Russell Lee Washington DC, “Cafe on L Street.” 1938

Great metaphor.

• A System That Is Stable Only When Under The Influence (BBG)

From BBG’s Richard Breslow: “When investors used to say they didn’t like uncertainty, it meant they expected consistency in how policy makers would interpret incoming data. Situations evolve and exogenous shocks happen, but at least let’s all be on a similar wave length. Then you do your analysis, I’ll do mine and that’s what makes markets. That ship has sailed. Current levels of volatility aren’t good or fun and certainly not “normal.” It’s a problem of our own making. From top to bottom we have redesigned a system that is stable only when under the influence. I read this morning that money managers are pining away for a return to the happy and calm days of 2011-2015. The world was in existential crisis, but stocks were being manipulated higher. Happy days, I’m getting my (market) fix.

A casualty of this current volatility is that at any given time there are no rational explanations for what’s going on. Back and forth swings of meaningful proportion are characterized, by necessity, with a random reason generator. If we don’t do so we’d have to admit to a much deeper systemic defect. Better to just put it down to simple things like China’s economy or the European banking system is collapsing. They’ll be forgotten at the next rally. What would be hard news is G-20 participants giving more than lip service to their host’s pre-summit statement: “We cannot just rely on monetary policy. Fiscal policy must play a role,” and “We understand that, as the second-largest economy, our policies spill over to others. We also understand that U.S. policies spill over, we must stress policy coordination.”

Yes, Mr. Lew, there is a crisis. German 10-year bund yields 15 basis points. Analysts are touting technical hammer patterns formed yesterday in the S&P 500 and Treasury 10-year yields. Everything should rally now. Somehow, I doubt they’ve hit the nail on the head. The only thing that has changed is the price. El Condor Pasa. A condor by any other name is still a vulture.”

Read more …

A few words of wisdom.

• OECD’s William White: In Terms of Debt, This Is Way Worse than 2007 (FS)

William White, chairman of the Economic and Development Review Committee at the OECD and former chief economist at the Bank for International Settlements (BIS), says the risks posed by global debt levels are greater today than they were in 2007 and that central banking monetary policy has lost its effectiveness. He also explains the crucial differences between modern macroeconomic modeling and complexity theory (or viewing the economy as a complex adaptive system) and the key lessons this has for policymakers, both fiscal and monetary. Here’s a portion of his recent interview with Financial Sense airing Friday on the Newshour page:

“If you think about a crisis period as a period of deleveraging, in fact this has not happened and we’ve gone in the very opposite direction. Now, on the household side, clearly there have been some improvements made but on the corporate side in the US, things have gotten significantly worse—the debt ratios for corporations have gone up very substantially as has government debt… More importantly—again, when I say the situation is worse today than it was in 2007—in 2007 this debt problem was essentially confined to the advanced market economies. Since then, the debt ratios—the private debt ratios in particular—have exploded in the emerging market countries and so we now have in a sense a global problem whereas in 2007 you might say we had a regional problem with the advanced market economies.

But now it’s basically everywhere so, yes, I do think that the situation is worse than it was then… When I first came to the BIS in 1994, we started warning about the credit flows into Southeast Asia well before the Asian crisis happened and…it was in the early 2000s that we really started to focus on what was going on in the advanced market economies… The story that we were telling then was really one of the Greenspan put starting in 1987 and every time there was a problem, the answer was to print the money or ease monetary conditions and the debt ratios ratcheted up and up and up…

So we had this problem in ’87 and the answer was easy money; then we had this problem in 1990-1991 and, again, the answer was easy money. The response to the Southeast Asian crisis was don’t raise rates even though all sorts of other indicators said you should. Then it was easy money again in 2001 and, of course, in 2007…every time the headwinds of debt have been getting higher and higher and the monetary easing required to overcome that has had to get greater and greater and the logic of that takes you to the point where you say, well, in the end monetary easing is not going to work at all and…that’s where I am today… Unfortunately, we are still, as far as I can tell, both the BIS and myself are still talking to a brick wall…

Read more …

David in fine form: “China is a monumental doomsday machine that bears no more resemblance to anything that could be called stable..”

