DPC Cab stand at Madison Square, NY c1900

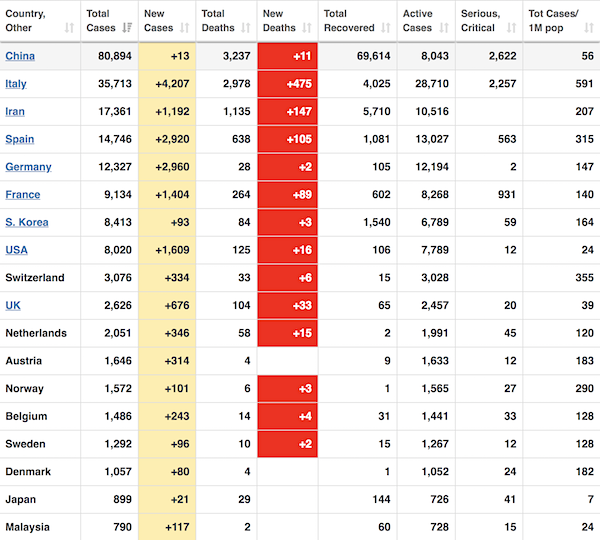

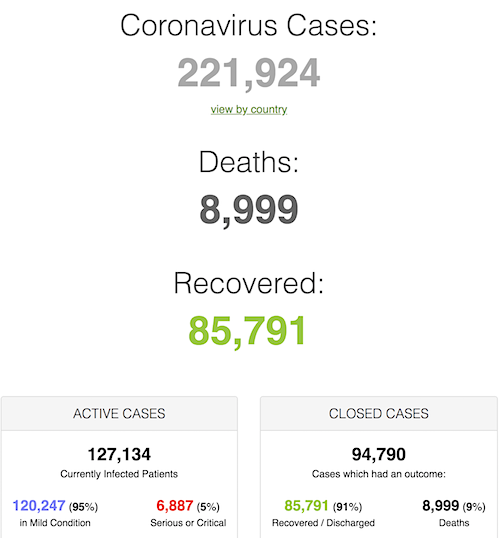

• Cases 221,934 (+ 19,664 from yesterday’s 202,270)

• Deaths 8,999 (+ 987 from yesterday’s 8,012)

From Worldometer yesterday evening (before their day’s close)

From Worldometer -NOTE: mortality rate briefly touched 10% –

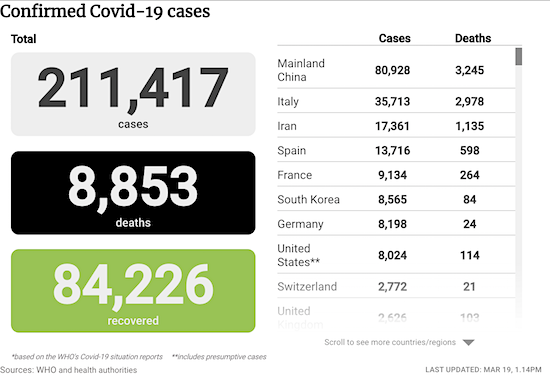

From SCMP: (Note: the SCMP graph was useful when China was the focal point; they are falling behind now)

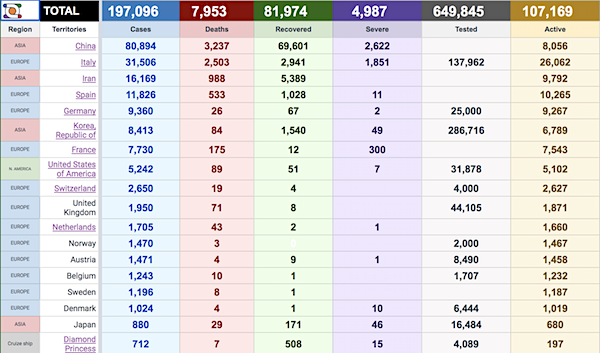

From COVID2019.app: (New format lacks new cases and deaths)

I wanted to show you how widespread the virus has become. Worldometer keeps a constantly updated record of new cases and deaths every day. Here is the harvest of just the past 10 hours; I left out the sources, go to their site for those.

