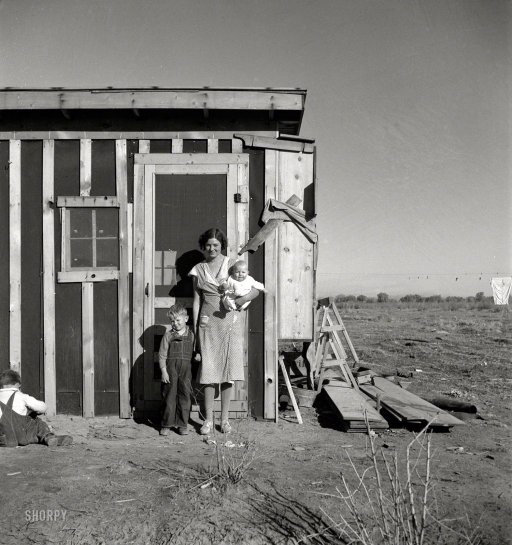

Dorothea Lange Sons of Negro tenant farmer, Granville County, North Carolina July 1939

This is the second installment of Nicole’s series on food security.

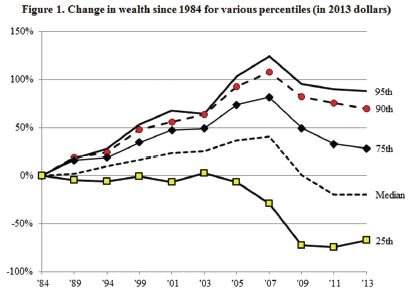

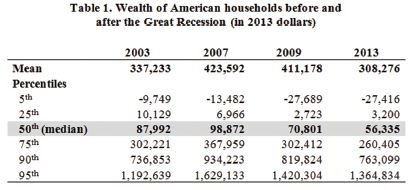

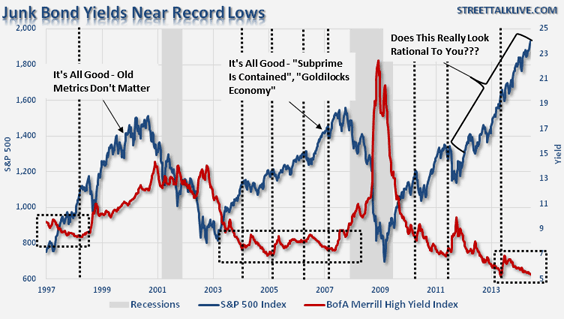

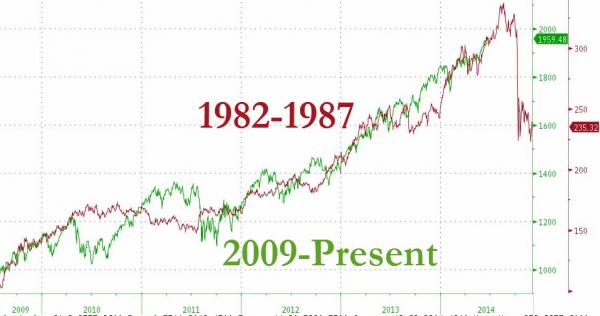

Nicole Foss: In part one of this series, we looked at finance as a major causal factor in the development of food insecurity. The boom and bust cycles that result from over-financialization are, however, only one aspect of a food crisis already present for many, and looming for many more in the years to come. Finance can, and does, generate artificial scarcity, initially through the manipulation of land and commodities for profit and, and latterly by over-reaching itself and crashing the human operating system, with tremendous negative impact on the supply of all goods and services. Food is one of the vital factors that will be substantially affected in a financial crash where connecting producers and consumers will be extremely difficult due to lack of money in circulation.

The inherent instability of our human operating systems is only one of a large number of limiting factors for food production and distribution. The very real scarcity coming as a result of limiting factors grounded in the physical world is far more serious in the longer term. While we can make changes capable of addressing both human and physical limits, we are highly unlikely to do so in a timeframe, or on a scale, that would prevent us from experiencing the consequences of of over-shooting our natural carrying capacity. Nevertheless, whatever we can achieve in the time available will be an improvement.

This series is not meant to be a comprehensive assessment of each limiting factor in relation to food supply, but an overview of vulnerability in its many forms, clarifying the imperative for re-engineering our food systems. Given the extent of the over-stretch of the current model, the possibility of rapid collapse in response to very predictable system shocks is uncomfortably high. We are at risk of cascading system failure. We cannot expect facilitation of this transition to come from the top down, however – far from it. The larger scale centralized human construct, highly over-stretched and inflexible, can only be expected to look after itself and defend the status quo at the expense of decentralization initiatives. Meaningful change will have to come from the bottom up, one local initiative at a time.

There is a considerable urgency to making this transition to a human-scale food system. While many are generally aware that our current means of producing and distributing food is unsustainable, few seem to realize that what cannot continue will not continue, that the limits are already being reached, and that the effects will most certainly be felt in our lifetimes, even in what are now wealthy countries. This is not an issue where we can continue business as usual and expect the impact to be felt only by distant populations or by subsequent generations. It will be one where we must take personal responsibility for change, both for our own benefit and that of society in general.

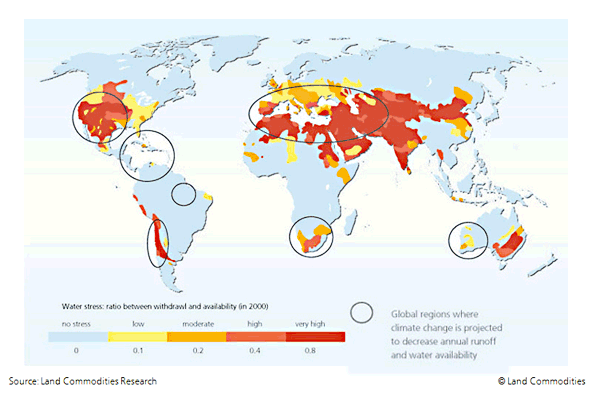

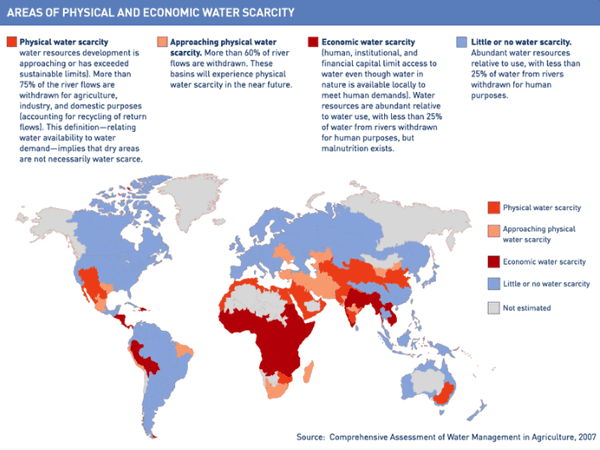

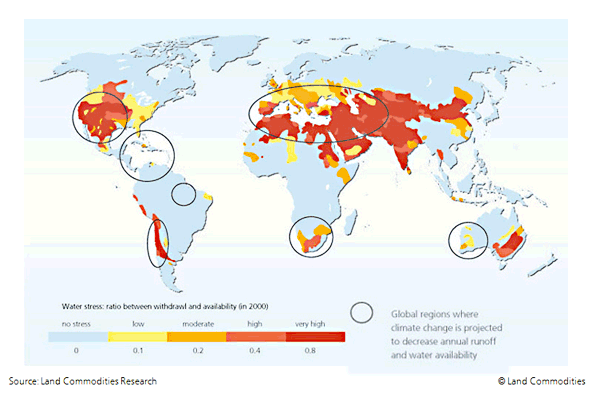

We are facing non-negotiable physical limits in terms of water and climate, which are the subject of this instalment, but also energy, soil fertility and carrying capacity, the subjects for the next part of the series. Our human systems for trade and agricultural regulation are frequently exacerbating the scope of the problems we face and will be covered subsequently. Ultimately we are going to have to face the root of the problem, which lies in the inherently expansionist nature of agriculture itself, as practiced not just in the industrial age, but from the dawn of the neolithic period. We will need to develop polycultural food production systems along permaculture lines if we are to avoid the worst consequences of over-reach. We will need to learn to live within limits.

