Alfred Palmer Annette del Sur in salvage campaign, Douglas Aircraft Co., Long Beach, CA 1942

US “intelligence” is at it again. Russia, China, Iran are all spying, but they take care of us. Now fork over more money for your security. Has there ever been a bigger scam in history?

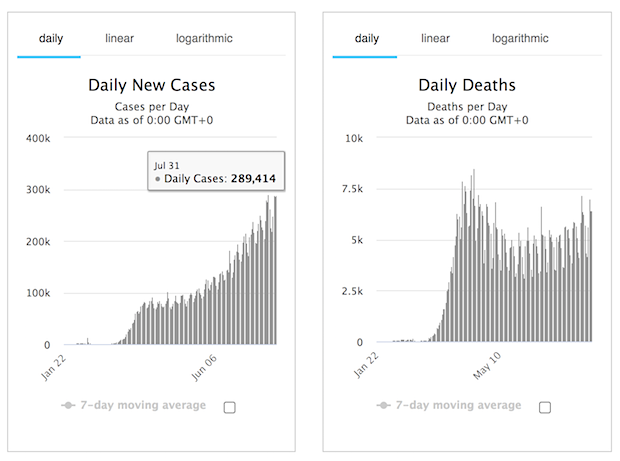

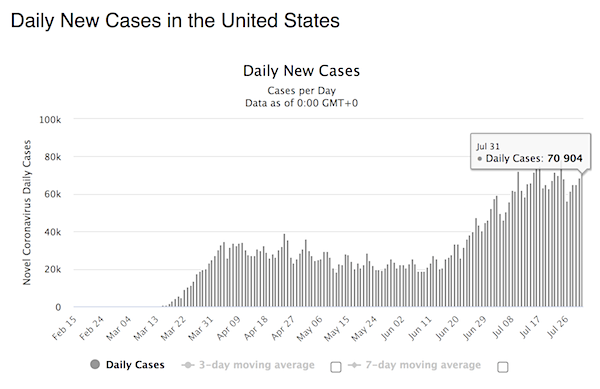

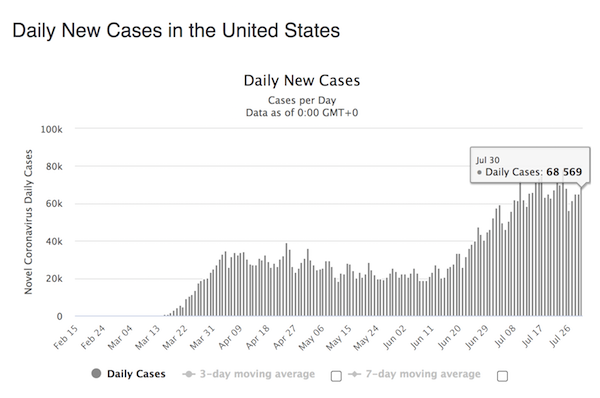

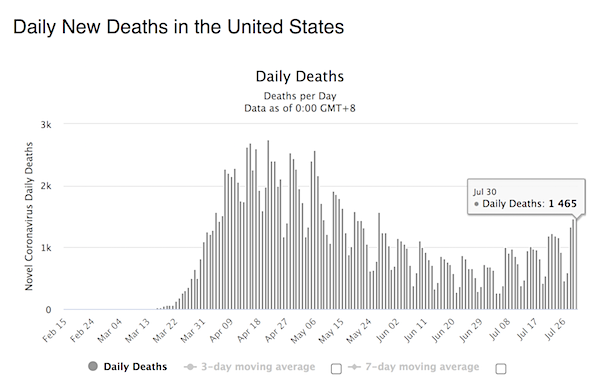

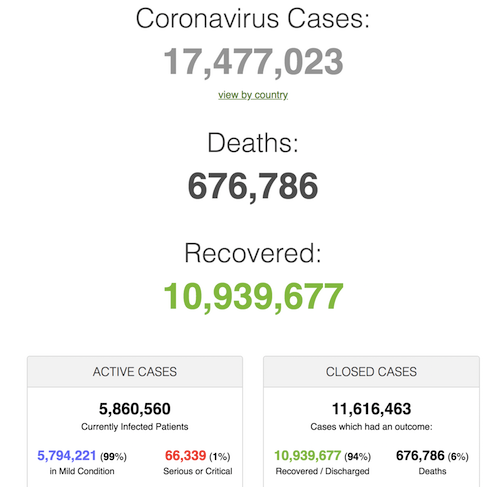