• 1 new case in Sweden

• 5 new cases in Sri Lanka

• 309 new cases and 7 new deaths in Belgium

• 12 new cases in Bahrain

• 35 new cases in Norway

• 756 new cases and 3 new deaths in Germany

• 10 new cases in Tunisia

• 245 new cases and 2 new deaths in Spain

• 10 new cases in Peru

• 22 new cases in Pakistan

• 12 new cases in Armenia

• 104 new cases and 2 new deaths in Switzerland

• 2 new cases in Lithuania:

• 28 new cases in Finland

• 3 new cases in Tanzania

• 3 new cases in the State of Palestine

• 4 new cases in Bangladesh

• 4 new cases in Guam

• 5 new cases in Brunei Darussalam

• 1 new death in Greece

• 13 new cases and 1 new death in Croatia

• 4 new cases in Morocco

• 6 new cases in Bosnia and Herzegovina

• 15 new cases in the Philippines

• 7 new cases and 1 new death in Algeria

• 75 new cases and 2 new deaths in Denmark

• 2 new cases in Ghana

• 113 new cases in Australia (NSW), including a 6-year-old child

• 6 new cases in Slovakia

• 7 new cases in the DR Congo

• 6 new cases in Lebanon

• 96 new cases in Israel

• 132 new cases and 2 new deaths in Luxembourg

• 15 new cases in Latvia

• 50 new cases in Czechia

• 1st death in Russia

• 110 new cases in Malaysia

• 14 new cases in Faeroe Islands

• 6 new cases in Kuwait

• 1 new case in Cuba: a Canadian citizen

• 60 new cases in Thailand

• 82 new cases and 6 new deaths in Indonesia

• 18 new cases in Poland

• 8 new cases in Kazakhstan

• 1st death in Mexico

• 197 new cases and 1 new death in Austria

• 3 new cases in Bangladesh

• 8 new cases in Serbia

• 2 new cases in Sri Lanka

• 5 new cases in India

• 15 new cases in Hungary

• 2 new cases in Georgia

• 8 new cases in Taiwan

• 2 new cases and 1 new death in Bulgaria

• 5 new cases in Uzbekistan

• 5 new cases in Armenia

• 205 new cases and 5 new deaths in the United States

• 9 new cases and 3 new deaths in Japan

• 3 new cases in Honduras

• 2 new cases in Trinidad and Tobago

• 1 new case in French Polynesia

• 1 new death in Argentina

• 1st case in Nicaragua

• 1st case in El Salvador

• 1st case in Fiji

• 1 new death in Curaçao.

• 9 new cases in Colombia

• 152 new cases and 7 new deaths in South Korea

• 8 new cases in New Zealand

• 34 new cases, 8 new deaths (all in Hubei) in China

Time to wonder about mental health as well.

• ‘A Generation Has Died’ (G.)

Coffins awaiting burial are lining up in churches and the corpses of those who died at home are being kept in sealed-off rooms for days as funeral services struggle to cope in Bergamo, the Italian province hardest hit by the coronavirus pandemic. As of Wednesday, Covid-19 had killed 2,978 across Italy, all buried or cremated without ceremony. Those who die in hospital do so alone, with their belongings left in bags beside coffins before being collected by funeral workers. In Bergamo, a province of 1.2 million people in the Lombardy region, where 1,640 of the total deaths in the country have taken place, 3,993 people had contracted the virus by Tuesday. The death toll across the province is unclear, but CFB, the area’s largest funeral director, has carried out almost 600 burials or cremations since 1 March.

“In a normal month we would do about 120,” said Antonio Ricciardi, the president of CFB. “A generation has died in just over two weeks. We’ve never seen anything like this and it just makes you cry.” There are about 80 funeral companies across Bergamo, each receiving dozens of calls an hour. A shortage of coffins as providers struggle to keep up with demand and funeral workers becoming infected with the virus are also hampering preparations. Hospitals have adopted more stringent rules regarding the handling of the dead, who need to be placed in a coffin straight away without being clothed due to the risk of infection posed by their bodies. “Families can’t see their loved ones or give them a proper funeral, this is a big problem on a psychological level,” said Ricciardi. “But also because many of our staff are ill, we don’t have as many people to transport and prepare the bodies.”

