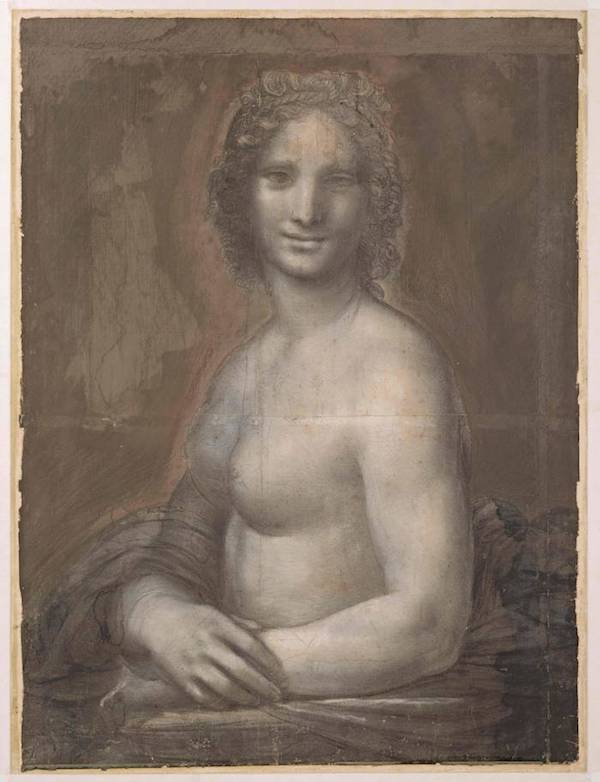

Leonardo da Vinci (?) La Joconde nue or Monna Vanna 1515

We will from now on no longer use the term No-Deal Brexit, it is to be replaced with: Car-Crash Brexit.

NOTE: there are numerous factions and fractions that all think Brexit can mean what they happen to want it to mean. And then there’s all the people who don’t want Brexit. Whatever the outcome, there’ll be a lot of pissed-off and angry people. Both May and Corbyn are responsible for not managing the expectations.

• Furious Tory MPs Will Bid To Oust May If UK Fights Euro Poll (O.)

Theresa May is being warned by her mutinous MPs that they will move to oust her within weeks if the UK is forced to take part in European elections next month and extend its EU membership beyond the end of June. Tory MPs are increasingly angry at the prospect of voters being asked to go to the polls to elect MEPs three years after the Brexit referendum, in an election they fear will be boycotted by many Conservatives and be a gift to the far right and Nigel Farage’s new Brexit party. Senior Tories said one silver lining of a long extension would be that it would allow them to move quickly to force May out, and hold a leadership election starting as soon as this month.

The warnings came as the prime minister made a last desperate appeal on Saturday night to MPs to back a deal, saying there was an increasing danger Brexit would “slip though our fingers”. May said: “Because parliament has made clear it will stop the UK leaving without a deal, we now have a stark choice: leave the European Union with a deal or do not leave at all. “The longer this takes, the greater the risk of the UK never leaving at all. It would mean letting the Brexit that the British people voted for slip through our fingers. I will not stand for that. It is essential we deliver what people voted for, and to do that we need to get a deal over the line.”

Conservative MP Nigel Evans, an executive member of the 1922 committee of backbenchers said last night that, if May failed to deliver Brexit and all she could do was secure a long extension at an EU summit on Wednesday, she would face overwhelming pressure to step down. “At the moment there is focus on delivering Brexit, but if a long delay becomes a reality I believe the noises off about removing the prime minister will become a cacophony,” he said. “I and many other Conservatives would prefer leaving the EU on World Trade Organisation terms to any humiliating long extension that forces us to take part in the European elections.”

Problem is, you’re three years late.

• I Had No Choice But To Approach Labour Over Brexit – May (BBC)

Prime Minister Theresa May has insisted she had to reach out to Labour in a bid to deliver Brexit or risk letting it “slip through our fingers”. In a statement on Saturday night, Mrs May said there was a “stark choice” of either leaving the European Union with a deal or not leaving at all. Some Conservatives have criticised her for seeking Labour’s help after MPs rejected her Brexit plan three times. Three days of talks between the parties ended without agreement on Friday. Labour leader Jeremy Corbyn said he was “waiting to see the red lines move” and had not “noticed any great change in the government’s position”. He is coming under pressure from his MPs to demand a referendum on any deal he reaches with the government, with 80 signing a letter saying a public vote should be the “bottom line” in the negotiations.

