DPC Maumee River waterfront, Toledo, OH 1910

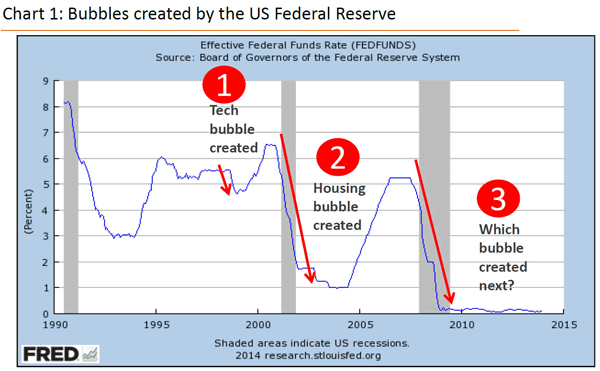

This is it. This will decide the US elections the same way it did Brexit, and many European elections over the next 2 years and change.

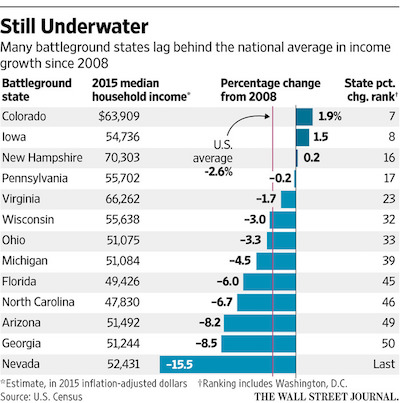

• Many Presidential Swing States Lag Behind in Income Gains (WSJ)

Key swing states such as Nevada, North Carolina and Florida have seen some of the weakest income growth in the country since the last non-incumbent presidential contest in 2008, new census figures show. A Wall Street Journal analysis of state-by-state income data set for release on Thursday shows that more than half of the 13 states where the presidential race appears closely contested have seen below-average income growth since 2008. Among the eight laggards, three states saw the lowest wage growth in the U.S. during that time—Nevada, Georgia and Arizona. The new data show how America’s uneven economic recovery is adding another layer of unpredictability to an already volatile electoral map.

The traditional realm of battleground states has expanded, putting into play states such as Arizona and Georgia, which haven’t gone to a Democratic presidential candidate in at least 20 years. The Census Bureau also said income inequality across the country increased in 2015. The recovery’s income gains have been concentrated in central cities, with suburbs and rural areas largely lagging behind for years. “You actually see the bottom and the top pulling apart a little bit more in some of these keys states,” said David Damore, professor of political science at the University of Nevada Las Vegas. On a national basis, most states still haven’t seen income recover to pre-recession levels. Americans’ median household income in 2015 was 2.6% lower than in 2008, census figures show.

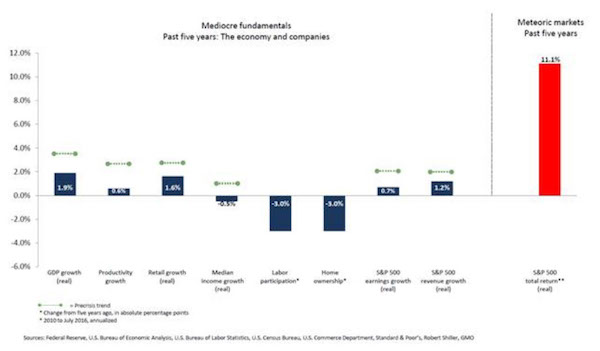

“Much of the run-up over the past few years has been primarily about multiple expansions. And the scary thing about multiple expansions is that they are reliably mean-reverting—if they run too far, the market always takes it back, sometimes with a vengeance. And we are currently almost 70% too far.”

• Mediocre Fundamentals Mean Meteoric Markets Are 70% Overvalued (GMO)

While all eyes were on Federal Reserve Chair Janet Yellen in Jackson Hole, we were watching something else. In August, the Shiller P/E, a well-regarded metric for measuring the valuation of U.S. equities, breached 27. Given that its normal range is something a bit above 16, valuations are looking rather stretched. Further, the last time the Shiller P/E was above 27 was in October … 2007. And we all know how that movie ended. While nobody here at GMO is saying that a crash is imminent (and there’s no law that says stocks cannot become even more expensive), we continue to maintain our bias against U.S. stocks. We will also take this end-of-summer moment to point out the yawning disconnect between fundamentals (of the U.S. economy and even corporate America) and their stocks. It really is a tale of two cities, one of mediocre fundamentals versus a meteoric rise in markets (see the chart below).