For those who die at home, the bureaucratic process is lengthier as deaths need to be certified by two doctors. The second is a specialist who would ordinarily have to certify the death no later than 30 hours after a person has passed away. “So you have to wait for both doctors to come and at this time, many of them are also ill,” added Ricciardi. Stella, a teacher in Bergamo, shared the story of one of the deceased with the Guardian. “Yesterday, an 88-year-old man died,” she said. “He’d had a fever for a few days. There was no way to call an ambulance because the line was always busy. He died alone in his room. The ambulance arrived an hour later. Obviously, nothing could be done. And since no coffins were available in Bergamo, they left him on the bed and sealed his room to keep his relatives from entering until a coffin could be found.”

Adding to the torment is the fact that relatives cannot visit their loved ones in hospital, or give them proper funerals. “Usually you would be able to dress them and they would stay one night in the family home. None of this is happening,” said Alessandro, whose 74-year-old uncle died in Codogno, the Lombardy town where the outbreak began. “You can’t even see them to say goodbye, this is the most devastating part.” The harrowing impact of the virus on Bergamo can be gleaned from the obituary section of the local newspaper L’Eco di Bergamo. On Friday, reader Giovanni Locatelli shared online footage comparing the newspaper’s obituary section on 9 February, when listings took up just one page, to a copy dated 13 March, when 10 pages were needed to commemorate the dead.

Test? Where do I get one?

• Scientists Say Mass Tests In Italian Town Have Halted COVID-19 (G.)

The small town of Vò, in northern Italy, where the first coronavirus death occurred in the country, has become a case study that demonstrates how scientists might neutralise the spread of Covid-19. A scientific study, rolled out by the University of Padua, with the help of the Veneto Region and the Red Cross, consisted of testing all 3,300 inhabitants of the town, including asymptomatic people. The goal was to study the natural history of the virus, the transmission dynamics and the categories at risk. The researchers explained they had tested the inhabitants twice and that the study led to the discovery of the decisive role in the spread of the coronavirus epidemic of asymptomatic people.

When the study began, on 6 March, there were at least 90 infected in Vò. For days now, there have been no new cases. “We were able to contain the outbreak here, because we identified and eliminated the ‘submerged’ infections and isolated them,” Andrea Crisanti, an infections expert at Imperial College London, who took part in the Vò project, told the Financial Times. “That is what makes the difference.” The research allowed for the identification of at least six asymptomatic people who tested positive for Covid-19. ‘‘If these people had not been discovered,” said the researchers, they would probably have unknowingly infected other inhabitants.

“The percentage of infected people, even if asymptomatic, in the population is very high,” wrote Sergio Romagnani, professor of clinical immunology at the University of Florence, in a letter to the authorities. “The isolation of asymptomatics is essential to be able to control the spread of the virus and the severity of the disease.” [..] the problems of mass tests are not only of an economic nature (each swab costs about 15 euros) but also at a organisational level. [..] Massimo Galli, professor of infectious diseases at the University of Milan and director of infectious diseases at the Luigi Sacco hospital in Milan, warned carrying out mass tests on the asymptomatic population could however prove to be useless. “The contagions are unfortunately constantly evolving,” Galli told the Guardian. “A man who tests negative today could contract the disease tomorrow.”

Every day brings new stories of miracles. And then you read them.

• Japanese Flu Drug ‘Clearly Effective’ Against Coronavirus, But.. (G.)

Medical authorities in China have said a drug used in Japan to treat new strains of influenza appeared to be effective in coronavirus patients, Japanese media said on Wednesday. Zhang Xinmin, an official at China’s science and technology ministry, said favipiravir, developed by a subsidiary of Fujifilm, had produced encouraging outcomes in clinical trials in Wuhan and Shenzhen involving 340 patients. “It has a high degree of safety and is clearly effective in treatment,” Zhang told reporters on Tuesday. Patients who were given the medicine in Shenzhen turned negative for the virus after a median of four days after becoming positive, compared with a median of 11 days for those who were not treated with the drug, public broadcaster NHK said.