• The Red Swan And Other Reasons To Be Very Afraid (David Stockman)

The Red Chip casino took another one of its patented 6.5% belly flops last night. In fact, more than 1,300 stocks in Shanghai and Shenzhen fell by 10% – the maximum drop permitted by regulators in one day – implying that the real decline was far deeper. This renewed carnage was the worst since, well, the last 6% drop way back on January 29, and It means that the cumulative meltdown from last June’s high is pushing 45%. And all this red chip mayhem did not come at an especially propitious moment for the regime, as the Wall Street Journal explained: It comes at an awkward moment for the Chinese government, which is hosting the world’s leading central bankers and finance ministers starting Friday. China has been expected to use the G-20 meeting to address global anxiety about its economy and financial markets.

Worries about China’s economic slowdown and the volatility of its markets have weighed on investment decisions around the world. But if we are remarking on “awkward”, here’s awkward. The G-20 central bankers, finance ministers and IMF apparatchiks descending on Shanghai should take an unfiltered, eyes-wide-open view of the Red Ponzi fracturing all about them, and then make a petrified mad dash back to their own respective capitals. There is nothing more for G-20 to talk about with respect to China except how to get out of harms’ way, fast. China is a monumental doomsday machine that bears no more resemblance to anything that could be called stable, sustainable capitalism than did Lenin’s New Economic Policy of the early 1920s. The latter was followed by Stalin’s Gulag and it would be wise to learn the Chinese word for the same, and soon.

The regime is in a horrendous bind because it has played out the greatest credit spree in world history. This cycle of undisciplined, debt-fueled digging, building, spending and speculating took its collective balance sheet from $500 billion of debt in the mid-1990s to the $30 trillion tower of the same that now gyrates heavily over the land. That’s a 60X gain in debt over just two decades in an “economy” that has no honest financial markets; no legal system and tradition of bankruptcy and financial discipline; and a banking system that functions as an arm of the state, cascading credit down from the top in order to “print” an exact amount of GDP each month on the theory that anything that can be built, should be built in order to hit Beijing’s targets.

Read more …

One by one, the big banks have double digit losses when reporting their numbers. The RBS CEO tries a “I meant to do that”. Yeah.

• RBS Falls -11% After £1.98 Billion Annual Loss (BBG)

Royal Bank of Scotland said it would take longer than originally planned to resume shareholder payouts after reporting its eighth consecutive annual loss, driven by costs for past misconduct. The shares dropped the most since 2012. The net loss narrowed to 1.98 billion pounds ($2.77 billion) in 2015 from 3.47 billion pounds a year earlier, the Edinburgh-based lender said in a statement on Friday. Pretax profit excluding conduct and litigation charges and restructuring costs fell about 28% to 4.41 billion pounds, missing the 4.45 billion-pound average estimate in a company-compiled survey of seven analysts. RBS last posted net income in 2007.

Chief Executive Officer Ross McEwan, 58, is facing a pivotal year in his efforts to resume dividends for the first time since the bank’s 45.5 billion-pound taxpayer-funded bailout in 2008. The bank said Friday outstanding issues, including a potential settlement with U.S. authorities over sales of mortgage-backed securities, mean it’s now “more likely that capital distributions will resume later” than his original target of the first quarter of 2017. “Clearly there are big conduct charges we still face, not least in relation to U.S. mortgage-backed securities,” McEwan said on a conference call with journalists. “I look forward to the day when we can put these issues behind us.”

Read more …

Curious choice of words. China is a big looming crisis. Straight-faced pretending is not going to change that.

• China Unveils Its Deliverables for G-20 (BBG)

China began signaling what its officials plan to present to counterparts at the two-day Group of 20 meeting in Shanghai, laying out a platform for more government spending and renewed pledges of currency stability. Notably rejected in comments from Finance Minister Lou Jiwei published Thursday was a proposal that emanated from some private-sector analysts for a grand, 1985 Plaza Accord-style deal among G-20 members to guide exchange rates. Vice Finance Minister Zhu Guangyao said fiscal stimulus should be deployed to boost global growth, while Yi Gang, the deputy central bank governor, said China will maintain a relatively stable currency as it embraces market forces. Clouding what should have been China’s chance to showcase its agenda, the nation’s stocks plunged anew on the eve of the Feb. 26-27 meetings of central bank chiefs and finance ministers, as surging money-market rates signaled tighter liquidity.

