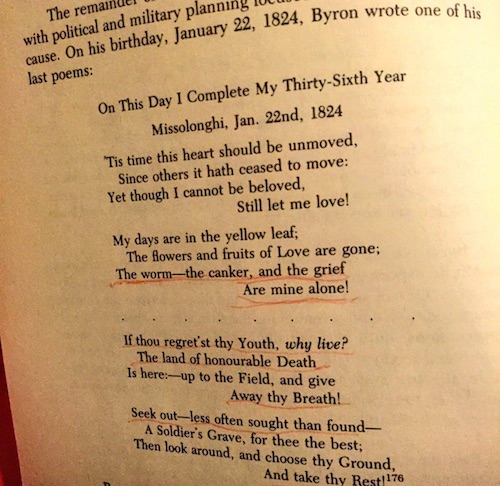

“..Though he is as undeniably German as the Nord Stream pipeline, Putin (and anyone else anywhere) has a right to quote him morning, noon and night..”

• Immanuel Kant Goes To War (Hayes)

First off, a hat tip to Russia Today (and to the VPN, which allows me access to it) for telling me that German Chancellor Olaf Scholz has lashed out at Russian President Vladimir Putin for quoting iconic German philosopher Immanuel Kant. Because Putin cited the philosopher at an event marking the 300th anniversary of Kant’s birth, Scholz accused Putin of trying to “poach” the great thinker as well as misrepresenting his ideas.n bThe story, at first glance, is so ridiculously funny that I had to google to ensure I was not being taken in by that mercurial NATO chameleon dubbed “Russian disinformation.” Sure enough, as plenty of Western sources later verified the story, we can proceed. Die Zeit cites Scholz at the Berlin-Brandenburg Academy of Sciences ranting that “Putin doesn’t have the slightest right to quote Kant, yet Putin’s regime remains committed to poaching Kant and his work at almost any cost”.

Let’s just stop the reel there. Kant was born in 1724 in Koenigsberg (present-day Kaliningrad), which belonged to the Kingdom of Prussia before later becoming part of the Russian Empire. The philosopher, famous for his work on ethics, aesthetics and philosophical ontology, is rightly considered one of the pillars of German classical philosophy. Though he is as undeniably German as the Nord Stream pipeline, Putin (and anyone else anywhere) has a right to quote him morning, noon and night. Though Kant is as German as Tolstoy, who regarded himself as a philosopher and not a writer, is Russian, their brilliance belongs to the world. Scholz, in other words, is free to quote Tolstoy, once, of course, he first learns to read. As Putin delivered his talk in Kant’s famous birth place, it was, of course, entirely appropriate that Putin should quote the great philosopher and Scholz, if he was not an ignoramus, should have used that to his advantage, rather than coming across as the obvious baboon that he is.

Putin, as it happens, spent much of his working life in Germany and he speaks the language of Kant, Schiller and Goethe at least as fluently as Scholz which is, admittedly, a low bar. Not only that but Putin has been praising and quoting Kant for decades and has even gone so far as saying that the philosopher should be made an official symbol of Kaliningrad Region. Germany and Germans like Kant have had a profound and often benign effect on Russia since even before Vasili III, Grand Prince of Moscow, established Moscow’s German Quarter in the fifteenth century. Catherine the Great, who was actually born in Prussia, and the German speaking and Kant admiring Putin have carried on those links into more modern times. And, though Catherine the Great, sadly, is no longer with us, Putin is, and his remarks that Kant is “one of the greatest thinkers of both his time and ours,” is not only worthy of consideration but it is one more cultured German leaders than Scholz would have leveraged to their advantage.

Scholz, who fancies himself as something of a bar room philosopher, is having none of that. He believes Russia’s role in the Russian speaking areas of Ukraine contradicts Kant’s fundamental teachings on the interference of states in the affairs of other nations, and he defended Kiev’s decision not to engage in peace talks with Moscow, unless they are on NATO’s terms of unconditional Russian surrender. Scholz, with no sense of irony or self awareness regarding the aborted Minsk Accords, said Kant believed that forced treaties were not the way to reach ‘perpetual peace’ – a direct reference to Perpetual Peace: A Philosophical Sketch, one of Kant’s major and most influential works.

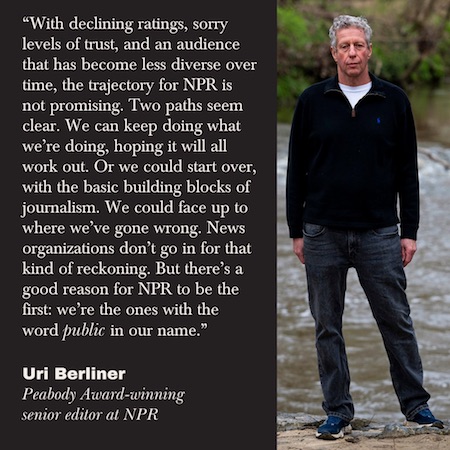

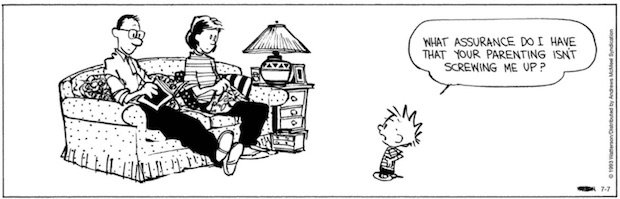

“..past 400 ppm, “the CO2 concentration can no longer cause any increase in temperature.”