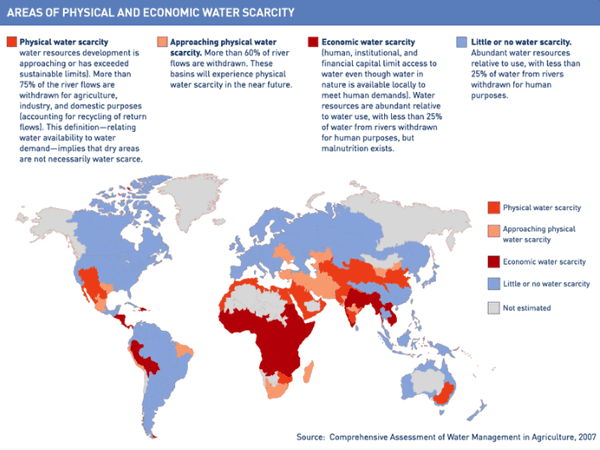

Farming and Water

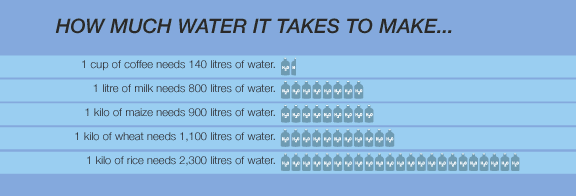

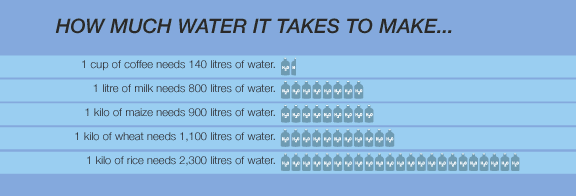

Fresh, clean water is the ultimate precious resource – the lifeblood of the planet – yet it is increasingly scarce in many places already and set be become far scarcer in the foreseeable future. Only a tiny percentage of the Earth’s fresh water is sufficiently accessible to be available for human use, and of that, agriculture consumes the lion’s share. It takes 1000 tons of water to grow a ton of wheat for instance.

Irrigated land is far more productive in the short term, allowing us to use the cheap energy we have had access to to expand the areas under cultivation and increase yields in order to feed our expanding population. However, in the longer term, irrigation leads to soil water-logging and salinization, as evaporation of mineralized water leaves salts behind in the soil. Land can be badly damaged and eventually abandoned, while new land is then subjected to the same treatment:

Although only 17% of all cropland is currently irrigated, it provides 40% of the world’s food….But much existing irrigated land is threatened by salinization — a build-up of salts in the soil. This lowers yields and can damage the land beyond economic repair. Salinization is reducing the world’s irrigated area by 1-2% every year, hitting hardest in the arid and semi-arid regions. “No one is really certain of the figures, but it seems that at least 8% of the world’s irrigated land is affected,” says FAO water expert Julián Martínez Beltrán. “In the arid and semi-arid regions, it’s somewhere around 25%.”

In this way, land is being consumed as a non-renewable resource. Needless to say, there is a finite supply of land available, and with irrigation damage occurring most quickly in the most water-stressed regions, the risk of food insecurity is compounded.

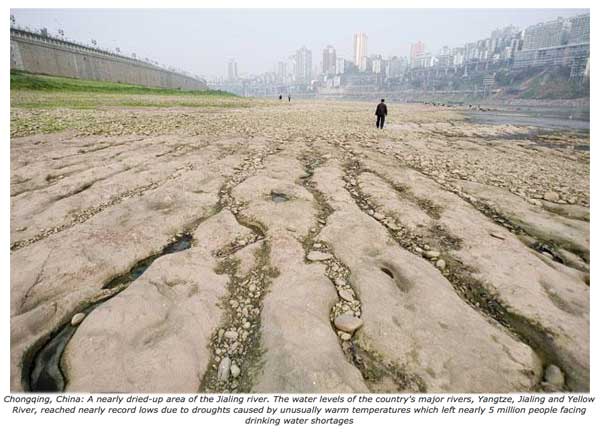

Some 60% of irrigation draws on surface water sources, but chronic over-use has led to major rivers no longer reaching the sea, destroying the health and productivity of formerly fertile delta lands which had previously been substantial food sources for local populations:

For six million years, the Colorado River ran its course from its soaring origins in the Rockies to a once-teeming two-million-acre delta, finally emptying 14 million acre-feet of fresh water into the Sea of Cortez. But now, a multitude of straws are drinking from the river….Indeed, the Colorado River has not reached the sea since 1998 but ends rather in a cracked and desolate expanse of barren mud flats and abandoned boats — a “dry river cemetery.”….

….Referred to as the Nile of North America, the Colorado River is the arid West’s lifeline. It provides water to more than 30 million Americans, including people in cities like Phoenix, Denver and Los Angeles. Over 100 dams and thousands of miles of canals divert the river to nearly every farm, industry and city within a 250-mile radius of its banks. It is one of the most diverted and dammed rivers in the world.

Dry Rivers are increasingly common worldwide.

Where irrigation depends on aquifers, draw-down often exceeds the natural recharge rate. We are depending on fossil water that is also effectively a non-renewable resource, and when the limit of feasible extraction is reached, whole regions are at risk of becoming unable to support either the human population or what remains of the existing ecosystem. Water tables are falling by several feet per year in many parts of the developing world dependent on groundwater sources, notably beneath rapidly growing urban centres with an insatiable demand for water, but also beneath agricultural regions:

Shijiazhuang, China — Hundreds of feet below ground, the primary water source for this provincial capital of more than two million people is steadily running dry. The underground water table is sinking about four feet a year. Municipal wells have already drained two-thirds of the local groundwater. Above ground, this city in the North China Plain is having a party. Economic growth topped 11% last year. Population is rising. A new upscale housing development is advertising waterfront property on lakes filled with pumped groundwater. Another half-built complex, the Arc de Royal, is rising above one of the lowest points in the city’s water table. “People who are buying apartments aren’t thinking about whether there will be water in the future,” said Zhang Zhongmin, who has tried for 20 years to raise public awareness about the city’s dire water situation….

….The North China Plain undoubtedly needs any water it can get. An economic powerhouse with more than 200 million people, it has limited rainfall and depends on groundwater for 60% of its supply….But scientists say [the aquifers] below the North China Plain may be drained within 30 years.

The same phenomenon is occurring under the major breadbaskets of the world, for instance the Punjab in India and the Ogallala Aquifer underlying the great plains of the US:

The Ogallala Aquifer, the vast underground reservoir that gives life to these fields, is disappearing. In some places, the groundwater is already gone. This is the breadbasket of America—the region that supplies at least one fifth of the total annual U.S. agricultural harvest. If the aquifer goes dry, more than $20 billion worth of food and fiber will vanish from the world’s markets. And scientists say it will take natural processes 6,000 years to refill the reservoir….