In her statement, Mrs May said that after doing “everything in my power” to persuade her party – and its backers in Northern Ireland’s DUP – to approve the deal she agreed with the EU last year, she “had to take a new approach”. “We have no choice but to reach out across the House of Commons,” the PM said, insisting the two main parties agreed on the need to protect jobs and end free movement. “The referendum was not fought along party lines and people I speak to on the doorstep tell me they expect their politicians to work together when the national interest demands it.” Getting a majority of MPs to back a Brexit deal was the only way for the UK to leave the EU, Mrs May said. “The longer this takes, the greater the risk of the UK never leaving at all.”

The Tories don’t want a customs deal.

• UK PM May Has Plan To Offer Labour Brexit Customs Arrangement (R.)

British Prime Minister Theresa May’s government has a plan to enshrine in law a customs arrangement with the European Union in a bid to win over the opposition Labour Party to back a Brexit deal, The Sunday Times newspaper reported. n“Under the new plan, the prime minister would offer to rewrite the government’s withdrawal bill to enshrine a customs arrangement in law,” the newspaper said. May is trying to win over the main opposition party after her negotiated Brexit deal was voted down by parliament on three occasions.

Merkel has told Macron to do the heavy lifting.

• Merkel Throws May A Lifeline Over Brexit Departure Date (O.)

Angela Merkel is open to backing Theresa May’s request for a short Brexit extension as the German chancellor seeks to maintain the pressure on British MPs to support the withdrawal agreement, according to senior EU sources. In the face of moves from elsewhere in the EU to insist on a longer delay to Britain’s departure, Merkel is keeping all options on the table ahead of this week’s EU summit and is said to be willing to back 30 June as an exit date. She is thought to be concerned that Donald Tusk’s proposal of a year-long extension, with an option to exit earlier on ratification of the withdrawal agreement, could be self-defeating. The thinking in Berlin will be a boon to the prime minister, who on Friday proposed the 30 June extension, with the promise that the UK would hold European elections if it had not ratified the withdrawal agreement by 22 May.

Tusk, as president of the European council, suggested on the same day that his “flextension” would put the onus on the British government to decide its own fate while freeing Brussels from repeatedly revisiting the issue. But Merkel is said to understand May’s anxiety that this idea would lift pressure on the Commons to ratify the withdrawal agreement. Diplomats from other EU capitals have suggested that, given the divisions between leaders, a compromise position could be a summer-end date, with a commitment to hold European elections. Germany has clashed with France over the issue. Last week the French president, Emmanuel Macron, warned that Britain and the EU were heading for no deal, and that the bloc could not “forever be the hostage of a political crisis in the UK”.

Both parties are divided as can be. And everyone thinks they can get what they want.

• Labour Chairman Attacks Corbyn Over ‘People’s Vote’ On Brexit (O.)

Jeremy Corbyn was warned by Labour party chairman Ian Lavery that he risked going down in history as the leader who split his party if he backed another referendum on Brexit, in an extraordinary outburst during a meeting of the shadow cabinet last week, according to senior party sources. The Observer has been told that Lavery, who has twice defied the whip and abstained on votes on another referendum, delivered the broadside at Corbyn during a shadow cabinet meeting on Wednesday evening, at which Corbyn updated his frontbench team on talks with the government aimed at ending the Brexit impasse. According to senior figures, Lavery spoke out at the end of the meeting saying he knew his comments would be leaked but was determined to make his point.

“He was very angry and wagged his finger at Jeremy, telling him that if he backed a referendum he would go down in history as the Labour leader who split the party,” said one shadow cabinet member. “Jeremy just sat there.” The outburst stunned shadow cabinet members who said it would have sparked a full-scale shouting match if MPs had not been called to vote at the very moment he made his intervention. At the same meeting several senior figures, including shadow home secretary Diane Abbott and deputy leader Tom Watson, spoke out in favour of Labour backing a “confirmatory referendum” on any deal agreed by MPs, with remaining in the EU as the alternative on the ballot paper.

