Carl Mydans Auto transport at Indiana gas station. May 1936

Britain’s Institute of Economic Affairs (IEA) recently issued a report on the future of pensions and healthcare that reads as one big warning sign. But the chances that the warning will be heeded are slim to none, simply because the task is too daunting for both politicians and their voters to even begin to contemplate.

No politician who tells the truth about the report’s contents has a chance in frozen over hell of being elected, and thus the issues, which have been many decades in the making, will simply continue to be ignored by everyone. Until the dam breaks and perhaps the first shot is fired. But then it will be way too late. Not that it isn’t already. It’ll be interesting to see how people across the board claim ignorance and innocence, but it will of course do nothing to even come close to solving anything at all.

And frankly speaking, there are no solutions available within the present political system that could be executed and still let people get away relatively unscathed. We seem to have reached an inherent and built-in boundary and limitation of the democratic system, an event horizon of which we are bound to see a lot more going forward. What some 20 years ago Jay Hanson phrased as

“Democracy only works until people realize they can vote themselves an ever bigger piece of the pie”

IEA program director Philip Booth says in these words:

For too long people have voted themselves benefits to be paid for by the next generation of taxpayers, not by sacrifices that they will make themselves.

It truly is democracy as a Ponzi scheme. A development that has been so carefully and utterly neglected and ignored that bringing it out into the open risks evoking such severe denial that entire societies could be ripped to shreds, with one group teaming up against the other in clashes that can easily turn violent. Or, in Booth’s words:

We have never been in a situation like this before. It is quite possible that we will not find our way through without serious social breakdown and/or mass emigration of the most mobile and productive people.

And it all seemed to be going so well for so long, with cars and smartphones and far away vacations and retirement bungalows in the sun for – almost – everyone. People believed it because they wanted to believe it, and politicians were all too eager to prolong the dream that for the first time in history everyone could live like kings and queens of old. Cheap energy was one leg of the dream, ignoring future consequences of present behavior was another. Booth:

“The underlying problem is that successive governments have made promises which can simply not be honoured from the existing tax base. The electorate is grazing a fiscal commons at the expense of future generations … “

The price must now be paid. There is no more postponing the inevitable. First, retirement age will go to 70, then 75, and then the point will come when there’s no money left for any pensions or other entitlements. We will also return to large numbers of people dying of entirely preventable afflictions, simply because healthcare systems become unaffordable, because the base of people paying taxes shrinks, while the number of those who need care rises exponentially as the population ages.

Here’s the Telegraph article the quotes come from:

UK faces ‘crippling’ tax rises and spending cuts to fund pensions and healthcare

Britain faces “crippling” tax rises and spending cuts if it is to meet the needs of an ageing population, according to the Institute of Economic Affairs. The IEA calculated the Government would need to slash spending by more than a quarter or impose significant tax hikes because official calculations had failed to factor in future pension and healthcare liabilities. “As populations age, tax bases will grow more slowly while government spending rises faster,” the report said.

… the think-tank said Britain faced tax rises equivalent within just two years to more than 17% of GDP – more than £300 billion ($500 billion) – in order to meet all future spending commitments. This is larger than the entire annual NHS budget and would increase taxes from 38% to 55% of national income.[..] … tax increases of this magnitude would be “impossible” to implement “without choking off economic growth and actually reducing tax revenues”.

Can you imagine such tax raises? While the economy is in the doldrums? Me neither. But that would mean:

In the absence of further tax hikes [..] total spending would have to be cut by more than 25% or health and welfare expenditure by 53% compared with the current implied level if all future spending was to be met out of tax revenue.

[..] … it said policies were being implemented too slowly and were “inadequate” on their own [..] … policies to address pension saving and healthcare costs were needed now or the problem would quickly grow out of control. “Without significant changes to spending levels, huge sacrifices will have to be made by future generations either through significantly higher taxes or reduced benefits [..]

The IEA calculated that delaying crucial pension and healthcare reforms by just a few years would dramatically increase the burden because of growing debt interest payments. It said the ratio would increase from 13.7% of GDP in 2010 – already higher than the EU average of 13.5% – to almost 17.1% by 2016 if no policy adjustments were made.

People will be forced to work longer and longer, till they’re 75, 80 and so on. And they’ll be forced to pay a fast growing part of their healthcare bill themselves. And even then both healthcare and pension systems have no chance of surviving in the long run. Because too many people have been promised too much for too long.

And just in case you were thinking that raps her up, here’s another piece of fine news from yesterday:

UK Interest Rates Could Rise Sixfold In Three Years (Telegraph)

Interest rates will rise six-fold by 2017 as Britain’s economy becomes one of the fastest growing in the developed world, the Bank of England Governor said on Tuesday. The increase to more “normal” levels will be welcomed by many savers who have faced record low rates for more than six years, but is likely to plunge many borrowers into financial difficulty. Mark Carney said that Bank rate could reach 3% within three years, six times the current 0.5%.

[..] Industry calculations suggest that an increase of 2.5 percentage points on a typical £150,000 repayment mortgage would push up monthly payments by around £230 a month. For interest-only mortgages, the rise would be even steeper. The cost of servicing an interest-only loan that tracks the Bank rate plus 1% would jump from £188 a month to £500.

Nationwide, one of Britain’s biggest mortgage lenders, said last month that the long period of low rates had left a generation of house- buyers with no experience of higher borrowing costs, leaving some at financial risk. Around 8% of all mortgage- holders currently have to spend more than 35% of their pre-tax income paying off the loan. Bank data suggests that this proportion would double if rates rose by 2.5 percentage points.

Mr Carney said the Bank was now carrying out more research into how many borrowers are “most vulnerable” to higher rates.

Yup. Your taxes will go up, slowly at first because the government will delay dealing with serious issues as long as it can get away it, and faster later when they have no such choice left. Meanwhile, interest rates will rise, which is bad news if you have debt, which is about everyone. And it’s not just your debt: there’s a lot of government debt that will need to be serviced, and guess how we’re going to pay for that? Raise taxes.

This simple pattern is not exclusive to Britain at all of course, but then you know that. This is what will happen in every western – formerly – rich country. And you can therefore safely ignore any proclamations about recovery. The first major hit, developing as we speak, is Japan, where people are more cautious and fearful and perhaps better informed. The Japanese started cutting back on their spending 20 years ago (they stopped buying things they didn’t need), and are now in a deflation that no stimulus will get them out of anymore (it’ll just make it worse).

But at least they have savings. In most formerly rich countries, people have counted on entitlements instead of savings. And now those entitlements turn out to be based on elaborate Ponzi schemes, sanctioned by successive governments that all had one thing in common: short term views.

David Stockman knows a thing or two …

• Yellenomics: The Folly of Free Money (David Stockman)

The Fed and the other major central banks have been planting time bombs all over the global financial system for years, but especially since their post-crisis money printing spree incepted in the fall of 2008. Now comes a new leader to the Eccles Building who is not only bubble-blind like her two predecessors, but is also apparently bubble-mute. Janet Yellen is pleased to speak of financial bubbles as a “misalignment of asset prices,” and professes not to espy any on the horizon.

Let’s see. The Russell 2000 is trading at 85X actual earnings and that’s apparently “within normal valuation parameters.” Likewise, the social media stocks are replicating the eyeballs and clicks based valuation madness of Greenspan’s dot-com bubble. But there is nothing to see there, either–not even Twitter at 35X its current run-rate of sales or the $19 billion WhatsApp deal. Given the latter’s lack of revenues, patents and entry barriers to the red hot business of free texting, its key valuation metric reduces to market cap per employee–which computes out to a cool $350 million for each of its 55 payrollers. Never before has QuickBooks for startups listed, apparently, so many geniuses on a single page of spreadsheet.

Indeed, as during the prior two Fed-inspired bubbles of this century, the stock market is riddled with white-hot mo-mo plays which amount to lunatic speculations. Tesla, for example, has sold exactly 27,000 cars since its 2010 birth in Goldman’s IPO hatchery and has generated $1 billion in cumulative losses over the last six years—–a flood of red ink that would actually be far greater without the book income from its huge “green” tax credits which, of course, are completely unrelated to making cars. Yet it is valued at $31 billion or more than the born-again General Motors, which sells about 27,000 autos every day counting weekends.