….With a liquid treasure below their feet and a global market eager for their products, farmers here and across the region have made a Faustian bargain—giving up long-term conservation for short-term gain. To capitalize on economic opportunities, landowners are knowingly “mining” a finite resource.

As with so many aspects of our human systems, short term gains trumps long term ability to provide that which sustains existence. Unfortunately, as the shared resource diminishes, competition over what remains intensifies, and the potential for conflict increases enormously. Resources previously used in common often become privatized and used for the exclusive benefit of a dominant group. The land grabs we discussed in relation to financial aspects of food insecurity are also reflections of this competition over water resources, and in fact are often water grabs in disguise:

Water grabbing refers to situations where powerful actors are able to take control of or divert valuable water resources and watersheds for their own benefit, depriving local communities whose livelihoods often depend on these resources and ecosystems. The ability to take control of such resources is linked to processes of privatisation, commodification and take-over of commonly-owned resources. They transform water from a resource openly available to all into a private good whose access must be negotiated and is often based on the ability to pay. Water grabbing thus appears in many different forms, ranging from the extraction of water for large scale food and fuel crop monocultures, to the damming of rivers for hydroelectricity, to the corporate takeover of public water resources….

….The causes of water grabbing are similar to those of ‘land grabbing’: the phenomenon whereby investors acquire or lease vast tracts of land, with negative socio-economic and environmental effects. An investor’s control of land usually comes with a corresponding control of water resources. Indeed, access to water could be the most valuable part of the deal. This is especially so given that host governments seek to entice investors by offering them concessions with regards to water use….

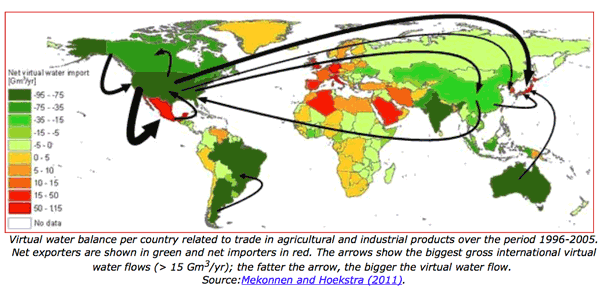

….Acquiring land in order to access and control water is especially relevant to countries facing water scarcity. Renewable water resources in the Gulf states for example are set to run out in the next three decades. The implications of this water scarcity are profound. Saudi Arabia, once a net exporter of wheat, intends to phase out domestic production of wheat by 2016 due to the depletion of fresh water reserves in the country. It seeks to compensate for this loss in domestic food production by acquiring farmland abroad, thereby transferring much of the pressure on water resources caused by agricultural production to other countries. This is a strategy likely to be pursued by other water deficit countries as they seek to ‘lock in’ access to water reserves and resolve their own water constraints by acquiring land abroad.

The problem is compounded by the use to which acquired land is put, as this use, generally by absentee land owners, does not reflect a condition of resource scarcity. Water resources, which may already be under stress as local populations rise, are all too often being rapidly squandered in the pursuit of short term profit, with the result that ecosystems are damaged or destroyed and local populations forced to migrate:

All of the land deals in Africa involve large-scale, industrial agriculture operations that will consume massive amounts of water. Nearly all of them are located in major river basins with access to irrigation. They occupy fertile and fragile wetlands, or are located in more arid areas that can draw water from major rivers. In some cases the farms directly access ground water by pumping it up. These water resources are lifelines for local farmers, pastoralists and other rural communities. Many already lack sufficient access to water for their livelihoods. If there is anything to be learnt from the past, it is that such mega-irrigation schemes can not only put the livelihoods of millions of rural communities at risk, they can threaten the freshwater sources of entire regions.

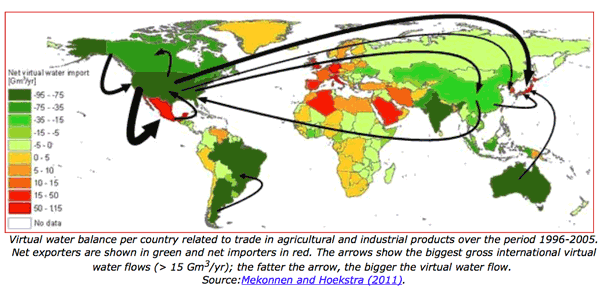

The concept of virtual water trade refers to the quantity of water effectively exported when countries export agricultural products, which consume local water resources. Importing countries can save water at the expense of exporting ones:

When a country imports one tonne of wheat instead of producing it domestically, it is saving about 1,300 cubic meters of real indigenous water. If this country is water-scarce, the water that is ‘saved’ can be used towards other ends. If the exporting country is water-scarce, however, it has exported 1,300 cubic meters of virtual water since the real water used to grow the wheat will no longer be available for other purposes.

In 2007, the global water trade was estimated to be some 567 billion litres, double that in 1986 as the water trade has become increasingly globalized.

Exporting virtual water becomes problematic where exporting nations are water scarce. The decision to export virtual water anyway is generally a matter of short term economic gain, either for wealthy foreign purchasers of land, as we have seen in Africa, or for large domestic land owners. For instance, Australia is the driest inhabited continent, but also, according to UNESCO, the largest net exporter of virtual water in the world, with agricultural exports feeding 60 million people worldwide. This is currently possible due to the availability of the necessary energy to supply the water when and where needed, but it is obviously unsustainable. Australia has only just established an independent agency tasked with monitoring and setting sustainable limits on water use.

Similarly, drought-stricken California uses artificially cheap water provided with temporarily affordable energy to export thirsty hay and rice crops to Japan:

In the Imperial Valley of California, a region drier than part of the Sahara Desert, farmers have found a lucrative market abroad for a crop they grow with Colorado River water: They export bales of hay to land-poor Japan….Container ships from Japan unload electronics and other goods in the Port of Long Beach, and the farmers fill up the containers with hay for the trip back across the Pacific. Since the containers would otherwise return empty, it ends up costing less to ship hay from Long Beach to Japan than to California’s Central Valley.

“Everything is done for economics,” said Ronnie Leimgruber, an Imperial Valley hay grower who is expanding into the export market. “Japan cannot get hay cheaper. The freight is cheaper from Long Beach than from anywhere else in the world.” Water is cheap for valley farmers, too: urban rates there are four times as high. It costs only $100 to irrigate an acre of hay in the desert for a year. But what makes economic sense to farmers may not be rational behavior for California in the third year of a severe drought, say some conservationists. At the very least, they contend, the growing state debate over water allocation should take into account the exports of crops such as hay and rice — two of the most water-intensive crops in the West — because they take a toll on local rivers and reservoirs.

“This is water that is literally being shipped away,” said Patrick Woodall, research director at Food and Water Watch, an international consumer advocacy group with headquarters in Washington, D.C. “There’s a kind of insanity about this. Exporting water in the form of crops is giving water away from thirsty communities and infringing on their ability to deal with water scarcity.”

Increasingly, limits are going to be reached and hard choices are going to have to be made. The current pursuit of individual or corporate economic benefit at the expense of rational resource use cannot continue where the resources in question are increasingly limited and therefore subject to competing interests. Those competing interests will increasingly make themselves know in a highly socially disruptive manner destined to force change.

