M. C. Escher Circle limit III 1959

From https://wereldintransitie.files.wordpress.com/2021/10/covid-19-in-perspectief.pdf

Veritas Pfizer

BREAKING: @Pfizer Scientists: ‘Your [COVID] Antibodies are Probably Better than the [Pfizer] Vaccination’

'We’re Like Bred And Taught to be Like “Vaccine is Safer Than Actually Getting Covid”'

“Our Organization is Run on Covid Money”#ExposePfizer https://t.co/Fj2tBsbBc9

— Ivory Hecker (@IvoryHecker) October 5, 2021

Qantas

https://twitter.com/i/status/1444644291758919686

“The ghouls involved in this up and down the line, from hospital administrators to doctors to nurses to politicians all must hang for this.”

• They All Lied. Throw Them All Out NOW (Denninger)

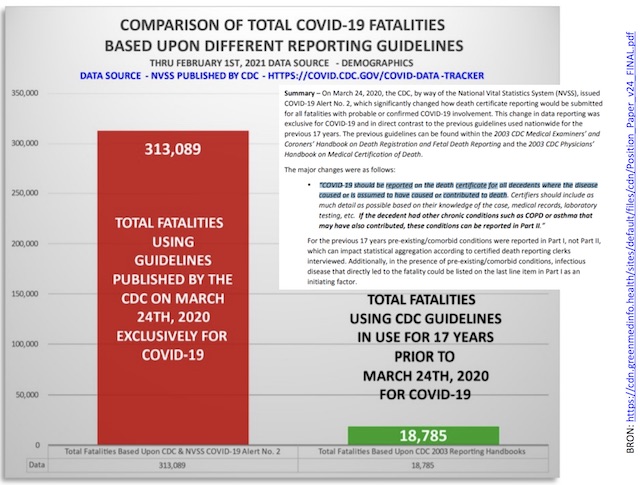

The Government has been analyzing CMS data. Not a shock; they have every person over 65’s medical records, in real time, as everyone over 65, statistically speaking, is on Medicare and the government pays for it. They therefore have the records. The US Government has been analyzing this data through Project Salus. They know that:

• 71% of the Covid-19 cases occurred in these fully-vaccinated people and roughly 80% of the population >65 is vaccinated. In other words they know the vaccines do not stop you from getting Covid.

• Both of the mRNA vaccines lose effectiveness between 4-6 months post-injection; the failure rate doubles between 5-6 months as opposed to 3-4 months.

• Age is NOT why the vaccines lose effectiveness. It is simply that they stop working.

• While Moderna vaccines work slightly better than the Pfizer ones, the key word here is slightly. Both degrade materially and the difference in the 5-6 month timeframe is not statistically significant. Yes, it appears to be slightly better but not statistically so. In other words the damn things do not work to provide durable protection — period.

• The nuclear lie: As of August 7th 60% of hospitalizations were among fully-vaccinated individuals. You have heard repeatedly that this is now a “disease of the unvaccinated.” That is a damned, knowing lie.

• In the 5-6 month timeframe the hospitalization protection also is wildly ineffective; the rate per 100,000 approximately doubles between the 3-4 month and 5-6 month time periods.

• Prior infection is highly protective but post six months vaccination has become much less-so. Note that “prior infection” now goes back 18 months to the first wave. Do we still need to have a conversation about “natural immunity”? No: THE US GOVERNMENT KNOWS DAMNED WELL AND HAS PROVED THAT INFECTION PROTECTS BETTER THAN THEIR FRAUDULENT JABS.This is now all in the data folks, and the US Government knows it. You have been lied to repeatedly folks — these are not errors, and what Fauci did yesterday on TV was not an error either. These are not “noble” anything; they are lies. The jabs are a failure in that no matter the promise you care to hang your hat on they become more and more worthless over time and that time period is short enough to void the effectiveness which the FDA claims must exist in order to approve such a thing as a “vaccine.” The Government has been analyzing this data and knows damned well the jabs stop working and in fact this is not a disease of the unvaccinated; the claims that the hospitals are “full of unvaccinated people” are damned lies intended to coerce you into a dangerous and, over time worthless act.