We pulled together some meaningful metrics on the health of the economy and some top-line/bottom-line numbers on the S&P 500 Index: GDP growth, productivity, and household income, as well as a few others, including revenue and earnings for U.S. stocks, for good measure. It is a tale of mediocrity, at best. Then, we contrasted those with the actual market returns of the S&P 500 Index over the past five years. Truly meteoric. (As an aside, we at GMO have always been leery of drawing too many investment conclusions from staring at economic data—we are more valuation-oriented, after all—but even we are struck by the divergence.) Which brings us back to the Shiller P/E. Much of the run-up over the past few years has been primarily about multiple expansions. And the scary thing about multiple expansions is that they are reliably mean-reverting—if they run too far, the market always takes it back, sometimes with a vengeance. And we are currently almost 70% too far.

“Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited..” “..the bank is aiming for an amount between $2 billion and $3 billion..”

• US Seeks $14 Billion From Deutsche Bank Over Mortgage Securities Fraud (AFP)

Authorities in the US are seeking as much as $14 billion from Deutsche Bank to resolve allegations stemming from the sale of mortgage securities in the 2008 crisis, the German financial giant confirmed Thursday. The payout would be the largest ever inflicted on a foreign bank in the United States, easily surpassing the $8.9 billion that French bank BNP Paribas paid in 2014 for sanctions violations. But in a quick reaction, Deutsche Bank rejected the $14 billion figure, which the bank said was an opening proposal in settlement talks with US prosecutors. “Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited,” the statement said. “The negotiations are only just beginning. The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts.”

The US investment bank Goldman Sachs in April agreed to pay more than $5 billion to settle similar allegations. US authorities have accused major banks of misleading investors about the values and quality of complex mortgage-backed securities sold before the 2008 financial crisis. Much of the underlying lending was worthless or fraudulent, delivering billions of dollars in losses to holders of the mortgage bonds when the housing market collapsed, bringing down numerous banks and touching off the country’s worst recession since the 1930s. According to securities filings, Deutsche Bank as of June 30 had set aside $5.5 billion to resolve pending legal matters. In the mortgage-backed securities matter, the bank is aiming for an amount between $2 billion and $3 billion, according to knowledgeable sources.

“They have declined about 46% this year.”

• Deutsche Bank Shares Plunge After Rebuffing $14 Billion US Fine (BBG)

Deutsche Bank shares slumped after receiving a $14 billion claim from the U.S. Justice Department to settle an investigation into the firm’s sale of residential mortgage-backed securities, a figure the German lender said it won’t pay. “Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited,” the company said in a statement early Friday in Frankfurt. “The negotiations are only just beginning. The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts.” Bank of America paid $17 billion to reach a settlement in a similar case in 2014, the biggest such accord to date.

Goldman Sachs agreed to a $5.1 billion settlement with the U.S. earlier this year, including a $2.4 billion civil penalty and $875 million in cash payments, to resolve U.S. allegations that it failed to properly vet mortgage-backed securities before selling them to investors as high-quality debt. The settlement included an admission of wrongdoing. “Overall it’s very negative for the share price if you look at the Justice Department figure but you don’t know where it will end up,” said Andreas Plaesier at Warburg Research with a hold recommendation on the shares. “If you come down to the Goldman amount they may not need to do much in terms of reserves.” The shares dropped as much as 8.2% and were down 7.8% at 12.08 euros at 9:04 a.m. in Frankfurt. They have declined about 46% this year.

“..we project global corporate credit demand (flow) of $62 trillion over 2016-2020, with new debt representing two-fifths and refinancing the rest.”