“The stock slump has been triggered by the disappointment of investors in the government’s ability to deliver economic reforms,” said Hong Kong-based Lu Ting, chief economist at Huatai Securities Co. “Any recovery in the stock market will rely on concrete outcomes of reforms, not empty talk.” How policy makers should respond to weakening global demand is set to dominate the agenda at the Shanghai meeting. Chinese officials including Yi’s boss, Zhou Xiaochuan, have stepped up communication leading into the summit, trying to relieve global concerns over China’s economic and currency outlook. Bank of Japan Governor Haruhiko Kuroda Thursday called for a dialog on China’s economy at the G-20 meeting. “The nation is going through various structural changes,” Kuroda told lawmakers in Tokyo. Given China’s size, it “can have a large impact on Asia and the global economy. So, I would like to have honest exchange of opinions.”

Read more …

What’s the correct word? Obfuscation sounds about right.

• China Tweaks Monetary Stance as Zhou Flags Scope to Act (BBG)

China’s central bank tweaked the description of its monetary policy stance to reflect a recent ramp-up in liquidity injections and moves to guide money market rates lower, with Governor Zhou Xiaochuan highlighting scope for further actions if needed. “China still has some monetary policy space and multiple policy instruments to address possible downside risks,” Zhou said at a conference in Shanghai, speaking hours before meeting his counterparts from the Group of 20 developed and emerging markets. Asian stocks, industrial metals and higher-yielding currencies rose. The People’s Bank of China separately published a statement defining current policy as “prudent with a slight easing bias.” The PBOC had previously used language pledging to maintain a prudent policy while maintaining “reasonable, ample” liquidity.

The latest comments confirm “the underlying reality that the central bank is doing its bit to cushion growth and keep the wheels churning,” said Frederic Neumann at HSBC. “Today’s statement is thus a deliberate signal to FX traders the world over not to fret too much over the PBOC’s firepower.” Economists surveyed by Bloomberg News this month forecast additional reserve requirement ratio and benchmark interest-rate reductions in 2016. The shift “brings the language on the central bank’s policy stance into line with the reality,” Bloomberg Intelligence chief Asia economist Tom Orlik wrote in a note. Still, “the need to avoid selling pressure on the yuan will make it more difficult to cut benchmark rates in the short term.”

Read more …

No time to panic.

• “This Is Not A Moment Of Crisis”: US Treasury Sec. Jack Lew (NA)

“This is not a moment of crisis,” U.S. Treasury Secretary Jacob “Jack” Lew said, in an interview with Bloomberg TV. “This is a moment where you’ve got real economies doing better than markets think, in some cases.” The interview, which ran on Wednesday, just before Lew headed to Shanghai, China, for the latest G20 summit of finance ministers and central bankers, will probably do little to allay investor fears that the global economy is indeed “in the middle of a full blown crisis.” “I don’t think this is a moment in time when you’re going to see individual countries make the kinds of specific commitments that have been made in some other contexts that have been marked by real crisis,” Lew said of the G20 meeting (of the world’s 20 largest national economies), which will take place in Shanghai Friday and Saturday, February 26-27.

“The idea is how do you avoid having things go to a place that you don’t want them to go,” Lew said. “That’s a different conversation than what do you do when you’re in the middle of a full blown crisis.” “Weakness in demand globally is a problem that can’t be solved just by everyone looking at the United States,” said Lew, leading into his central interventionist message that governments must work together to “stimulate” the global economy with more government spending and more government debt. Other countries and regions, including China, have to look at what they can do “to stimulate consumer demand,” he stressed. “There are structural issues that need to be addressed,” said Lew, with some countries needing regulatory and/or financial reform. “But fiscal and monetary policies are important tools. When used together they’re powerful. That’s the message we bring.”

Lew’s “non-crisis” message echoed that of International Monetary Fund Managing Director Christine Lagarde a few days earlier. On February 19, Lagarde, who had just been confirmed for a second five-year term as IMF chief, urged the G20 nations to coordinate economic policy. “Are we in a 2009 moment, I don’t think so. Are we in a moment where coordination is needed? Yes,” Lagarde said, a reference to the 2008-2009 financial crisis.