At the same time they know that prior infection and recovery is effective and remains effective yet they continue to claim that there is “no data” to prove this. They’re full of crap; they not only have the data they’ve analyzed it and know that’s yet another lie; there is no reason to take a jab that wears off if you have been previously infected. Period. And finally a new analysis shows this is not US-centric; infection rates are not correlated with vaccination percentages, which is hard, statistical proof that the jabs are worthless to stop you from getting and giving Covid-19 to others. The ghouls involved in this up and down the line, from hospital administrators to doctors to nurses to politicians all must hang for this.

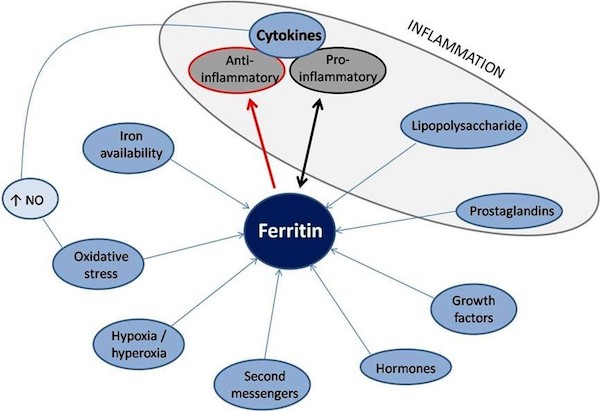

Check your iron.

• Covid-19: The Hyperferritinemic Syndrome (Chesnut)

Ferritin is double edged. It is both an inflammation promoter and an immunosuppressant. But, it needs a trigger for BOTH of its abilities to be engaged. That trigger is none other than the Spike Protein’s cytotoxic attack on virtually EVERYTHING due to its affinity for ACE2! It is said that the Devil’s greatest trick is getting mankind to believe he doesn’t exist. It is the WHO’s and the CDC’s greatest trick that they convinced mankind that SARS-CoV-2 is a natural virus. It is a bioweapon. In particular, the Spike Protein. Only something invented could so artfully, perfectly bridge the gap and induce BOTH a hyperinflammatory state and immunosuppression. The result? ARDS in the short term. AUTOIMMUNITY in the long run.

“Help wanted signs are plastered everywhere and no help is on the way.”

• Slowly, Then All at Once (Kunstler)

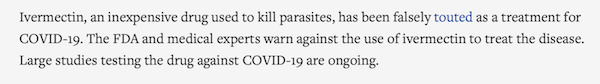

Meanwhile, the country is too busy committing suicide by Covid-19. The stupid vaccine mandates guarantee the loss of hospital services and the failure of medical care generally as nurses, technicians, doctors, and even the cleaning crew peel away from their jobs. Ditto, public education… and just about everything else, really, where employment is conditioned on getting vaxed. A lot of ordinary people have weighed the costs and benefits and have decided to opt out. No thank you on blood clots and a premature death. Help wanted signs are plastered everywhere and no help is on the way. For many businesses, no parts or raw materials are on the way either. The truckers don’t want the vax. With the vaccine program failing, Pfizer and the gang are looking to ride to the rescue with a new magic Covid cure pill that does exactly what Ivermectin has been doing, though constantly maligned in the mainstream news. Get a load of this statement issued by the Associated Press on Friday.

“Falsely touted as a treatment for Covid-19?” That’s about as maliciously dishonest as you can get, since it will contribute to killing people whose lives would otherwise be saved by the Ivermectin protocol — which has been shown to be safe and effective in the clinical setting around the world. By the way, Ivermectin is an off-patent drug costing only about two dollars a pill. Since the Covid-19 early treatment protocol runs five days, that’s about $10 for that medication. It must gall the pharma companies to see that enormous profit-potential slip through their hands. Their go-to drug the past two years has been Remdesivir, which is neither safe nor effective and costs $3,100 for a course of treatment (NPR-News). How much do you suppose Pfizer will charge for its new ivermectin replacement? So, while America strangles its economy to death, seemingly on-purpose, do you suppose the capital markets will not notice? You bet they will, and that means big trouble for Wall Street, probably soon. This is their season of the witch, you know, and just last week they twitched up-and-down five hundred points a day. Looking a little shaky.