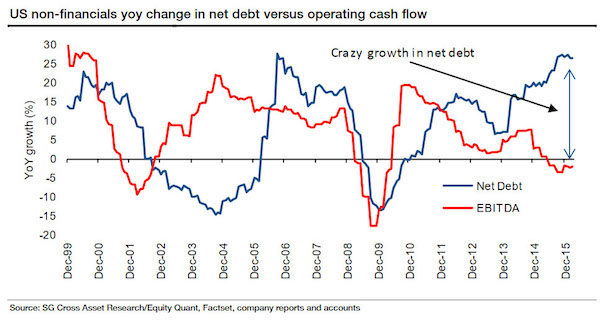

• Observations About US Corporate Debt (ZH/Kestel)

Extraordinary low interest rates around the world have delivered a monumental blow to many investors. Falling interest rates have translated into rising liabilities for (defined benefit) pension plans and, secondly, millions of retirees, who depend on income from savings to take them through retirement, are struggling to make a decent living. Consequently, investors take risks that they weren’t previously prepared to take. Take US corporate high yield bonds. The prevailing view seems to be that US corporates (ex. energy) are in very good shape with loads of cash on their balance sheet, and that they therefore offer a relatively attractive, and a comparatively safe, investment opportunity. I beg to disagree. Firstly, we are late in the economic cycle, and it is usually a bad idea to buy corporate high yield bonds late in an economic upturn. Secondly, let me share some facts with you that undermine the perception outlined above:

- The 1% most cash-rich of all US companies control over 50% of all US corporate cash.

- The five most cash-rich US companies (Apple, Microsoft, Google, Cisco and Oracle) control 30% of all US corporate cash.

- Total US corporate debt (the other side of the balance sheet) was $5.03 trillion at the end of 2015- up from $2.62 trillion at the end of 2007.

- Net debt (i.e. debt ex. cash) amongst US corporates was $3.39 trillion at the end of 2015 vs. $1.88 trillion at the end of 2007.

- US corporate debt has risen by $2.8 trillion over the last five years, while corporate cash has only risen by $600 billion.

- If you back out the top 1% referred to in (1) above, the cash holdings of the remaining 99% fell 6% in 2015 to stand at just $900 billion by the end of December vs. $6.6 trillion of debt.

Based on those numbers, I think it is fair to say that, with the exception of a few extremely cash-rich companies, corporate America is increasingly indebted and not at all as cash-rich as widely perceived. This also explains why corporate investments in the US are at a 60-year low.

Governments globally are persisting with monetary expansion to support economic growth and prop up inflation, to the detriment of credit quality, particularly for over-indebted Chinese corporates and U.S.leveraged borrowers. In our base-case scenario, we project global corporate credit demand (flow) of $62 trillion over 2016-2020, with new debt representing two-fifths and refinancing the rest. Outstanding debt would expand by half to $75 trillion, with China’s share rising to 43% from 35%.

We estimate that two-fifths (43%) to half (47%) of nonfinancial corporates (unrated and rated) are highly leveraged-of which 2% to 5% face negative earnings or cash flows, based on a sample of about 14,400 corporates. With weakened borrower credit quality, a credit correction is inevitable. Our base case is for an orderly credit slowdown stretching over several years (‘slow burn’ scenario), but a series of major economic or political shocks, such as the recent Brexit vote in the U.K., could trigger a more system-wide credit contraction (‘Crexit’ scenario).

I see big protests in the offing as public pensions get bailed out by taxpayers who see their private plans left to die.

• This is How You Will Bail Out Municipal Pension Funds (WS)

[..] the beneficiaries are voters and employees of the government, and politicians of all stripes bought their votes with promises of low contributions and rising benefits. They got away with it for decades because no one cares about “underfunded pensions.” Even the term makes people’s eyes glaze over. But someone is going to pay. And it’s not going to be the politicians. This is how they will pay for it in Chicago – the city whose credit rating Moody’s cut by two notches to junk in April last year, and whose interest payments, despite historically low interest rates, have continued to skyrocket as it borrows more and skids deeper into the sinkhole of its own making.

On Wednesday, the City Council approved Mayor Rahm Emanuel’s scheme to bail out its largest and worst-off pension fund, the Municipal Employees’ Annuity and Benefit fund, which would otherwise be insolvent within ten years – and a lot quicker if markets have a hissy fit. Despite seven years of rampant asset price inflation, and asset bubbles nearly everywhere, the fund’s obligations are only 20% funded. It forms part of Chicago’s $34 billion in retirement debt, accumulated over the decades by politicians making promises to buy votes and support from special interest groups. But neither the beneficiaries nor taxpayers via the city contributed enough to pay for those promises.

To save this one pension fund out of its four pension funds from insolvency, the city is jacking up water and sewer levies by 33%, phased in over a few years. Property owners in Chicago will pay, one way or the other, $3 billion into the fund by 2022, up from $1 billion under the prior scheme. Despite these billions of dollars involved, the fund covers only 77,000 workers and retirees.