In addition, X-rays confirmed improvements in lung condition in about 91% of the patients who were treated with favipiravir, compared to 62% or those without the drug. Fujifilm Toyama Chemical, which developed the drug – also known as Avigan – in 2014, has declined to comment on the claims. Shares in the firm surged on Wednesday following Zhang’s comments, closing the morning up 14.7% at 5,207 yen, having briefly hit their daily limit high of 5,238 yen. Doctors in Japan are using the same drug in clinical studies on coronavirus patients with mild to moderate symptoms, hoping it will prevent the virus from multiplying in patients. But a Japanese health ministry source suggested the drug was not as effective in people with more severe symptoms. “We’ve given Avigan to 70 to 80 people, but it doesn’t seem to work that well when the virus has already multiplied,” the source told the Mainichi Shimbun.

Not the first time we mention Richard Horton, editor-in-chief of the Lancet.

• UK Failures Over COVID-19 Will Increase Death Toll, Says Leading Doctor (G.)

A “collective failure” to appreciate the enormity of the coronavirus pandemic and enact swift measures to protect the public will lead to unnecessary deaths, according to a leading doctor, who said the UK ignored clear warning signs from China. Richard Horton, editor-in-chief of the Lancet, rounded on politicians and their expert advisers for failing to act when Chinese researchers first warned about a devastating new virus that was killing people in Hubei eight weeks ago. The team from Wuhan and Beijing reported in January that “the number of deaths was rising quickly” as the virus spread in China. They urged the global community to launch “careful surveillance” in view of the pathogen’s “pandemic potential”.

But writing in the Guardian, Horton said the warning was met with complacency in Britain, where for unknown reasons, medical and scientific advisers watched and waited. At the time, scientists advising ministers appeared to believe it could be treated like influenza, and that a “controlled epidemic” would generate “herd immunity” that would help protect the most vulnerable against the infection. The scenario called for upwards of 60% of the population to contract the virus. The government’s strategy changed dramatically on Monday when the prime minister announced that new modelling from Imperial College London demonstrated that more draconian measures were needed to slash the estimated death toll from 260,000 to about 20,000. Without those measures, which have transformed society, the NHS would be overwhelmed, leading to a situation that has driven a brutal death toll in Italy.

Excuse me, but why do they let it happen? Once you’ve been through Wave 1, shouldn’t you know better than to let people travel abroad and come back?

• Asian Nations Face Second Wave Of Imported Cases (BBC)

South Korea, China and Singapore are among the Asian countries facing a second coronavirus wave, spurred by people importing it from outside. China, where the virus first emerged, reported no new domestic cases on Thursday for the first time since it started recording numbers in January. But it reported 34 new cases among people recently returned to China. South Korea saw a jump in new cases on Thursday with 152, though it is not clear how many were imported. A new cluster there is centred on a nursing home in Daegu, where 74 patients have tested positive. On Wednesday, Singapore reported 47 new infections – of which 33 were imported, including 30 residents who had been infected abroad and brought the infection back.

In China, there were eight more deaths, all in the central province of Hubei and most of them in Wuhan. All three countries had been showing success in controlling domestic cases, but there is concern that increases elsewhere could unravel their progress. Much of the focus has now shifted to Europe and the US, but the new numbers signal that the outbreak is far from over in Asia. Malaysia’s senior health office on Wednesday begged people to “stay at home and protect yourself and your family. Please”. The country has tallied 710 people with the virus, many of them linked to one religious event in the capital, Kuala Lumpur, in February. “We have a slim chance to break the chain of COVID-19 infections,” Noor Hisham Abdullah, director general of Health Malaysia, said on Facebook. “Failure is not an option here. If not, we may face a third wave of this virus, which would be greater than a tsunami, if we maintain a ‘so what’ attitude.”

Far as I can see, the dollar sold of a lot recently. But now people need dollars to pay off their losses.

• Dollar Resumes Ascent As Investors Panic, Scramble For Cash (R.)