Competition over water access is already inflaming regional tensions in areas of water scarcity, with unequal provision reflecting relative power. The powerless may be prevented, by lack of sufficient water, from growing food at all, cementing a state of dependency where the powerful hold hostage the ability to provide basic essentials:

Published Monday by the Ramallah-based human rights organization Al-Haq, “Water for One People Only: Discriminatory Access and ‘Water-Apartheid’ in the Occupied Palestinian Territory”, reports that Israel has claimed up to 89% of an underground aquifer that is largely located in the West Bank, giving Palestinians only access to the remaining 11%. The water grab has fueled increased discrepancy in water usage in the region with the 500,000 Jewish settlers consuming approximately six times the amount of water used by the 2.6 million Palestinians living in the West Bank—with the discrepancy growing even greater when agricultural water use is accounted for.

“There is a grave injustice in the division of water, and the results have been catastrophic,” Tawfiq Salah, mayor of West Bank village al-Khader, told Al-Monitor….

….Writing about the report, Al-Monitor’s Jihan Abdalla quotes Musa, a Palestinian father of six, who had attempted to build a rainwater cistern in his field before the Israeli authorities quickly issued it with a demolition order. Abdalla continues: Musa says if they had access to sufficient, affordable water, his family would be able to live off their ancestral field, selling their grapes, olives and fruit in nearby markets. That, he says, is the reason why Israeli authorities prevent them from building a cistern, and why they do not have any running water. “They don’t want us to plant or grow anything, they just want us to have barely enough water for drinking and that’s it,” Musa says looking at the unfinished, empty hole in the ground.

It is not only in situations of long term ethnic conflict where actions such as collecting rainwater for self-sufficiency are seen as competing with established interests. In drought prone regions of the US southwest, precious water rights are considered to be threatened by domestic rainwater capture, even though the water captured would otherwise have been more likely to have evaporated than to have made its way to the fully allocated river:

The Rocky Mountain state uses a convoluted mix of first-come, first-serve water rights, some of which date back to the 1850s, and riparian rights that belong to the owners of land lying adjacent to water. A single person catching rain wouldn’t make a difference to water rights holders, according to Brian Werner of the Northern Colorado Water Conservancy District. But if everyone in Denver captured rain, he says, that would upset the state’s 150-year-old water-allocation system. The Colorado Department of Natural Resources estimates that 86% of water deliveries go to agriculture, which is already stressed by dwindling supplies. And because 19 states and Mexico draw water from rivers that originate in the Colorado Rockies, backyard water harvesting can have widespread implications….

….With water systems across the country already highly or fully appropriated, and with drought aggressively depleting supplies, Aiken predicts that legal battles over who owns the rain won’t go away anytime soon. Old water-allocation systems remain in direct conflict with a growing movement for DIY water conservation, including rainwater collection.

Bulk water transfers are being contemplated in a number of locations, but these are highly controversial as they would have significant environmental impacts. They are so highly capital and energy intensive that limits on those parameters may prevent this kind of development, although it would depend on which critical resource first became limiting in a given location. Both farms and cities, increasingly competing for water in arid regions, could prioritize water over money and energy if the latter remain available.

An illustration of the emerging tension between critical resources can be seen in relation to the water requirements of fracking for unconventional fossil fuels:

The move to tap petroleum-rich shale reserves in some of the country’s driest regions, including Colorado, may be setting up a battle between oil and water. The water is needed for hydraulic fracturing, a process that pumps millions of gallons of sand and water into a well to crack the hard shale and release oil and gas. Nearly half of the 39,294 reported “fracked” wells drilled in the U.S. since 2011 are in regions with high or extreme water stress, according to a report by Ceres, an investor and environmental-advocacy group….

….In Colorado, 86% of the state’s water is used by agriculture. Municipalities and industry use 7.4%. While oil and gas companies have created a small market for water, it hasn’t had a major impact on farms, said Bill Midcap, a spokesman for the Rocky Mountain Farmers Union. “There are cases where companies have bid up water to more than farmers can afford, but it is in a few cases,” Midcap said.

Over-use of water sources and inappropriate or uncontrolled land use has had a substantial impact on water quality in many regions, damaging both surface water sources and also the oceans into which those surface waters emerge. Both urban pollution and agricultural runoff have major impacts. Fertilizers and animals wastes from agricultural land wash into water courses, causing eutrophication – the nutrient enrichment of the water to an extent that allows algal blooms to form. As these decay, the available oxygen is consumed, suffocating the inhabitants of the river and creating dead zones at river mouths. For instance, the one at the mouth of the Mississippi is the size of New Jersey.

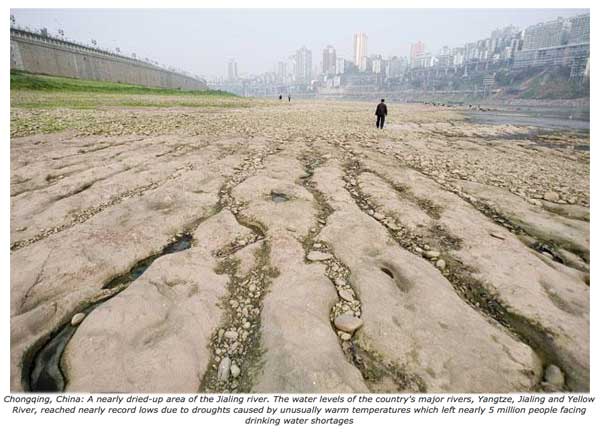

Of China’s 23,000 miles of large rivers, 80% are no longer able to support fish and aquatic ecosystems are on the brink of collapse. This will have a profound effect on food security is the world’s most populous country. Of course, food security is hardly the only issue with regard to rampant mis-use of water resources. Water-borne diseases are also going to prove to be strongly limiting factors in many places where more and more people have no access to safe drinking water.

Given the critical nature of water availability for drinking, for food security and for ecosystem health, a global water crisis represents a systemic threat.

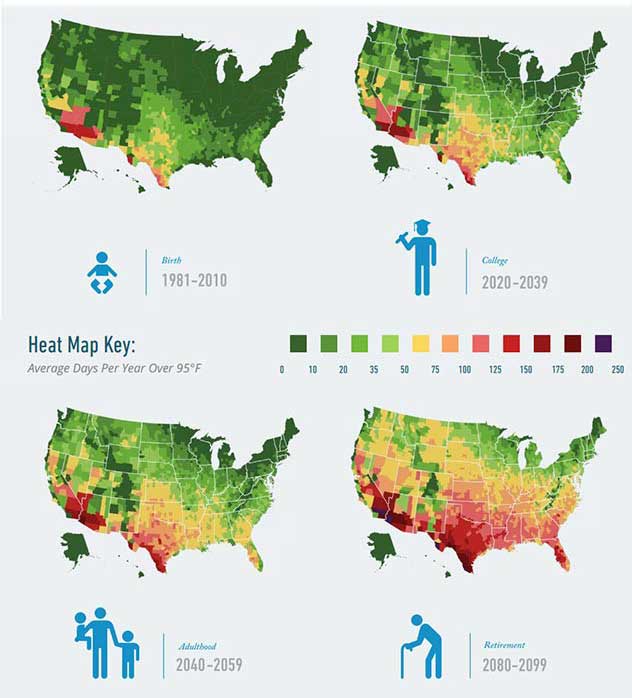

Farming and Climate:

Climate change is already proving to be a factor in food insecurity, and is likely to have an increasing impact over time. The effects are complex, interacting with, and exacerbating, other factors, most notably the availability of water. Water will be affected by climate disruption through melting glaciers reducing surface water, increased evaporation, shifting rainfall patterns, droughts, an increasing number of extreme weather events and instances of coastal flooding. Where changes happen relatively quickly, they are much more difficult to adapt to, particularly in places where the local food system is already operating near a number of limits. This could easily lead to conflict:

“Battles over water and food will erupt within the next five to 10 years as a result of climate change,” said World Bank President Jim Yong Kim of the IPCC report. “The water issue is critically related to climate change. People say that carbon is the currency of climate change, water is the teeth. Fights over water and food are going to be the most significant direct impacts of climate change.”