“A 100-city index compiled by SouFun surged by a worrisome 14% in the last year.”

• The Next Bubble: China’s Housing Gets Scarily Expensive (Balding)

For many years, China’s authorities took a Goldilocks approach to housing prices: They wanted a market that was neither too hot nor too cold, and took measures as needed to control prices. Although an explicit asset-price target was never announced, it was widely assumed that the government wanted home prices to grow in line with the rate of economic growth. To accomplish this, technocrats in Beijing deployed a combination of monetary stimulus and regulatory measures. When prices overheated, they put the brakes on credit growth, required higher down payments for mortgages and placed administrative restrictions on who could buy in which cities. When prices started to drop, they tried loosening credit and boosting the number of units people could own.

But in the past few years, with economic growth sluggish, the planners became much more tolerant of rising prices, even as signs of a bubble emerged. Official data shows the price-to income-ratio hitting 9.2 at the end of 2015; housing prices have continued to rise significantly since. All this has led to some widespread distortions. China’s homeowners have come to see near double-digit real-estate returns as a birthright, a bet on par with death and taxes. According to one study, more than 70% of Chinese household wealth is in housing. Investors believe there’s an implicit guarantee that the government won’t let home prices drop, even as many buildings sit empty.

Meanwhile, banks have gone on a lending spree: Total outstanding mortgage loans rose more than 30% and new mortgage growth clocked in at 111% in the past year. Since June 2012, outstanding mortgage loans have grown at an annualized rate of 30%. Predictably, that’s pushed prices higher and higher. In urban China, the average price per square foot of a home has risen to $171, compared to $132 in the U.S. In first-tier cities such as Beijing and Shenzhen, prices have increased by about 25% in the past year. A 100-city index compiled by SouFun surged by a worrisome 14% in the last year. Developers are buying up land in some prime areas that would need to sell for $15,000 per square meter just to break even.

Break their power!

• Europe, Japan Banking Sectors Threaten Revolt Over Basel Rules (BBG)

Europeans told the world’s top banking regulator that they’ve had enough. In two heated meetings in the past week, regulators from countries including Germany and Italy told the Basel Committee on Banking Supervision that proposed changes to how banks assess credit, market and operational risks must be scaled back and slowed down, according to two people with knowledge of the matter. Some European officials went so far as to say they wouldn’t adopt the proposals on the table, according to the people, who asked not to be identified because the deliberations were private. If the EU – home to nearly half of the world’s most systemically important banks – balks at implementing the Basel Committee’s rules, it could undermine the global regulator’s authority and contribute to fragmentation of the industry.

The Basel Committee is racing to finish work on the post-crisis capital framework known as Basel III by the end of the year, and it’s under instructions not to increase capital requirements significantly in the process. The debate in Basel pits bank regulators from Tokyo to Frankfurt against a U.S.-backed push for stiffer standards, which take effect when they’re implemented by national governments. The industry says the proposed revisions to risk-assessment rules and limits on banks’ use of their own models to make these calculations would send capital requirements spiraling. Key policy makers have heeded their message. German FinMin Schaeuble last week insisted that the Basel Committee not only keep any overall increase in capital requirements to a minimum, but also ensure the rules have no “particularly negative consequences for specific regions,” such as Europe.

Shunsuke Shirakawa, vice commissioner for international affairs at Japan’s Financial Services Agency, has said the regulator needs to “make adjustments” to bring the new rules in on target. The Basel Committee’s members include Japan’s FSA, Germany’s Bundesbank and the U.S. Federal Reserve. Large European banks may be more vulnerable than their global peers to the changes under discussion. The biggest European banks had an average common equity Tier 1 capital ratio – a key measure of financial strength – higher than their global peers at end-2015, according to data from the European Banking Authority and the Basel Committee.

“..mass failure of many Chinese buyers to settle on apartment contracts..”