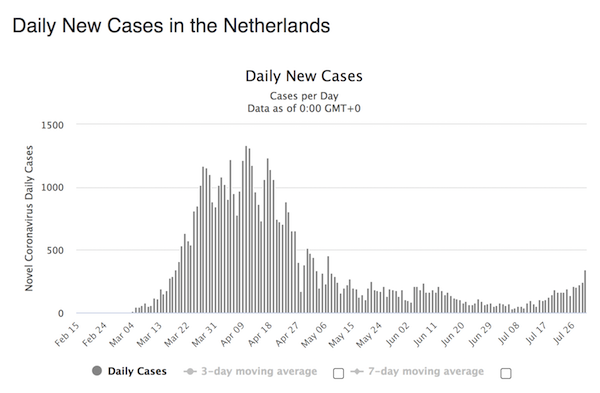

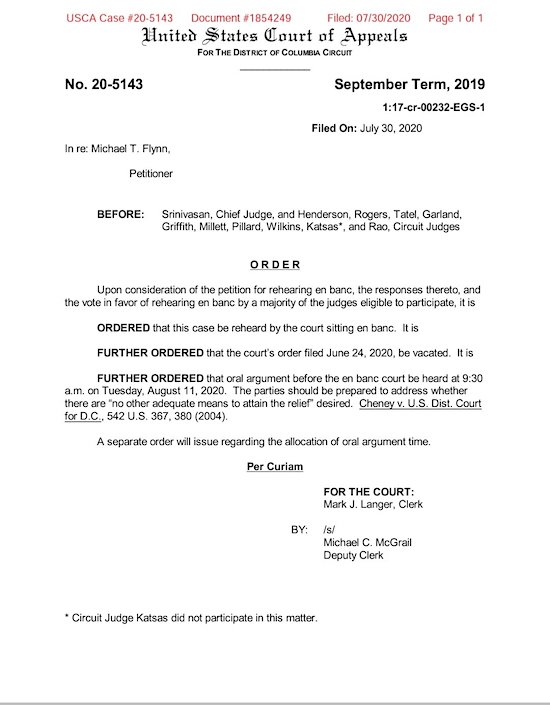

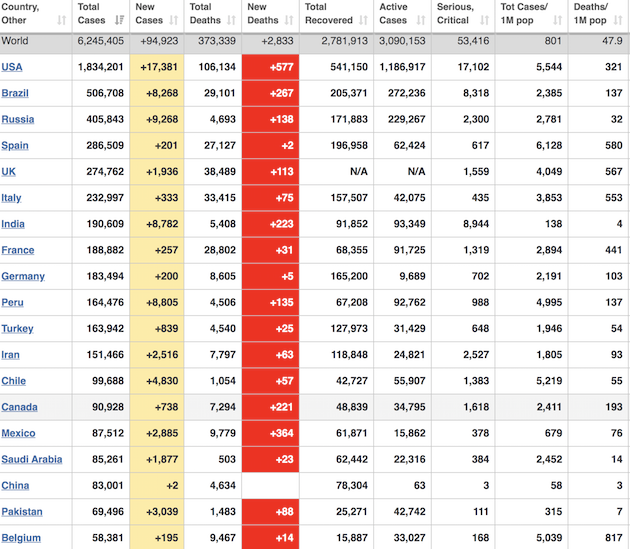

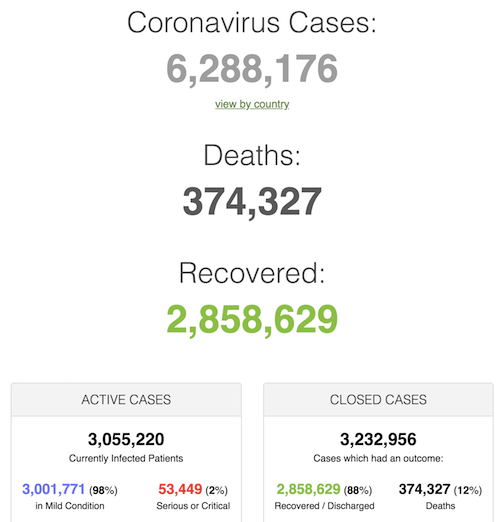

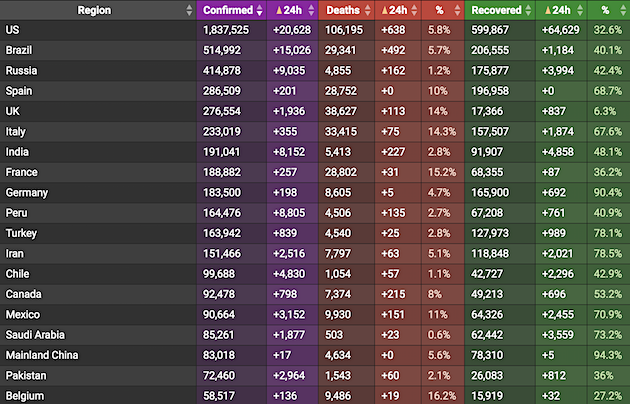

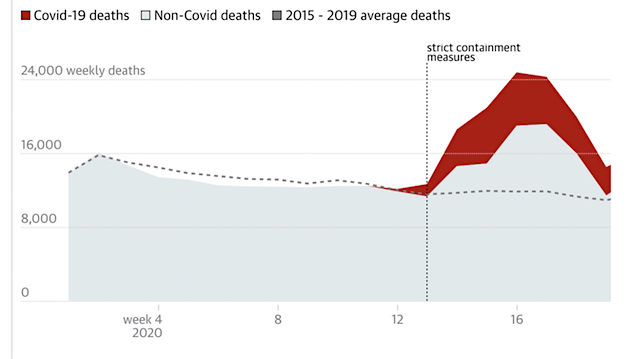

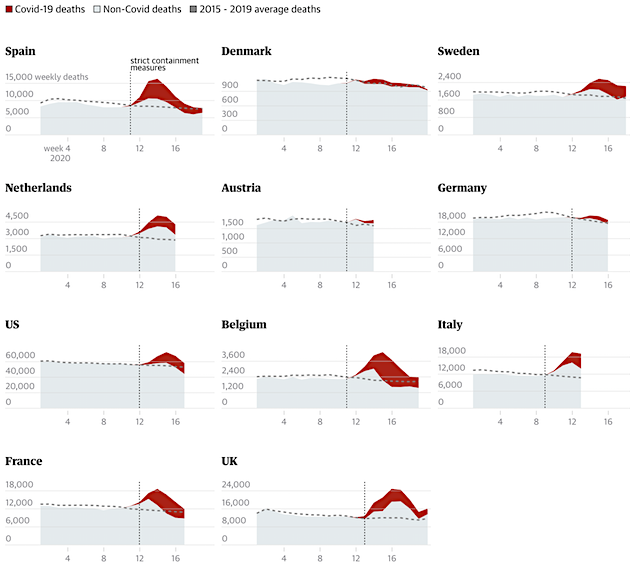

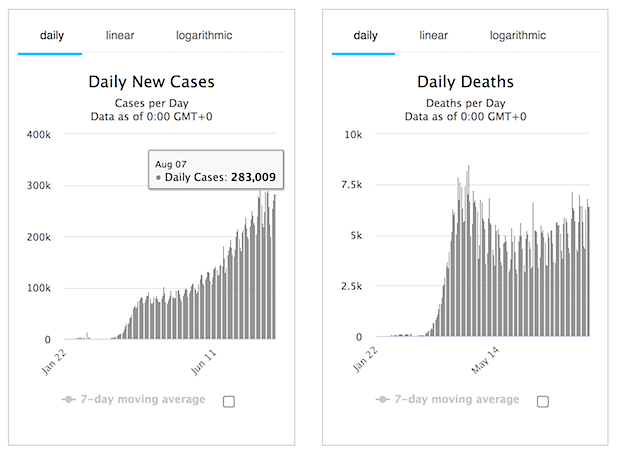

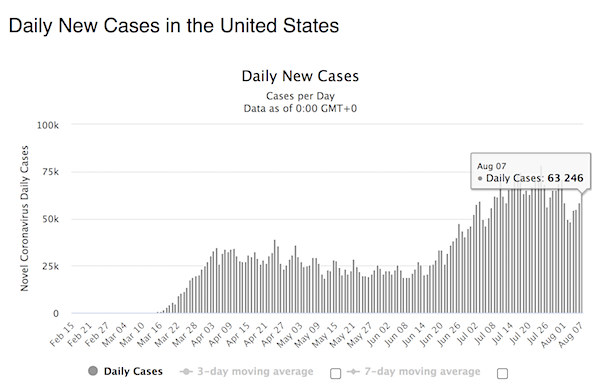

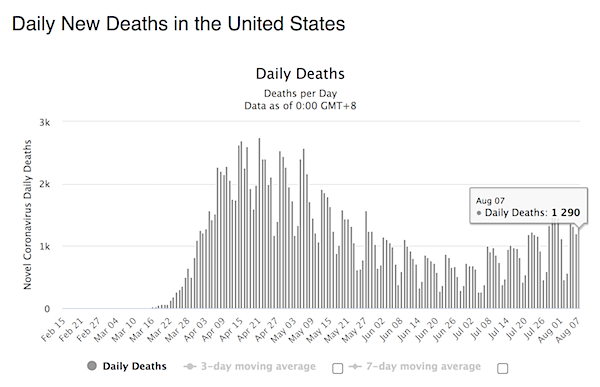

Can we get those numbers down please?! All of them!

At first I thought this was a parody account.

Adam, we’re stil waiting for all the evidence you said you had time and again of collusion. Why not show us that and then after maybe open your mouth again. It’s to do with credibility.

Trump says “I don’t care what anybody says” when intel agencies disclosed Russia is interfering in our election to hurt Biden.

Of course he doesn’t.

He has solicited foreign help again and again.

From Russia, Ukraine & China.

He doesn’t care about our democracy. Only himself.