Read more …

And then there’s Schäuble.

• Germany Opposes Any G-20 Fiscal Stimulus (BBG)

Germany’s finance minister opposed any fiscal stimulus plan from the Group of 20, whose top economic officials gather Friday, and instead sought to focus on structural reforms to strengthen national growth rates. Wolfgang Schaeuble, speaking hours before meeting with his counterparts from the G-20 developed and emerging markets, also said that the space for monetary policy has been exhausted. He warned that using debt to fund growth just leads to “zombifying” economies. “Talking about further stimulus just distracts from the real tasks at hand,” Schaeuble said at a conference in Shanghai. German policy makers “do not agree on a G-20 fiscal stimulus package, as some argue in case outlook risks materialize.”

Schaeuble’s stance potentially puts him in conflict with other G-20 members. Treasury Secretary Jacob J. Lew said in an interview before heading to Shanghai that the U.S. wants a more serious commitment from other G-20 nations to use monetary policy, fiscal measures and structural reforms to stoke demand. China’s finance chief said that his nation for its part will be expanding its fiscal deficit. The German finance minister said that the slide in oil prices has already offered a “huge” stimulus for demand. He also said that expansive fiscal policies could lay the groundwork for a future crisis.

Read more …

Lamest headline of the year award. Trying to lull you to sleep.

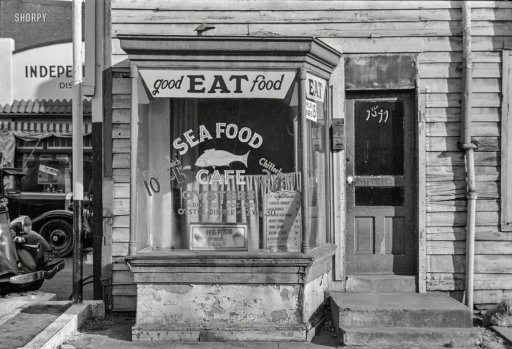

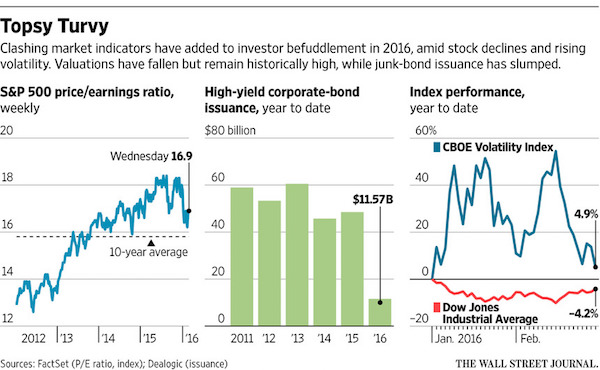

• Market Turmoil Eases, but Investors Remain Wary (WSJ)

The crushing start to the year for markets has taken a respite. But poor earnings, heightened volatility and turbulence in the market for low-rated corporate bonds remain, stoking concerns that the breather for stocks may be just a blip. Thursday marked the sixth trading day out of nine that U.S. stocks ended on an up note, putting February in the green for major indexes. The Dow industrials are up 1.4% this month after slumping more than 9% in the first three weeks of the year. In a sign of newfound resilience, stock markets in both Europe and the U.S. on Thursday shrugged off a 6.4% selloff in Chinese stocks. Two months ago, declines like that dragged down global indexes. And U.S.-traded oil, which lately has moved in the same direction with stocks, has posted a strong week, up 4.2% in what bulls call a positive sign for global growth.

The buoyancy suggests investors are weathering negative news or aren’t as worried the global economy is in decline or that the aging bull market has peaked. Yet, the recent rally faces obstacles. Even as stocks rose Thursday, investors bought U.S. Treasurys, sending prices up and yields down. And new cracks emerged in the corporate bond market. Bankers for Solera Holdings this week had trouble generating interest in bonds for a takeover of the software firm, suggesting it is getting harder for heavily indebted companies to borrow. The slowdown in the market for high-yield, or riskier, corporate bonds comes amid a poor fourth-quarter earnings season. Earnings at S&P 500 companies are on track to have dropped from a year ago for three straight quarters, which would be the first time that has happened since 2009.