Even the “big cap” multiple embedded in the S&P500 is stretched to nearly 19X trailing GAAP earnings—the exact top-of-the-range where it peaked out in October 2007. And that lofty PE isn’t about any late blooming earnings surge. At year-end 2011, the latest twelve months (LTM) reported profit for the S&P 500 was $90 per share, and during the two years since then it has crawled ahead at a tepid 5 percent annual rate to $100.

So now the index precariously sits 20% higher than ever before. Yet embedded in that 19X multiple are composite profit margins at the tippy-top of the historical range. Moreover, the S&P 500 companies now carry an elephantine load of debt—$3.2 trillion to be exact (ex-financials). But since our monetary politburo has chosen to peg interest rates at a pittance, the reported $100 per share of net income may not be all that. We are to believe that interest rates will never normalize, of course, but in the off-chance that 300 basis points of economic reality creeps back into the debt markets,that alone would reduce S&P profits by upwards of $10 per share.

America’s already five-year old business recovery has also apparently discovered the fountain of youth, meaning that recessions have been abolished forever. Accordingly, the forward-year EPS hockey sticks touted by the sell-side can rise to the wild blue yonder—even beyond the $120 per share “ex-items” mark that the Street’s S&P500 forecasts briefly tagged a good while back. In fact, that was the late 2007 expectation for 2008—a year notable for its proof that the Great Moderation wasn’t all that; that recessions still do happen; and that rot builds up on business balance sheets during the Fed’s bubble phase, as attested to by that year’s massive write-offs and restructurings which caused actual earnings to come in on the short side at about $15!

In short, recent US history signifies nothing except that the sudden financial and economic paroxysm of 2008-2009 arrived, apparently, on a comet from deep space and shortly returned whence it came. Nor are there any headwinds from abroad. The eventual thundering crash of China’s debt pyramids is no sweat because the carnage will stay wholly inside the Great Wall; and even as Japan sinks into old-age bankruptcy, it demise will occur silently within the boundaries of its archipelago. No roiling waters from across the Atlantic are in store, either: Europe’s 500 million citizens will simply endure stoically and indefinitely the endless stream of phony fixes and self-serving lies emanating from their overlords in Brussels.

Read more …

• Russia Said to Ready for Iran-Style Sanctions (Bloomberg)

Russian government officials and businessmen are bracing for sanctions resembling those applied to Iran after what they see as the inevitable annexation of Ukraine’s Crimea region, according to four people with knowledge of the preparations.

Iran-style retaliation from the West, which would include freezing Russia’s foreign reserves, banking assets and halting lending to companies, is being treated as an unlikely worst case, according to the people, who asked not to be identified as talks are confidential. Still, officials are calculating the economic cost of a sanctions war with the West, the people said. “If Russia begins to answer sanctions with sanctions, it will be a pure loss for the country,” Natalia Orlova, chief economist at Alfa Bank in Moscow, said by phone. “More than 40% of consumption is imported goods.”

Some Russian political leaders are hoping that President Vladimir Putin will moderate his response to the crisis, the people said. Putin is consulting with the security forces and military about Ukraine, and some officials are afraid to voice opposition to what they see as a course he’s already chosen, two of the people said. Russia retaliating with sanctions against the West could wipe out 10 years of achievements in financial and monetary policy, one of the people said. Such escalation could erase as much as a third of the ruble’s value, another said.

The ruble has slumped 9.8% against the dollar this year, the worst-performer after Argentina’s peso among 24 emerging-market currencies tracked by Bloomberg. The yield on Russia’s February 2027 ruble bond was unchanged from yesterday’s record-high close of 9.36%.

The Ukraine crisis triggered the worst standoff between Russia and the West since the end of the Cold War after Russian forces seized the Crimean peninsula. German Chancellor Angela Merkel said today Russia risks “massive” political and economic damage, after saying yesterday that a round of European Union sanctions is “unavoidable” if Putin’s government fails to take steps to ease tensions. [..]

The government is in talks with Russian billionaires and state companies about risks they face in case of Western sanctions, the people said. The Kremlin needs to know which companies are most likely to be affected by fallout including loss of access to new foreign loans and the prospect of margin calls, they said.

Business is not yet showing too much concern about the possible sanctions, according to three top executives who took part in the meetings. The EU, Ukraine and Russia are economically dependent on each other in many regards, so strict sanctions will be hard on all sides, Putin has said. “In the modern world, when everything is interconnected and everybody depends on each other one way or another, of course it’s possible to damage each other — but this would be mutual damage,” Putin told reporters March 4.

The Russian economy’s prospects in a “difficult global economic environment” were the topic of a closed meeting between Putin and senior officials yesterday in the Black Sea resort of Sochi, Peskov said by phone. Putin yesterday urged the government to ensure Russia’s “ability to react immediately to internal and external risks.”

The Russian government is also in talks with companies about speeding up state support in the form of guaranteed loans to reduce potential damage from sanctions, said two of the people. Business leaders have asked for a meeting with Russian Prime Minister Dmitry Medvedev to discuss the situation, the people said.

Read more …

The Truman show meme shows up more frequently, and it’s not a bad analogy.

• Hedge fund managers face up to ‘Truman Show’ markets (FT)

In the Truman Show, the late nineties Hollywood film, the eponymous character lives a seemingly charmed world, snuggled comfortably into an American suburbia of white picket fences and crisply cut lawns. But gradually Truman starts to notice something is not quite right. He is actually trapped inside a film set controlled by hidden directors, and discovers to his horror that he is the unknowing star of the world’s most popular reality TV show.

The question some of the world’s biggest hedge funds are starting to ask is whether overly placid investors will also wake up to discover they are living in a “Truman Show market” – where central bankers’ ultra loose monetary policy has manufactured a fake reality that is bound to end. For Seth Klarman, the manager of the $27bn hedge fund the Baupost Group who recently coined the analogy in a letter to clients, investors have been lulled into a false sense of security that is creating an ever greater risk of a sharp correction.

“All the Trumans – the economists, fund managers, traders, market pundits – know at some level that the environment in which they operate is not what it seems on the surface,” Mr Klarman wrote in his letter, later adding: “But the zeitgeist is so damn pleasant, the days so resplendent, the mood so euphoric, the returns so irresistible, that no one wants it to end.”

But no matter how sceptical hedge fund managers may be, they find themselves in a bind. While the assumption that central bank bond-buying will continue for the foreseeable future has been a boon to broader markets, indiscriminately surging equities have made life frustrating for most specialised stock pickers.

At the same time other hedge fund strategies, such as making bets on interest rates and currencies according to views on the direction of the global economy, have faltered as markets have refused to obey previously presumed iron rules, such as money printing leading to devaluation. Of late these so-called global macro funds have retreated from such trades as their performance has suffered.

“Many hedge funds continue to predict this ongoing drift upwards in asset prices due to an implicit backstop from central banks, who want to believe they are omnipotent, and that when data is bad they can just turn on the taps again and make it go away,” says Anthony Lawler, portfolio manager at GAM, one of the world’s biggest investors in hedge funds. As a result, while many managers feel deeply uneasy with the lofty valuations attached to certain parts of the US stock market, and low returns offered by risky assets such as junk bonds, few are willing to step out just yet.

More recently, encouragement has been taken from falling correlations between assets, meaning some portfolio managers are confident they can start to exploit more effectively the pricing anomalies between better and worse quality securities. “The number of individual stocks mispriced to each other is high, there are some trading on vapour whilst others are still trading on reasonable valuations,” says Luke Ellis, president of Man Group, the world’s largest listed hedge fund. “Are there lots of cheap stocks? No, but on a long short basis there are opportunities.”

“The big question is when this is all going to change. From a purely intellectual point of view, it is interesting how central banks will reverse their policies. From a market point of view, it is uncertain and complicated.”

Sir Michael Hintze, chief executive and founder of CQS, one of Europe’s largest hedge funds, has argued that loose central banks have actually increased the riskiness of markets as a result of their policies forcing too much money into the same assets, meaning any corrections are likely to be sharper than normal. “Everyone is thinking the same and being driven into the same trade,” he wrote in a note to clients. “Shifts when moving from one state to another can be difficult and abrupt. It is not healthy to have a ‘rigged’ market”.

Yet, for now, as long as markets continue to believe in the willingness and ability of central bankers to maintain current conditions, few hedge fund managers are ready to make any big bets against a reversal. “Few argue that equities are cheap on any metric, but the majority of hedge fund managers are opting to remain invested,” says Mr Lawler of GAM. The Truman Show market looks set to continue, even if an increasing number of participants have started to spot the cameras hidden behind the trees.