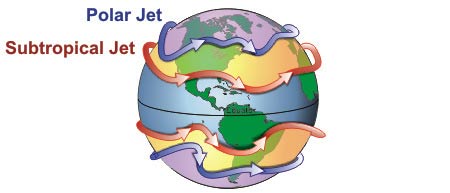

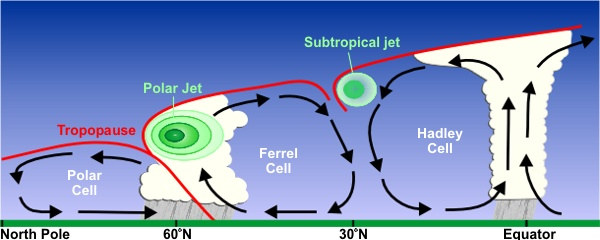

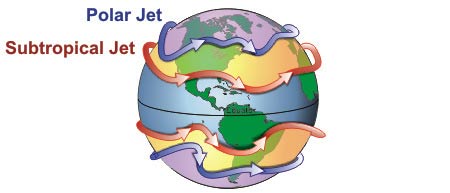

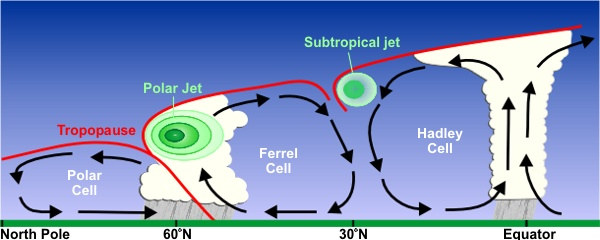

Droughts have have had an increasing impact in recent years, with the shifting of of atmospheric jet stream patterns being a contributing factor. These upper level rivers of air guide low pressure systems and determine the storm track, with its attendant rainfall patterns. Where there are jet stream disturbances, weather patterns can be substantially altered:

Scientists expect the amount of land affected by drought to grow by mid-century—and water resources in affected areas to decline as much as 30%. These changes occur partly because of an expanding atmospheric circulation pattern known as the Hadley Cell—in which warm air in the tropics rises, loses moisture to tropical thunderstorms, and descends in the subtropics as dry air. As jet streams continue to shift to higher latitudes, and storm patterns shift along with them, semi-arid and desert areas are expected to expand.

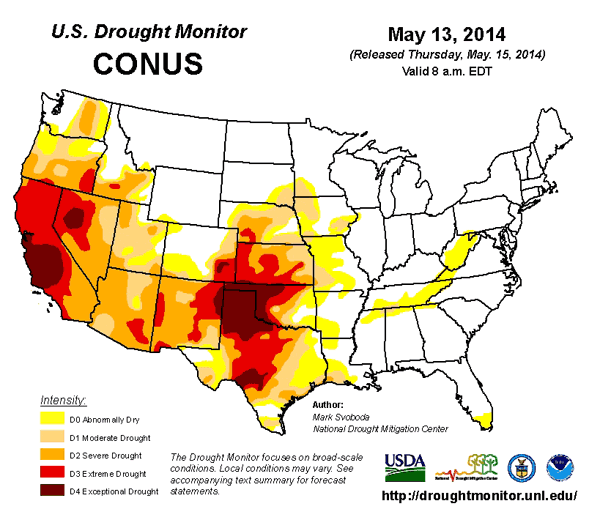

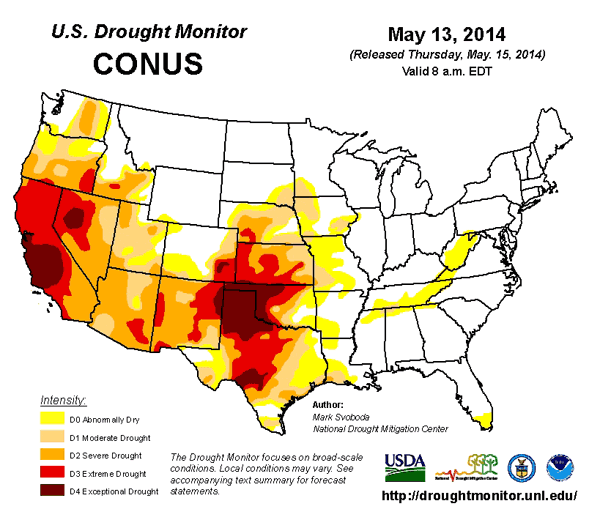

For instance, the historic drought in California this past winter is a reflection of exactly this dynamic in action:

From November 2013 – January 2014, a remarkably extreme jet stream pattern set up over North America, bringing the infamous “Polar Vortex” of cold air to the Midwest and Eastern U.S., and a “Ridiculously Resilient Ridge” of high pressure over California, which brought the worst winter drought conditions ever recorded to that state. A new study published this week in Geophysical Research Letters, led by Utah State scientist S.-Y. Simon Wang, found that this jet stream pattern was the most extreme on record, and likely could not have grown so extreme without the influence of human-caused global warming. The study concluded, “there is a traceable anthropogenic warming footprint in the enormous intensity of the anomalous ridge during winter 2013-14, the associated drought and its intensity.”

California is a major food producing region, and the lack of water is already reducing production, with on-going effect.

Farmers in the state probably will leave as much as 500,000 acres unplanted, or about 12% of last year’s principal crops, because they won’t have enough water to produce a harvest, which will mean fewer choices and higher prices for consumers, said Mike Wade, executive director of the California Farm Water Coalition, a Sacramento-based group of farmers, water district managers and farm-related businesses. “Any job that’s associated with agriculture is hurting,” Wade said. While some farmers were able to conserve water in years past, they won’t get “any preferential treatment” over uses by municipalities, he said.

Extreme weather around the world is wreaking havoc with farmers and threatening global food production. Dry weather in China turned the world’s second-biggest corn grower into a net importer of the grain in 2010, and ranchers in Texas have yet to recover from a record dry spell three years ago. One in eight people in the world go hungry, some of which can be blamed on drought, according to the United Nations.

Although California is a relatively wealthy place, food security is affecting an increasing number of people as the financial bubble leaves more and more people behind, unable to keep up with a treadmill that keeps running faster and faster. As a result, the drought is impacting food security for the poorest residents:

The effects of California’s drought could soon hit the state’s food banks, which serve 2 million of its poorest residents. Fresh produce accounts for more than half the handouts at Bay Area food banks, but with an estimated minimum of 500,000 acres to be fallowed in California, growers will have fewer fruits and vegetables to donate.

With less local supply, food prices will spike, increasing as much as 34% for a head of lettuce and 18% for tomatoes, according to an Arizona State University study released last week. With fewer fields planted, there could be as many as 20,000 unemployed agricultural workers who will need more food handouts, especially in the Central Valley. And if urban food banks like those in Oakland and San Francisco can’t get produce from the valley, which grows a third of the nation’s fruits and vegetables, their transportation costs to haul in out-of-state produce will soar.