It’s safe to say the ultimate betrayal has already occurred: a government that utterly failed to prepare.

• Second Brexit Vote Would Be ‘Ultimate Betrayal’: Leadsom (R.)

A second public vote on Britain’s membership of the European Union would be the “ultimate betrayal”, Andrea Leadsom, the leader of the House of Commons or lower house of parliament, wrote in the Sunday Telegraph newspaper. “The ultimate betrayal would be a second referendum,” wrote Leadsom, a Brexiteer. “It would require lengthy delay, it would reignite the divisive debate, and since Parliament has so far failed to follow the first result, there is no reason to believe it would honor a second referendum either.” Lawmakers have rejected Prime Minister Theresa May’s negotiated agreement on Brexit with Brussels, and talks are underway with the opposition Labour Party to reach a compromise. “The vision we had of Brexit is fading away – and we are running out of time to save it,” Leadsom said.

Cassandra Fairbanks.

I don’t really think much of people congratulating themselves because he hasn’t been expelled yet and they think they made that happen. What I think this is about is two-fold:

1) UN got involved.

2) Moreno is under investigation in Ecuador for fraud. He better sit still for now and not stir up things. If Assange is targeted now, Moreno will be accused of doing that for political purposes.

• Leaked Assange Court Transcript Sheds Light on Ecuador Expulsion Plans

The Gateway Pundit has exclusively obtained a court transcript of an appeal made by WikiLeaks publisher Julian Assange in an Ecuadorian court, in which the publisher accused the Ecuadorian government of preparing to revoke his political asylum at the behest of the United States and United Kingdom. Assange has not been heard from in public since March 28, 2018 after an executive gag order by the government of Ecuador. The following, unpublished, “leaked” transcript of Assange asking an Ecuadorian court for an urgent injunction (“protection order”) against his gagging and isolation is from October 29, 2018.

Journalists and media were banned from recording the proceedings, but a court record was later obtained through legal process and provided to The Gateway Pundit. It has never before been revealed. “I have been in this embassy without sunlight for six years and essentially isolated from most people for seven months and, including electronic communication, the telephone etc, from my young children,” Assange told the court according to the transcript. “It has … interfered with my ability to work, to make a living, and with my deeply held principles that I have fought for all my life, which is to uphold the right of freedom of expression, the right for people to know, the right of the freedom of the press and the right for everyone to participate in their society and the broader society.”

Assange also told the Ecuadorian court that his gag order meant that he could not respond to false statements about himself. “Due to my isolation, I have not been able to participate in the debates occurring around me and that has resulted in a climate of libel and fake news that might be expected for someone who has been in the business of exposing very large and very powerful corrupt organisations or organisations that abuse human rights.” Assange also said that members of the Ecuadorian Government had been involved in spreading information denigrating his character, something that he said saddened him given how proud he was of becoming an Ecuadorian citizen in 2017.

The publisher, who was nominated for the Nobel Peace Prize in 2019, went on to detail the importance of his work. He specifically highlighted his publication of US diplomatic cables which revealed hard truths about the wars in Iraq and Afghanistan. “There was no allegation that I had done anything other than what a journalist does, just that I have been a rather good one and effective one.” The publisher stated that he did not apply for asylum at the embassy to live there. He applied so that he may go and live safely in Ecuador, but that the UK’s efforts to arrest him have made that impossible.

Melzer wants to visit Assange on April 25. Looks like Ecuador will make sure he’s still in the embassy by then.

• UN Against Extraditing Assange To US: He Could Be Tourtured There (Taer)

The UN Special Rapporteur on torture Nils Melzer is alarmed by reports that Julian Assange, the founder of WikiLeaks, may be expelled imminently from the Embassy of Ecuador in London, saying he intended to personally investigate the case. “In my assessment, if Mr. Assange were to be expelled from the Embassy of Ecuador, he is likely to be arrested by British authorities and extradited to the United States,” said the UN expert. “Such a response could expose him to a real risk of serious violations of his human rights, including his freedom of expression, his right to a fair trial and the prohibition of cruel, inhuman or degrading treatment or punishment.