Read more …

America must get rid of the Fed and the big banks, or it will turn into a scorched landscape.

• Engine Of Wall Street Profits Sputters In First Quarter (FT)

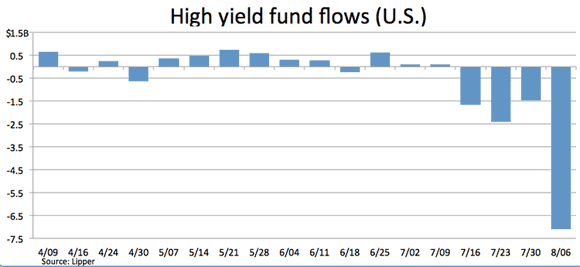

Wall Street’s once lucrative fixed income divisions are set for their worst start to the year since before the financial crisis, with revenue declines of up to 25% prompting banks to plan more redundancies on top of the tens of thousands of job cuts they have already made.

Citigroup and JPMorgan Chase have warned publicly that fixed income revenues – the engine of most investment banks’ profits since 2000 – will be down by double digits when they report first-quarter earnings next month. But other banks privately warn that their year-on-year declines could exceed 25% after both institutional investors and banks shied away from trading. The first quarter is traditionally a high point for revenues. “Effectively, the casino is empty this quarter,” said Brad Hintz, analyst at AllianceBernstein.

The top 10 banks are expected to make a combined $24.8bn of revenues in fixed income trading, which includes bonds, currencies and commodities, according to Morgan Stanley and Credit Suisse estimates, more than 40% below the first quarter of 2009 when the market rebounded sharply from the crisis.

Two of the top five fixed income divisions told the Financial Times they expected to respond by cutting more jobs because the market is worse than expected, with traders blaming patchy macroeconomic data, interest rate uncertainty, regulation that limits risk taking and worries about the situation in Ukraine. Analysts now expect Goldman Sachs to record its weakest first quarter since 2005 and JPMorgan Chase and Bank of America are forecast to see their lowest revenues since they bought Bear Stearns and Merrill Lynch, respectively, in 2008.

The weakness is expected to be even more severe among European banks such as Deutsche Bank and Credit Suisse, which are looking to meet new capital requirements by shrinking their balance sheets. “Anecdotally it seems Europeans are losing most share in the US itself and so are losing global diversification,” said Huw van Steenis, analyst at Morgan Stanley. Some US banks hope their European rivals will cede market share. “Those outside of the top five will have to think about if they can continue to be in that business,” said James Chappell, analyst at Berenberg.

New regulations such as the Volcker rule – which prohibits proprietary trading – and tougher capital requirements restrict the risk banks can take and are sapping liquidity, bankers say, even though final versions of the rules have not proven as harsh as some feared.

Four years after the outlines of the post-crisis regulation were put into place, traders claim that outstanding areas of uncertainty are hitting activity among big bond traders such as JPMorgan, Citi, Deutsche Bank, Bank of America, Goldman and Barclays. “There’s a significant amount of uncertainty about what the endgame is going to be,” said the head of trading at one bank. “We probably haven’t reached a peak of effort and management time. We’re not turning the page yet on regulation.”

Christian Bolu, analyst at Credit Suisse, estimated that US government bond trading volumes are down about 8% so far this year compared with the same period in 2013. Trading of mortgage-backed securities backed by the US government is down 41%, while corporate bond trading has increased by 12%.

Read more …

Funny to see how George Soros says Europe is the only place that got it right, while others, like Ambrose Evans-Pritchard here, say it got it terribly wrong.

• Paralysed ECB leaves Europe at the mercy of deflation shock from China (AEP)

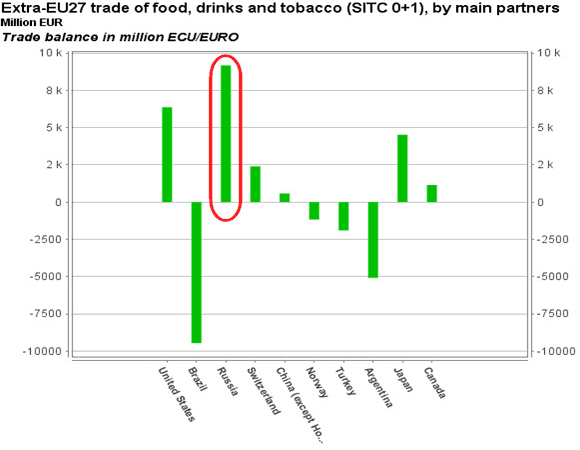

Most of western Europe is already in outright deflation. So are the Balkans, the Baltic states and the old Habsburg core. The Continent has left its flank open to an external shock from Asia. There is a high chance that this will occur as China attempts to extricate itself from a $24 trillion credit misadventure by debasing its currency to regain lost competitiveness and bail out its export industry.

The yuan has fallen by nearly 2% against the dollar since early January, and 4% against the euro. For all the talk of weaning China off chronic over-investment, Beijing engineered a record $5 trillion of investment in fixed capital last year – up 20% from the year before, and as much as the US and Europe combined. This has created a vast overhang of excess manufacturing capacity in the global system. It is coming our way in the form of a slow, powerful, deflationary undercurrent.

Europe’s headline price data understate the full deflation risk. Eurostat’s HICP index “at constant taxes” – stripping out the one-off effects of austerity – shows that 23 of the EU’s 28 countries have seen a fall in prices over the past seven months. “The risk of deflation is definitely before us,” said Olivier Blanchard, the International Monetary Fund’s chief economist.

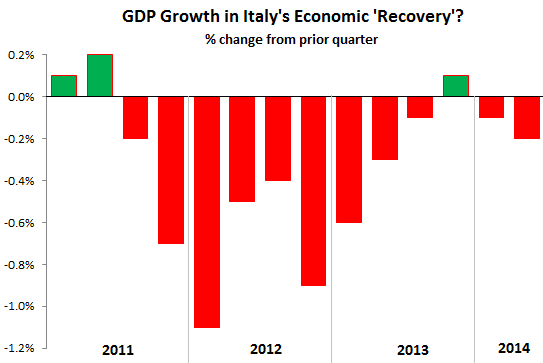

By this measure, inflation since June has been running at a rate of -1% in France, -2% in Holland, Belgium and Slovenia, -4% in Italy, Spain and Portugal, -6% in Greece and -10% in Cyprus. Sweden and Switzerland are also in deflation. Germany rolled over in July. The UK still clings to a little inflation – now a precious commodity – but it too turned negative in September.

This is a nightmare for the debt-stricken states of southern Europe, still trapped in a slump with mass unemployment regardless of whether they manage to eke out the odd quarter of miserable growth. With Germany at zero inflation, they have to go into even deeper deflation to claw back lost competitiveness within EMU under “internal devaluations”.

This, in turn, plays havoc with debt dynamics through the denominator effect. Their debt loads are rising on a base of flat or contracting nominal GDP. It is a key reason why Italy’s public debt has risen from 119% to 133% of GDP since 2010 despite achieving a primary budget surplus, or why Portugal’s debt jumped from 94% to 129% (IMF data).

These countries have an impossible task, damned if they do and damned if they don’t. Mr Blanchard said their gains in competitiveness risk being overwhelmed by a rise in the “real value” of their debt. “The danger is that the second effect dominates the first, leading to lower output and further deflation.”

There is, of course, no magic line when inflation falls below zero. A recent IMF study said the effects become lethal for economies with high public/private debt loads – mostly over 300% of GDP in Club Med – even at “lowflation” rates. The European Central Bank is betting that this downward lurch in prices is a temporary blip due to lower energy costs, insisting that inflation expectations remain “firmly anchored”. The collapse of iron ore and copper prices over recent days – on China jitters – should puncture these illusions.

The ECB’s expectations doctrine is in any case a Maginot Line. “Long-term inflation expectations on the eve of three deflationary episodes in Japan were also reassuringly positive,” said the IMF. Indeed, they were a lagging indicator and therefore useless. “One needs to act forcefully before deflation sets in,” said the Fund, adding that the Bank of Japan was too slow to cut rates and boost the money base. “In the event, it had to resort to ever-increasing stimulus once deflation set in. Two decades on, that effort is still ongoing.”