Jet stream fluctuations are now driving the development of dangerous heat conditions further inland, exacerbating persistent drought conditions reminiscent of the 1930s. In fact the US Department of Agriculture has recently issued what is effectively a dust bowl warning:

Meanwhile, US Department of Agriculture officials issued a warning Tuesday that conditions in the US Heartland were rapidly deteriorating along lines last seen during the infamous 1930s Dust Bowl as expectations for the US domestic winter wheat crop again fell after the USDA’s most recent agricultural tour.

Even prior to the extreme early May heatwave emerging over the Central US Sunday, Monday and Tuesday, the% of the US wheat crop in either good or excellent condition had fallen another 2% to 31% late last week. Meanwhile, crops listed as ‘very poor’ rocketed from an already abysmal 34% to 39% over the same period. The net result is that the US wheat crop is in its worst condition since at least 1996, according to findings by Commerzbank analysts.

For Oklahoma, at the epicenter of current agricultural harm and flash heatwaves, only 6% of the state’s entire wheat crop was listed as in either good or excellent condition. Department of Agriculture crop scouts described the Oklahoma situation in, perhaps, the starkest possible terms during their most recent report stating: “Producers in the Panhandle continued to experience high winds … and low moisture conditions similar to the Dust Bowl in the 1930s.” Overall, analysts now expect a US wheat crop of just 762 million bushels, the third lowest in 15 years despite record areas planted.

In other parts of the world, climate-driven changes in rainfall patterns over longer periods could have catastrophic effects where rain is highly seasonal and the food security of very large numbers of people depends on its regularity. For instance, the Indian summer monsoon is critical for farming in a country of over a billion people, but is predicted to be significantly affected in a future of rising temperatures:

Global warming could cause frequent and severe failures of the Indian summer monsoon in the next two centuries, new research suggests. The effects of these unprecedented changes would be extremely detrimental to India’s economy which relies heavily on the monsoon season to bring fresh water to the farmlands. The findings have been published November 6, in IOP Publishing’s journal Environmental Research Letters, by researchers at the Potsdam Institute for Climate Impact Research and Potsdam University….

….The Walker circulation usually brings areas of high pressure to the western Indian Ocean but, in years when El Niño occurs, this pattern gets shifted eastward, bringing high pressure over India and suppressing the monsoon, especially in spring when the monsoon begins to develop. The researchers’ simulations showed that as temperatures increase in the future, the Walker circulation, on average, brings more high pressure over India, even though the occurrence of El Niño doesn’t increase.

Unfortunately, surface water resources in both India and China will also be badly affected by the on-going melting of the Himalayan glaciers, with additive effect:

The world is now facing a climate-driven shrinkage of river-based irrigation water supplies. Mountain glaciers in the Himalayas and on the Tibet-Qinghai Plateau are melting and could soon deprive the major rivers of India and China of the ice melt needed to sustain them during the dry season. In the Ganges, the Yellow, and the Yangtze river basins, where irrigated agriculture depends heavily on rivers, this loss of dry-season flow will shrink harvests.

The world has never faced such a predictably massive threat to food production as that posed by the melting mountain glaciers of Asia. China and India are the world’s leading producers of both wheat and rice — humanity’s food staples. China’s wheat harvest is nearly double that of the United States, which ranks third after India. With rice, these two countries are far and away the leading producers, together accounting for over half of the world harvest.

The Intergovernmental Panel on Climate Change reports that Himalayan glaciers are receding rapidly and that many could melt entirely by 2035. If the giant Gangotri Glacier that supplies 70% of the Ganges flow during the dry season disappears, the Ganges could become a seasonal river, flowing during the rainy season but not during the summer dry season when irrigation water needs are greatest.

The combination of shifting seasonal rainfall, disappearing glacial meltwater, and the falling water tables already discussed adds up to a major predicament for Asian food security going forward:

Asia is home to some of the world’s biggest natural-disaster hot spots, and no other continent is more prone to the cumulative impact of droughts, flooding and large storms. This fragility is compounded by the region’s unmatched population size and density, and its concentration of people living in deltas and other low-lying regions.

The specter of a hotter, drier future for Asia can be seen in the degradation of watersheds, watercourses and other ecosystems, as well as in the shrinking forests and swamps and over-dammed rivers. Such developments undermine the region’s hydrological and climatic stability, fostering a cycle of chronic droughts and flooding. To make matters worse, Asia is likely to bear the brunt — as the report by the U.N. Intergovernmental Panel on Climate Change warns — of the global effects of extreme weather, rising seas and shortages of drinking water. Water wars may only be a matter of time.

Asia’s droughts are becoming longer and more severe, and the availability of water per capita is declining at a rate of 1.6% a year. This is a troubling trend for a region where agriculture alone guzzles 82% of the annual water supply. The rapid spread of irrigation since the 1960s has helped turn a continent once plagued by food shortages and famines into a food exporter. But it has also exacted a heavy toll on the environment and resources.

Higher temperature in many locations are also set to lead to substantially higher rates of evaporation, compounding the problem:

Sure, scientists expect the changing climate to bring on more drought. There’s going to be less rainfall in already arid regions, that’s fairly certain. And that alone would be bad news for denizens of the planet’s dry zones—in some places in North Africa, the American Southwest, India, and the Middle East, water shortages could well become an existential threat to civilization. But new research shows that evaporation may be more of a problem than previously thought: Climate change could dry out up to a third of the planet.

The study, published in the journal Climate Dynamics last month, estimates that climate change will cause reduced rainfall alone to dessicate 12% of the Earth’s land by 2100. But if evaporation is factored in, the study’s authors say that it will “increase the percentage of global land area projected to experience at least moderate drying by the end of the 21st century from 12 to 30%.”

“We know from basic physics that warmer temperatures will help to dry things out,” the study’s lead author, Benjamin Cook, a climate scientist with Columbia University and NASA’s Goddard Institute for Space Studies, said in a statement. “Even if precipitation changes in the future are uncertain, there are good reasons to be concerned about water resources.”

Writing in a 2011 literature review in the science journal Nature, the physicist Joe Romm elaborates on how increased heat and evaporation can lead to a vicious cycle: “Precipitation patterns are expected to shift, expanding the dry subtropics. What precipitation there is will probably come in extreme deluges, resulting in runoff rather than drought alleviation. Warming causes greater evaporation and, once the ground is dry, the Sun’s energy goes into baking the soil, leading to a further increase in air temperature.”

Disappearing soil moisture is likely to be a greater problem than previously thought, and the occasional downpour won’t sate year-round crops. As Columbia University notes, “An increase in evaporative drying means that even regions expected to get more rain, including important wheat, corn, and rice belts in the western United States and southeastern China, will be at risk of drought.”

Australia, already the driest continent, is set to become drier as a result of reduced rainfall and higher evaporation. While the continent current produces a huge excess of food for export, it’s ability to continue doing so is likely to be substantially compromised in an increasingly arid future:

Australia emerged from a decade-long drought in 2009, which was said to be the worst in the country’s history. The report states the drought was estimated to have caused an 80% reduction in grain production and a 40% reduction in livestock production, and climate models predict that rainfall in southern and eastern Australia will continue to decrease as the century progresses.

Increasing aridity can lead to additional risks, notably the threat of wildfires. California is facing a potentially catastrophic fire season this year following on from its recent drought:

Even before this year’s drought, forest officials were reporting a longer fire season, and more catastrophic mega-fires, in California and other western states. Half of the worst fires in recorded Californian history have occurred since 2002. Climate change and land-use patterns are adding fuel to those fires. Higher temperatures, with recurring and intensifying droughts are drying out landscapes. Pest invasions, such as the pine bark beetle, have killed off stands of trees.