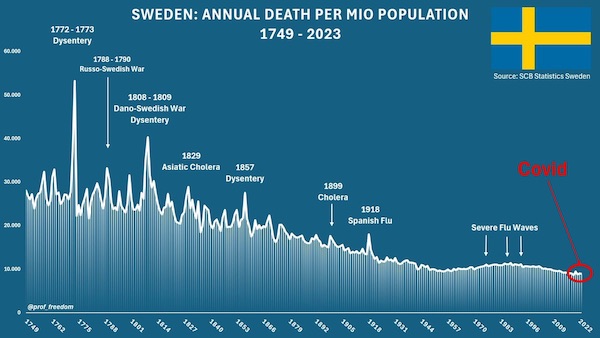

• Carbon Emissions CANNOT Cause ‘Global Warming’ (Slay)

A bombshell new peer-reviewed study has provided conclusive scientific evidence proving that carbon dioxide (CO2) emissions in Earth’s atmosphere cannot cause “global warming.” Dr. Jan Kubicki led a group of world-renowned Polish scientists to study the impact of increases in CO2 emissions on the Earth’s global temperatures. However, not only did they find that higher levels of CO2 made no difference, but they also proved that it simply isn’t possible for increases in carbon dioxide to cause temperatures to rise. Kubicki and his team recently published three papers which all conclude that Earth’s atmosphere is already “saturated” with carbon dioxide. This saturation means that, even at greatly increased levels of CO2, the “greenhouse gas” will not cause temperatures to rise. Kubicki et al. summarize their evidence by noting that as a result of saturation, “emitted CO2 does not directly cause an increase in global temperature.”

Current levels of CO2 in the atmosphere are around 418 parts per million (ppm) but the scientists state that past 400 ppm, “the CO2 concentration can no longer cause any increase in temperature.” The saturation of CO2 in the atmosphere is the hypothesis that dares not speak its name in mainstream media, politics, and across much of climate science. The World Economic Forum’s (WEF) “Net Zero” collectivism agenda is doomed without the constant fearmongering of a so-called “climate crisis.” One of the key propaganda messages behind this “green agenda” is that humans are responsible for the ever-warming climate by burning hydrocarbons and releasing CO2 into the atmosphere. The saturation hypothesis is complex, but in simple terms, it can be described by the example of loft insulation in a house.

After a certain point, doubling the lagging will have little effect since most of the heat trying to escape through the roof has already been trapped. Carbon dioxide traps heat only within narrow bands of the infrared spectrum. Levels of the gas have been up to 20 times higher in the past without any sign of runaway “global warming.” At current levels, the Polish scientists suggest that there is “currently multiple exceedances of the saturation mass for carbon dioxide in the Earth’s atmosphere.” The latest study is published in the prestigious Elsevier’s Science Direct peer-reviewed journal. Many other scientists are attracted to the saturation hypothesis because it provides more plausible explanations to fit past changes in the climate.

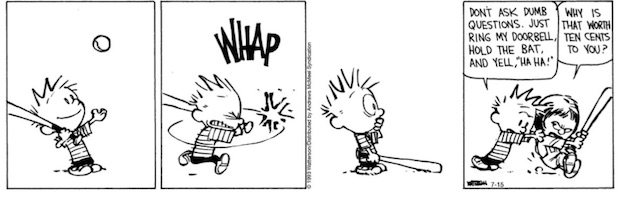

Trump pizza

Here is a rare Dominos Pizza commercial with President Trump from 2005. pic.twitter.com/jeA32cFGjP

— Dom Lucre | Breaker of Narratives (@dom_lucre) April 24, 2024

Roadster

Did you know how a roadster ended up on a Falcon heavy in space ? Elon Musk shares the story.

pic.twitter.com/JlPrOZxPLc— Tesla Owners Silicon Valley (@teslaownersSV) April 25, 2024

Saba

Baby’s first steps! This wobbly footed ele calf is Saba. She's was born in 2021 to Sunyei, an orphan we rescued, raised & rewilded. Amazingly, elephant calves can stand within 20 mins of birth & can walk within their first hour. What is your favourite fact about elephants? pic.twitter.com/sqWNNADO2z

— Sheldrick Wildlife Trust (@SheldrickTrust) April 24, 2024

Lay Down Your Tomato Plants

DO YOU

LAY DOWN

YOUR

TOMATO PLANTS?HERE'S WHY YOU SHOULD! pic.twitter.com/b4YWh8O8Fi

— DR. Kek (@Thekeksociety) April 25, 2024

Mwinzi

Mwinzi is our drought miracle, rescued moments from death. He’s a chilled & chubby character with a loving personality – as Keeper Jackson can attest. Learn more about little Mwinzi & how donations ensured he beat the odds to survive: https://t.co/dlRIUcBTab pic.twitter.com/YnoNjrtmdx

— Sheldrick Wildlife Trust (@SheldrickTrust) April 24, 2024

Donkeys

https://twitter.com/i/status/1783156462681739671

Cutting

Horse trained in 'cutting' keeps cow back as rancher tags calf pic.twitter.com/W0yvV9swE8

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 25, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.