BoJ governor Yasuo Matsushita said as late as January 1998 that there was “no reason to expect that overall prices will drop sharply and exert deflationary pressure on the entire economy”. As a result of this lordly certitude, Japan suffered shattering effects when the East Asia crisis entered its second and more deadly phase that summer.

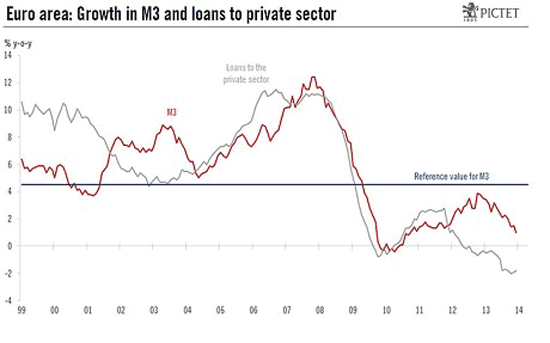

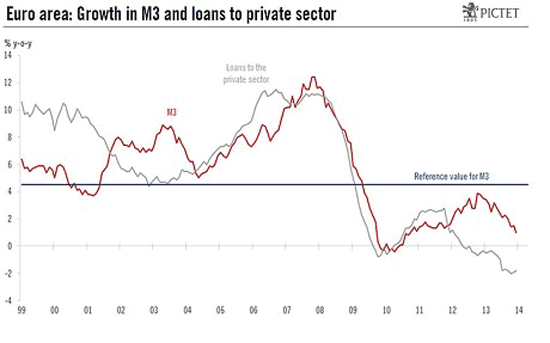

The ECB’s Mario Draghi risks going down in history as Europe’s Mr Matsushita, as he continues to insist that EMU inflation today is merely where it was in 2009 (in the post-Lehman mayhem) and therefore benign, and that Euroland is not remotely like Japan. “The ECB has taken decisive action at a very early stage of this crisis,” he said. The proof is in the monetary pudding, and this shows that EMU is already in worse shape than Japan in early 1998 by a large margin. Private lending is contracting at 2.3%, the M3 money supply has ground to a halt and EMU-wide unemployment is stuck at a near-record 12%.

The ECB is by definition ferociously tight. Marcel Fratzscher, head of the German Institute for Economic Research (DIW) in Berlin, is right to berate the bank for betraying its primary duty, demanding €60bn of bond purchases each month before it is too late. “It is high time for the ECB to act. Otherwise Europe risks falling into a dangerous downward spiral,” he said.

Euro Intelligence said failure to act would be “an existential disaster for the eurozone” and a “shocking derogation” of the ECB’s mandate. Mr Draghi has bent over backwards to assuage the hard-money monks at the Bundesbank – much to the fury of one ex-ECB governor who told me he had become the “captive” of Right-wing German elites – judging that it would be too risky for the Latin Bloc and their allies to mobilize their majority voting power and force through a reflation policy.

His task has become even more complicated since the German constitutional court ruled last month in thunderous language that the ECB’s bond rescue plan for Italy and Spain (OMT) “exceeds the ECB’s monetary policy mandate, infringes the powers of the Member States, and violates the prohibition of monetary financing of the budget”. It also said the OMT is probably “Ultra Vires”, meaning that the German Bundesbank may not take part.

The ruling is not final – and does not prohibit ECB bond purchases as such – but it raises the bar for quantitative easing to a punishingly high level. While the Fed and the Bank of England were able to act instantly once it became clear that QE on a huge scale was imperative, the ECB is paralysed by politics, ideology and judges.

There have been dovish mutterings from ECB members over recent days but any action is likely to be confined (for now) to token gestures such as a negative deposit rate or easier collateral rules for banks, not the €1 trillion blast of QE that is so obviously needed immediately. The rise in the euro to €1.39 against the dollar tells us that markets expect nothing of substance.

Europe is left at the mercy of world events. The Fed is pressing ahead with $10bn of tapering each meeting, slowly forcing up the global price of credit and tightening the vice further for emerging markets. The bank has ignored the pleas for mercy from the developing world – still addicted to dollar liquidity – just as it did in the months before the Asian crisis in 1998. The OECD warned this week that the real impact of Fed tapering has “only just begun” and the effects threaten to ricochet back into Europe through trade and banking stress in emerging markets.

China is tightening as well in what amounts to a G2 monetary squeeze. It has been so successful that shadow banking virtually froze in February, prompting the central bank to step back in consternation at its own handiwork. Some have a touching faith that the Communist Party knows what it is doing, even though it is the same body responsible for just having blown the most spectacular credit bubble of modern times, more than a match for the pre-Lehman booms in Greece, Spain or Ireland in character and much greater in scale. I prefer the Chinese metaphor of feeling the stones beneath the water, their way of saying trial and error.

China will not collapse because the banking system is an arm of the state, but it will have to cope with the colossal malinvestments left from a hubristic five-year blow-off. Deflation is already stalking the country. Factory gate inflation has dropped to -2%.

We can be sure that China will seek to pass this deflationary parcel to somebody else, just as the Japanese have already done with their epic devaluation under Abenomics. The package will land in Europe, the one region that lacks a proper central bank and the governing coherence to protect its own interests. The implications for the depression-wracked societies of the Mediterranean are nothing less than calamitous.

Read more …

• UK faces ‘crippling’ tax rises and spending cuts to fund pensions and healthcare (Telegraph)

Britain faces “crippling” tax rises and spending cuts if it is to meet the needs of an ageing population, according to the Institute of Economic Affairs. The IEA calculated the Government would need to slash spending by more than a quarter or impose significant tax hikes because official calculations had failed to factor in future pension and healthcare liabilities. “As populations age, tax bases will grow more slowly while government spending rises faster,” the report said.

In a stark warning, the think-tank said Britain faced tax rises equivalent within just two years to more than 17% of GDP – more than £300bn – in order to meet all future spending commitments. This is larger than the entire annual NHS budget and would increase taxes from 38% to 55% of national income.

Philip Booth, the IEA’s programme director, said tax increases of this magnitude would be “impossible” to implement “without choking off economic growth and actually reducing tax revenues. “The underlying problem is that successive governments have made promises which can simply not be honoured from the existing tax base. The electorate is grazing a fiscal commons at the expense of future generations,” he said.

In the absence of further tax hikes, Jagadeesh Gokhale, the author of the report, said total spending would have to be cut by more than one quarter or health and welfare expenditure by 53% compared with the current implied level if all future spending was to be met out of tax revenue.

While the IEA said increases to the state pension age would help to soften the blow of future tax rises, it said policies were being implemented too slowly and were “inadequate” on their own. Mr Gokhale said policies to address pension saving and healthcare costs were needed now or the problem would quickly grow out of control. “Without significant changes to spending levels, huge sacrifices will have to be made by future generations either through significantly higher taxes or reduced benefits,” the report said.

The IEA calculated that delaying crucial pension and healthcare reforms by just a few years would dramatically increase the burden because of growing debt interest payments. It said the ratio would increase from 13.7% of GDP in 2010 – already higher than the EU average of 13.5% – to almost 17.1% by 2016 if no policy adjustments were made.

“We have never been in a situation like this before. It is quite possible that we will not find our way through without serious social breakdown and/or mass emigration of the most mobile and productive people,” said Mr Booth. The report also warned that governments would not be able to grow their way out of trouble, and were too often “fixated” on short term growth. It said while the Government’s decision to move assets of the Royal Mail pension fund had reduced short-term debt measures, long-term state pension liabilities had increased.

“The Government took the assets of the Royal Mail pension fund and gave the workers promises of government pensions in return,” the report said. “The explicit government debt was reduced but future government liabilities – in this case contractual – were increased.”

“Without reform, today’s young people are likely to be disappointed, either in terms of higher tax rates or in terms of reduced future benefits provided by government,” said Mr Booth. “The quicker the government changes policy, the more painlessly the situation will be resolved. For too long people have voted themselves benefits to be paid for by the next generation of taxpayers, not by sacrifices that they will make themselves.”

Read more …

A whole list of China related articles that all keep on pointing to the country’s vulnerability because of all the credit created there off late.

• China premier warns on economic slowdown as data fans stimulus talk (Reuters)

Chinese Premier Li Keqiang warned on Thursday that the economy faces “severe challenges” in 2014 – comments that came as weak data fanned speculation the central bank would relax monetary policy to support stuttering growth. Li, speaking at a news conference on the final day of China’s yearly parliament, hinted Beijing would tolerate slower economic expansion this year while it pushes through reforms aimed at providing longer-term and more sustainable growth.