The dollar resumed its relentless climb against major currencies on Thursday as wild financial market volatility and worries over tightening liquidity triggered by the coronavirus pandemic sparked an investor flight into cash. Sterling teetered near the lowest since at least 1985 against the greenback. The Australian dollar skidded to a 17-year low, while the New Zealand dollar crashed to an 11-year low as investors dumped riskier assets. The euro briefly rose against the dollar and the pound after the European Central Bank announced a €750 billion asset-purchase programme in response to the coronavirus outbreak, but even this effort was overwhelmed by a stampede into the dollar.

Investors are selling what they can to keep their money in dollars due to the unprecedented amount of uncertainty caused by the virus epidemic, which threatens to paralyse large swaths of the global economy. “This is similar to what happened during the global financial crisis in that investors are even selling what are normally considered safe-haven assets,” said Junichi Ishikawa, senior foreign exchange strategist at IG Securities in Tokyo. “The logic is the biggest hedge against risk is holding your money in cash, so the dollar is being bought. Investor uncertainty is about as high as it can get.” [..] In some cases investors are unloading Treasuries and gold in order to keep their money in dollars. This has confounded many analysts because investors normally buy government debt and precious metals during times of uncertainty.

Same as above. “We’re in this phase where investors are just looking to liquidate their positions..” We’re in the phase where they have to pay their gambling debts. “Investor” just sounds better than “gamblig addict”.

• Cash Is King As Emergency Stimulus Fails To Stop Market Panic (R.)

The dollar surged and everything else was blown away on Thursday as emergency central bank measures in Europe, the United States and Australia failed to halt a fresh wave of panic selling. “There’s no buyers, there’s not much liquidity and everyone is just getting out,” said Chris Weston, head of research at Melbourne brokerage Pepperstone. Stocks, bonds, gold and commodities fell as the world struggles to contain coronavirus and investors and businesses scramble for hard cash. U.S. stock futures were a hair’s breadth from hitting session down limits. The growth-sensitive Australian dollar was crushed 4% to a more than 17-year low. Nearly every stock market in Asia was down and circuit breakers were hit in Seoul, Jakarta and Manila.

Traders reported huge strains in bond markets as distressed funds sold any liquid asset to cover losses in stocks and redemptions from investors. Benchmark 10-year sovereign bond yields in Australia, New Zealand, Malaysia, Korea and Singapore and Thailand surged as prices tumbled. Gold fell 1% and copper hit its downlimit in Shanghai. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 5% to a four-year low, with Korea and Hong Kong leading losses. The Nikkei fell nearly 1%, the ASX 200 nearly 3%, while the Kospi lost 8% and the Hang Seng 5%. “We’re in this phase where investors are just looking to liquidate their positions,” said Prashant Newnaha, senior interest rate strategist at TD Securities in Singapore.

[..] J.P. Morgan economists forecast the U.S. economy to shrink 14% in the next quarter, and the Chinese economy to drop more than 40% in the current one, one of the most dire calls yet as to the scale of the fallout. “There is no longer doubt that the longest global expansion on record will end this quarter,” they said in a note. “The key outlook issue now is gauging the depth and the duration of the 2020 recession.”

We could all write this by now.

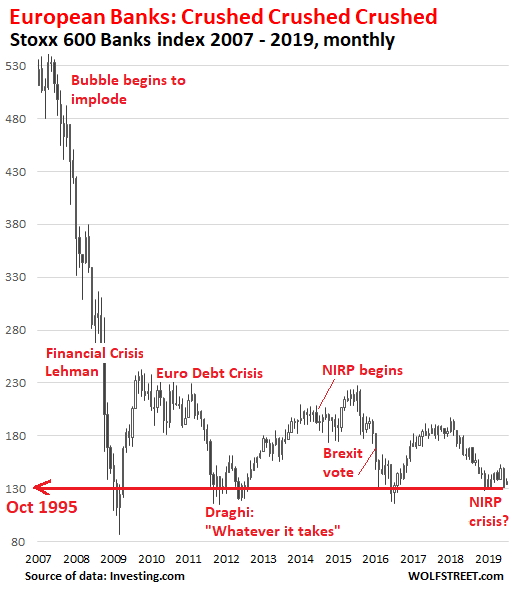

• Misunderestimate: Banks Are Going To Drown In An Ocean Of Defaults (Black)