California’s state fire chief, Ken Pimlott, said: “We can’t recall when we have seen this level of fire activity early in this year. “This is usually the time of year when much of the state is greening up. We haven’t even got into the months that historically are the worst in California – late August, September and October – so that’s a big red flag right there.”

Similarly, Australia is facing increased risk of major conflagrations as climatic shifts cause further drying. There have been an increasing number of hot, dry and windy days over the last 30 years, amounting to greatly increased fire risk. The country only recently emerged from the worst drought in its history, which was accompanied by huge fires. Fire has always been a feature of the arid landscape, reflected in the fire tolerance of many trees, but not on the scale seen in recent years. These intense fires are a far bigger threat. They incinerate all before them and remove all the oxygen from the air as they pass by:

The 2009 Black Saturday bushfires in Victoria were also preceded by extreme fire danger conditions: a decade-long drought and a number of record hot years, all compounded by a heatwave in the week prior. The ferocity of these fires was unprecedented, and so severe were they that they broke the record for the Forest Fire Danger Index, and a new category – ”catastrophic” or ”code red” – was added. Worryingly, since 2009, we have experienced more days of ”catastrophic” fire danger, and this number will very likely increase in the future. Fire frequency and intensity is also predicted to increase in already fire-prone areas – areas in which a large proportion of the Australian population lives. We are now also seeing the season of bushfire weather lengthening from October to March, and this will continue to extend in future….

….So, while bushfires are part of the Australian story, more intense and frequent bushfires are part of the Australian climate change story. The current environment in which we experience bushfires is changing. The lengthened bushfire season, and increased frequency and intensity of heatwaves, mean that the overall risk of bushfires in Australia has amplified.

Bushfires are capable of wiping out areas of food production. This is of particular concern for tree crops which take many years to re-establish. Intense fires can also cause soil damage.

Apart from the problem of too little water, climate change can also lead to too much. Flooding can inflict enormous damage on food production, often in areas where food insecurity is already prevalent:

The impact of extreme weather events on food production and consumption are well documented. For example, extreme floods in Pakistan in 2010 destroyed an estimated two million hectares of crops, killed 40% of the livestock in affected areas, and delayed the planting of winter crops, causing the price of basic foods such as rice and wheat to rocket. As a consequence, an estimated eight million people reported eating less food and less nutritious food over an extended period of time.

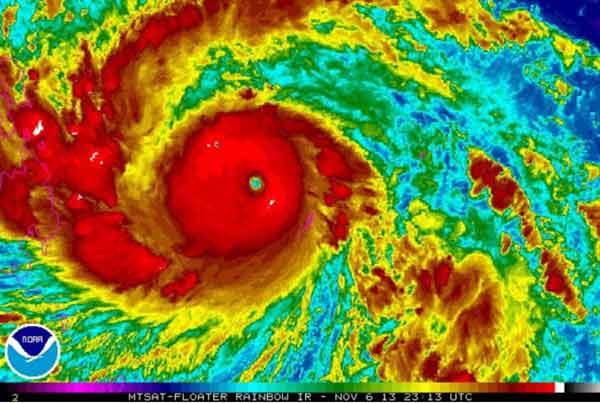

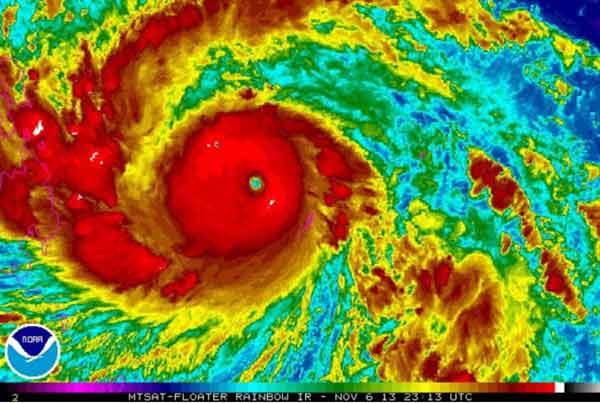

Increasingly intense storms can bring deluges, but also damaging winds and storm surges high enough to cause serious coastal flooding. For instance, Typhoon Haiyan, which hit the Philippines in late 2013 was the most powerful to make landfall since records began, with winds reaching 310km/h. While one cannot say definitively that any one event is caused by climate change, warmer air and oceans, leading to greater evaporation and therefore more moisture in unstable air masses, would be expected to raise the probability of increasingly intensity of storm events. Storms draw their energy from warm water, and their impact is enhanced by rising sea levels, the disappearance of protective coastal wetlands and coastal over-development.

Storms threaten not only land crops, but also the biologically diverse and highly productive coastal food production relied upon by so many people. Some 95% of marine food production originates from coastal ecosystems, but damage to mangrove forests and coastal wetlands destroys spawning and feeding grounds for fisheries.

Increasing temperature, even in the absence of acute threats such as drought, wildfires and severe storms, are capable of lowering crops yields, particularly for grains:

Warmer temperatures may make many crops grow more quickly, but warmer temperatures could also reduce yields. Crops tend to grow faster in warmer conditions. However, for some crops (such as grains), faster growth reduces the amount of time that seeds have to grow and mature. This can reduce yields (i.e., the amount of crop produced from a given amount of land).

Yield declines are expected to be significant as heat and aridity increase:

“Almost everywhere you see the warming effects have a negative affect on wheat and there is a similar story for corn as well. These are not yet enormous effects but they show clearly that the trends are big enough to be important,” Lobell said. Wheat is the first big staple crop to be affected by climate change, because it is sensitive to heat and is grown around the world, from Pakistan to Russia to Canada. Projections suggest that wheat yields could drop 2% a decade….

….Declines in crop yields will register first in drier and warmer parts of the world but as temperatures rise two, three or four degrees, they will affect everyone. In the more extreme scenarios, heat and water stress could reduce yields by 25% between 2030 and 2049.

In addition, seasonal boundaries, and therefore vegetation zones, are shifting, which is making it far more difficult to produce food in the ways people have traditionally done in a given area:

Paul Roberts has been producing wine in Friendsville in Garrett County for 17 years. Last year, for the first time, his growing season began in March — six weeks earlier than the historical timeline. It was “unprecedented,” he said. For farmers and gardeners, climate change is making the art of coaxing a flower to blossom or fruit to grow precarious and unpredictable….

….A midwinter thaw or an early frost can kill many plants and ruin crops. With increasingly extreme and unpredictable weather due to climate change, plants’ health is at the whim of the weather. An early warm spell triggers fresh growth that is vulnerable to frost, Roberts said. When the growing season starts early, it means more nights for him to worry about the temperature dropping below freezing and damaging his crops….

…The mismatch of pollinators’ and plants’ schedules also threatens plants’ ability to reproduce and produce food. Plants and insects respond to changes in hours of sunlight and temperature. But if a pollinator emerges during an early temperature spike, the plants it pollinates may not be in blossom. Crops rely heavily on insects such as bees, whose populations have struggled in recent years.