Is it a coincidence, by the way, that four officers of the Federal Reserve have been outed for trading stocks and bonds in a pattern that looks an awful lot like front-running the Fed’s own “guidance?” Robert S. Kaplan, head of the Dallas Fed, and Eric Rosengren, head of the Boston Fed announced their “early retirements” last week over stock-trading ethics issues. Fed Vice-chair Richard Clarida’s financial disclosure statement indicated that he dumped millions of dollars in a Pimco bond fund and jammed them into a Pimco stock fund the day before Fed Chair Jerome Powell announced emergency interventions to battle the Covid-19 epidemic in early 2020. Mr. Clarida was involved in deliberations leading to the change in fed policy. And Richmond Fed president Thomas Barkin is under scrutiny for voting to bail out the corporate bond market while sitting on a portfolio of corporate bonds. In his past role as CFO of McKinsey & Co, a global consulting firm, Barkin advised Purdue Pharma L.P. on maximizing sales of its painkiller OxyContin, the infamous scourge of the US opioid epidemic.

“In 2020 the average life expectancy in the US has declined by nearly 2% for a total of 600,000 extra deaths, most of them old people. So, we are talking of some 20 billion dollars saved just in terms of pensions. But it is much more than that considering the saving in health care costs.”

• The Age of Exterminations – III (Ugo Bardi)

Let’s make a few calculations. In the US, there are nowadays about 46 million retirees living on social security. The US spends about 7% of its GDP on pensions, that is, about 1.5 trillion dollars per year (about $30.000/person/year). That’s more than the about 1 trillion dollars that the US government spends for the military budget, bloated as it is. Assuming that you could remove just 10% of the retirees, it would mean saving some 150 billion dollars per year. But, in practice, much more than that if you take into account the health care costs. For instance, summing nursing care facilities and home care for the elderly, we are talking of something close to 300 billion dollars per year, and that does not include hospitalization costs. The potential savings are truly huge: hundreds of billions of dollars.

Of course, exterminating the elderly cannot be done using the same demonization techniques used in the past against the witches and the Jews. Old people are fathers and grandfathers and their offspring won’t normally like to see them burned at the stake or gassed in extermination chambers. But extermination takes many forms, and it is rarely explicitly proclaimed. After all, it never happened in history that you could find a sign with the words “extermination camp” at the gate of an extermination camp. During WWII. for instance, the Germans were told that the Jews were just being relocated, not that they were being exterminated. In other cases, the people being exterminated were glorified as heroes. So, what form could the extermination of old people take? It would be done using well-known propaganda techniques, the main one being to state the exact opposite of what is being done. In other words, when the idea is to kill some people, propaganda will convince everybody that it is done to do them a favor (do you remember the “humanitarian bombs” dropped on Serbia?)

In practice, the weak spot of the middle-class retirees is that they need medical assistance and that they cannot normally pay the skyrocketing costs on their personal saving. So, they could be gently removed from the state budget by degrading the public health care system while saying that it is being modified in order to protect them. A clever way of doing it would be to focus so much on curing a specific single disease that the result would be a decline of the care for the illnesses that mostly affect aged people: cardiovascular diseases and tumors. A parallel measure to intensify the effect would be to degrade the quality of the food available, making it become less nutritious and contaminated with all sorts of pollutants.This method would not affect the elites, who can pay for good health care and and good food, but it will hit directly those who live on pensions.

Now, let’s take a look at the current situation. In 2020 the average life expectancy in the US has declined by nearly 2% for a total of 600,000 extra deaths, most of them old people. So, we are talking of some 20 billion dollars saved just in terms of pensions. But it is much more than that considering the saving in health care costs. These numbers are not large in comparison to the US budget, but not peanuts, either. And what we are seeing is just the start of a trend.