— Adam Schiff (@RepAdamSchiff) August 8, 2020

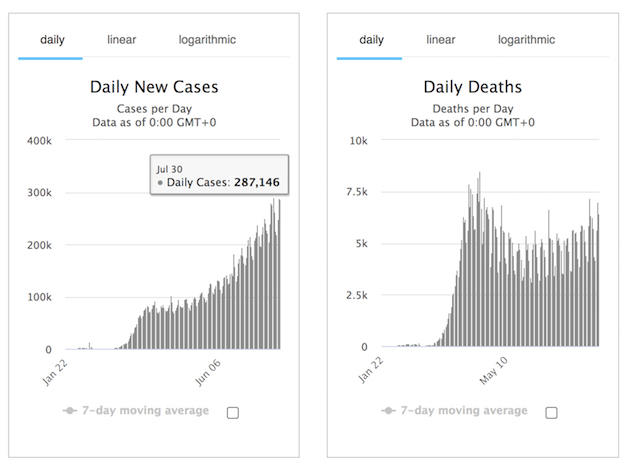

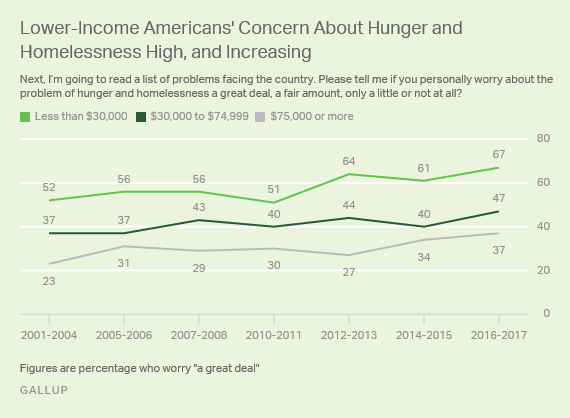

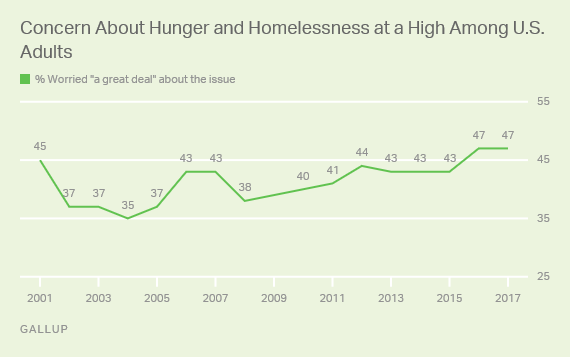

What happens when a large segment of them have this for life? What are the costs to them, to society, and to the health care system?

• 55% Of COVID Patients Still Have Neurological Problems 3 Months Later (MW)

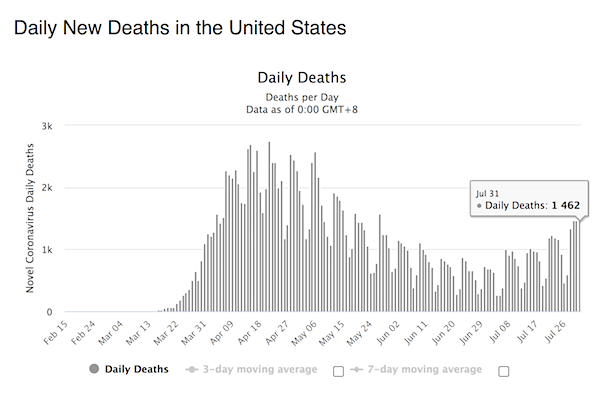

Could the coronavirus lead to chronic illness? While lung scarring, heart and kidney damage may result from COVID-19, doctors and researchers are starting to clock the potential long-term impact of the virus on the brain also. Younger COVID-19 patients who were otherwise healthy are suffering blood clots and strokes. And many “long-haulers,” or COVID-19 patients who have continued showing symptoms for months after the initial infection passed, report neurological problems such as confusion and difficulty concentrating (or brain fog), as well as headaches, extreme fatigue, mood changes, insomnia and loss of taste and/or smell.= Indeed, the CDC recently warned that it takes longer to recover from COVID-19 than the 10- to 14-day quarantine window that has been touted throughout the pandemic.

In fact, one in five young adults under 34 was not back to their usual health up to three weeks after testing positive. And 35% of surveyed U.S. adults overall had not returned to their normal state of health when interviewed two to three weeks after testing. Now a study of 60 COVID-19 patients published in Lancet this week finds that 55% of them were still displaying such neurological symptoms during follow-up visits three months later. And when doctors compared brain scans of these 60 COVID patients with those of a control group who had not been infected, they found that the brains of the COVID patients showed structural changes that correlated with memory loss and smell loss.

And that’s not exclusive to adults. A case study published in JAMA Neurology in June highlighted four U.K. children with multisystem inflammatory syndrome, a severe and potentially fatal condition that appears to be linked to COVID-19. These children developed neurological manifestations such as headaches, muscle weakness, confusion and disorientation. While two of the kids recovered, the other two continued to show symptoms, including muscle weakness so severe that they needed a wheelchair.

The US pays huge salaries to its various intelligence agencies so they can make up stories from whole cloth that can then be used to argue that we must spend more money on intelligence.

This is so incredibly vapid it’s hard to see why people don’t tell them to stick it where the sun don’t shine.

“2020 will be the most protected and most secure election in modern history…” Yeah, just not from you…

• US Intel: China Opposes Trump Reelection; Russia Works Against Biden (NPR)

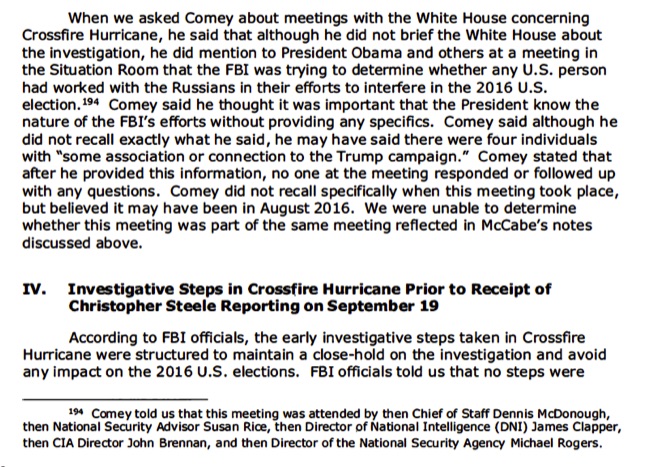

The top counterintelligence official in the U.S. government warned Friday of ongoing interference and influence efforts by China, Russia and Iran. William Evanina, who leads the National Counterintelligence and Security Center, said that the U.S. government has assessed that China prefers President Trump losing the election, because Beijing considers him “unpredictable,” while Russia is working to undermine Democrat Joe Biden. “Ahead of the 2020 U.S. elections, foreign states will continue to use covert and overt influence measures in their attempts to sway U.S. voters’ preferences and perspectives, shift U.S. policies, increase discord in the United States, and undermine the American people’s confidence in our democratic process,” Evanina said.