“I therefore urge the Government of Ecuador to abstain from expelling Mr. Assange from its Embassy in London, or from otherwise ceasing or suspending his political asylum until such time as the full protection of his human rights can be guaranteed. “Should Mr. Assange come under British jurisdiction for any reason, I urge the British Government to refrain from expelling, returning or extraditing Mr. Assange to the United States or any other jurisdiction, until his right to asylum under refugee law or subsidiary protection under international human rights law has been determined in a transparent and impartial proceeding granting all due process and fair trial guarantees, including the right to appeal,” said Melzer.

“According to information I have received, Mr. Assange is at risk of extreme vulnerability, and his health is in serious decline. I therefore appeal to the Ecuadorian authorities to continue to provide him, to the fullest extent possible in the circumstances, with adequate living conditions and access to appropriate medical care.

“UK knows that Julian Assange had a reasonable cause. It was his universal human right to seek asylum. So the arrest warrant has no basis & Julian did not breach his bail.”

UK’s arrest warrant is illegal under international law.

• The Breach of Bail Allegation Against Assange (M.)

The only legal issue generally thought to be outstanding for Julian Assange in the UK is a breach of bail conditions. However, a list circulated by Wikileaks to correct misconceptions has rightly stated: “It is false and defamatory to suggest that Julian Assange has ever “breached his bail”, “jumped bail”, absconded, fled an arrest warrant, or that he has ever been charged with such at any time.” In fact, bail is not actually breached unless there is a failure to meet bail conditions “without reasonable cause.” This was mentioned in passing when Emma Arbuthnot ruled to uphold the arrest warrant for breach of bail:

“The offence of absconding by a person released on bail is set out in section 6 of the Bail Act. If a person who is on bail fails without reasonable cause to surrender he shall be guilty of an offence. On a straightforward reading of the section, which makes no mention of any underlying proceedings, 1. Mr Assange has been released on bail, 2. He has failed to surrender and 3. If he has no reasonable cause he will be guilty of an offence.”

The excerpt below from Page 2 of an earlier ruling from Judge Riddle ironically reflects the fact that there was indeed a reasonable cause and the UK knew it. This reasonable cause was the universal human right to seek asylum, and it was exercised with unprecedented international notoriety. This was apparently not lost on whoever was directing the UK strategy, since it was a full nine days before his appearance was requested with a day’s notice at Belgravia Police Station, predictably followed the next day with an arrest warrant when he did not appear.

[..] without such an arrest warrant, the UK would have no pretext to extract him from the embassy. Its awareness of lacking justification was then further shown by waiting another six weeks for Ecuador to fold under pressure to reject the asylum claim. Yet when it was finally obvious that asylum was about to be granted, they did in fact try their luck with a threat to revoke the diplomatic status of the embassy in order to arrest him. That obviously did not work. Waiting so long and then overplaying their hand was a reassuring indication that their wits didn’t quite measure up to their malice. Yet what else could they do, since it was obvious that international law took precedence on the world stage when he walked into the embassy?

That so-called ‘market’ is the Fed and the companies its ultra-low rates allow to buy themselves.

• Banning Buybacks Would Crash The Market – Goldman (ZH)

Few topics prompt as powerful (and violent) a response from financial professionals as what the role of financial buybacks is in determining stock prices. One group, largely those bulls who after a decade of central bank manipulation still believe that markets are efficient and unrigged, and in hope of increasing their AUMs claim that they are financial geniuses for riding the world’s biggest financial bubble in history, argue that stock buybacks have no impact on stock prices.

Others, those who actually understand that if there is a trillion dollars in price indiscrimiante stock bids (as was the case in 2018 and will again happen in 2019) is the single most effective way to boost stock prices (and management’s incentive-linked comp, linked to higher stock prices), know – correctly – that corporate buybacks, which until not too long ago were banned, and which over the past decade emerged as the single biggest source of stock purchases, are one of the two most important factors behind the all time highs in the stock market (the other being the Fed, whose policies have allowed companies to issue debt with record low yields, allowing them to fund these trillions in buybacks).