“..suspended without pay in February..”

• Italian Court Sides With Nurse Wrongly Suspended For Refusing Covid-19 Jab (LSN)

A civil court has sided with a nurse who was suspended without pay after she refused the COVID-19 vaccine. The ruling was given by the Tribunal of Milan on September 16, following the appeal of the Italian nurse, who was not named. She had been suspended without pay in February because she refused to receive the jab in defiance of a vaccine mandate imposed by her employer. The tribunal called the suspension “illegitimate” and ordered the employer to pay the nurse her full wages with interest and arrears. The decision overturns previous court rulings for similar cases. It is the first time in Italy that a court of law has ruled in favor of an employee in a case of a suspension or a dismissal for failure to vaccinate.

The decision comes from one of Italy’s most authoritative courts and is considered particularly significant because it overturns precedents and enshrines in law the illegitimacy of dismissing or suspending employees without pay for failing to vaccinate. “This was one of the first cases of suspension of a healthcare worker,” stated Mauro Sandri, the nurse’s lawyer, in an interview on YouTube. Sandri compared the case to that of 5 nurses in a similar situation; they lost their appeal in May. “Everyone [in Italy] will remember the ruling in Belluno, when 5 nurses who were suspended by their employer launched an appeal and lost it,” he said. “The mainstream [media] amplified the outcome of that ruling by going so far as to say that it was pointless to appeal to suspensions imposed by employers.”

Sandri then recalled that the ruling in that case was “unfortunately emulated by other tribunals, including Modena and Verona” and that “a jurisprudence had been created, giving employers license to suspend their employees.” All of Sandri’s previous attempts to appeal such decisions had been unsuccessful. However, he sees that this new decision had overturned the trend. “This decision was overwhelmingly positive, as it established the illegitimate nature of the suspension,” he said. The nurse in question had been suspended since February and had not received any salary since that time. The court therefore ordered the employer to pay her salary for the full period in which she had not been compensated, with added interest, as Sandri pointed out. “The appeal aimed at obtaining her reinstatement in the workplace (…) So we requested that, as well as a full payment of her wages, with arrears.”

But the people who implemented it get to stay? How does that work?

• New Zealand Abandons Controversial ‘Zero COVID’ Policy (SN)

New Zealand has announced it is dropping its controversial ‘zero COVID’ policy after numerous critics pointed out that such an approach to eliminating the virus was impossible. Prime Minister Jacinda Ardern made the announcement earlier today during a press conference in which she acknowledged, “The return to zero has been extremely difficult.” “What we have called a long tail has been more like a tentacle that has been difficult to shake,” she added, noting that the delta variant of the virus forced a change in policy. Critics had repeatedly asked how the country expected to maintain a ‘zero COVID’ policy given the emergence of new variants of the virus and decreasing efficacy of the initial round of vaccinations.

However, with 48% of the population fully vaccinated, no return to normal is expected anytime soon given that Ardern has said 90% will need to be fully vaxxed before the lockdowns will end. Kiwis have faced continuous lockdown measures almost as brutal as their Aussie neighbors since the beginning of the pandemic. As we highlighted in August, Ardern mimicked Australia’s top public health official by telling citizens, “Don’t talk to your neighbors,” after the country went into full lockdown as a result of just a single COVID case being detected. Authorities also previously announced that they would put all coronavirus infectees and their close family members in “quarantine facilities” even if they refuse.

Where will it stop?

Well this is different! Mysterious team appears in Edinburgh to raise awareness… pic.twitter.com/QJ1fjHeQbb

— No More Lockdowns UK (@NMLockdownsUK) October 4, 2021

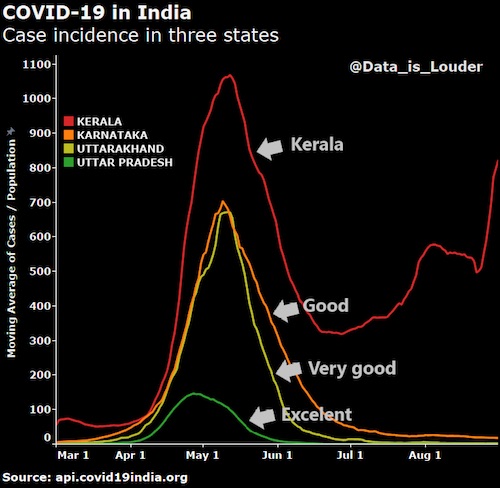

The differences within India are stunning.