On November 6, 2000, then US presidential candidate George W. Bush told a crowd of cheering supporters, “they misunderestimated me.” [..] ‘Misunderestimate’ seems to be a conflation of the words ‘misunderstand’ and ‘underestimate’. And while that was utterly hysterical 20 years ago when Bush first said it, ‘misunderestimate’ may be the most appropriate word of today. The entire world has completely ‘misunderestimated’ the Corona Virus. Banks are about to drown in an ocean of defaults. I’ll talk about this a lot more in the coming days, but briefly:

• There’s $250 TRILLION in global debt right now– mortgages, credit card debt, business loans, government debt, etc.

• And banks own a large portion of that debt.

• This virus crisis is going to trigger a wave of defaults from consumers, businesses, and even governments.

• Think about it: tourism alone makes up 10% of global GDP. Revenue in that entire sector– hotels, airlines, cruise ships, etc. has collapsed, and many of those companies aren’t going to survive.

• The crash in oil prices is going to wipe out countless oil companies.

• Many large retail chains, which were already struggling in the age of e-commerce, will likely declare bankruptcy.

• Countless businesses around the world have ‘temporarily’ closed due to public health policies, and many of them will go out of business entirely.

• MOST of these businesses owe lots of money to the banks, whether it’s a small business working line, or the $34 billion in debt that American Airlines owes. So the defaults are going to be massive.

• On top of that, millions of people are going to lose their jobs and be unable to make payments on their credit card debt, auto loans, and even mortgages.

• Again, there’s $250 trillion in global debt right now. Total bank capital worldwide is less than $10 trillion.

• So if the coming defaults trigger a mere 4% loss in total debt, it will exceed the entirety of global bank capital.

• And this doesn’t even take into consideration the impact of the $1 QUADRILLION derivatives exposure.Misunderestimate? Absolutely.

Why save something so bloated?

• Airline Industry Turmoil Deepens As Coronavirus Pain Spreads (R.)

Airline industry turmoil deepened on Thursday as Qantas told most of its 30,000 employees to take leave and India prepared a rescue package of up to $1.6 billion to aid carriers battered by coronavirus, government sources said. The U.N.’s International Civil Aviation Organization called on governments to ensure cargo operations were not disrupted to maintain the availability of critical medicine and equipment such as ventilators, masks, and other health and hygiene items that will help reduce the spread of the coronavirus pandemic. Passenger operations have collapsed at an unprecedented rate as the virus spreads around the world, with Delta Air parking more than 600 jets, cutting corporate pay by as much as 50%, and scaling back its flying by more than 70% until demand begins to recover.

Shares in U.S. airlines fell sharply on Wednesday after Washington proposed a rescue package of $50 billion in loans, but no grants as the industry had requested, to help address the financial impact from the deepening coronavirus crisis. The Trump administration’s lending proposal would require airlines to maintain a certain amount of service and limit increases in executive compensation until the loans are repaid. American Airlines in a memo to staff rebuffed criticism that it had rewarded its shareholders with too many dividends and stock buybacks in better times, leaving it with less cash to manage the crisis. “Unfortunately, this is no ordinary rainy day,” said Nate Gatten, American’s senior vice president global government affairs. “These are extraordinary circumstances, and additional support is necessary to protect jobs and ensure that the flying public can continue to rely on our industry after the crisis ends.”

[..] Air Canada said it was gradually suspending the majority of its international and U.S. transborder flights by March 31. India is poised to join a growing list of countries offering aid to its aviation industry. The Finance Ministry is considering a proposal worth up to $1.6 billion that includes temporary suspension of most taxes levied on the sector, according to two government sources who have direct knowledge of the matter. New Zealand on Thursday outlined the first tranche of a NZ$600 million ($344 million) aviation relief package, including financial support for airlines to pay government passenger charges and cover air traffic control fees.

Mariana Mazzucato is professor of economics at University College London.

I understand the temptation to theorize and wax enthusiastically about underlying systems, but isn’t it more useful to talk about how we can have 1 million tests per day by tomorrow morning?