And with the debate raging, either side happy to “convince” others in its echo chamber while hurling insults at the other, few have been as vocal in their defense of stock buybacks as Goldman Sachs. One month ago, the firm’s chief equity strategy David Kostin wrote a report – let’s call it the carrot – seeking to debunk “misconceptions” about stock buyabcks, which he claimed had gotten an unfair rap in the US. Specifically, Kostin said that “one of the greatest misconceptions in the public discourse surrounding corporate buybacks is the belief that managements repurchase stock in an attempt to inflate earnings per share and meet incentive compensation targets,” Goldman wrote.

What’s become of the media when the NY Post provides the most balanced view?

Note: Judicial Watch has launched the first lawsuit, see video.

• Give Up, Trump-Haters (NYPost)

Proving themselves happy to pander to folks who can’t let go of the Collusion Delusion, The New York Times and Washington Post are both suggesting that Attorney General William Barr spun special counsel Robert Mueller’s report to make President Trump look good. But neither account amounts to more than clickbait. Previewing Thursday’s front-page story, a Times online headline Wednesday screamed: “Some on Mueller’s Team Say Report Was More Damaging Than Barr Revealed.” The Washington Post ran a similar story. Message: The truth is out there! Barr’s just corruptly covering up for Trump!

Except that neither paper even pretends to have such info from anyone “on Mueller’s team” — just chatter from people who say they’ve talked to Muellerites. It’s a shameless followup to months of stories in both papers, and across much of the media, that relied on anonymous sources to feed the Delusion. Especially when it’s already known that Mueller’s report has some info that will make the president look bad — because Barr said so, noting that Mueller found “evidence on both sides of the question” of obstruction.

Of course Barr’s four-page summary of a 300-plus page document left out plenty. But there’s no coverup: The AG plans to release the report in a week or two (after it’s redacted in accordance with laws and Department of Justice rules) so folks can read it for themselves. It’s also nuts to think Barr would lie about Mueller’s findings: Mueller himself would go public rather than let that happen. But die-hard Trump haters can’t let go, and their media and political enablers don’t want to disappoint them. (Thus Rep. Jerry Nadler’s grand show of threatening to subpoena the full Mueller report.) Much of the news media, and many top Democrats, already have egg on their faces, thanks to Mueller’s findings. It’s astounding that they’re trying to recover by digging the hole deeper.

https://twitter.com/i/status/1114664077551267841

Confirms what I wrote a few days ago. A niece of Ralph Nader was killed in the second crash. He won’t rest.

• Why Was There No Backup System On 737 MAX? (USAToday)

When it comes to safety, modern commercial aircraft are known not only for having back-up systems, but in some cases, back-ups of their back-ups. So even as Boeing has taken responsibility for a fatal flaw in a key anti-stalling system in its 737 Max 8, mystery still surrounds why the software was designed to be dependent on a single outside sensor, though it was equipped with two, triggering a chain of events that led to the crashes of Lion Air and Ethiopian Airlines jetliners less than five months apart. Boeing “violated a basic principle of aircraft design by allowing a single point failure to trigger a sequence of events that could result in a loss of control,” said Brian Alexander, an attorney for a law firm specializing in aviation accidents, Kreindler & Kreindler in New York, that is contemplating lawsuits on behalf of victims’ families in the Ethiopian Airlines crash.

Based on an initial report from crash investigators, Boeing CEO Dennis Muilenburg acknowledged Thursday that erroneous data sent to the system led to the Lion Air crash off Indonesia in October that killed 189 passengers and crew and the Ethiopian Airlines disaster in Africa that took 157 lives on March 10, both in the 737 Max 8. He vowed Boeing would fix the problem. Others, however, aren’t so sure that Boeing can find an adequate repair, saying that the twin crashes are proof that the plane’s problems run deeper than flawed sensors. They say the design itself has created inherent problems that simple fixes won’t solve. “You go to the source of the problem, not the symptom,” said consumer advocate Ralph Nader, who lost a niece in the Ethiopian Airlines crash. “An aircraft has to be designed stall proof, not stall prone.”

[..] The single source of data seems unusual given the lengths that Boeing has gone to build redundancies into its jetliners. For the 777, Boeing’s twin-aisle intercontinental jet, engineers created triple redundancy for its computers, hydraulics, communications and electrical power. Perhaps the best illustration of the lengths that the company was willing to go on back-ups was found in the plane’s primary flight computer. It was built with three microprocessors, instead of one, and each of them came from a different manufacturer: Intel, AMD and Motorola, according to an account by a Boeing engineer.