• India To Pay $674 Compensation For Every Covid-19 Death (BBC)

India’s top court has approved the government’s decision to pay 50,000 rupees ($674; £498) as compensation for every death due to Covid-19. The Supreme Court’s order followed a petition by lawyers seeking compensation under India’s disaster management laws. India has officially recorded more than 447,000 Covid-19 deaths so far. However, experts believe that up to 10 times more people could have died in the pandemic. They have arrived at different estimates after examining excess deaths – a measure of how many more people are dying than would be expected compared to the previous few years. On Monday Justice MR Shah said the “next of kith and kin of the deceased person” shall be paid this compensation within a month of applying. This would be “over and above the amounts paid by the centre and state under various benevolent schemes”, he said.

The court added that the compensation should be paid within 30 days after a family submits an application. In June, petitioners sought the court’s intervention in paying compensation to the families of Covid-19 victims. They said since Covid-19 was “specially” notified as a disaster under India’s National Disaster Management Act, compensation should be paid to the victims. The 2005 law was enacted for efficient management of disasters, including preparation of mitigation strategies, capacity-building and compensation for lost lives, injuries and damaged properties. The law says monetary assistance of 400,000 rupees should be paid to family of people who have lost their lives in a disaster.

Kulldorff.

• Harvard Epidemiologist Censored by LinkedIn for Defending Healthcare Jobs (BI)

Now LinkedIn – owned by Microsoft – appears to have joined the censorship brigade, targeting probably many venues but the Brownstone Institute in particular. The timing is particularly awkward because of the potentially millions of people who could be fired from their positions in the coming weeks and months for non-compliance with Covid mandates. Brownstone has defended the rights of workers to choose against vaccination and in favor of natural immunity or exposure through normal living. The takedowns of our posts began last week when the venue took down a piece arguing against the politicization of disease. The post was put up and disappeared. This happened to everyone who attempted to post the piece. It was a magic disappearing act, clearly targeting the URL and content.

We thought we found a workaround by posting the link for mobile viewing but LinkedIn’s algorithms figured that one out quickly and took it down too. As with all such cases, the first impulse is to believe that there was something about that piece that the censors found objectionable, perhaps in tone or content. And that piece did have an edge about it. Surely it was just once. It won’t happen again, or so we hoped. Now we find a pattern. The famed Harvard epidemiologist Martin Kulldorff – one of three brave scientists who drafted the Great Barrington Declartion one year ago today – wrote a piece in defense of the nurses at a Harvard hospital who are refusing the vaccination. These nurses and others in the hospital had worked mightily and tirelessly for 21 months with daily exposure to SARS-CoV-2 and had thereby acquired natural immunity which all research has shown to be as good or better than the vaccine.

They do not need it. It is unscientific to the point of absurdity for these immunity mandates not to consider natural immunity, about which humanity has known for 2.5 millennia. “Hospitals are firing nurses and other staff with superior natural immunity while retaining those with weaker vaccine-induced immunity,” wrote Kulldorff. “By doing so, they are betraying their patients, increasing their risk for hospital-acquired infections…. If university hospitals cannot get the medical evidence right on the basic science of immunity, how can we trust them with any other aspects of our health?” LinkedIn at first accepted the article on its platform. It unfurled the post with image and excerpt. It achieved a very high reach with many likes and shares. This makes sense because so many people on this platform are either losing their own jobs or losing colleagues in every profession. Kulldorff was bravely coming to their defense.