Very rapid change can destabilize ecosystems in this way, as climate sensitivities for different species can vary. As prime growing temperatures shift to higher latitudes, they may no longer coincide with suitable soils and nutrients. In addition insect and plant pests may thrive without cold winters to control their populations. Novel pests may also invade with shifting temperature and humidity. Over time, land use patterns are expected to change as ecosystems shift:

Vegetation around the world is on the move, and climate change is the culprit, according to a new analysis of global vegetation shifts led by a University of California, Berkeley, ecologist in collaboration with researchers from the U.S. Department of Agriculture Forest Service….“This is the first global view of observed biome shifts due to climate change,” said the study’s lead author Patrick Gonzalez, a visiting scholar at the Center for Forestry at UC Berkeley’s College of Natural Resources. “It’s not just a case of one or two plant species moving to another area. To change the biome of an ecosystem, a whole suite of plants must change.”…

….Some examples of biome shifts that occurred include woodlands giving way to grasslands in the African Sahel, and shrublands encroaching onto tundra in the Arctic. “The dieback of trees and shrubs in the Sahel leaves less wood for houses and cooking, while the contraction of Arctic tundra reduces habitat for caribou and other wildlife,” said Gonzalez, who has served as a lead author on reports of the Intergovernmental Panel on Climate Change (IPCC). “Globally, vegetation shifts are disrupting ecosystems, reducing habitat for endangered species, and altering the forests that supply water and other services to many people.”

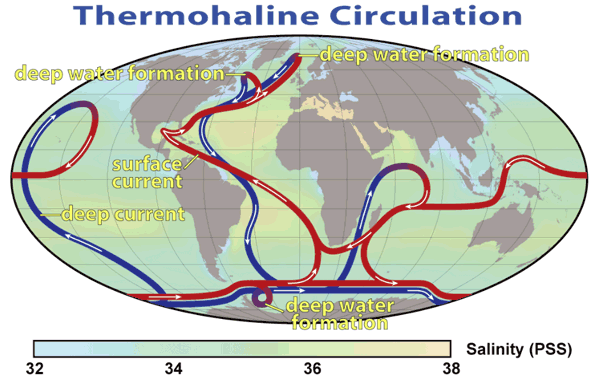

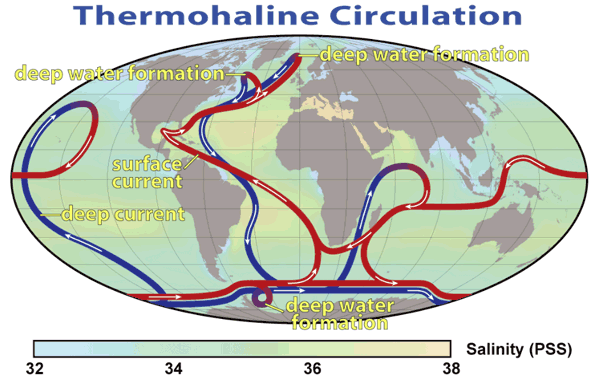

Important shifts with major implication for food security are happening not just on land, but also in the oceans. Climate change is compounding the impact of fish stocks collapsing due to over-fishing. Oceans are warming. This translates into rising sea levels due to thermal expansion, combined with the effect of melting glaciers and ice sheets. Ocean currents are being altered as temperature changes in the atmosphere drive changes in wind patterns and therefore surface currents, and ice melting changes the ocean density profile. As thermohaline circulation in the oceans provides nutrients through upwelling, changes have the potential to cause much damage to marine ecosystems by starving the base of the food chain.

Changes in ocean heat flow have the potential to alter the climate on land as well. For instance, a weaker Gulf Stream would be expected to cause substantial cooling in northern Europe. Cold periods in Europe’s past have been associated with a weaker Gulf Stream, and climate change is predicted to pose a risk this may happen to a greater extent:

“The strength of the Gulf Stream was about 10% weaker during the Little Ice Age,” David Lund, of the Massachusetts Institute of Technology/Woods Hole Oceanographic Institution, told Reuters. He and two colleagues studied sediment cores off Florida and the Bahamas, and found evidence of a weaker flow that may have contributed to the Little Ice Age from about 1200-1850, when Alpine glaciers grew and London’s Thames River froze. “The possibility of abrupt changes in Gulf Stream heat transport is one of the key uncertainties in predictions of climate change for the coming centuries,” the scientists wrote in the journal Nature.

In addition, ocean acidification, as the oceans absorb CO2 from the atmosphere, is also impacting at the base of the food chain, affecting the millions of small organisms increasingly unable to form their carbonate shells:

Ocean acidification is sometimes called “climate change’s equally evil twin,” and for good reason: it’s a significant and harmful consequence of excess carbon dioxide in the atmosphere that we don’t see or feel because its effects are happening underwater. At least one-quarter of the carbon dioxide (CO2) released by burning coal, oil and gas doesn’t stay in the air, but instead dissolves into the ocean. Since the beginning of the industrial era, the ocean has absorbed some 525 billion tons of CO2 from the atmosphere, presently around 22 million tons per day….

….When carbon dioxide dissolves in seawater, the water becomes more acidic and the ocean’s pH (a measure of how acidic or basic the ocean is) drops. Even though the ocean is immense, enough carbon dioxide can have a major impact. In the past 200 years alone, ocean water has become 30% more acidic—faster than any known change in ocean chemistry in the last 50 million years. Scientists formerly didn’t worry about this process because they always assumed that rivers carried enough dissolved chemicals from rocks to the ocean to keep the ocean’s pH stable. (Scientists call this stabilizing effect “buffering.”) But so much carbon dioxide is dissolving into the ocean so quickly that this natural buffering hasn’t been able to keep up, resulting in relatively rapidly dropping pH in surface waters. As those surface layers gradually mix into deep water, the entire ocean is affected….

….Reef-building corals craft their own homes from calcium carbonate, forming complex reefs that house the coral animals themselves and provide habitat for many other organisms. Acidification may limit coral growth by corroding pre-existing coral skeletons while simultaneously slowing the growth of new ones, and the weaker reefs that result will be more vulnerable to erosion. This erosion will come not only from storm waves, but also from animals that drill into or eat coral. By the middle of the century, it’s possible that even otherwise healthy coral reefs will be eroding more quickly than they can rebuild.

Coral bleaching, as a result of environmental stressors such as rising temperature and increasing acidification, is an indicator that highly productive marine ecosystems are under threat. Marine food webs can collapse, with reefs dying and top predators over-fished, leaving the simple organisms such as sea urchins and jellyfish to proliferate unchecked. This is a tragedy in its own right, but will inevitably have knock-on consequences for human food security as well, as so many people either make, or supplement, their living from the sea.

While specific climate impacts are only probabilistically predictable over the longer term, there is every reasons to think that these impacts are going to exacerbate the the problem of food security.

The Bottom Line

Water will be in increasingly short supply as more and more people attempt to provide for themselves in regions where the supply is diminishing and resources are being used at far greater than replacement rate. Climate change is expected to accentuate water shortages in many ways, as well as having destabilizing effects on ecosystems forced to shift latitude or altitude rapidly. The potential for conflict is already increasing, as we saw in part one of this series in relation to food prices. Water and climate change are going to add to the pressure, and this is likely to precipitate some very unfortunate situations.

Our relentless human expansion is running up against hard, non-negotiable limits to food security, which is already threatened in so many places. Our current extractive methods amount to a draw down of natural capital, allowing us to feed (most of) ourselves today, but in highly wasteful ways which are already compromising our ability to feed ourselves and our descendants tomorrow. Those in a position to do so chase short term economic gain at the expense of burning through non-renewable resources in ways which clearly make no sense with respect to any logic other than short term economic benefit. Those at the other end of the financial food chain also prioritize what could, in a sense, be called short term gain, but for them is in fact a matter of short term survival.

The next part of this series will address the equally pressing issues of energy, soil fertility and carrying capacity.