Overall, earnings for S&P 500 companies fell 3.6% from a year ago in the fourth quarter, with about 95% of companies having reported, according to FactSet data. “You still have a profits recession,” said Russ Koesterich at BlackRock. “There are limits to how far [the rally is] going to go.”

Read more …

Export it?!

• The Big New Threat to Oil Prices: A Glut of Gasoline (WSJ)

Refineries in the U.S. Midwest are losing their thirst for oil, posing a new risk for the battered crude market. The Midwest accounts for nearly a quarter of the crude processed in the U.S. and is home to shale producers that have few other outlets for their oil. But refiners there are already swimming in gasoline and other fuel, forcing them to cut back production until the excess can be worked off. The result has been more crude oil available in the market, worsening a glut that has been undermining oil prices for the past year and a half. With U.S. crude inventories at the highest level in more than 80 years, some storage hubs have little room left to store oil. CVR Refining is among the companies that have scaled back. The company said recently that it reduced runs at its 70,000-barrels-a-day refinery in Wynnewood, OK, by as much as 10,000 barrels a day.

“It doesn’t make sense to process something when you’re not making anything on it,” Chief Executive Jack Lipinski said during a Feb. 18 earnings call. Refiners in the Department of Energy’s Midwest region, which stretches from North Dakota to Ohio and south to Oklahoma and Tennessee, ran at 92.9% of capacity last week, down from 98.2% a month ago. That drop is significant because it marks the first time several refineries in the region have opted to reduce activity for economic reasons—a marked change after more than a year of refiners processing as much crude as possible. Refining margins are lower throughout the country this year, including in the Gulf Coast region, where more than 50% the country’s refining capacity is concentrated.

But refiners there have more choices when it comes to buying crude oil and can substitute cheaper options if they become available. And they can put fuel on tankers to sell overseas if supplies build up too much. Refiners profit on the difference between oil prices and fuel prices. Oil prices have dropped 70% since mid-2014 to around $32 a barrel currently, but robust demand for gasoline kept prices at the pump from falling as quickly last year, boosting refiner margins. However, analysts question whether demand will increase strongly this year, especially given broader concerns about sluggish economic growth. On a four-week average basis, U.S. gasoline demand fell in January compared with the year before, according to Energy Information Administration estimates. “Crude is well-supplied, products are well-supplied,” said David Leben at BNP Paribas. “We have to find the demand.”

Read more …

29,000 in total now.

• Halliburton Cuts Another 5,000 Workers to Cope with Oil Downturn (BBG)

Halliburton said it’s cutting another 5,000 workers, or 8% of its global workforce, to cope with the worst crude market downturn in 30 years. The world’s second-largest oilfield services provider said last month it cut nearly 4,000 jobs in the final three months of 2015. With the latest layoffs, the company will have let go of nearly 29,000 workers, or more than a quarter of its headcount since staffing reached its peak in late 2014. “We regret having to make this decision but unfortunately we are faced with the difficult reality that reductions are necessary to work through this challenging market environment,” Emily Mir, a spokeswoman, said Thursday in an e-mailed statement. “We thank all impacted employees for their many contributions to Halliburton.” The oil industry slashed more than $100 billion in spending and more than 250,000 jobs globally last year to cope with tumbling oil prices, which are down about 70% over the past year and a half due to an oversupply of crude.

Read more …

Too many threats to defuse them all.

• Brexit: Fraying Union (FT)

“We are not withdrawalists as a party, but we want to have a new deal with the EU,” says Morten Messerschmidt, who won a seat in the European parliament after [his] party topped all others in Denmark’s 2014 EU elections, with 26.6 per cent of the vote. “We are happy that a big country such as Britain is talking about taking back sovereignty and is willing to make the final sacrifice.” Denmark is seen as one of the countries most vulnerable to contagion if Britain were to vote to leave the EU. In many ways, the Danish are the most British of continental Europeans when it comes to Brussels, delaying its EU membership until the UK became a member in 1973 and remaining the only other country with an “opt-out” of the EU requirement to join the euro.