Within the first hour of posting, the unfurled posts started disappearing. Kulldorff’s own posting on his LinkedIn page disappeared. So did the Brownstone post. Along with it, all shares were made to disappear too. This article – by one of the world’s leading scientists at one of the world’s most prestigious universities that defended workers and their jobs – was being torn down by a platform designed to assist people in their career advancement.

“..the timeline for when the virus was actually spreading in the wild would dramatically shift: from December 2019 to as early as May 2019..”

• New PCR Test Intelligence Suggests Covid-19 Virulent Earlier Than Thought (RM)

The coronavirus may have been spreading through Wuhan, China much earlier than previously thought, according to an analysis of Chinese procurement records by Internet 2.0, a company that specializes in digital forensics and intelligence analysis. According to a report released Monday, entitled “Procuring for a Pandemic: An Assessment of Hubei Province PCR Procurement Contracts,” there was a dramatic increase in the number of Polymerase Chain Reaction, or PCR, contracts inked by Hubei Province and institutions in and around Wuhan in the second half of 2019. [..] PCR tests are the gold standard for COVID-19 virus testing and if there was spike in the use of those tests in the Spring of 2019, as the report suggests, that could mean the timeline for when the virus was actually spreading in the wild would dramatically shift: from December 2019 to as early as May 2019.

Among other things, there was a dramatic increase in the total amount of money spent on these tests in and around Wuhan, in Hubei province, the report said. In 2015, institutions there spent about 19.1 million yuan ($2.9 million) on PCR tests. Two years later, in 2017, they spent about 29.1 million yuan and in 2018, institutions around Wuhan spent 36.7 million on these tests. But when analysts looked at the spending in 2019, the government contract value for PCR tests was higher than the previous two years combined: 67.4 million yuan. (The tests got more expensive, which also suggests they got pricer as demand went up, the report says.) A team of experts from the World Health Organization investigating the origins of the pandemic visited The Wuhan Institute of Virology back in June to see if it could link its research on coronaviruses with the pandemic.

WHO’s findings have been inconclusive, though the Internet 2.0 report notes that the institute was one of the biggest purchasers of PCR tests and equipment in the second half of 2019. The company’s analysis is based on data collected through bidcenter.com.cn, which tracks Chinese government contracts. According to the researchers, there were 52 contracts found in 2015, and about the same number in 2016. In 2019, though, institutions like the Wuhan University of Science and Technology, the Wuhan CDC, and Hubei CDC had secured 135 contracts for PCR tests. Nearly double the number of the previous two years combined.

The monthly breakdown of purchases offers clues, too. There was a significant increase in spending on PCR tests and equipment over the summer of 2019, starting in May, which was remarkably different from the spending patterns in previous years. “The full inventory of this catastrophe is still being compiled,” Robert Potter, one of the authors of the report, said in a written statement. “What is clear is that investigating the coverup of the virus still has some distance to go before it is fully understood. The data presented here gives us a strong indication that the outbreak started prior to December 2019, meaning the information gap and window for the emergence of the virus is larger than when we started this project.”

Are we measuring the right thing? This appears to suggest that those who had severe Covid are better protected. I doubt it.

• Antibodies Last Over A Year After Covid-19 Infection (JTN)

Most people who have been infected with SARS-CoV-2, the virus that causes COVID-19, will carry antibodies for at least a year, according to a recent peer-reviewed study. The European Journal of Immunology accepted a study on Sept. 24 from scientists at the Finnish Institute for Health and Welfare, who studied 1,292 subjects eight months after infection for the presence of antibodies. Their findings included 96% of subjects still carrying neutralizing antibodies and 66% with the nucleoprotein IgG antibody. After randomly selecting 367 subjects from the original cohort who were not yet vaccinated a year following infection, the scientists found that 89% of subjects still had neutralizing antibodies, and 36% with the IgG antibody.

Subjects who had experienced a severe SARS-CoV-2 infection had higher antibody levels, anywhere from two to seven times as many antibodies as those with mild infections at least 13 months after contracting the disease. While the antibodies provide lasting protection against the original SARS-CoV-2 virus, their neutralization efficiency against the Alpha, Beta, and Delta variants decreased over time. The neutralizing antibodies “were only slightly reduced” in the Alpha variant and “considerably declined” in the Beta variant. However, “over 80% of the subjects who had recovered from severe” SARS-CoV-2 infection still had neutralizing antibodies against the Delta variant a year after being infected.