Data released shortly after his comments suggested that tolerance may face an early test. Growth in investment, retail sales and factory output all slumped to multi-year lows, suggesting a marked slowdown in the first two months of the year. “A storm is coming,” said Gao Yuan, an analyst at Haitong Securities in Shanghai, while Hao Zhou, the China economist for ANZ said “policy easing should be imminent.”

At the carefully orchestrated briefing where questions had to be vetted in advance, Li spent most time discussing the economy. But he also touched upon other topics, including friction in relations with Washington, corruption, pollution, and the disappearance of a Malaysia Airlines aircraft. While acknowledging the economy faced difficulties, Li suggested Beijing would not let growth slip too far. The government has targeted a rise of GDP in 2014 of 7.5% after actual growth last year of 7.7%. “We believe we have the ability, and all the means, to ensure that economic growth will stay within a reasonable range this year,” he said.

He also signaled the government will allow further debt defaults after Shanghai Chaori Solar Energy Science and Technology Co Ltd failed last Friday to pay an interest payment on its five-year bonds. The first default on a domestic bond was hailed by experts as a landmark that will impose more market discipline, a break from the past when bonds enjoyed an implicit guarantee because the government would bailout troubled firms to ensure stability.

Growth in Chinese corporate debt has been unprecedented. A Thomson Reuters analysis of 945 listed medium and large non-financial firms showed total debt soared by more than 260% to 4.74 trillion yuan ($777.3 billion) between December 2008 and September 2013. “We are reluctant to see defaults of financial products, but some cases are hard to avoid,” Li said. “We must enhance oversight and solve problems in a timely way to ensure no systemic and regional risks.” [..]

The signs of a slowdown in the economy this year have raised worries among some investors that China will miss the 7.5% growth target. “The momentum is really quite weak,” Wei Yao, China economist for Societe Generale said after Thursday’s data. “Q1 GDP growth is probably already below 7.5%. The government will probably do some easing.” Yao said she expected the central bank to reduce bank reserve requirements by 50 basis points. Major banks currently have to put aside a fifth of their cash as reserves and such a measure would represent the central bank’s strongest policy easing since 2012.

Li skillfully dodged a question on how far Beijing would let economic growth slip before it steps in with policy measures to support activity. Still, he hinted at tolerance for below-target growth, as long as enough new jobs are created. “The GDP growth target is around 7.5%. ‘Around’ means there is some flexibility and we have some tolerance,” he said, adding that the lower limit on growth must ensure job creation.

Read more …

• China Data Show Economy Cooling as Indicators Trail Estimates (Bloomberg)

China’s industrial-output, investment and retail-sales growth cooled more than estimated in the first two months of the year, signaling a slowdown in the economy as leaders seek to sustain 7.5% expansion. Factory production rose 8.6% in the January-February period from a year earlier, the National Bureau of Statistics said today in Beijing, compared with the 9.5% median projection of analysts surveyed by Bloomberg News. Retail sales advanced 11.8%, while fixed-asset investment excluding rural households was up 17.9%.

Premier Li Keqiang today said there’s some flexibility around the nation’s growth goal this year and that the government’s key concerns are jobs and livelihoods. Even so, an extended slowdown would add to chances of stimulus and test the Communist Party’s commitment to give market forces a bigger role in the world’s second-largest economy while clamping down on overcapacity, debt and pollution.

The Shanghai Composite Index (SHCOMP) pared gains after the data and was up 0.9% at 1:50 p.m. local time. China combines data for industrial output, retail sales and fixed-asset investment for January and February, citing distortions from the weeklong Lunar New Year holiday, whose timing differs each year.

Read more …

People in the west will continue to cut their discretionary spending, and that seals China’s fate.

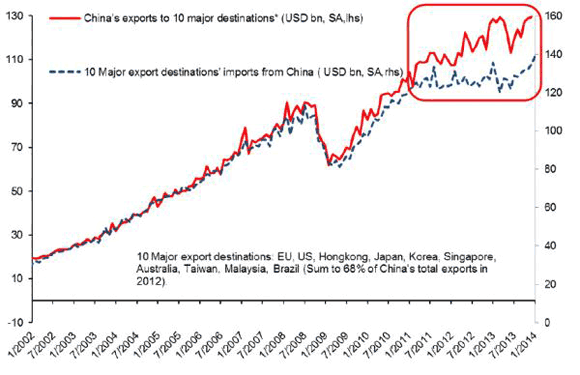

• China Export Prowess Wanes in U.S., Europe (Bloomberg)

The Made in China label is losing traction with its two biggest customers. After three decades of gains, China’s share of U.S. imports has plateaued and in Europe it’s in decline. The steepest losses are in the European Union, where China’s share of imports slumped to 16.5% in the first 11 months of last year, from a 2010 high of 18.5%, according to data compiled by Bloomberg News. In the U.S. the needle has barely moved in the past five years, holding around 19%.

China’s low-cost vantage has been blunted by rising wages and an appreciating currency, with cheaper nations including Vietnam and Bangladesh competing to sell products from T-shirts to shoes. With an unexpected drop in total exports in February compounding the challenges, the trends underscore the need for President Xi Jinping’s government to foster competitiveness in higher-technology items from semiconductor chips to medical-imaging equipment to airplanes.

“It’s a sea change,” said Andrew Tilton, chief Asia economist at Goldman Sachs Group Inc. in Hong Kong, who previously worked for the international office of the U.S. Treasury Department. “China’s period of unusually strong competitive advantage in exports may have run its course.”

The yuan has appreciated about 35% against the dollar since July 2005, wages have tripled in the past decade and China’s labor force has begun to shrink. The currency weakened today for a fourth day to 6.1435 per dollar, while the benchmark Shanghai Composite Index of stocks fell 0.2%.

The nation’s working-age population began declining in 2012, Chinese government data show. The pool of 15- to 39-year-olds — the backbone of factories making clothes and toys — has contracted by 35 million in the past five years, a U.S. estimate indicates. The changes have led global manufacturers to begin shifting production to countries such as Bangladesh and Vietnam, which surpassed China in 2010 as the largest supplier of Nike Inc. footwear. Higher costs and wages in China are prompting some Asian companies to set up manufacturing plans in neighboring countries. Samsung Electronics Co. is building a $2 billion plant in Vietnam that may make 120 million handsets by 2015.

U.S. and European clothing makers are also looking elsewhere. Some 72% of chief purchasing officers who oversee a collective $39 billion in annual purchases for apparel firms expected to shift to lower-cost nations — with Bangladesh, Vietnam and India as the top three destinations for the coming five years, a survey conducted by advisory firm McKinsey & Co. in 2013 shows.

More than a decade ago, China was the darling as it entered the World Trade Organization, with expanding commerce helping it boost growth, which averaged 10.6% in the decade that followed 2001. The nation also reshaped the world economy as China put cheap toys, souvenirs and jeans on shop shelves from New York to London to Paris.

Now, the beneficiaries of China’s slide in developed markets can be found as far away as Mexico. Its share of U.S. imports rose to 12.4% last year from 10.3% in 2008. Before China became a WTO member, Mexico’s proportion was 11.2%. As China’s competitiveness wanes, Mexico is benefiting from its proximity to the U.S. market and lower transportation costs, said Louis Kuijs, chief China economist at Royal Bank of Scotland Group Plc in Hong Kong, who formerly worked at the World Bank and the International Monetary Fund.

Read more …

• China needs to solve its debt crisis, says former Treasury minister (Telegraph)

China’s debt issues are the country’s biggest economic concern and need to be tackled, former Treasury minister and chairman of the China-Britain Business Council Lord Sassoon has said. Lord Sassoon, a former Treasury mandarin as well as Commercial Secretary to the Treasury from 2010 to 2013, told The Telegraph that Chinese debt is a more pressing worry than the recent mixed figures concerning the country’s economic growth rate.

“I think the biggest question I would have, and China itself has in the short term, is the debt issues which they need to resolve. “If there’s something to focus on, it’s around banking, shadow banking, provincial debt and I don’t know where that will all land”, he said.

Last year, China’s local government debt surged to nearly £1.8trn, 67% higher than in 2010. The rise brought China’s total public debt, including money owed by central government, to 58% of its £5.11trn economy. Meanwhile, China’s banks have overseen a rapid expansion of lending that has seen £9.1trn of credit created, and figures released in February showed that under-performing loans made by Chinese banks have risen to the highest level since the financial crisis.