Denmark is hardly alone in harbouring political movements that wish to leave the EU. The failure of most of Europe to pull out of its post-eurocrisis economic funk, coupled by the largest influx of refugees in more than a generation, has left mainstream parties across the continent under siege. Some fear a British exit would push many of these countries over the edge, sparking louder calls for copycat referendums that could begin to unravel the great postwar European project. Although EU leaders believe Scandinavia and the “Visegrad Four” countries in central and eastern Europe — Poland, Hungary, Slovakia and the Czech Republic — would feel the most immediate pressure from a British exit because of longstanding anti-EU sentiment in those blocs, leading voices from “core Europe” are now lending support for similar ventures.

In the Netherlands, a founding member of both the EU and the euro, Geert Wilders, whose far-right Freedom party has held a commanding lead in national polls for months, recently said a British exit would make it easier for his country to leave the EU — something he promised to deliver should he become prime minister. “The beginning of the end of the EU has already started,” he said last month. “And it can be an enormous incentive for other countries if the UK would leave.” In France, another member of the EU’s founding six, the far-right National Front, which like the Freedom party is also leading in polls ahead of a presidential election next year, has promised a British-style referendum over EU membership within six months of coming to power. “Until now, the EU has only enlarged itself. Brexit would prove the EU is not an inevitable plan,” says Florian Philippot, the National Front vice-president. “Soon people would also realise that the UK lives well without being part of the EU. That there would be no economic collapse, no chaos.”

Read more …

That’s how to do it.

• Greek Health Minister Instructs Hospitals To Treat Uninsured Patients (Kath.)

The process of providing free healthcare to patients who have not recently earned social security credits got under way on Thursday. Health Minister Andreas Xanthos issued instructions to state hospitals to provide medicines, tests and treatment to uninsured patients without charge. The minister’s note came in the wake of the so-called “parallel program” being voted through Parliament on Saturday. The package of measures is aimed at easing the impact of the crisis on the most vulnerable social groups, with the provision of free healthcare for all being its centerpiece.

The law also allows migrants living in Greece legally, as well as specific categories that do not have residence papers, such as pregnant women, refugees and minors, to receive free care. According to ministerial decisions in 2014, uninsured Greeks could claim free healthcare if they could prove they could not afford it, while they could also obtain medicines under the same terms as those insured with EOPYY, meaning they would have to pay 1 euro for each prescription as well as part of the cost of the drugs.

Read more …

And we thought they were so well organized…

• Over 130,000 Migrants Missing In Germany (EUO)

More than 13 percent of asylum seekers arriving to Germany last year have disappeared from view of the authorities, the German daily Sueddeutsche Zeitung reported Friday (26 February) based on a response from the federal interior ministry to a question by the left-wing Die Linke party. More than 130,000 asylum seekers who were registered last year in Germany have not arrived at their designated reception facility, according to the report. The interior ministry said the reasons could be traveling on to a different country or “submersion into illegality”. Some asylum seekers who have family or friends already living in Germany might decide to stay with them, rather than in big reception facilities with little information or few things to do.

The head of Germany’s federal office for migration Frank-Juergen Weise said on Thursday that there are currently up to 400,000 people in the country whose identities are unknown to authorities. Germany is also struggling to send back asylum seekers to other EU countries under the Dublin regulation, which says people have to register their request in the country where they first enter the EU. German authorities made a request to a European partner to take back refugees for only one in every 10 applicants. In 2014, this was the case for one in every five refugees. The report comes on a day when the German upper house, the Bundesrat is to hold a final vote on new asylum rules.

The legislation, already passed by the Bundestag, the lower house on Thursday, aims to speed up asylum procedures, making it easier to deport migrants whose claim has been rejected. It also sets up special reception centers in which asylum applications by certain groups of asylum-seekers would be processed within three weeks. Asylum seekers from so-called “safe countries of origin”, where they can be sent back or people who have refused to help authorities process their applications would be housed there.

Read more …

if Turkey doesn’t do what they want, they will close the Greek border? That’s exactly what Turkey ia aiming for, put pressure on Greece.