In discussing tactics, Evanina noted that the countries could try to compromise election equipment either to affect results or give the illusion of tampered results, but he did not say that such activities have been observed. China has grown more aggressive in recent months, criticizing the U.S. response to the coronavirus, although Evanina noted that Beijing continues to weigh the “risks and benefits of aggressive action” when it comes to influencing the election. Russia, however, has been observed using a number of tactics, including spreading propaganda on social media and Russian television, to denigrate Biden, the former vice president and presumptive Democratic nominee.

Iran also seeks to spread disinformation online, with the intent to undermine U.S. institutions and Trump, and to divide the country ahead of the election, according to Evanina. The statement did not refer to any specific cyberattack attempts on the part of any of the three countries in the style of Russia in 2016. And Evanina noted that it would be difficult, due to the disparate nature of America’s election infrastructure, to affect vote tallying at scale. Similarly, Chris Krebs, the Department of Homeland Security’s top cybersecurity official, said in a speech this week that his team had seen “nothing at the directed, focused level of 2016.” The year “2020 will be the most protected and most secure election in modern history,” Krebs said.

In a joint statement, Rep. Adam Schiff, D-Calif., who leads the House Intelligence Committee, and House Speaker Nancy Pelosi, said the disclosure was a good step toward more transparency, but they expressed frustration at how Evanina lumped the countries’ actions together. Instead, the lawmakers said, intelligence officials should share more specific information to “allow voters to appraise for themselves the respective threats posed by these foreign actors, and distinguish these actors’ different and unequal aims, current actions, and capabilities.” “Unfortunately, today’s statement still treats three actors of differing intent and capability as equal threats to our democratic elections,” the lawmakers said.

In a statement, Tim Murtaugh, a spokesman for the president’s reelection campaign, said: “We don’t need or want foreign interference, and President Trump will beat Joe Biden fair and square.” In a separate statement, Tony Blinken, a senior adviser to the Biden campaign, said: “Joe Biden … has led the fight against foreign interference for years, and has refused to accept any foreign materials intended to help him in this election — something that Donald Trump and his campaign have repeatedly failed to do.”

More pushing for mail-in ballots.

• US Officials Now Worry About Election Logistics More Than Hacking (R.)

In a reversal from a few years ago, many officials who oversee U.S. election technology and outside security experts now worry less about hacking in the November elections than about misinformation and logistics such as a shortage of poll workers and slowdowns at the U.S. postal service. Though most computerized voting systems can be hacked, some undetectably, more states have moved away from paperless balloting and more vendors are listening to warnings about software flaws, longtime specialists told the annual Black Hat and Def Con security conferences this week. “We finally know how to do this well,” Georgetown University professor Matt Blaze said in a keynote at Black Hat, held online this year because of the pandemic.

In addition, the sheer number of jurisdictions and varied versions of software would make fraud with a national impact impractical, officials said. On Friday, the U.S. head of counterintelligence, William Evanina, said publicly that while Russia, China and Iran might all act to interfere in the election, substantial vote changes were a low risk. U.S. Senator Ron Wyden, an Oregon Democrat who sits on the intelligence committee, said at Def Con he remained concerned about electronic pollbooks that could malfunction and internet voting by armed forces overseas. But Blaze and others said they were mainly worried that many localities do not have enough funding for election-day workers to handle in-person votes under pandemic conditions, with possible protests and disruptions, at the same time as they plan for a record number of mailed ballots.

Christopher Krebs, director of the Cybersecurity and Infrastructure Security Agency, said people should vote as early as possible and prepare for delayed election results. Any delay is likely to be fertile ground for misinformation both foreign and domestic, others warned. A Def Con panel including Kimber Dowsett, director of security engineering at Truss, said instead of flagging new voting machine flaws to an already cynical public, researchers should talk to Krebs’ agency and the vendors and hope for the best.

There will be no agreement.

• Trump Tees Up Executive Orders On Economy But Won’t Sign Yet (Hill)

President Trump said Friday that he is prepared to act unilaterally to reinstate expanded unemployment benefits and suspend the payroll tax due to the coronavirus, but signaled he wouldn’t do so immediately. Trump told reporters that his administration is working “in good faith” to reach an agreement on the next stimulus package with Democratic leaders, before lambasting House Speaker Nancy Pelosi (D-Calif.) and Senate Minority Leader Charles Schumer (D-N.Y.) for seeking funding for states and cities that he said have been mismanaged by Democratic politicians. “If Democrats continue to hold this critical relief hostage, I will act under my authority as president to get Americans the relief they need,” Trump said during a hastily scheduled news conference at his golf club in Bedminster, N.J., on Friday evening.

Trump said he is prepared to take four actions without Congress: defer the payroll tax until the end of the year; enhance unemployment benefits until the end of the year; defer student loan payments and forgive interest indefinitely; and reinstate a federal moratorium on evictions. Asked for a timeline, Trump said he could act as soon as the end of the week. The president also insisted he has the legal authority to take the actions unilaterally, despite doubts about his ability to do so. Trump also acknowledged that the moves were likely to invite legal challenges. “You always get sued,” Trump said. “We’ll probably get sued.”