China’s debt overhang has raised concerns about a credit crisis and slowdown of China’s economy. Recent economic figures have shown a decline in manufacturing PMI and exports, but Lord Sassoon said he’s more focused on long-term developments. “I think people can get excessively excited about China’s short term numbers, which have been mixed in recent months. “For me, it’s not so much one month’s, one quarter’s trade figures”, he said.

He went on to say that he believes the Chinese government are prepared and able to tackle the problems, however. “The new Chinese leadership recognise they’ve got a big problem they need to deal with immediately around the overhang of the public sector, particularly provincial, debt. “I think there’s a lot of issues for the Chinese government to work on but they’re not hiding them and they’ve got very good people on the case”, he said.

Lord Sassoon said the Asian super-power’s banks were also prepared to address their own issues. “If you go and talk to the big state-owned banks, the four big Chinese banks are very open and interesting on the subject of loans to sectors where there’s been over-capacity and there are businesses that have failed or failing. “I happen to believe there will be a soft landing because it’s the quality of the people in Beijing who are managing these issues”, he concluded.

Read more …

• Chinese yuan’s decline leaves observers guessing (Barry Eichengreen)

Since December, when the US Federal Reserve began tapering its monthly purchases of long-term assets, emerging-market currencies have fallen across the board. The main exception until recently was China’s indomitable yuan. But now the yuan, too, has been falling against the dollar. So is this more evidence of the disruptive impact of the Fed’s policy? The yuan’s decline is not large, and whether it will continue is uncertain. But the movement is striking by the standards of what is still a heavily managed currency. And it is in the opposite direction from what everyone has come to expect.

Certainly, the Fed’s tapering of its quantitative-easing policy has had some effect. A standard money-making strategy for investors with access to Chinese financial markets has been to borrow dollars at low interest rates and buy high-yield Chinese assets. But tapering, by auguring higher US interest rates, makes it more expensive to borrow dollars and invest in Chinese assets. As “the carry trade” falls out of fashion, demand for the yuan declines and its exchange rate depreciates.

But, while the Fed has been tapering since December, the weakness of the yuan materialised only in February. Evidently something else is going on. The reality is that China’s tightly controlled currency falls only when the People’s Bank of China wants it to fall. The PBOC, not the Fed, calls the tune to which the yuan dances. So why has it been singing the depreciation song?

One possibility is that a weaker yuan is, paradoxically, part of the Chinese government’s strategy for encouraging its wider international use. China is committed to broadening the yuan’s role for foreign trade and investment-related purposes. Ultimately, it would like to see the yuan achieve an international status comparable to that of the dollar.

To do that, China will have to develop its financial markets and open them to foreign investors. But opening those markets is feasible only if the authorities eliminate the perception that exchange-rate movements are a one-way proposition. So long as investors believe that the yuan can only appreciate, opening the country’s markets will cause it to be flooded by foreign money, with unpleasant financial consequences, not the least of which is inflation.

Foreign investors therefore need to be reminded that the yuan can fall as well as rise. Some observers regard the yuan’s recent slide as an attempt to squeeze the speculators and signal the advent of a more flexible exchange rate. They believe that the PBOC is about to widen the currency’s trading band.

If so, the PBOC’s recent market moves are a good thing. If there is one clear lesson from history, it is that the combination of open financial markets and a rigid exchange rate is a disaster waiting to happen. China has already begun opening its financial markets. Thus, greater exchange-rate flexibility is overdue.

A second, less positive interpretation is that the PBOC is weakening the yuan in order to boost Chinese exports. Reacting against excesses in the country’s property markets and shadow banking system, the PBOC has moved, not unreasonably, to limit the availability of cheap credit. But this may have caused domestic demand growth to slow more rapidly than expected. And boosting exports is, of course, China’s customary response to weaker domestic demand.

This less encouraging interpretation of the yuan’s recent weakening suggests that official efforts to clamp down on the shadow banking system are not going well, and that the effort to engineer a soft economic landing is not on course. If this view is correct, efforts to rebalance the Chinese economy could now be put on hold, which would not bode well for future economic and financial stability.

Moreover, if China is pushing down the yuan in order to goose its exports, its policy will not sit well with its foreign competitors, be they the US or Japan. Complaints about currency manipulation and the associated diplomatic tensions will quickly return.

China is sufficiently opaque that it is hard to know from the outside which interpretation is correct. Future yuan movements will tell the tale. Mainly up-and-down fluctuations would be a sign that the policymakers’ goal is to eliminate one-way bets and advance the cause of yuan internationalisation. A secular decline, by contrast, would indicate that demand in China is weakening and rebalancing has been suspended. For now, the only thing observers can do is to watch closely and hope for the best. And it is the PBOC they should be watching, not the Fed.

Read more …

Using copper as collateral to buy more copper. Isn’t life wonderful?

• Copper sell-off following China bond default brings market to four-year low (Reuters)

China’s first domestic bond default has shaken the foundations of the copper market, stoking investor worries about the possible unravelling of financing deals that have locked up vast quantities of copper. This anxiety has led to three days of heavy selling in the metal, while having little noticeable effect on other global financial markets.

The Shanghai Futures Exchange’s most-traded copper contract reached its lowest level in more than four years on Tuesday, and the London copper benchmark fell to its lowest in more than three years later in the day. “A lot of that is linked to the financing deals and you start to wonder, ‘are they at risk?’ and I think that is what the market is indeed worried about, and that’s why copper has taken the brunt,” BNP Paribas analyst Stephen Briggs said.

The default on a bond payment by China’s Chaori Solar last week signalled a reassessment of credit risk in a market where even high-yielding debt had been seen as carrying an implicit state guarantee. On Tuesday, solar panel maker and power company Baoding Tianwei Baobian Electric announced a second straight year of net losses, leading to a suspension of its stock and bonds on the Shanghai Stock Exchange and stoking fears that it, too, may default.

The metals markets saw the default as a sign of tighter credit to come for users of metals and for financiers that have used the metal as collateral for borrowing, analysts said. If their loans are not renewed and financing deals start to unravel, the investors could unload their metal supplies on to the market.

Similar financing deals are in place using metals such as zinc and iron ore, but copper has been the preferred choice for the Chinese trade and finance community. “If there are worries in a general sense about financial conditions in China, copper is perhaps more exposed to that than other metals, because we’ve seen a substantial rise in inventories in China this year,” Briggs said.

At least one US scrap copper trader has suffered “large” losses after the Chinese default, one of the first signs that sinking prices and tightening credit are taking a toll on the physical market. Some analysts and traders estimated that 60% to 80% of China’s copper imports in recent years may have been used as collateral, although none of them could give a definitive figure for how much copper is now tied up in deals.

The mainland’s imports of copper products hit a record 536,000 tonnes in January, up 53% year on year, customs data showed. The inflow slowed in February to 379,000 tonnes but was still higher than in February 2013. Copper stocks in warehouses monitored by the Shanghai Futures Exchange are bulging, up 65% since early January to around 200,000 tonnes . Another 745,000 tonnes of the metal is held in bonded warehouses, minerals consultancy CRU estimated. No official figures are available.

“Given rising inventories, a negative arbitrage and a seemingly soft post-Lunar New Year increase in activity, we doubt that real demand lies behind the strong copper numbers,” Credit Suisse said in a research note. Benchmark Shanghai and London Metal Exchange copper prices have been falling steadily this year, mostly because of tepid economic growth in China, which accounts for more than 40 per cent of global demand for the metal.

But after the sharp price drops in recent days following the bond default, would-be importers in China are finding it tough to get credit. “Right now it is very difficult for clients to issue an LC (letter of credit) to import copper because the bank loan is very tight. Also if you import the copper in China, you will lose a lot of money,” one trader in Singapore said. [..]

Read more …

Want to grow? Get yourself an earthquake!

• New Zealand Raises Key Rate, First Developed Nation to Tighten

New Zealand raised its key interest rate, the first developed nation to exit record-low borrowing costs this year, and said it plans to remove stimulus faster than previously forecast to contain inflation. “It is necessary to raise interest rates toward a level at which they are no longer adding to demand,” Reserve Bank of New Zealand Governor Graeme Wheeler said in a statement in Wellington after increasing the official cash rate by a quarter%age point to 2.75%, as forecast by all 15 economists in a Bloomberg News survey. The Kiwi gained after Wheeler said further increases are likely in coming months and the OCR may rise by a total of 125 basis points this year.