• Ministers Demand Drop In Migrant Flows From Turkey Before March 7 (Reuters)

EU ministers on Thursday raised the prospect of further tightening unilateral border controls unless there was a sharp drop in the number of migrants arriving from Turkey by the time of an EU-Turkey summit on March 7. Seven European states have already reinstated border controls within the cherished but creaking Schengen free-travel zone, putting huge strain on Greece, which can no longer wave the tide of arrivals from Turkey onward through the Balkans. More states said they would follow suit unless a deal promising Turkey €3 billion in help to house refugees from the Syrian war in return for preventing them travelling on to Europe yielded fruit before the summit. “By March 7, we want a significant reduction in the number of refugees at the border between Turkey and Greece,” German Interior Minister Thomas de Maiziere said as he arrived at an EU justice and home affairs ministers’ meeting in Brussels.

Germany has been pushing the Turkey plan hard but many other EU states are increasingly frustrated and sceptical. [..] “The 6th of March, the 7th of March is when you can expect the spring influx to rise … we have until that time to find solutions that mostly involve the Greek-Turkish influx, the border there,” said Klaas Dijkhoff, migration minister for the Netherlands, which now holds the EU’s rotating presidency. ”If that doesn’t lead to lower numbers, we’ll have to find other measures and we’ll have to do more contingency planning … That’s a very crucial date to see to what extent we succeed in lowering the influx towards Europe as a whole, or we have to take other measures.” [..] “The outlook is gloomy … We have no policy any more. We are heading into anarchy,” said Jean Asselborn, Luxembourg’s foreign minister. “Our credibility is in doubt, and that is very bad for Schengen and the EU.”

Read more …

This is exactly what I talked about in my article “The Balkanization of Europe” yesterday. Now Erdogan holds the power over the survival of Schengen, and the EU. What an insane alliance that is. Stick a fork in all of it.

• Europe’s Free Travel Will End Unless Turkey Halts Migrant Flow (Reuters)

Europe’s cherished free-travel zone will shut down unless Turkey acts to cut the number of migrants heading north through Greece by March 7, EU officials said on Thursday. Their declaration came as confrontations grow increasingly rancorous among European countries trying to cope with the influx of refugees. Those recriminations culminated in Greece’s recalling its ambassador to Austria on Thursday. “In the next ten days, we need tangible and clear results on the ground,” the top EU migration official, Dimitris Avramopoulos, said after EU justice and home affairs ministers met in Brussels on Thursday. “Otherwise there is a danger, there is a risk that the whole system will completely break down.” EU leaders are now pinning their hopes on talks with Turkey on March 7 and their own migration summit on March 18-19. The two meetings look like their final chance to revive a flailing joint response to the crisis before warmer weather encourages more arrivals across the Mediterranean.

Seven European states have already restored border controls within the creaking Schengen passport-free zone. More said they would unilaterally tighten border controls unless a deal with Turkey shows results before the two March summits. That deal promises Turkey 3 billion euros ($3.3 billion) in aid to help it shelter refugees from the Syrian war, in return for preventing their traveling on to Europe. “By March 7, we want a significant reduction in the number of refugees at the border between Turkey and Greece,” German Interior Minister Thomas de Maiziere said. “Otherwise ,there will have to be other joint, coordinated European measures.” Germany has been pushing the Turkey plan hard. Many other EU states are increasingly frustrated and skeptical, though.

[..] “Many discuss how to handle a humanitarian crisis in Greece, which they themselves are trying to create,” said the country’s migration minister, Yannis Mouzalas. “Greece will not accept unilateral moves. Unilateral moves can also be made by Greece.”

Read more …

A set-up.

• EU: Greece Wouldn’t Be The Worst Place To Have A Humanitarian Crisis (WSJ)

Senior European officials are embracing the so-far taboo idea of cutting off the migrant trail in Greece, a step that they acknowledge could create a humanitarian crisis in the country. This so-called Plan B, floated until now only by Europe’s populist leaders, is a sign of rapidly waning confidence in other European Union policies to deal with the migration crisis—in particular in German Chancellor Angela Merkel’s game plan of relying mainly on Turkey to stem the human tide. Greece in recent days has tried to fight back at the prospect of having tens of thousands of migrants trapped on its territory. “We will not accept turning the country into a permanent warehouse of souls,” Prime Minister Alexis Tsipras said Wednesday night.