Lots suggesting this is illegal. Yes, and Trump is daring the democrats to take him to court and stop him.

So either Trump wins by being Santa Claus, or he wins by making the dems look like Scrooge.

I would not be surprised if they cut a deal by tomorrow.

— Jim Bianco (@biancoresearch) August 7, 2020

Yes, they’re private companies. You buy a ticket under their conditions.

• Can An Airline Put You On A No-Fly List For Refusing To Mask Up? (NPR)

Early this week, Delta Air Lines made news after a plane headed to Atlanta circled back to its gate in Detroit, delaying takeoff. The crew was returning to expel two passengers who had been unwilling to follow a new but quintessential coronavirus rule. They had refused to don masks. That transgression is the latest addition to a bevy of infractions that can get you booted from an aircraft — even before contagion racked our world. Those no-nos vary wildly in severity and how often they’re enforced, but the theoretical gamut is wide: from a joke about, say, hijacking, to smoking a cigarette … all the way to more serious acts like transporting illegal contraband like guns or drugs.

[..] When it comes to the new rules for the novel coronavirus, airlines like Delta are taking them very seriously. So far, the carrier has banned 100 anti-maskers from taking their flights and gone a step further by adding them to a “no fly” list. Delta says its strict policies about masking are part of an effort to promote best public health practices and safety amid the pandemic. In a statement provided to NPR, Delta wrote: “Medical research tells us that wearing a mask is one of the most effective ways to reduce the COVID-19 infection rate.” The airline “remains committed to requiring customers and employees to wear a mask or face covering as a consistent layer of protection across all Delta touchpoints.”

And it’s not just Delta. All major U.S. airlines now require passengers to wear face coverings — a dramatic change to plane etiquette. Children under age 2 and slightly older children who cannot maintain a face covering are exempt from the requirement on Delta and other airlines. Adults are generally permitted to remove a mask only when eating or drinking, though policy varies. Though the scientific consensus is clear and strong that masks are critical in stemming the spread of the virus, some consumers feel aggrieved by what they consider an attack on personal freedom. But according to aviation, health and legal experts, such outrage ignores a few fundamentals: In entering into agreements (read: contracts) with airline carriers (by purchasing a ticket), you’re required to adhere to their policies. And that pretty much ends the matter.

In other words, Delta’s no-fly list is perfectly within its scope of rights, experts stress. The legal reasoning is pretty straightforward, says Sharona Hoffman, co-director of Case Western Reserve University’s Law-Medicine Center. She puts it simply: “They’re a private business, and private businesses can have rules.”

What I said yesterday, but in more words.

• The WeChat Ban (China Collection)

The ban on WeChat will not cut people in the US off from their friends and family in China. They communicated before WeChat existed and will continue to do so if it’s banned. There are many quite serviceable alternatives. And who exactly is bigger in the banning business, anyway? I’m seeing a lot of what seem to me to be overwrought reactions to the WeChat ban on my Twitter feed. For example, when the ban was first mooted by Pompeo, Stuart Lau of the South China Morning Post tweeted that if it went through, “countless Chinese people who live in the US could be cut off from their friends and families in China, where WhatsApp or Facebook Messenger is banned.” Two points:

First, can we please remember that before WeChat existed, people somehow managed to communicate between the US and China, and it wasn’t difficult? At this very moment, there are a number of ways that it can be done: telephone calls, text messages, email, WhatsApp, Signal, and let’s not forget QQ, another TenCent app that does basically everything WeChat does in terms of communication, and used to be widely used in China before it was supplanted by WeChat. So before you tell me that people won’t be able to communicate with friends and family in China any more, you need to explain (a) why what they did before WeChat won’t work any more, and (b) why none of the communications methods I’ve mentioned above won’t work any more. I get that WeChat has many convenient functions and a great interface that people like. That’s why it’s been so successful. But come on, people: the idea that banning it cuts off communication between people in the US and China is silly.

Second, let’s suppose for the sake of argument (but only for the sake of argument) that banning WeChat did indeed seriously impinge on the ability of people to communicate between the US and China. Where does the fault lie, causally speaking? To figure that out we need to ask why alternatives are not available, and who is responsible for that. Two alternatives are (as the Stuart Lau post notes) Whats App and Facebook Messenger. There is also Line, a communications app that is widely used in Japan and Taiwan, with over 700 million users worldwide by 2017, according to the Wikipedia entry. But they are all banned in China. So it is a bit hard to say that it is the ban on WeChat that is making communications difficult. The Chinese government is the one that is actively in the banning business, and they’ve got a big head start on the Trump administration.

Amidst the first (re-appearing) rumors of dollar shortages in the country.

• China Allows First Commercial Bank To Go Bankrupt (Xinhua)

China’s central bank has announced that the disposal of risks concerning the troubled Baoshang Bank will be completed soon, and the bank will file for bankruptcy. Equity and unsecured claims from its original shareholders will be liquidated by law, according to a report released by the People’s Bank of China (PBOC) on Thursday. The PBOC and the China Banking and Insurance Regulatory Commission took over the Inner Mongolia-based commercial bank in May last year due to its “serious credit risks.”