Soaring dairy prices, the NZ$40 billion ($34 billion) rebuild of earthquake-damaged Christchurch and the strongest immigration in 10 years are fueling growth in the South Pacific economy. Wheeler is departing from global peers as surging house prices in the nation’s biggest city of Auckland stoke concerns of a bubble and add to inflationary pressures. “We’re on a different planet,” Stephen Toplis, head of research at Bank of New Zealand Ltd. in Wellington, said in an interview. “New Zealand’s environment is fundamentally different to most of our peers” because of record-high commodity prices and construction, he said.

The RBNZ today lifted its forecast for the 90-day bank bill rate, suggesting borrowing costs will rise more quickly than previously expected. The tightening is set to come in an election year, with Prime Minister John Key seeking a third term in a poll set this week for Sept. 20.

Wheeler will raise rates at his next two opportunities in April and June then pause until December, according to the median forecast in a Bloomberg News survey of 15 economists conducted after today’s decision. Six analysts expect a rise at the Sept. 11 review. “If the economic environment makes it a pre-requisite, then he’ll go, but any central bank governor would prefer to not get involved in the election,” said Toplis.

New Zealand’s dollar rose to its highest since May 1 after the RBNZ decision. It bought 85.59 U.S. cents at 5:36 p.m. in Wellington, up from 84.65 cents immediately before the statement. “The bank does not believe the current level of the exchange rate is sustainable in the long run,” Wheeler said, reiterating that the currency’s strength is a “headwind” for exporters and local manufacturers who compete against imports.

Read more …

Fonterra’s link to China is painfully strong.

• New Zealand’s Fonterra, World’s Largest Dairy Exporter, In Guilty Plea Over Food Safety (BBC)

New Zealand’s Fonterra has admitted four food-safety violations following a botulism scare last year that led to recalls of milk products in China. Government officials had filed charges against the dairy company, accusing it of processing and exporting dairy products which did not meet standards. Fonterra is also accused of failing to issue notification about its products not being fit for consumption.

The charges come as Fonterra faces civil court action from Danone. Earlier this year, the French company said it was suing Fonterra over recalls which Danone alleged led to the company losing hundreds of millions of dollars in sales. Danone uses Fonterra ingredients in its infant milk formula. Maury Leyland, a Fonterra manager said: “We have accepted all four charges, which are consistent with the findings of our operational review and the Independent Board Inquiry.” The dairy co-operative has since stepped up its quality control procedures.

In August last year Fonterra sparked a worldwide product recall and food-safety scare when it admitted there could be a bacteria in one of its products which could cause botulism, a severe form of food poisoning. The product suspected of containing the bacteria which could cause botulism was commonly used in infant formula. But the bacteria scare turned out to be a false alarm when later tests found another strain, but of a less harmful kind which does not cause food poisoning.

The threat of botulism led to many countries including China blocking imports of dairy products from New Zealand. The import ban was lifted about three weeks after the initial scare. Fonterra is the biggest dairy firm in New Zealand, which is the world’s largest exporter of dairy products.

Read more …

If only we frack till we drop, we will be saved! Hmm, so shy do Shell just announce it’s getting out of US shale because it can’t manage to make it profitable?

• EU parliament excludes shale gas from environmental code (Guardian)

EU politicians on Wednesday voted for tougher rules on exposing the environmental impact of oil and conventional gas exploration, while excluding shale gas. Member states such as Britain and Poland are pushing hard for the development of shale gas, seen as one way to lessen dependence on Russian gas, as well as to lower energy costs as it has in the United States. The plenary vote of the European Parliament in Strasbourg, France follows a compromise deal on the draft law in December, which was struck only after negotiators agreed to leave out references to shale gas.

Member states are expected to give their endorsement over the coming weeks, after which the law will become final. Under the planned law, assessments of a range of infrastructure projects, as well as oil and gas, will include their impact on biodiversity and climate change, plus measures to ensure authorities granting approval have no conflict of interest. Industry said the new law avoided placing too many restrictions on projects during their early phases when commercial viability is unclear.

While not imposing unnecessary requirements on the upstream oil and gas industry, the new rules will guarantee that any development, including exploration for shale gas, will be subject to strict environmental standards, Roland Festor, director for EU affairs at the International Association of Oil & Gas Producers, said. Shale Gas Europe, which brings together companies such as Chevron, Total and Cuadrilla Resources, also welcomed the law. Shale gas could potentially play an important role in meeting Europe’s acute energy challenges, Marcus Pepperell, spokesman for Shale Gas Europe, said.

Green politicians, however, said the decision to leave out shale gas was a major setback and that the fracking process, which involves using chemicals to extract gas from the shale rock, posed risks to health and the environment. The Greens believe there is already sufficient evidence to ban fracking but ensuring informed permit decisions through the environmental impact assessment procedure must be the absolute minimum, Sandrine Belier, environment spokeswoman for the European Greens, said.

Read more …

Euan’s conclusion: “We seem set to become increasingly reliant upon Russia for gas supplies that also provides our electricity security”.

• Blackout Britain? (Euan Mearns)

Why is there a perception that the UK faces an ongoing risk of electricity grid failures? At the end of May 2013 the UK had 416 power stations, counting wind farms and hydro dams, ranging in nameplate capacity from 1 to 3870 MW. The combined capacity in 2013, following large combustion plant closures, was 80,514 MW down from 92,044 MW in 2012 (Figure 1). With peak winter demand roughly 55,000 MW there still seems to be ample spare capacity to guarantee electricity supplies (Figure 1). Why then is there so much talk on the media, blogs and from the CEO of National Grid about pending blackouts in Britain? The answer is not what many may presume it to be.

Figure 1 During the 1960s to the 1980s Britain was largely dependent upon coal and nuclear power for electricity supplies. Natural gas (CCGT) was introduced in the early 1990s and expanded year on year until 2004. At the end of that decade a second phase of CCGT building got under way adding a further 9,274 MW of capacity, which with hindsight appears to be an extraordinary investment decision. The closure of 11,530 MW of large combustion plants has resulted in the decline of UK generating capacity. The expansion of wind got underway in the early 21st century. Wind capacity is not varied into the future. It can be expected to grow some, but not at the historic rate since companies are becoming shy of investing in Britain’s chaotic energy market. Data from DECC table dukes5_11.

Britain has 31,637 MW of CCGT capacity (combined cycle gas turbines) but lacks access to sufficient gas to run this fleet at anything close to capacity. During the cold spell at the end of last winter when gas storage was run down to empty the maximum output from the CCGT fleet was 22,000 MW, just 70% of the installed capacity. The closure of 11,530 MW of large combustion plants (coal and oil) has of course created the electricity supply crisis. But given that these power stations are now gone, it is a shortage of gas that creates the current blackout risk.

Figure 2 shows the pattern of electricity demand in the UK for January and July 2009. In 2009, peak demand was 58.9 GW at 6pm on a Tuesday in January and the minimum demand was 22.3 GW at 6 am on a Sunday morning in July. Peak demand is 2.64 times greater than the minimum demand and the electricity delivery system requires the flexibility and controllability to match supply with demand exactly at all times.

Figure 2 UK electricity demand for January and July 2009 shows three cycles in the pattern of demand. The daily cycle has peaks during day time, with maximum demand normally at 6pm, and troughs at night. The weekly cycle shows increased demand Monday to Friday with reduced demand on Saturday and Sunday. The annual cycle shows increased demand in winter compared with summer. This provides a picture of activity and expectations of the society we live in. We like to stay warm in winter, we go to bed at night and we have weekends off work.

For the time being, blackout risk in the UK is confined to the short periods of peak winter demand that invariably occur at 6pm in the winter months. And the blackout risk is hightened towards the end of the winter when our’s and Europe’s gas storage has been run down. Figure 3 shows gas generating capacity curtailed to 22,000 MW which is an approximation for current gas supply limits. Wind, that is not dispatchable, is removed.

Figure 3 An approximation for the deliverability from UK power stations with CCGT curtailed to 22,000 MW and wind power removed. On a calm, cold weekday at the end of a long cold winter, there is a risk of blackouts in the UK and that risk will increase as the decade progresses.