During fractious talks among interior ministers in Brussels on Thursday, several people present said the Greek migration minister made an impassioned plea to EU counterparts not to ringfence Greece as nationalist leaders in Central and Eastern Europe, notably Hungary’s Viktor Orban and Slovakia’s Robert Fico, have long demanded. But the ringfencing is already happening, as Austria and the Balkan countries over the past week have coordinated a tightening of their borders and started to send back Afghan migrants, resulting in more than 10,000 people being stuck in Greece. On Thursday, the Greek government recalled its ambassador to Austria—a rare move within the EU—in outrage over the border controls and for being left out of a meeting of Balkan countries called by Vienna on the crisis.

Some European officials are now looking to a March 7 summit of EU and Turkish leaders as a deadline for the bloc’s existing migration strategy, particularly the cooperation with Turkey and a NATO sea-monitoring mission, to yield fruit. If it doesn’t, it will become more imperative, they warn, to stop migrants from traveling farther north and to speed up preparations for assisting Greece with a possible humanitarian emergency. “Greece wouldn’t be the worst place to have a humanitarian crisis for a few months,” one EU official said, adding that the population there was much more refugee-friendly than those in the Balkans or Eastern Europe.

Read more …

What I wrote yesterday in The Balkanization of Europe.

• “We Are Heading Into Anarchy”, “EU Will “Completely Break Down In 10 Days” (ZH)

[..[] on Thursday, EU migration commissioner Dimitris Avramopoulos warned that the bloc has just 10 days to implement a plan that will bring about “tangible and clear results on the ground” or else “the whole system will completely break down.” Avramopoulos also cautioned that a humanitarian crisis in Greece and in the Balkans is “very near.” Moves by countries to adopt ad hoc, state-specific measures to stem the flow are exacerbating the problem, the commissioner contends. “We cannot continue to deal through unilateral, bilateral or trilateral actions; the first negative effects and impacts are already visible,” he said. “We have a shared responsibility – all of us – towards our neighbouring states, both EU and non-EU, but also towards those desperate people.”

By “the negative effects,” of unilateral actions, Avramopoulos is likely referring to the bottlenecks that are leaving thousands stranded in the Balkans. The chokepoints are being pressured by a series of border fences that have been erected over the past six months and the problem is exacerbated by stepped up border checks. In short: we’re witnessing the death of the bloc’s beloved Schengen. “Seven European states have already reinstated border controls within the cherished but creaking Schengen free-travel zone, putting huge strain on Greece, which can no longer wave the tide of arrivals from Turkey onward through the Balkans,” Reuters writes. Earlier today, Athens recalled its Austrian ambassador.

“Greece will not accept unilateral actions. Greece can also carry out unilateral actions,” migration minister, Yannis Mouzalas told reporters on Thursday. “Greece will not accept becoming Europe’s Lebanon, a warehouse of souls, even if this were to be done with major [EU] funding.” On March 7, officials will attend a summit with Turkey where buy in from Ankara is critical if there’s to be meaningful reduction in the flow of asylum seekers to Western Europe. Leaked documents recently showed President Erdogan is essentially attempting to blackmail Europe. “We can open the doors to Greece and Bulgaria at any time. We can put them on busses,” he was quoted as saying, during a conversation with European Commissioner Jean Claude Juncker and President of the European Council Donald Tusk on 16th November 2015 during the G20 Summit in Antalya.

In addition to the seven states that have already reinstated border checks, more countries have promised to follow suit unless Erdogan and Tsipras can figure out a way to make progress in defending the bloc’s external border. Officials fear the onset of spring will embolden still more migrants to make the journey as warmer weather will thaw the Balkan route. On Wednesday, Hungarian PM Viktor Orban called for a referendum on the propsed quota system that Brusells hoped would help distribute and place refugees. It’s only a matter of time before other countries conduct similar plebiscites. Perhaps Jean Asselborn, Luxembourg’s foreign minister put it best: “The outlook is gloomy … We have no policy any more. We are heading into anarchy.”

Read more …