• It’s A Long Way Down In Australia’s Looming Apartment Fall (Aus.com.au)

While Australia debates its interest rate policy, the mass failure of many Chinese buyers to settle on apartment contracts is looming as a much bigger catastrophe than markets are expecting. This emerged from the comments of a reader to my commentary yesterday on the Sydney and Melbourne apartment markets. One of my readers who did not allow his full name to be published but used the name “James” complained that I had grossly understated the problem. James revealed that he owned and ran a debt and equity funding business that is on the frontline of the apartment settlement problem. His business deals with the developers of the apartment complexes rather than rather than the investors. James describes what is ahead this way:

“The problem is much worse than what you have described. Our analysis of every development in the country suggests that settlement failures will be between $1 billion and $1.5bn every month for the next 12 months. This is from the Chinese alone, but when settlement prices start coming more than 10% under purchase prices, we will also start to see local buyers attempting to walk away from settling. As Julius Caesar famously said: ‘the die is cast.’” To understand the implication of what James’ analysis reveals we need to step back and see how the apartment boom was funded. Most developers of apartments in Australia collect their Chinese off-the-plan deposits and then use them to gain security for a bank loan. Those bank loans can constitute 40, 50 or even 60% of the cost of the apartment complex.

The developers obtain the rest of their funding from businesses like those operated by James. This is an area of finance which we know very little about because it is hidden from public view. The banks feel they are safe in their loans to developers because there is a big difference between their loans and the cost of the buildings. But the banks are often funding other players in the apartment development. Apart from the developer, the people at risk include unsecured suppliers and the enterprises that are providing the second mortgage funding. If the Chinese fail to settle on the scale that Harry Triguboff is warning about, then there will be a deep problem. But if James’ study is correct that deep problem will develop into an economic catastrophe.

It’s over. Wind it down peacefully please.

• EU Leaders Search For Way Out Of ‘Existential Crisis’ (R.)

Shaken by Britain’s decision to leave the European Union, the leaders of its other 27 countries meet on Friday to try to inject new momentum into their ailing communal project amid deep-seated divisions over migration and economic policy. The Brexit vote in June ended more than half a century of EU enlargement and closer integration. Long seen as a guarantor of peace and prosperity, the bloc is now struggling to convince its citizens that it remains a force for good. Years of economic and financial crisis have pushed up unemployment in many member states, while a spate of attacks by Islamist militants and a record influx of refugees from the Middle East and Africa have unsettled voters, who are turning increasingly to populist, anti-EU parties.

“After the vote in the UK the only thing that makes sense is to have a sober and brutally honest assessment of the situation,” European Council President Donald Tusk told reporters in Bratislava on the eve of the meeting. “We must not let this crisis go to waste.” European Commission President Jean-Claude Juncker said earlier this week the EU was in an “existential crisis”. Despite the pressure to lay out a new vision, leaders have played down expectations of real breakthroughs in the Slovak capital, in part because of intractable differences on the biggest issues, notably how to handle the influx of migrants.

Instead they are expected to focus on areas where there is common ground, pledging closer defence cooperation, bolstering security at the EU’s external borders and boosting the capacity of an EU investment fund meant to generate growth and jobs. The aim is to present more concrete proposals at a summit in March of next year that coincides with the 60th anniversary of the bloc’s founding Rome Treaty. But some officials admit in private that major initiatives may not be possible until elections in the Netherlands, France and Germany are out of the way by late 2017.

Many Greeks accuse Stournaras of exaggerating deficits in order to bring in the Troika.

• Greece Raids Home Of Central Bank Head (ZH)

While the US the media lashes out at Trump every time he dares to tell the truth that the central bank is a biased, engaged, political member of the decision-making landscape, other “developed” countries are happily willing to demonstrate just how apolitical the central bank truly is. Take Greece, for example, where today the chief prosecutor ordered a raid of the home of the governor of the Greek central bank, Yannis Stournaras and the company office of his wife, Lina. The searches were part of a probe conducted by the Financial Police in connection to the alleged mismanagement of more than €1 million in state funding by the Hellenic Center for Disease Control and Prevention, KEELPNO.

The investigation related to funds that KEELPNO allegedly received through a company owned by Nikolopoulou as well as complaints regarding the disappearance of documents tied to the case. According to the WSJ, the raid was part of a continuing investigation into business Stournaras’ wife has done with a state entity, officials said, in a probe that may heighten tension between the top bank official and the left-wing government. Lina Nikolopoulou-Stournaras, the wife of central bank Governor Yannis Stournaras and owner of an communications company specializing in the medical sector, is under investigation from Greek authorities for business she has done with the Hellenic Center for Disease Control and Prevention, or Keelpno.

Any and all wars declared on nouns are epic fails. But follow the money.