• The COVID-19 Crisis Is A Chance To Do Capitalism Differently (Mazzucato)

Since the 1980s, governments have been told to take a back seat and let business steer and create wealth, intervening only for the purpose of fixing problems when they arise. The result is that governments are not always properly prepared and equipped to deal with crises such as Covid-19 or the climate emergency. By assuming that governments have to wait until the occurrence of a huge systemic shock before they resolve to take action, insufficient preparations are made along the way. In the process, critical institutions providing public services and public goods more widely – such as the NHS in the UK, where there have been cuts to public health totalling £1bn since 2015 – are left weakened.

The prominent role of business in public life has also led to a loss of confidence in what the government can achieve alone – leading in turn to the many problematic public-private partnerships, which prioritise the interests of business over the public good. For example, it has been well documented that public-private partnerships in research and development often favour “blockbusters” at the expense of less commercially appealing medicines that are hugely important to public health, including antibiotics and vaccines for a number of diseases with outbreak potential. On top of this, there is a lack of a safety net and protection for working people in societies with rising inequality, especially for those working in the gig economy with no social protection.

But we now have an opportunity to use this crisis as a way to understand how to do capitalism differently. This requires a rethink of what governments are for: rather than simply fixing market failures when they arise, they should move towards actively shaping and creating markets that deliver sustainable and inclusive growth. They should also ensure that partnerships with business involving government funds are driven by public interest, not profit. First of all, governments must invest in, and in some cases create, institutions that help to prevent crises, and make us more capable to handle them when they arise. The UK government’s emergency budget of £12bn for the NHS is a welcome move. But equally important is a focus on long-term investment to strengthen health systems, reversing the trends of recent years.

Second, governments need to better coordinate research and development activities, steering them towards public health goals. Discovery of vaccines will necessitate international coordination on a herculean scale, exemplified by the extraordinary work of the Coalition for Epidemic Preparedness Innovations (CEPI).

Unbelievable. More harmful than the virus. Or rather a virus in itself, one that kills slowly.

• Russia Coronavirus Disinformation Designed To Sow Panic In West – EU (R.)

Russian media have deployed a “significant disinformation campaign” against the West to worsen the impact of the coronavirus, generate panic and sow distrust, according to a European Union document seen by Reuters. The Kremlin denied the allegations on Wednesday, saying they were unfounded and lacked common sense. The EU document said the Russian campaign, pushing fake news online in English, Spanish, Italian, German and French, uses contradictory, confusing and malicious reports to make it harder for the EU to communicate its response to the pandemic. “A significant disinformation campaign by Russian state media and pro-Kremlin outlets regarding COVID-19 is ongoing,” said the nine-page internal document, dated March 16…

“The overarching aim of Kremlin disinformation is to aggravate the public health crisis in Western countries…in line with the Kremlin’s broader strategy of attempting to subvert European societies,” the document produced by the EU’s foreign policy arm, the European External Action Service, said. An EU database has recorded almost 80 cases of disinformation about coronavirus since Jan. 22, it said, noting Russian efforts to amplify Iranian accusations online, cited without evidence, that coronavirus was a U.S. biological weapon. Most scientists believe the disease originated in bats in China before passing to humans. Kremlin spokesman Dmitry Peskov pointed to what he said was the lack in the EU document of a specific example or link to a specific media outlet.

“We’re talking again about some unfounded allegations which in the current situation are probably the result of an anti-Russian obsession,” said Peskov. The EU document cited examples from Lithuania to Ukraine, including false claims that a U.S. soldier deployed to Lithuania was infected and hospitalized. It said that on social media, Russian state-funded, Spanish-language RT Spanish was the 12th most popular news source on coronavirus between January and mid-March, based on the amount of news shared on social media. The European Commission said it was in contact with Google, Facebook, Twitter and Microsoft. An EU spokesman accused Moscow of “playing with people’s lives” and appealed to EU citizens to “be very careful” and only use news sources they trust.