This now shows the nature of the blackout risk that we face. Should we have a cold winter that drains storage and cold weather in February or March and little wind across the UK and near continent then there is a blackout risk, especially if there are outages at nuclear or other generating plant, which is quite common. This risk will increase towards the end of the decade if planned nuclear closures go ahead and if there are further closures of large combustion plants.

At present, understanding the blackout risk in Britain boils down to understanding the security of future gas supplies and that is not a simple task. The hightened blackout risk of March 2013 came about because of LNG Heading East as a consequence of the Fukushima nuclear disaster in Japan. Closer to home, UK supplies may get some relief in the next few years as a number of new projects come on line, and if there are significant shale gas discoveries. Offsetting that are plans in the Netherlands to cut production in the giant Groningen field and the inevitability of a future peak in Norwegian gas production. We seem set to become increasingly reliant upon Russia for gas supplies that also provides our electricity security.

Read more …

• Tim Berners-Lee on 25 Years of the Web (Spiegel)

In March 1989, Tim Berners-Lee, 58, established a place for himself in the history books by creating the World Wide Web. That month, the Briton, who at the time worked for the European Organization for Nuclear Research (CERN), wrote a paper titled “Information Management — A Proposal.” His research led to the development of the first Web browser and, finally, the World Wide Web. Today, Berners-Lee is a professor at the Massachussetts Institute of Technology (MIT) and the University of Southhampton in England.

SPIEGEL ONLINE: You are considered to be the father of the World Wide Web. When you look at how your idea developed over time, do you view the Web more with pride, disbelief or concern?

Berners-Lee: All of the above. Certainly all the people who have been part the Word Wide Web can be very proud of what has been achieved, and especially about the spirit of collaboration behind this amazing development. That said: All that collaboration and working together is to a certain extent under threat, because the Web has become so powerful, because it has become such an important technology for everyday life and almost everything we do. Therefore there is a strong tendency for governments, big organizations and companies to try to control it.

SPIEGEL ONLINE: It isn’t just China and Iran that are attempting to control the Internet and spy on its users. Intelligence agencies in the country of your birth, Britain, and the United States are acting like hackers, undermining security and even encryption standards. How big is the loss of trust, in your view, and what can be done about it?

Berners-Lee: What that has shown is the lack of oversight over the spying systems both in the United Kingdom and the US. That needs to change. We need a serious overhaul of those social systems around spying. Any country that has a part of the government or the police spying on the Internet to combat crime must demonstrate that they have a very solid level of accountability and that the information they get is never abused. The privacy of the individual must be respected and the data captured cannot be abused for commercial purposes. What’s really great about Edward Snowden revelations is that they raise awareness about these problems and about the Internet and its integrity.

SPIEGEL ONLINE: Some countries and companies want to build regional safe havens for data. For example, Brazil wants to force international companies to store Brazilian customers’ data on servers located inside the country. Germany’s Deutsche Telekom is thinking of a Schengen Net that would keep data inside the EU. What is your take on that?

Berners-Lee: Any division or Balkanization of the Web into segments is a very bad idea. The reason we had this shoot growth of creativity on the Web that got us to where we are now, to this incredible richness, is that the Web has been a non-national, open, universal thing. It initially grew without any reference to national borders. It is only when you try to police the Internet that you need to use laws, and most sets of laws we have are nation-based. So we must be very careful to make sure the Internet remains open.

SPIEGEL ONLINE: You and others are launching a global campaign to ensure the legal protection of Web users’ rights internationally. What would you include in your personal Magna Charta for the Web?

Berners-Lee: First, I would like us to have that conversation together. That is why we created webwewant.org. I want us to use this year to define the values that we as Web users are going to insist on. I would like every country to debate what that means in terms of their existing laws. In what areas must we enhance our regulations to guarantee fundamental rights on the Internet? The right to privacy must be in there, the right not to be spied on and the right not to be blocked. The commercial marketplace should be completely open. You should be able to visit any political website apart from the things that we all agree are illegal, nasty and horrible. Access to the Web is, of course, a fundamental right. As we celebrate the Web’s 25th anniversary, we need to think about the fact that less than half the world’s population uses the Web at all.

SPIEGEL ONLINE: How would you like to change that?

Berners-Lee: The advance of the mobile web has made the problem much easier to address. At best, a poor person in Africa will have a $10 mobile phone that still has no browser. The question now is how we can drive down the price of a basic smartphone with a browser on it. The next question is how we can we create data plans that are affordable and provide enough bandwidth to allow the user to participate in the Information Society. Then we need to them to write, share their creativity and not just read.

SPIEGEL ONLINE: You have suggested that the Web has developed quite well without national regulations. Do you see a role here for governments as well?

Berners-Lee: We started the Alliance for Affordable Internet (A4AI), which sees governments, NGOs and companies working together in order to overcome big drags.

SPIEGEL ONINE: What do you mean by “drags”?

Berners-Lee: Well, often there are seemingly “sweet deals” in which big foreign telecommunications companies offer to connect all schools for free in a certain country on the condition that they become the monopoly provider. That keeps prices high and hinders innovation. A4AI wants to make sure the regulatory landscape is good and to try to get companies to offer low start-up charges and fees for people who want to get onboard for the first time.

SPIEGEL ONLINE: Looking back 25 years, what was one of the most important milestones in the Web’s development?

Berners-Lee: When I first developed the Web technology at CERN in Geneva, there was another system called Gopher. I didn’t think it was as good as the Web, but it started earlier and had more users. At a certain point the University of Minnesota, which had created the Gopher system, said that in the future they would possibly charge a royalty for commercial uses. Gopher traffic immediately dropped off and people moved to the World Wide Web. CERN management then made a commitment — I can still remember the date, April 30, 1993 — that royalties would never be charged for using the Web. That was a very important step because it established a trend.

SPIEGEL ONLINE: So far the Web has been steered, administered and “governed” by many organizations. The US plays a dominate role through the Internet Corporation for Assigned Names and Numbers (ICANN), which manages the allocation of IP addresses and the .com and .net names of sites associated with them. Is this multistakeholder approach the right model for the next 25 years?

Berners-Lee: Nothing is perfect and every multistakeholder solution means hard work and involves a lot of communication. We need to revise how that works, but incrementally. It is also important for the US to formally let go of ICANN. But, yes, I think the solution for the future is a revised version of the existing multistakeholder model.

Read more …

Almost all animals see UV light. We do not.

• Most Animals Can See UV Light, See Power Lines As Flashing Bands Across The Sky (Guardian)

Power lines are seen as glowing and flashing bands across the sky by many animals, research has revealed. The work suggests that the pylons and wires that stretch across many landscapes are having a worldwide impact on wildlife. Scientists knew many creatures avoid power lines but the reason why was mysterious as they are not impassable physical barriers. Now, a new understanding of just how many species can see the ultraviolet light – which is invisible to humans – has revealed the major visual impact of the power lines.

“It was a big surprise but we now think the majority of animals can see UV light,” said Professor Glen Jeffery, a vision expert at University College London. “There is no reason why this phenomenon is not occuring around the world.” Dr Nicolas Tyler, an ecologist at UIT The Arctic University of Norway and another member of the research team, said: “The flashes occur at random in time and space, so the power lines are not grey and passive, but seen as lines of light flashing.”

He said the discovery has global significance: “The loss and fragmentation of habitat by infrastructure is the principle global threat to biodiversity – it is absolutely major. Roads have always got particular attention but this will push power lines right up the list of offenders.” The avoidance of power lines can interfere with migration routes, breeding grounds and grazing for both animals and birds.

Autopsies on dozens of mammals from zoos and abbatoirs showed their eyes were able to see UV, including cattle, cats, dogs, rats, bats, okapi, red pandas and hedgehogs. Also on the list were reindeer and further work published in the journal Conservation Biology showed these animals, whose eyes are specially adapted to the dark Arctic winters, are particularly sensitive to UV light. UV vision helps reindeer find plants in snow cover, but in the depths of winter their wide irises and sensitive eyes means the power lines appear particularly bright.

The avoidance of power lines had been explained in the past by the corridors cut through forests to accomodate them, where animals would be exposed in the open to predators. But this explanation could not apply in the treeless tundra of northern Norway, where 220,000 reindeer are tended by 7,000 herders from the traditional Sami people. “Right now, there is a plan to build a 186-mile long power line in north Norway,” said Tyler. “This new work will encourage power companies to negotiate with herders about where they put the power lines.”