• Jay Z: ‘The War on Drugs Is an Epic Fail’ (NYT)

This short film, narrated by Jay Z (Shawn Carter) and featuring the artwork of Molly Crabapple, is part history lesson about the war on drugs and part vision statement. As Ms. Crabapple’s haunting images flash by, the film takes us from the Nixon administration and the Rockefeller drug laws – the draconian 1973 statutes enacted in New York that exploded the state’s prison population and ushered in a period of similar sentencing schemes for other states – through the extraordinary growth in our nation’s prison population to the emerging aboveground marijuana market of today. We learn how African-Americans can make up around 13% of the United States population – yet 31% of those arrested for drug law violations, even though they use and sell drugs at the same rate as whites.

Quite a statement for the Wall Street Journal to publish.

To repeat: “racist, sexist, homophobic, xenophobic, Islamophobic.” Those are all potent words. Or once were. The racism of the Jim Crow era was ugly, physically cruel and murderous. Today, progressives output these words as reflexively as a burp. What’s more, the left enjoys calling people Islamophobic or homophobic. It’s bullying without personal risk. Donald Trump’s appeal, in part, is that he cracks back at progressive cultural condescension in utterly crude terms. Nativists exist, and the sky is still blue. But the overwhelming majority of these people aren’t phobic about a modernizing America. They’re fed up with the relentless, moral superciliousness of Hillary, the Obamas, progressive pundits and 19-year-old campus activists.

Evangelicals at last week’s Values Voter Summit said they’d look past Mr. Trump’s personal résumé. This is the reason. It’s not about him. The moral clarity that drove the original civil-rights movement or the women’s movement has degenerated into a confused moral narcissism. One wonders if even some of the people in Mrs. Clinton’s Streisandian audience didn’t feel discomfort at the ease with which the presidential candidate slapped isms and phobias on so many people. Presidential politics has become hyper-focused on individual personalities because the media rubs them in our face nonstop. It is a mistake, though, to blame Hillary alone for that derisive remark. It’s not just her.

Hillary Clinton is the logical result of the Democratic Party’s new, progressive algorithm—a set of strict social rules that drives politics and the culture to one point of view. A Clinton victory would enable and entrench the forces her comment represents. Her supporters say it’s Donald Trump’s rhetoric that is “divisive.” Just so. But it’s rich to hear them claim that their words and politics are “inclusive.” So is the town dump. They have chopped American society into so many offendable identities that only a Yale freshman can name them all. If the Democrats lose behind Hillary Clinton, it will be in part because America’s les déplorables decided enough of this is enough.

Lovely piece.

• The Cold War Is Over (Hitchens)

Perhaps we would understand Russia’s situation better if we imagined that NATO has been dissolved and that the Confederate States and the territories conquered in the Mexican-American War have declared independence. The U.S. retains a precarious hold on the naval station at San Diego, sharing it with the Mexican Navy on an expensive lease that Mexico regularly threatens to cancel. Americans still living in San Diego are compelled to adopt Spanish names on their drivers’ licenses, and movie theaters are instructed to show films only in Spanish. Schools teach anti-American history. Quebec has seceded from Canada, and is being wooed by a Russo-Chinese economic union, with a pact including military and political clauses.

Russian politicians are in the streets of Montreal, urging on a violent anti-American mob, which eventually succeeds in overthrowing Quebec’s pro-American president and replacing him with a pro-Russian one—violating Quebec’s constitution in the process. This brings military forces aligned with Russia right up to the border with New York, Maine, New Hampshire, and Vermont. In such a case, I cannot see the U.S. sitting about doing nothing, especially if it had repeatedly warned in major diplomatic forums against this expansion of Russian power on its frontiers, and been repeatedly ignored over fifteen years or so. If a Marxist takeover in Grenada was considered good enough reason for military action, what would these circumstances provoke?

Mikhail Gorbachev’s feline spokesman, Gennadi Gerasimov, once teased suspicious Western correspondents by sneering at them in the early days of the great perestroika and glasnost experiment, “We have done the cruelest thing to you that we could possibly have done. We have deprived you of an enemy.” He was laughing at us, but he was dead right. The Cold War was a period of moral clarity when the other side really was an evil empire, and when armed resolve for once succeeded in defeating the expansion of evil in the world. It allowed my own poor country to feel more important than it really was, and it suppressed the seething impulses and rivalries of the European continent.