[..] Russian media in Europe have not been successful in reaching the broader public, but provide a platform for anti-EU populists and polarize debate, analysis by EU and non-governmental groups has shown. The EEAS report cited riots at the end of February in Ukraine, a former Soviet republic now seeking to join the EU and NATO, as an example of the consequences of such disinformation. It said a fake letter purporting to be from the Ukrainian health ministry falsely stated here were five coronavirus cases in the country. Ukrainian authorities say the letter was created outside Ukraine, the EU report said. “Pro-Kremlin disinformation messages advance a narrative that coronavirus is a human creation, weaponized by the West,” said the report, first cited by the Financial Times.

It quoted fake news created by Russia in Italy – which is suffering the world’s second most deadly outbreak of coronavirus – alleging that the 27-nation EU was unable to effectively deal with the pandemic, despite a series of collective measures taken by governments in recent days.

$50 billion.

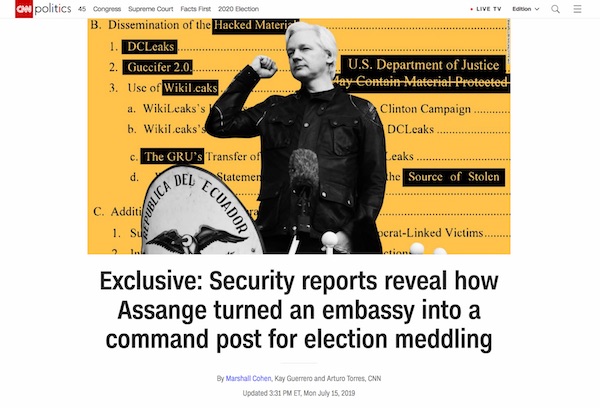

• ‘Putin’s Chef’ Threatens To Sue US Over Charges Of 2016 Election Meddling (G.)

A businessmen allied with Vladimir Putin has said he will sue the US for $50bn (£41bn) in damages after prosecutors dropped charges of meddling in the 2016 elections. Yevgeny Prigozhin, often dubbed “Putin’s chef,” claimed in a statement on Tuesday that he had been “wrongfully persecuted” by US prosecutors who said his company Concord had funded an internet troll factory that had promoted Donald Trump’s candidacy during the US elections. The charges, which were filed by special counsel Robert Mueller following his nearly two-year investigation into Russian meddling, were abruptly dropped on Monday, a month before trial. Prosecutors said the Russian company had “no exposure to meaningful punishment” and that the prosecution risked exposing investigative sources and methods.

A day later, Prigozhin went on the attack, saying the dropped charges showed that the US government “feared publicity and just court proceedings”. “This means that the allegations that ‘Prigozhin interfered in the US presidential election,’ ‘Concord interfered in the US presidential election,’ or ‘Russia interfered in the US presidential election’ are mendacious and false,” said Prigozhin, according to the statement released by his company. Prosecutors had previously complained that documents they had provided to the defence had ended up online, and had been hesitant to deliver more sensitive information to Concord’s defence team. It is not clear whether the plans to file a lawsuit are serious, where the lawsuit will be filed, and why Prigozhin values the damages against him at $50bn. The company’s press office declined to give any more information about Prigozhin’s plans on Tuesday.

Threats on her life. But not from the FBI.

• Ghislaine Maxwell Sues Jeffrey Epstein’s Estate Over Legal Fees (BBC)

Ghislaine Maxwell, the former girlfriend of Jeffrey Epstein, is suing the late US financier’s estate seeking reimbursement for legal fees and security costs, court documents say. Ms Maxwell’s complaint states that she “had no involvement in or knowledge of Epstein’s alleged misconduct” and that he had promised to cover her costs. She also “receives regular threats to her life and safety”, it adds. [..] Ms Maxwell, a long-time friend of Epstein, has not been accused by the authorities of wrongdoing. Ms Maxwell’s lawsuit, which is dated 12 March but was made public on Wednesday, claims that “extensive global coverage” of the investigation resulted in her having to “hire personal security and find safe accommodation”. It adds that she “formed a legal and special relationship” with Epstein that obligated the estate to compensate her, and that “assurances” were made but later ignored after she filed a reimbursement claim in November.

If you read us, please support us. Help the Automatic Earth survive.