Nature Medicine published a study in May that found “that neutralization level is highly predictive of immune protection” against SARS-CoV-2. A preliminary study, which is not yet peer-reviewed, found that antibodies decreased 10-fold just seven months after subjects received the second dose of the Pfizer COVID-19 vaccine.

The decisions are made by people who don’t understand what energy is.

• Europe’s Energy Crisis Presents A Real Danger (Lacalle)

This week the wholesale price of electricity has exceeded the psychological barrier of 200 euros per megawatt hour in most countries of the European Union. Although the daily price currently only affects 15% of the energy sold, since the rest is locked for almost twelve months since last winter at much lower prices, it is a sign of future risk. Thousands of contracts are going to have to be revised with huge price increases in the next three months when the locked contracts expire. The price of liquefied natural gas (LNG) has soared to $34/mmbtu delivered in December and January. In comparable energy terms it would be about $197 per barrel of oil equivalent, according to Morgan Stanley. Meanwhile, the price of natural gas (NBP) has risen more than 200% in 2021.

The price of CO2 emission rights has increased more than 1,000% since 2017, and more than 200% in 2021. This concept, which is a hidden tax for which the governments of the European Union are going to collect more than 21 billion euros in 2021, adds to the inflationary spike.These extraordinary tax revenues should be used to mitigate the price increases in consumer bills and avoid an energy crisis in Europe that will sink the recovery. Two key factors explain the rise in energy prices and in both there is a responsibility of governments: The forced closure of the economy is a key factor to understand the damage generated in the supply chains, and the prohibition of investment in gas resources and abandoning nuclear in Germany has led to a more volatile and expensive energy mix in peak demand periods.

This, coupled with a political decision to impose a volatile and intermittent energy mix has left Europe much more dependent and exposed to gas price fluctuations. Renewable energies work 20% of the time and when they do not work, the only guarantee of supply is to use natural gas, which tends to happen as Asia demand rises and when its price has skyrocketed. Of course, demand is a very important factor, but we cannot forget that, in natural gas, as in coal, there is no supply problem. There is, in fact, excess capacity. Under normal circumstances, the price of natural gas and CO2 would have moderated once the base effect dissipated -in June-, but we forget the disastrous impact of monetary and government interventionism. The rise in CO2 emission rights is directly the fault of the tax voracity of European governments, which have massively limited the supply of these rights so that the price rises.

Additionally, the increase of many goods and services is directly due to the massive money supply growth in 2020, well above the demand for money, generating inflation by political decree. I do not understand how the fiscal voracity of some governments blinds them to two important risks: an energy crisis that leaves businesses and families suffocated by a price increase caused by political decisions, and a massive reaction of the population against environmental policies when they see prices skyrocket due to planning errors (more volatile and intermittent energy mix and dependent on gas) and legislation (charging citizens with the full cost of environmental policies and making those who pollute pay, and those who do not, pay even more ).

15 years of WikiLeaks

Julian Assange: Why the world needs WikiLeaks (Within months of this talk, #Assange was under house arrest. He has been arbitrarily detained since 7 December 2010.)

Ron Johnson

The question all Americans should be asking: did Dr. Fauci and our federal health agencies’ policy prescriptions work?

700,000 dead, the human toll, the economic devastation, and trillions added to our debt. pic.twitter.com/PxdCW8Zbmg

— Senator Ron Johnson (@SenRonJohnson) October 5, 2021

.@SenRonJohnson says we do not have a FDA approved vaccine in America. The @US_FDA did a bait and switch with the vaccine approval. The vaccine available in Europe is approved but the @pfizer vaccine used in America only has emergency authorization use. pic.twitter.com/rr22iwmBPQ

— The Dirty Truth (Josh) (@AKA_RealDirty) October 5, 2021

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.