My first thought was that looks like a really big number. But I don’t want to question the Smithsonian either.

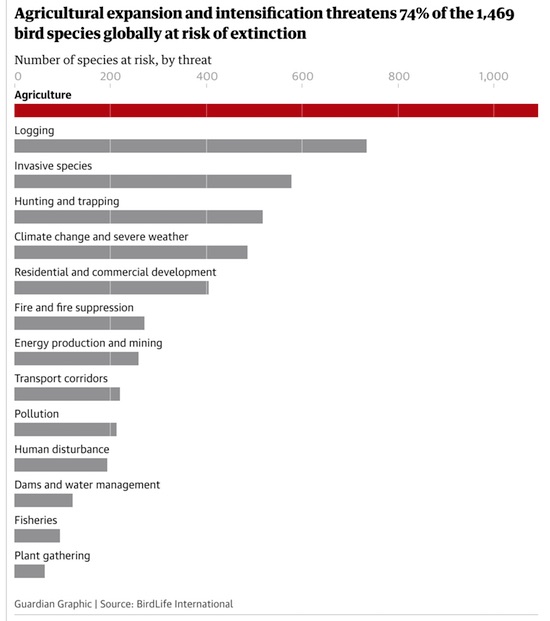

• Skyscrapers Are Killing Up To 1 Billion Birds A Year In US (G.)

Scientists estimate that at least 100 million and maybe as many as a billion birds die each year in the US when they collide with buildings, especially glass-covered or illuminated skyscrapers. And, in a new report, conservationists now have a better idea which American cities are the deadliest for those on the wing. Chicago, with its many glass superstructures that spike into what is the busiest US avian airspace during migration, is the most dangerous city for those feathered travelers. More than 5 million birds from at least 250 different species fly through the Windy City’s downtown every fall and spring. They journey twice a year, many thousands of miles, going north in the spring from Central and South America, across the Great Lakes to Canada, and back south in the fall.

The famous skyline of Manhattan is another death trap for birds, especially those migrating. “They wind up landing somewhere that’s unfamiliar, like a sidewalk somewhere,” said Susan Elbin, director of conservation and science at New York City Audubon, a leading bird advocacy organization. “Then when daylight comes, and they want to get more food, they’ll fly into a tree that they think is a tree, and it’s really a reflected tree in some glass building … Then they’ll slam into the glass, and then they die.” Most birds migrating through the US do so at night, when the airspace is cool and calm – and often end up veering through cities because their glow stands out. Scientists have long known that birds are attracted to light, so when they fly over a bright city at night, they are naturally drawn toward it, unaware they are in dangerous territory.

[..] As the experts admit, it’s hard to get reliable statistics. New York City Audubon conducts “collision monitoring studies” in September and April each year, sending dozens of volunteers into the city streets to track fallen birds. The organization estimates about 90,000 to 200,000 birds are killed via building collision in the city each year. Local Audubon chapters and other bird conservation groups around the country coordinate similar data collection exercises. On a national scale, the Smithsonian’s migratory bird center estimated the number of deaths to be between 100 million and one billion birds annually, using data from a wide variety of different groups across the country.

Skyscrapers in New York City. Photograph: Michael Nagle/Bloomberg

Is it okay if I find this okay?

• Rhino Poacher Trampled By Elephant Then Eaten By Lions (BBC)

A suspected rhino poacher has been trampled on by an elephant then eaten by a pride of lions in Kruger National Park, South Africa. Accomplice poachers told the victim’s family that he had been killed by an elephant on Tuesday. Relatives notified the park ranger. A search party struggled to find the body but eventually found a human skull and a pair of trousers on Thursday. The managing executive of the park extended his condolences to the family. “Entering Kruger National Park illegally and on foot is not wise,” he said. “It holds many dangers and this incident is evidence of that.” Kruger National Park has an ongoing problem with poaching and there remains a strong demand for rhino horn in Asian countries. On Saturday, Hong Kong airport authorities seized the biggest haul of rhino horn in five years, valued at $2.1m.

Getty images