With capital from deposit insurance funds and the PBOC, principal and interest on personal savings deposits, and those of most institutional creditors, are guaranteed the full amount, while large corporate deposits are guaranteed an average level of 90 percent, the report said. After the takeover, the PBOC arranged for 23.5 billion yuan (about 3.39 billion U.S. dollars) in a standing lending facility (SLF) quota for Baoshang Bank on the premise of enough high-quality collateral.

Apart from AOC, it’s the same old same old crowd that lost bigly in 2016. Most of them are way past retirement age in any other job. But the lust for power is eternal.

And who do you think they’re going to talk about most?

• Democratic Convention Lineup To Include AOC, Clinton, Warren (Hill)

The speaking lineup for this month’s Democratic National Convention is beginning to take form, with several high-profile Democrats securing spots. Rep. Alexandria Ocasio-Cortez (D-N.Y.), a progressive superstar, is expected to have some sort of speaking slot, a House member told Politico, and Sen. Elizabeth Warren (D-Mass.) and 2016 presidential nominee Hillary Clinton will also speak, according to Axios. Warren and Clinton are reportedly slated to speak on Aug. 19, the day before former Vice President Joe Biden will formally accept the 2020 Democratic nomination. Other Democrats expected to have speaking slots are Biden’s wife, Jill Biden, Speaker Nancy Pelosi (D-Calif.), Sen. Kamala Harris (D-Calif.) and Barack and Michelle Obama.

Both Warren and Harris are known to be on Biden’s shortlist to be his running mate. Neither the Democratic National Committee nor the convention immediately responded to requests for comment from The Hill. The convention has largely been relegated to digital events so participants can observe social distancing and other health guidance during the ongoing coronavirus pandemic. Biden was originally slated to deliver his acceptance speech from Milwaukee, but will now do so virtually from Delaware, his home state.

Just another multi-millionaire who raked in fortunes while providing “public service”.

• Dems VP Candidate Susan Rice Made a Lot of Money in Fossil Fuels (Jacobin)

Former national security adviser Susan Rice, reportedly one of two finalists in Joe Biden’s vice presidential search, had millions invested in fossil fuels and energy companies as recently as 2015. The revelations come as Biden has faced renewed questions about his commitment to environmental policies that would combat climate change. A financial disclosure form obtained by Too Much Information reveals that Rice had investments in at least five such companies, including as much as $100,000 in TransCanada, which is behind the controversial Keystone XL pipeline. Rice also had over $1 million invested in pipeline firm Enbridge as well as more than $2 million split between fossil fuel companies Cenovus, Encana, and Imperial Oil — all companies with significant involvement in developing the tar sands of Alberta.

The investments netted as much as $237,000 in dividends that year. In addition, Rice reported significant holdings in Canadian banks which fund pipeline projects, according to the disclosure. A veteran of multiple Democratic administrations, Rice has a traditionally impressive resume on paper. She worked as a consultant for McKinsey & Co. before serving as assistant secretary of state for African affairs under Bill Clinton, UN ambassador under Barack Obama, and national security adviser. But her record has made her a controversial candidate for VP. Pledged delegates for Vermont Sen. Bernie Sanders have urged Biden to avoid naming her to the ticket, and have also urged him to remove a number of other foreign policy hawks from his team. Among other things, the delegates cited her past support for military intervention in Iraq, Libya, and Syria.

On Friday, environmental advocates criticized Rice’s past fossil fuel investments in a Politico report. In 2012, when Rice was a candidate to succeed Hillary Clinton as secretary of state, environmentalists took aim at her for the holdings, even circulating a petition urging Obama not to select her. Even then, Rice, whose net worth with her husband was estimated to be between $23.5 million and $43.5 million, had significant investments in Canadian energy interests, including as much as $600,000 in TransCanada. She also owned stock in Enbridge, Encana, Cenovus, and Suncor, along with other fossil fuel companies like Chesapeake Energy, Devon Energy, Royal Dutch Shell, Iberdrola, ATP Oil & Gas Corp., and energy utility TransAlta. Rice would hardly be the first person with fossil fuel ties that Biden has brought onboard this cycle. Biden’s climate adviser, Heather Zichal, previously served on the board of a natural gas company, Cheniere Energy.

Have you ever trusted a billionaire? They only get so rich by wanting ever more money. That doesn’t stop all of a sudden.

• Billionaires That Donated to Gates-Buffet Pledge Now Richer Than Ever (MPN)

A study released by the Institute for Policy Studies (IPS) through its Program on Inequality and the Common Good, titled “Gilded Giving 2020: How Wealth Inequality Distorts Philanthropy and Imperils Democracy” examines the reality behind the ostensible charitableness of the billionaire donor class and the disturbing trend of charitable organizations and foundations relying more and more on fewer and fewer wealthy donors; funds which “end up in family foundations and donor-advised funds that could legally exist in perpetuity,” while donations from lower and middle-income sources are disappearing. In particular, the paper looks at The Giving Pledge initiative started in 2010 by a few dozen U.S. billionaires and led by Bill Gates and Warren Buffet.

The professed goal of the initiative was to have the wealthiest people in the world pledge to give at least half of their fortunes away to charitable causes before their death. The study found that contrary to the stated purpose of the philanthropic commitment of the organization, a full 75 percent of participants have actually increased their net worth in the ten years since they made their charitable vow. More concerning is the finding that a growing share of “high-end” donations never ends up in organizations that do any kind of altruistic work. Rather, they go to tax-privileged private foundations designed to serve as tax shelters for the very wealthy, which then only disburse a small percentage of their assets to charitable non-profits; a particularly galling fact considering how much more wealthy the one-percenters have gotten over the course of the pandemic in contrast to the 54 million Americans who’ve filed for unemployment in that same span of time.

“[..] who needs an online class in Contemporary Sexual Transgression ($2000-a-credit) when you can just click on Porn-hub for free?

Localize!

• Things Going By (Jim Kunstler)

Higher education committed suicide with its dual racketeering model. First was the college loan racket, in which schools colluded with the federal government to jam too many “customers” through the pipeline who didn’t belong there, and who buried themselves under a lifetime debt obligation they could never escape. The second was the intellectual racket of creating sham fields of study that contaminated all the other “humanities” with poisonous bullshit theory, and eventually even invaded the STEM disciplines. Covid-19 screwed the pooch on all that, scotching the four-year party-hearty in-residence part of the deal. For now, who needs an online class in Contemporary Sexual Transgression ($2000-a-credit) when you can just click on Porn-hub for free? Hundreds of colleges and universities will be going out of business in the years ahead.

The outlook for the big centralized high schools is also pretty dark. The teachers’ unions’ insatiable needs are only part of the picture. Consolidating many smaller schools to save on administrative costs seemed like a good idea at the time. But we ended up with thousands of gigantic schools that looked like insecticide factories and felt like minimum security prisons. They all depend on the costly yellow bus fleets to collect the kids from far and wide. The whole scheme ended up as an elaborate day-care operation that actually retarded the development of young people into functional, autonomous adults.

Covid-19 and the economic collapse it triggered will put an end to all that. How will the school districts cope with an epic loss of tax revenue from all the homeowners defaulting on their mortgages? They won’t. Schooling will have to reorganize, and probably at a very grassroots level, with home-schools evolving into neighbor-pods of tiny schools, and only among parents who have the literacy and numeracy to pull it off. We’ll be lucky if, years from now, we’ll see something like local academies spring up that can handle a few hundred students. I’d also warn you about assuming that the Internet is a permanent installation of the human condition. It depends utterly on a pretty fragile electric grid. We do, after all, have libraries, and maybe they can be persuaded to stop trying to get rid of all their books.

Didn’t we already know we’re stardust? That some of it is calcium makes a lot of sense.

• Your Bones Are Made Out of Exploded Stars (Fut.)

According to new research, half the calcium in our universe came from “calcium-rich supernova.” That means the stuff our teeth and bones is made from is, essentially, the remains of dead stars that blew up a long, long time ago. “These events are so few in number that we have never known what produced calcium-rich supernova,” said Wynn Jacobson-Galan, Northwestern graduate student and lead author of the new study published in The Astrophysical Journal this week, in a statement. “By observing what this star did in its final month before it reached its critical, tumultuous end, we peered into a place previously unexplored, opening new avenues of study within transient science,” Jacobson-Galan added.

An extremely bright event some 55 million light years from Earth grabbed the attention of the international astronomy community in April 2019. “Every single country with a prominent telescope turned to look at this object,” Jacobson-Galan recalled. Astronomers were so quick that many observed the supernova just ten hours after the explosion. “The explosion is trying to cool down,” Raffaella Margutti from Northwestern University and a senior author of the study, explained in the statement. “It wants to give away its energy, and calcium emission is an efficient way to do that.” As it turns out the explosion spewed out an immense amount of calcium. “It wasn’t just calcium rich,” Margutti said. “It was the richest of the rich.”

They caught the event just in time to conclude that it was the most calcium to have ever been observed to be emitted from just a single event. “The luminosity tells us how much material the star shed and how close that material was to the star,” Jacobson-Galan explained. “In this case, the star lost a very small amount of material right before it exploded. That material was still nearby.”

“This is an unusually strong stock, and we are predicting it will see at least six months of straight gains, probably more.”

• Dow Skyrockets After Coronavirus Begins Trading On NY Stock Exchange (Onion)

With investors highly bullish about the long-term prospects of the respiratory virus, market reports confirmed Friday the Dow Jones Industrial Average skyrocketed nearly 400 points after the novel coronavirus began trading on the New York Stock Exchange. “Following its initial public offering, this coronavirus has become the hot new thing on Wall Street, and you can bet everyone will be getting a piece of it soon if they haven’t already,” said Darya Abbas, an analyst at Zacks Investment Research, observing that the SARS-CoV-2 virus, which is listed under the ticker symbol COV, traded at incredibly high volumes throughout the day. “This is an unusually strong stock, and we are predicting it will see at least six months of straight gains, probably more. Not since the original SARS in 2003 have we seen an airborne pathogen with such massive growth potential.” At press time, the coronavirus was reportedly in talks to take part in a major merger with Johnson & Johnson.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

Speed reading

Speed reading is any of several techniques used to improve one’s ability to read quickly. There are several methods and techniques to achieve it with different results: https://t.co/OpvEdzUyPf [gif: https://t.co/5I6AHjv642] pic.twitter.com/gHxVWrl0et

— Massimo (@Rainmaker1973) August 7, 2020

Support the Automatic Earth in virustime.